2016 Postmortem

Related: About this forumI need those figures for tax rates under recent presidents.

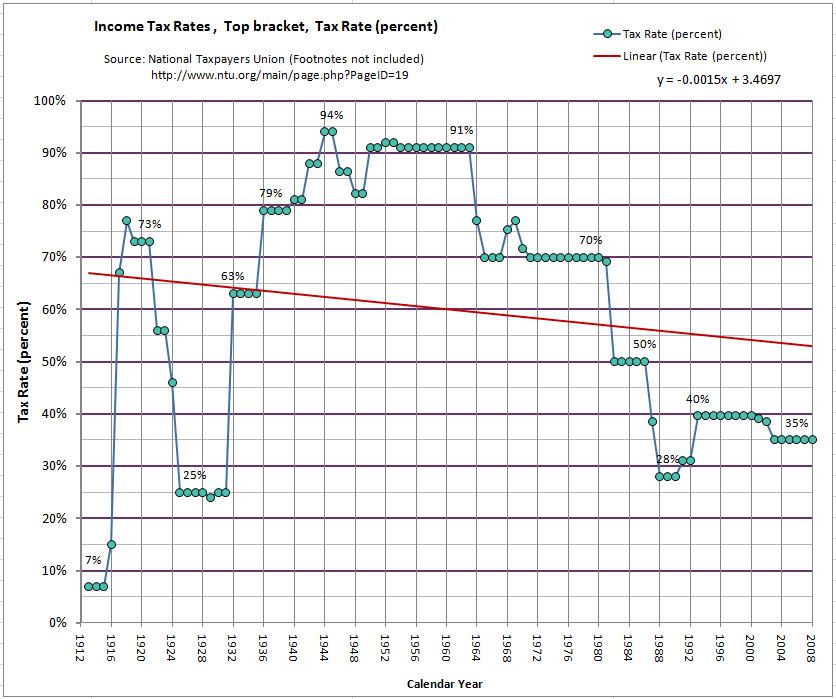

Does someone have that offhand? I keep seeing people screaming on FB about Bernie taking 90 percent from everyone.

JonLeibowitz

(6,282 posts)They also have versions in nominal dollars and in Excel format.

Live and Learn

(12,769 posts)

seabeyond

(110,159 posts)Eric J in MN

(35,619 posts)Or say that he wants to keep income tax brackets the same.

Give us something to reply to the "Bernie Sanders wants to tax you at 90%" claim.

senz

(11,945 posts)90% of us would never get there, and even those that did would only pay on the portion of their income that's over the top.

If anyone says, "Bernie wants to tax you at 90%" tell 'em they don't know what they're talking about.

Thinkingabout

(30,058 posts)JonLeibowitz

(6,282 posts)Thinkingabout

(30,058 posts)is not helpful either and did not address the OP

JonLeibowitz

(6,282 posts)Thinkingabout

(30,058 posts)JonLeibowitz

(6,282 posts)Thinkingabout

(30,058 posts)Addressed it either, now can you explain why you did not address the op but expect others to do so?

JonLeibowitz

(6,282 posts)I fail to see how I didn't address the OP. However, you clearly have not.

Thinkingabout

(30,058 posts)The op stated "I keep seeing people screaming on FB about Bernie taking 90 percent from everyone."

To which I replied in post #4 "Sanders has said he did not think it would be 90% but did not know what the rate would be."

To which you replied "Your comment appears not to address the OP. As such it is unhelpful. n/t"

Clearly I made a comment about Sanders saying the same which people are screaming about on fb, I also followed the thread and saw the chart had been provided and I decided to address the next portion of the OP.

Live and Learn

(12,769 posts)Thinkingabout

(30,058 posts)In post #15 I have shown I did respond to the OP of which I was told I had not.

JonLeibowitz

(6,282 posts)Live and Learn

(12,769 posts)Travis_0004

(5,417 posts)Nobody paid 90% back then. You could write off things you wouldnt dream of writting off today. Pull some tax returns of old presidents if you dont believe me.

90% was there on paper, perhaps just so people with no clue about the differences in the tax code can talk about how 90% would work today.

In 1950, I can go on a business trip. Deuct every single meal I ate 100%. Bring my wife along, deduct her expenses 100%. Put it on my credit card, and deduct the interest 100%. Not to shabby.

If you are bored look up housers law. Despite vast changes in marginal tax rates, revenue as a percent of GDP has not really changed in 50 years.

senz

(11,945 posts)The source is the National TaxPayers Union

senz

(11,945 posts)senz

(11,945 posts)I'm no expert, but I do know that we have a graduated income tax, with the percentage going up in regular steps from 0% for those who had little or no income to the highest % (currently ~ 39%) on the portion of a person's income that exceeds the top margin. The vast majority of us will never reach the top bracket. The very rich also pay in brackets, so their first x number of dollars is taxed at the lowest rate, the next x number of dollars at the next rate, until whatever they have over the top bracket is taxed at the top rate.

I hope that's clear. I'm sure someone else could explain it better.