2016 Postmortem

Related: About this forumThe Clintons and Wall Street: 24 Years of Enriching Each Other

The Clintons and Wall Street: 24 Years of Enriching Each Other

by RICHARD W. BEHAN

CounterPunch, FEBRUARY 26, 2016

EXCERPT...

President Clinton appointed Robert Rubin, the Co-chairman of Goldman-Sachs, as his Treasury Secretary in January of 1995. Mr. Rubin went to work fashioning two laws of stupendous value to the New York banks, but President Clinton’s first term of office ended before they could be enacted.

Perhaps sensing the need to assure Clinton’s re-election, Wall Street saw fit nearly to triple its campaign contributions—from $11.17 million in 1992 to $28.37 million in 1996.

Continued nicely in office, Secretary Rubin triumphed with the passage of the Financial Services Modernization Act of 1999, which repealed the Glass-Steagall legislation of 1933. Now it was legal once more for financial institutions to mix commercial and investment banking; in essence, to use depositors’ funds for trading the bank’s own account in the stock market.

A year later President Clinton signed the Commodity Futures Modernization Act. This law ended the regulation of derivatives, freeing Wall Street to manufacture mortgage-backed securities and sell them without restriction; these complex derivatives would power the “subprime” swindle soon to commence.

Meanwhile, in Clinton’s Justice Department a deputy Attorney General named Eric Holder in 1999 authored a memo entitled “Bringing Criminal Charges Against Corporations.” It became the Holder Doctrine, and after the financial crisis of 2008 it would be of incalculable value to the Wall Street banks. On leaving the Administration Mr. Holder joined Covington Burling, the largest law firm in Washington, D.C.. Among its clients were Morgan Stanley, Citigroup, JP Morgan Chase, UBS, Bank of New York Mellon, Deutsche Bank, Wells Fargo, and Bank of America.

CONTINUED...

http://www.counterpunch.org/2016/02/26/the-clintons-and-wall-street-24-years-of-enriching-each-other/

The nation needs a president who represents the interests of ALL Americans, not just the wealthy. Democrats used to stand for that, too, but, you know.

tazkcmo

(7,300 posts)Money has no influence on anything, especially in politics. It's immune because the politicians are honorable, truthful and completely transparent and Wall Street is made up of the finest philanthropists this Great Country has to offer. Altruism puddles are a very real slip hazard on the NYSE floor! In summation:

LEAVE BRITNEY ALONE!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

sarcasm

peace13

(11,076 posts)Spot on.

Octafish

(55,745 posts)

Larry Summers: Goldman Sacked

Monday, September 16, 2013

By Greg Palast for Reader Supported News

Joseph Stiglitz couldn't believe his ears. Here they were in the White House, with President Bill Clinton asking the chiefs of the US Treasury for guidance on the life and death of America's economy, when the Deputy Secretary of the Treasury Larry Summers turns to his boss, Secretary Robert Rubin, and says, "What would Goldman think of that?"

Huh?

Then, at another meeting, Summers said it again: What would Goldman think?A shocked Stiglitz, then Chairman of the President's Council of Economic Advisors, told me he'd turned to Summers, and asked if Summers thought it appropriate to decide US economic policy based on "what Goldman thought." As opposed to say, the facts, or say, the needs of the American public, you know, all that stuff that we heard in Cabinet meetings on The West Wing.

Summers looked at Stiglitz like Stiglitz was some kind of naive fool who'd read too many civics books.

CONTINUED...

http://www.gregpalast.com/larry-summers-goldman-sacked/

tazkcmo

(7,300 posts)Where's your other hand?

snagglepuss

(12,704 posts)Octafish

(55,745 posts)Are you sitting down?

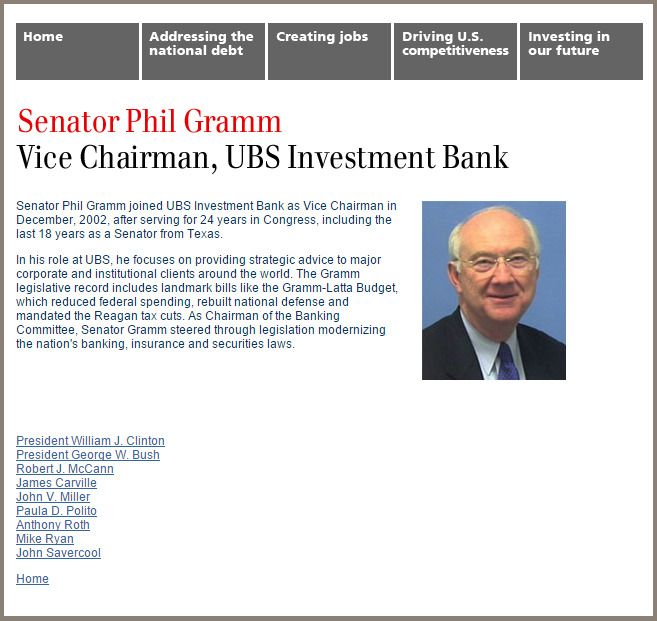

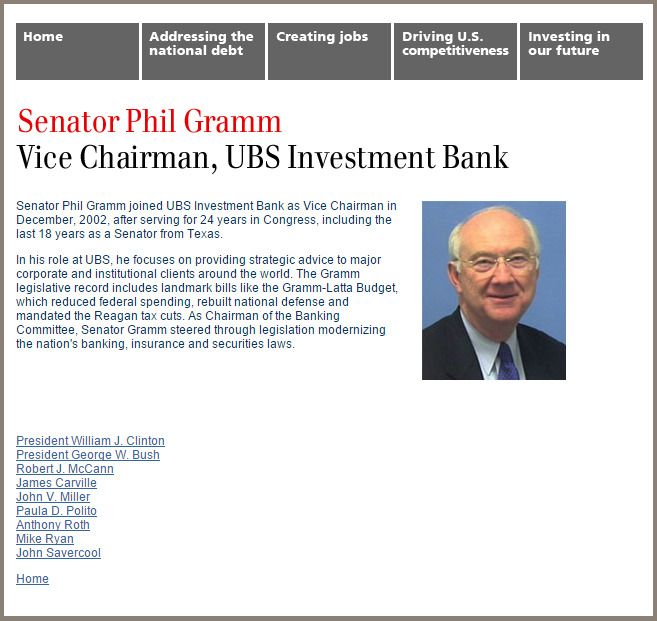

Guess who mans the ''Wealth Management'' department at UBS?

The two guys responsible for the repeal of the New Deal protections: Phil Gramm and his hireling Bill Clinton.

When the law was no more, the Banksters used the deposits on all sorts of risky investments that crapped out. Then, the taxpayers got to make the Banks whole and even gave the Banksters a bonus.

The repeal of Glass-Steagall in 1999 spelled disaster in the 2008 Bankster Bailout. The Democratic president who signed it into law was working in a spirit of buy-partisanship with his Republican Senate colleague to encourage new areas of banking by deregulating the financial industry cough gutting the New Deal protections of the Wall Street casino from using taxpayer-backed bank deposits.

See if you can spot some other familiar names on this list:

They now work together at UBS -- which received uncounted billions in bailout money -- to specialize in some kind of "Weath Management."

Forensic economist and former Fed regulator William K. Black wrote it reminds him of what happened during the Savings and Loans Crisis of the late 80s and early 90s. At the time, that was the greatest bank heist in history. Iceland hired Dr. Black to help prosecute 70 or 80 banksters responsible for their nation's losses in the meltdown of 2008 -- something I learned in Michael Moore's "Where to Invade Next."

The great DUer Raster told me about "The Big Short." The movie shows how Wall Street shafted America and then We the People enjoyed the pleasure of picking up the tab to make them whole and pay their hundreds of billions in bonuses. Here in Detroit, we've seen too many friends lose all they worked to build up. I'm not going to stand by and see it happen to the rest of the nation.

Octafish

(55,745 posts)Brave New World Order Thing globalist endgame benefits the Have-Mores, Big Time.

Larry Summers and the Secret "End-Game" Memo

Thursday, August 22, 2013

By Greg Palast for Vice Magazine

EXCERPT...

The year was 1997. US Treasury Secretary Robert Rubin was pushing hard to de-regulate banks. That required, first, repeal of the Glass-Steagall Act to dismantle the barrier between commercial banks and investment banks. It was like replacing bank vaults with roulette wheels.

Second, the banks wanted the right to play a new high-risk game: "derivatives trading." JP Morgan alone would soon carry $88 trillion of these pseudo-securities on its books as "assets."

Deputy Treasury Secretary Summers (soon to replace Rubin as Secretary) body-blocked any attempt to control derivatives.

But what was the use of turning US banks into derivatives casinos if money would flee to nations with safer banking laws?

[font color="green"]The answer conceived by the Big Bank Five: eliminate controls on banks in every nation on the planet – in one single move. It was as brilliant as it was insanely dangerous. [/font color]

CONTINUED...

http://www.gregpalast.com/larry-summers-and-the-secret-end-game-memo/

PS: Thanks for grokking, AzDar. It's strange how angry this information makes some DUers.

Punkingal

(9,522 posts)And I saw The Big Short last night. We are so screwed, and the Clintons set this all up. I wonder how long before the next crash? And the next bailout of banks, while regular citizens lose their 401K's and pensions. It is absolutely frightening.

Octafish

(55,745 posts)The two guys responsible for the repeal of the New Deal protections: Phil Gramm and his hireling Bill Clinton. When the law was no more, the Banksters used the deposits on all sorts of risky investments that crapped out. Then, the taxpayers got to make the Banks whole and even gave the Banksters a bonus.

The repeal of Glass-Steagall in 1999 spelled disaster in the 2008 Bankster Bailout. The Democratic president who signed it into law was working in a spirit of buy-partisanship with his Republican Senate colleague to encourage new areas of banking by deregulating the financial industry cough gutting the New Deal protections of the Wall Street casino from using taxpayer-backed bank deposits.

See if you can spot some other familiar names on this list:

They now work together at UBS -- which received uncounted billions in bailout money -- to specialize in some kind of "Weath Management."

PS: Forensic economist and former Fed regulator William K. Black wrote it reminds him of what happened during the Savings and Loans Crisis of the late 80s and early 90s. At the time, that was the greatest bank heist in history. Iceland hired Dr. Black to help prosecute 70 or 80 banksters responsible for their nation's losses in the meltdown of 2008 -- something I learned in Michael Moore's "Where to Invade Next."

Thanks for the heads-up on "The Big Short." Here in Detroit, we've seen too many friends lose all they worked to build up. I'm not going to stand by and see it happen to the rest of the nation.

Punkingal

(9,522 posts)I confess I don't understand how the market works, but what they did to cause the housing crisis was nothing short of criminal, and Standard and Poor's was as crooked as a dog's hind leg in the whole mess. You should see it if you can, or better yet, read the book. The author is Michael Lewis.

Speaking of Detroit, I lived there in 1970 when my son was born. We lived at Joy Road and Southfield, which was a nice middle class area. Two years ago we went to Detroit to purchase a semi-truck for his business and went over to the old neighborhood so he could see the house we lived in when he was born. It was like a war zone....I still can't believe it.....boarded up houses, deserted houses, houses completely gone. No American city should look like that...if people only knew!

Octafish

(55,745 posts)For example, all of Washington turned their backs on Detroit's bankruptcy, shafting a million people and a thousands of retirees.

The Rroots of the crisis in Flint and Detroit

World Socialist Web Site, 22 January 2016

EXCERPT...

Seventy miles away in Detroit, thousands of teachers have organized “sickouts,” independent of and in opposition to the trade unions, to protest the disastrous state of the public school system. Detroit’s public schools have been starved of funds for decades, as resources have been diverted into privately-owned, for-profit charter schools.

As a result, Detroit’s 50,000 students study in rat-infested schools that have poisonous black mold, mushroom growth, a lack of heating and crumbling building structures.

Officials from both political parties and at every level of state, local and federal government are implicated in the catastrophe in both Flint and Detroit. The response from officials has been crocodile tears, lies, evasions and blame shifting.

Michigan Governor Rick Snyder, a former venture capitalist with an estimated net worth of roughly $200 million, bears personal responsibility. Emails released Wednesday show his administration knew of the Flint poisonings, covered up the crisis and referred to the issue as a “political football.” Appearing on CBS News that same day, Snyder made the incredible statement that Detroit teachers must end their protests over school conditions because they were “harming the children.”

The Democrats—including individuals brought in to contain the outrage, such as Michael Moore and Jesse Jackson—for their part blame the Republicans and no one else. In a visit to Detroit on Wednesday, President Barack Obama spoke to a room full of cheering UAW bureaucrats at the joint United Auto Workers-General Motors Center for Human Resources. “I am very proud of what I’ve done in Michigan,” he said, before making an empty statement about how “If I were a parent I would be beside myself” over the water crisis in Flint.

Obama told the UAW audience that, “all kinds of good things are happening” in the aftermath of the Detroit Bankruptcy of 2013-2014.

In fact, the catastrophe in Flint and devastation of Detroit during the bankruptcy—which was supported by Obama—are two sides of the same process. During the bankruptcy, wages, pensions, infrastructure and social programs were slashed and the city threatened to sell the art in the Detroit Institute of Arts to pay off the Wall Street creditors. On top of this, tens of thousands of families had their electricity and water shut off. Detroit was not “rebuilt,” it was restructured in the interests of the rich.

CONTINUED...

https://www.wsws.org/en/articles/2016/01/22/pers-j22.html?view=article_mobile

Southfield is a paradise compared to some if not most parts of Detroit. The schools in Southfield are high quality, great public library, many good people. Great tax base. Detroit has great people, but not much money. I wonderxwhy there's always enough to make war and bailout banksters.

That's when the next "down turn" is supposed to happen according to what little I've heard. Yay!

Punkingal

(9,522 posts)libtodeath

(2,888 posts)Octafish

(55,745 posts)by PAM MARTENS

CounterPunch, SEPTEMBER 1, 2015

The riveting writer, Michael Hudson, has read our collective minds and the simmering anger in our hearts. Millions of American have long suspected that their inability to get financially ahead is an intentional construct of Wall Street’s central planners. Now Hudson, in an elegant but lethal indictment of the system, confirms that your ongoing struggle to make ends meet is not a reflection of your lack of talent or drive but the only possible outcome of having a blood-sucking financial leech affixed to your body, your retirement plan, and your economic future.

In his new book, “Killing the Host,” Hudson hones an exquisitely gripping journey from Wall Street’s original role as capital allocator to its present-day parasitism that has replaced U.S. capitalism as an entrenched, politically-enforced economic model across America.

This book is a must-read for anyone hoping to escape the most corrupt era in American history with a shirt still on his parasite-riddled back.

Hudson writes from his most powerful perch in chapters describing how these financial parasites have tricked our society into accepting them as a normal, productive part of our economy. (Since we write about these thousands of diabolical tricks four days a week at Wall Street On Parade, poignant examples came springing to mind with every turn of the page in “Killing the Host.” From the well-placed articles in the Wall Street Journal to a front group’s pleas for more Wall Street handouts in a New York Times OpEd, to the dirty backroom manner in which corporate speech was placed on a par with human speech in the Supreme Court’s Citizens United decision, to Wall Street’s private justice system and the Koch brothers’ multi-million dollar machinations to instill Ayn Rand’s brand of “greed is good” in university economic departments across America — America has become a finely tuned kleptocracy with a sprawling, sophisticated public relations base.

How else to explain, other than kleptocracy, the fact that Wall Street’s richest mega banks collect the life insurance proceeds and tax benefits on the untimely deaths of their workers – all codified into law by the U.S. Congress – making death a profit center on Wall Street. Or, as Frontline revealed, that two-thirds of your 401(k) plan over a working lifetime is likely to be lost to financial fees.

CONTINUED...

http://www.counterpunch.org/2015/09/01/how-wall-street-parasites-have-devoured-their-hosts-your-retirement-plan-and-the-u-s-economy/

THIS is why the Banksters and Warmongers -- and their crooked enablers in Wall Street-on-the-Potomac need to be in prison.

PS: Thank you for your kind words, libtodeath! Your grokking means the world.

“The only victories which leave no regret are those which are gained over ignorance.” ― Napoléon Bonaparte

SMC22307

(8,090 posts)Octafish

(55,745 posts)I hate what the facts show, but here's why "hope" is about all we can expect in terms of "democratic action" since Nixon. The author was a Chicago Boy helping implement the scam for Pinochet:

President Clinton and the Chilean Model.

By José Piñera

Midnight at the House of Good and Evil

"It is 12:30 at night, and Bill Clinton asks me and Dottie: 'What do you know about the Chilean social-security system?'” recounted Richard Lamm, the three-term former governor of Colorado. It was March 1995, and Lamm and his wife were staying that weekend in the Lincoln Bedroom of the White House.

I read about this surprising midnight conversation in an article by Jonathan Alter (Newsweek, May 13, 1996), as I was waiting at Dulles International Airport for a flight to Europe. The article also said that early the next morning, before he left to go jogging, President Bill Clinton arranged for a special report about the Chilean reform produced by his staff to be slipped under Lamm's door.

That news piqued my interest, so as soon as I came back to the United States, I went to visit Richard Lamm. I wanted to know the exact circumstances in which the president of the world’s superpower engages a fellow former governor in a Saturday night exchange about the system I had implemented 15 years earlier.

Lamn and I shared a coffee on the terrace of his house in Denver. He not only was the most genial host to this curious Chilean, but he also proved to be deeply motivated by the issues surrounding aging and the future of America. So we had an engaging conversation. At the conclusion, I ventured to ask him for a copy of the report that Clinton had given him. He agreed to give it to me on the condition that I do not make it public while Clinton was president. He also gave me a copy of the handwritten note on White House stationery, dated 3-21-95, which accompanied the report slipped under his door. It read:

Dick,

Sorry I missed you this morning.

It was great to have you and Dottie here.

Here's the stuff on Chile I mentioned.

Best,

Bill.

Three months before that Clinton-Lamm conversation about the Chilean system, I had a long lunch in Santiago with journalist Joe Klein of Newsweek magazine. A few weeks afterwards, he wrote a compelling article entitled,[font color="green"] "If Chile can do it...couldn´t North America privatize its social-security system?" [/font color]He concluded by stating that "the Chilean system is perhaps the first significant social-policy idea to emanate from the Southern Hemisphere." (Newsweek, December 12, 1994).

I have reasons to think that probably this piece got Clinton’s attention and, given his passion for policy issues, he became a quasi expert on Chile’s Social Security reform. Clinton was familiar with Klein, as the journalist covered the 1992 presidential race and went on anonymously to write the bestseller Primary Colors, a thinly-veiled account of Clinton’s campaign.

“The mother of all reforms”

While studying for a Masters and a Ph.D. in economics at Harvard University, I became enamored with America’s unique experiment in liberty and limited government. In 1835 Alexis de Tocqueville wrote the first volume of Democracy in America hoping that many of the salutary aspects of American society might be exported to his native France. I dreamed with exporting them to my native Chile.

So, upon finishing my Ph.D. in 1974 and while fully enjoying my position as a Teaching Fellow at Harvard University and a professor at Boston University, I took on the most difficult decision in my life: to go back to help my country rebuild its destroyed economy and democracy along the lines of the principles and institutions created in America by the Founding Fathers. Soon after I became Secretary of Labor and Social Security, and in 1980 I was able to create a fully funded system of personal retirement accounts. Historian Niall Ferguson has stated that this reform was “the most profound challenge to the welfare state in a generation. Thatcher and Reagan came later. The backlash against welfare started in Chile.”

But while de Tocqueville’s 1835 treatment contained largely effusive praise of American government, the second volume of Democracy in America, published five years later, strikes a more cautionary tone. He warned that “the American Republic will endure, until politicians realize they can bribe the people with their own money.” In fact at some point during the 20th century, the culture of self reliance and individual responsibility that had made America a great and free nation was diluted by the creation of [font color="green"] “an Entitlement State,”[/font color] reminiscent of the increasingly failed European welfare state. What America needed was a return to basics, to the founding tenets of limited government and personal responsibility.

[font color="green"]In a way, the principles America helped export so successfully to Chile through a group of free market economists needed to be reaffirmed through an emblematic reform. I felt that the Chilean solution to the impending Social Security crisis could be applied in the USA.[/font color]

CONTINUED...

http://www.josepinera.org/articles/articles_clinton_chilean_model.htm

Thank you for grokking, SMC2307. It's like Greek Tragedy fused with Grand Theft America, this stuff. Your support means the world to me.

slipslidingaway

(21,210 posts)Octafish

(55,745 posts)Democrat Andy Dillon, then State Treasurer, signed off on the water switch. The memos Snyder released say Dillon was the official who made the call to OK the switch to Flint River water.

Dillon said he thought Flint wouldn't be using the water to drink. Honest.

http://www.mlive.com/news/flint/index.ssf/2016/01/former_michigan_state_treasure.html

Important for DUers and Democrats to know:

After failing to win the Democratic nomination to oppose Snyder in the gubernatorial campaign of 2010, he failed to support the Democratic nominee, Lansing Mayor Virg Bernero. [font color="green"]So, Dillon was invited to serve as State Treasurer. [/font color]

Ex-rival Andy Dillon slights Virg Bernero

Mich. Democrat leaders: Party is unified

by Chris Christoff

Detroit Free Press,August 7, 2010

House Speaker Andy Dillon was drubbed in the Democratic gubernatorial primary by television ads that portrayed him as a greedy Wall Street raider who opposes a woman's right to choose abortion.

Then he was drubbed by rival Lansing Mayor Virg Bernero in Tuesday's election.

Friday, a visibly relieved Dillon smiled and said he was ready to work for Democrats in the fall campaign.

But he caused a buzz by not endorsing Bernero in front of about 200 Democrats assembled in downtown Detroit for a post-election unity breakfast.

"I want to make certain some of the things I was fighting for are going to be embraced," he told reporters afterward. "Then we'll get there. We don't have to decide that today."

He added, "It's not a slap. We just got done with a campaign. I'm going to take a vacation. We'll sort it out when I come back."

It was another enigmatic move from a politician who has become an iconoclast to some fellow Democrats, scorned by some union leaders as too cozy with business and too frosty with organized labor, and criticized as a legislative leader.

CONTINUED...

http://archive.freep.com/article/20100807/NEWS15/8070314/Ex-rival-Andy-Dillon-slights-Virg-Bernero

From there, he got to be the water decider. Loyalty to the Almighty Dollar is Buy Partisan. Heckuva job, Andy.

PS: In "The Big Short," they close with a nice little reminder that the Wall Street vampire turds who brought taxpayers the multi-Trillion Bankster Bailout tab are now investing big in Water.

amborin

(16,631 posts)Octafish

(55,745 posts)Thing's gold plated.

How could a billionaire look down on everyone and not laugh? (Short people like me want to know)

raouldukelives

(5,178 posts)And that is all we are living in today. The best that corporate America and the combined will of shareholders can give us. A long string of victories for them, no matter the consequences of their actions.

We've had a good 30 years of it, and for those of us who remember the days before it, well, I'm not sure we have another 10 years to waste on their grand experiment, let alone another 30.

Octafish

(55,745 posts)US taxpayers get to pick up the Banksters' tab at the casino. How did it happen? The repeal of Glass Steagall.

In plain English

The law prevented banks like JPMorgan and Bank of America from dealing with both Main Street and Wall Street. Banks either had to cater to Main Street by taking deposits and doing mortgages and small business type loans or they could cater to Wall Street by buying and selling stocks and bonds or helping big companies merge.

The thinking was that the Wall Street component of banking was too risky and would put regular Americans' savings and loans at risk.

The law came into being after the stock market crash of 1929 and the Depression that followed.

The official name of the law was the Banking Act of 1933, but it became known as Glass-Steagall because it was championed by Senator Carter Glass, a Virginia Democrat, and Congressman Henry Steagall, an Alabama Democrat and former Treasury secretary.

SOURCE: http://money.cnn.com/2015/10/14/investing/democratic-debate-what-is-glass-steagall-act/

There was no DU when it was repealed. When the Bankster crash of 2008 happened, though, I smelled a familiar rat of deregulation:

N'yeah, shee.

Nobody likes a told-ya-so, see?

From Feb. 28, 2008:

Know your BFEE: They Looted Your Nation’s S&Ls for Power and Profit

Then, after the Bankstershitstorm in September 21, 2008, I asked them who stole it to put it back:

Know your BFEE: Phil Gramm, the Meyer Lansky of the War Party, Set-Up the Biggest Bank Heist Ever.

What's weird is how, rather than the jail cell he so richly deserved, Phil Gramm ended up as Vice Chairman of UBS -- the Swiss Bank that received about $59 Billion with a Billion in TARP funds -- from where Gramm hired Bill Clinton, who signed into law the repeal of Glass Steagall. Since then, they've also brought in George W Bush to specialize in Wealth Management:

http://financialservicesinc.ubs.com/revitalizingamerica/SenatorPhilGramm.html

Now that We the People are on to their gangster asses, historically, it seems like they're going to need a bigger war.

sabrina 1

(62,325 posts)out of DC with Greenspan yelling at her when she THOUGHT she was doing the job she was hired to do.

Brooksley Born predicted the collapse but was told to be quiet. Too bad the people didn't know about her warning until after it was too late.

Rubin and Ayn Rand fan, Greenspan and Clinton silenced her and the rest is history, sadly. They however all enriched themselves.

Orsino

(37,428 posts)Is she enough of her own person to do a one-eighty and say fuck off to all that sweet cash? History argues against that possibility.

think

(11,641 posts)Octafish

(55,745 posts)Which really channels...

Who was in touch with this guy when Beethoven still looked up to him...

If they don't wake up, the USA will more resemble Haiti than Norway.

SamKnause

(13,108 posts)They will vote for her no matter what information comes forward.

They don't care if she is truthful or not.

They want a woman in the White House at all costs.

Her uninformed voters, vote for what they know and have been told for decades.

Clinton is a global household name.

They think she is looking out for their best interests.

They have never done any research on her.

Many churches are supporting her.

I don't have any answers on how to change the opinions of her supporters.