2016 Postmortem

Related: About this forumHillary Helped UBS—and Then the Bank Funneled Millions to the Clintons

UBS is a Swiss bank that is enjoying better days, thanks to the US taxpayer and a number of key US political leaders.

Hillary Helps a Bank—and Then It Funnels Millions to the Clintons

The Wall Street Journal’s eyebrow-raising story of how the presidential candidate and her husband accepted cash from UBS without any regard for the appearance of impropriety that it created.

by CONOR FRIEDERSDORF, The Atlantic, JUL 31, 2015

The Swiss bank UBS is one of the biggest, most powerful financial institutions in the world. As secretary of state, Hillary Clinton intervened to help it out with the IRS. And after that, the Swiss bank paid Bill Clinton $1.5 million for speaking gigs. The Wall Street Journal reported all that and more Thursday in an article that highlights huge conflicts of interest that the Clintons have created in the recent past.

The piece begins by detailing how Clinton helped the global bank.

“A few weeks after Hillary Clinton was sworn in as secretary of state in early 2009, she was summoned to Geneva by her Swiss counterpart to discuss an urgent matter. The Internal Revenue Service was suing UBS AG to get the identities of Americans with secret accounts,” the newspaper reports. “If the case proceeded, Switzerland’s largest bank would face an impossible choice: Violate Swiss secrecy laws by handing over the names, or refuse and face criminal charges in U.S. federal court. Within months, Mrs. Clinton announced a tentative legal settlement—an unusual intervention by the top U.S. diplomat. UBS ultimately turned over information on 4,450 accounts, a fraction of the 52,000 sought by the IRS.”

Then reporters James V. Grimaldi and Rebecca Ballhaus lay out how UBS helped the Clintons. “Total donations by UBS to the Clinton Foundation grew from less than $60,000 through 2008 to a cumulative total of about $600,000 by the end of 2014, according to the foundation and the bank,” they report. “The bank also joined the Clinton Foundation to launch entrepreneurship and inner-city loan programs, through which it lent $32 million. And it paid former president Bill Clinton $1.5 million to participate in a series of question-and-answer sessions with UBS Wealth Management Chief Executive Bob McCann, making UBS his biggest single corporate source of speech income disclosed since he left the White House.”

The article adds that “there is no evidence of any link between Mrs. Clinton’s involvement in the case and the bank’s donations to the Bill, Hillary and Chelsea Clinton Foundation, or its hiring of Mr. Clinton.” Maybe it’s all a mere coincidence, and when UBS agreed to pay Bill Clinton $1.5 million the relevant decision-maker wasn’t even aware of the vast sum his wife may have saved the bank or the power that she will potentially wield after the 2016 presidential election.

SNIP...

As McClatchy noted last month in a more broadly focused article that also mentions UBS, “Ten of the world’s biggest financial institutions––including UBS, Bank of America, JP Morgan Chase, Citigroup and Goldman Sachs––have hired Bill Clinton numerous times since 2004 to speak for fees totaling more than $6.4 million. Hillary Clinton also has accepted speaking fees from at least one bank. And along with an 11th bank, the French giant BNP Paribas, the financial goliaths also donated as much as $24.9 million to the Clinton Foundation––the family’s global charity set up to tackle causes from the AIDS epidemic in Africa to climate change.”

CONTINUED...

http://www.theatlantic.com/politics/archive/2015/07/hillary-helps-a-bankand-then-it-pays-bill-15-million-in-speaking-fees/400067/

About UBS Wealth Management

It's Buy Partisan

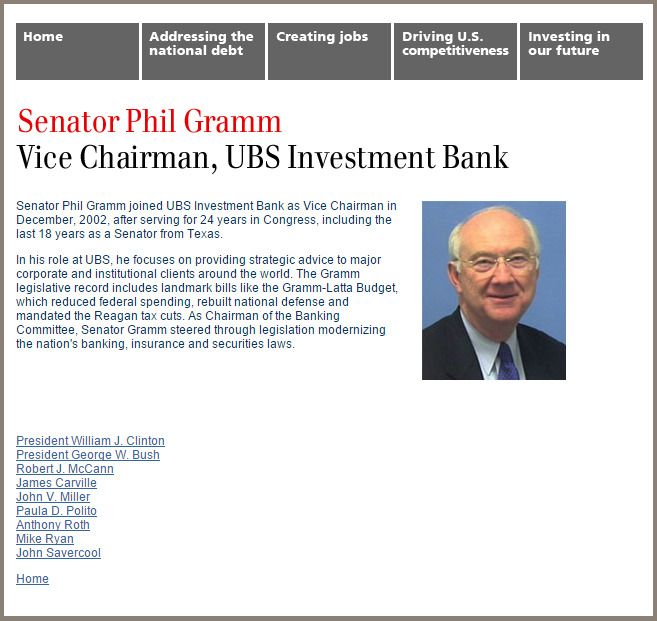

After his exit from the US Senate, Phil Gramm found a job at Swiss bank UBS as vice chairman. He later brought on former President Bill Clinton. What a coincidence, they are the two key figures in repealing Glass-Steagal. Since the New Deal it was the financial regulation that protected the US taxpayer from the Wall Street casino. Oh well, what's a $16 trillion bailout among friends?

It's a Buy-Partisan Who's Who:

President William J. Clinton

President George W. Bush Heh heh heh.

Robert J. McCann

James Carville

John V. Miller

Paula D. Polito

Anthony Roth

Mike Ryan

John Savercool

SOURCE: http://financialservicesinc.ubs.com/revitalizingamerica/SenatorPhilGramm.html

One of my attorney chums doesn't like to see his name on any committees, event letterhead or political campaign literature. These folks, it seems to me, are past caring.

Some of why DUers and ALL voters should care about Phil Gramm.

The fact the nation's "news media" isn't really following this story should also be of great concern -- for the 99-percent.

FreakinDJ

(17,644 posts)nc4bo

(17,651 posts)No surpises at this party.

Octafish

(55,745 posts)They even paid the whistleblower Bradley Birkenfeld $104 million to shut him up -- after he went to prison for blowing the whistle on...the people avoiding taxes by moving their fortunes offshore to UBS.

Why did the US pay this former Swiss banker $104M?

Eamon Javers CNBC, Thursday, 30 Apr 2015 | 7:10 AM ET

Bradley Birkenfeld was released from federal prison in August 2012 after serving 2½ years for his role as a Swiss banker hiding millions of dollars for wealthy American clients.

Five weeks later, he found himself in the kitchen of a small rental house in Raymond, New Hampshire. At that moment, Birkenfeld was an ex-con. He was out of work, infamous in a famously discreet profession, and probably unemployable as a private banker anywhere.

But then his lawyer walked into the room, carrying a check from the U.S. Treasury to Birkenfeld for $104 million—minus taxes. On the face was a picture of the Statue of Liberty.

It was Birkenfeld's cut as a whistleblower of the massive settlement his former employer—the Swiss bank UBS—had paid to the United States government in a settlement for helping Americans dodge taxes. As Birkenfeld signed the check, he was transformed from convicted felon to government-made multimillionaire.

CONTINUED...

http://www.cnbc.com/2015/04/30/why-did-the-us-pay-this-former-swiss-banker-104m.html

Something's seriously wrong somewhere.

Faux pas

(14,681 posts)Octafish

(55,745 posts)I'd like reminder young people about that, so they don't have to borrow money from the banks to pay for the wars and welfare for the wealthy.

Tax Offshore Wealth Sitting In First World Banks

James S. Henry

Forbes Magazine, July 1, 2010

Let's tax offshore private wealth.

How can we get the world's wealthiest scoundrels--arms dealers, dictators, drug barons, tax evaders--to help us pay for the soaring costs of deficits, disaster relief, climate change and development? Simple: Levy a modest withholding tax on untaxed private offshore loot.

Many aboveground economies around the world are struggling, but the economic underground is booming. By my estimate, there is $15 trillion to $20 trillion in private wealth sitting offshore in bank accounts, brokerage accounts and hedge fund portfolios, completely untaxed.

SNIP...

This wealth is concentrated. Nearly half of it is owned by 91,000 people--0.001% of the world's population. Ninety-five percent is owned by the planet's wealthiest 10 million people.

SNIP...

Is it feasible? Yes. The majority of offshore wealth is managed by 50 banks. As of September 2009 these banks accounted for $10.8 trillion of offshore assets--72% of the industry's total. The busiest 10 of them manage 40%.

CONTINUED....

http://www.forbes.com/forbes/2010/0719/opinions-taxation-tax-havens-banking-on-my-mind.html

The JFK Assassination: A False Mystery Concealing State Crimes

Taxing those who have looted the US economy is certainly better than cutting what little of the New Deal and Great Society that remains.

Faux pas

(14,681 posts)When the millionaires paid taxes the country boomed. We had the money for infrastructure and all kinds of good things back then. ![]()

LongTomH

(8,636 posts)The magazine of Plutocracy? Wowzers!!!! ![]()

![]()

![]()

![]()

![]()

![]()

![]()

cali

(114,904 posts)They are CORRUPT.

Octafish

(55,745 posts)Questions for Department of Justice and IRS after disclosure of leak revealing HSBC’s private Swiss bank helped clients to conceal undeclared ‘black’ accounts

The US government will come under intense pressure this week to explain what action it took after receiving a massive cache of leaked data that revealed how the Swiss banking arm of HSBC, the world’s second-largest bank, helped wealthy customers conceal billions of dollars of assets.

The leaked files, which reveal how HSBC advised some clients on how to circumvent domestic tax authorities, were obtained through an international collaboration of news outlets, including the Guardian, the French daily Le Monde, CBS 60 Minutes and the Washington-based International Consortium of Investigative Journalists.

The files reveal how HSBC’s Swiss private bank colluded with some clients to conceal undeclared “black” accounts from domestic tax authorities across the world and provided services to international criminals and other high-risk individuals.

The disclosure amounts to one of the biggest banking leaks in history, shedding light on some 30,000 accounts holding almost $120bn (£78bn) of assets. Of those, around 2,900 clients were connected to the US, providing the IRS with a trail of evidence of potential American taxpayers who may have been hiding assets in Geneva.

SNIP...

HSBC deal ‘fundamentally wrong’

The Democratic senator from Massachusetts Elizabeth Warren famously labelled the HSBC deal “fundamentally wrong”. “HSBC paid a fine, but no individual went to trial, no individual was banned from banking and there was no hearing to consider shutting down HSBC’s actives in the US,” Warren said at a Senate committee hearing in 2013. “How many billions of dollars do you have to launder for drug lords and how many sanctions do you have to violate before someone will consider shutting down a financial institution like this?”

CONTINUED...

http://www.theguardian.com/news/2015/feb/08/us-government-biggest-leak-banking-history-questions-irs-taxes

jillan

(39,451 posts)this is one of their biggest talking points against her.

Octafish

(55,745 posts)The Sting

In the best rip-off, the mark never knows that he or she was set up for fleecing.

In the case of the great financial meltdown of 2008, the victim is the U.S. taxpayer.

Going by the lack of analysis in Corporate McPravda, We the People are in for a royal fleecing.

Don’t just take my word about the current situation between giant criminality and the politically connected.

[font color="green"][font size="5"]You see, there is evidence of conspiracy. An honest FBI agent warned us in 2004 about the coming financial meltdown and the powers-that-be stiffed him, too.[/font size][/font color]

The story’s below. And it’s not fiction. It is true to life.

The Set-Up

You don’t have to be a fan of Paul Newman or Robert Redford to smell a BFEE rat. The oily critter’s name is Gramm. Phil Gramm. He helped Ronald Reagan push through his trickle-down fiscal policy and later helped de-regulate the nation's once-healthy Saving & Loan industry. We all know how well that worked out: Know your BFEE: They Looted Your Nation’s S&Ls for Power and Profit.

In 1999, then-super conservative Texas U.S. Senator Gramm helped pass the Gramm-Leach-Bliley Financial Services Modernization Act. This law allowed banks to act like investment houses. Using federally-guaranteed savings accounts, banks now could make risky commercial and real-estate loans.

The law should’ve been called the Gramm-Lansky Act. To those who gave a damn, it was obviously a potential disaster. During the bill’s debate, the specter of a “taxpayer bail-out” was raised by Sen. Byron Dorgan of North Dakota, warning about what had happened to the deregulated S&Ls.

Gramm wasn’t alone on the deregulation bandwagon. The law passed, IIRC, like 89-9. More than a few of my own Democratic faves went along with this deregulation, “get-government-off-the-back-of-business” law.

Today we have their love child, MOAB—for the Mother Of All Bailouts.

The Mark

In a sting, someone has to supply the money to be ripped off. Crooks call that person the mark or target or mope. In the present case, that’s the U.S. taxpayer.

Today’s financial crisis seems like a re-run of what happened to the Savings & Loans industry in the late 1980s. Well it is a lot like what happened to the S&Ls. Then, as now, it’s the U.S. taxpayer who gets to pick up the tab for someone else’s party.

Don’t worry, U.S. taxpayer. You’re getting something (among several things) for your $700 billion. You’re getting all the bad mortgage-based paper on almost all of Wall Street. I’d rather have penny stocks, because if there ever was something of negative value it’s the complicated notes and derivatives based on this mortgage debt.

When it comes to Bush economic policy, left holding the bag are We the People, er, Mopes. Don’t worry, it can’t get worse. As St. Ronnie would say, “Well. Yes.” You see, what the bag U.S. taxpayers hold is less than empty. It’s filled with bad debt.

The Mastermind

Chief economist amongst these merry band of thieves and traitors was one Phil Gramm (once a conservative Democrat and then an ultraconservative Republican-Taxus). An economist by training and reputation, Gramm was one of the guiding lights of Reaganomics, the cut taxes, domestic spending, and regulations while raising defense-spending to new heights. In sum, it was a fiscal policy to enrich friends – especially the kind connected to the BFEE.

Foreclosure Phil

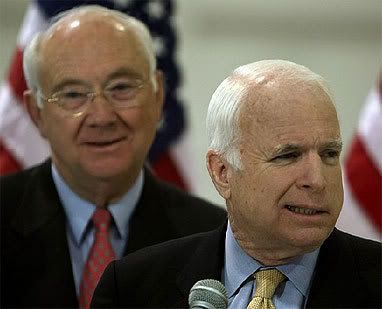

Years before Phil Gramm was a McCain campaign adviser and a lobbyist for a Swiss bank at the center of the housing credit crisis, he pulled a sly maneuver in the Senate that helped create today's subprime meltdown.

David Corn

MotherJones.com

May 28, 2008

Who's to blame for the biggest financial catastrophe of our time? There are plenty of culprits, but one candidate for lead perp is former Sen. Phil Gramm. Eight years ago, as part of a decades-long anti-regulatory crusade, Gramm pulled a sly legislative maneuver that greased the way to the multibillion-dollar subprime meltdown. Yet has Gramm been banished from the corridors of power? Reviled as the villain who bankrupted Middle America? Hardly. Now a well-paid executive at a Swiss bank, Gramm cochairs Sen. John McCain's presidential campaign and advises the Republican candidate on economic matters. He's been mentioned as a possible Treasury secretary should McCain win. That's right: A guy who helped screw up the global financial system could end up in charge of US economic policy. Talk about a market failure.

Gramm's long been a handmaiden to Big Finance. In the 1990s, as chairman of the Senate banking committee, he routinely turned down Securities and Exchange Commission chairman Arthur Levitt's requests for more money to police Wall Street; during this period, the sec's workload shot up 80 percent, but its staff grew only 20 percent. Gramm also opposed an sec rule that would have prohibited accounting firms from getting too close to the companies they audited—at one point, according to Levitt's memoir, he warned the sec chairman that if the commission adopted the rule, its funding would be cut. And in 1999, Gramm pushed through a historic banking deregulation bill that decimated Depression-era firewalls between commercial banks, investment banks, insurance companies, and securities firms—setting off a wave of merger mania.

But Gramm's most cunning coup on behalf of his friends in the financial services industry—friends who gave him millions over his 24-year congressional career—came on December 15, 2000. It was an especially tense time in Washington. Only two days earlier, the Supreme Court had issued its decision on Bush v. Gore. President Bill Clinton and the Republican-controlled Congress were locked in a budget showdown. It was the perfect moment for a wily senator to game the system. As Congress and the White House were hurriedly hammering out a $384-billion omnibus spending bill, Gramm slipped in a 262-page measure called the Commodity Futures Modernization Act. Written with the help of financial industry lobbyists and cosponsored by Senator Richard Lugar (R-Ind.), the chairman of the agriculture committee, the measure had been considered dead—even by Gramm. Few lawmakers had either the opportunity or inclination to read the version of the bill Gramm inserted. "Nobody in either chamber had any knowledge of what was going on or what was in it," says a congressional aide familiar with the bill's history.

It's not exactly like Gramm hid his handiwork—far from it. The balding and bespectacled Texan strode onto the Senate floor to hail the act's inclusion into the must-pass budget package. But only an expert, or a lobbyist, could have followed what Gramm was saying. The act, he declared, would ensure that neither the sec nor the Commodity Futures Trading Commission (cftc) got into the business of regulating newfangled financial products called swaps—and would thus "protect financial institutions from overregulation" and "position our financial services industries to be world leaders into the new century."

Subprime 1-2-3

Don't understand credit default swaps? Don't worry—neither does Congress. Herewith, a step-by-step outline of the subprime risk betting game. —Casey Miner

CONTINUED…

http://www.motherjones.com/news/feature/2008/07/foreclo...

A fine mind for modern Bushonomics. Kill the middle class. Then, rob from the poor to give to the rich.

The Mentor

Anyone who’s ever heard him talk knows that Gramm must’ve learned all this stuff from somebody. He could never think it all up on his own. He had to have help. That’s where Meyer Lansky, the man who brought modern finance to the Mafia, comes in.

Money Laundering

Answers.com

EXCERPT...

History

Modern development

The act of "money laundering" was not invented during the Prohibition era in the United States, but many techniques were developed and refined then. Many methods were devised to disguise the origins of money generated by the sale of then-illegal alcoholic beverages. Following Al Capone's 1931 conviction for tax evasion, mobster Meyer Lansky transferred funds from Florida "carpet joints" (small casinos) to accounts overseas. After the 1934 Swiss Banking Act, which created the principle of bank secrecy, Meyer Lansky bought a Swiss bank to which he would transfer his illegal funds through a complex system of shell companies, holding companies, and offshore accounts.(1)

The term "money laundering" does not derive, as is often said, from Al Capone having used laundromats to hide ill-gotten gains. It was Meyer Lansky who perfected money laundering's older brother, "capital flight," transferring his funds to Switzerland and other offshore places. The first reference to the term "money laundering" itself actually appears during the Watergate scandal. US President Richard Nixon's "Committee to Re-elect the President" moved illegal campaign contributions to Mexico, then brought the money back through a company in Miami. It was Britain's Guardian newspaper that coined the term, referring to the process as "laundering."

Process

Money laundering is often described as occurring in three stages: placement, layering, and integration.(3)

Placement: refers to the initial point of entry for funds derived from criminal activities.

Layering: refers to the creation of complex networks of transactions which attempt to obscure the link between the initial entry point, and the end of the laundering cycle.

Integration: refers to the return of funds to the legitimate economy for later extraction.

However, The Anti Money Laundering Network recommends the terms

Hide: to reflect the fact that cash is often introduced to the economy via commercial concerns which may knowingly or not knowingly be part of the laundering scheme, and it is these which ultimately prove to be the interface between the criminal and the financial sector

Move: clearly explains that the money launderer uses transfers, sales and purchase of assets, and changes the shape and size of the lump of money so as to obfuscate the trail between money and crime or money and criminal.

Invest: the criminal spends the money: he/she may invest it in assets, or in his/her lifestyle.

CONTINUED...

http://www.answers.com/topic/money-laundering

The great journalist Lucy Komisar has shone a big light on the subject:

Offshore Banking

The U.S.A.’s Secret Threat

Lucy Komisar

The Blacklisted Journalist

June 1, 2003

EXCERPT…

In 1932, mobster Meyer Lansky took money from New Orleans slot machines and shifted it to accounts overseas. The Swiss secrecy law two years later assured him of G-man-proof banking. Later, he bought a Swiss bank and for years deposited his Havana casino take in Miami accounts, then wired the funds to Switzerland via a network of shell and holding companies and offshore accounts, some of them in banks whose officials knew very well they were working for criminals. By the 1950s, Lansky was using the system for cash from the heroin trade.

Today, offshore is where most of the world's drug money is laundered, estimated at up to $500 billion a year, more than the total income of the world's poorest 20 percent. Add the proceeds of tax evasion and the figure skyrockets to $1 trillion. Another few hundred billion come from fraud and corruption.

Lansky laundered money so he could pay taxes and legitimate his spoils. About half the users of offshore have opposite goals. As hotel owner and tax cheat Leona Helmsley said---according to her former housekeeper during Helmsley's trial for tax evasion---"Only the little people pay taxes." Rich individuals and corporations avoid taxes through complex, accountant-aided schemes that routinely use offshore accounts and companies to hide income and manufacture deductions.

The impact is massive. The IRS estimates that taxpayers fail to pay in excess of $100 billion in taxes annually due on income from legal sources. The General Accounting Office says that American wage-earners report 97 percent of their wages, while self-employed persons report just 11 percent of theirs. Each year between 1989 and 1995, a majority of corporations, both foreign- and U.S.-controlled, paid no U.S. income tax. European governments are fighting the same problem. The situation is even worse in developing countries.

The issue surfaces in the press when an accounting scam is so outrageous that it strains credulity. Take the case of Stanley Works, which announced a "move" of its headquarters-on paper-from New Britain, Connecticut, to Bermuda and of its imaginary management to Barbados. Though its building and staff would actually stay put, manufacturing hammers and wrenches, Stanley Works would no longer pay taxes on profits from international trade. The Securities and Exchange Commission, run by Harvey Pitt---an attorney who for more than twenty years represented the top accounting and Wall Street firms he was regulating---accepted the pretense as legal.

"The whole business is a sham," fumed New York District Attorney Robert Morgenthau, who more than any other U.S. law enforcer has attacked the offshore system. "The headquarters will be in a country where that company is not permitted to do business. They're saying a company is managed in Barbados when there's one meeting there a year. In the prospectus, they say legally controlled and managed in Barbados. If they took out the word legally, it would be a fraud. But Barbadian law says it's legal, so it's legal." The conceit apparently also persuaded the Securities and Exchange Commission.

CONTINUED…

http://www.bigmagic.com/pages/blackj/column92e.html

Socialize the risk for Wall Street. Privatize the loss to Uncle Sam’s nieces and nephews. Congratulations, Dear Reader! Now you know as much as Phil Gramm.

The Diversion

Still, a global financial meltdown sounds like something bad. Making things worse, we’re hearing that Uncle Sam is broke! Flat busted. Tapped out.

That’s odd, though. We the People see the Treasury being emptied with tax breaks for the wealthy and checks to the companies they own that make money off of war. Want to know how to make a buck these days? Invest in the likes of Halliburton and Northrup Grumman. Anything in the warmongering business connected to Bush and his cronies will weather the downturn or depression.

The Wall Street Journal -- a paper owned and operated by Fox News’ head, Rupert Murdoch – was very quick to promote the crisis, as DUer JustPlainKathy observed. The paper was even faster to pounce on a solution: What’s needed is a safety net for banks. And quick as a wink, they found the answer!

Only the U.S. taxpayer has the wherewithal to prevent the collapse of the global financial system -- a global economic meltdown that would freeze up credit and investment and expansion and prosperity and a return to the Great Depression. Who can be against that?

Oh. Kay. Sounds about right – Rupert the Alien agreeing with what Leona Helmsley said: “Only the little people pay taxes.”

Gramm and McCain also are in favor of privatization. How nice is that?

The Getaway

George Walker Bush and his right-wing pals feel they can get away with this, their latest rip-off the American taxpayers. Who can blame them? When compared to their clear record of incompetence, lies, fraud, theft, mass-murder, warmongering and treason, what’s a few trillion dollar rip-off?

Still, it's weird how they act.

They must really think they’ll be welcomed with open arms in Paraguay and Dubai and Switzerland.

Going by the welcome the world gave the Shah of Iran, they’re in for a big surprise.

The FBI Guy

Don’t say we weren’t warned. An intrepid FBI agent with something sorely lacking in the rest of the Bush administration, integrity, blew the whistle on the bank thing…

FBI saw threat of mortgage crisis

A top official warned of widening loan fraud in 2004, but the agency focused its resources elsewhere.

By Richard B. Schmitt

Los Angeles Times Staff Writer

August 25, 2008

WASHINGTON — Long before the mortgage crisis began rocking Main Street and Wall Street, a top FBI official made a chilling, if little-noticed, prediction: The booming mortgage business, fueled by low interest rates and soaring home values, was starting to attract shady operators and billions in losses were possible.

"It has the potential to be an epidemic," Chris Swecker, the FBI official in charge of criminal investigations, told reporters in September 2004. But, he added reassuringly, the FBI was on the case. "We think we can prevent a problem that could have as much impact as the S&L crisis," he said.

Today, the damage from the global mortgage meltdown has more than matched that of the savings-and-loan bailouts of the 1980s and early 1990s. By some estimates, it has made that costly debacle look like chump change. But it's also clear that the FBI failed to avert a problem it had accurately forecast.

Banks and brokerages have written down more than $300 billion of mortgage-backed securities and other risky investments in the last year or so as homeowner defaults leaped and weakness in the real estate market spread.

SNIP…

Most observers have declared the mess a gross failure of regulation. To be sure, in the run-up to the crisis, market-oriented federal regulators bragged about their hands-off treatment of banks and other savings institutions and their executives. But it wasn't just regulators who were looking the other way. The FBI and its parent agency, the Justice Department, are supposed to act as the cops on the beat for potentially illegal activities by bankers and others. But they were focused on national security and other priorities, and paid scant attention to white-collar crimes that may have contributed to the lending and securities debacle.

Now that the problems are out in the open, the government's response strikes some veteran regulators as too little, too late.

Swecker, who retired from the FBI in 2006, declined to comment for this article.

But sources familiar with the FBI budget process, who were not authorized to speak publicly about the growing fraud problem, say that he and other FBI criminal investigators sought additional assistance to take on the mortgage scoundrels.

They ended up with fewer resources, rather than more.

CONTINUED…

http://www.latimes.com/business/la-fi-mortgagefraud25-2008aug25,0,6946937.story

We were warned and nothing happened.

Repeat: And nothing happened.

They must think We the People are really stupid. Are we supposed to believe that all that $700 billion in bad debt just happened? Where did all that money go? Who got all the money?

Meyer Lansky moved the Mafia’s money from the Cuban casinos to Switzerland. He did so by buying a bank in Miami. Phil Gramm seems to have done the same thing as vice-chairman of UBS, except the amounts are in the billions.

Who cares? He’s almost gone? Nope. That money still exists somewhere. I have a pretty good idea of where it might be. And George Bush and his cronies are poised to get away with a whole lot of loot.

Who Should Pay for the Bailout

If you are fortunate enough to be one, good luck American taxpayer! You’re in for a royal fleecing. Once the interest is figured into the bailout, we’re looking at a couple of trill.

[font color="green"]The people who should pay for the bailout aren’t the American people. That distinction should go to the crooks who stole it -- friends of Gramm like John McCain and George Bush and the rest of the Raygunomix crowd of snake-oil salesmen. For them, the Bush administration -- and a good chunk of time since Ronald Reagan -- has not been a disaster. It’s been a cash cow.

[/font color]

The above was posted on DU on Sept. 21, 2008. (Check out the responses, lots of info from DUers.) What's changed since then? Nothing near what I'd hoped for, certainly.

http://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=389x4055207

KoKo

(84,711 posts)Time to revisit all of this.

![]()

bulloney

(4,113 posts)Coupled with his wife, former CFTC chair Wendi, there aren't many couples more corrupt than those two. If integrity was cotton, you couldn't get enough from those two to make a T-shirt for a piss ant.

Octafish

(55,745 posts)Wendy Gramm! Yes, the wonderful wife of that smooth-talking ex-Senator and fun-loving deregulator, Phil Gramm. Holy smokes!

Here's the citation and source from the Federation of American Scientists website. If we've already gone over this, I've gotta go take an aspirin.

(Kerry subcommittee's BCCI report, no copyright problems)

CAPCOM

Introduction

In the entire BCCI affair, perhaps no entity is more mysterious and yet more central to BCCI's collapse and criminality than Capcom, a London and Chicago based commodities futures firm which operated between 1984 and 1988. Capcom is vital to understanding BCCI because BCCI's top management and most important Saudi shareholders were involved with the firm. Moreover, Capcom moved huge amounts of money -- billions of dollars -- which passed through the future's markets in a largely anonymous fashion.

Capcom was created by the former head of BCCI's Treasury Department, Ziauddin Ali Akbar, who capitalized it with funds from BCCI and BCCI customers. The company was staffed, primarily, by former BCCI bankers, many of whom had worked with Akbar in Oman and few of whom had any experience in the commodities markets. The major investors in the company were almost exclusively Saudi and were largely controlled by Sheik AR Khalil, the chief of Saudi intelligence. Additionally, the company employed many of the same practices as BCCI, especially the use of nominees and front companies to disguise ownership and the movement of money. Four Americans, Larry Romrell, Robert Magness, Kerry Fox and Robert Powell -- none of whom had any experience or expertise in the commodities markets -- played important and varied roles as frontmen.

While the Subcommittee has been able to piece together the history of Capcom and can point to many unusual and even criminal acts committed by the firm, it still has not been able to determine satisfactorily the reason Capcom was created and the purposes it served for the various parties connected to the BCCI scandal. It appears from the available evidence that Akbar, BCCI, and the Saudis all may have pursued different goals through Capcom, including:

-- misappropriation of BCCI assets for personal enrichment.

-- laundering billions of dollars from the Middle East to the US and other parts of the world.

-- siphoning off assets from BCCI to create a safe haven for them outside of the official BCCI empire.

SNIP...

Despite suspicions about highly unusual transactions, CFTC Chairperson Wendy Gramm told the Subcommittee:

In terms of finding trading violations or Commodity Exchange Act violations that perhaps could support money laundering, we did not find any discernible pattern...o one has ben able to --at least other law enforcement officials have not been able to find money laundering in Capcom US, to our knowledge, as of now.(133)

Money laundering, as Chairperson Gramm testified, is not even a violation of the Commodities Futures Trading Act. Incredibly, it appears that the CFTC and the self-regulatory organizations have never even made a criminal referral for possible money laundering:

Senator Kerry. ave you ever specifically referred, or have any of the exchanges ever made a criminal referral for money laundering?

Dr. Gramm. We have raised concerns.

Senator Kerry. Have you made a criminal referral for money laundering?

Dr. Gramm. No. Not-- not specifically in that regard...

Continued...

http://www.fas.org/irp/congress/1992_rpt/bcci/21capcom.htm

"If integrity was cotton, you couldn't get enough from those two to make a T-shirt for a piss ant."

Enthusiast

(50,983 posts)Enthusiast

(50,983 posts)SammyWinstonJack

(44,130 posts)2pooped2pop

(5,420 posts)I see more and more of money going into their foundation followed by po!itical favors. I especially want to know more about the supposed uranium right to Russia issue. If this is what she sold as Sos, what the hell would she sell as POTUS?

Octafish

(55,745 posts)Remember the words and example of Adlai Stevenson Jr: "Corruption in public office is treason."

Which, for smart-as-whip lawyers in government service became the issue: How can we lawmakers work to make law that benefits the lawmakers legal?

bulloney

(4,113 posts)The Gramms and other uber wealthy have used their wealth to change policy to their benefit, even if it couldn't pass a legal smell test otherwise.

You can take a pig and call it a cat, but it's still a pig.

earthside

(6,960 posts)The Clintons play these elitist games that benefit themselves and their one percent pals.

Meanwhile ...

Carrier Indianapolis plant is closing 2017

VIDEO

https://www.facebook.com/lakeisha.austin.9/videos/1006671252738025/

Octafish

(55,745 posts)Added 276 jobs. All gone.

Do you know the saga of Magnequench?

Outsourcing US Missile Technology to China

The Saga of Magnequench

By JEFFREY ST. CLAIR

Coutnerpunch Weekend Edition April 7 - 9, 2006

Magnequench is an Indianapolis-based company. It specializes in the obscure field of sintered magnetics. Essentially, it makes tiny, high-tech magnets from rare-earth minerals ground down into a fine powder. The magnets are highly prized by electronics and aviation companies. But Magnequench's biggest client has been the Pentagon.

The neodymium-iron-boron magnets made by Magnequench are a crucial component in the guidance system of cruise missiles and the Joint Direct Attack Munition or JDAM bomb, which is made by Boeing and had a starring role in the spring bombing of Baghdad. Indeed, Magnequench enjoys a near monopoly on this market niche, supplying 85 percent of the rare-earth magnets that are used in the servo motors of these guided missiles and bombs.

But the Pentagon may soon be sending its orders for these parts to China, instead of Indiana. On September 15, 2004 Magnequench shuttered its last plant in Indiana, fired its 450 workers and began shipping its machine tools to a new plant in China. "We're handing over to the Chinese both our defense technology and our jobs in the midst of a deep recession," says Rep. Peter Visclosky, a Democrat from northern Indiana.

It gets stranger. Magnequench is not only moving its defense plants to China, it's actually owned by Chinese companies with close ties to the Chinese government.

Magnequench began its corporate life back in 1986 as a subsidiary of General Motors. Using Pentagon grants, GM had developed a new kind of permanent magnet material in the early 1980s. It began manufacturing the magnets in 1987 at the Magnequench factory in Anderson, Indiana.

In 1995, Magnequench was purchased from GM by Sextant Group, an investment company headed by Archibald Cox, Jr-the son of the Watergate prosecutor. After the takeover, Cox was named CEO. What few knew at the time was that Sextant was largely a front for two Chinese companies, San Huan New Material and the China National Non-Ferrous Metals Import and Export Corporation. Both of these companies have close ties to the Chinese government. Indeed, the ties were so intimate that the heads of both companies were in-laws of the late Chinese premier Deng Xiaopeng.

At the time of the takeover, Cox pledged to the workers that Magnequench was in it for the long haul, intending to invest money in the plants and committed to keeping the production line going for at least a decade.

Three years later Cox shut down the Anderson plant and shipped its assembly line to China. Now Cox is presiding over the closure of Magnequench's last factory in the US, the Valparaiso, Indiana plant that manufactures the magnets for the JDAM bomb. Most of the workers have already been fired.

CONTINUED...

http://www.counterpunch.org/stclair04072006.html

Offshoring jobs, technology and national security for capitalism!

Octafish

(55,745 posts)Debating Hillary Clinton, Sept. 26, 2016

CharlotteVale

(2,717 posts)Octafish

(55,745 posts)By Robert Scheer

The Nation, DECEMBER 21, 2012

Where is Phil Gramm hiding? The former Republican senator from Texas, who wrote the radical banking deregulation of the 1990s and was rewarded for his efforts to enrich the banks with a plum job at Switzerland-based UBS, has not been heard from since his bank got nailed by the G-men. Or, as The New York Times put it, UBS now has the distinction of being “the first big global bank in more than two decades to have a subsidiary plead guilty to fraud.”

SNIP...

That “modernization” in 2000 made legal the mergers that created the too-big-to-fail banks that had to be bailed out by taxpayers, as well as insuring that the burgeoning markets in toxic derivatives and credit default swaps were summarily freed from all government regulation. Bill Clinton signed off on the new laws, and his successor, George W. Bush, enthusiastically enforced them.

How fitting then to find the two presidents united again on several occasions documented on the UBS website participating in bank-sponsored panels on “Revitalizing America.” Clinton’s foundation has partnered with UBS in mentoring small businesses in poorer communities, the very communities hit hardest by the banking shenanigans of the past decade. Ever the optimist, Clinton promised that “Our partnership with UBS Wealth Management Americas will give these businesses essential new opportunities to expand and to make a positive difference in underserved communities.” With friends like these…

The cozy bipartisan reunion of Gramm with the two presidents under the auspices of UBS goes a long way toward explaining the source of our economic misery. It would be instructive to now ask all three whether the crimes of UBS had been enabled by their own actions while they were still running the US government.

That is why I assume the normally loquacious Gramm is on the lam, or surely we would have heard from him by now, at least on the Fox News Channel that has been so solicitous of his wisdom in the past. But not just on Fox. Gramm and his wife Wendy, who was rewarded with a position on Enron’s board of directors after her own stint in government undermining consumer protections, were the high priest and priestess of the religion of radical deregulation that captivated US presidents from Ronald Reagan through Bill Clinton and on to George W. Bush.

CONTINUED...

http://www.thenation.com/article/clinton-and-gramm-crony-capitalisms-power-couple/

Doctor_J

(36,392 posts)I do not think this makes her any more shady than 99% of the DC ruling/owning class. That's the problem. I believe we have chance to try to get rid of some of this rot this time around, which is why I am hoping to elect Bernie. I believe Hillary was once at her core an honest liberal. There is just too much DC in her at this point.

bulloney

(4,113 posts)Some serious changes must be made in the makeup of Congress, too. Without overhauling Congress, there will just be more of the gridlock we've seen.

There's a major cognitive disconnect with people in this country. Congress has had an approval rating in the teens for years, but over 95 percent of incumbents get re-elected. Everybody I know bitches about government but they'll vote the incumbent back to office every time even though their congressman is part of the problem. All these clowns have to do is campaign on the 3 G's--Guns, Gays & Gynecology--and they easily get re-elected.

arcane1

(38,613 posts)nolabels

(13,133 posts)Seriously though, I have always heard it said that you can't heal the world. But at any rate and probably like a lot of others , i would at least like to help make a few well placed dents ![]()

WillyT

(72,631 posts)Octafish

(55,745 posts)by JP Sottile

ConsortiumNews, Feb. 15, 2016

It was supposed to be a feel-good moment. The Chairman and CEO of the world’s most powerful financial institution dropped by CNBC’s Squawk Box to crow a bit about his recovery from cancer. But it didn’t quite go the way Lloyd Blankfein — or Hillary Clinton — might’ve wanted.

First, the recently-minted billionaire boss of Goldman Sachs compared his 600 hours of chemotherapy to dropping “napalm” on the Islamic State (“You get ISIS, but you also get some of the Kurds and Iraqis and everybody else”). Lloyd went on to tell Andrew Ross Sorkin that unlike another notable, newly-minted billionaire — fellow cancer survivor and comparably-connected JPMorgan Chase CEO Jamie Dimon — his brush with mortality didn’t really inspire circumspection about his life or about his crucial role in the profitable business of giving other people the business (“I must be so thick, I missed that whole thing”).

And then Lloyd revealed that Hillary Clinton isn’t the only one “feeling the Bern.” The remarkably unreflective Blankfein said the anti-Wall Street sentiment fueling Sen. Bernie Sanders’s insurgent campaign represented a “dangerous moment” for Wall Street and, by extension, for America. In that revealing moment of truth, Blankfein’s blurb not only encapsulated Wall Street’s growing discomfort with the surging candidacy of, as Blankfein put it, “another kid from Brooklyn,” but it also exposed Wall Street’s lingering detachment from the costly outcomes of its free-wheeling actions.

And it didn’t do Hillary any favors — which is something new for Goldman Sachs. Lloyd unintentionally poured gasoline into an already white-hot news cycle that’s raced out of Hillary’s control. And it further reinforced Bernie’s case that Hillary, the former Senator from Wall Street, is just too closely linked to the “rigged economy” to actually reform it.

But perhaps the most interesting part of Lloyd’s warning centered on his concerns about the post-election political landscape and his sense that the real danger is not people with pitchforks taking to the street. Rather, Lloyd is worried that Washington’s political machine could stall if all that public anger hampers politicians by turning a demonstrated willingness to “compromise” into a political liability. And when Wall Streeters talk about “compromise,” they are referring to their seemingly innate ability to manufacture bipartisan consent in spite of the often-bemoaned acrimony that locks up Republicans and Democrats.

For example, the two big post-Crash bailouts were built on exactly this type of compromise. And yes, there were two bailouts. There was the highly-visible, widely-reported $700+ billion Troubled Assets Relief Program (TARP). But there was also a host of “other,” often-secret bailouts and programs that may cost somewhere around $4 trillion to $7.7 trillion or, according to one accounting, as high as $16.8 trillion. Most Americans are unfamiliar with those side-deals built on Washington’s reliable willingness to compromise with Wall Street.

CONTINUED w/links...

http://www.commondreams.org/views/2016/02/12/hillary-clintons-pay-play-reality

SMC22307

(8,090 posts)Octafish

(55,745 posts)By Corbin Hiar

Mother Jones | Fri Jan. 29, 2010

EXCERPT...

UBS was one of eight large investment banks that benefited from the now-infamous backdoor bailout of AIG—resulting in government cash infusions totaling $182.5 billion—in the dark days of September 2008. At the hearing, the Special Inspector General for the Troubled Asset Relief Program, Neil Barofsky, revealed to the House Oversight and Government Reform Committee that UBS was the only bank willing to settle its soured credit default swaps (CDS) contracts for less than their face value. Why did UBS play ball when all the other banks didn't? As the Washington Independent reported, "Barofsky speculated that the firm probably simply recognized that the American taxpayers 'had taken the global economy on its back.'"

SNIP...

At the time of the backdoor bailout, UBS was under scrutiny from both the Internal Revenue Service and the Securities and Exchange Commission as a result of information disclosed to them by a whistleblower—one of their former bankers, Bradley Birkenfeld. As the Senate Subcommittee on Investigations reported in July 2008, UBS had hidden from American authorities "an estimated 19,000 accounts in Switzerland for US clients with assets valued at $18 billion." Half a year later, UBS would agree to pay a record-breaking $780 million penalty to the US government and turn over 4,500 client names to avoid an indictment that FINMA, the Swiss regulatory agency, said "would have threatened its existence."

Despite what some brazen Wall Street CEOs now claim, the credit crunch was an existential threat to every over-leveraged big bank. What's most shocking about the AIG bailout—besides the dizzying amount of taxpayers' money involved—is that these endangered banks were able to extract such a sweet deal from the government. The banks were paid the full value of all the CDS contracts they had made with AIG—including those mortgage-backed securities they had bought when it was clear the subprime market was collapsing. After the housing market took a nosedive, these contracts were, of course, worth a fraction of their original value on the open market: Similar CDSs issued by other insurers that were settled during the crisis paid out at 13 cents on the dollar. Talking about the AIG deal with New York magazine, a former state insurance commissioner described it as being able "to collect on an insurance policy without having the loss."

Why didn't the government push for a tougher deal? At the Oversight Committee hearing, Barofsky revealed that as the New York Fed negotiated with AIG's trading partners about how much they would receive for their CDSs, it only dealt with mid-level managers at the banks, not top executives. Barofsky asked, "Would it have made a difference if (then-Treasury Secretary Hank Paulson and then-New York Fed chief Tim Geithner) talked to the CEOs? We'll never know because the effort was simply not taken."

Now, even the settlement the Department of Justice extracted from UBS looks to be in jeopardy. To avoid prosecution, UBS immediately paid its fine and disclosed 250 of the promised 4,500 names of holders of the hidden accounts. But the Swiss high court ruled that disclosure a violation of the country's banking secrecy laws. This could prevent the handover of the other secret accounts—and could hinder the US government's efforts to collect the fines owed by their owners. And as it turns out, UBS' offer to accept a lower payout on its bad derivatives bets never came to anything in the end. Treasury Secretary Tim Geithner told the House panel that, even in its weakened state, UBS only offered to bargain "if everybody else would agree to equal concessions on their prices." The other banks that had traded with AIG declined to do so, and so UBS received full payment on its CDS contracts, just like the others.

CONTINUED...

http://www.motherjones.com/mojo/2010/01/ubs-good-bank-aig-bailout

retrowire

(10,345 posts)navarth

(5,927 posts)Please keep speaking truth to power.

zentrum

(9,865 posts)…….posted this.

Where even to start? There's so much hand in glove business as usual.

Bottom line—either she's lying continuously to us or she lied to all the banksters to their faces when she took their money, intending to be an economic progressive once she entered office again.

Somehow though, I don't think Robin Hood ever would have needed focus groups to know what words to say to the peasants.

1norcal

(55 posts)Perfect timing with the facts...Thanks Octafish.

Duval

(4,280 posts)dragonfly301

(399 posts)this will get the light of day if she is the nominee. Just the kind of story that will keep Bernie's young voters enthused for Hillary (not).

salib

(2,116 posts)Apparently, "UBS ultimately turned over information on 4,450 accounts, a fraction of the 52,000 sought by the IRS."

If I were at UBS I would be jumping with joy because I could turn over only those I wish to punish, or I could get favors from others if I just punished some of the depositors. What a gift.

arcane1

(38,613 posts)Arugula Latte

(50,566 posts)I'm so tired of them both.

mgmaggiemg

(869 posts)HRC gets money for speaking to the private sector after working for the government for 18 years w/o a paycheck....so you see why you are having a hard time getting sympathy from women...we are title 9ing this one...like billie jean king...we are out there to beat your azz because you feel entitled....just as you want to beat HRC because you think she feels entitled the problem is half the total population of voters are women who are not entitled who know that women in politics is still very much a controversial and hated idea....but I can tell you this....Bernie has the privilege and honor of being HRC's handmaiden.(think margaret atwood). if you don't like it and want to throw a temper tantrum...it just makes it more satisfying for us...so thank-you ![]()

AlbertCat

(17,505 posts)mgmaggiemg

(869 posts)name something specific ...isn't it shroedinger's cat?

cali

(114,904 posts)And the post of yours referred to, is a hot mess.

mgmaggiemg

(869 posts)what did you think that I was saying?

zeemike

(18,998 posts)But they are powerful and will beat the men like BJK did and take over the world?

Or some such power fantasy that some people seem to enjoy.

AlbertCat

(17,505 posts)I'm still trying to figure out when Hillary worked for the government for free.... for 18 years. Senators get paid and so do SoSs, no? Not to mention perks and privileges. Could it mean her college years or something?

Otherwise it seemed like a "berniebros hate women.... but we're gonna git ya!" minitirade written in the form of a 3 volume fantasy novel.

ebayfool

(3,411 posts)shit just spewing in every direction, so it's impossible to make sense of it.

LondonReign2

(5,213 posts)she is a woman. Women have historically been opposed, thus it is perfectly acceptable for her to steal whatever she can, no matter how sleazy.

cali

(114,904 posts)NY is an equitable distribution distribution state. And the SoS salary is $203,000. Senators do just fine too. Bernie is doing just fine with women voters. Btw, your claim that Bernie is Hillary's "handmaiden" is weird and makes it look like you never even read the book.

Hillary gave those speeches for no other reason than simple greed. Hardly surprising

how much was mitt romney worth who didn't get elected...the transparency of the hatred of women who are voting for women because they are women by men who are voting for men just because they are men since the beginning of democracy....just makes you guys look like selfish jerks....![]() did read the book....handmaiden is what I call my sister in law...my genes are passed on through my brother so my sister in law is raising my kids....I mean it in the same way....Bernie is incubating the left for us and we love it ...I like bernie a lot...so I am happy he's running....(Bernie is doing the work and HRC will benefit...that is why he is the handmaiden....)

did read the book....handmaiden is what I call my sister in law...my genes are passed on through my brother so my sister in law is raising my kids....I mean it in the same way....Bernie is incubating the left for us and we love it ...I like bernie a lot...so I am happy he's running....(Bernie is doing the work and HRC will benefit...that is why he is the handmaiden....)

Kurovski

(34,655 posts)Or similar to that.

nashville_brook

(20,958 posts)it's not entitlement, but i'm willing to *work* for a government that isn't hobbled by corruption, where big money buys big favors.

i believe that it's a problem, that the Sec of State was selling favors to other governments in exchange for Clinton Foundation donations. when she was making those deals, do you think she was doing it for Billie Jean King, or for some kind of intersectional feminist agenda? no -- she was advancing her OWN agenda.

i'm sure you'll be satisfied when and if HRC takes office. if you're as interested in women's issues as you say you are, i'll bet you dimes to donuts you won't be so thrilled by the time she gets out of office. know how i know? i've been there and done that. she's already been "co-president" -- you can check the record on women's issues (and racial issues too..."super predators"!). we LOST ground.

PatrynXX

(5,668 posts)one guy who clearly woulda gone to jail for years but really didn't well if you got 2001-2008 were great guess your rooting for Hillary

PatrynXX

(5,668 posts)1993 World Trade Center Bombing 2001 World Trade Center bombing happened on who's watch. yeah that wasn't hillary but as she's running off Bills time you have to go with the baggage too

TIME TO PANIC

(1,894 posts)marmar

(77,081 posts)..... Another of millions of examples of the rot and corruption in our political system. The Clintons are waist deep in it.

Enthusiast

(50,983 posts)some turtle looking fuckers because the Republicans have them all on their team. ![]()

KoKo

(84,711 posts)Girding for a Fight, McConnell Enlists His Wife

By JASON HOROWITZMAY 13, 2014

WASHINGTON — At Harvard Business School, Elaine L. Chao kept card files on her classmates, then later kept tabs on their careers. As labor secretary, she had gold-colored coins minted with her name in bas-relief and employed a “Veep”-like staff member who carried around her bag.

And, as the steadfast spouse of Senator Mitch McConnell, she can recite the names of people who have donated to her husband — and how much they gave, friends say.

Those who have encountered Ms. Chao describe her as an unapologetically ambitious operator with an expansive network, a short fuse, and a seemingly inexhaustible drive to get to the top and stay there. Those characteristics helped lift Ms. Chao from her childhood as a Chinese immigrant who could not speak English to the heights of the George W. Bush administration, and they are coming in handy again now that her husband, the highest-ranking Republican in the Senate, confronts a re-election fight that could render him the Senate majority leader or a retiree.

Ms. Chao, who played an early role in her husband’s effort to neutralize a primary challenger he seems likely to dispatch next week, will be more crucial than ever as he turns to face a well-funded female candidate for the first time in his Senate career.

The McConnell campaign said that Ms. Chao, 61, would be a key surrogate in ads and at speaking events, especially if his Democratic opponent, Alison Lundergan Grimes, “runs a campaign that tries to paint a picture of Mitch McConnell as having some kind of a blind spot for women’s issues,” said Josh Holmes, Mr. McConnell’s former chief of staff and a senior adviser. “Obviously we have a pretty strong firsthand testimonial from somebody who can speak to how untrue that is.”

After starring in her husband’s first campaign commercial, Ms. Chao appeared in a campaign web video, shaking an encouraging fist for him.

“She is someone who I say is really great for Senator McConnell and needs to be out there really all the time,” said Rand Paul, the junior senator from Kentucky and a possible presidential aspirant who has forged a working, if wary, relationship with Mr. McConnell. “Because I think we need more strong women who have been successful in their careers out there.”

But while Ms. Chao’s inspiring immigrant story and high-flying résumé are clearly assets, she also reinforces Mr. McConnell’s image as the ultimate Washington establishment figure. Ms. Chao hobnobs with conservative moguls (“She’s on my board!” said Rupert Murdoch) and Obama administration movers, and she has spheres of influence stretching up the East Coast.

In New York, her father is a shipping magnate and several of her five younger sisters married Wall Street titans, including Bruce Wasserstein, the late owner of New York Magazine. In Cambridge last month, she broke ground at the Harvard Business School on a building endowed with $40 million of her family’s fortune.

She is known for being devoted to her family, and engendering great loyalty from some staff members. But she is at least equally renowned for her strong sense of self. In 2004, she likened herself and her husband to Bob and Elizabeth Dole, then the reigning Republican power couple, when she talked to The Paducah Sun about the prospect of her serving as a cabinet secretary while her husband ascended to Senate majority leader.

The power couple’s story is told on the walls of the McConnell-Chao Archives, located at the University of Louisville. On one side are McConnell family artifacts illustrating how the future senator overcame polio to play baseball and lead his high school class. There is no mention of his first wife, Sherrill Redmon, who went on to become a feminist scholar and collaborate with Gloria Steinem at Smith College.

Much More at:

http://www.nytimes.com/2014/05/14/us/politics/girding-for-a-fight-mcconnell-enlists-his-wife.html?_r=0

pnwmom

(108,980 posts)H2O Man

(73,558 posts)Thank you.

99th_Monkey

(19,326 posts)LongTomH

(8,636 posts)The article adds that “there is no evidence of any link between Mrs. Clinton’s involvement in the case and the bank’s donations to the Bill, Hillary and Chelsea Clinton Foundation, or its hiring of Mr. Clinton.”

Oh yeaahhhhh!!!!! We believe that, don't we kids????

HughBeaumont

(24,461 posts)But he predicted the billionaire would drop out after losing the upcoming Iowa and New Hampshire contests.

“There’s a big difference between liking somebody who tells it like it is and voting for them for president,” said Gramm, who ran for president in 1996. “I don’t see it happening.”

Octafish

(55,745 posts)Thank you for the heads-up, HughBeaumont! Great blog, that Trailblazersblog!

Not to say that Meyer Lansky of the War Party or even a Dr. Evil wannabe represents a broad spectrum of complex criminal behaviors, but I can see a glimmer of life imprisonment as opposed to what he merits based on what he's done to millions of families in the USA alone. Phil's no crazy turtle.

Enthusiast

(50,983 posts)rhett o rick

(55,981 posts)Enthusiast

(50,983 posts)rhett o rick

(55,981 posts)war on the 99%.

think

(11,641 posts)Kurovski

(34,655 posts)Oh how I wish these things were not so. Maybe that's why folks turn a blind eye?

ebayfool

(3,411 posts)Excellent, as usual - bookmarking, reccing and savoring ...!

rhett o rick

(55,981 posts)Uncle Joe

(58,365 posts)Thanks for your good works, Octafish. ![]()

![]()

colsohlibgal

(5,275 posts)Excuses are futile Hillary drones.

Feel The Bern!!

Kurovski

(34,655 posts)SMC22307

(8,090 posts)Kick.

AzDar

(14,023 posts)WillyT

(72,631 posts)Duppers

(28,125 posts)Amazing reporting, Octafish, per usual.

![]()

bigwillq

(72,790 posts)monicaangela

(1,508 posts)I don't know which would be worse in the White House...Clinton, Trump, or Cruz. ![]()

amborin

(16,631 posts)SidDithers

(44,228 posts)Writing for The Atlantic, Friedersdorf laid out his argument for why he refused to vote for Barack Obama in 2012 and was supporting Gary Johnson in his bid for president as the Libertarian Party candidate.[5]

Sid

Octafish

(55,745 posts)SidDithers

(44,228 posts)to attack Democrats.

Sid

Octafish

(55,745 posts)Or DUer, as the case may be.

http://www.democraticunderground.com/10026398318#post434

SidDithers

(44,228 posts)I merely pointed out that a right-wing Libertarian author is being used to attack a Democrat at DU.

Sid

Octafish

(55,745 posts)Otherwise, you might be able to show where they don't.