2016 Postmortem

Related: About this forumChicago Tribune: Bernie's top Federal tax rate: 77%. 85% including state and local.

Last edited Sat Feb 6, 2016, 08:07 PM - Edit history (2)

If you dispute this, do you know what the real numbers are? If this isn't true, Bernie's campaign should get out there and explain what the top rate WOULD be, if ALL his proposed increases were passed -- not just his single payer plan.By way of background, the Chicago Tribune endorsed Obama for President both in 2008 and 2012. It is not, as another DUer claimed, a "far right rag."

http://www.chicagotribune.com/news/opinion/editorials/ct-federal-debt-campaign-edit-0207-20160205-story.html

We were startled but not surprised Wednesday when an email from the nonpartisan Committee for a Responsible Federal Budget hit our inbox.

Turns out that even with the soak-the-rich tax hikes that presidential candidate Bernie Sanders envisions, his health proposal still would, over a decade, fall short by $3 trillion to $14 trillion. Projections depend on variables that would only terrify taxpayers — the same taxpayers whose federal debt just topped $19 trillion. CRFB says Sanders' health, Social Security and family leave tax plans would goose the top federal tax rate to about 77 percent. And, "When state and local taxes are included, the top rate rises to an average of about 85 percent (nationwide) ..."

Sanders at least acknowledges that his "Medicare for All" would force huge tax increases. Even though, as CRFB gently says in projecting those multitrillion-dollar shortfalls, "the numbers at the moment don't appear to add up."

Nor do the numbers add up for most of the candidates' plans. To borrow an apt headline from a Des Moines Register editorial on Iowa Caucuses Eve: "Candidates offer deficit of ideas on debt." This even though, half a year earlier, 94 percent of likely Republican caucus-goers, and 74 percent of Democrats, had told Register pollsters they wanted candidates to "spend a lot of time talking about" America's crushing debt.

SNIP

reformist2

(9,841 posts)pnwmom

(108,980 posts)forty years by 49 states to 1, and both times it was because the Democratic candidate pushed for higher taxes.

Admiral Loinpresser

(3,859 posts)Are you in favor of it?

pnwmom

(108,980 posts)Admiral Loinpresser

(3,859 posts)A tax that saves thousands per year for working and middle class. Everybody but the rich will experience profound savings in health care as in no health insurance premiums, no co-pay and vastly reduced drug costs. It's a huge transfer of income from health insurance to the middle class. Please enlighten me if I've got it wrong.

pnwmom

(108,980 posts)of their paychecks.

Admiral Loinpresser

(3,859 posts)I can't open your Trib link unless I pay them something. I'm not doing that.

kristopher

(29,798 posts)kristopher

(29,798 posts)http://www.oecdbetterlifeindex.org/topics/life-satisfaction/

Life Satisfaction

Background

Measuring feelings can be very subjective, but is nonetheless a useful complement to more objective data when comparing quality of life across countries. Subjective data can provide a personal evaluation of an individual’s health, education, income, personal fulfilment and social conditions. Surveys, in particular, are used to measure life satisfaction and happiness.

Life satisfaction

Life satisfaction measures how people evaluate their life as a whole rather than their current feelings. When asked to rate their general satisfaction with life on a scale from 0 to 10, people across the OECD gave it a 6.6 grade. Life satisfaction is not evenly shared across the OECD however. Some countries – Estonia, Greece, Hungary, Portugal and Turkey – have a relatively low level of overall life satisfaction, with average scores of less than 5.6. At the other end of the scale, scores reach 7.5 in Denmark, Iceland and Switzerland. There is almost no difference in life satisfaction levels between men and women across OECD countries. However, when looking at people’s education level, there is a clear difference: whereas people who have only completed primary education across OECD countries have a life satisfaction level of 5.9, this score reaches 7 for people with tertiary education....

Details by country...

World's Happiest Countries? Social Democracies

by

Craig Brown

A new report released by the Organization for Economic Co-Operation and Development (OECD) shows that happiness levels are highest in northern European countries.

Denmark, Finland and the Netherlands rated at the top of the list, ranking first, second and third, respectively.

The US? As expected, the United States failed to make the top 10 but ranked among the highest for obesity and child poverty. Americans spend less than half the amount of time eating as the French, but have three times the obesity rate. “This tells us something about slow food, I think,” Simon Chappele, editor of the report said in an interview with NPR.

The report also showed the United States has the lowest mean age for women when they first gave birth, at 25.1 years old...

http://www.commondreams.org/further/2009/05/11/worlds-happiest-countries-social-democracies

06/05/2015

Denmark’s residents are the most satisfied with their lives, according to the Better Life Index released Monday. According to the study, published annually by the Organization for Economic Co-operation and Development (OECD), the United States failed to crack the top 10 for the fifth consecutive year.

The Better Life Index rates the 34 OECD member nations, as well as Brazil and the Russian Federation, on 22 variables that contribute to overall well-being, including income, education, housing, health, and life satisfaction. 24/7 Wall St. reviewed the 10 countries with the highest life satisfaction score.

A healthy job market is one of the most important factors contributing to higher life evaluations. Employment rates — the percentage of the working-age population that is employed — were higher in each of the 10 countries with the highest life satisfaction score than the average employment rate for the countries reviewed.

Conversely, countries with relatively unhealthy job markets had lower life satisfaction scores. Unemployment rates were above 8.5% in seven of the 10 least happy countries, while they were lower than 7% in all but two of the happiest countries.

Healthy labor markets not only help promote job security, but also they can ...

http://www.huffingtonpost.com/2015/06/05/these-are-the-happiest-co_n_7521674.html

http://www.forbes.com/best-countries-for-business/list/#tab

Rank Name GDP Growth GDP per Capita Trade Balance/GDP Population

#1 Denmark 1.1% $44,600 6.3% 5.6 M

#2 New Zealand 3.3% $35,300 -3.2% 4.4 M

#3 Norway 2.2% $67,200 9.4% 5.2 M

#4 Ireland 5.2% $51,300 3.7% 4.9 M

#5 Sweden 2.3% $46,200 6.2% 9.8 M

#6 Finland -0.4% $40,700 -1.8% 5.5 M

#7 Canada 2.4% $45,000 -2.1% 35.1 M

#8 Singapore 2.9% $83,100 19.1% 5.7 M

#9 Netherlands 1% $48,000 10.4% 16.9 M

#10 United Kingdom 3% $39,800 -5.9% 64.1 M

#11 Hong Kong 2.5% $55,100 1.9% 7.1 M

#12 Switzerland 1.9% $58,100 7.2% 8.1 M

#13 Iceland 1.8% $44,000 3.6% 0.3 M

#14 Australia 2.7% $46,600 -3% 22.8 M

#15 Belgium 1.1% $43,100 1.6% 11.3 M

#16 Portugal 0.9% $27,100 0.6% 10.8 M

#17 Lithuania 3% $27,300 0.1% 2.9 M

#18 Germany 1.6% $46,200 7.4% 80.9 M

#19 Estonia 2.9% $27,900 0.1% 1.3 M

#20 Slovenia 3% $29,900 6.9% 2 M

#21 Taiwan 3.8% $46,000 12.4% 23.4 M

#22 United States 2.4% $54,400 -2.2% 321.4 M

#23 Japan -0.1% $37,500 0.5% 126.9 M

A crash course in social democracy.

By Ann JonesJANUARY 28, 2016

http://www.thenation.com/article/after-i-lived-in-norway-america-felt-backward-heres-why/

Autumn

(45,106 posts)and that doesn't count deductibles and out of pocket. Any person who actualy thinks it through for a few minutes will come to that conclusion.

Renew Deal

(81,861 posts)

reformist2

(9,841 posts)metroins

(2,550 posts)I'll vote Republican.

I don't care how crazy they are and I'd fire some employees.

thesquanderer

(11,989 posts)...only applies to each dollar of income over $10 million.

If that's your income, yeah, you might want to vote Republican.

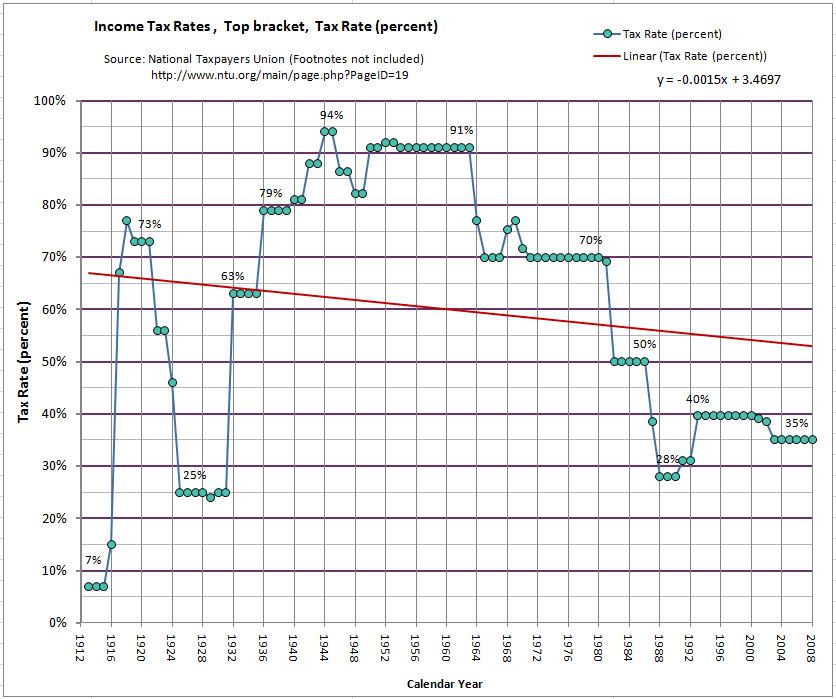

Check post #48 to see about what your top rate would be. It's not exactly right, but it gives you the idea. (And keep in mind that marginal tax rates only affect a portion of your income, not the entire thing.)

pangaia

(24,324 posts)DefenseLawyer

(11,101 posts)Or just the presidential election in 1984?

senz

(11,945 posts)When times were much better for many more Americans than they are now.

SoLeftIAmRight

(4,883 posts)surtax on corporations with profits over 1 million - equal to the current unemployment rate

Gothmog

(145,320 posts)redstateblues

(10,565 posts)Gothmog

(145,320 posts)That would be a worse defeat than Mondale

harun

(11,348 posts)Also we should mention on the first X amount of their income that is the same as the little people, they pay the same rate as the little people.

TTUBatfan2008

(3,623 posts)Maximum tax rates were 90% when Eisenhower was in office and the country's economy was doing a hell of a lot better at that point. Reagan really fucked over everything by slashing rates and moving the goal posts on acceptable tax rates. That is where our national debt started exploding.

dsc

(52,162 posts)otherwise not so much.

TTUBatfan2008

(3,623 posts)it was doing about $20 Trillion times better. Taxing the rich was a commonly accepted thing back then and Reagan completely changed that. A 90% tax on annual income above a level like $5m or something is not going to hurt anyone other than the super rich.

Warren DeMontague

(80,708 posts)Serious question.

dsc

(52,162 posts)but the wages of straight white men were artifically inflated by keeping competition from the rest of the people out of the labor market. I think that should be pointed out.

Warren DeMontague

(80,708 posts)It is specifically about the top marginal rates during that time.

If the argument is that tax cuts for the people who make six figures a DAY are somehow intrinsically helpful to minorities, man, I'd like to hear that one.

Travis_0004

(5,417 posts)Yes, tax rates were 90%, but there there were significantly more things you can deduct. Look at tax returns of politicians from this area. They were paying rates of around 40%, maybe 45%. Nobody was paying 90%.

Also, our economy was booming, but we just finished spending half a decade bombing the rest of the world to oblivion. All of Europe was in rebuilding mode.

And lets not forget, life was petty good if you were white. Not quite as good for everybody else.

Warren DeMontague

(80,708 posts)Which is why people at the very top can afford to pay higher marginal rates.

TTUBatfan2008

(3,623 posts)It was a huge problem in society. From a balanced budget standpoint the economy was a hell of a lot better off than it is now.

kysrsoze

(6,022 posts)All the money you have made up to that top bracket level is taxed at a lower rate, so your effective tax rate, including deductions, is much lower. The key so at level the top tax rate kicks in.

Gothmog

(145,320 posts)The kochs could run a couple hundred million dollars of attack ads using these numbers and Sanders would finish worse than Mondale

stonecutter357

(12,697 posts)HooptieWagon

(17,064 posts)They've been stealing from us for 36 years, now it's payback time.

MoonRiver

(36,926 posts)libdem4life

(13,877 posts)Gregorian

(23,867 posts)Yes, his top rate is what I said. Here's the link

Establishes four new brackets of 37%, 43%, 48%, and 52%. The top rate applies to taxable income over $10 million. Raises the rate of all other brackets by 2.2%.

http://taxfoundation.org/comparing-2016-presidential-tax-reform-proposals

fwiff

(233 posts)The increases would be on marginal rates, and only applies to what you make over that amount

They're making crap up again.

[link: |

|

thesquanderer

(11,989 posts)SickOfTheOnePct

(7,290 posts)No.

The tax for single payer will be a payroll tax, not an income tax, so it wouldn't be included in the income tax brackets.

Response to SickOfTheOnePct (Reply #119)

thesquanderer This message was self-deleted by its author.

thesquanderer

(11,989 posts)From page 7 of https://berniesanders.com/wp-content/uploads/2016/01/Medicare-for-All.pdf

...

This year, a family of four taking the standard deduction can have income up

to $28,800 and not pay this tax under this plan.

A family of four making $50,000 a year taking the standard deduction would

only pay $466 this year.

Note that the tax is described as being "income based". And that rather than being a fixed rate (payroll tax, like FICA), it is applied to that income you have after taking deductions. So it is a progressive income tax instead of a regressive payroll tax.

Though there is something that I just realized is vague... He specified new income tax rates for people making more than $250k (37%, 43%, 48%, and 52%)... you actually may have to add 2.2 to these figures as well (or possibly 8.4 if you're self-employed and have to cover the employer's share too).

SickOfTheOnePct

(7,290 posts)I could have sworn I read it was a payroll tax.

It really should be a payroll tax rather than an income tax. Make it progressive, but everyone should have to pay something.

thesquanderer

(11,989 posts)I wonder if there have been any changes to the PDF between its initial posting and now.

(Though from the employer side, I'm not sure what the actual difference would be anyway.)

cali

(114,904 posts)Sources.

Mrs. Pot, meet Mr. Kettle.

The Chicago Tribune believes in the traditional principles of limited government; maximum individual responsibility; minimum restriction of personal liberty, opportunity and enterprise. It believes in free markets, free will and freedom of expression. These principles, while traditionally conservative, are guidelines and not reflexive dogmas.

The Tribune brings a Midwestern sensibility to public debate. It is suspicious of untested ideas.

The Tribune places great emphasis on the integrity of government and the private institutions that play a significant role in society. The newspaper does this in the belief that the people cannot consent to be governed unless they have knowledge of, and faith in, the leaders and operations of government. The Tribune embraces the diversity of people and perspectives in its community. It is dedicated to the future of the Chicago region.

The Tribune has remained economically conservative, being widely skeptical of increasing the minimum wage and entitlement spending. Although the Tribune criticized the Bush administration's record on civil liberties, the environment, and many aspects of its foreign policy, it continued to support his presidency while taking Democrats, such as Illinois Governor Rod Blagojevich and Cook County Board President Todd Stroger, to task and calling for their removal from office.

https://en.m.wikipedia.org/wiki/Chicago_Tribune#The_2010s

senz

(11,945 posts)Hoyt

(54,770 posts)Warren DeMontague

(80,708 posts)

Jefferson23

(30,099 posts)Gregorian

(23,867 posts)

avaistheone1

(14,626 posts)Where are my smelling salts? ![]()

Live and Learn

(12,769 posts)cali

(114,904 posts)about Sanders supporters using right wing sources.

pnwmom

(108,980 posts)The Chicago Tribune did.

cali

(114,904 posts)EmperorHasNoClothes

(4,797 posts)GeoWilliam750

(2,522 posts)For private prisons

For pharmaceuticals

For our banking system

For the TSA

For immigration services and background checks

For sub-contracting military functions

For poor internet service

For them taking our water, and then selling it back to us at a higher price

For toll roads and other public utilities sold into private hands

For privatising a large number of public services, for which which now pay high prices for inferior goods and services

For subsidising their factories and stadiums

For weapons which cost a fortune and do not work

For privatising VA services

And now they want to privatise social security amongst many other things

To a significant degree, we have abdicated our responsibility as citizens. First, let us stop paying taxes to the super wealthy - typically at higher prices than we would pay for the public sector - that alone will generate a great deal of wealth.

Then let us get them to pay their fair share of taxes, and eliminate their fraud

Odin2005

(53,521 posts)cali

(114,904 posts)pnwmom

(108,980 posts)cali

(114,904 posts)Particularly economically. Are you contesting their statement? Fascinating.

pnwmom

(108,980 posts)are wrong, where are the right ones? Where has Bernie officially added up what all his separate tax increases would amount to? I can't find this anywhere, but you must know since you're so sure the figures in this article are incorrect.

cali

(114,904 posts)I think the highest rate that he's proposed is 50%.

Here:

<snip>

Bernie did not go crazy with the marginal rates. Forget about Dwight Eisenhower and the 90% . Looking at marginal income tax rates alone, Bernie could say, with a straight face, that he is less of a socialist than Ronald Reagan. In 1983, the top rate of 50% kicked in, for a married couple, at $109,400, which is the equivalent of about $260,000 today. On the other hand, when you consider the elimination of the social security cap and the new health care tax, a self-employed person making in the high six, low seven figure ballpark is facing a marginal rate in the high sixties.

<snip>

http://www.forbes.com/sites/peterjreilly/2016/01/19/bernie-sanders-tax-plan-moderate-on-top-income-tax-rate/2/#903a8f154277

And fucking again:

The Chicago Tribune believes in the traditional principles of limited government; maximum individual responsibility; minimum restriction of personal liberty, opportunity and enterprise. It believes in free markets, free will and freedom of expression. These principles, while traditionally conservative, are guidelines and not reflexive dogmas.

The Tribune brings a Midwestern sensibility to public debate. It is suspicious of untested ideas.

The Tribune has remained economically conservative, being widely skeptical of increasing the minimum wage and entitlement spending.

https://en.m.wikipedia.org/wiki/Chicago_Tribune#The_2010s

You posted smears.

pnwmom

(108,980 posts)also raise the tax rate, like the Medical leave plans (which Hillary would pay for by closing loopholes, not raising the rate), and his free college tuition plans.

So the question is what all his new taxes would amount to put together, not just the single-payer plan.

Gothmog

(145,320 posts)The cost savings are speculative at best and are on the same level as the GOP's claims of increased income due to tax cuts. I trust Prof. Krugman on this http://krugman.blogs.nytimes.com/2016/01/19/weakened-at-bernies/?_r=0

On health care: leave on one side the virtual impossibility of achieving single-payer. Beyond the politics, the Sanders “plan” isn’t just lacking in detail; as Ezra Klein notes, it both promises more comprehensive coverage than Medicare or for that matter single-payer systems in other countries, and assumes huge cost savings that are at best unlikely given that kind of generosity. This lets Sanders claim that he could make it work with much lower middle-class taxes than would probably be needed in practice.

To be harsh but accurate: the Sanders health plan looks a little bit like a standard Republican tax-cut plan, which relies on fantasies about huge supply-side effects to make the numbers supposedly add up. Only a little bit: after all, this is a plan seeking to provide health care, not lavish windfalls on the rich — and single-payer really does save money, whereas there’s no evidence that tax cuts deliver growth. Still, it’s not the kind of brave truth-telling the Sanders campaign pitch might have led you to expect.

Again, as noted by Prof. Krugman this plan does not add up.

Kip Humphrey

(4,753 posts)Matariki

(18,775 posts)The people in that tax bracket need to be slowed down in their quest to take all the things.

Bluenorthwest

(45,319 posts)That was paid by individuals making 200K or couples making 400K which in today's dollars would be about 1.7 million for an individual or 3.4 million for a couple.

During WW2 the top hit a record 94%.

I wonder if the OP can tell us how many people she knows to which those rates would apply. I know a few and the majority of them would happily pay up. Let's say you make about 2 million giving some speeches. If you 'only' end up with 200K are you really being under compensated for your few day's travel and chat? If you make a movie and are paid 20 million and you 'just' get to keep 2 million, are you not still rich as shit and getting another couple million for the next one and can't I in fact live a lifetime on 2 million and don't others live a lifetime on what some get for a series of chats in comfy chairs with lemon water and glory?

It's way more fun to have a few million in a society that is healthy than to have a hundred million in a society that veers toward squalor. It just is. Tax it. It's only money.

pangaia

(24,324 posts)TOO many posting here don't know what it is !!!

Shit, ,and these people actually VOTE!!

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Sorry to yell...

![]()

DefenseLawyer

(11,101 posts)sounds fine to me. Not only will it raise much needed revenue, it provides a disincentive to greed and a greater incentive to reinvest, pay higher wages, etc.

Ed Suspicious

(8,879 posts)Response to pnwmom (Original post)

cali This message was self-deleted by its author.

pnwmom

(108,980 posts)cali

(114,904 posts)when Sanders supporters do it, is a joke. I'll be glad to post another right wing hit job on Hillary from the Tribune as the link to that one doesn't work. I'll delete that one and find another- just for you.

pnwmom

(108,980 posts)not a right wing rag. Your ignorance is showing.

m-lekktor

(3,675 posts)pnwmom

(108,980 posts)Obama supporters, especially African Americans, to fall at Bernie's feet.

Gothmog

(145,320 posts)One of the reasons why Sanders is not doing well with African American voters lies in the attacks on President Obama and the difference between how Sanders supporters and Clinton supporters each view President Obama I admit that I am impressed with the amount accomplished by President Obama in face of the stiff GOP opposition to every one of his proposals and I personally believe that President Obama has been a great President. It seems that this view colors who I am supporting in the primary http://www.huffingtonpost.com/entry/clinton-sanders-obama_us_56aa378de4b05e4e3703753a?utm_hp_ref=politics

On one side of this divide are activists and intellectuals who are ambivalent, disappointed or flat-out frustrated with what Obama has gotten done. They acknowledge what they consider modest achievements -- like helping some of the uninsured and preventing the Great Recession from becoming another Great Depression. But they are convinced that the president could have accomplished much more if only he’d fought harder for his agenda and been less quick to compromise.

They dwell on the opportunities missed, like the lack of a public option in health care reform or the failure to break up the big banks. They want those things now -- and more. In Sanders, they are hearing a candidate who thinks the same way.

On the other side are partisans and thinkers who consider Obama's achievements substantial, even historic. They acknowledge that his victories were partial and his legislation flawed. This group recognizes that there are still millions of people struggling to find good jobs or pay their medical bills, and that the planet is still on a path to catastrophically high temperatures. But they see in the last seven years major advances in the liberal crusade to bolster economic security for the poor and middle class. They think the progress on climate change is real, and likely to beget more in the future.

It seems that many of the Sanders supporters hold a different view of President Obama which is also a leading reason why Sanders is not exciting African American voters. Again, it may be difficult for Sanders to appeal to African American voters when one of the premises of his campaign is that Sanders does not think that President Obama is a progressive or a good POTUS.

Again, I am not ashamed to admit that I like President Obama and think that he has accomplished a great deal which is why I do not mind Hillary Clinton promising to continue President Obama's legacy. I do not believe that Sanders is a racist but I also believe that there are valid reasons why many non-African American democrats (myself included) and many African American Democrats are not supporting Sanders.

Ferd Berfel

(3,687 posts)and yes they did endorse OBama...against Grampy and Caribou Barbie in 2008.

How screwed up did the candidates have to be in 2008 & 2012 to force a stanch Republican rag to not endorse the republican?

On the other hand Obama has given the Fascist oligarchy exactly what they always wanted in the TPP - Corporate sovereignty over State and Federal Governments.

pnwmom

(108,980 posts)is not a right wing rag. And it provides information to a wide spectrum of voters who will be participating in the General.

Not every Dem is a Bernista, even though I know it feels that way sometimes.

Ferd Berfel

(3,687 posts)I believe.

When I was a kid the Trib was the Republican paper (my dads) and the Sun Times the paper of Union Labor. now the same

"Centrist" democrats are just the disenfranchised Republicans from the old days

Fronkonsteen

(75 posts)Whatever journalistic integrity it once had, it abandoned years ago. Chicago is a Democratic bastion and Obama's 'home town', so there's no way they could not have endorsed Obama. They print what's necessary to stay relevant while serving their corporate masters.

Bluenorthwest

(45,319 posts)" This endorsement makes some history for the Chicago Tribune. This is the first time the newspaper has endorsed the Democratic Party's nominee for president.

The Tribune in its earliest days took up the abolition of slavery and linked itself to a powerful force for that cause -- the Republican Party. The Tribune's first great leader, Joseph Medill, was a founder of the GOP. The editorial page has been a proponent of conservative principles. It believes that government has to serve people honestly and efficiently.

The Republican Party, the party of limited government, has lost its way."

http://articles.chicagotribune.com/2008-10-19/news/chi-tribune-2008-presidential-endorsement_1_endorsement-obama-first-african-american-president

So yes they endorsed him and also they state that they are editorially conservative.

Ferd Berfel

(3,687 posts)Anyone reading the Trib that doesn't grasp this out of hand is probably just a disenfranchised republican telling themselves they are a 'Centrist' Dem

senz

(11,945 posts)elias49

(4,259 posts)Funny, that.

Nanjeanne

(4,961 posts)Ferd Berfel

(3,687 posts)what the Top Marginal Rate is to the few that don't know

Of course the republican, Clintons, Media and Oligarchs will team up to try and muddy the waters on this, they will all use FEAR and uncertainty because they of the same ilk

toothless dragon

(51 posts)who doesn't want to pay taxes will print anything...

doc03

(35,346 posts)Ferd Berfel

(3,687 posts)disinformation fear-mongering on this issue too.

![]()

pnwmom

(108,980 posts)added together?

Because if he gets to the general the other side will be adding them all up. It would be better if we knew now what we'd be expected to defend.

Ferd Berfel

(3,687 posts)is like believing Drudge.

Start here and let's see what else we can find.

pnwmom

(108,980 posts)(See the fine print at the bottom of the right side.)

I'm looking for the campaign's figures, and all the proposals put together.

But thanks.

senz

(11,945 posts)The Committee for a Responsible Federal Budget came up with these figures.

http://www.sourcewatch.org/index.php/Committee_for_a_Responsible_Federal_Budget

They're rightwing hacks.

lumberjack_jeff

(33,224 posts)Perhaps the OP could start a gofundme for those of us poor unfortunates who make more than $10 million annually.

Romulox

(25,960 posts)It's all just so tragic. ![]()

doc03

(35,346 posts)promisses through congress. It is just a waste of time even talking about such ridiculous claims. Why don't we just

elect Santa Claus.

EmperorHasNoClothes

(4,797 posts)promisses through congress. It is just a waste of time even talking about such ridiculous claims. Why don't we just

elect Santa Claus.

See, I can do it too.

doc03

(35,346 posts)elect me, I will make the minimum wage $50 an hour, give everyone 12 weeks paid vacation, free health care, SS and Medicare at 50 and no taxes for

anyone making less than $250000 a year. Clinton can work with Republicans and get things done. So what are you going to do if by some miracle

Bernie gets elected in 2016 then after he doesn't get anything done, desert him and let the Republicans take all of congress like so many did with Obama?

senz

(11,945 posts)Anyone who tries that should join the Republican Party, where they belong.

Tierra_y_Libertad

(50,414 posts)AOR

(692 posts)When I heard the two CNN 1% shills Christine Romans and Carol Costello mention this twisted bullshit I smelled a rat... especially when the "nonpartisan Committee for a Responsible Federal Budget" rang a bell. SourceWatch will do for now.

http://www.sourcewatch.org/index.php/Committee_for_a_Responsible_Federal_Budget

(Snip)

Since 1981, CRFB has kept up a steady drum beat of seminars, reports, blue ribbon commissions, and the like, all focusing on the nation's debt crisis and the need to reform "entitlements" such as Social Security and Medicare, which are better described as earned benefit programs that American workers pay into with each paycheck. Pete Peterson, Erskine Bowles, Alan Cranston, and Alice Rivlin all serve on its large board.[3]

CRFB is listed as a partner organization in the Fix the Debt Campaign, but is better described as a "parent organization."[8] The Campaign to Fix the Debt is the latest incarnation of a decades-long effort by former Nixon man turned Wall Street billionaire Pete Peterson to slash earned benefit programs such as Social Security and Medicare under the guise of fixing the nation's "debt problem." Fix the Debt is listed as a "project of" the Committee for a Responsible Federal Budget (CRFB) on the organization's website as of February 2013, which is itself a project of the New America Foundation (NAF).[9] The Peter G. Peterson Foundation gave NAF $2,050,000 from 2009 to 2011.[10] CRFB used to be an independent organization, but became associated with NAF in 2003.[11]

Funding from the Peter G. Peterson Foundation

Fiscal Year 2011[12]

$300,000 to support The Moment of Truth Project at the CRFB

$500,000 to support the Peterson-Pew Commission on Budget Reform at CRFB

Fiscal Year 2009[12]

$1,250,000 to support the Peterson-Pew Commission on Budget Reform at CRFB

Tom Rinaldo

(22,913 posts)Now that is a benchmark I've never seen used by anyone before. So Bernie is going to dictate tax policy at the county level and or/be measured by cumulative decisions made at all levels of governments - a standard never applied to any other Federal politicians tax proposals. That's inventive.

pnwmom

(108,980 posts)don't live in a state with particularly high taxes. In those states, people often talk about the combined effects of all the taxes.

Tom Rinaldo

(22,913 posts)thesquanderer

(11,989 posts)The actual top rate (for that amount of your income over 10 million) is 52% in federal income tax.

If you are self-employed (and therefore don't have an employer who is paying any share of payroll tax), and the cap on the payroll tax is lifted, you could possibly also be liable for 12.4% social security, 2.9% medicare, and .4% for Gillebrand's family leave bill which Sanders supports. So that could possbly bring you to 67.7%.

State and local varies with your state and locality. It could be zero, of if you're in pricey New York City, it could be about 12.7%, which could bring you to 80.4%.

I don't see how they quite to the numbers you posted (I can't load their link), maybe I'm missing something... but I do see how it can at least get somewhat close in that kind of "perfect storm" scenario.

So yeah, if you make over $10 million, you could have a beef. Sanders may have to give up on getting too many of those votes.

OTOH, if you make, $250,000 a year or less, and you have an employer, and your current income is not from capital gains (which would now be taxed at regular income rates instead of reduced rates), then your income tax rate will be 2.2 points higher than it is today, and your FICA will be .2% higher (for family leave). This would be offset by the fact that you would no longer need to pay private health insurance premiums, nor have to worry about high deductibles and copays. So most people would be far better off.

Personally, I think talking about what the vast majority would pay is more useful than asking what the top rate (on income over $10 mill) would be, as there are very few of us who will ever have the dilemma of how to deal with the taxes on our income over $10 million.

You can see more detail at

https://berniesanders.com/wp-content/uploads/2016/01/Medicare-for-All.pdf

pnwmom

(108,980 posts)the additional raises he's calling for for his other plans.

thesquanderer

(11,989 posts)There is no additional income tax or higher rate in his plans.

Additional sources of revenue for his other proposals are detailed at:

https://berniesanders.com/issues/how-bernie-pays-for-his-proposals/

pnwmom

(108,980 posts)and he's calling for raising taxes on high income people for other proposals.

thesquanderer

(11,989 posts)As I said, it could be up to .4% for family leave if you're self-employed, I included that in my figures.

There is no higher rate for high income people than what I listed. They may also lose some deductions, i.e. carried interest, but that doesn't change what the top rate is, which is the question at hand.

pnwmom

(108,980 posts)thesquanderer

(11,989 posts)SickOfTheOnePct

(7,290 posts)But there is additional payroll tax for single payer.

thesquanderer

(11,989 posts)...but there is a small change in payroll tax to cover family leave.

Dawson Leery

(19,348 posts)Otherwise, no.

bkkyosemite

(5,792 posts)He never say this.

Bjornsdotter

(6,123 posts)....if you are a Democrat and the Tribune is against it, vote for it.

If the Tribune is for, vote against it.

californiabernin

(421 posts)Red Knight

(704 posts)Bernie isn't abolishing Obamacare the first day in office and replacing with a single payer plan.

But he will start the process.

As for filling in costs--I'm pretty sure that part of that process will be cutting some things like military spending and some wealthy corporate subsidies. I don't expect all of Bernie's plans to happen instantly. But at least he's willing to apply the brakes to this bus we're using to drive the middle class off a cliff and to look for a different route. We need that and need it now. Or we can just enjoy the ride. That's the other choice.

Hell Hath No Fury

(16,327 posts)A "non-partisan" group with a hardcore agenda:

Since 1981, CRFB has kept up a steady drum beat of seminars, reports, blue ribbon commissions, and the like, all focusing on the nation's debt crisis and the need to reform "entitlements" such as Social Security and Medicare, which are better described as earned benefit programs that American workers pay into with each paycheck. Pete Peterson, Erskine Bowles, Alan Cranston, and Alice Rivlin all serve on its large board.[3]

Committee for a Responsible Budget Once Partnered With Big Tobacco Interests

In the 1990s, CRFB formed a "Cost Containment Coalition" that objected to the Clinton Health Care reform proposals and any new taxes to pay for health care. CRFB's opposition was portrayed as a tough, principled stand, but years later, documents were revealed that showed the Tobacco Institute, a now defunct industry lobbying group, funding the coalition[4] while Philip Morris funded CRFB President Carol Cox Wait.[5] Internal Philip Morris memos found in the Tobacco Library describe how the firm worked with CRFB to set up the coalition to help the company achieve its "overriding objective" of avoiding tobacco excise taxes as part of any health care reform package.[6]

Cox Wait, who is reportedly married to Philip Morris vice president Bob Wait,[7] was doing double duty as a federal budget consultant to the tobacco giant. An internal Philip Morris document explains why this is helpful to them: "Because of her bipartisan Board, 'Committee for a Responsible Federal Budget,' and given her 'neutral' status, Carol is able to access many people who would be inaccessible to us given our issues."[5]

More recently, CRFB and its Fix the Debt project have come under fire for fronting for firms pushing for a territorial tax system, a tax break for profits earned offshore (see IPS' "The CEO Campaign to 'Fix' the Debt: A Trojan Horse for Massive Corporate Tax Breaks"![]() and for fronting for defense industry firms anxious to avoid budget cuts (see Public Accountability Initiative's "Operation Fiscal Bluff"

and for fronting for defense industry firms anxious to avoid budget cuts (see Public Accountability Initiative's "Operation Fiscal Bluff"![]() .

.

http://www.sourcewatch.org/index.php/Committee_for_a_Responsible_Federal_Budget

They are part of the New America Foundation, a group that pushed Common Core.

pnwmom

(108,980 posts)And so far all I've seen are his numbers for Medicare-for-all, not for all his proposals put together.

Wherever this came from, the Chicago Tribune endorsed Obama in 2008 and 2012 and has a large readership in the midwest.

If Bernie is the nominee,there will be many reports like this. His supporters can't just put their heads in the sand. If this analysis is wrong, he needs to explain the correct numbers for all his plans put together.

senz

(11,945 posts)When Bernie decides on a top marginal tax rate, then you can attack it.

But not before.

Arazi

(6,829 posts)Its completely right wing. It even loves Peter Roskam - a tea partier made infamous at the Benghazi hearing.

Your attempt to spin the Trib as liberal is pretty sad

Nanjeanne

(4,961 posts)Those are the tax brackets he is proposing for federal tax. Medicare for all is the payroll tax of 2.2% and the $1.65 a week is the Family Leave addition.

They are all outlined on his site but you may have to look at different proposals. Like the College one has the transaction tax for Wall Street associated with it.

Perhaps he will have an opportunity to explain things in more detail when he doesn't have to provide a sentence to an interviewer in a 5 minute interview. But you can find all the info on his website. I'm still looking for even 1/10 of this detail on Hillarys site.

Gothmog

(145,320 posts)The Kochs can use this paper's analysis to support all of the attack ads needed to guarantee victory for the GOP candidate

Spider Jerusalem

(21,786 posts)a top rate of 77% on incomes above $10 million, or $20 million, or whatever, wouldn't kick in below that level and all incoe below that would be taxed at the lower rate. (As an example of this? the top marginal rate for 1935 was 75%; it applied to a single US taxpayer by the name of John D Rockefeller.)

TheProgressive

(1,656 posts)And, if, repeat IF, it is 77% for the top earners - sounds good to me...

Response to pnwmom (Original post)

Post removed

white_wolf

(6,238 posts)Seriously, I never thought I'd see the day where so-called Democrats were opposed to raising taxes on the wealthy to pay for social services. Just goes to show this sure as hell isn't the party of FDR anymore.

Kang Colby

(1,941 posts)who are attempting to take third way politics in the wrong direction.

white_wolf

(6,238 posts)Sanders is trying to bring the party back to the days of the New Deal, which is something this country desperately needs. We already have one conservative party. We don't need so-called "democrats" creating a second.

ChiciB1

(15,435 posts)about giving TAX CUTS to them? His was a bit higher, and he decided we NEEDED a Highway system. Yeah, I think he was a REPUB, that Democrats fought AGAINST!

My, my how times have changed!

workinclasszero

(28,270 posts)They will have the average american believing Bernie will tax them to death.

They already have the perfect sound byte from him for it.

amborin

(16,631 posts)Persondem

(1,936 posts)Bradical79

(4,490 posts)They're pretty economically conservative and always have been. President Obama is the rare exception when it comes to Democratic endorsements from them. Maybe they saw the GOP coming off the rails after the Bush administration? Anyway, he's the first Democrat they had ever endorsed for president, and they have an explicit "limited government" philosophy.

If you like the source (The Committee for a Responsible Federal Budget) I think you'd be better off going straight to them without the baggage the Chicago Tribune has accumulated.

They have a page that is continually being updated (notice a new update is in the works):

http://fiscalfactcheck.crfb.org/analysis-of-the-sanders-single-payer-offsets/

I don't know how reliable they are, but it's far less of a distraction and gets to the point quicker.

pnwmom

(108,980 posts)It could have endorsed John McCain or Mitt Romney, both non-tea party Repubs.

It's not a "right wing" paper.

Bradical79

(4,490 posts)Endorsement of Barack Obama is not a litmus test for whether opinion is conservative or not. President Obama got support from numerous conservatives.

From their statement of principles they published:

"The Chicago Tribune believes in the traditional principles of limited government; maximum individual responsibility; minimum restriction of personal liberty, opportunity and enterprise. It believes in free markets, free will and freedom of expression. These principles, while traditionally conservative, are guidelines and not reflexive dogmas."

You must not have seen the articles calling Obamacare a "ticking timebomb" or claiming the president lied about Obamacare either.

Gothmog

(145,320 posts)Many democrats are scared of Sanders massive tax increases http://www.theatlantic.com/politics/archive/2016/02/sanderss-party-problem/460293/

To be sure, Sanders says that Americans would save money because they wouldn’t be paying private insurance premiums. But his plan has no limits on the scope of coverage and no patient cost-sharing—it transfers all private health spending into the Treasury, without any clear means of cost restraint. Free can be expensive. The plan would create winners and losers: The losers will surely fight it, and many of those who might be winners won’t trust the federal government enough to go along with it.

The taxes for Sanders’s health plan, combined with other tax increases on wages he’s proposed, would raise the top marginal federal rate to 77 percent, as Dylan Matthews shows at Vox. In addition to those taxes on earnings, Sanders is calling for an increase in the capital-gains tax, a new financial-transaction tax, and a new carbon tax.

The last of these, the carbon tax, is a good idea and a hard sell in itself. But the total package is not a platform that Democrats can run on—it’s a platform they’re going to run from. And it is a fantasy-come-true for Republicans. For decades, they’ve been falsely accusing Democrats of favoring huge tax increases. In this case, it would be the truth.

So far, many Democrats have hardly registered the full significance of what Sanders’s candidacy would mean for their party. But I don’t think Republican strategists have missed the possibilities. A Sanders nomination would be their opportunity to capture decisive control of all branches of the federal government from a divided and weakened Democratic Party. Among other things, Republicans would be able to consolidate a Supreme Court majority for a long time to come. As those who supported Ralph Nader in 2000 should recognize now, the costs of purity can be heavy indeed.

Motown_Johnny

(22,308 posts)Why are people who claim to be progressive attacking this?