Economy

Related: About this forumStocks' Return to Records Paves Way for Volatile Autumn

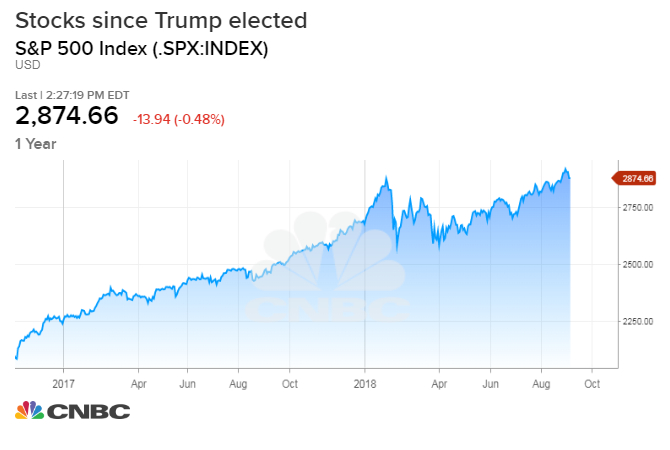

U.S. stocks are back at all-time highs after a dizzying August rally, prompting some investors to fear a reckoning heading into what historically has been a weak stretch for markets... Yet many investors, burned by previous snapbacks, can’t help but view September with a degree of apprehension.

Global-fund managers are holding higher-than-average levels of cash in their portfolios. Shares of utilities and real-estate firms, considered bond-like because of their dividend payouts, have started to rebound over the past couple of months. And firms including Morgan Stanley and RBC Capital Markets have recommended unloading technology stocks, the best-performing S&P 500 sector in 2018.

Fall has often been a volatile stretch for global markets. Stocks tumbled in 2017 after North Korea-U.S. tensions ratcheted higher, lost ground in 2016 as investors questioned central bank-policy and fell in 2015 when the global economic expansion appeared to stall. The phenomenon is far from new: Going back to 1945, the S&P 500 has notched its worst monthly return in September, followed by February and then August, according to investment research firm CFRA.

(snip)

Others worry that, with global trade negotiations still in flux, investors may be caught off guard by an unexpected breakdown in talks. Even as trade fears have spurred selling in markets across Asia and Europe, the U.S. has held up relatively well—something some analysts worry points to complacency among investors. The S&P 500 is up 8.5% for the year, compared with the Shanghai Composite’s 18% fall, the Stoxx Europe 600’s 1.8% decline and the Hong Kong’s Hang Seng Index’s 6.8% fall.

(snip)

Then there is the recent softening in the U.S. housing market, which has cast a pall on an otherwise bright economic picture. Sales of existing homes have fallen for four consecutive months, the longest such streak in five years. The dropoff is a troubling sign to many analysts, especially because the housing market is considered an indicator of the U.S. economy’s overall health.

More..

https://www.wsj.com/articles/stocks-return-to-records-paves-way-for-volatile-autumn-1535972400 (paid subscription)

progree

(10,918 posts)The crisis has engulfed countries across the globe — from economies in South America, to Turkey, South Africa and some of the bigger economies in Asia, such as India and China. A number of these countries are seeing their currency fall to record levels, high inflation and unemployment, and in some cases, escalating tensions with the United States.

Last week, Argentina approaching the International Monetary Fund (IMF) for an emergency loan came as a shocker for the markets. The country saw its currency fall by more than 50 percent against the dollar and its interest rates go up by a whopping 60 percent.

Meanwhile, the sell-off on the back of an ongoing spat between the U.S. and Turkey over the release of American pastor Andrew Brunson has not only seen the Turkish lira hit record low levels, but has also spread to other global assets. The Turkish currency has lost 40 percent of its value this year, largely due to President Erdogan's unfriendly policies.

Emerging markets are also heavily plagued by debt and a stronger dollar makes it tougher for them to pay this debt. The latest data from the Institute of International Finance shows that debt in emerging markets including China increased from $9 trillion in 2002 to $21 trillion in 2007 and finally to $63 trillion in 2017. The MSCI Emerging Markets index is down nearly 9 percent since the start of the year.

MORE: https://finance.yahoo.com/m/56d43e3f-9587-30cc-93b6-05081ce6bdcb/the-emerging-market-crisis-is.html

elleng

(131,107 posts)S.&P. 500

-0.24%

Dow

-0.13%

empedocles

(15,751 posts)would love to push market to new DJIA highs well before Election Day. Not far to go.

at140

(6,110 posts)