The Glut Strikes Back as Oil Returns to Brink of Bear Market

The bullish spirit that gripped oil traders as industry giants from Saudi Arabia to Goldman Sachs Group Inc. declared the supply glut over is rapidly ebbing away.

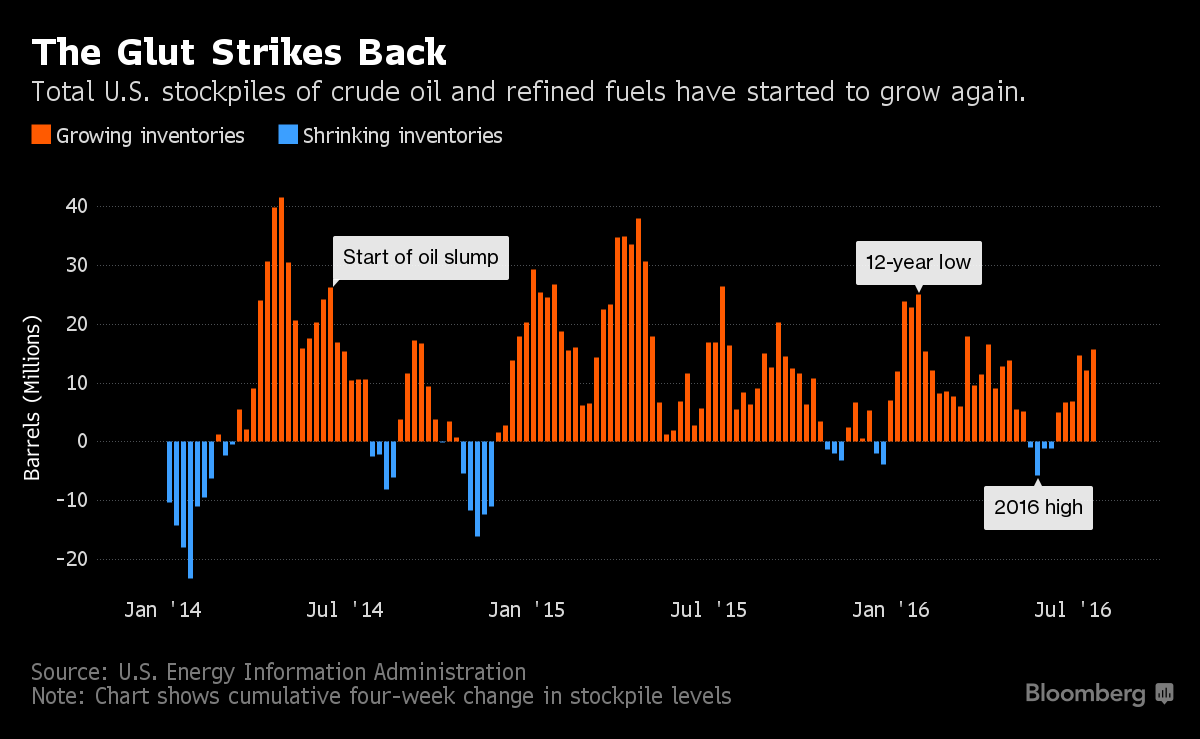

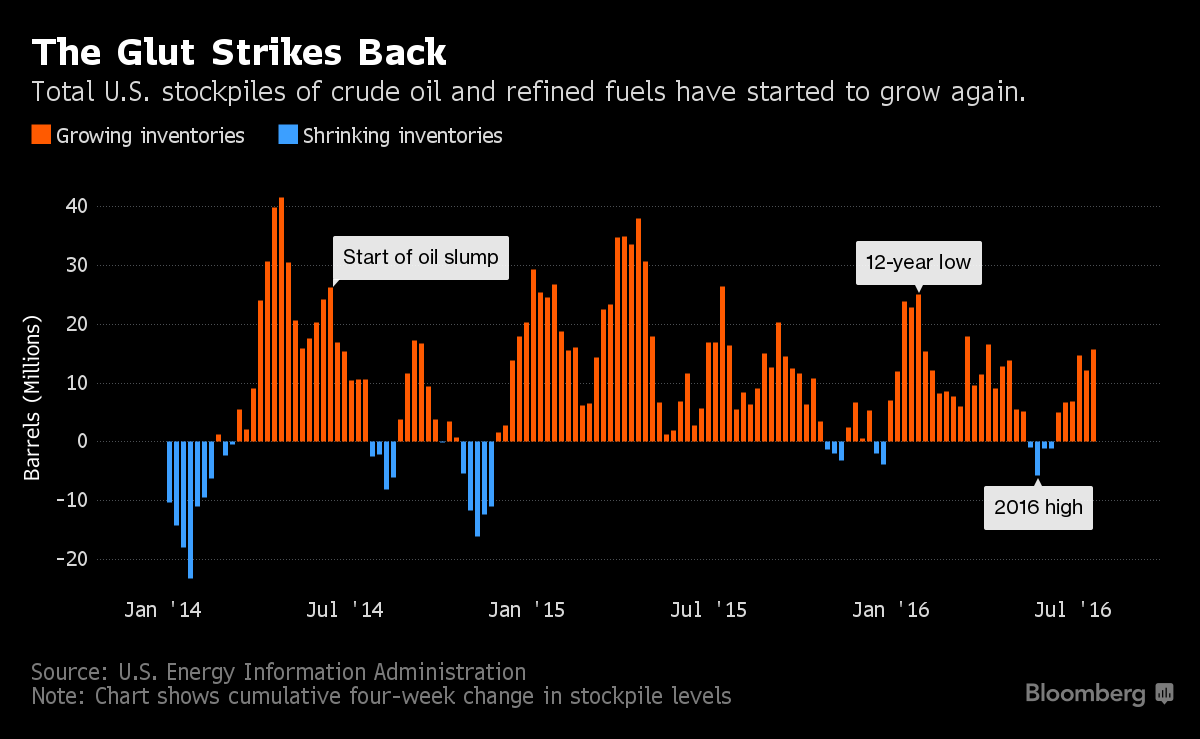

Oil is poised for a drop of 20 percent since early June, meeting the definition of a bear market. While excess crude production is abating, inventories around the world are brimming, especially for gasoline, and a revival in U.S. drilling threatens to swell supplies further. As the output disruptions that cleared some of the surplus earlier this year begin to be resolved, crude could again slump toward $30 a barrel, Morgan Stanley predicts.

“The tables are turning on the bulls, who were prematurely constructive on oil prices on the basis the re-balancing of the oil market was a done deal,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA in London. “It’s probably going to take a little longer than they expected.”

Oil almost doubled in New York between February and June as big names from Goldman and the International Energy Agency to new Saudi Energy Minister Khalid Al-Falih said declining U.S. oil production and disruptions from Nigeria to Canada were finally ending years of oversupply. Prices are set for their biggest monthly loss in a year amid a growing recognition the surplus will take time to clear.

MORE...

http://www.bloomberg.com/news/articles/2016-07-28/oil-glut-proves-harder-to-kill-than-saudis-to-goldman-predicted