Economy

Related: About this forumAre renters of today worse off than their parents?

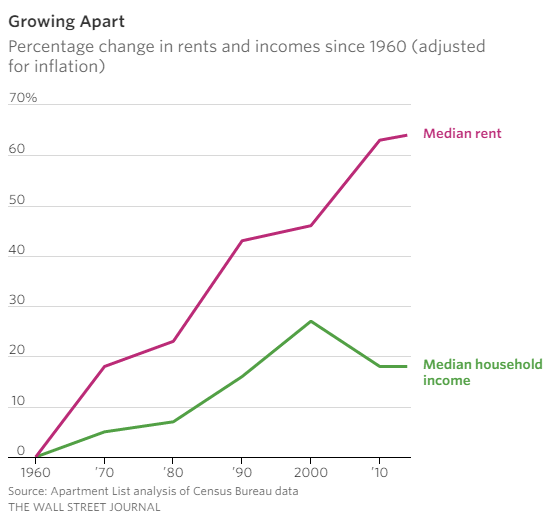

Examining rental and household income growth going back to 1960.

http://www.doctorhousingbubble.com/renters-worse-off-today-rents-income-lease-rent-prices/

Inflation adjusted rents have gone up by 64 percent since 1960. During this same period real household income is up 18 percent. What this means is that more net household income is locked up by rents. In places like Los Angeles it is not uncommon for households to spend 50 percent of their net income on rent. In San Francisco you have many high paid tech workers shacking up with roommates just to get by. On a nationwide scale this trend has been happening consistently.

So this bodes well for home buying right? Not at all. Home prices are up as well. In high priced areas, the barrier to entry is the down payment – so that $700,000 crap shack would likely require a 10 or 20 percent down payment for you to be competitive – $70,000 or $140,000. And this is absolutely common in competitive markets. Looking at sales data for the past couple of years on some crap shacks you find the buyers coming in with 10 or 20 percent down (at least). In other areas you have cash buying still being a big player.

So renters with stagnant incomes are basically treading water. Millennials, the next batch of potential buyers are stuck between living at home or renting. The home buying trend for this group is not actually showing some amazing pent up demand. The idea of 3.5 percent down payments in high priced areas is just not happening.

Skittles

(153,193 posts)I remember when rent was a fixed payment - now they add on insurance, water, trash, bug control, etc

Warpy

(111,339 posts)and the postwar housing crunch was a big deal. I remember one of the first houses (not apartments) they rented. The electricity in the kitchen would fail and my mother would yell at me to bounce my ball, I knew the right place to smack the floor with it to jog the wires back into place and restore the juice. (no, it was a slab house or my dad would have fixed it) There were also cramped apartments in weird areas.

However, through it all, they were able to afford the rent enough that I didn't have to sleep with them and they didn't have to sleep in the living room. That's not the case with some families I know now. The problem isn't that rents have gone up too far for people to afford them, it's that wages have not gone up at all.

My parents managed in a time of short supply and decent wages. Now people are looking at an adequate supply and feeling like poor Tantalus, everything just out of reach because cheap labor conservatives have run both parties for 40 years and it's just fine for employers to pay starvation wages and pocket the rest.

So many economic problems in this country can be traced to one thing: Congress and its unwillingness to index the minimum wage to inflation. Inflation is a fact of life for fiat currency, it's built in. Allowing the lowest wage to stagnate and then fall is the cruelest policy they've ever come up with.

SheilaT

(23,156 posts)Every so often a debate crops up here on DU about whether it's better to rent or to buy a home. The extreme positions are: NEVER buy, always rent. Or: ALWAYS own your own home, never rent.

A corollary of the always buy is: NEVER have a mortgage after retirement age.

There was even someone here who said that property owners who rented out their property were the essential cause of most financial misery, and so such renting should be illegal. As if everyone is in a position to buy. Just think about someone who has, for example, taken a short term job and won't be staying more than a few months or a couple of years. If no one could ever rent an apartment or home and always had to buy, either illegal rentals would become very common, or there would be almost no mobility at all.

None of those rules make sense for everyone.

Also, where's the graph that shows median home cost compared to income over that time? In some parts of the country the cost to buy has far, far outstripped income. Other places, not so much.

Kilgore

(1,733 posts)Median numbers are misleading. There is no adjustments for location.

For example, I happen to have a child who rents in Portland OR and pays astronomical rent for a "crapshack" and another in very rural eastern Oregon who pays very reasonable rent for a decent house. Both make about the same income.

It was difficult for the one in Portland to even find a place to rent, but the other had three to choose from.

eridani

(51,907 posts)Why don't we just apply "free markets" to retirement security and abolish Social Security while we're at it?

Kilgore

(1,733 posts)There happens to be good employment in both locations in my example. However there are more rental units available in the rural location making the price competitive.

Portland has severely restricted construction which has resulted in a shortage of housing, coupled with it being a trendy place has made demand skyrocket. Suggested reading,

http://www.huffingtonpost.com/entry/portland-housing-crisis-high-rents_us_56ab8ce8e4b00b033aaec738

eridani

(51,907 posts)denverbill

(11,489 posts)What do you think the wealthy are doing with all their wealth? They ain't stockpiling food.

A few more generations like this and nobody in America will own their own property.

CrispyQ

(36,509 posts)