Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 4 February 2016

[font size=3]STOCK MARKET WATCH, Thursday, 4 February 2016[font color=black][/font]

SMW for 3 February 2016

AT THE CLOSING BELL ON 3 February 2016

[center][font color=green]

Dow Jones 16,336.66 +183.12 (1.13%)

S&P 500 1,912.53 +9.50 (0.50%)

[font color=red]Nasdaq 4,504.24 -12.71 (-0.28%)

[font color=black]10 Year 1.88% 0.00 (0.00%)

[font color=red]30 Year 2.71% +0.01 (0.37%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

ErisDiscordia

(443 posts)Last edited Wed Feb 3, 2016, 08:36 PM - Edit history (1)

and I am getting a head cold from it all. The snowdrops, foolish darlings, are ready to burst into bloom...during a 6" snowstorm?

The center does not hold. I've got to go to bed now...try to get some more up in the AM...you all may have to do it yourselves, otherwise.

ErisDiscordia

(443 posts)Editor's note: This story was originally published in mid-January. In the aftermath of her win in a closely contested Iowa caucus, it's worth taking another look at what the U.S. economy may look like under a President Clinton.

When it comes to economic matters, what would Hillary Clinton do?

...The former New York senator supports all of Obama's singular achievements in addition to strengthening the Volcker Rule, which imposes a "risk fee" on banks that make speculative bets with funds from their own accounts, and passing the "Buffett Rule," which would close tax loopholes by establishing a higher minimum rate for those in the highest income bracket. True to her centrist roots on economic issues, Clinton, it seems, wants to appeal to those whose livelihood is tied to financial services as well as the consumer/labor advocates who increasingly comprise the base of the Democratic Party.

"If she is thinking about a policy issue, she's going to want to hear from the business side, the consumer side, the labor side, and in that regard, her positions may not be starkly black-and-white," said Tracy Sefl, a Democratic strategist and former Clinton campaign staffer. "She likes to bring together multiple voices."

One thing is clear: Clinton isn't going to adopt Bernie Sanders' leftist rhetoric or his policy prescriptions. She's not about to promise to break up the country's largest financial institutions within a year of getting elected, or label Wall Street an industry that's run on "greed, fraud, dishonesty and arrogance," as Sanders often does. As the Sanders campaign isn't shy about exclaiming, Clinton's top campaign donors are investment banks.

But perhaps she should think a bit more about Sanders and his positions. After all, the leftist senator nearly beat her in Iowa...

more garble

ErisDiscordia

(443 posts)Editor's note: This story was originally published in October. As Bernie Sanders, a serious contender in the Democratic primary continues to challenge Hillary Clinton the national polls, it's worth taking another look at what the U.S. economy may look like under a President Sanders. The section on taxes has been updated with an analysis from the Tax Foundation and the section on health care has also been updated with more details from the Vermont Senator's plan.

Would you want a socialist in the White House? If the polls are accurate, very few people would. But it's closer to happening than almost ever before, with self-avowed socialist Bernie Sanders running a close second in the early going to Hillary Clinton to win the Democratic nomination for President of the United States.

The Vermont senator has shaken up the Democratic presidential field, igniting crowds all over the country and giving front-runner Clinton a run for her money in the polls. Many Americans will get their first good look at him in action at the Democratic presidential debate on CNN Tuesday evening (which TheStreet will be covering live). And while Sanders as president remains an unlikely scenario, it's worth pondering what the U.S. markets and economy would look like with the Democratic Socialist at the helm.

"The great thing about Bernie Sanders is that there's no guile about him. His authenticity is pretty much based on him saying what he believes," said Middlebury University political science professor and expert in presidential politics Matt Dickinson. In other words, Sanders would probably be much better off in the polls if he used the "s-word" less.

While the U.S. economy would certainly look different under a socialist Sanders presidency, it might not be as crazy as you'd think...

more garble

This article is commentary by an independent contributor. At the time of publication, the author held no positions in the stocks mentioned.

Fuddnik

(8,846 posts)ErisDiscordia

(443 posts)it's been remarkably quiet overnight...the Swarm went somewhere to sleep it off.

Wonder what the NEXT ridiculous meme will be....the law degree was the absolute worst, imo.

Hotler

(11,425 posts)I have no hope. I see no future.

![]()

ErisDiscordia

(443 posts)Saira Malik, head of global active equity portfolio management for TIAA-CREF, believes the U.S. is not at risk of a recession. Instead, she's using the pullback in the market this year to get long a group of stocks she thinks will outperform in the months ahead.

"We aren't worried about a recession at the present time as we believe developed markets can continue to demonstrate low single-digit positive GDP growth," Malik told CNBC Pro.

Her investment thesis is based on cyclical stocks taking over from momentum names as the leaders in 2016...

(whatever she's selling, I don't buy it!)

ErisDiscordia

(443 posts)After a brutal start to the year, professional investors find themselves in a miasma of confusion and loss — which could lead to even more dramatic moves in the sessions ahead. So contends Neil Azous, an investment strategist at Rareview Macro.

"The professional community is either very confused or impaired at the moment, and possibly both," Azous wrote in a Wednesday morning missive.

Investors are currently suffering "duress" on their profit-and-loss statements, Azous explained, with mutual funds seeing declines of 7 percent, and retail investors "down somewhere between 5 and 15 percent."

What's more, the pain is coming through multiple channels, many of which are difficult to fully understand. The Federal Reserve is in tightening mode even as some think it should be cutting rates; crude oil's decline is being alternately blamed on oversupply and mere market positioning; China is devaluing its yuan amid slowing growth; and more central banks are pursuing negative interest rate policies...In this market fog, any sudden movement could provide highly unsettling. That's why Azous warns that the market reaction to a soft jobs report could be dramatic...

ErisDiscordia

(443 posts)The IRS anticipates some of the systems will remain unavailable until Thursday...

The U.S. Internal Revenue Service said on Wednesday it is experiencing computer failure across several systems and temporarily cannot accept many taxpayer returns.

"Several of our systems are not currently operating, including our modernized e-file system and a number of other related systems," the IRS said in a statement.

"A number of taxpayer and tax practitioner tools are unavailable," it said. "IRS.gov remains available, although a number of the services on the site are not, including Where’s My Refund."

The agency said it is in the process of making repairs and anticipates some of the systems will remain unavailable until Thursday.

The IRS said it does not anticipate major refund disruptions. "We continue to expect that nine out of 10 taxpayers will receive their refunds within 21 days," the agency said.

Fuddnik

(8,846 posts)Filed on the 20th, deposited on the 29th.

Spent before the 1st.![]()

ErisDiscordia

(443 posts)Yves here. Stocks around the world took a nosedive today WEDNESDAY, due to WTI sliding to under $30 a barrel, as well as disappointing earnings announcements from Chevron and BP, along with a warning from Standard & Poors...But the bigger cause of the sour mood which apparently swept from oil stocks into the broader market, was that a rumored deal among Russia, Iran, and the Saudis is nowhere near as imminent as the hype of last week would have investors believe. And there’s an obvious reason why.

As we indicated last year, when Saudi Arabia embarked on its oil-price-cutting strategy, which is what refusing to reduce production to support prices amounted to, it looked like a masterstroke. It had several sets of opponents in its crosshairs. The first was US frackers, who posed an intermediate-term threat if the shale boom and resulting government subsidies supported the construction of LNG transport facilities (which on a cold-blooded economic calculation are not justifiable given that under the old normal, shale production would have peaked around 2022 and started declining gradually, then more sharply around 2030, and that assumed no curbs due to earthquakes or water supply impact). Second was clean energy, which becomes much less attractive if conventional energy becomes cheap. Third was Saudi Arabia’s geopolitical opponents, most important Russia and iran.

Recall that the Western media went all in on the story of Russian vulnerability. In 2015, Europe tightened sanctions, and the Western leaders were in barely-veiled terms calling for regime change in Russia, on the premise that Putin could not survive the one-two punch of low oil prices and foreign sanction.

Here we are, in 2016, with barely an acknowledgment of that period. Not only did the Europeans overestimate Putin’s vulnerability, but the Saudis badly underestimated theirs...

ErisDiscordia

(443 posts)Much of the rout in oil prices has been predicated upon the staying power of Saudi Arabia and other OPEC producers. As oil prices have continued to fall, virtually all of OPEC has been pumping oil as fast as possible to generate increased revenues at lower prices. That practice has helped to fuel the oil glut and led to a price that would have been unthinkably low just a couple of years ago. Oil markets have been largely assuming that OPEC producers could go on producing at these levels for years, but what if that’s not the case?

Take the strongest of the OPEC producers, Saudi Arabia for instance. Saudi Arabia has very low cost per barrel of production – much lower than any shale producer in the U.S. But as a country, Saudi Arabia also has other significant obligations that it has to meet and oil revenues are effectively its only way of meeting these obligations. The same principle holds true for all other OPEC producers, though most are in worse shape than the Saudis. With oil at these prices, all of OPEC is bleeding fast. The oil revenues that the Saudis and others are bringing in are simply not enough to meet their on-going obligations. As a result, Saudi Arabia and others have been forced to turn to their savings – foreign currency reserves.

Saudi Arabia started 2015 with roughly $720B in reserves. By August it was down to $650B. As of December, Saudi Arabia has around $620B in reserves. If oil averages $20 a barrel going forward for the next couple of years, Saudi Arabia will be broke by mid-2018 even after accounting for its recent budget cuts that trimmed internal spending. $30 a barrel oil buys the country about 6 months, tiding it over to early 2019. Libya, Iraq, and Nigeria are all in much worse shape, as of course is Venezuela.

Even before Saudi Arabia gets to the point of bankruptcy though, panic may begin to set in for OPEC. Saudi Arabia is the most stable member of OPEC, and other than its rival Iran, who is used to budgetary pressure, the rest of OPEC is largely bloated and ill-prepared for a long period of low oil prices... the Saudis don’t want to see oil prices this low, nor can they afford a prolonged period of oil prices below $50 a barrel. To say that oil is crucial to Saudi Arabia is an understatement; oil is to Saudi Arabia what gambling is to Las Vegas. The Saudi’s cannot withstand low oil prices forever, and if drastic changes don’t happen, then within two years, the world’s largest oil producer maybe facing very hard times.

ErisDiscordia

(443 posts)Wall Street, based in New York City, collapsed the U.S. financial system under the weight of its own corruption in 2008. We’ve just come off another year of unprecedented corruption on Wall Street, topped off with two major U.S. banks, Citigroup and JPMorgan Chase, pleading guilty to felony counts for rigging foreign currency trading. Elsewhere in the state of New York, the heads of both legislative branches, Dean Skelos, the Senate Majority Leader, and Sheldon Silver, Speaker of the Assembly, were convicted on corruption charges in the waning days of 2015. Last evening, the CBS investigative news program, 60 Minutes, produced video evidence that 15 out of 16 lawyers in New York City were willing to discuss strategies with a potential client for laundering dirty money into the U.S. financial system through shell companies. In short, New York State is facing an epidemic of corruption and it’s long past the time to bring in a Justice Department Taskforce to clean up the mess.

In 2013, we warned in an article at CounterPunch that New York was drowning in corruption; that both lawyers and judges were fixing court cases. Five years earlier, reporter Wayne Barrett wrote the following in the pages of The Village Voice, following an in-depth investigation:

Just last February, the New York Times published its investigative findings on a foreign dirty money epidemic in New York City. The article looked at the luxury condos of the Time Warner Center and opened with these two revealing paragraphs:

“Last fall, another shell company bought a condo down the hall for $21.4 million from a Greek businessman named Dimitrios Contominas, who was arrested a year ago as part of a corruption sweep in Greece.”

The Times investigation found further that almost half of luxury homes nationwide worth at least $5 million are being purchased through shell companies.

Now, 60 Minutes has provided the public with a close look at the logistics of the role played by ethically challenged lawyers in New York City to keep the spigot of foreign bribes flowing into the U.S. Tragically, the video evidence didn’t come from U.S. law enforcement but from a London-based nonprofit, Global Witness, which works to stop developing countries from being looted through backdoor money-laundering channels. The group found that the U.S. has an “open door” policy for receiving tainted money...Global Witness had a man posing as a potential client make appointments with 13 New York City law firms and secretly videotaped the conversations with the 16 lawyers he met with at those firms. The Global Witness employee posed as a consultant to a Minister of Mines in a small African nation and told the lawyers that the Minister made the equivalent of a teacher’s salary in the U.S. but had accumulated enough to buy a $10 million brownstone, a $10 to $20 million Gulfstream jet and a $200 to $300 million yacht – all from “facilitating” foreign corporations in buying up mineral rights in the small African nation. Only one of the 16 lawyers refused to be a party to the money laundering. The other 15 lawyers, reports 60 Minutes, “suggested ways that the suspicious funds could be moved into the U.S. without compromising the minister’s identity.”

The standard tactics are to set up shell companies where secrecy is protected under the limited liability corporation (LLC) structure; route the money first through a series of offshore tax havens; use “straw men” as fronts for the real source of funds; and engage small U.S. money managers who “are often more flexible and understanding and less concerned about their reputation. Because they fly, to a greater extent, below the radar screen,” said one actual attorney who appears in a video.

The 60 Minutes report also notes a World Bank study that looked at 100 countries and found that the U.S. “was the favorite place for corrupt officials to set up anonymous shell companies,” other than Kenya.

ErisDiscordia

(443 posts)U.S. consumers are cautious about spending their windfall from cheap gasoline and are saving more, according to a Reuters/Ipsos poll and official data, suggesting low oil prices are less of a boon for the U.S. economy than in the past.

Commerce Department data shows that the crude's 70 percent drop since mid-2014 cut households' annual spending on gasoline and other energy products by $115 billion, equivalent to roughly 0.5 percent of gross domestic product.

At the same time, however, savings increased by $121 billion and while the data gives no indication where the money has come from, the survey suggests the windfall accounted for a significant part of the sum.

The Reuters/Ipsos poll shows 75 percent of 3,068 Americans who answered questions on gasoline savings said the extra money helped them cover basic needs and the majority have not used their windfall to buy big ticket items. Over 40 percent of respondents said the savings had helped them pay down debts, according to the Jan. 15-27 online poll, which had a credibility interval of plus or minus 1.8 percentage points...

ErisDiscordia

(443 posts)(She'd be better off pushing birth control and mosquito eradication)

http://www.bloomberg.com/news/articles/2016-02-02/rousseff-pitches-renewed-austerity-push-to-wary-brazil-congress

Brazil’s President Dilma Rousseff urged legislators to approve caps on government spending growth, cuts in pension benefits and the revival of a financial transaction tax to shrink the growing budget deficit and boost investor confidence.

"Brazil requires the contribution of Congress to continue with fiscal stabilization and assure the recovery of growth," Rousseff, 68, said Tuesday in a speech to commemorate the beginning of the legislative year. Unlike last year, when she sent her chief of staff, the president personally delivered the message.

Congress’s divisions were on full display during the event, as supporters shook hands with the president and slapped her on the back as she made her way to the main stage for the speech. Others booed when she proposed the temporary revival of the financial transaction tax known as CPMF, and some waved signs expressing their opposition to the plan.

The president will need to bridge the divide to overcome some of her biggest challenges this year, which include a deepening recession and a push to impeach her. While efforts to oust the president lost momentum during Congress’s end-of-the-year recess, she is likely to confront stiff opposition to her measures that are designed to shore up fiscal accounts...

Roland99

(53,342 posts)runs deeper than that.

Brazilian waxing and waning

http://www.economist.com/blogs/graphicdetail/2015/12/economic-backgrounder

Brazil’s fall

Disaster looms for Latin America’s biggest economy

http://www.economist.com/news/leaders/21684779-disaster-looms-latin-americas-biggest-economy-brazils-fall

Roland99

(53,342 posts)8:30a

U.S. productivity drops at 3% rate in fourth quarter

8:30a

U.S. output increases 0.1%, hours worked up 3.3%

8:30a

Unit-labor costs rise 4.5% but pay still not rising rapidly

8:30a

U.S. weekly jobless claims climb 8,000 to 285,000

8:30a

Four-week jobless claims average rises 2,000 to 284,750

ErisDiscordia

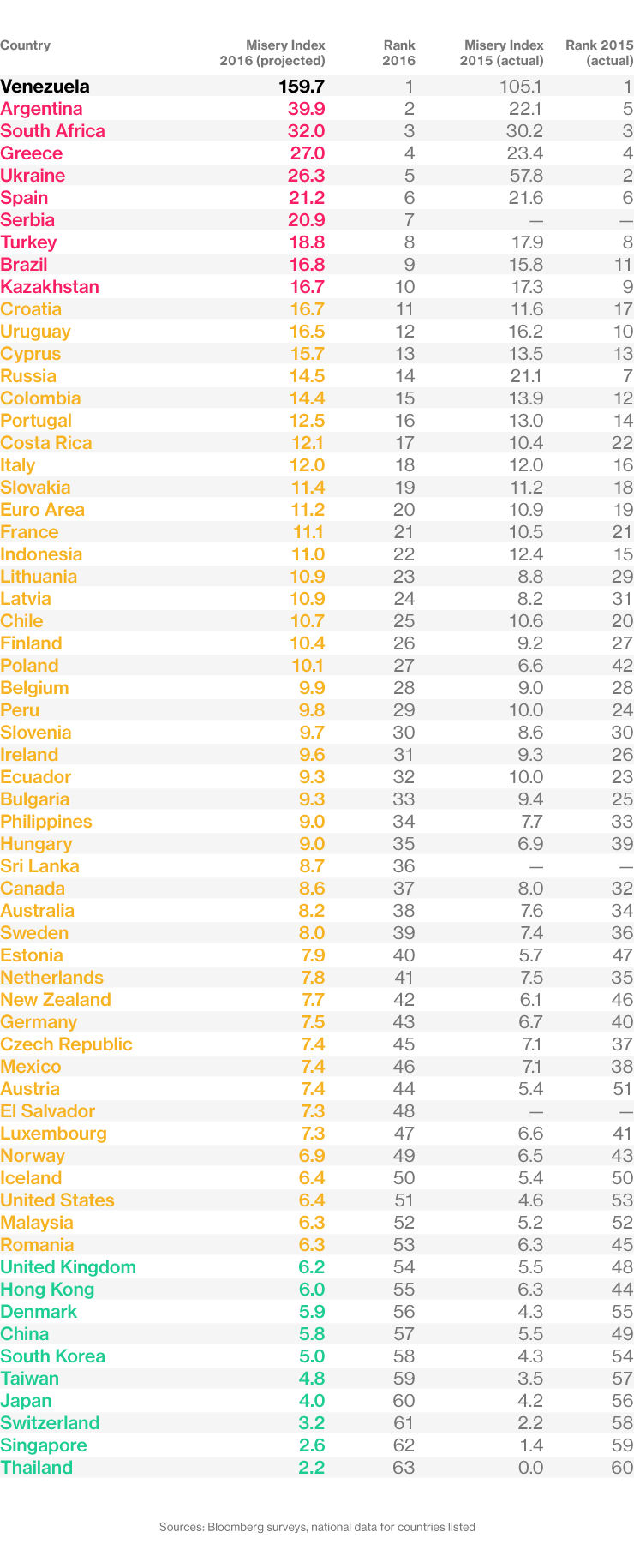

(443 posts)...The ranking of 63 economies is compiled by adding a country's jobless rate and inflation, a long-standing calculation in which a higher score indicates more misery. Venezuela's 159.7 tally for the 2016 misery index done by Bloomberg quadruples the next-worst ranking Argentina...Misery index calculations were compiled using the median estimates in Bloomberg economic surveys from the past three months. Figures for 2015 inflation and unemployment data reflect the average over the year and use the most current data available for each country....

ErisDiscordia

(443 posts)As baby boomers leave the workforce, professions like air traffic controller, farmer, and geriatrician could be crippled. Gulp... it will be difficult for the Federal Aviation Administration to keep fully trained and adequately experienced eyes on radar screens at some of the nation’s busiest airports. The “FAA has not yet established an effective process for balancing training requirements with pending retirements,” the Office of Inspector General says in a statement—even though prior reports had highlighted the same issue in 2012, 2002, and 1986. Even in 1981, when Reagan first lowered the ax, anyone capable of simple math could have seen the issue coming: New hires, all roughly the same age, would eventually retire at roughly the same time. But then and now, very little was done.

This might sound like a minor pain at worst. The labor market tends to sort itself out, after all. If there aren’t enough controllers, then the FAA just has to entice applicants by offering a higher starting wage, right?

Unfortunately, that isn’t happening, and the controller shortage is already here. The FAA has a staffing plan in place for its critical facilities through 2017, but as the Office of Inspector General has pointed out, because trainees often count as full-fledged controllers at air traffic facilities, many are effectively understaffed at this very moment. And, as many control tower managers report, “on-the-job training requirements for trainees limit their contribution.”

Shortages in crucial workforces aren’t limited to air traffic. Across sectors, the aging of the baby boomers is leading to heightened retirement rates. In certain fields, that’s no big deal. Postal workers, for instance, constitute the oldest workforce of any industry, but their retirement will be relatively manageable, because entry-level Postal Service positions don’t require much training...

ErisDiscordia

(443 posts)A new paper by economist Lance Taylor for the Institute For New Economic Thinking takes on the way economists have looked at wealth and income inequality. Taylor’s research challenges some conclusions about what’s driving inequality made by Thomas Piketty and Joseph Stiglitz. What’s really causing the startling gap between haves and have-nots? Is it mechanical market forces? Outsourcing? Real estate? As Taylor sees it, economists have gotten the answer wrong. Worker exploitation and outsized business profits are factors, but even more key are the unjustified payments to the wealthy generated by our outsized financial sector. This hasn’t just “happened.” Flawed economic theory and politicians beholden to the rich lead to policies that make it happen. We can fix the problem, but it will take bold steps.*A version of this interview originally appeared on the Institute’s blog.

Lynn Parramore: You recently dived into the debate on what causes wealth and income inequality — and whether or not we can fix it within the existing social order. Heated discussions among economists got touched off by Thomas Piketty’s bestselling book, Capital in the Twenty-First Century, but you say that a key part of the story is actually a debate that happened in the late 60s and early 70s. What is it and why should we care?

Lance Taylor: It’s key because mainstream economists have been wrong in how they think about inequality for a long time. Which means that they haven’t been particularly helpful in solving the problem. This is one of the key challenges of our time. We can do better.

The debate from the 60s and 70s is known as the “Cambridge capital controversy” and took place between economists at MIT in the U.S. and at Cambridge University in the U.K. First, especially for the Brits, it was about whether distributions of income and wealth are partly shaped by social and political relationships – class conflict if you will – or mostly by “market forces.”

There were technical skirmishes at the second level – one in particular about the nature of capital and the role of the rate of profit made by producers. Most economists want to say that market processes pay different forms of capital, labor, and real estate pretty much in line with their economic productivities. Everything comes out about right. The Invisible Hand knows best. But the Cambridge debate showed that different profit rates can show up with the same combinations of capital — stuff like machines and computers — and workers. Why is that? The Invisible Hand must be guided by something other than economic factors. What, exactly? There are different answers. But you can’t ignore the question.

more

Roland99

(53,342 posts)ErisDiscordia

(443 posts)Roland99

(53,342 posts)Orders for goods manufactured in U.S. factories slid 2.9% in December, the Commerce Department said Thursday.

The consensus forecast among economists surveyed by MarketWatch was for a 3.0% decline.

Orders have fallen in four of the last five months as the manufacturing sector struggles with a stronger dollar and the energy slowdown.

antigop

(12,778 posts)“It has the potential to personalize it, it has the potential to be a dangerous moment. Not just for Wall Street not just for the people who are particularly targeted but for anybody who is a little bit out of line,” Blankfein said. “It’s a liability to say I’m going to compromise I’m going to get one millimeter off the extreme position I have and if you do you have to back track and swear to people that you’ll never compromise. It’s just incredible. It’s a moment in history.”

In January, Sanders was asked to list examples of corporate greed, and he listed Blankfein, according to Politico.

Blankfein said he doesn’t “take it personally” because he has never met Sanders.

But Politico points out that there’s an awareness of the anger against the so-called 1% that arose and continues to simmer after the 2007 mortgage crisis that led to a widespread economic recession.

Check out Bill Clinton's quote.

Hotler

(11,425 posts)1.) You need to shut your fucking mouth.

2.) Tumbrels and guillotines are easy to build.

Roland99

(53,342 posts)ErisDiscordia

(443 posts)Then people won't notice...