Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 1 February 2016

[font size=3]STOCK MARKET WATCH, Monday, 1 February 2016[font color=black][/font]

SMW for 29 January 2016

AT THE CLOSING BELL ON 29 January 2016

[center][font color=green]

Dow Jones 16,466.30 +396.66 (2.47%)

S&P 500 1,940.24 +46.88 (2.48%)

Nasdaq 4,613.95 +107.28 (2.38%)

[font color=green]10 Year 1.92% -0.03 (-1.54%)

30 Year 2.75% -0.01 (-0.36%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

ErisDiscordia

(443 posts)and pays double for medical care, clothing, etc...

ErisDiscordia

(443 posts)On such turns of Fate lives are changed...

kickysnana

(3,908 posts)Got to watch "I married a Witch" and a 1960 Korean film on Sunday on TCM. Today I gained a year with an immediate bump up in car insurance and life insurance.

The building we rent is being sold to a large NYC investment firm and I believe they are letting us stay here while they do extensive remodeling this year for the carriage trade at which time living here will be difficult for us. But I always think the worst just so if it doesn't happen it is like I won the lottery.

ErisDiscordia

(443 posts)Darrell Read was the last of six to be cleared of helping Tom Hayes, as group says SFO’s handling of investigation made them ‘scapegoats’...The six brokers found not guilty of helping Tom Hayes rig Libor interest rates have said their trial was a sham and they were made scapegoats, in heavy criticisism of the Serious Fraud Office’s handling of the investigation.

They spoke outside Southwark crown court after Darrell Read was found not guilty of the one outstanding count against the brokers, meaning they have all been cleared.

The jury returned a majority verdict of not guilty against Read, prompting cheers from the other five men, who were in court supporting him a day after they were cleared.

more

ErisDiscordia

(443 posts)Myself, Michael Hudson, John Perkins, and a few others have reported the multi-pronged looting of peoples by Western economic institutions, principally the big New York Banks with the aid of the International Monetary Fund (IMF).

Third World countries were and are looted by being enticed into development plans for electrification or some such purpose. The gullible and trusting governments are told that they can make their countries rich by taking out foreign loans to implement a Western-presented development plan, with the result being sufficient tax revenues from economic development to service the foreign loan.

Seldom, if ever, does this happen. What happens is that the plan results in the country becoming indebted to the limit and beyond of its foreign currency earnings. When the country is unable to service the development loan, the creditors send the IMF to tell the indebted government that the IMF will protect the government’s credit rating by lending it the money to pay its bank creditors. However, the conditions are that the government take necessary austerity measures so that the government can repay the IMF. These measures are to curtail public services and the government sector, reduce public pensions, and sell national resources to foreigners. The money saved by reduced social benefits and raised by selling off the country’s assets to foreigners serves to repay the IMF. This is the way the West has historically looted Third World countries. If a country’s president is reluctant to enter into such a deal, he is simply paid bribes, as the Greek governments were, to go along with the looting of the country the president pretends to represent.

When this method of looting became exhausted, the West bought up agricultural lands and pushed a policy on Third World countries of abandoning food self-sufficiency and producing one or two crops for export earnings. This policy makes Third World populations dependent on food imports from the West. Typically the export earnings are drained off by corrupt governments or by foreign purchasers who pay little while the foreigners selling food charge much. Thus, self-sufficiency is transformed into indebtedness.

With the entire Third World now exploited to the limits possible, the West has turned to looting its own. Ireland has been looted, and the looting of Greece and Portugal is so severe that it has forced large numbers of young women into prostitution. But this doesn’t bother the Western conscience...

more

ErisDiscordia

(443 posts)Saudi Arabia has managed to buy itself a couple of months.

The global rout of oil prices is taking its toll on the kingdom's bottom line. The country has been forced to cut government spending in its upcoming budget and increase production of crude oil—even though its hardly worth pulling it out of the ground.

Still, the world's largest producer of oil appears on a crash-course for bankruptcy as early as of 2018, according to a new Big Crunch analysis.

Many oil-dependent nations are having to dig deep to balance budgets, with crude oil fetching so little on the global market. Money-rich nations like Qatar and Kuwait look to be getting by, while poorer nations like Libya have descended further into strife and civil war. Oil would need to be selling for $269 a barrel for Libya to balance its budget, according to the IMF...

Bankruptcy? No wonder they were thinking of going public and selling stock in Aramco...

ErisDiscordia

(443 posts)It was about time the other shoe dropped in this story of the American tech giants, the Google GOOGL +1.45%, Facebook FB +2.67%, Apple AAPL +3.09% tax dodging stuff, not paying their righteous and just tithe to the governments of Europe. Because over here the shouting is all about how those companies don’t pay tax anywhere. Which is true in the here and now but cannot possibly be true off into the future. The way that the international corporate taxation system works, is supposed to work, is that corporate taxation is applied where the economic value is created and failing that, in the tax jurisdiction of residence of the main or holding company. And that’s how it does work. That currently tax rates are low is simply a quirk of American tax law, not European. And the US is entirely conscious of this: at some point, if those profits are to be paid out to investors, something which is the point and purpose of a company, then US corporate income tax will be paid on those profits. And any amount that Europe manages to snaffle before that will simply lead to a diminution of the amount paid to Uncle Sam.

This does not, as we might imagine, make America happy:

“We are greatly concerned that the EU commission is reaching out to tax income that no member state has the right to tax under internationally accepted standards,” Stack said.

“The mere fact that the US system has left these amounts untaxed until repatriated, does not provide under international tax standards a right for another jurisdiction to tax those amounts.”

This is entirely correct. Those profits of American companies are justly and righteously to be taxed in America. And any taxation by others leads to a reduction in that future amount of American taxation.

Again, quite right. A corporation formed under US law should be taxed under US law. The Financial Times has more:

Mr Stack also mentioned Washington’s fears that an unexpected consequence of the tax recoveries could be that the affected companies would claim credits in the US over the international tax demands. “If so US taxpayers would end up footing the bill for these state aid settlements.”

The way that tax system works is that all foreign taxes are deducted from whatever the American tax bill of those American companies will be. Meaning that every $1 taken by European governments is a $ less to Uncle Sam at some point in the future. And this is true even if America does provide a tax holiday for corporates repatriating such foreign profits. If they do that then those couple of trillions will be paid out in stock buybacks and dividends and Uncle Sam will simply get his cut that way.

The important underlying economic and public policy point here is that for large corporations all this offshore stuff doesn’t actually allow the non-payment of taxes. All it does is allow the delay of the payment of taxes. The Man will indeed get his bite at some point in the future. Meaning that all of the arguments currently going on are not in fact about payment of the dues to The Man, but rather about which version of The Man gets to spend the loot.

As ever, better by far to simply stop this entire charade and abolish corporate taxation. Just tax investors on their incomes from their investments and be done with it.

ErisDiscordia

(443 posts)http://finance.yahoo.com/news/someone-spent-6-hours-paying-170827340.html

Walmart announced earlier this month that it would close 269 stores and lay off thousands of employees.

And this brought to life a classic retail arbitrage scheme: Buy cheap stuff in a defunct store and sell it for a markup somewhere else.

From The Wall Street Journal:

Wal-Mart’s store closings presented a special bonanza. Earlier this month, the Bentonville, Ark.-based retailer began slashing prices by 50% in an effort to clear inventory before closing Supercenter and smaller Express stores. It eventually cut prices by 75%.

And while these store closures might be a boon for a few online retailers, the company is also laying off thousands of employees as part of this plan...

more

ErisDiscordia

(443 posts)It's not brown-nosing if you really mean it...

http://www.huffingtonpost.com/entry/how-to-bond-with-your-boss_us_566b0195e4b009377b24bf99?ir=Business§ion=us_business&utm_hp_ref=business

(yes it is...this article is nauseating)

Hotler

(11,425 posts)The level of commitment. ![]()

Thank you, I'll be here all week, please tip your server.

ErisDiscordia

(443 posts)I have to do laundry today...

Fuddnik

(8,846 posts)ErisDiscordia

(443 posts)Fuddnik

(8,846 posts)Fuddnik

(8,846 posts)I got home and was counting up my tips, and came across a couple of $5 bills stamped in red ink that said Help Stamp Out Money In Politics. And on the other side written "Feel The Bern".

I thought about putting them away, but decided it was better to put them out in circulation.

DemReadingDU

(16,000 posts)We should put more of those into circulation

![]()

ErisDiscordia

(443 posts)Europe's largest lender, HSBC, is imposing a hiring and pay freeze across the bank globally in 2016, two sources familiar with the matter told Reuters.

An email was sent to staff on Friday detailing the latest cost-saving measures, according to the sources who spoke on condition of anonymity.

Like numerous other global banks, HSBC (HSBA.L) is in the midst of a cost-cutting drive to boost profitability and returns to shareholders, and is pushing through with plans for annual cost savings of up to $5 billion by 2017.

Europe's biggest bank said in June that it planned to slash nearly one in five jobs and shrink its investment bank by a third in response to sluggish economic growth and tighter global regulation of bank balance sheet risk...

ErisDiscordia

(443 posts)JPMorgan Chase is partnering with start-up Digital Asset Holdings to launch a trial project using blockchain technology that could reduce the cost and complexity of trading, the Financial Times reported on Sunday.

The agreement comes as another sign that blockchain, which is best known as the basis of the digital currency Bitcoin, has wide-ranging applications for some of Wall Street's biggest banks.

One potential use for the technology is addressing liquidity mismatches in some of JPMorgan's loan funds, the Financial Times said.

“To sell a loan is a very cumbersome, time-consuming process; settlement can take weeks,” Daniel Pinto, head of JPMorgan’s investment bank, told the Financial Times. It “makes all the sense in the world" to explore blockchain's potential to improve that process...

ErisDiscordia

(443 posts)The Bank of England set out on Friday how much extra capital it wants banks to wrap round their deposit-taking arms from 2019 to keep customer money safe during market shocks, and shield taxpayers from footing the bill for losses.

The proposals, put out to public consultation, aim to give final clarity to banks on how much capital they will have to hold in their "ring-fenced" arms.

The BoE said the ring-fenced banks as a sector, which includes HSBC, Lloyds, Barclays and RBS, effectively comply already with the new "systemic risk buffer" or SRB requirement.

Any extra capital requirement would be incremental, no more than 0.5 percent of the banking system's total risk-weighted assets...

ErisDiscordia

(443 posts)Barclays (BARC.L) and Credit Suisse (CSGN.VX) have settled federal and state charges that they misled investors in their dark pools, with Barclays admitting it broke the law and agreeing to pay $70 million, federal and New York state officials said on Sunday.

The settlements between the banks and the U.S. Securities and Exchange Commission and the New York state attorney general mark the two largest fines ever paid in connection with cases involving dark pools.

The amount to be paid, in fines and disgorgement, is a combined total of $154.3 million.

At the heart of the cases against both Barclays and Credit Suisse are allegations they misled investors in the dark pools, saying they would be protected from predatory high-frequency trading tactics...

ErisDiscordia

(443 posts)...The dispute centered on whether the banks disclosed enough to their clients about trading in their dark pools. Barclays misrepresented to clients how it monitored its dark pools for high-frequency trading, according to the statement. Credit Suisse systematically routed orders to its own dark pool, but told clients that it didn’t prioritize one trading venue over another, according to New York Attorney General Eric Schneiderman.

“These cases mark the first major victory in the fight against fraud in dark pool trading that began when we first sued Barclays: coordinated and aggressive government action, admissions of wrongdoing, and meaningful reforms to protect investors from predatory, high-frequency traders,” Schneiderman said. “We will continue to take the fight to those who aim to rig the system and those who look the other way.”

Independent Consultant

Barclays agreed to settle the charges by admitting that it misled investors and violated securities laws, according to the SEC statement. The London-based bank also agreed to install a third-party consultant to review how the firm manages certain aspects of its dark pools business...Zurich-based Credit Suisse didn’t admit or deny wrongdoing in the settlement, which involved two of its trading platforms, Crossfinder and Light Pool. “We are pleased to have resolved these matters with the SEC and the New York attorney general,” Nicole Sharp, a bank spokeswoman, said in a statement...

The private trading venues are the first to be sanctioned by Schneiderman, who almost two years ago began investigating whether U.S. stock exchanges and Wall Street dark pools provide improper advantages to high-frequency traders. He sued Barclays in June 2014, alleging it lied to customers about what high-frequency trading firms were doing inside its platform in an effort to expand the venue’s business...

ErisDiscordia

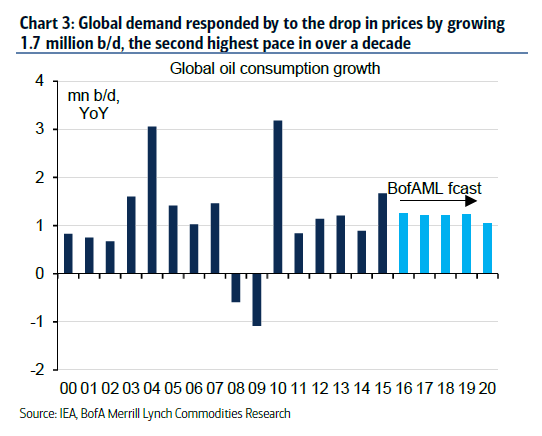

(443 posts)A $3 trillion shift...A new note from Francisco Blanch at Bank of America Merrill Lynch, however, puts the oil move into a much bigger perspective, arguing that a sustained price plunge "will push back $3 trillion a year from oil producers to global consumers, setting the stage for one of the largest transfers of wealth in human history."

Blanch and his team already see evidence that the fall in the price of crude is having a positive impact on demand, and say that it could accelerate even further if prices don't pick up.

Says Blanch: "Alternatively in a lower oil price scenario, e.g. if prices were to average just $40 over the next five years which is close to the current forward curve, demand would grow by 1.5 million barrels per day, which is 0.3 above our base case. Finally, at $20 oil demand would grow by an explosive by 1.7 per year on average, 0.5 above the base case, on our estimates."...

Combine these trends with the decline in, say, Saudi Arabia's foreign exchange reserves, or the stock price of any oil company, and you can see the dramatic wealth shifts now taking place in the world.

ErisDiscordia

(443 posts)...Capitalism does millions of things better than the alternatives. It balances supply and demand in an elegant way that central planning has never come close to. However, it is totally ill-equipped to deal with a small handful of issues. Unfortunately, today, they are the issues that are absolutely central to our long-term wellbeing and even survival. It doesn't think long-term very well because of high discount rate structure.

If you're a typical corporation anything lying out 30 years literally doesn't matter. Or, as I like to say: QED, your grandchildren have no value. And they usually act as if that was true, even though I'm sure they are actually very kind to their grandchildren.

My favourite story is about the contract between the farmer and the devil. The devil says, "sign this contract and I'll triple your farm's profits". But there are 25 footnotes, as there always is with the devil. Footnote 22 says that 1% of your soil will be eroded each year, which is actually horrifyingly close to the real average over the past 50 years. The farmer signs and makes a fortune on a 40-year contract. And his son then signs up for the next 40-year contract and makes a fortune. And his son then signs up for the third and final contract. He still does very well, and in the final 20 years the family has accumulated enormous wealth, but the soil has gone. It's the same story for all his neighbouring farms and everyone is out of business. My sick joke is that at least he will die a rich farmer when all the starving hordes arrive from the city.

Every graduate who took Econ 101 would probably sign that contract. There is no single theory that is used in economics that considers the finite nature of resources. It's shocking...

ErisDiscordia

(443 posts)When drought hits, trees can suffer—a process that makes sounds. Now, scientists may have found the key to understanding these cries for help.

In the lab, a team of French scientists has captured the ultrasonic noise made by bubbles forming inside water-stressed trees. Because trees also make noises that aren't related to drought impacts, scientists hadn't before been able to discern which sounds are most worrisome. (Watch a video: Drought 101.)

"With this experiment we start to understand the origin of acoustic events in trees," said Alexandre Ponomarenko, a physicist at Grenoble University in France, whose team conducted the research.

This discovery could help scientists figure out when trees are parched and need emergency watering, added Ponomarenko, who presented his team's results in 2013 at an American Physical Society meeting in Baltimore, Maryland...

ErisDiscordia

(443 posts)http://www.telegraph.co.uk/finance/financialcrisis/9993266/Financial-crisis-caused-by-too-many-bankers-taking-cocaine-says-former-drugs-tsar.html

David Nutt, the former Government drugs tsar sacked after claiming that horse riding was as safe as taking ecstasy, has said that the banking crisis was caused by too many workers taking cocaine...Prof Nutt said that too many bankers who took the drug were “overconfident” and so “took more risks” and said that not only did it lead to the current crisis in this country, but also the 1995 collapse of Barings bank.

He said cocaine was perfect for their "culture of excitement and drive and more and more and more", adding: “Bankers use cocaine and got us into this terrible mess. It is a 'more' drug."

Prof Nutt is not a stranger to making controversial claims about drugs. His latest attack is on the Government for “absurd” and “insane” laws dealing with magic mushrooms, ecstasy and cannabis, which he said were hindering medical research because regulations meant one of the ingredients - psilocybin, which is used to treat depression - was so hard to get hold of.

He was sacked as the Government’s most senior drugs advisor in 2009 after publishing a paper saying that there was "not much difference" between the harm caused by riding and ecstasy. Society, he argued, did not always "adequately balance" all of the risks inherent in it...

Fuddnik

(8,846 posts)Psilocybin is hard to get? Walk out into any cow pasture in Florida and you can find it. It's why the University of Florida is so much fun.