Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 28 January 2016

[font size=3]STOCK MARKET WATCH, Thursday, 28 January 2016[font color=black][/font]

SMW for 27 January 2016

AT THE CLOSING BELL ON 27 January 2016

[center][font color=red]

Dow Jones 15,944.46 -222.77 (-1.38%)

S&P 500 1,882.95 -20.68 (-1.09%)

Nasdaq 4,468.17 -99.51 (-2.18%)

[font color=green]10 Year 1.99% -0.03 (-1.49%)

30 Year 2.79% -0.02 (-0.71%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

flying rabbit

(4,644 posts)Lurker guy.

Proserpina

(2,352 posts)Dr. John Kotter is one of the most known management thinkers and change management experts on the planet which is why I reached out to him when I was writing my book, The Future of Work. Dr. Kotter created a widely used and referenced model knows as the “8-Step Process for Leading Change” which inspired me to create something specifically around adapting to the future of work which I call, The Six-Step Process for Adapting to the Future of Work,” which you can see below. This is actually something that I will be exploring on a webinar in a few weeks as well. The best way to think of this is as a never ending loop.

The six steps and what are included are outlined below:

- Challenge assumptions

The simplest, easiest, and most common way that some kind of a new initiative around the future of starts off is by looking at one aspect of how work has always been done and asking “why?” Why is it that we have to review employees once a year? Why is it that employees have to sit in cubicles? Why is it that various departments work in silos? Why do employees have to work 9-5? Why…? We haven’t changed most of our work practices for decades so this question really starts the conversation around why change needs to happen. At Cisco their flexible work program started with this very concept and exploration of “hey wait a minute, our sales guys are always on the road and don’t always have to come into an office, why can’t we do this across the company?” - Create a team to help lead the effort

Sometimes initiatives around the future or work are led by HR, IT, a specifically designated task force, or other mix of employees. But the point is that someone needs to be driving these efforts across the organization. More recently I’m seeing HR teams actually lead this change within progressive organizations which is part of the evolution that this function is going through. Whether it’s HR or not, this group will be tasked with things such as experimenting with ideas, educating and training employees, and researching trends shaping the future of work. Companies like Xerox work with ethnographers to truly understand how and why people work. - Define your “future of work”

The next step in the process is defining what the future of work is going to look like for the organization. A great starting point here is defining a few things: what does it mean to work at your organization? What does it meant to be an employee at your organization? What does it mean to be a manager at your organization? What does your organization value and stand for? Mars Drinks does a great job of this by trying to create a “coffee shop” culture across the entire organization. They revamped their physical space, revisited their values, explored new leadership structures, and everything in between. - Communicate your “future of work”

Once the organization goes through the “define” step it’s crucial to actually communicate this to employees. The Daily Telegraph has recently been written about quite a bit recently after they installed workplace monitors on the desks of employees to monitor whether or not they actually use them. This effort was quickly killed off after employees revolted against this idea. This was a poor job on behalf of the Daily Telegraph to communicate what the purpose of this was, why they were doing it, and if employees are on board. Unilever is a great example of a company that does this well with their agile working initiative that is proudly displayed on the company career page and is actively promoted and marketed inside of the company. - Experiment and empower employees to take action

As I’ve written about many times, the only constant that exists is change. So how do you adapt to that type of environment? You have to experiment. Our organizations are structured to be very luck like factories; linear process-centric institutions that don’t care about innovation, engagement, empowerment or the like. Instead we have to think of our organizations like laboratories where employees are empowered to experiment with ideas, get access to resources, and can potentially turn their ideas into products or services. Adobe does a great job of this with their KickStart innovation program where any employee can take a course on innovation and then get a $1,000 pre-paid credit card to build a concept prototype. I’ve written much more about that here. - Implement broad based changed

After running experiments or tests around a particular concept the next step is to implement it across the organization (assuming the results of the experiment were positive). Adapting to the future of work only makes sense when it is looked at across the whole organization. Accenture is a great example of this with their recent initiative to abandon annual performance reviews. What started off as something for a pilot group within the company is now being scaled across hundreds of thousands of employees in under a year which is phenomenal for a company of that size.

If you will notice in the image above this process then repeats by going back to step 1 and then step 3-6. At the most forward thinking and progressive organizations this process is continuous and the questioning around how work gets done occurs regularly. Organizations that follow this process will definitely be ahead of the game when it comes to adapting and preparing for the future of work. If your organization doesn’t think about and prepare for the future of work, then your organization will have no future.

Jacob Morgan is a keynote speaker, author, and futurist. To have Jacob speak at your event, see his videos, podcasts and articles, or to subscribe to his newsletter visit TheFutureOrganization.

*************************************************************

Maybe I'm just born to be a lowly peon or slave, but this looks a lot more like make-work than work to me.

Proserpina

(2,352 posts)The global digital assembly line has arrived. Its workers labor at computer keyboards, performing the behind-the-scenes tasks that make the Internet appear intelligent and functional. They assign labels like “family” or “theme park” to photos, check that Web URLs work, verify addresses on Yelp, review social media posts flagged as “adult.” Corporations, from the smallest start-ups to the largest firms, can now “taskify” everything from scheduling meetings and debugging websites, to finding sales leads and managing fulltime employees' HR files. Instead of hiring help, firms just post their needs to the Web.

This online piecework, or “crowdwork,” represents a radical shift in how we define employment itself.

The individuals performing this work are of course not traditional employees, but neither are they freelancers. They are, instead, “users” or “customers” of Web-based platforms that deliver pre-priced tasks like so many DIY kits ready for assembly. Transactions are bound not by employee-employer relationships but by “user agreements” and Terms of Service that resemble software licenses more than any employment contract.

Researchers at Oxford University's Martin Programme on Technology and Employment estimate that nearly 30% of jobs in the U.S. could be organized like this within 20 years. Forget the rise of robots and the distant threat of automation. The immediate issue is the Uber-izing of human labor, fragmenting of jobs into outsourced tasks and dismantling of wages into micropayments.

In the U.S. and overseas, crowdwork payments can mean the difference between scraping by and saving for a home or working toward a degree. But as Riyaz Khan, a 32-year-old from a small town in the coastal state of Andhra Pradesh in India, discovered, doing work on spec posted by someone you'll never meet and who has no legal obligations to you has serious disadvantages.

My team at Microsoft Research spent two years studying the lives of hundreds of American and Indian crowdworkers like Khan to learn how they manage this nascent form of employment and the capriciousness that comes with it. Khan, when we met him, had spent three years finding work on Amazon Mechanical Turk. AMT is one of the largest online marketplaces that connect “providers” from around the world like Khan with “requesters,” typically U.S. or European businesses or individuals. He did tasks for companies as big as Google and as small as neighborhood print shops...On good days, he made $40 in 10 hours — more than 100 times what neighboring farmers earned. He soon found more tasks than he could complete himself. So he hired locals to work with him out of his living room. In exchange for a cut of their pay, Khan helped his crew create their own accounts, taught them how to complete tasks efficiently, and ferreted out tasks that best matched his workers' skillsets. He also handled any final queries after the completed task was submitted. They called themselves Team Genius.

Three years in, now dependent on this income to support family and friends, Khan heard worrying tales of Indian workers' AMT accounts being shut down. One by one, members of Team Genius lost their accounts. Then it happened to him. An email from Amazon's Customer Service Team offered no explanation beyond: “I am sorry but your Amazon Mechanical Turk account was closed due to a violation of our Participation Agreement and cannot be reopened. Any funds that were remaining on the account are forfeited, and we will not be able to provide any additional insight or action. You may review the Participation Agreement/Conditions of Use at this URL: http://www.mturk.com/mturk/conditionsofuse. Thank you for trying Amazon Mechanical Turk. Best regards, Laverne P. We value your feedback, please rate my response using the link below.''

Using a “Contact Us” link, Khan sent several messages pleading his case. He received auto-replies thanking him for his patience, but no information about how to appeal or retrieve the funds he'd banked with AMT for completed tasks over the last two months. Instead, he was referred to the agreement's “Restrictions and Limitations” clause, which grants AMT the “right to terminate or suspend any Payment Account… for any reason in our sole discretion.”

more

Mary L. Gray is a researcher at Microsoft Research, a fellow at Harvard's Berkman Center for Internet and Society, and an associate professor at Indiana University. She is co-writing a book about on-demand economies and the future of work with computer scientist Siddharth Suri.

Proserpina

(2,352 posts)http://www.marketwatch.com/story/federal-reserve-takes-more-dovish-tone-says-economy-has-slowed-2016-01-27?siteid=yhoof2&ref=yfp

The Federal Reserve on Wednesday said "economic growth slowed" since its last meeting in December and that inflation is unlikely to rise rapidly toward its 2% target, a more dovish tone that suggests the bank won't be quick to raise interest rates again. "Inflation is expected to remain low in the near term," The Fed said in new, more cautious language. The central bank also alluded to stock market turmoil in the U.S. and China, saying it "is closely monitoring global economic and financial developments." Yet despite a more subdued near-term outlook, the Fed said it expects the economy to continue to grow "at a moderate pace," helped by a strengthening labor market. The vote was 10-0.

Proserpina

(2,352 posts)The Federal Reserve hasn't taken more interest rate hikes off the table, but it's likely to be very cautious in the lead up to the U.S. presidential election, Robert Heller, a former Fed governor told CNBC.

"The Fed itself says we'll have four more hikes, but I think they're afraid of their own shadow," Heller told CNBC's Street Signs.

"Whenever it comes to raising rates, they start to back up and they won't do it. So I wouldn't be surprised if there would be only two rate hikes. I expect two or three," said Heller, who was on the board of governors of the Federal Reserve System between 1986 and 1989.

Heller's call followed the Fed's latest meeting Wednesday, where the central bank's statement fueled market expectations that its previously stated goal of about four interest rate hikes this year wasn't likely to come to fruition...

http://www.cnbc.com/2016/01/27/ex-governor-heller-fed-is-afraid-of-its-own-shadow.html

Proserpina

(2,352 posts)A new government report to Congress warns of rising threats to U.S. financial stability, including the looming risk of surging corporate loan defaults.

While big banks and other systemically important financial institutions have been steadily reducing their risks since the financial crisis, debt among nonfinancial companies is at an historic high relative to U.S. gross domestic product, the Office of Financial Research, an independent unit of the U.S. Treasury Department, said in its annual report to Congress Wednesday.

Slowing economic growth, therefore, could hurt companies' ability to repay their loans and lead to a tidal wave of defaults, warned the OFR, which was mandated by the Dodd-Frank Act to study financial stability following the financial crisis. This, in turn, could hurt banks, which are already seeing loans to energy companies sour due to severe declines in oil prices.

In its fourth annual report to Congress, the OFR warned of other looming threats to the financial system, including concerns that persistently low interests rates could prompt investors to seek out riskier investments, which "may encourage excessive borrowing."

The U.S. economy has remained largely resilient to the global slowdown so far, OFR said. "But continued or magnified problems overseas could harm future growth and financial stability in the United States. Profits are declining, debt levels are high, and the ability to pay down or pay off their debts is declining," the research agency warned.

Proserpina

(2,352 posts)Mansion prices show no signs of slowing in rich enclaves such as the Hamptons, Beverly Hills and Aspen, suggesting that the global market panic has yet to spread to top trophy homes.

According to sales data from Douglas Elliman, the median sales price in Beverly Hills for a single family home jumped 54 percent in the fourth quarter over the same period last year, to $5.5 million. In Aspen, the median single-family home price increased 35 percent to $6.7 million and 2015 was the market's best year ever for sales.

In the Hamptons, there was a record number of homes sold for more than $5 million and more than $10 million in the fourth quarter. Granted, the data only covers the fourth quarter, before this year's rout in financial markets. And the first quarter numbers could show a decline. But the numbers suggest that at least the end of last year — when jitters about China and global growth were already starting to rattle markets — the rich still saw real-estate as a strong investment.

And while the most expensive homes in broader markets may be slowing, sales in the marquis "ego-towns" like Beverly Hills and Aspen keep growing...

Proserpina

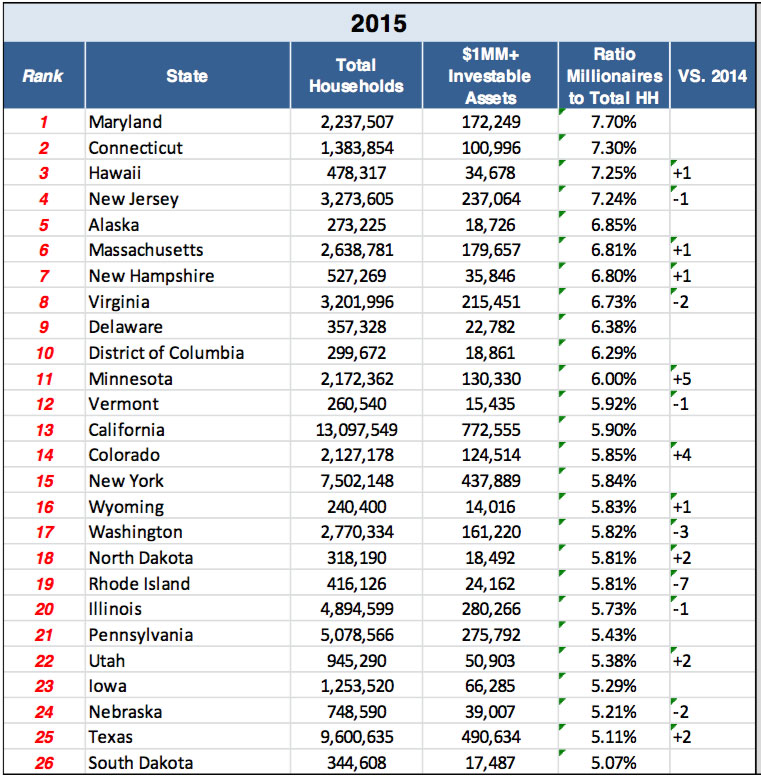

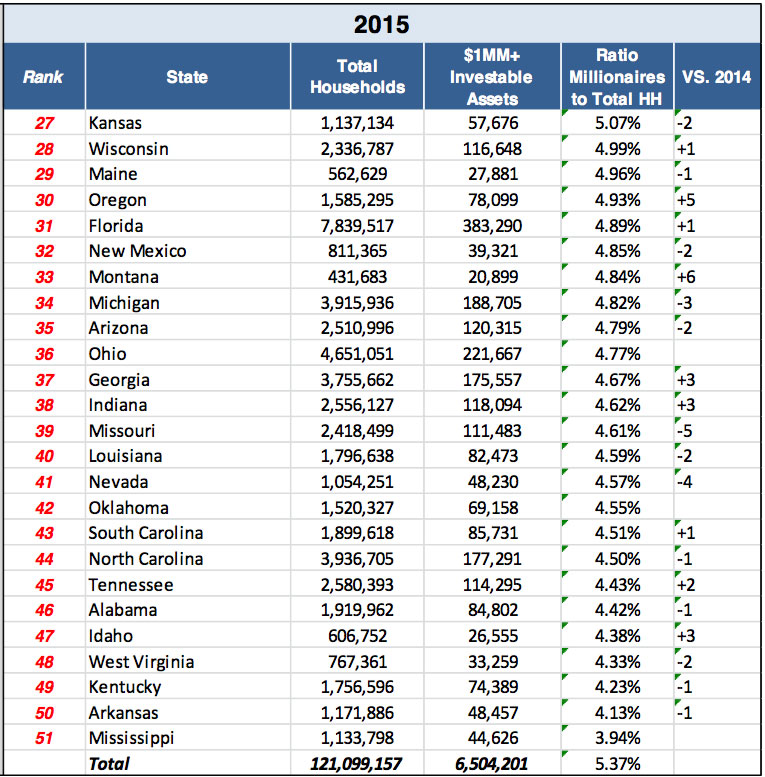

(2,352 posts)Want to be a millionaire? As it turns out, your odds of achieving that status may go up if you live in one of these two states.

A new report by Phoenix Marketing International found that Maryland and Connecticut have the most millionaires per capita than any other state.

The research firm said 7.7 percent of all the households in Maryland have more than $1 million in investible assets, making the state No. 1 in the country. That means 1 in every 13 households is a millionaire household.

Connecticut ranked second, with 7.3 percent of households achieving millionaire status; Hawaii ranked third, with 7.25 percent...California, the most populous state, had the most millionaires in total, with 772,555 millionaire households. Texas, the second largest state by population, also ranked second by total millionaires, with 490,634 millionaire households.

Proserpina

(2,352 posts)In the coming weeks, the organization charged with maintaining the internet’s infrastructure will unveil a plan to surrender the US government’s oversight, marking a symbolic step towards more decentralized internet control after years of international pressure. If all goes as planned, on September 30, the US will cede its control of the Internet Corporation for Assigned Names and Numbers (ICANN), the nonprofit charged with managing components like internet protocols and domain names. The decision has been on the horizon since ICANN was founded in the 1990s, but the scheduled transition has not been without opposition.

The US Department of Commerce announcement that it would finally change its role was initially greeted with backlash from American companies that feared it would affect ICANN’s ability to cater to US trademarks and from politicians who warned the Obama Administration was “giving up control of the internet.”

Fadi Chehadé, who has served as CEO of ICANN for the last four years and will end his term in March, told Motherboard that now, after months of deliberation, arguments, and discussion from these parties and other stakeholders, the nonprofit is ready to hand over a consensus plan to the US government... the House and Senate, initially hesitant about the decision, have been working with ICANN, and companies like Verizon, AT&T, Google, Intel, Cisco, are now on board. Google previously expressed support of the plan put forth by the Cross Community Working Group on Enhancing ICANN Accountability (CCWG) with some caveats in December but declined to comment on the current structure. Intel also offered support of the CCWG in September with some suggestions for “accountability enhancements” but has not since updated its views. Verizon, Cisco, and AT&T did not respond to request for comment.

“It takes time, and now you have more people supporting this,” Chehadé said. “It took some participation and education, and we are now in a good place. We are working with all these people constructively, because they now understand keeping this layer of the internet out of control of governments or special interests is the best thing for the internet.”

The policy will not affect the actual content of the internet, but represents a shift for the building blocks that comprise it, like domain names, which have become controversial with ICANN’s recent additions. One such domain, .sucks, was accused of being “predatory” and evaluated by the FTC, but has since been allowed, and many celebrities have been preemptively scooping up .sex and .porn domains to protect their brands. Soon decisions about addresses like these will be put in the hands of a broader range of stakeholders. Chehadé said the change was inevitable: with the vast majority of new internet users in countries like China and India, it was no longer politically feasible for the group to keep its US ties.

“The status quo was no longer sustainable,” he said. “The internet is no longer a side show. This is the digital century; it’s the next industrial revolution. The prevalence of the internet as a platform that enables the digital century made it incredibly hard for ICANN to continue doing its critical role under the control of one party, whoever that party is, whether it is a government or a company.”

This was especially clear as countries like China, Brazil, and Russia demanded control of ICANN be taken away and given to an international body like the UN, calls that grew louder in light of the NSA spying scandal. These appeals to transition power over ICANN from the US would also potentially allow other major powers like Russia and China to have more control over internet policy and could lead to censorship and fragmentation, allowing conservative countries to create their own walled-off, controlled internets.

“Countries that have failed to stifle free expression at their borders have now turned their attention to the task of gaining control of the root of the Internet itself—meaning a takeover of the nonprofit Internet Corporation for Assigned Names and Numbers by the Chinese, the Russians or some combination of governments unfriendly to the United States and the democratic process is a possibility that must be taken seriously,” Peter Roff wrote at US News in October. It remains to be seen when the plan is unveiled what safeguards are in place to keep ICANN independent and the internet free, but Chehadé believes the current multi stakeholder process will prevent this scenario.

“I think if, at this layer, if the transition we are about to finish occurs we would have reduced considerably that risk,” he said. “If we don’t have this, we don’t have a global internet. It’s just that simple. We’d have multiple internets. Everything would change; the ability to share knowledge, share experiences, to remove barriers, to lower misunderstandings.”

more

Why does this sound like the first article posted?

Proserpina

(2,352 posts)A person often reads that low oil prices–for example, $30 per barrel oil prices–will stimulate the economy, and the economy will soon bounce back. What is wrong with this story? A lot of things, as I see it:

1. Oil producers can’t really produce oil for $30 per barrel.

A few countries can get oil out of the ground for $30 per barrel. Figure 1 gives an approximation to technical extraction costs for various countries. Even on this basis, there aren’t many countries extracting oil for under $30 per barrel–only Saudi Arabia, Iran, and Iraq. We wouldn’t have much crude oil if only these countries produced oil.

Figure 1. Global breakeven prices (considering only technical extraction costs) versus production. Source: Alliance Bernstein, October 2014

2. Oil producers really need prices that are higher than the technical extraction costs shown in Figure 1, making the situation even worse.

Oil can only be extracted within a broader system. Companies need to pay taxes. These can be very high. Including these costs has historically brought total costs for many OPEC countries to over $100 per barrel.

Independent oil companies in non-OPEC countries also have costs other than technical extraction costs, including taxes and dividends to stockholders. Also, if companies are to avoid borrowing a huge amount of money, they need to have higher prices than simply the technical extraction costs. If they need to borrow, interest costs need to be considered as well.

3. When oil prices drop very low, producers generally don’t stop producing.

4. Oil demand doesn’t increase very rapidly after prices drop from a high level.

5. The sharp drop in oil prices in the last 18 months has little to do with the cost of production.

6. One contributing factor to today’s low oil prices is a drop-off in the stimulus efforts of 2008.

7. The danger with very low oil prices is that we will lose the energy products upon which our economy depends.

8. The economy cannot get along without an adequate supply of oil and other fossil fuel products.

9. Many people believe that oil prices will bounce back up again, and everything will be fine. This seems unlikely.

10. The rapid run up in US oil production after 2008 has been a significant contributor to the mismatch between oil supply and demand that has taken place since mid-2014.

Conclusion

Things aren’t working out the way we had hoped. We can’t seem to get oil supply and demand in balance. If prices are high, oil companies can extract a lot of oil, but consumers can’t afford the products that use it, such as homes and cars; if oil prices are low, oil companies try to continue to extract oil, but soon develop financial problems...

Oil production, demand and pricing is just a major sub-problem of the much larger global economy problem...

Proserpina

(2,352 posts)http://wolfstreet.com/2016/01/22/freight-recession-blamed-on-consumers-and-commodities/

“Consumers just don’t seem to be showing up….”

As much as we would have liked to, the Dow Transportation Average wasn’t kidding. It has plunged 27% since its high on December 5, 2014. Nearly two-thirds of that plunge came over the past two months. Transportation companies are singing the blues. Railroads, trucking, air freight….Union Pacific, the largest US railroad, reported awful fourth-quarter earnings Thursday evening. Operating revenues plummeted 15% year over year, and net income dropped 22%.

It was broad-based: The only category where revenues rose was

automotive (+1%).

Otherwise, revenues fell:

Chemicals (-7%),

Agricultural Products (-12%),

Intermodal containers (-14%),

Industrial Products (-23%), and

Coal (-31%).

Shipment of crude plunged 42%.

So Union Pacific did what American companies do best: it laid off 3,900 people last year. This is what CEO Lance Fritz told Reuters about the American consumer: “What’s causing us some concern is it’s hard to figure out where the consumer is at.” Consumers were sending mixed signals. Spending is shifting from retail of goods toward services. People were buying automobiles, and auto shipments rose in the quarter. And unemployment numbers looked good, he said, but labor participation “is lackluster and consumers just don’t seem to be showing up to purchase goods and services.” And another disappointment about consumer behavior, according to Fritz: “There was a widespread belief that consumers would turn the savings from low fuel into spending, and we haven’t seen that so much.”

Canadian Pacific, which is trying to buy US rival Norfolk Southern in a deal that is vigorously contested by other railroads, reported a 4% drop in fourth-quarter revenues and a 29% drop in net income. Among its biggest decliners: crude-oil shipments (-17%) and consumer-products shipments (-24%). It garnished the report with an announcement of up to 1,000 layoffs...CSX, in its earnings release earlier in January, reported a revenue decline of 7% for the year...On January 7, the Association of American Railroads (AAR) reported on the deterioration in shipment volumes late last year. In December, total volume dropped 8.9% year over year: intermodal containers and trailers, which had been holding up for much of the year, edged down 0.7%; and carloads (bulk commodities, autos, and the like) plunged 15.6%. This was echoed by the Cass Freight Index, which tracks freight transactions by “hundreds of large shippers,” regardless of mode of transportation, including by truck and rail. It does not cover bulk commodities, but is focused on consumer packaged goods, food, automotive, chemical, OEM, heavy equipment, and retail. In December, shipment volume fell 3.7% year over year. Note how the index for 2015 (red line) has been lower that in 2014 (blue line) every month, with the exception of January and February:

The Cass report added some bitter morsels:

High inventories are a problem for retailers, wholesalers, and manufacturers, so a majority of goods were discounted.

Export demand was way off in 2015 because of global economic conditions and the relative strength of the U.S. dollar.

Consumers remained cautious about extending any new credit for holiday purchases, waiting for the best bargains. Retailers had hoped the extra cash generated by still-falling gas prices would boost sales, but instead consumers increased their visits to restaurants and similar businesses.

The never-dying meme of gas savings going into brick-and-mortar retail! Instead it’s going into housing costs, healthcare, education, etc., which have risen relentlessly, and for many people have soared...

kickysnana

(3,908 posts)First, the good news: The two major real estate trade groups serving this market–the Minneapolis Area Association of Realtors (MAAR) and the St. Paul Area Association of Realtors–reported that 2015 ended with 56,390 closed sales, a 13.7 percent increase from 2014 and the best sales level in 10 years. The market’s median sales price last year was $220,000, up seven percent from the previous year, while distressed sales made up 10.6 percent of all closed sales, a staggering 26.7 percent year-over-year drop.

“Last year really showcased the durability of our economic and housing recovery, despite a few obstacles. Attractive rates, rising rents, job growth, wage increases and the lowest unemployment rate of any major metro area will continue to be positive factors for real estate,” said Judy Shields, president of MAAR.

But, now, the bad news: Local housing inventory dropped to a 10-year low last month, according to a study by the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business. Last month, the Twin Cities metro area had only 10,301 homes for sale. During 2015, residential properties costing less than $200,000 represented 30 percent of all homes on the market, but 42 percent of the sales.

“The bottom line is that there is said Herb Tousley, director of real estate programs at the university. “The continuing shortage of homes for sale coupled with increased demand for houses in that price range will continue to keep an upward pressure on prices but will likely be a drag on the number of closed sales. This is great if you are a seller but is much more challenging if you are a buyer.”

kickysnana

(3,908 posts)• A 17 percent decline was registered last year in homelessness among families with children, a cohort among whom homelessness had been climbing since the Great Recession.

• Minnesota’s progress has come as many other states saw rising counts, noted Cathy ten Broeke, state director to prevent and end homelessness. That suggests that recent state policy changes may have mattered at least as much as the economy in driving down homelessness.

What changed? In a nutshell, better coordination of services that can be brought to bear to either prevent the imminent loss of a home or remedy that loss soon thereafter. That, plus an infusion of state funds: the 2014 Legislature invested $110 million via both housing and general-obligation bonds to create or preserve more than 4,000 units of affordable housing.

kickysnana

(3,908 posts)Klobuchar points out the business relationships between the countries and that Norway and Sweden have shouldered much of the burden of the European refugee crisis in recent years. “It’s no way to treat your friends,” she said. “The point is all these other European nations have ambassadors. Why would you put a hold on two of our best allies from having ambassadors?”

Democratic U.S. Sen. Al Franken said he also would increase pressure for a vote. “We need to move on ambassador openings for both Norway — where there’s a highly qualified Minnesota nominee who has yet to be confirmed — and Sweden,” Franken said. “I’m going to continue pressing to get these positions filled.”

Norway and Sweden are two of the largest investors in the U.S. economy. Norway is invested in more than 2,100 American companies, which amounts to about $175 billion. It also has about $94 billion in U.S. bonds and $5 billion worth of U.S. real estate. Meanwhile, the U.S. exports $9 billion in goods and services to Sweden, a country that supports about 330,000 American jobs annually, embassy officials said.