Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 17 December 2015

[font size=3]STOCK MARKET WATCH, Thursday, 17 December 2015[font color=black][/font]

SMW for 16 December 2015

AT THE CLOSING BELL ON 16 December 2015

[center][font color=green]

Dow Jones 17,749.09 +224.18 (1.28%)

S&P 500 2,073.07 +29.66 (1.45%)

Nasdaq 5,071.13 +75.77 (1.52%)

[font color=red]10 Year 2.30% +0.01 (0.44%)

[font color=black]30 Year 3.01% 0.00 (0.00%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Proserpina

(2,352 posts)The typical demand of the powerful over the powerless.

Proserpina

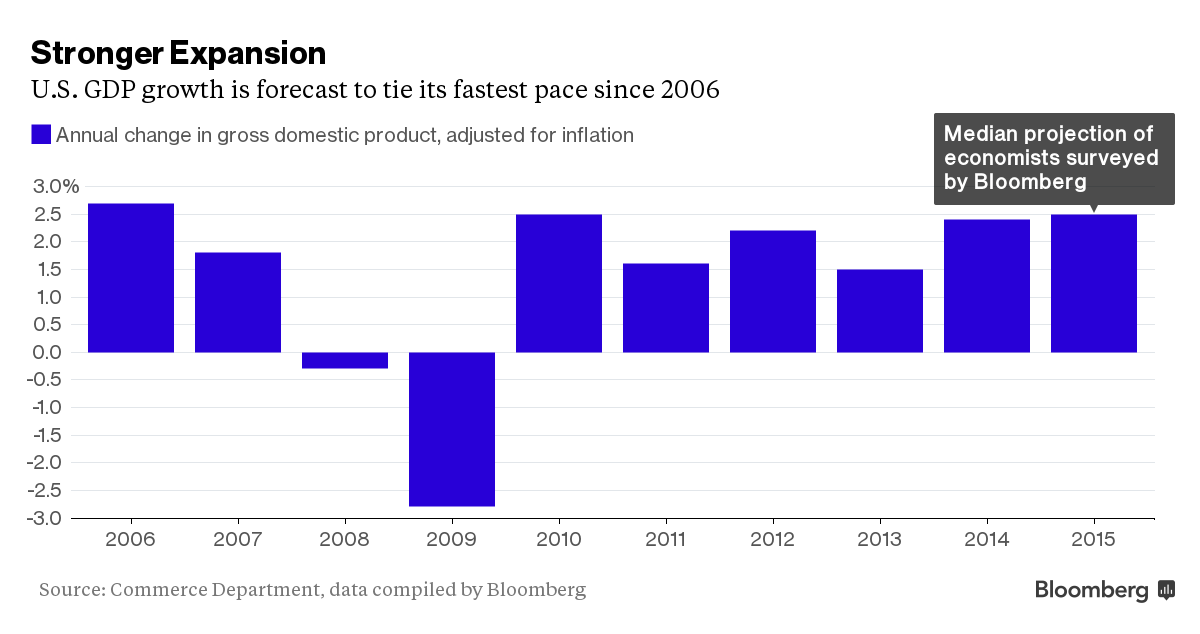

(2,352 posts)The Federal Reserve raised interest rates for the first time in almost a decade, a widely telegraphed move that Chair Janet Yellen said would be followed by “gradual” tightening as officials watch for evidence of higher inflation.

The Federal Open Market Committee unanimously voted to set the new target range for the federal funds rate at 0.25 percent to 0.5 percent, up from zero to 0.25 percent. Policy makers separately forecast an appropriate rate of 1.375 percent at the end of 2016, the same as September, implying four quarter-point increases in the target range next year, based on the median number from 17 officials.

“The economic recovery has clearly come a long way, although it is not yet complete,” Yellen told a press conference following the conclusion of the FOMC’s two-day meeting in Washington. “The committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will continue to expand at a moderate pace and labor market indicators will continue to strengthen.”

The increase draws to a close an unprecedented period of record-low rates that were part of extraordinary and controversial Fed policies designed to stimulate the U.S. economy in the wake of the most devastating financial crisis since the Great Depression. The FOMC lowered its benchmark rate to near zero in December 2008, three months after the collapse of investment bank Lehman Brothers Holdings Inc. and 10 months before unemployment in the U.S. peaked at 10 percent....

and none of this would have been necessary, if Congress had done its job: raising taxes on the wealthy, instituting large infrastructure building programs and other job-creating projects, strengthening the safety net, and setting up universal single payer, instead of the sham Obamacare con game...by destroying the value of saving, the Fed has fundamentally undermined the entire global economy.

Proserpina

(2,352 posts)http://www.bloomberg.com/news/articles/2015-12-16/how-yellen-sees-the-fed-s-rate-hike-affecting-average-americans

...what does such a seemingly small move mean for the average American? Fed Chair Janet Yellen spelled it out in a press conference following the central bank's decision...

Proserpina

(2,352 posts)John Kanas wants to be clear: Investors need to lower their expectations that higher interest rates will translate quickly into fatter bank profits.

“Pundits, and the market itself, are drastically oversimplifying the thesis,” Kanas, chief executive officer of Miami Lakes, Florida-based BankUnited Inc., said in an interview, recounting a message he gave to two dozen investors at a Boston luncheon this month. “This may not be the big holiday and celebration that people think.”

Kanas is among a growing group of U.S. bank executives taking to private meetings and public forums to curb enthusiasm as the Federal Reserve prepares to increase interest rates for the first time since 2006. Investors rushed into financial stocks this year, anticipating that a rate hike would enable lenders to bolster margins by charging more for loans while paying little for deposits. Instead, profits may be hobbled by fierce competition and rate-setters who slow the pace of future increases, capping the long-term yields the industry counts on to make money...

not to mention that strengthening the dollar further will crush US manufacturers' export markets...which are already prostrate

Proserpina

(2,352 posts)Janet Yellen and the Federal Open Market Committee have finally taken the world’s biggest economy off life support. Now, U.S. government deficits will rise, insurance companies will get relief and savers -- who’ve weathered years of earning next to nothing -- will continue to survive on crumbs...The rate hike comes as no surprise, but it’s new territory nonetheless. Investment bankers, traders and analysts who were in business school back in December 2008 when then-Fed Chairman Ben S. Bernanke began the journey known as ZIRP, for zero-interest-rate policy, are now in their 30s, their entire careers spent in what current Fed Vice Chairman Stanley Fischer called “far from normal” times. Here are some winners, some losers and some who won’t be much affected by the Fed’s “liftoff”:

WIN: Other central banks

The Bank of Japan, the European Central Bank and the People’s Bank of China are pumping more money into their economies. The Fed’s tightening will put those efforts on steroids, said Carl Riccadonna, Chief U.S. Economist for Bloomberg Intelligence. Winners will be countries “with low inflation who are large exporters to the U.S.,” he said.

LOSE: Federal budget

The U.S. government could pay as much as $2.9 trillion more in interest over the next 10 years if rates slowly escalate, according to calculations by the Congressional Budget Office and Dean Baker, co-director of the Center for Economic and Policy Research in Washington.

MEH: Savers

Rates on savings accounts and certificates of deposit accounts are likely to improve, allowing consumers to generate more interest on the cash they’ve parked at the bank. At the same time, what Christopher Whalen, senior managing director at Kroll Bond Rating Agency, called the “huge wealth transfer from savers to debtors” over the last seven years will probably continue. Returns on money market funds, longtime havens for retirees and others on fixed incomes, have cratered to near-zero from 4.79 percent in October 2007, before the financial crisis, according to Crane Data. Savers will likely be the last to benefit from higher rates.

WIN: Long-Term Treasuries and Corporate Bonds

Corporate pension managers were waiting for higher rates to buy debt since higher yields make it easier to match their income to what they’ll need to pay pensioners, said Anthony Gould, head of global pension solutions with JPMorgan Asset Management. Pension plans and retirement funds should buy $68 billion of fixed-income assets next year, according to strategists at JPMorgan Chase & Co. Combined with the $1.1 trillion other institutions will buy, demand could outstrip supply by $100 billion next year, they said.

LOSE: Brazil, China

As if political scandals and a deepening recession aren’t enough, the interest-rate rise will weaken the real, giving an unwelcome push to Brazil’s inflation, which is 10.5 percent and rising. As for China, “debt is still increasing at twice the pace of the economy,” said Ruchir Sharma, head of emerging market equities at Morgan Stanley Investment Management. “That’s not a sustainable model.” Come to think of it, trying to squeeze out 7 percent annual growth in the middle of the world’s biggest borrowing binge might be tough to overcome with or without a Fed hike.

MEH: Banks

Under the Fed’s record-low rate, banks were limited on what they can charge on loans and earn on other investments. So lending margins have plummeted, revenue growth has stagnated and overall earnings have suffered. Now banks will be able to charge more. But higher rates can also have a negative effect on banks’ earnings if the interest lenders have to pay to depositors rises faster than what they’re charging on loans. And since banks have varying businesses mixes, not all of them will see the same effects from rising rates, leaving analysts guessing about which banks will see the biggest gains.

“On paper, the banks look leveraged to rising rates, but history raises some key questions,” said Sanford C. Bernstein & Co. analyst John McDonald. The timing and effects of rising rates on banks “remains a key debate that will likely rage on for much of 2015 and beyond.”

WIN: Insurance companies

Since they invest customers’ premiums with the aim of being able to cover losses with the profits, insurance companies hated ZIRP. U.S. property-casualty insurers are earning an average annualized yield of 3.1 percent on investments, the lowest in half a century. That will improve, albeit slowly, as the Fed raises rates, said Doug Meyer, an analyst at Fitch Ratings. “It’ll have an impact over time, a favorable impact on earnings across virtually every product line,” Meyer said.

LOSE: Automakers

Liftoff would reduce demand for new vehicles by about 150,000 units, or about 1 percent of the market, over the next 12 months, according to a J.D. Power poll of 2,301 Americans planning to purchase a vehicle in the next 12 months. Dealers and automakers would likely reduce prices, increase incentives or subvent interest rates to boost demand, said David Sargent, J.D. Power vice president of global vehicle research. “A lot of the effect in the short term is probably going to be psychological rather than practical,” Sargent said.

MEH: Commodity prices

Boom and bust cycles in commodities are decades in the making, so the rate hike will have little effect on price declines, said Robert Stimpson, a fund manager at Oak Associates Ltd. in Akron, Ohio, which manages about $900 million. In other words, don’t blame Yellen.

WIN: The Fed

Good economic news! The national jobless rate is at its lowest in seven years and economic growth has surpassed expectations. Not that Yellen ought to don a flak jacket and declare mission accomplished, but the first rate hike since 2006 is a sign that at least the ATMs will continue spitting out twenties when Americans need them. That was an open question when rates went to near-zero in 2008.

LOSE: The Fed

Too late! That’s the opinion of Paul Mortimer-Lee, BNP Paribas SA’s chief economist for North America. “The die may already be cast and the path to the next recession may have been taken,” Mortimer-Lee told clients in a report last month. “The reason for our recession concern is not so much because of what the Fed is about to do -- likely embark on a slow hiking cycle beginning in December -- but because it did not start the tightening much sooner.”

MEH: The Fed

Monetary policy has already tightened! While the Fed dithered, markets did it on their own. Goldman Sachs Group Inc. tracks that sort of thing with its Financial Conditions Index, a measure that incorporates variables like stock prices, credit spreads, interest rates and the exchange rate. Though the bank says it’s a rough estimate of conditions, it also says that every 1 percent rise in the Fed funds rate shows up as a 1.5 percent increase in the index. The index rose to its highest level in five years before the Fed policy makers met on Sept. 17. The index has hovered near that peak since, equating to a Fed hike of 75 percentage points.

Proserpina

(2,352 posts)Colombia is nursing paper losses of more than $100 billion after its oil boom fell short of expectations, wiping out 90 percent of the value of what was once Latin America’s biggest company.

From being the world’s fifth-most valuable oil producer at its zenith in 2012, worth more than BP Plc, state-controlled Ecopetrol SA now ranks 38th. Its market capitalization has fallen to $14.5 billion, down from its peak of $136.7 billion.

“They just haven’t found oil, it’s as simple as that,” Rupert Stebbings, the managing director of equity sales at Bancolombia SA, said from Medellin. “The whole oil sector got massively over-bought, and people assumed that one day they’d hit an absolute gusher.”

As the army wrested back territory from Marxist guerrillas over the last decade and a half, opening up more land for exploration, the outlook was bright for the oil sector in Colombia, which borders Venezuela, the nation with the world’s largest reserves. Ecopetrol’s share price soared to “irrational levels” as investors bet on surging output that then failed to materialize, Stebbings said.

******************************************

With shares in the oil producer still high, the government opted in 2013 to sell a stake in electricity producer Isagen SA rather than Ecopetrol. Finance Minister Mauricio Cardenas, who sits on the board of Ecopetrol, said in an August 2013 interview that the government didn’t want to sell a further stake in the company because its growth prospects were better than Isagen’s. Since then, Isagen shares have risen 4.2 percent, while Ecopetrol’s have fallen 74 percent. The Isagen stake sale has yet to take place due to a series of legal challenges...

more

Proserpina

(2,352 posts)The world’s biggest energy consumer may have a message for OPEC.

China’s decision to suspend fuel price cuts as crude continues its decline is sending a signal to the Organization of Petroleum Exporting Countries that prices are too low, according to a report from Sanford C. Bernstein & Co. The move gives oil a price floor around $38, according to the analysis.

“China’s decision to not cut refined product (gasoline, diesel) prices is a first,” analysts including Neil Beveridge wrote in the report. The move “sends a signal to OPEC that its largest customer (China) believes that oil prices are too cheap.”

China, the world’s second-biggest oil consumer, said it will suspend fuel price cuts while crude continues to fall in order to slow consumption growth and trim automobile emissions. Gasoline demand in the country increased 10.4 percent in the first 10 months of the year from the same period of 2014, according to the Paris-based International Energy Agency...

video at link stresses worry about Iranian oil coming to market for first time in a decade or more of sanctions...

more

Proserpina

(2,352 posts)U.S. shale drillers will soon be able to sell their oil all over the world. Too bad no one needs it right now.

A congressional deal to lift the 1970s-era prohibition on shipping crude overseas has the potential to unleash a flood of oil from Texas and North Dakota shale fields into markets already flush with cheap supplies from the Persian Gulf, Russia and Africa.

The arrival of U.S. barrels in trading hubs from Rotterdam to Singapore will intensify competition for market share between oil-rich nations, publicly traded producers and trading houses, adding pressure to prices that have tumbled 67 percent in the past 18 months. In the longer term, it may also extend a lifeline to shale drillers strapped for cash after amassing huge debt loads during the boom years.

“The winners in all of this are the U.S. oil producers who now have a bigger market for their shale” output, said Gianna Bern, founder of Brookshire Advisory and Research Inc. in Chicago and a former BP Plc oil trader. “Unfortunately, it’s coming at a time when there’s already way too much crude on the global market.”

U.S. oil explorers from Exxon Mobil Corp. to Continental Resources Inc. have been agitating for an end to the export ban for most of this decade as technological advances in drilling and fracking opened up vast, untapped reserves of crude. The so-called shale revolution has lifted U.S. oil output for seven straight years, making the nation the world’s third-biggest producer behind Russia and Saudi Arabia...

US Consumers,

The Environment.

Punx

(446 posts)Here in Oregon said this morning that we would also be selling from the Strategic Oil Reserve as well due to this. $90 a barrel oil from there for ?...well a lot less. Makes perfect sense. ![]()

Proserpina

(2,352 posts)http://www.bloomberg.com/news/articles/2015-12-16/billionaire-sam-zell-says-recession-likely-in-next-12-months

Billionaire investor Sam Zell said the U.S. economy could go into a recession in the next year and that an expected Federal Reserve interest-rate increase is coming at least six months too late.

The central bank has been too cautious and the economy would already be adjusting if it raised rates six to nine months ago, giving Chair Janet Yellen “more room if a recession is on the way,” Zell said Wednesday in an interview on Bloomberg Television. Multinational companies are laying off workers, global trade is slowing and there’s a possibility China’s economy will falter, he said.

“There is a high probability that we are looking at a recession in the next 12 months,” Zell said on the “Bloomberg<GO>” program. “The strong dollar is having a tremendous impact on U.S. production and U.S. businesses.”

more

http://www.reuters.com/article/us-highyield-lasry-redemptions-idUSKBN0TY03120151215

Billionaire hedge fund manager Marc Lasry on Monday backed a junk bond mutual fund hemorrhaging assets at his Avenue Capital Group as jittery investors exit high-yield bonds amid a market rout.

Investors have taken note that Lasry's $884 million Avenue Credit Strategies Fund is run by the same portfolio manager who in 2009 helped launch the Third Avenue Focused Credit Fund, which abruptly shut down last week and blocked investor redemptions, fund disclosures show...In January 2012, Jeff Gary joined Lasry from Third Avenue, where he once ran the now defunct fund. Gary left Third Avenue in December 2010. Despite some similarities, Lasry sought to draw distinctions between the two junk bonds in a telephone interview with Reuters.

“We have a diversified and well-positioned portfolio and our illiquid assets are in the single digits,” Lasry said about his fund. By contrast, Third Avenue's fund had an estimated 20 percent of its assets in illiquid, hard-to-trade securities. And Lasry's Avenue Capital, a powerhouse in the distressed investing sector, has about $12 billion in assets, compared with less than $10 billion at Third Avenue Capital.

"I think overall redemptions at some point are going to slow down across the market," Lasry said. "I'm not sure if that will be tomorrow or next week, but people are going to start putting money back into the market at some point."

shades of 1929!

more

Proserpina

(2,352 posts)http://www.bloomberg.com/news/articles/2015-12-16/force-awakens-can-t-hope-to-match-box-office-of-original-star-wars

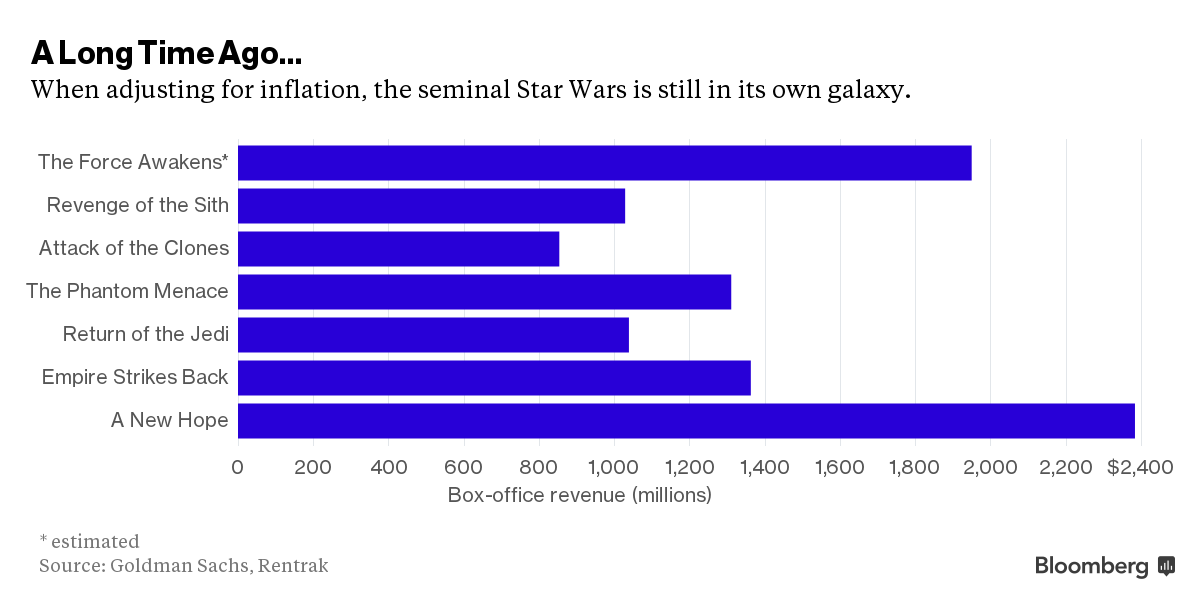

Box-office analysts project that The Force Awakens will easily haul in more ticket revenue than any other film in the Star Wars franchise. The long-running saga’s first movie in a decade could very well break the $2.8 billion record set by Avatar in 2009. But that won’t give the new blockbuster the same financial force as 1977’s A New Hope, the original Star Wars film that launched the series.

The Force Awakens “gets to $1 billion without breaking a sweat,” said Paul Dergarabedian, senior media analyst at Rentrak, who sees a chance the movie’s box-office revenue will surpass $3 billion. Despite Hollywood’s affinity for time-travel tropes, the box-office horse race typically doesn’t account for the time-value of money. In drawing up its record books, the industry almost always ignores inflation. This is one of two areas in which the original Star Wars film shines.

A New Hope was a smash success financially, a bona fide blockbuster in the dawn of the blockbuster era. With cinemas screening the original Star Wars for most of 1977 and 1978, the film garnered $512 million in ticket sales. What’s truly incredible about that figure is that movie tickets in 1977 cost just $2.23 on average. That means about 230 million people went to see the film, slightly more than the population of the U.S. at the time. “It was an absolute phenomenon,” Dergarabedian said. “And it came just after Jaws, which kind of set up the blockbuster mentality.”

more

In today’s dollars, the first Star Wars is a $2.4 billion movie, slightly more than what Goldman Sachs expects from The Force Awakens.

Proserpina

(2,352 posts)After months of anticipation, a flurry of merchandise and massive demand for tickets that crashed websites selling them, Star Wars: The Force Awakens, has finally hit the big screen. But does it live up to the galactic hype?

Here's a roundup of reviews...

expectations are high on this one...Yoda

Proserpina

(2,352 posts)http://www.bloomberg.com/news/articles/2015-12-16/air-force-one-update-is-delayed-by-budget-deal-in-blow-to-boeing

An order for the first Boeing Co. 747 jumbo jet for the new, upgraded Air Force One fleet to ferry U.S. presidents will be postponed by a year to fiscal 2017 under a congressional budget agreement.

The delay is a setback to Boeing’s efforts to gin up sales of its humpbacked 747-8 model as unfilled orders for the plane dwindle to about two years of production. The planemaker has netted just two orders this year for its largest aircraft, which pioneered long-range travel in the 1970s.

An omnibus federal spending bill hashed out late Tuesday by congressional negotiators provides $82.4 million for the presidential aircraft, $20.2 million less than the U.S. Air Force had sought for fiscal 2016. The Obama administration had proposed buying the first plane this year and a second one in 2020. Boeing’s 747 is the only U.S. plane that meets the Pentagon’s requirement of a modified four-engine airliner.

The upgraded fleet would replace Boeing jumbos flying since the early 1990s. The new 747s also will be packed with equipment not available to commercial customers, including dual auxiliary power units, military avionics, self-defense systems and “autonomous enplaning and deplaning” systems, according to a Feb. 1 budget document...

and on-board drone launching, no doubt...

more

Proserpina

(2,352 posts)

Proserpina

(2,352 posts)by Yves Smith

A seismic shift is underway.

I have never seen an editorial of a trade publication, much the less a mainstream media publication, take on its establishment in as brutal a manner as Pensions & Investments did yesterday in Shining new light on fees. Mind you, the strident tone is fully deserved, indeed necessary given the complacency, severity of capture, and fecklessness of most “alternatives investment” limited partners, particularly in private equity.

The members of this too-cozy industry are not used to being called out by fellow insiders. But the fact that P&I has taken this bold step says that a considerable minority recognizes that the retrograde position of blind loyalty to private equity lords and masters is a long term losing proposition, particularly now that it is being revealed that private equity is failing to deliver on its its promise of clearly superior returns. Once the emperor is revealed to be scantily clad, it’s well-nigh impossible to justify the lack of transparency, the one-sided agreements, the fee gouging, and the outright criminality.

Of course, the private equity firms still have a tremendous amount of power, particularly by virtue of their near-lock on top legal expertise by virtue of how much they throw around in fees. But a turn in political sentiment and media coverage is going to mean many of the standard lines that investors accepted that were just a crock, like the claim that private equity agreements are trade secrets. will increasingly have to be defended on their merits. And a lot of them simply won’t hold up to any degree of critical scrutiny.

I urge you to read the op-ed in full. You’ll see I am not overstating in depicting this article as brutal. http://www.pionline.com/article/20151214/PRINT/312149986/shining-new-light-on-fees

Proserpina

(2,352 posts)Author Claudia Kolker took a closer look at such cultural practices for her 2011 book, The Immigrant Advantage. Her book examines why immigrants are often healthier than native-born Americans—a question that continues to be explored. Some credit this perplexing phenomenon to the idea that immigrants must be healthy to migrate. Kolker’s research shows its connection to customs like Danza Azteca: close community bonds, traditional foods, and la cuarentena, a Latin American tradition in which a new mother rests for the first 40 days after giving birth, not lifting a finger except to breastfeed and bond with her child. Kolker also has a hunch that a lack of smoking is a factor, and other researchers agree.

But these findings not only show an immigrant advantage; they present a paradox, too.

Recently arrived immigrants, especially Hispanics, experience nearly double the poverty rate of the U.S.-born population. Despite their economic situation and lack of health insurance, Hispanics tend to live longer than both black and white males and females: about three years more than whites and six years more than blacks. However, they still have higher death rates when it comes to diabetes, cirrhosis, and hypertension.

Aguilar’s mother and grandmother, who are from rural Mexico, have developed diabetes and hypertension, diseases Aguilar is sure their change in diets caused. “Right now we’re all pretty much eating the same crap,” she says. “It’s cheap, and it’s fast.”

Kolker says immigrants who are not used to consuming so much fast or processed food have an upper hand when they arrive in the United States because their dishes are usually made up of more natural, healthier ingredients. Maintaining that diet once in the United States takes commitment...As generations become more Americanized, their health begins to decline...

Proserpina

(2,352 posts)Canarsie Capital founder Owen Li managed to lose $57 million in two weeks, leaving his investors with only $200,000 and a letter of apology. Now, he can add a felony conviction to that record after admitting he lied to investors and regulators about his hedge fund’s performance. All before his 30th birthday. Li, 29, surrendered to U.S. authorities Wednesday and pleaded guilty to a single count of securities fraud and making a false statement, Manhattan U.S. Attorney Preet Bharara said in a statement. He faces as long as 20 years in prison when he’s sentenced.

Li’s fund collapsed in January after the firm lost $57 million, or almost all the money held by its 41 investors, from Dec. 31 to Jan. 16. Prosecutors said Li lost about $18 million at the start of January 2015 when he began selling off long equity positions in the fund and eliminated all of its short positions. The resulting unhedged, long portfolio lost almost all its value about two weeks later when index options prices moved against Canarsie’s positions, according to the government.

Li was barred Wednesday from the securities industry in a settlement of claims against him by the U.S. Securities and Exchange Commission, the agency said in a statement.

According to the SEC, Li, after graduating from college in 2008, worked as a trading assistant for Galleon Management LP, an arm of the hedge fund company run by Raj Rajaratnam, who was convicted of insider trading and sentenced to 11 years in prison...

Proserpina

(2,352 posts)Source: CNBC

Pharmaceutical entrepreneur Martin Shkreli was arrested by the FBI on Thursday, amid a federal investigation related to his former hedge fund and a drug company he previously headed.

The previously disclosed investigation of Shkreli, 32, who is now chief executive of Turing Pharmaceuticals, stemmed from his time as manager of hedge fund MSMB Capital Management and chief executive of biopharmaceutical company Retrophin Inc .

His arrest, witnessed by Reuters, comes amid a continuing separate controversy that has turned Shkreli into a lightning rod for growing outrage over the soaring prices of prescription drugs.

Read more: http://www.cnbc.com/2015/12/17/turing-pharmaceuticals-ceo-shkreli-arrested-by-fbi-reuters.html

http://www.bloomberg.com/features/2015-martin-shkreli-securities-fraud/

A boyish drug company entrepreneur, who rocketed to infamy by jacking up the price of a life-saving pill from $13.50 to $750, was arrested on securities fraud related to a firm he founded.

Martin Shkreli, 32, ignited a firestorm over drug prices in September and became a symbol of defiant greed. The federal case against him has nothing to do with pharmaceutical costs, however. Prosecutors charged him with illegally taking stock from Retrophin Inc., a biotechnology firm he started in 2011, and using it pay off debts from unrelated business dealings. He was later ousted from the company, where he’d been chief executive officer, and sued by its board.

In the case that closely tracks that suit, federal prosecutors accused Shkreli of engaging in a complicated shell game after his defunct hedge fund, MSMB Capital Management, lost millions. He is alleged to have made secret payoffs and set up sham consulting arrangements.

Shkreli’s extraordinary history—and current hold on the public imagination—makes the case more noteworthy than most involving securities fraud. The son of immigrants from Albania and Croatia who worked as janitors and raised him deep in working-class Brooklyn, Shkreli both epitomizes the American dream and sullies it. As a youth, he showed exceptional promise and independence and, after dropping out of an elite Manhattan high school, began his conquest of Wall Street before he was 20.

DemReadingDU

(16,000 posts)12/17/15 Celebrating Ludwig van Beethoven's 245th Year

Help Beethoven's unfortunate journey to the symphony hall by arranging his masterpieces in time for the big crescendo!

http://www.google.com/doodles/celebrating-ludwig-van-beethovens-245th-year

edit: I had to try couple different browsers to get the sound to play. Finally worked using the AOL browser. It's really cool arranging the pieces of manuscript to play a few chords from the famous symphonies.

Proserpina

(2,352 posts)Fuddnik

(8,846 posts)My stepson was finally released from Cleveland Clinic last week. He has a lot of physical, and occupational therapy every day, and he met with his Neurosurgeon yesterday, and they're hopeful for a complete recovery, but he still can't swallow.

But, the Neurosurgeon told him that his stroke had them baffled, and they had a hard time figuring out what caused the stroke, and he asked one question. "Have you been on a roller coaster recently"?

He said yes, he'd been to Cedar Point a few days before he came down here, which would be about 2 1/2 weeks before the stroke. The doctor told him that they had a 5 year old boy, who had the exact same type of stroke, but he had it within days of his coaster ride, and the difference was that it took a little longer for an adult to build up a clot big enough to do the damage.

His sister asked specifically, about his failure to take his blood pressure meds over a couple of week period preceding his stroke, and the doctor ruled that out. He said not for this type and location of the stroke.

Weird.

Proserpina

(2,352 posts)Thanks for the heads up, Doc!

Fuddnik

(8,846 posts)But, a 5 yo kid?

DemReadingDU

(16,000 posts)being young, with all the physical and occupational therapy, a full recovery is very hopeful.

and I never will ride any amusement rides ever again.

antigop

(12,778 posts)mahatmakanejeeves

(57,524 posts)News Release

TRANSMISSION OF MATERIALS IN THIS RELEASE IS EMBARGOED UNTIL

8:30 A.M. (Eastern) Thursday, December 17, 2015

UNEMPLOYMENT INSURANCE WEEKLY CLAIMS

SEASONALLY ADJUSTED DATA

In the week ending December 12, the advance figure for seasonally adjusted initial claims was 271,000, a decrease of 11,000 from the previous week's unrevised level of 282,000. The 4-week moving average was 270,500, a decrease of 250 from the previous week's unrevised average of 270,750.

There were no special factors impacting this week's initial claims.

The advance seasonally adjusted insured unemployment rate was 1.7 percent for the week ending December 5, unchanged from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending December 5 was 2,238,000, a decrease of 7,000 from the previous week's revised level. The previous week's level was revised up 2,000 from 2,243,000 to 2,245,000. The 4-week moving average was 2,199,750, an increase of 16,250 from the previous week's revised average. The previous week's average was revised up by 500 from 2,183,000 to 2,183,500.

....

UNADJUSTED DATA

....

The total number of people claiming benefits in all programs for the week ending November 28 was 2,353,710, an increase of 419,114 from the previous week. There were 2,577,306 persons claiming benefits in all programs in the comparable week in 2014.

antigop

(12,778 posts)And here is what he has to say about Social Security:

These so-called entitlements are growing at 8% or more a year, Greenspan said. It's a huge drain on the economy. Money that could be going toward education and investment or the next big thing is instead going to retirees.

Fuddnik

(8,846 posts)Him and his Ayn Rand bullshit are consistently wrong about everything.