Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 20 November 2015

[font size=3]STOCK MARKET WATCH, Friday, 20 November 2015[font color=black][/font]

SMW for 19 November 2015

AT THE CLOSING BELL ON 19 November 2015

[center][font color=red]

Dow Jones 17,732.75 -4.41 (-0.02%)

S&P 500 2,081.24 -2.34 (-0.11%)

Nasdaq 5,073.64 -1.56 (-0.03%)

[font color=black]10 Year 2.25% 0.00 (0.00%)

[font color=red]30 Year 3.01% +0.01 (0.33%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)China's four biggest lenders may have to raise up to $400 billion in new capital to conform with onerous new post-crisis capital rules a global regulator said on Monday they would have to fall into line with. The announcement by international banking watchdog the Financial Stability Board (FSB) represents a coup for Western banks, who had complained that a proposed exemption for emerging market institutions would give China's state lenders an unfair competitive advantage as they continue to expand overseas. The decision could also put pressure on Chinese banks to begin paring back lending at a time when the government is pushing them to prop up growth amid a broader slowdown.

The FSB outlined its final rules for ending "too big to fail" banks on Monday, a key pledge made by the G20 after governments spent more than $1.5 trillion rescuing financial firms during the 2008 financial crisis. The reforms require the world's systemically important 30 banks, known as GSIBs, to issue a buffer of capital that can be written down to raise funds if the bank goes bust. This layer of Total Loss Absorbing Capital, or TLAC, is largely comprised of bonds and comes on top of banks' core Basel capital requirements.

China has four GSIBs, Bank of China, Agricultural Bank of China, Industrial and Commercial Bank of China , and China Construction Bank which was added to the GSIB list only last week.

The country's regulators lobbied hard for an open-ended exemption from TLAC, arguing its capital markets are not deep enough to absorb so much issuance - leading the FSB to propose an exemption for emerging markets banks in February. Global banks opposed the idea, arguing it would give China's Big Four lenders a more competitive cost of capital. On Monday, the FSB scrapped the emerging markets waiver in favour of a much longer phase-in period.

"At face value, this final version looks a lot fairer," said Royce Miller, a partner at law firm Freshfields in Hong Kong. "There were powerful voices at the table, and valid arguments, on both sides and this is a compromise which means the Chinese banks have to comply by fixed deadlines, but they have a very long window."

GSIBs from developed markets will be required to meet a minimum TLAC requirement of at least 16 percent of the group's risk-weighted assets (RWAs) from January 2019, and at least 18 percent from January 2022, while this time frame is 2025 and 2028 respectively for emerging markets banks. Industry insiders said the Big Four banks would be required to raise between $350 and $400 billion in total to comply with the rules, although they were unlikely to do this until after 2020. Shares in these Big Four banks fell an average of 1.7 percent in Hong Kong trading on Tuesday, slightly underperforming the benchmark Hang Seng index...

Although Chinese banks' raised record levels of capital last year and boast healthy average core equity ratios of around 12-15 percent, this buffer is under growing pressure as lending growth outstrips these firms' ability to retain earnings. The capital requirements are, however, unlikely to cause a shock to the system, said Matthew Smith, China banks analyst at Macquarie, citing the banks' generous deadline. "By then, the capital market in China should be more developed to accommodate these sizable fund raising activities." But the new requirements are likely to spur a change in Chinese banks' behavior, as they look to rely more on wholesale funding, potentially pare down risk-weight assets, and become more familiar with TLAC debt instruments such as subordinated bonds, said bankers.

"The Chinese banks have won a stay of execution," said one Hong Kong banker who has helped Chinese banks raise capital. "But they are going to have to become extremely active in the capital markets."

Demeter

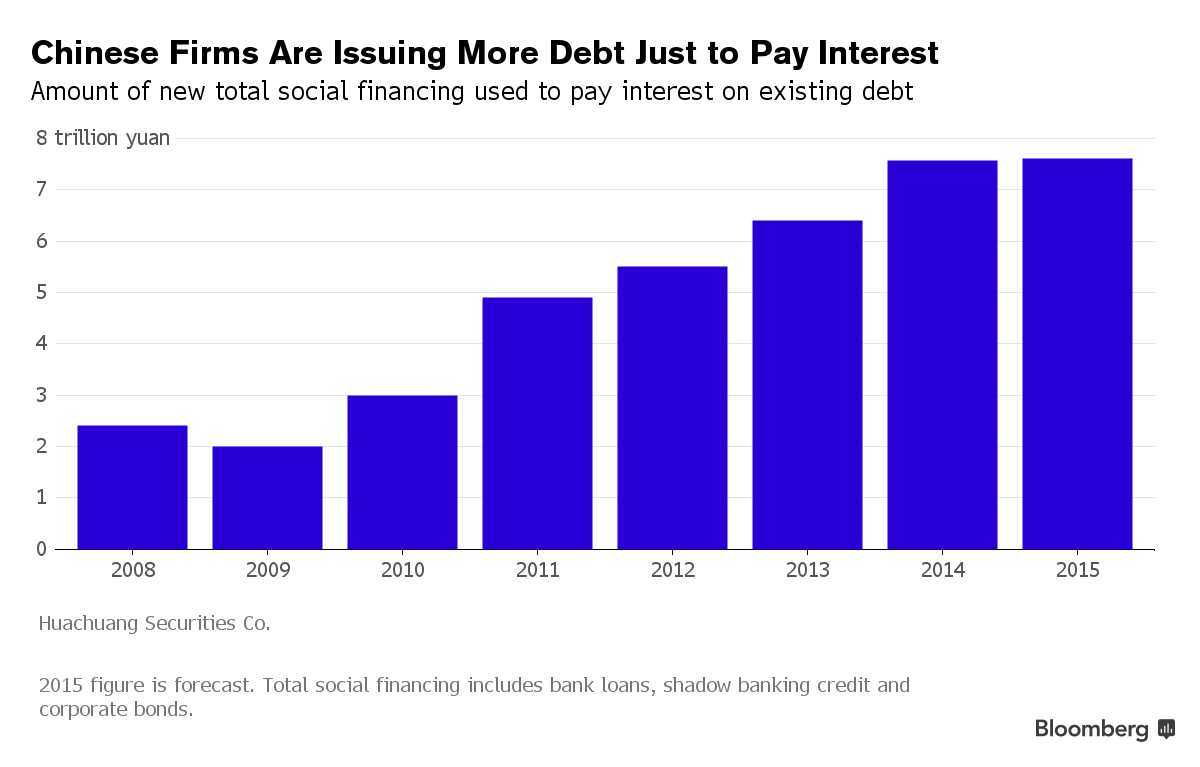

(85,373 posts)Chinese borrowers are taking on record amounts of debt to repay interest on their existing obligations, raising the risk of defaults and adding pressure on policy makers to keep financing costs low.

The amount of loans, bonds and shadow finance arranged to cover interest payments will probably rise 5 percent this year to a record 7.6 trillion yuan ($1.2 trillion), according to Beijing-based Hua Chuang Securities Co., whose lead fixed-income analyst was top-ranked by China’s New Fortune magazine in 2012 and 2013. Dubbed “Ponzi finance” by Hyman Minsky, the use of borrowed funds to repay interest was seen by the late U.S. economist as an unsustainable form of credit growth that could precipitate financial crises.

Chinese companies are struggling to generate the cash flow needed to service their obligations as economic growth slows to the weakest pace in 25 years and corporate profits shrink. While the debt burden has been eased by six central bank interest-rate cuts in 12 months and a tumble in corporate borrowing costs to five-year lows, the number of defaults in China’s onshore corporate bond market has increased to six this year from just one in 2014.

“Some Chinese firms have entered the Ponzi stage because return on investment has come down very fast,” said Shi Lei, the Beijing-based head of fixed-income research at Ping An Securities Co., a unit of the nation’s second biggest insurance company. “As a result, leverage will be rising and zombie companies increasing.”

MORE

Demeter

(85,373 posts)Federal Reserve Chair Janet Yellen urged lawmakers to reject proposed legislation to increase congressional oversight of the central bank that she said would harm the economy, a message later reinforced by a White House veto threat.

"The bill would severely impair the Federal Reserve’s ability to carry out its congressional mandate and would be a grave mistake, detrimental to the economy and the American people,” Yellen wrote in a letter to U.S. House Speaker Paul Ryan and House Democratic leader Nancy Pelosi on Tuesday. The legislation was introduced in July by Michigan Republican Bill Huizenga and is scheduled for a vote this week in the Republican-controlled House.

Yellen’s letter is the latest maneuver in skirmishes between the Fed and Congress, where lawmakers from both sides of the aisle have criticized it in the aftermath of the financial crisis for a lack of accountability and for being under the sway of Wall Street. Republican presidential candidates, courting conservative voters wary of its zero interest rate policies in place for seven years, were sharply critical of the central bank during a debate last week.

The proposal before the House, called the Fed Oversight Reform and Modernization Act, would require the Fed to establish a mathematical formula that would dictate how the Federal Open Market Committee adjusts policy, and would give the Government Accountability Office responsibility for determining whether the adopted rule met the legislation’s criteria...

CONGRESS HEAL THYSELF AND PASS A BUDGET ON TIME

Demeter

(85,373 posts)BIGGEST INSURANCE COMPANY IN NATION....SAYS OBCARE IS SHIT

http://www.bloomberg.com/news/articles/2015-11-19/unitedhealth-may-pull-out-of-obamacare-marketplace-stock-slides

The biggest U.S. health insurer is considering pulling out of Obamacare as it loses hundreds of millions of dollars on the program, casting a pall over President Barack Obama’s signature domestic policy achievement.

UnitedHealth Group Inc. has scaled back marketing efforts for plans sold to individuals this year and may quit the business entirely in 2017. It’s an abrupt shift from October, when the health insurer said it was planning to sell coverage through the Affordable Care Act in 11 more states next year, bringing its total to 34. The company also cut its 2015 earnings forecast.

While millions of Americans have gained coverage under Obamacare since new government-run marketplaces for the plans opened in late 2013, in UnitedHealth’s case they haven’t been the most profitable. Customers the company has added have tended to use more medical care. UnitedHealth also said today that some people are signing up for coverage, getting care and then dropping their policies.

“We cannot sustain these losses,” Chief Executive Officer Stephen Hemsley told analysts on a conference call. “We can’t really subsidize a marketplace that doesn’t appear at the moment to be sustaining itself.”

DO TELL

Demeter

(85,373 posts)Weeks before the attacks that killed 129 people in Paris, U.S. warplanes resumed sorties above Syria and Iraq, targeting anew oil fields and other parts of a vast petroleum infrastructure that fuels—and funds—Islamic State, one of the richest terrorist armies the world has known.

These airstrikes were launched not because U.S. officials were prescient. They came after the Obama administration found and quietly fixed a colossal miscalculation. U.S. intelligence had grossly overestimated the damage they’d inflicted during airstrikes on the militants’ oil production apparatus last year, while underestimating Islamic State’s oil revenue by $400 million. According to U.S. Department of the Treasury officials and data they released in the wake of the Paris mayhem, the terrorist group is actually taking in $500 million from oil a year. What’s more, just a few hours before the first Islamic State suicide bomber blew himself up outside the Stade de France on Nov. 13, U.S. Army Colonel Steve Warren conceded at a press briefing that some American airstrikes disrupted IS oil operations for no more than a day or two.

The Obama administration “misunderstood the [oil] problem at first, and then they wildly overestimated the impact of what they did,” says Benjamin Bahney, an international policy analyst at the Rand Corp., a U.S. Department of Defense-funded think tank, where he helped lead a 2010 study on Islamic State’s finances and back-office operations based on captured ledgers. He says the radical revision on oil revenue came after Treasury officials gained new intelligence on Islamic State’s petroleum operations—similar to the ledgers Rand used for its study—following a rare ground assault by American Special Operations Forces this May. U.S. forces, operating deep into the group’s territory in eastern Syria, targeted and killed an Islamic State “oil emir,” a man known by the Arabic nom de guerre Abu Sayyaf, Pentagon officials said at the time. (Treasury officials, who are charged with leading the administration’s war on Islamic State’s finances, declined to comment specifically on whether Abu Sayyaf’s ledgers were at the root of their new estimates, but the agency has said the figures are extrapolated from the militant group’s oil earnings from a single region in a single month earlier this year.)

It’s not clear how the U.S. got it so wrong, Bahney says, but he suspects that the latest round of airstrikes are directly related to the administration’s new math. “You have to go after the oil, and you have to do it in a serious way, and we’ve just begun to do that now,” he says. Yet even if the U.S. finally weakens the group’s oil income, Bahney and other analysts in the U.S., the Middle East, and Europe contend, Islamic State has resources beyond crude—from selling sex slaves to ransoming hostages to plundering stolen farmland—that can likely keep it fighting for years. In any case, $500 million buys a lot of $500 black-market AK-47s....

YUP....OBAMA ADMINISTRATION IS A MISERABLE FAILURE

Demeter

(85,373 posts)Ernst & Young LLP’s failure to vet financial audits backed by con man Bernie Madoff’s accountant may cost the consulting firm $25 million based on the verdict in the first trial of an auditor over losses tied to the biggest Ponzi scheme in U.S. history.

FutureSelect Portfolio Management Inc., which sued Ernst & Young in 2010 over faulty audits of a Madoff-linked feeder fund, is entitled to recoup a portion of the $112 million it lost in its investment in the fund, jurors in Seattle state court ruled Friday.

The jury found Ernst & Young liable for half of the $20.3 million in damages it awarded. With interest added, the firm is on the hook for about $25 million, a FutureSelect lawyer said.

While negligence cases against Big Four accounting firms are rare, this one was brought under a Washington state securities law that is more protective of investors than similar state and federal statutes. In the end, the jury issued mixed findings on the state securities claims while ruling in FutureSelect’s favor on Ernst & Young’s negligent misrepresentation.

Amy Call Well, a spokeswoman for Ernst & Young, said the firm is pleased the jury rejected the “vast majority” of FutureSelect’s claims. She said Ernst & Young is considering whether to appeal....MORE

Demeter

(85,373 posts)BACK IN THE 60'S, THE POLISH-AMERICAN COMMUNITY BUZZED WITH STORIES OF PEOPLE RETIRING TO THE OLD COUNTRY AND LIVING WELL OFF SOCIAL SECURITY...

THIS STORY IS A LITTLE DIFFERENT...GO READ!

DemReadingDU

(16,000 posts)Christine has the retirement of a lifetime

![]()

Demeter

(85,373 posts)While the EU recently took steps to treat bitcoin like any other currency, the Paris attacks seem to have prompted a new round of debate on the issue in Brussels.

Reuters reports that EU interior and justice ministers meeting tomorrow (Nov. 20) will propose cracking down on electronic payments, digital currencies, and the anonymous use of pre-paid cards, presumably to keep these channels from being used as a means for terrorist financing.

The policy shift underscores the uphill battle bitcoin faces. Not only do mainstream consumers not understand the technology, but the potential for using bitcoin for criminal activities has spooked authorities. Bitcoin was a major payment method in Silk Road—the online marketplace for illicit goods, which the FBI eventually shut down. The anonymity afforded by bitcoin is a major issue for regulators, and a key feature of bitcoin that New York’s Department of Financial Services eliminated in its framework (pdf) for licensing digital currency firms.

Former Federal Reserve chairman Ben Benanke discussed the anonymity aspect of bitcoin in a recent interview with Quartz’s Matt Phillips, calling it “a feature, and … also a bug, in that it has become in some cases a vehicle for illicit transactions, drug selling or terrorist financing or whatever. And you know, governments are not happy to let that activity happen, so I suspect that there will be oversight of transactions done in bitcoin or similar currencies and that will reduce the appeal.”

A month before the Paris attacks, the UK Treasury assessed that there was a “low” risk (pdf, p.82) that bitcoin or other digital currencies are being used for money laundering or by terrorists trying to move money into and out of the UK.

But governments clearly are still trying to figure out how to regulate bitcoin, to protect consumers and to ensure that rules to guard against money-laundering are followed.

Demeter

(85,373 posts)...There are “many strands of blame,” according to a recent New York Times article (paywall), but an indisputable element is Camp Bucca, an American prison in southern Iraq during the US occupation. It was there that many of the key figures in the group that would succeed al-Qaida in Iraq and go on to form what it calls a caliphate across parts of Iraq and Syria met—including the current leader of the group, Abu Bakr al-Baghdadi.

It was sometimes referred to as “Jihadi University” because of the training provided there. “If you were looking to build an army, prison is the perfect place to do it,” Maj. Gen. Douglas Stone, a prison commander in Iraq, is quoted by the Times as saying. “We gave them health care, dental, fed them, and most importantly, we kept them from being killed in combat.”

Andrew Thompson, a veteran of the US war in Iraq, wrote in 2014 (paywall) that “the radicalization of the prison population was evident to anyone who paid attention.” Al-Baghdadi and other extremists were imprisoned alongside moderates, many of whom had no history of violence...

MORE

Demeter

(85,373 posts)In his book "Why the West Rules -- for Now," historian Ian Morris draws a distinction between two ways of running a country. He calls these “high-end” and “low-end” strategies. High-end states have efficient, centralized bureaucracies and a credible legal apparatus, while low-end states rely on local authorities to do things like collecting taxes and providing security. According to Morris, high-end states are more effective at creating rich, powerful, technologically advanced civilizations, but they are also more expensive -- when resources are strained, countries sometimes revert to the cheaper, low-end solutions. Often, transitions from high-end to low-end strategies follow wars, famines and other disasters that reduce the state’s ability to finance its activities directly.

Modern rich nations, with their extensive court systems, bureaucracies, militaries and infrastructure, look distinctly high-end compared with the feudal lands of past centuries. But in the U.S., I see some troubling signs of a shift toward low-end institutions. Bounty hunting was a recent example (now happily going out of style). Another example is the use of private individuals or businesses to collect taxes, a practice known as tax farming. A third has been the extensive use of mercenaries in lieu of U.S. military personnel in Iraq and elsewhere. Practices such as these can save money for the government, but they encourage abuses by reducing oversight.

I’ve recently been reading about an even more worrying example of low-end statecraft: Stop-and-seize. This term refers to a practice, increasingly common since the turn of the century, of police confiscating people’s property without making an arrest or obtaining a warrant. That may not sound legal, but it is! The police simply pull you over and take your money. A Washington Post investigative report from a year ago explains:

Behind the rise in seizures is a little-known cottage industry of private police-training firms…

A thriving subculture of road officers…now competes to see who can seize the most cash and contraband, describing their exploits in the network’s chat rooms and sharing “trophy shots” of money and drugs. Some police advocate highway interdiction as a way of raising revenue for cash-strapped municipalities.

“All of our home towns are sitting on a tax-liberating gold mine,” Deputy Ron Hain of Kane County, Ill., wrote in a self-published book under a pseudonym…Hain’s book calls for “turning our police forces into present-day Robin Hoods.”

This is exactly the process of devolution that Morris describes. With government unable to pay police as much as they need or would like, police are confiscating their revenue directly from the populace.

The threat to individual liberty from stop-and-seize is painfully clear. Without requirements for an arrest or for a warrant, the power to confiscate cash is a clear diminution of property rights. Effectively, the police have been given official sanction to commit literal highway robbery without the threat of punishment. People whose property was seized must pay a lot of money and spend a long time in court for even the chance of getting it back, and police who seize money with no good reason don't, apparently, suffer any threat of discipline.

But stop-and-seize also presents a danger to public trust. When the cops go around taking money from innocent people to fund their own departments and salaries, it understandably decreases trust in the government and the legal system. That is something we can ill-afford at the present time, with trust in the police already at a low ebb over a series of videos of police killings. If they don’t trust the government, people will be less likely to report criminals, and possibly less likely to follow the law themselves.

Even more fundamentally, though, stop-and-seize is part of a worrying trend of less government accountability. The lack of oversight virtually ensures that the quality of government services will decline. This has been painfully apparent in abuses by bounty hunters, mercenaries and private prisons. But if the police are transformed into independent, self-funding armed gangs, the quality of policing -- and thus the effectiveness of all our legal institutions -- is sure to decline.

If you believe -- as many economists do -- that the rule of law is a key determinant of a nation’s prosperity, then you should be worried about this. Stop-and-seize should be stopped.

Demeter

(85,373 posts)On Friday, the ACLU settled a class action lawsuit, pending court approval, against officials in the East Texas town of Tenaha and Shelby County over the rampant practice of stopping and searching drivers, almost always Black or Latino, and often seizing their cash and other valuable property. The money seized by officers during these stops went directly into department coffers. It was highway robbery, targeting those who could least afford to challenge the officers’ abuse of power, under the guise of a so-called “drug interdiction” program and made possible by Texas’s permissive civil asset forfeiture laws.

Hundreds, if not more than a thousand, people have been stopped under the interdiction program. From 2006 to 2008, police seized approximately $3 million from at least 140 people as part of the program. None of the ACLU’s clients were ever arrested or charged with a crime after being stopped and shaken down.

Officers who are defendants in the case testified that there were no limits on the searches and seizures conducted under the interdiction program. One of the defendants, Barry Washington, testified that he considered the ethnicity and religion of the motorists to be factors relevant to establishing reasonable suspicion of criminal activity. Under oath, when asked what indicators of criminal activity might be, Washington testified:

Well, there could be several things. There could even be indicators on the vehicle. The number one thing is you have two guys stopped, and these two guys are from New York. They’re two Puerto Ricans. They’re driving a car that has a Baptist Church symbol on the back, says First Baptist Church of New York.

The plaintiffs in the ACLU’s lawsuit lost hundreds or even thousands of dollars to the defendant officers. If they refused to part with their money, officers threatened to arrest them on false money laundering charges and other serious felonies. The consequences for parents of color were even worse: officers threatened mothers like Jennifer Boatwright that if they did not part with their cash and valuables, their children would be taken away from them and put in foster care. This was not an empty threat; when Dale Agostini, a successful restaurant owner, refused to hand over $50,000 in business earnings he was carrying to buy new restaurant equipment, police seized both his money and his 16-month-old son. When Agostini pleaded to keep his son or at least kiss him goodbye, the officers refused and simply continued counting the money they had seized from him.

Thankfully, pending court approval of the ACLU’s settlement, police will now be required to observe rigorous rules that will govern traffic stops in Tenaha and Shelby County. All stops will now be videotaped, and the officer must state the reason for the stop and the basis for suspecting criminal activity. Motorists pulled over during a traffic stop must be advised orally and in writing that they can refuse a search. In addition, officers are no longer using dogs in conducting traffic stops. No property may be seized during a search unless the officer first gives the driver a reason for why it should be taken. All property improperly taken must be returned within 30 business days. And any asset forfeiture revenue seized during a traffic stop must be donated to non-profit organizations or used for the audio and video equipment or training required by the settlement.

To the best of our knowledge, this settlement is unprecedented in not only strictly monitoring traffic stops for racial profiling and other abuses, but also removing the incentives that can lead law enforcement to engage in highway robbery...

MORE

Demeter

(85,373 posts)Too much going on to concentrate on economics.

It's supposed to snow (3 inches) and go below freezing and stay there, this weekend. Well, we knew it had to come. Stay warm, everyone! G'night!

MattSh

(3,714 posts)This is PERFECT and perfectly creepy at the same time. This says all you need to know about the anointed one...

Demeter

(85,373 posts)Good morning, Matt! And everyone!

Trying to get my mind ready for 5-8 inches of snow and windchills of 8F....the body will never be ready, but at least there are some warm clothes in the closet and the car runs...and to think, it hit 70F earlier this week!

I am listening to Bernie's Georgetown speech. It will live forever alongside Washington's and Lincoln's. I am in tears.

We are blessed in this time of great danger and greater lies, to have people like Bernie Sanders, Edward Snowden, and those who rate with them, to teach us, lead us, and protect our democracy from all fascists.

Hotler

(11,425 posts)will not be enough to save us unless hundreds of thousands of us take to the polls and the streets. If there ever was a time in this country or the world for that matter the oligarchs need a beat down. I was reading about the 1989 fall of communist Romania the other day and how it did not end well for the rulers (Ceaucescu). I do not say these words lightly, it may need to get ugly almost to the point of a revolution to bring meaningful change to our corrupt political system and the concentration of power by the rich. The days of voting every 2-4 years is not going to do it.

On a side note, we had about 8 inch of snow the other day and it is now almost melted.

Stay warm and safe my friend.

Killed my late best friend's father.

Because he had the temerity, (and foolishness!) to report abuses, thinking the people at the top cared. He was an important health official at the time. Literally guys in white coats came and took him away in an ambulance, never to be seen again. A week or so later a government official came and told them he had died because he was sick!

She had lots of great stories about living in Romania. Sadly she died of complications from cancer several months ago. RIP ![]()

Demeter

(85,373 posts)Demeter

(85,373 posts)Today’s 20-somethings and even those in their early 30s came of age in what may have been the worst national real estate market on record since their grandparents were born. Now a major real estate ad company wants to persuade them that it’s high time to take a risk; that it’s time to walk away from paying high rents in some costly markets and pay high prices to buy their own homes. There’s nothing wrong with the mathematics at the heart of the analysis by Trulia: the raw data show that it’s 23% cheaper for a millennial aged 25 to 34 to buy their own home than to rent, based on the fact that they might only be able to afford a 10% down payment and are likely to move every five years or so.

The fact that interest rates are near historic lows, while rents are at astronomic levels in many urban areas, also tilts the balance in favor of buying by any objective standard. Trulia argues that the 30-year fixed mortgage rate would have to hit at least 5% to make renting cheaper than buying in Los Angeles, and top 5.1% in New York City (assuming a 10% down payment). While mortgage rates are on the rise, in anticipation that Federal Reserve policymakers will finally begin boosting key central bank interest rates next month, the rate charged on a 30-year mortgage still averages only 3.98%. Trulia is even urging millennials to push the envelope. Buy a house, they suggest, and nosh on ramen noodles to make mortgage payments for a year or so, because after a raise or promotion or two, that new apartment or house in Boston or Seattle will look like a bargain and be a much easier financial burden.

But for many Americans, the tradeoff isn’t that easy. And to be blunt, it shouldn’t be. The ideal of home ownership is wonderful – and there are many advantages, not least of them the fact that your mortgage interest payments are tax deductible and your monthly payments help you acquire an asset, rather than assisting your landlord in building his or her wealth. For most Americans, it will end up being the single biggest financial asset.

But if you don’t plan carefully, your dream of home ownership can end up as a financial nightmare... Trulia is arguing that millennials should stretch themselves financially, basing that argument on a hypothesis that may – or may not – be valid: that they can expect their incomes to rise and their personal financial outlook to improve. You’ll need to be ruthlessly honest with yourself: is that likely to be the case with you?

More than any other single factor, what anyone wrestling with the buy vs rent decision needs to ponder is the extent to which they are stable. That means how stable their job is (and how likely they are to get promotions and raises over the coming years), how stable their relationship or marriage is (is there a risk that they might have to sell the house at a bad time in the market because of a divorce or split?), and how stable their career path is (might they move cities or states to work for a different company or attend graduate school?). If the answers to any of those questions signals doubt – that they might not be committed to staying in that house for the next five or more years – then regardless of what the mathematics says, buying probably isn’t a good idea. That’s because while a house purchase can make sense – even tenuously – when you run the math, it may still not be wise when you examine life circumstances...

Demeter

(85,373 posts)Last edited Fri Nov 20, 2015, 01:34 PM - Edit history (1)

http://www.reuters.com/article/2015/11/20/usa-tax-inversions-idUSL1N13E30720151120#KMPWIUP5YpDL4FbF.99The U.S. Treasury Department on Thursday took steps to clamp down on tax-avoiding "inversion" deals with new rules, though there was scarce evidence they would stop the biggest inversion of them all, between Pfizer Inc and Allergan Plc. The $150 billion proposed deal, still under negotiation, would see New York-based Pfizer redomicile in Ireland, where Botox-maker Allergan is registered.

Treasury, which said its new measures are effective immediately, has been wrestling with inversion deals for years because they erode the U.S. corporate tax base by shifting profits overseas. A wave of inversions peaked in September 2014, when Treasury last cracked down, reducing deal flow but not stopping it. U.S. companies are still taking advantage of the law "to move their tax residence overseas to avoid paying taxes in the U.S., without making significant changes in the nature of their overall operations," Treasury Secretary Jack Lew said. "While we intend to take additional action in the coming months, there is only so much the Treasury Department can do to prevent these tax-avoidance transactions. Only legislation can decisively stop inversions," Lew said in a statement.

In an inversion, a U.S. company typically buys a smaller foreign rival and relocates, at least on paper, to the rival's home country so the new combined company is not U.S.-based, though core management usually stays in the United States. Because of the expected structure of the Pfizer and Allergan deal, many analysts believe the new Treasury inversion rules may present little risk. Allergan shareholders would own more than 40 percent of the combined company following a merger with Pfizer, people familiar with the terms being negotiated have said.

"If ... Allergan is more than 40 percent of the new company, most (if not all) of the content of today's Treasury press release doesn't even apply," Evercore ISI senior analyst Umer Raffat said in an emailed note.

MORE

StoneCarver

(249 posts)Stanley tools tried moving off shore 20 years ago. The pentagon freaked out since Stanley provides a lot of tools to the military. So in the name of patriotism the pentagon simply said they would not buy equipment from foreign held companies. Stanley caved and is a US company. Do the same thing with Medicare. In the name of patriotism Medicare will not buy or pay for medical products from any foreign based company that does most of its business in the US. Pfizer, Medtronic, etc. will undo the inversions immediately!

Stonecarver

Demeter

(85,373 posts)in Washington, maybe to Bernie.

Demeter

(85,373 posts)POOR DARLINGS! WHATEVER SHALL THEY DO?

http://www.reuters.com/article/2015/11/19/us-usa-companies-laborcosts-idUSKCN0T82WN20151119#WHdiK3OhSzlgQSZz.99

Early indications of wage pressures in pockets of corporate America have begun emerging in recent weeks, suggesting labor costs could be a bigger headwind for U.S. companies in 2016. Over the course of the latest corporate earnings reporting season, executives from nearly 20 S&P 500 companies have flagged labor costs, shortages or wage pressure as headwinds. That is up from about a dozen companies who singled out these concerns a quarter earlier and a year ago, a sign that more companies are talking about wage issues, an analysis of earnings season comments by Thomson Reuters showed.

Wage inflation has been largely nonexistent in the plodding economic expansion out of the Great Recession, a key factor behind the robust recovery in company profits over the past six years even as sales growth has remained muted. Now, though, a combination of rising U.S. payrolls, political pressures to increase state and federal minimum wages and some industry-specific issues, such as expensive labor contracts in the airlines and automakers and labor shortages in construction, could finally be gelling to force up labor costs.

"The conditions are beginning to be in place for something that has been languishing really since the bottom of the recession," said Mark Dawson, chief investment officer at Rainier Investment Management in Seattle. "We're closer to the point where wage pressures in certain areas are increasingly going to be seen. I would expect it to be more of an issue next year."

MORE

Demeter

(85,373 posts)Demeter

(85,373 posts)I've brought in the last possible flowers. It looks like deer have been eating my roses on the patio...will have to fence them in next spring. Although, there's supposed to be a big hunt this winter in our ward to shoot them all....

Hotler

(11,425 posts)there are people in this country that mean and selfish.

Demeter

(85,373 posts)and then there are those that live next door....yikes!