Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 13 November 2015

[font size=3]STOCK MARKET WATCH, Friday, 13 November 2015[font color=black][/font]

SMW for 12 November 2015

AT THE CLOSING BELL ON 12 November 2015

[center][font color=red]

Dow Jones 17,448.07 -254.15 (-1.44%)

S&P 500 2,045.97 -29.03 (-1.40%)

Nasdaq 5,005.08 -61.94 (-1.22%)

[font color=green]10 Year 2.32% -0.03 (-1.28%)

30 Year 3.09% -0.03 (-0.96%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)I, with my measly 40% chance of serving on a jury, have been jurying right and left this week. What gives?

It looks like there are terrorists roaming the website, picking nits and taking offense for "language". Given the 1st Amendment protections, and the Terms of Service of this website, I am manifestly not impressed by these specious alerts, always presented in such inflammatory language as to make one doubt the sanity and the verbal skills of the alerter.

And this is more than a year before the election, months before the first primary!

It's going to be a long year. And there may not be much of an Underground left after that.

Hotler

(11,425 posts)They feed on themselves over in GD, it's a hoot to watch. ![]() Most do not know that the first rule of GD is to have thick skin.

Most do not know that the first rule of GD is to have thick skin. ![]()

It is only going to get worse now tell election time. Get out the beer and popcorn.

![]()

Demeter

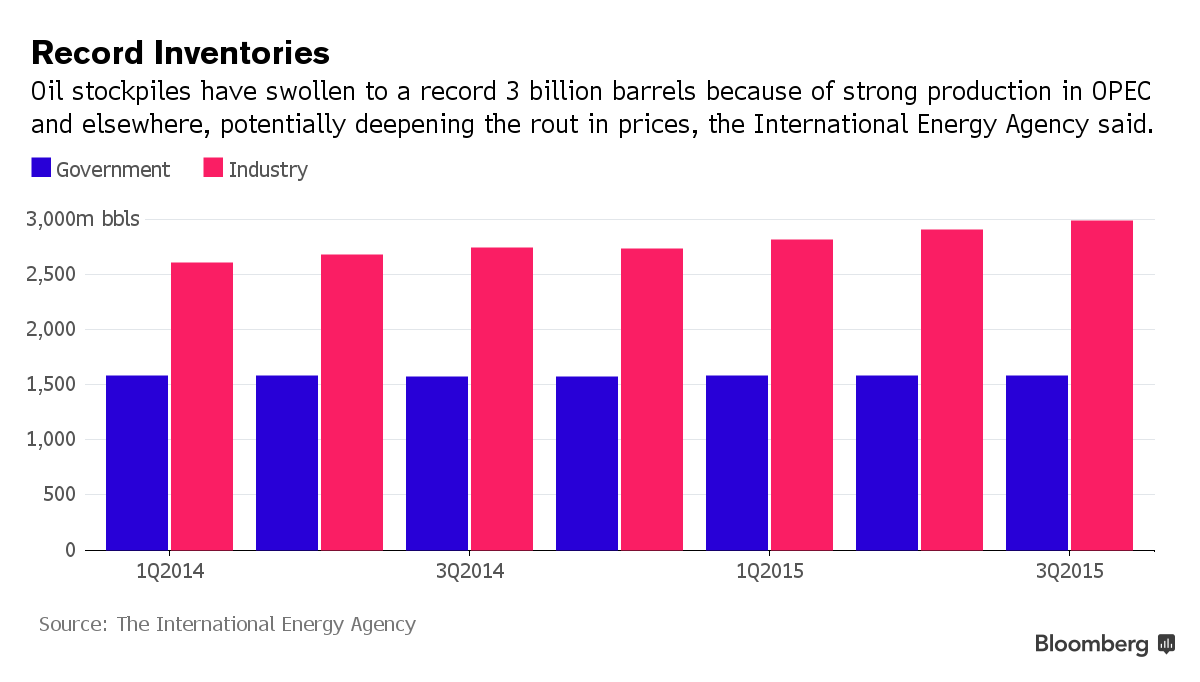

(85,373 posts)Having exposed the world yesterday to the 2-mile long line of tankers-full'o'crude heading from Iraq to the US, several weeks after reporting that China has run out of oil storage space we can now confirm that the global crude "in transit" glut is becoming gargantuan and is starting to have adverse consequences on the price of oil.

While the crude oil tanker backlog in Houston reaches an almost unprecedented 39 (with combined capacity of 28.4 million barrels), as The FT reports that from China to the Gulf of Mexico, the growing flotilla of stationary supertankers is evidence that the oil price crash may still have further to run, as more than 100m barrels of crude oil and heavy fuels are being held on ships at sea (as the year-long supply glut fills up available storage on land). The storage problems are so severe in fact, that traders asking ships to go slow, and that is where we see something very strange occurring off the coast near Galveston, TX.

FT reports that "the amount of oil at sea is at least double the levels of earlier this year and is equivalent to more than a day of global oil supply. The numbers of vessels has been compiled by the Financial Times from satellite tracking data and industry sources."

The storage glut is unprecedented:

“A lot of the storage off Singapore is fuel oil as the contango is stronger,” said Petromatrix analyst Olivier Jakob. Fuel oil is mainly used in shipping and power generation.

Off China, which is on course to overtake the US as the world’s largest crude importer, five heavily laden VLCCs — each capable of carrying more than 2m barrels of oil — are parked near the ports of Qingdao, Dalian and Tianjin.

In Europe, a number of smaller tankers are facing short-term delays at Rotterdam and in the North Sea, where output is near a two-year high. In the Mediterranean a VLCC has been parked off Malta since September.

On the US Gulf Coast, tankers carrying around 20m barrels of oil are waiting to unload, Reuters reported. Crude inventories on the US Gulf Coast are at record levels.

A further 8m barrels of oil are being held off the UAE, while Iran — awaiting the end of sanctions to ramp up exports — has almost 40m barrels of fuel on its fleet of supertankers near the Strait of Hormuz. Much of this is believed to be condensate, a type of ultralight oil.

And unlike the last oil price collapse during the financial crisis only half of the oil held on the water has been put there specifically by traders looking to cash in by storing the fuel until prices recover. Instead, sky-high supertanker rates have prevented them from putting more oil into so-called floating storage, shutting off one of the safety valves that could prevent oil prices from falling further...

Demeter

(85,373 posts)NOTHING DOUBTFUL ABOUT IT--LOOK AT THE OIL PRICE GRAPH ABOVE!

http://www.bloomberg.com/news/articles/2015-11-13/iea-says-record-3-billion-barrel-oil-stocks-may-weaken-prices

Oil stockpiles have swollen to a record of almost 3 billion barrels because of strong production in OPEC and elsewhere, potentially deepening the rout in prices, according to the International Energy Agency.

This “massive cushion has inflated” on record supplies from Iraq, Russia and Saudi Arabia, even as world fuel demand grows at the fastest pace in five years, the agency said. Still, the IEA predicts that supplies outside the Organization of Petroleum Exporting Countries will decline next year by the most since 1992 as low crude prices take their toll on the U.S. shale oil industry.

“Brimming crude oil stocks” offer “an unprecedented buffer against geopolitical shocks or unexpected supply disruptions,” the Paris-based agency said in its monthly market report. With supplies of winter fuels also plentiful, “oil-market bears may choose not to hibernate.”

Demeter

(85,373 posts)Competition is growing in Russia’s biggest oil market. While Saudi Arabia’s encroachment in Europe is getting all the attention, the greatest threat comes from another part of the Middle East -- Iran.

Saudi Arabia has started shipping crude to traditional Russian markets like Poland and Sweden, but supplies to Europe from the world’s largest exporter won’t increase by enough to reduce prices, said Texas-based consultant Stratfor. In contrast, a surge in Iranian exports after the lifting of sanctions could erode the value of Russian shipments to the region as soon as next year, according to KBC Advanced Technologies.

Tougher competition in Europe, the destination for almost 70 percent of Russia’s oil exports, comes as the country is already battling recession. Oil and gas sales account for about half of government revenues and the commodity-price slump has amplified the economic blow from international sanctions over Ukraine. An increase in Iranian exports following a nuclear deal with world powers could make matters worse.

“Eastern European refineries are geared to process Russian crude, the Urals blend, and the closest sort to it would be Iranian oil,” Michael Nayebi-Oskoui, senior energy analyst for Middle East and South Asia at Stratfor, said by phone. For Saudi shipments to push prices down, “they would have to be significantly rerouted from Asia towards Europe, and we don’t see that happening,” he said.

Before Sanctions

Iranian shipments to Europe came to about 600,000 barrels a day, or 17 percent of its production, before sanctions blocked imports in 2012. Once restrictions are lifted, Oil Minister Bijan Namdar Zanganeh has said the National Iranian Oil Co.’s priority will be to regain its “lost share” of the market, regardless of the impact on crude prices.

“Iran is going to be looking at marketing fairly aggressively,” David Fyfe, head of market research and analysis at oil trader Gunvor Group Ltd., said by phone from Geneva. “They want to reclaim the foothold they previously had.”

Former customers in southern Europe already have shown an interest in resuming purchases of Iranian oil...MORE

Demeter

(85,373 posts)Expect his thread Saturday early AM. He's cooking up something great, as usual. This is doubly good because not only if Friday Euchre Night, but I seem to be coming down with another cold (or the original is relapsing...I'm so sick and tired of being sick and tired).

On a more joyful note, the 7th bud on the larger rosetree has bloomed. Because it was the last, and the tree has leafed out considerably, growing more food, etc. it is the most beautiful of the 7, fully formed and much larger than the first ones. This is the size and quality flower the tree produced in the summer. So, maybe I can keep them alive! The second tree has still the one new bud, and lots of new foliage. I'm hoping for 2 to 4 times as many leaves when the two of them are fully active again....outdoors, the Knockout rose is still at it. A truly exceptional variety.

In recognition of the impending virus, I am going to bed. Perchance to post a bit in the morning...

Demeter

(85,373 posts)They are worried. They should be! But I am afraid that the Fed, figuring that there will never be a good time, is going to go ahead and do it anyway, to break the psychology.

The Fed doesn't realize that it is only psychology that is keeping the economy relatively calm and functional. They are going to destablize this house of cards, and the whole shebang will collapse.

But at least the stalemate will be broken!

Now, if the Fed waited until after the election....with a big changing of the guard in House, Senate and Bernie in the White House, they would give us a jobs/infrastructure program which would boost domestic demand and help pull other countries that are exporters of raw materials out of danger. THEN the Fed could and should raise interest rates. But until the US government starts acting like adults, it's a dangerous idea, going it alone.

Demeter

(85,373 posts)The Federal Reserve, starting from Janet Yellen on down (with a couple of exceptions), are on a “jihad” to raise rates for no other reason but to pat themselves on the back for averting the 2008-2009 sub-prime scam and resultant global financial crisis. Before you decide whether my suggestion of a globally televised flogging is too Draconian, first read the following:

- Just yesterday, the IMF warned that the global economy risks extended “sub-par growth” just ahead of its G-20 leaders’ summit in Turkey beginning on Sunday.

- “With global economic prospects repeatedly marked down over the last five years, there is a concrete risk of a world economy persistently mired in sub-par growth, with unacceptably high levels of poverty and unemployment,” the IMF said in a report.

- “Growth remains fragile and could be derailed if transitions are not successfully navigated. In an environment of declining commodity prices, reduced capital flows to emerging markets, and higher financial market volatility, downside risks to the outlook remain elevated, particularly for emerging economies,” the IMF said.

- The IMF said the three biggest risks to global growth were US Federal Reserve interest rate policy (hawkish for over a year now), weakness in China and the shellacking in global commodity pricing.

- Also yesterday, UBS said that the Latin American region faced the worst recession since 2008.

- “We perceive the risks to the region to be skewed almost exclusively to the downside. We would highlight two: one, the risk that China slows more than expected, putting further downward pressure on trade with the Asian giant and on commodity prices, and potentially reducing Chinese external financing to the region; and two, the risk that Latin America faces a corporate credit event, particularly in Brazil,” UBS stated.

- This past Monday, the OECD cut is global growth forecast for next year to 2.9% from 3% in September and 3.1% forecasted in July.

- Yesterday the German IFO Institute said that it’s world economy index dropped to 89.6 in Q4, down from 95.9 in Q3 and well below the long term average of 96.1.

I have not even included comments and statements made by the World Bank, the ECB,and irrelevant services like Moody MCO -1.01% and the S&P have been saying about global economic growth or declining global economic growth.

Now compare the above bullet points with the ones below:

- In New York, William Dudley said: “I see the risks right now of moving too quickly versus moving too slowly as nearly balanced.”

- “While the dollar’s appreciation and foreign weakness have been a sizable shock, the U.S. economy appears to be weathering them reasonably well,” Vice Chairman of the Federal Reserve, Stanely Fischer said.

- “The committee has been very clear that the normalization path here is going to be shallower,” than the steady quarter-point-per-meeting hikes used by the Fed early this century or the faster hikes enacted in the early 1990s, said James Bullard, St. Louis Fed President.

The only Fed head that seems to understand what’s happening globally is Chicago Fed Head Evans who said, “We have had different points in time since the downturn where certain regions of the world thought they could delink against the rest of the world. There’s often a trail of tears that follows that hope that their own area is stronger. That makes me nervous.”

So, having read the above, what do you think now? Not convinced yet? Talk to the CEO’s of Apple, Priceline, Cisco, Amazon, Alphabet/Google and ask them how much better their reported results would have been were it not for the adverse effects of a strong dollar which should only further strengthen once the “geniuses” at our Federal Reserve start on their rate hike “jihad.”

I am working on an article where I will explain exactly why the Federal Reserve is and always has been doing what it’s doing with no regard for global condition, good, bad, or ugly. Should be out shortly.

Demeter

(85,373 posts)The Federal Reserve’s policy committee may need to begin raising interest rates for the first time since 2006, though some slack remains in the labor market, Federal Reserve Bank of New York President William C. Dudley said Thursday.

“I think it is quite possible that the conditions the Committee has established to begin to normalize monetary policy could soon be satisfied,” Dudley said in a speech in New York. “I will be evaluating the incoming information to see if it confirms my expectation that growth will be sufficient to further tighten the U.S. labor market.”

Fed President James Bullard of St. Louis earlier on Thursday urged the Fed to raise interest rates from near zero, while Chicago Fed leader Charles Evans stressed any increases should be “gradual” and rates could be less than 1 percent at the end of next year. Fed Chair Janet Yellen has told Congress that the U.S. economy was performing well and that a December rate hike is a "live possibility."

“The economy looks to be in decent shape and is likely to continue to grow at a slightly above-trend pace,” Dudley told the Economic Club of New York. “Spare labor resources are shrinking. But there still is some risk that the growth pace could slow as the trade sector acts as a drag on aggregate economic activity.”

While noting that the job market has made progress, Dudley said he wasn’t ready to commit to December...

MORE

Demeter

(85,373 posts)The Fed’s decision to delay raising interest rates has helped to offset the economic headwinds caused by a strengthening U.S. dollar, Fed Vice Chairman Stanley Fischer said, adding that it “may be appropriate” to raise rates next month.

"While the dollar’s appreciation and foreign weakness have been a sizable shock, the U.S. economy appears to be weathering them reasonably well," Fischer said in prepared remarks at a Fed conference in Washington Thursday. "Monetary policy has played a key role in achieving these outcomes through deferring liftoff relative to what was expected a little over a year ago."

The dollar has gained around 10 percent against the euro and 2.3 percent against the yen since the start of the year. The greenback’s rise has dragged on trade and slowed growth as a result. Widening interest rate differentials and "heightened concern about the global outlook and an associated decrease in investor risk tolerance" are causes behind the dollar’s rise, Fischer said Thursday.

While Fischer didn’t make any predictions about whether the Fed will raise rates for the first time since 2006 at its Dec. 15-16 meeting, he did note that the October Federal Open Market Committee statement indicated that a move next month "may be appropriate."

MORE

Demeter

(85,373 posts)Peru kept borrowing costs unchanged for a second month as policy makers maintain monetary stimulus as the economy recovers and inflation slows.

The central bank board, led by bank President Julio Velarde, kept the rate at 3.5 percent, matching the median estimate of all 17 economists surveyed by Bloomberg.

Inflation expectations are converging to the target range while the economy is recovering gradually though growth remains below potential, the central bank said in a statement accompanying its decision. Inflationary pressure from currency weakness and some food items isn’t expected to affect other prices in the economy in a generalized way, it said. Peru’s economy is expanding at the fastest pace in a year on a surge in copper output, even as consumer demand and construction activity remains weak.

Economic growth “has increased above all because of mining,” Luis Gonzalez-Prada, an analyst at Apoyo Consultoria, said by phone from Lima before the bank’s decision. “Domestic demand remains cold so for that part of the economy, stimulus is still needed.”

MAYBE THERE IS A NORMAL ECONOMY OUT THERE, SOMEWHERE

MORE

Demeter

(85,373 posts)Workers who wait for the right opportunity instead of taking a short-term gig could be better off in the long run....TELL THAT TO THE STARVING CHILDREN! THERE IS NO SAFETY NET, EXCEPT WHATEVER ONE HAS IN FAMILY AND FRIENDS

Good jobs come to those who wait, according to a recent study published by the National Bureau of Economic Research.

The study – conducted by a team of researchers from Arizona State University, Princeton University and the University of California-Los Angeles – set out with the goal of assessing how employers respond to equally qualified job applicants who vary in age and have been unemployed for different lengths of time.

It ultimately found that middle-aged workers' duration of unemployment didn't meaningfully impact whether they would receive a call from a recruiter after applying for a job. But individuals who had already taken jobs for which they were overqualified were actually less likely to get a call than those without a job at all...The U.S. labor market shed more than 8.6 million jobs in 2008 and 2009, according to the Bureau of Labor Statistics. During and immediately following the Great Recession, many laid-off American workers turned to part-time work or interim employment to keep a steady – though often diminished – stream of income flowing. But the NBER report suggests such a decision could have backfired in the long run...

IN THE LONG RUN, WE ARE DEAD FROM LACK OF INCOME...

bread_and_roses

(6,335 posts)THERE IS NO SAFETY NET! Let anyone who doubts it read the post I made a few days ago on the ACTUAL AMOUNTS our so-called "safety net" gives a family.

It's all so simple, right?

Fuddnik

(8,846 posts)Demeter

(85,373 posts)We had sleet (or baby hail) today. No accumulation except gloom and doom. Get a sunburn for me!

Demeter

(85,373 posts)Draft rules to curb high-speed trading blamed for China's summer stock market crash could kill off billions of dollars of investment into China, global banks and investors have told Chinese regulators in a letter. Industry participants who signed off on the letter said it warned Chinese regulators that the proposals would inadvertently sabotage major investment channels worth around $160 billion, including the Stock Connect scheme, one year old next week, which links the Hong Kong and Shanghai bourses. The lobbying efforts reflect growing fears that Beijing is responding to the summer rout by halting or even reversing reforms to allow greater access to its capital markets.

Plans to expand the Stock Connect scheme to the Shenzhen exchange and to include new listed products stalled after mainland bourses tumbled 45 percent between June and August and Beijing intervened through a range of measures to stop the plunge.

In a letter sent on Sunday by the Asia Securities Industry & Financial Markets Association (ASIFMA) to the China Securities Regulatory Commission (CSRC), foreign investors and brokers said the rules to stop "program trading" domestically would mean foreign firms could not send electronic trades from Hong Kong to brokers onshore.

"The proposed restriction on investors using algorithmic trading to connect to Chinese brokers onshore is huge - if you can't use automated systems, you can't trade on Stock Connect," said one person involved in drafting the letter....

IF THEY REALLY WANT TO, THEY CAN FIND A WAY THAT DOESN'T INVOLVE HFT

Demeter

(85,373 posts)European Union lawmakers have reached a "broad understanding" on new rules to curb risky trading in the bloc's biggest banks, a measure that is fiercely opposed by the banking sector. Draft rules were proposed in January 2014 and are seen as Europe's answer to the Volcker Rule on Wall Street to stop risks from trading hurting other parts of a bank, such as customer deposits.

Lawmakers from the main parties in the European Parliament met on Wednesday evening in a bid to find enough consensus to hold a vote on the rules that could take place as early as next month. Under the draft rules, Europe's biggest banks would be subject to closer scrutiny of their trading activities, and may be forced to split them off into separate legal entities if they prove too risky.

Gunnar Hoekmark, the Swedish centre-right lawmaker who is steering the measure through parliament, said consensus in parliament was now emerging. This follows an initial vote on the draft law earlier this year which ended in stalemate. Lawmakers had sparred over whether it was up to regulators to decide when a bank must isolate its trading operations or if there should be criteria which triggers this automatically.

"We are proceeding in order to establish full clarity and legal certainty that there shall be no automaticity, only discretionary assessments, when supervisors are assessing the bigger banks activities," Hoekmark said.

THE BANKS ARE OPPOSED, OF COURSE

Demeter

(85,373 posts)The world’s biggest banks agreed to rewrite trillions of dollars of financial contracts as the industry responds to pressure from regulators to help make sure lenders can fail without bringing down the global economy.

The contracts help lubricate the workings of the global financial system, governing securities financing transactions and derivatives trades. The new protocol, drawn up by the International Swaps and Derivatives Association and three other industry groups, will allow agreements between the signatory banks to remain intact for a period after a bank fails, ISDA said in a statement on Thursday.

The goal is to prevent a recurrence of the messy bankruptcy of Lehman Brothers Holdings Inc. in 2008, which helped trigger a global economic slump. The protocol will complement regulators’ efforts to solve the problem of too-big-to-fail banks, including the total loss-absorbing capacity rules announced by the Financial Stability Board this week. Group of 20 leaders are set to endorse the TLAC rules at a summit next week.

“This is all about too-big-to-fail and systemic risk,” said Doug Shaw, a capital markets lawyer at Linklaters LLP in London. “The protocol involves giving up existing rights, so entities signing up actually don’t get very much in return if they’re facing a counterparty that might enter into resolution. It’s a bit of a one-way street.”

MORE

Demeter

(85,373 posts)It’s been a quarter century since the fall of the Soviet empire triggered one of history’s greatest wealth transfers. Now bankers are preparing for another as Russia’s first generation of capitalists makes way for the next.

Confidential surveys of dozens of millionaires and billionaires conducted since European and U.S. economic sanctions began last year show Russia’s wealthy are finding little support within the country’s legal framework to pass down businesses. A majority say they’re taking the issue of succession seriously for the first time.

“Owners of major enterprises are basically hostages,” said Alena Ledeneva, a professor of politics at University College London, who has studied the workings of power networks in Russia for two decades. “They can suggest their kids as hostages to take their place, but only Putin’s system will decide whether to incorporate them or not.”

The result could be a surge in transactions for Russian businesses in coming years, according to Phoenix Advisors, a Moscow-based investment firm that helps entrepreneurs navigate succession and transition planning challenges.

MORE

INTERESTING IDEA...IS A FIRM BETTER OFF OUT OF FAMILY HANDS? US EXPERIENCE SUGGESTS NOT; BOTH EMPLOYEES AND CUSTOMERS FARE BETTER IN A WELL-RUN FAMILY FIRM, AS OPPOSED TO ONE SUBJECT TO VULTURE INVESTORS AND BUYOUT ARTISTS

OF COURSE, A BADLY-RUN FAMILY FIRM IS TOAST AND MUCH FASTER THAN A PUBLICLY HELD ONE. RUSSIA'S GOAL IS TO PREVENT DYNASTIC WEALTH. GOOD LUCK WITH THAT! THE ONLY WAY TO PREVENT IDLE HEIRS IS TO TAX THE WEALTH.

Demeter

(85,373 posts)Contrast that with the rest of the world, where the rich have long benefited from legal structures that safeguard the transfer of wealth between generations. One-third of the 400 billionaires on the Bloomberg index inherited the fortunes they control. A quarter of the 125 billionaires from the U.S. in the ranking inherited their wealth while half of Europe’s 106 biggest fortunes were passed down at least one generation.

Demeter

(85,373 posts)Hint: A LOT of money!

http://www.bloomberg.com/news/articles/2015-11-12/the-benchmark-podcast-what-it-takes-to-be-rich

How much money do you need to be rich, ultra rich and out-of-your-mind rich? Tori and Aki discuss, along with what growing income inequality means for the U.S. economy. Executive pay reporter Caleb Melby drops by to recount his exchanges with billionaires, including Donald Trump, and to explain why we should care about how much money the rich are making.

PODCASTS AT LINK

Demeter

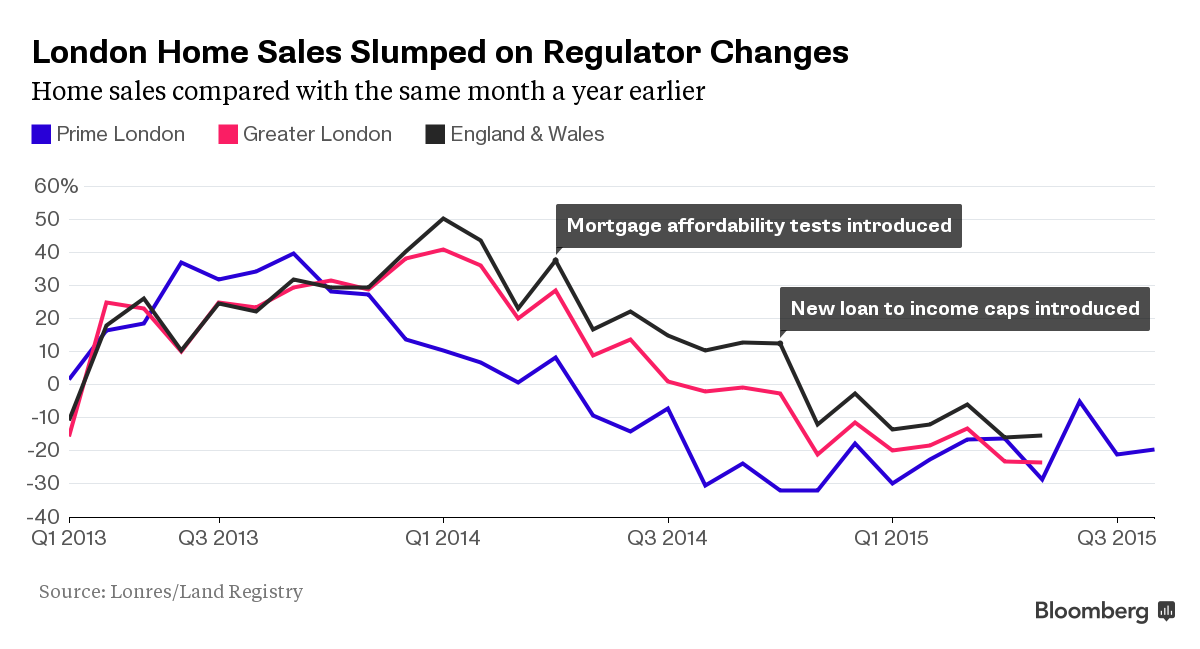

(85,373 posts)London’s most expensive homes and apartments have slumped in value as the government’s stamp duty sales tax damps demand.

Prices of homes valued at 5 million pounds ($7.6 million) or more fell 11.5 percent on a per square foot basis in the third quarter from a year earlier, according to Richard Barber, a director at broker W.A. Ellis LLP, a unit of Jones Lang LaSalle Inc. Sales volumes across all homes in the best parts of central London dropped 14 percent in the period, the realtor said on Thursday.

“The bubble may already have burst” for the most expensive homes, Barber said. Now, “36 percent of all properties currently on the market across prime central London are being marketed at a lower price than they were originally listed at, with the average reduction in price being 8.5 percent.”

Sales of luxury homes have fallen since Chancellor of the Exchequer George Osborne increased stamp duty for the most expensive homes in December. The purchaser of a 5 million-pound home now pays 513,750 pounds in duty, almost 164,000 pounds more than before the change...

MORE

Demeter

(85,373 posts)Even the world’s biggest financial market can’t escape the global liquidity drought.

Currency traders accustomed to shifting billions of dollars around the globe are starting to suffer as dealers retrench. Investors facing higher costs in this environment could rein them in with strategies that include splitting trades into several tranches, timing transactions to match peak turnover and avoiding a change of position too close to big events, according to money managers at Pioneer Investments and Macro Currency Group.

We’re not talking about emerging markets here. From the Australian and New Zealand dollars to the currencies of Norway, Sweden and Switzerland, the gap between the price quoted for sales and for purchases is widening, data compiled by Bloomberg show. Those five represent 19 percent of daily average foreign-exchange volumes. For the kiwi and krone, the mean spreads are at levels unseen since the 2008 global credit crunch...As regulation pushes banks to reduce their market-making activities, liquidity -- the ability to trade without having prices move against you -- is becoming more patchy. That’s leading to undependable pricing during times of stress and belying the 24-hour nature of the currency market...

“The markets are significantly less liquid now than they were before the financial crisis,” said Mark Farrington, the London-based managing partner at Macro Currency Group, which oversees more than $7.7 billion. “Where we had a very fluid, deep, liquid 24-hour market in 2007, you have now pockets of liquidity in the FX market based on the depth and strength of the market makers that are specialists in those currencies.”

THE LESS CHURNING, THE BETTER, IMO

MORE

Demeter

(85,373 posts)HILLARY AND THE FED RESERVE? TPP AND TISA?

http://www.bloomberg.com/news/articles/2015-11-12/credit-suisse-here-are-the-two-biggest-threats-to-the-global-economy-in-2016

A cut in China's investment spending and the return of U.S. core inflation could derail the global economy...

WAIT A MINUTE...I THOUGHT THE FED WAS BUSTING A GUT TO GET THE CORE INFLATION RATE UP!

Credit Suisse has published its 2016 Global Outlook, in which economists and strategists offer their favorite trades and base-case view for economic activity around the world, as well as possible developments that could derail their prophesied path from being realized.

The title—"The Fed Awakens"—would seem to imply that the U.S. central bank looms large as a source of potential downside for the global economy. While chief economist James Sweeney believes the Federal Reserve will have hiked rates four times by the end of 2016, he doesn't see this tightening cycle as one of the two most noteworthy gray swans on the horizon. The unwelcome scenarios Credit Suisse sees as substantial sources of downside risk for the global economy are if Chinese investment spending goes comatose or U.S. core inflation revives.

Getting to a Goldilocks level of investment spending poses a challenge for Chinese policymakers that is sure to spill over into the global economy, Credit Suisse says. In the midst of a reorientation of economic growth toward domestic demand, Beijing will be sure not to fully switch off the credit spigots that have driven investment spending. On the other hand, the marginal efficacy of these expenditures has waned, with investment threatening to exacerbate existing imbalances and raising the specter of a Chinese financial crisis.

Because of the immense scale of Chinese capital formation, Sweeney admits that all the assumptions embedded in Credit Suisse's base case would have to be reevaluated in the event that investment "were to contract or come close to contracting."

MORE TEA LEAVES AT LINK

Demeter

(85,373 posts)Bond traders’ inflation expectations are way too low, say analysts at Goldman Sachs Group Inc.

Sliding energy prices and slowing global economic growth have weighed down a measure of inflation expectations known as the 10-year break-even rate -- the gap between yields on Treasury notes and inflation-linked debt of that maturity. The gauge has rebounded from a six-year low set in September, and Goldman Sachs says it’s poised to keep climbing as oil prices stabilize and the U.S. economy accelerates. Rick Rieder, chief investment officer of fundamental fixed income at BlackRock Inc., wrote in a separate note that the drop in oil distorts inflation readings.

The Goldman analysts predict the break-even rate -- at about 1.57 percent -- will jump to 2 percent, though they don’t specify a timeframe. At that level, the market’s forecast for inflation would match the Fed’s goal, and it would be closer to the 15-year average of 2.1 percent. To profit from the projection, the bank recommends buying inflation-linked 10-year Treasuries versus regular notes.

"The market is way too bearish on U.S. inflation in the medium term," meaning between five and 10 years, said Silvia Ardagna, an analyst in London with Goldman Sachs, one of the 22 primary dealers that trade with the Fed.

A rebound in the bond market’s inflation view would signal rising investor confidence in the Fed’s ability to increase interest rates without derailing the economy. Stronger-than-forecast U.S. jobs data on Nov. 6 backed up the case for the central bank to boost its benchmark rate from near zero at its meeting next month. A turnaround in the inflation measure could happen quickly because the gauge is so low compared with where the bank assesses fair value -- a statistically rare two standard deviations away -- according to Ardagna...

I SENSE A DISTURBANCE IN THE FORCE...THE POWERS ARE NOT IN AGREEMENT!

MORE

Demeter

(85,373 posts)A man accused of plotting the 1978 Lufthansa airline heist made famous in the movie “Goodfellas” walked out of the federal courthouse in Brooklyn, New York, a free man after jurors found him not guilty in what may be the last big mob trial of a bygone era.

Vincent Asaro, 80, a purported captain in the Bonanno crime family, was charged with a raft of wrongdoing over decades, including extortion, loansharking, arson and the murder of a suspected informant with a dog chain. Prosecutors reminded jurors in their summation that Asaro had a tattoo on his forearm that read, “Death Before Dishonor.”

Standing outside the courthouse Thursday with his arms around his lawyers, Elizabeth Macedonio and Diane Ferrone, Asaro praised their work.

“Without them I wouldn’t be here now,” he said, smiling broadly. He told reporters he plans to “have a good meal” and “see my family.”

AT LEAST SOMEBODY WILL HAVE A GOOD THANKSGIVING...

Demeter

(85,373 posts)There's snow within driving distance, but not likely to actually fall in Ann Arbor...streaks of blue open sky are breaking through.

TGIF and I'll see you all on the WEEkend!

Fuddnik

(8,846 posts)Good thing I have an electric car.

Demeter

(85,373 posts)Not much, a nickel or so, but it was in a negative direction!

Fuddnik

(8,846 posts)NEW YORK (AP) — Sharp declines in retailers are dragging stocks lower Friday as the market heads for its first losing week after six straight weeks of gains. After disappointing reports from Nordstrom and Macy's, investors are worrying the holiday shopping season will be a dud.

RETAIL WOES: Department store operator Nordstrom retreated $10.62, or 16.7 percent, to $52.85 after its report Thursday afternoon. J.C. Penney's results were about equal to analyst projections, but its stock lost $1.25, or 15.2 percent, to $7.54. Earlier this week Macy's also posted disappointing quarterly results. Both Macy's and Nordstrom hit two-year lows.

Other chains like Ross Stores and TJX, the parent of TJ Maxx, also slumped. So did Kohl's, which jumped Thursday following a strong third-quarter report. E-commerce giant Amazon fell $14.75, or 2.2 percent, to $650.85.

HOLIDAY WORRIES: The latest reports were another warning sign about the holiday shopping season, which will soon kick into high gear. Black Friday is in two weeks and Christmas is six weeks away. Video game retailer GameStop sank $7.41, or 16.6 percent, to $37.12 and watchmaker Fossil Group plunged $17.76, or 34.8 percent, to $33.25. Fossil posted disappointing earnings Thursday afternoon and also said it will buy activity tracker maker Misfit for $260 million.

DON'T CRY IN YOUR EGG NOG: Stifel Nicolaus analyst Richard Jaffe suggested the steep drop in retail stocks was an overreaction. Shoppers will spend plenty of money this holiday season, he said, and while they're spending more money on smartphones and TVs and other big items than they used to, there will still be plenty of socks and sweaters exchanged over the holidays.