Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Economy

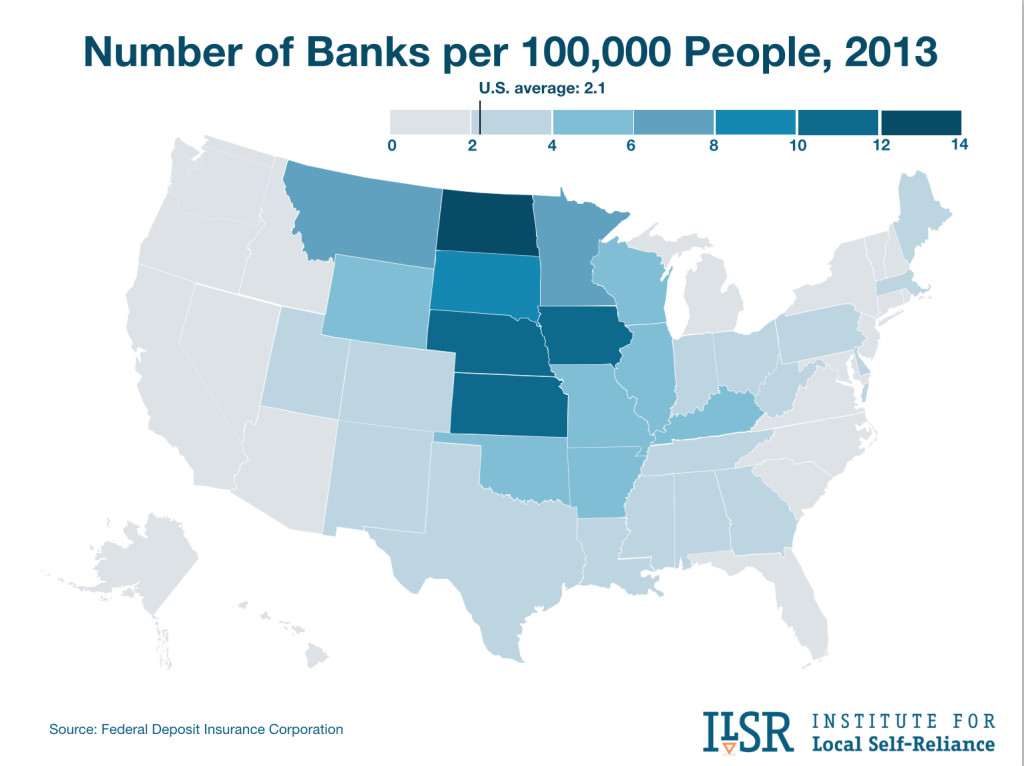

Related: About this forumHow One State Escaped Wall Streetís Rule and Created a Banking System Thatís 83% Locally Owned

http://ilsr.org/map-shows-how-well-the-bank-of-north-dakota-works/What has enabled North Dakota to go its own way? Much of the answer lies in the Bank of North Dakota, the only state-owned bank in the country. Since 1919, when it was founded to free North Dakotans from the tyranny and crushing interest rates of Minneapolis banks, BND has worked to nurture the state’s economy and communities. It continues to grow, nearly quadrupling in size since the early 2000s, and now has a $3.9 billion lending portfolio.

BND does most of its lending in partnership with local banks and credit unions, granting its support to their productive lending activities. About half of the bank’s loan portfolio consists of loans to small businesses and farms, and with its aid, North Dakota community banks averaged 49 percent more lending for small businesses over the last decade than those in South Dakota, and 434 percent more than the national average.

The other half of BND’s portfolio is residential mortgages and student loans. Thanks to BND, roughly 20 to 25 percent of the state’s mortgage debt is held and serviced within North Dakota, and students can directly access loans for their education with some of the lowest loan rates in the country.

While the publicly owned BND might well be characterized as a socialist institution, it has had the effect of enabling North Dakota’s local banks to be very successful capitalists. Over the last three years, they’ve operated more efficiently, and earned a return on their capital nearly twice that of the nation’s largest 20 banks, according to federal data.

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

5 replies, 1192 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (22)

ReplyReply to this post

5 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

How One State Escaped Wall Streetís Rule and Created a Banking System Thatís 83% Locally Owned (Original Post)

eridani

Sep 2015

OP

Everyone knows the public sector can't do anything right. This is why we had to semi-privatize or

merrily

Sep 2015

#1

The fact that it works jointly with local banks and credit unions is a key point.

rogerashton

Sep 2015

#2

merrily

(45,251 posts)1. Everyone knows the public sector can't do anything right. This is why we had to semi-privatize or

privatize so many things.

Here's to creating infrastructure banks! ![]()

![]()

http://www.democraticunderground.com/12779978

http://www.democraticunderground.com/111653186

rogerashton

(3,920 posts)2. The fact that it works jointly with local banks and credit unions is a key point.

Local knowledge, statewide resources.

MisterP

(23,730 posts)4. that's also a very interesting geographic distribution: it's a Great Plains thing

dang Norwegians!

snot

(10,530 posts)5. K&R'd & Bookmarked