Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 4 September 2015

[font size=3]STOCK MARKET WATCH, Friday, 4 September 2015[font color=black][/font]

SMW for 3 September 2015

AT THE CLOSING BELL ON 3 September 2015

[center][font color=green]

Dow Jones 16,374.76 +23.38 (0.14%)

S&P 500 1,951.13 +2.27 (0.12%)

[font color=red]Nasdaq 4,733.50 -16.48 (-0.35%)

[font color=red]10 Year 2.16% +0.01 (0.47%)

30 Year 2.94% +0.01 (0.34%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)The PPT held the line Thursday, but there's all kinds of "good" reports due out today.

Our heat wave broke with a steady drenching Thursday night, only one peach dropped. The Kid is still recovering from the bug she found 2 weeks ago....most of the congestion is gone, but not all. Whatever it was, it was potent.

Labor Day Weekend Economists reveal Ida Tarbell and muckraking, another name for investigative journalism of the type the Intercept and Wikileaks favor. Should be enlightening.

There's a name I haven't heard in a while. Supposedly, Thomas Paine's writings had an influence on her.

Her middle name was "Minerva", after the Roman goddess of Wisdom. Seems like it took. Though I would add taking on the Rockefellers in her time took a lot of courage as well.

Demeter

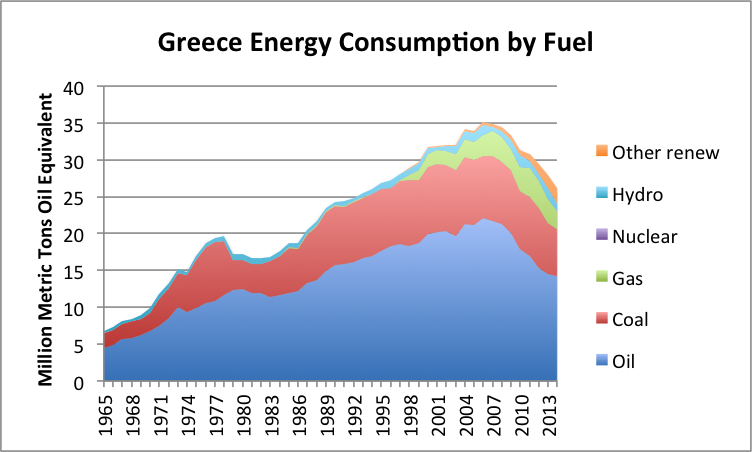

(85,373 posts)We all know one thing that Greece, Cyprus, and Puerto Rico have in common–severe financial problems. There is something else that they have in common–a high proportion of their energy use is from oil. Figure 1 shows the ratio of oil use to energy use for selected European countries in 2006.

?w=640

?w=640

Greece and Cyprus are at the top of this chart. The other “PIIGS” countries (Ireland, Spain, Italy, and Portugal) are immediately below Greece. Puerto Rico is not European so is not on Figure 1, but it if were shown on this chart, it would appear between Cyprus and Greece–its oil as a percentage of its energy consumption was 98.4% in 2006. The year 2006 was chosen because it was before the big crash of 2008. The percentages are bit lower now, but the relationship is very similar now.

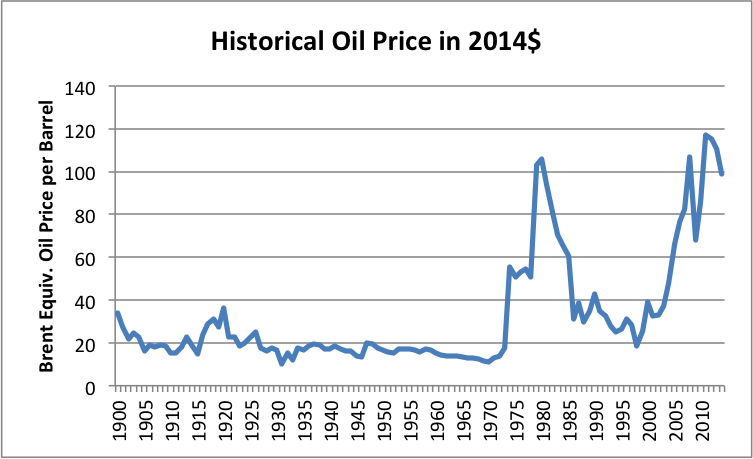

Why would high oil consumption as a percentage of total energy be a problem for countries? The issue, as I see it, is competitiveness (or lack thereof) in the world marketplace. Years ago, say back in the early 1900s, when countries built up their infrastructure, oil price was much lower than today–less than $20 a barrel (even in inflation-adjusted dollars). Between 1985 and 2000 there was another period when prices were below $40 barrel. Back then, the price of oil was not too different from the price of other types of energy, so an energy mix slanted toward oil was not a problem.

?w=640&h=390

?w=640&h=390

Oil prices are now in the $60 barrel range. This is still high by historical standards. Furthermore, much of the financial difficulty countries have gotten into has occurred in the recent past, when oil prices were in the $100 per barrel range.

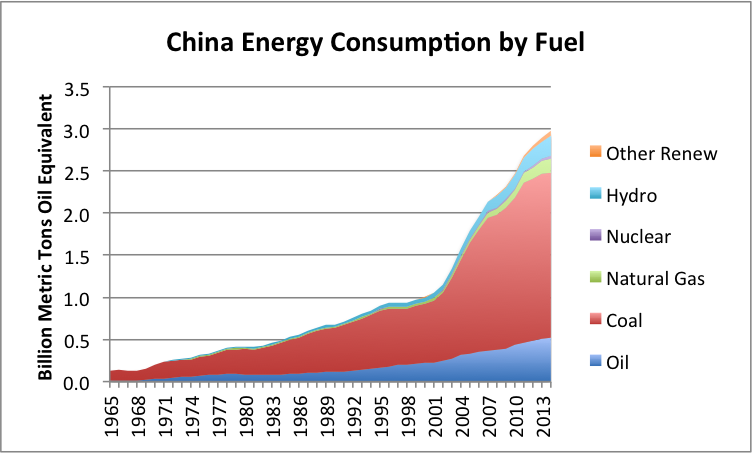

While countries with a large share of oil in their energy mix tend to fare poorly, at least some countries with a preponderance of cheap energy fuels in their energy mix have tended to do very well. For example, China’s economy has grown rapidly in recent years. In 2006, its share of oil in its energy mix was only 23.0%, putting it below Norway but above Poland, if it were included in Figure 1.

Let’s look a little at what it takes for an economy to produce economic growth, and what goes wrong in countries with high energy costs....

Demeter

(85,373 posts)The following reflects my view regarding what is needed for an economy to grow:

1. A growing supply of energy products, either internally produced or purchased on the world market, is needed for an economy to grow.

The reason why a growing supply of these energy products is needed is because it takes energy (human energy plus supplemental energy) to make goods and services. The availability of today’s jobs is also tied to the use of supplemental energy. High-paying jobs such as operating a bull-dozer, producing large quantities of food on a farm using modern equipment, or operating a computer, require supplemental energy in addition to human energy. While jobs can be created that use little supplemental energy to leverage human energy (for example, manual accounting without electricity or computers, growing food without modern equipment, or digging ditches with shovels), these jobs tend to pay very poorly because output per hour worked tends to be low.

To obtain growth in the number of jobs available to workers, a growing supply of energy products to leverage human energy is needed. Looking at the world economy, we can see that historically, growth in energy consumption is highly correlated with economic growth.

Figure 3. World GDP in 2010$ compared (from USDA) compared to World Consumption of Energy (from BP Statistical Review of World Energy 2014).

In fact, we tend to need an increasing percentage growth in energy supply to produce a given percentage growth of GDP because the y intercept of the fitted line is -17.394, rather than 0.000. Back in 1969, 1.0% growth in the consumption of energy products produced 2.2% GDP growth. The fitted line implies that recently, the amount of GDP growth associated with one percentage growth in energy consumption is only 1.2% of GDP. This poor result is taking place, despite all of our efforts toward increased efficiency. Thus, as time goes on, we need more and more energy growth to produce the same level of GDP growth. This is a rather unfortunate situation that world leaders don’t mention. They tend to focus instead on the fact that the growth in GDP tends to be at least a little higher than the growth in energy use.

2. This growing energy supply must be inexpensive, in order to be able to create goods that are competitive in the world market.

Human energy is by its nature expensive energy. Humans require food, water, clothing, and housing to support their biological needs–we are not adapted to eating entirely uncooked food, or to living in climates that get very cold in winter, unless we have protection from the elements. Thus, wages must be high enough to cover these costs.

Cheap supplemental energy provides a great deal more leveraging power than expensive supplemental energy. If we can leverage human energy with cheap energy such as wood or fossil fuels, it is easy to bring down the average cost of energy. (This calculation is made on a Calorie or Btu basis, for the sum of the energy provided by human labor plus that provided by supplemental energy.) If we are dealing with supplemental energy that is by itself high-cost, it is very difficult to bring down this weighted average cost. This is why high-cost oil, or for that matter high-cost supplemental energy of any kind, is a problem.

If human energy can be leveraged with increasing amounts of cheap energy, it can produce an increasing amount of goods and services, ever more cheaply. In fact, this seems to be where economic growth comes from. These goods and services can be shared with many parts of the economy, including government funding, wages for elite workers, wages for non-elite workers, payback of loans with interest, and dividends to stockholders. If there are enough goods and services produced thanks to this increased leverage, all of the various parts of the economy can get a reasonable share, and all can adequately prosper. If there is not enough to go around, then there are likely be shortfalls in many parts of the economy at once. It is likely to be hard to find good paying jobs, for ordinary “non-elite” workers. Governments are likely to find it difficult to collect enough taxes. Governments may lower interest rates, or may take other steps to make it easier for businesses to continue their operations. Even with lower interest rates, debt defaults may become a problem. See my post, Why We Have an Oversupply of Almost Everything. The entire economy tends to do poorly.

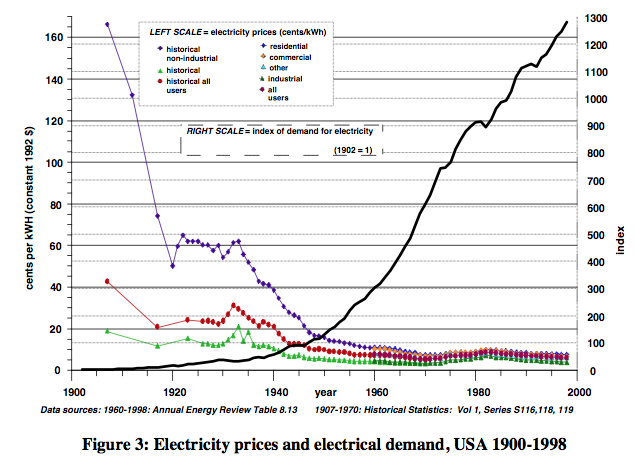

Ayres and Warr provide an illustration of how an increasingly inexpensive supply of energy can lead to greater consumption of that energy–in this case electricity–in their paper Accounting for Growth: The Role of Physical Role of Physical Work.

Figure 4. Ayres and Warr Electricity Prices and Electricity Demand, from “Accounting for growth: the role of physical work.”

There is a logical reason why falling energy prices would lead to rising use of an energy product. If a person can afford to buy, say, $100 worth of energy and the cost is $1 per unit, the person can afford to buy 100 units. If the cost is $5 per unit, the person can afford to buy 20 units of energy. If it is the energy itself that aids growth in economic output (by moving a truck farther, or operating a machine longer), then lower energy prices lead to more energy consumed. This higher amount of energy consumed in turn leads to more economic output. This greater economic output is frequently shared with workers in the form of higher wages because of the workers’ “higher productivity” (thanks to the leveraging of cheap supplemental energy).

When it comes to the cost of energy production, there are “tugs” in two different directions. In one direction, there is the savings in costs that technology can provide. In the other, there is the trend toward higher extraction costs because companies tend to extract the cheapest resource of a given type first. As the inexpensive-to-extract resources are exhausted, the cost of resource extraction tends to rise. We can see from Figure 2 that oil prices first began to spike in the 1970s. After some temporary “fixes” (shifting much electrical production away from oil to cheaper fuels, shifting home heating from oil to other fuels, and starting new extraction in Alaska, Mexico, and the North Sea), the problem was more or less solved for a while. The problem came back in the early 2000s, and hasn’t really been solved. Thus, most of the tug now is in the direction of higher costs of production.

[1] While cost of oil production is rising, oil prices are not necessarily rising to match the cost of production, and in fact, have fallen below the cost of production. This occurs because costs are now too high relative to wages, so oil isn’t affordable. This is an important story in its own right, and is likely to eventually bring down the whole system. See for example my post, Ten Reasons Why a Severe Drop in Oil Prices is a Problem.

Once oil prices rose, Greece and other countries that continued to use a high percentage of oil in their energy mix were handicapped because their products tended to become too high-priced for customers. Wages of customers did not rise correspondingly. Potential tourists could not afford the high cost of airline tickets and cruise ship tickets, because these prices depended on the price of oil. Even when oil prices dropped recently, airline companies have not reduced airline ticket prices to reflect their savings. Because of the high-cost energy structure, manufacturing costs have tended to be high as well. With fewer tourism jobs and few possibilities for making goods for exports, the number of good-paying jobs has tended to shrink. Without enough good-paying jobs, Greek demand for fuel products of all kinds dropped rapidly. (Demand reflects the amount of goods a person wants and can afford. Young people without jobs live with their parents, and thus do not buy new homes or cars, lowering consumption.)

Figure 5. Greece’s energy consumption by fuel, based on BP Statistical Review of World Energy, 2015 data.

Other countries that were positioned to add huge amounts of inexpensive energy were able to continue to grow. The country that did this best was China. It was able to cheaply and rapidly ramp up its coal supply, once it entered the World Trade Organization in 2001. If Greece now adds production of goods, it needs to be able to compete in price with China and other goods-producers.

?w=640&h=386

?w=640&h=386

Figure 6. China’s energy consumption by fuel, based on data of BP Statistical Review of World Energy 2015.

3. If the energy supply that a country plans to use is cheap, it doesn’t matter whether the energy supply is locally produced or not.

If the energy supply that a country is locked into using is expensive, then using locally produced high-priced energy is “less bad” than using imported energy, but there is still a problem.

If a growing supply of cheap energy is available, this can be used to leverage local human labor to produce inexpensive goods. This works well, regardless of whether the fuel is imported or not. Because imported energy “works” in such a situation, many island nations (including Cyprus and Puerto Rico) were able to develop their economies using oil as the energy base. These island nations typically did not have natural gas available, unless they imported expensive LNG. Coal and nuclear were also difficult to use, because power plants of these types are built on too a large scale to be suitable for on an island. But oil generally worked well, even if imported.

Greece includes 227 inhabited islands, and thus is faced with many of the problems of an island nation. Back when oil was cheap, oil was an easy solution. It could be used for electricity and for many processes that require heat, such as baking bread, dying cloth, making bricks, and recycling metals.

If a county is using imported oil, once oil becomes high-priced, there is essentially nothing that can be done to fix the problem. Devaluing the currency doesn’t work, because then oil becomes higher-priced in the new devalued currency. As a result, it still is prohibitively expensive to make goods, even after the devaluation. In fact, devaluing the currency also tends to make other imported energy products, such as LNG and solar PV panels, more expensive as well.

With respect to previously purchased renewables, the ongoing cost is typically the debt payments for the devices used to generate this energy. How devaluation will affect these payments depend on the currency the debt is in. If these debt payments are in the country’s own currency, then devaluing the currency will not affect the payments (so devaluation won’t help reduce costs). If debt payments for renewables are in another currency (such as the dollar or Euros), then devaluing the currency will increase the cost, making the loans more difficult to repay.

Even for an oil exporter like Saudi Arabia, high-priced oil is a problem, for a number of reasons:

- If the oil exporter uses some of its oil itself, the revenue that would have been gained by selling this oil abroad is lost. The government may be able to purchase the oil for essentially the cost of extraction, but it loses the extra revenue that it would gain by selling the oil abroad. This revenue could be used to fund government programs and new oil investment.

- The countries that import this high-priced oil tend to find their economies depressed, leading to less use of the oil. Thus, oil exports tend to become depressed.

- The price of oil may fall (and in fact has fallen, and may fall more), because of low demand. With low prices, it becomes difficult for exporters to collect enough revenue for government projects and investment in new supply.

The reason why locally produced high-priced oil is “less bad” than imported oil is because jobs related to producing the oil tend to stay in the country. This is a plus, in itself. If there is a currency devaluation, wage costs and other local costs will be lower, making the energy product less expensive to produce. Unfortunately, production costs (including taxes needed to support government services) may still be above the market price, because of depressed demand.

4. Debt helps increase demand for goods. But to make the debt repayable, these goods need to be made with low-priced energy products.

Ramping up debt for a country helps, but only if, with this debt, the country is able to profitably sell more goods and services in the world marketplace. Greece seems to have added debt, but wasn’t able to use this debt to create goods and services that could be sold cheaply enough that their prices would be competitive in the world market.

China clearly has been willing to add huge amounts of debt to support all of its new industry and new homes it has built with the coal it has been extracting. There is no doubt that the growth in China’s debt has played a major role in extracting growing quantities of coal. Now China’s coal consumption is slowing for a number of reasons including overbuilding of factories, too much pollution, and higher cost of coal production. China’s slowdown in energy consumption is leading to a slow-down in economic growth, and may even lead to a hard crash.

Greece has added a lot of debt in recent years, but it has not been used for ramping up the use of a new cheap supply of energy. Instead, much of Greece’s debt seems to be for purposes such as bailing out banks. This doesn’t really tell us what is/was wrong with the economy to begin with. I would argue that high-priced fuel tends to make it difficult to make any kind of goods or services inexpensively enough to compete in the world market, and this is at least part of the problem. The result of this is that companies, no matter what they invest debt in, have a difficult time being profitable.

The Greek government tries to cover up the country’s problems with programs that are funded by debt. Hidden subsidies may be occurring in several government-owned energy-related firms: Public Power Corporation of Greece (Greece’s largest electric utility), Hellenic Petroleum, DEPA Natural Gas, and ADMIE Grid Operating Company. There have been proposals to privatize these companies because they are poorly run. Whether or not they are poorly run, I expect that it will be very difficult to run them profitably, simply because of the inherent high-cost nature of the products they produce and workers’ lack of disposable income. This problem reflects the high cost of the underlying products they are producing.

There have been some proposals to try to get energy costs down, including a proposal to install a new lignite coal-fired electric power plant. There is also a plan to connect four of the islands to the electric grid, so that the islands won’t have to depend on oil-fired electricity. Even if these changes are made, it is not clear that Greece’s energy costs will be low enough to produce goods that are competitive in the world market. For one thing, airplanes and cruise ships operate using oil, not electricity produced by lignite, so will not be affected by additional inexpensive lignite electricity production.

From everything I can see, Greece’s debt needs to be written off. There is no way that the country can change its system to repay it. Greece can perhaps repay a little new debt, if it is channeled to support low-cost energy production to substitute for current high-cost energy.

Conclusion

Most people don’t understand that our world economy runs on cheap energy. High-priced energy is not an adequate substitute, even if the high-priced energy is “low carbon” or claims to have a reasonably high EROEI (Energy Return on Energy Invested) ratio. Our world economy is sensitive to prices and costs, even if the current “politically correct” discussion ignores these matters.

MORE---THIS WOMAN IS AMAZING!

Demeter

(85,373 posts)US crude oil output fell this past week, but our oil imports were the highest since early April, and with a major refinery idled, that unexpectedly led to the largest increase in our inventories of oil in storage in 4 months, precipitating yet a further crash in the price of oil.

US field production of crude oil fell for the third week in a row in the week ending August 14th, from 9,395,000 barrels per day in the week ending August 7th to 9,348,000 barrels per day in this week's report. While that was down 2.7% from the modern record of 9,610,000 barrels per day set in the week ending June 5th, it was still 9.6% higher than our output of 8,556,000 barrels per day in the same week last year. Our imports of crude oil, meanwhile, rose for the 3rd week in a row, jumping from 7,573,000 barrels per day in the week ending August 7th to 8,038,000 barrels per day in the current report. While that's 2.4% more than the same week last year, our 7.6 million barrels per day average crude imports of the last 4 weeks is still 0.9% lower than the same 4 week period of last year..

However, even with the increased oil supply brought about by that large increase in imports, that oil was not being put to use to the same degree as last week. Due in large part to the unexpected August 8 outage at the BP refinery in Whiting, Indiana, the largest BP refinery and the largest in the US Midwest, U.S. crude oil refinery inputs dropped to 16,775,000 barrels per day, from the 17,029,000 barrel per day level of the week ending August 7th. So with greater supply and less refinery throughput, our crude oil inventories in storage rose by 2,620,000 barrels to 456,213,000 barrels in week ended August 14th, 24.3% more oil than the 367,019 ,000 barrels we had stored at the end of the 2nd week of August last year. That was more oil than was ever stored anytime in August in the 80 years that the EIA has records for, which had never seen the 400 million barrel inventory level breached before this year. The news of even higher inventories during the summer driving season when inventories usually fall sent oil prices down by 4.8% to a six and a half year low at $40.57 a barrel on Wednesday, and although the expiring September contract price inched up on Thursday on news of the first hurricane of the Atlantic season, oil prices for October delivery crashed again on Friday in the midst of a global market panic, briefly slipping below $40 a barrel, before closing the week at $40.45, capping the longest weekly losing streak for oil prices in 29 years.

So, if we've got plenty of oil stored, and with at least two refineries operating below capacity, why do we continue to import near fracking-era record amounts of crude oil? One reason is the contango trade that we've talked about in the past, wherein contracts for oil to be delivered in the future are at a price somewhat higher than the cost of buying oil now, such that it pays for speculators to buy oil and pay for its storage, and enter into a contract to sell it back at a higher price in the future. At one point last week, the contract for oil to be delivered in December was more than a dollar a barrel higher than the current price, meaning that a speculator could buy oil at today's price, pay the fees to have it stored at Cushing or elsewhere, and sell it back in December with a clear profit. But as we should all know, for every contract there has to be a counterparty, and for everyone who's buying oil now with a contract to sell it in December, there was a seller of that oil at today's price and a someone else buying a contract to take delivery of that oil for a dollar more a barrel in December. So for every one who's trading oil like this, there is someone on the other side of those trades, be it a bank, commodities house, or an oil company, taking the other side of those contracts, and effectively betting against the contango trader. They both can't be right, and those who bet on higher prices in March and a month ago have since lost their shirts...

Another reason for continued high imports of oil is that we're exporting more refined products than ever before.. In the 2nd week of August, our total exports of refined petroleum products averaged 3,884,000 barrels per day, up 10.6% from the 3,512,000 barrels per day we were exporting in the same week last year. But that's also more than double the 1,851,000 barrels per day of refined products we were exporting in August 2009, and more than quadruple the 964,000 barrels per day of refined products we were exporting in August of 2004. We're also exporting more crude oil too, mostly from the Bakken to Canada, where the lighter grades of distillates are blended with tar from the oil sands to produce diluted bitumen, or dilbit, which can then be delivered by pipeline. On a monthly basis, our total exports of crude and petroleum products hit a record 4,943,000 barrels per day in April, more than double the 2,432,000 total exports of April five years earlier...

MORE

Demeter

(85,373 posts)Monday’s worldwide stock selloff was reportedly triggered after J.P. Morgan Chase announced that recent hire Raymond Odierno was let go, citing hundreds of complaints and multiple FTC investigations into the general’s high-pressure sales tactics, cold-calling, and down-playing of high-risk investments while executing his new role as financial adviser.

Odierno, who accepted a position with the company in August after retiring from the Army, was allegedly hawking financial vehicles he claimed offered “little to no risk” for casual investors. However, as an unnamed source close to the investigation said, Odierno’s recommendations proved to be the opposite.

“Odierno’s investors were all trading sub-prime mortgage futures via margin accounts opened through an offshore, unregulated shell company that has only weak connection to J.P. Morgan Chase,” said the source. “We also obtained a prospectus for the ‘F-35 Freedom Fund’ — a mutual fund we found he sold to senior Pentagon functionaries and cost the government hundreds of billions of dollars.”

While it is a setback for Odierno, executives at J.P. Morgan Chase view the shake-up as a “bump in the road” for the former 38th Chief of Staff of the Army. According to J.P. Morgan Chase CEO Jamie Dimon, what made Odierno stand out from other applicants on Monster.com — other than his veteran status and high level contacts in the political and financial arenas — was his “aggressive, ‘never give up’ personality.”

“Making the transition from the military to civilian world is a learning process,” Dimon said. “During his week-long interview in St. Barts I could tell Ray was rough around the edges, but what new employee with 40 years of military service and access to tens of thousands of prospective investors aren’t?”

“With enough grit, hard work, and heavy lobbying for more lax regulations on the burgeoning financial industry, Ray will make a great addition to another ‘too-big-to-fail’ firm,” Dimon said.

Optimistic that he will quickly find employment elsewhere, Odierno held a press conference to address his dismissal publicly....

SOUNDS LIKE THE GENERAL WAS THTH (TOO HOT TO HANDLE) BY THE TBTF....

UPDATE: The telecom sector saw a small surge after Comcast announced Odierno had accepted a position in their customer service department. CEO Brian Roberts told Forbes that he is “confident [Odierno] will do for our quality service team what he did for the military.”

I ONCE KNEW A MILITARY FAMILY NAMED ODIERNO IN NH....IN A PREVIOUS LIFE

I WONDER...

Demeter

(85,373 posts)"NOW HE TELLS ME!" --TSIPRAS

http://www.cnbc.com/2015/09/01/grexit-may-be-better-for-greece-euro-architect.html

Leaving the euro might help struggling Greece, according to Otmar Issing, the former European Central Bank (ECB) board member and chief economist who is known as one of the euro currency's architects.

"The euro is irreversible – but if it is irreversible for every country has become an open question," Issing told CNBC on Tuesday.

Issing raised eyebrows earlier this summer when he said that the euro's irreversibility was an "illusion," contradicting current ECB members who have insisted that there is no going back from the single currency.

However, economists and politicians away from the ECB have questioned whether highly indebted Greece can remain in the euro zone and whether it might in fact do better economically outside the currency union.

"For Greece, there are very good arguments that it would do well outside the euro area for some time to come, but it all depends on the Greek government's reactions" Issing told CNBC.

MORE CRYPTIC COMMENTARY AT LINK

MattSh

(3,714 posts)Russia Insider has previously said Greek Prime Minister Tsipras’s approaches to Russia earlier this year during Greece’s negotiations with the European institutions were manipulative and were not intended to lead to a realignment with Russia.

Instead we said that Tsipras was trying to use Russia as a scarecrow to panic the Europeans into concessions.

We also said that though the Russians were initially willing to help, they quickly figured out what Tsipras was up to, so that beyond a certain point their offers of help became progressively less generous.

This was an isolated view. Pretty much all of the rest of the international media was reporting Tsipras’s approaches to Moscow differently. In fact there was a great deal of alarmed - or hopeful - talk about how Greece’s loyalty to the West was in jeopardy, and about how it was preparing to tilt towards Russia and the BRICS.

Confirmation that what we said was true has now come from Stathis Kouvelakis, a former member of Syriza’s central committee, who is close to Panayiotis Lafazanis, Greece’s former energy minister, who now heads Popular Unity, the new left wing grouping formed from former members of Syriza who oppose the latest bailout agreement.

Complete story at - http://russia-insider.com/en/politics/syriza-insider-confirms-tsipras-tried-take-russia-ride/ri9463

Demeter

(85,373 posts)He's a crooked power-grasping hack, and unworthy of service.

Demeter

(85,373 posts)Research shows 1.5 million households and 3 million children are living in desperate economic conditions...The World Bank and other global institutions use a very specific measure to record global poverty rates. They gather data designed to record the number of people in a country who live on less than $2 a day, and then use the information to make a “poverty headcount ratio”— the percentage of people in a country who live under this standard. In most recent data, Sierra Leone, for example, had a staggering 82.5% of its citizens living in poverty by this count.

What is less known is that millions of Americans are living in situations of similar poverty. A new book, $2.00 a Day: Living on Almost Nothing in America, explores the status of Americans who face this extreme level of poverty

“Most of us would say we would have trouble understanding how families in a country as rich as ours could live on so little," Kathryn J. Edin, who co-wrote the book with H. Luke Shaefer, said in a conference call recorded by CBS News. "These families, contrary to what many would expect, are workers, and their slide into poverty is a failure of the labor market and our safety net, as well as their own personal circumstances."

According to her research, the number of Americans living on $2 a day or less has “more than doubled since 1996, placing 1.5 million households and 3 million children in this desperate economic situation.”

1996 is an important marker, because that's the year the Clinton administration, working alongside Republicans in Congress, eliminated the Aid for Families with Dependent Children program, which provided a guaranteed safety net for the poor. In its place they created Temporary Aid for Needy Families (TANF), a much more meager and temporary safety net. CBS News notes that the two authors of the book cite this change as harming the poor:

The authors' research, which includes data analysis and interviews with ultrapoor families in four regions, found that many families aren't even aware of TANF. "One person said, 'They aren't just giving it out anymore,'" Shaefer said. "In fact, in Appalachia it has, in some ways, disappeared. We asked, 'Have you thought about applying for TANF?' and they said, 'What's that?'

MattSh

(3,714 posts)DemReadingDU

(16,000 posts)Punx

(446 posts)Impoverished and easily controlled. Without the $ to fight back and desperate people will jump at a chance to work, keeping wages suppressed. I don't know who they think they are going to sell things to on $2 a day though.

It's no accident what is happening.

Demeter

(85,373 posts)As the battle between the bulls and the bears heats up over the direction of this six-year bull market, charts of the S&P 500 index are flagging a potential rebound ahead, according to a JPMorgan chart analyst.

After moving sideways for most of the year, the S&P 500 broke below its trading range last month, dipping into correction territory for the first time in four years, down more than 10 percent.

The rapid drop, however, was quickly followed by a rally of 6.7 percent from the double bottom at the 1,867-level hit in late August, leaving the index right in the middle of the major support and resistance parameters, according to the top chart analyst.

VIDEO AT LINK

Demeter

(85,373 posts)London day trader Navinder Sarao has been formally indicted by a U.S. federal grand jury on charges of market manipulation that prosecutors say helped contribute to the 2010 "flash crash," according to a Sept. 2 court filing made public on Thursday.

The Justice Department first announced criminal charges against Sarao in April and is seeking to have him extradited to the United States to stand trial.

Sarao is accused of using an automated trading program to "spoof" markets by generating large sell orders that pushed down prices. He then canceled those trades and bought contracts at lower prices, prosecutors say. Attorneys for Sarao could not be immediately reached outside of London business hours.

The indictment made public Thursday contained the same criminal charges announced in the spring, which include wire fraud, commodities fraud, commodity price manipulation and attempted price manipulation.

But it revealed new details about how prosecutors say Sarao sought out the help of computer programmers to design a manipulative automated trading program.

Demeter

(85,373 posts)This spring, traders and analysts working deep in the global swaps markets began picking up peculiar readings: Hundreds of billions of dollars of trades by U.S. banks had seemingly vanished.

"We saw strange things in the data," said Chris Barnes, a former swaps trader now with ClarusFT, a London-based data firm.

The vanishing of the trades was little noted outside a circle of specialists. But the implications were big.

The missing transactions reflected an effort by some of the largest U.S. banks - including Goldman Sachs, JP Morgan Chase, Citigroup, Bank of America, and Morgan Stanley - to get around new regulations on derivatives enacted in the wake of the financial crisis, say current and former financial regulators.

The trades hadn't really disappeared. Instead, the major banks had tweaked a few key words in swaps contracts and shifted some other trades to affiliates in London, where regulations are far more lenient. Those affiliates remain largely outside the jurisdiction of U.S. regulators, thanks to a loophole in swaps rules that banks successfully won from the Commodity Futures Trading Commission in 2013....

IT'S A LONG LAUNDRY LIST OF BAD-BEHAVING-BANKS AND THE TRICKS THEY ARE TRYING TO PULL

MattSh

(3,714 posts)IMF Officials Implicated In Theft, Concealment Of Ukraine Loan Corruption, Us Justice Department Investigating | Dances With Bears

By John Helmer, Moscow

Officials of the International Monetary Fund (IMF) are in flight from evidence of negligence, incompetence, and corruption in their management of billions of dollars in loans for Ukraine.

Nikolai Gueorguiev, head of the Ukraine team at IMF headquarters in Washington, DC, and Jerome Vacher, the IMF representative in Kiev, refuse to respond to questions on their role in the offshore diversion of IMF loan money through Privatbank and Credit Dnepr Bank, banks owned by Ukrainian oligarchs Igor Kolomoisky and Victor Pinchuk. (Remember that name)... The Fund’s Managing Director Christine Lagarde and her spokesman, Gerry Rice, are covering up evidence of conflicts of interest and multiple violations of the IMF Staff Code of Conduct which have been occurring in the Ukraine loan programme. Simonetta Nardin, head of the Fund’s media relations, refuses to explain her apparent violations of the Code, or respond to evidence that she fabricated elements of her career resume.

On Tuesday a spokesman at the US Department of Justice in Washington confirmed that an investigation is under way of the role played by US clearing banks in the movement of IMF funds through the Privatbank group and companies connected with Kolomoisky. Speaking for the Asset Forefeiture and Money Laundering Section, Peter Carr declined to give more details.

In recent indictments presented to US courts, Justice Department officials have defined the crime of money laundering as the transmission or transfer of money through “a place in the United States to or through a place outside the United States” with the “intent to promote the carrying on of specified unlawful activity”; with knowledge that the transfer of funds represents “the proceeds of some unlawful activity”; and with the intention to “conceal or disguise the nature, the location, the source, the ownership, or the control of the proceeds of unspecified unlawful activity”.

The role of US system banks, such as Citibank, Bank of America, and JPMorgan Chase, in clearing US dollar transactions has been the basis of selective Justice Department prosecutions of Russian and pro-Russian Ukrainian companies and individuals since the toppling of President Victor Yanukovich in Kiev in February 2014. In contrast, Ukrainian allies of the US in that operation, including Yulia Tymoshenko, Kolomoisky, and Pinchuk, have not been pursued on court evidence of their involvement in corruption and money-laundering.

Complete story at - http://johnhelmer.net/?p=14017#more-14017

MattSh

(3,714 posts)Enemies of Hillary Clinton waiting to discredit her bid for the White House are likely to seize on news that one of the biggest benefactors to the Clinton Foundation has been trading with Iran and may be in breach of US sanctions imposed on the country.

Ukrainian oligarch Victor Pinchuk, 54, has courted the Clintons for at least nine years – in the United States, the Alps and Ukraine.

Earlier this year, he was confirmed as the largest individual contributor to the Clinton Foundation, whose aims include the creation of “economic opportunity and growth”. He also has links to the Tony Blair Foundation and represented its biggest single donor in 2013.

The fourth richest man in Ukraine, Pinchuk owns Interpipe Group, a Cyprus-incorporated manufacturer of seamless pipes used in oil and gas sectors.

Complete story at - http://www.newsweek.com/2015/04/24/hillary-clinton-runs-white-house-and-row-over-ukrainian-benefactors-trade-322253.html

And now, sanctions against Iran will be lifted shortly. Maybe, possibly. It's all in your head Matt, it's all in your head. There is no connection. There is no connection...

Personally, I don't believe in co-incidences of this type.

DemReadingDU

(16,000 posts)$2.17 yesterday

Demeter

(85,373 posts)Regular stations down to $2.49 Yippee

Warpy

(111,367 posts)to reflect the switch to winter gasohol. My little car doesn't seem to know the difference so I always welcome the switchover. The air smells a little better, too.

MattSh

(3,714 posts)

mahatmakanejeeves

(57,647 posts)WATERLOO, Ont. - BlackBerry Ltd. expects to strengthen its position in the Apple world by integrating California-based Good Technology and its products through a US$425-million friendly acquisition announced Friday.

The pioneering smartphone company, based in Waterloo, Ont., said two-thirds of Good Technology's product activations are on devices using Apple's iOS and the rest are on Android and Windows devices.

BlackBerry(TSX:BB) has its own operating system but has been working to broaden its product reach, including through closer integration with Android-driven devices from Samsung.

The two companies have a long-standing focus on providing highly secure technology for organizations and they have complementary strengths in different market segments, BlackBerry executive chairman John Chen said Friday. ... "What's most attractive to me is that the product platforms are extremely complementary," Chen told analysts on a conference call.

Demeter

(85,373 posts)THEY ARE AFRAID THE FED WILL PULL THE TRIGGER AND SHOOT THE ECONOMY IN THE FOOT

NOT TO MENTION THAT ALL THE DEBT THE CORPORATIONS TOOK ON FOR BUY-BACKS WILL PROBABLY COST THEM MORE

http://www.cnbc.com/2015/09/04/januss-gross-jobs-number-was-sufficient-for-either-sept-or-dec-rate-hike.html

August's job number is sufficient proof enough for the Fed to raise interest rates in either September or December, Bill Gross said Friday.

"The jobs number was mediocre, but decent, and probably in terms of Janet Yellen and the Fed, sufficient for either September or December," the bond guru told CNBC's "Power Lunch."

Gross said that near-zero percent interest rates have exerted a negative influence on the economy, albeit a positive one on equity markets. That negative influence has destroyed business models for insurance companies and pension funds, he said.

"We have a very positive monetary policy that has stimulated asset markets, but they [Fed] are now infringing on the ability of an economy to grow in real terms," he said...

MORE

IF THE FED WAITS FOR DECEMBER (WHO IN RIGHT MIND WOULD RAISE THE RATES IN THE CHRISTMAS SEASON?) THEY MAY FIND THERE'S NO WAY TO DO IT, PERIOD.

I'M BEGINNING TO WISH THEY WOULD JUST DO IT, GET THE CRASH STARTED....THE QUICKER IT STARTS, THE SOONER PEOPLE STOP ACTING LIKE HORSE'S ASSES AND FIX THE UNDERLYING ECONOMIC BASIS OF OUR NATION. LIKE JOBS.