Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 7 August 2015

[font size=3]STOCK MARKET WATCH, Friday, 7 August 2015[font color=black][/font]

SMW for 6 August 2015

AT THE CLOSING BELL ON 6 August 2015

[center][font color=red]

Dow Jones 17,419.75 -120.72 (-0.69%)

S&P 500 2,083.56 -16.28 (-0.78%)

Nasdaq 5,056.44 -83.50 (-1.62%)

[font color=green]10 Year 2.23% -0.04 (-1.76%)

30 Year 2.89% -0.05 (-1.70%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

jtuck004

(15,882 posts)A lack of academic integrity seems to run far deeper in College Board’s AP program. For one, its new U.S. History course, appropriately nicknamed “A-PUSH,” has departed from College Board’s reputation for offering objective measures of students’ preparation for serious academic work. A former AP teacher whom the College Board has given numerous awards and now makes his living from teaching kids to ace the tests has begun to publicize that new A-PUSH dictates revise more than the curriculum—they appear to revise history itself.

Beginning in August, such a course will be offered to 500,000 of America’s most talented high-school sophomores and juniors – the College Board’s new AP U.S. History Framework. The new College Board Framework will replace the traditional 5-page topical outline with a 98-page document that dictates how teachers should cover the required topics. George Washington gets one brief mention; other founders, such as Benjamin Franklin and James Madison, none. The Declaration of Independence is referred to in passing in one clause of one sentence.

If the Framework virtually ignores the most important men and documents in American history, what does it find worthy of attention? The answer is, pretty much anything that casts a negative light on our country. The redesigned Framework inculcates a consistently negative view of American history by highlighting oppressors and exploiters while ignoring the dreamers and innovators who built our country.

The College Board’s Trevor Packer has so far responded largely by smearing Larry Krieger and attacking things he did not say rather than responding to Krieger’s arguments. That is also troubling, since it is the hallmark of a true academic institution to promote open inquiry and spirited debate.

...

http://thefederalist.com/2014/06/04/why-college-board-is-revising-u-s-history/

Another - http://www.realclearpolitics.com/articles/2015/06/02/college_boards_reckless_spin_on_us_history.html

Oh, babies. It ain't just Kansas anymore..think about how interested in Democracy these little minions will be after a few years of this shit.

Funny - I was just reading some snarky crap about how pathetic China is for altering and rewriting their history for political reasons. Mirrors..."

magical thyme

(14,881 posts)Every year I walked into my history class and every year the teacher told the class that since we'd already had x years of American history, instead we were going to study "world cultures" or "current events" or something similar.

As a result, I went through my 6 years without a single class in American History! But I knew enough to protest the Vietnam war... ![]()

It wasn't that long ago that I remember the complaints that American History classes were totally one-sided and false in their presentation.

How dare we presume to show the "other" side of our history?

Btw, did you realize you're in the Economy Group, not the Education group?

Demeter

(85,373 posts)The first trader to stand trial in the global investigation into Libor-rigging told prosecutors in 2013 that UBS had circulated “an instruction manual on fixing Libor”, a court heard today. Tom Hayes, who formerly worked for UBS and Citigroup in Tokyo, passed details of the UBS “Guide to Publishing Libor Rates” to the Serious Fraud Office as part of his claim that manipulating the key interest rate benchmark was widespread.

“If 3m Libor” exposure “is 4,125 this means we are receiving” and “therefore we want to increase the fixing by 25 basis points,” according to the internal UBS guide. “If the number is negative then vice-versa.”

Mr Hayes, 35, has pleaded not guilty and is due to set out his defence later in the trial, which is set to last until August. He told the SFO that managers at UBS had large trading positions tied into the level of Libor. “This is where what UBS is doing in terms of throwing individuals under the bus is really wrong,” he told the Serious Fraud Office in 2013, according to the prosecution lawyer Mukul Chawla.

The trial at Southwark Crown Court also heard that the international probe into Libor manipulation initially focused on dollar rates, and only turned to the yen rates that Mr Hayes traded in late 2010. Steven Sletten, a lawyer from Gibson Dunn and Crutcher who was called as a witness for the SFO, told the jury that UBS received three subpoenas from the US Commodity Futures and Trading Commission between April 2011 and July 2012, about four years after the regulator started to examine the Libor market.

The SFO alleges Mr Hayes was a ringleader in a conspiracy with 25 staff from at least 10 banks and brokerages to rig Libor, the London interbank offered rate used to price an estimated $450 trillion of financial contracts and loans worldwide.

SO, WHO WROTE THE BOOK?

Demeter

(85,373 posts)The U.S. judge overseeing private litigation accusing global banks of manipulating Libor on Tuesday said she found a "viable legal theory" that could justify relief for investors who claim they were harmed by a conspiracy to rig the benchmark rate. In a 431-page decision covering part of the litigation, U.S. District Judge Naomi Reice Buchwald in Manhattan said the theory turns on what banks may have disclosed to a London administrator who oversees the so-called London Interbank Offered Rate.

Libor underpins hundreds of trillions of dollars of transactions, and is used to set rates on credit cards, student loans and mortgages. It is calculated based on submissions by banks that sit on panels. Investors and regulators have accused big banks of suppressing Libor during the financial crisis to boost earnings or make their finances appear healthier.

"According to plaintiffs' allegations, each panel bank lied to the Libor administrator about its own borrowing costs, knowing that entities such as plaintiffs would rely on the accuracy of that information; as was to be expected, plaintiffs then relied to their disadvantage, perhaps reasonably, on this false information," Buchwald wrote. "If these allegations prove true, then defendants' conduct was fraud."

Buchwald also said various banks may be able to recover from each other should they be held liable. She has yet to decide whether punitive damages should be available.

Tuesday's decision covers complaints filed under 28 separate court dockets by individual plaintiffs who are not pursuing and do not want to join class-action lawsuits. Buchwald said all of the complaints may go forward, but she dismissed some claims, and dismissed some bank defendants from six of the lawsuits. The litigation began in 2011, and accused 16 banks including Bank of America Corp, Citigroup Inc, Credit Suisse Group AG, Deutsche Bank AG, HSBC Holdings Plc, JPMorgan Chase & Co, Societe Generale and UBS AG of conspiring to manipulate Libor.

In March 2013, Buchwald dismissed what she called a "substantial portion" of the litigation, including federal antitrust claims that could justify triple damages. Authorities worldwide have levied about $9 billion of fines against banks and brokerages to settle Libor rigging probes.

MORE

Demeter

(85,373 posts)Senate Majority Leader Mitch McConnell (R-Ky.) says he will not allow a government shutdown this fall and has pledged to begin talks “at some point.” McConnell on Tuesday said he is willing to negotiate with Democrats to solve the funding impasse, after refusing for weeks to participate in the budget summit they have been calling for.

“Let me say it again, no more government shutdowns,” he told reporters. He added that he would find a way forward “through negotiations...We have divided government. The different parties control the Congress, control the White House, and at some point we’ll negotiate the way forward,” he said.

The government's budget authority expires at the end of September, and Democrats are warning of a shutdown because the Senate has failed to pass any appropriations bills as lawmakers disputed levels for defense and nondefense programs.

“We should have rolled up our sleeves weeks ago and started this conversation between the House, the Senate and the White House to come up with a budget for America that is fair,” said Senate Democratic Whip Dick Durbin (Ill.).

New York Sen. Charles Schumer, the third-ranking member of the chamber's Democratic leadership, warned Republicans would risk a shutdown by trying to add controversial policy provisions, such as a proposal to defund Planned Parenthood, to a year-end spending bill.

“If they try to add extraneous riders and say, 'You have to keep those riders,' important riders where there’s great disagreements in the country ... they’re headed for a government shutdown,” he said.

Senate Democratic Leader Harry Reid (Nev.) said there has been little sign as of yet that Republicans are ready to hash out a compromise.

“I checked with the White House today, not a word,” he said. “I don’t understand when this negotiation is going to start. We’re ready.”

PRIME INDICATION THAT THERE IS DEFINITELY GOING TO BE A GOVERNMENT SHUTDOWN THIS FALL...

Demeter

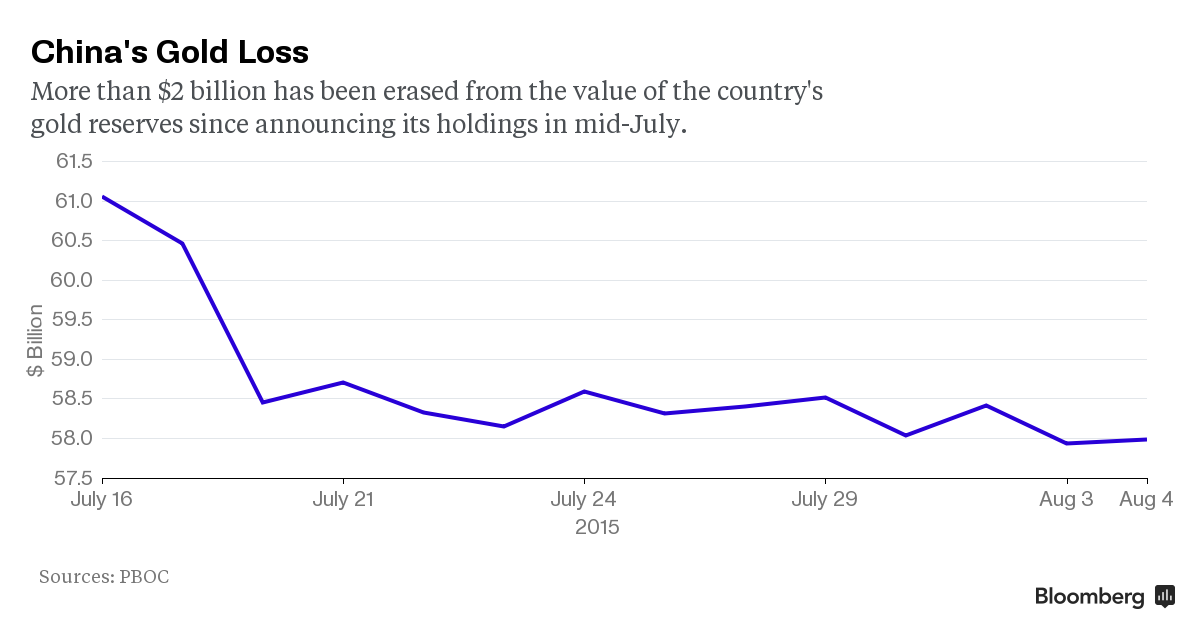

(85,373 posts)PAPER LOSSES...NO BIG DEAL. THIS IS THE POINT OF SUPPRESSING THE PRICE OF GOLD BY ISSUING 125 CONTRACTS PER OUNCE....PLUS SCARFING UP ENOUGH OF THE PHYSICAL TO PAY OFF GERMANY.

http://www.bloomberg.com/news/articles/2015-08-06/gold-crash-costs-russia-and-china-5-4-billion-in-just-three-weeks

The two biggest bullion buyers, Gold’s meltdown has cost Russia and China about $5.4 billion. That’s the value of the two countries’ gold reserves that has been wiped out in less than three weeks as prices slump to five-year lows, dragged down by expectations for higher U.S. interest rates and a stronger dollar. Bullion’s tumble is especially painful for Russia and China, the biggest buyers of gold over the past six years. China has expanded its holdings by almost 60 percent since 2009, while Russia more than doubled its assets and added reserves last month as prices fell another 6.5 percent.

Neither the Greek debt crisis nor China’s stock-market rout has been enough to boost gold’s appeal as a haven. Higher rates curb bullion’s allure because it doesn’t pay interest, unlike competing assets such as bonds.

“Holders of gold should be very concerned about the dislocation of gold’s status as a safe-haven investment,” Edward Dempsey, the chief investment officer at Pension Partners LLC in New York, said in a telephone interview. “The strength in the dollar continues to weigh on gold.”

Nations have expanded bullion holdings in the past few years, a reversal from two decades of selling since the late 1980s.

China on July 17 announced that it had boosted holdings to 1,658 metric tons, the first update on its hoard since 2009. Russia bought more gold in July and now holds about 1,275 tons, according to data from the International Monetary Fund. While they’ve been accumulating to diversify foreign-exchange reserves, investors have been selling.

Demeter

(85,373 posts)Companies will have to provide investors with a ratio showing how the median pay of their workforce squares with their chief executive officers' compensation, according to new rules adopted by U.S. securities regulators on Wednesday. Under the Securities and Exchange Commission's final rules, companies will get some flexibility in how they find the median. For instance, they can exclude 5 percent of their overseas workers when arriving at the number and use statistical sampling. In addition, only larger and mid-sized companies will need to comply, while smaller ones are exempt.

However, those changes did not assuage corporate trade groups, which have opposed any rule and are widely expected to file a legal challenge. The SEC has been under mounting pressure by Democrats, like Massachusetts Senator Elizabeth Warren and unions such as the AFL-CIO, who support the rule and have lamented delays in its adoption. The measure was tucked into the 2010 Dodd-Frank law amid concerns about the growing disparity between compensation for chief executives and their corporate workers.

"Pay ratio disclosure should provide a valuable piece of information to investors," said Democratic Commissioner Kara Stein said.

Republicans and trade groups like the U.S. Chamber of Commerce have fought back against the measure at every turn, saying it will be too expensive, could mislead investors and is not material to a company's financial statements. The Chamber has urged the SEC to defer working on the rule at all, and it called for permitting companies to disclose the ratio in an addendum instead of formal filings in order to reduce their liability.

"This rule is more harmful than helpful," David Hirschmann, head of the Chamber's Center for Capital Markets Competitiveness, said in a statement. He said the Chamber would explore options to "clean up the mess" it believes the rule has created.

Both SEC Republican commissioners also opposed the rule on Wednesday.

"To steal a line from Justice Scalia: This is pure applesauce," said Republican Commissioner Daniel Gallagher.

Companies will have to start reporting the new pay ratio disclosures in the first fiscal year beginning on or after Jan. 1, 2017...

AND JOE SIX-PACK WILL SAY---WHAT AM I SUPPOSED TO DO ABOUT IT? GO ON STRIKE?

Demeter

(85,373 posts)Last edited Fri Aug 7, 2015, 06:43 AM - Edit history (1)

Sluggish economic growth can’t boost profit margins any higher

http://www.marketwatch.com/story/what-the-bull-market-needs-to-keep-going-2015-07-31

The stock market must jump over a very high hurdle if it’s to live up to historical averages in coming years: Sky-high corporate profit margins will have to expand even further.

This crucial point is being overlooked by the bulls, who this week are celebrating long-time bear Jeremy Grantham’s apparent retreat from his previous insistence that profit margins would soon contract. In his latest quarterly letter, Grantham, co-founder of money-management firm GMO, wrote that “profit margins in the U.S. seem to have stopped mean reverting in the old, normal way.”

It’s true that it would be particularly bearish if profit margins did contract, as I have discussed previously. But Grantham’s change of heart represents a Pyrrhic victory, at best, for the bulls: Even if profit margins remain at a permanently high plateau, the stock market is still destined to produce low-single-digit returns.

That’s because, without expanding profit margins, future earnings can grow no faster than sales — and sales growth is tied to an economy that is unable, even in the sixth year of a recovery, to produce real growth in excess of 2% annually. Even with dividends, it becomes difficult to see how the stock market can produce an inflation-adjusted growth rate of even 4% annually over the next decade...MORE

Hydra

(14,459 posts)Unless they dig more out of the treasury, there's nothing left to steal except from each other. They're perfectly capable of doing that though.

Demeter

(85,373 posts)Leith van Onselen at MacroBusiness tells us:

The latest talks on the Trans-Pacific Partnership (TPP) did not end well and election timetables in Canada and the US mean that the prospect of a deal being ratified before the end of 2016 (at the earliest) is remote. The usual problem of agricultural markets was prominent, headlined by Canada’s refusal to open its dairy sector. For New Zealand—one of the four founder countries of the TPP, along with Brunei, Chile and Singapore—this was a non-negotiable issue. Dairy was not the only problem. As usual, Japan was worried about cars and rice, and the US about patent protection for its pharma companies.

The TPP was probably doomed when the US joined, and certainly when Japan did. It then became more of a political project than an economic one. Big trade agreements had hitherto focused on physical goods, while the TPP had an aim of forging rules of trade beyond this in intellectual property, investment and services. China was a notable absence, and the US and Japan, in particular, were keen to set these rules with enough of the global economy behind them such that China would be forced into line later on. For now, the shape of international standards in these areas remains up for grabs. The next step for the TPP, if anything, is whether a smaller group—such as the founding four —will break away and go ahead on their own, with a much smaller share of global GDP involved, and in the hope that others will join later.

Yves here. This conclusion is even more deadly than it seems, particularly coming from a neoliberal organ like the Economist. I have to confess to not reading the Economist much on this topic, precisely because the articles I did see hewed so tightly to party line: that the TPP and its ugly sister, the Transatlantic Trade and Investment Partnership, were “free trade” deals and therefore of course should be passed, since more “free trade” was always and ever a good thing. In fact, trade is already substantially liberalized, and the further GDP gains that economists could gin up using their models (which have overstated results) were so pathetically small as to amount to rounding error. Accordingly, contacts in DC told us that the business community was not pushing the deal hard: “Multinationals don’t see much benefit to be had from being able to sue Malaysia over environmental regulations.” The corporate support for the TPP in the US was thus much narrower than the cheerleading in the press would have you believe.

The coverage of the TPP in the media was schizophrenic, on the one hand describing it as part of Obama’s “pivot to Asia” (as in an effort to contain China’s growing hegemony), meaning it was clearly a political enterprise, an “everybody but China” deal, and on the other hand, saying that the reason Americans should support it was those miniscule trade benefits. And of course, there was nary a mention of the cost in terms of national sovereignty.

What is intriguing and heartening about the Economist verdict isn’t merely that the TPP is dead. It’s that it’s so dead that for it to be revived, it would have to be in radically different form, with a much smaller group of countries. And if I read the Economist piece correctly, the “founding four” does not include Japan, which joined the negotiations late. Japan’s famously powerful farmers are not likely to sign up for a deal that encroaches on the island nation’s beef and rice lobbies. And it’s hard to see how anyone would take a Pacific political or economic pact all that seriously that did not have China or Japan as members.

I DON'T KNOW...

magical thyme

(14,881 posts)afraid to celebrate its demise prematurely...waiting and watching with bated breath though!

Punx

(446 posts)But like a zombie from a horror movie I have a feeling it will rise from the dead at some point.

I still feel there are a lot of powerful interests that want to see the ISDS part of this enacted at the very least to thwart "National and Local Sovereignty".

Perhaps some of the other countries leaders that are part of this aren't as willing to sell out their people as quickly as ours are.

Punx

(446 posts)Tom Chamberlain, head of the AFL-CIO here in Oregon just stated that “The protests against Fast Track delayed the negotiations for around five months and that helped lead to the situation we have with TPP now.” I’m not quoting verbatim, but believe I’ve got the gist right.

If so, It’s nice to know our voices can matter.

Demeter

(85,373 posts)Deals among the nation’s largest health insurers in recent weeks have been almost head-spinning. But whatever the details, if the combinations are finalized, the result will be an industry dominated by three colossal insurers...Anthem, which operates for-profit Blue Cross plans in 14 states, merging with Cigna, another large for-profit carrier, along with the planned deal for Aetna to join Humana, a smaller rival known for its private Medicare plans, would create two behemoths. Along with the already enormous UnitedHealth Group, these companies would control nearly half of the American commercial health insurance market, according to Decision Resources Group. Each would have tens of millions of people enrolled in their plans, offered largely through employers or government programs like Medicare...The insurers insist that combining companies will lead to lower prices and better care for their customers. They point to billions of dollars in efficiencies...

“I don’t think there’s a guarantee that bigger is better for the consumer,” said Sarah Lueck, a senior policy analyst at the Center on Budget and Policy Priorities who is also a consumer representative for the National Association of Insurance Commissioners, a group of state regulators who may individually weigh in on the potential mergers.

William J. Baer, who oversees the antitrust division of the Justice Department, which is reviewing the insurance mergers, told Bloomberg TV last month that the agency would look at each deal on its own merits but also take into account “a trend towards consolidation in the health care insurance market.” The agency declined to comment further.

*************************

The sweeping changes in the market caused by the federal health care law, including greater government oversight and intense pressure to keep prices low, would also prevent insurers from raising prices too much, the insurers said. “If plans are going to be competitive,” said Clare Krusing, a spokeswoman for America’s Health Insurance Plans, a trade group, “they have to offer the most affordable premiums.”

The insurers also point to new rules under the health care law that require them to spend a fixed amount of the premiums they collect on care, essentially capping their profits even if they are charging much higher prices.

Still, businesses and brokers question the necessity of these mergers. “Are these companies not big enough that they needed to be bigger?” asked Don Mucci, a broker at Garrett-Stotz Company in Louisville, Ky., who helps small businesses find coverage. “They’re all huge.” When area hospitals merged, they also promised greater efficiencies, he noted, but “I don’t see medical costs going down.”

Other brokers are also watching the developments closely. “In markets where there is less choice, there tends to be higher costs,” said Lisa Hawker, the president of employee benefits for Hylant, an insurance brokerage based in Toledo, Ohio. While the consolidation of insurers like Anthem and Cigna might improve their ability to focus on consumers, for example, businesses could also have a harder time negotiating, Ms. Hawker says.

After the mergers, regulators will be looking for changes in the competitive landscape, which will vary by location and the type of insurance — whether it serves large employers or offers private Medicare Advantage plans. In Kansas, for example, Aetna and Humana have 90 percent of the market for Medicare Advantage plans, according to data from the Kaiser Family Foundation. For large employers that rely on national carriers to provide coverage to workers scattered across states, the pool of the five major entities would shrink to just three. To give their employees choice, for example, FedEx and Robert Half each offered both Anthem and Cigna to their employees. Combined, Anthem and Cigna service about 21 percent of the commercial market, said Paula Wade, a health care analyst for Decision Resources Group, but in some areas, their market share is much more. In Richmond, Va., the two companies have nearly two-thirds of the market.

MUCH SCOFFING FOLLOWS--CONCLUSION:

...Consumer advocates, policy experts and former regulators say that what may be good for the insurers may not be good for consumers, especially in the wake of a similar frenzy of deal-making among hospitals and doctors’ groups...“The consolidation in both of these industries has been shown to have an adverse impact on consumers,” said Leemore S. Dafny, a former official at the Federal Trade Commission who is now a professor at Northwestern University’s Kellogg School of Management...consumer advocates and others remain wary of the pending insurance mergers. “I don’t think any of us is under the illusion that this is great for consumers,” Ms. Lueck said.

Demeter

(85,373 posts)

The Dodd-Frank financial reform legislation just celebrated its fifth anniversary on July 21 and the gaping holes it left in the promise to protect our Nation from another systemic financial crash are becoming clearer every day. No other agency has done more to highlight these growing risks than the Office of Financial Research (OFR), created under Dodd-Frank as a unit of the U.S. Treasury. In its most recent report, it provides the stunning news that private hedge funds in the U.S. now control one-third of all assets under management in the financial services industry – a stunning $4.1 trillion when leverage is included.

In February of this year, OFR released a jaw-dropping report showing dangerous levels of systemic and interconnected risk among some of the same Wall Street players that held pivotal roles in the crash of 2008. The report found that five Wall Street banks had high contagion index values — Citigroup, JPMorgan, Morgan Stanley, Bank of America, and Goldman Sachs.

On June 11, OFR released a paper warning that banks were up to their old tricks again, using dodgy “capital relief trades” with unknown counterparties in order to hold less capital than would otherwise be required against potential losses. And regulators remain in the dark about the extent of these trades because the banks have reporting loopholes.

Last Thursday, the OFR was back on its bully pulpit again, this time warning that transparency as to what hedge funds are really up to is as clear as mud, despite efforts under Dodd-Frank to provide greater visibility on the levels of systemic risk they might be introducing into the financial system. The report makes the startling finding that assets under management (AUM) at hedge funds, adding in the leverage factor, as of December 2013 “was about $4.1 trillion, in sharp contrast with the approximately $2.6 trillion industry aggregate AUM estimated from public sources as of that date.”

Title IV of Dodd-Frank required that hedge funds must register with the Securities and Exchange Commission (SEC), maintain records regarding their activities, and file reports with the SEC “as necessary and appropriate in the public interest and for the protection of investors, or for the assessment of the systemic risk.” In 2011, the SEC and the Commodity Futures Trading Commission (CFTC) boiled those requirements down into a reporting form called the “Form PF.”

The problem, according to a highly credible report from the OFR, is that there is enough wiggle room in that Form PF to launch an aircraft carrier. OFR’s report found, specifically, that Form PF “may obscure reporting funds’ actual risks.” If the public wants to have a look at the portfolio holdings or strategies the hedge funds are reporting on Form PF, they can’t. It’s confidential between the respective hedge fund and regulators. There had also been proposals that the data filings should be certified as accurate under penalty of perjury. That was gutted from the final rule.

One criticism lodged in the OFR report is the use of VaR data (value at risk) on the reporting form. The report recommends that “additional reporting of a more diverse set of risk measures could improve the precision of the form’s risk measurement.” The ability to game VaR played a key role in the $6.2 billion in losses at JPMorgan Chase in 2012. That trading fiasco became known as the London Whale: traders in London engaged in high risk derivative trades using bank depositors’ funds at the commercial bank of JPMorgan Chase.

The danger of a giant hedge fund setting off a chain reaction that could implode the whole U.S. financial system is not far-fetched. In 1998, a derivatives debacle at the insanely leveraged Long-Term Capital Management hedge fund (LTCM) posed just such a systemic threat, leading the Federal Reserve Bank of New York to effectively put a gun to Wall Street’s head to bail it out.

The only difference between then and now is that hedge funds are massively larger while regulators still have their heads securely perched in the sand...

Demeter

(85,373 posts)

According to the OCC, Just Four Banks (JPMorgan Chase, Citigroup, Bank of America and Goldman Sachs) Hold 91.3 Percent of All Derivatives Held By More Than 6,000 U.S. Banks as of the First Quarter of 2015

William D. Cohan has joined Paul Krugman and Andrew Ross Sorkin at the New York Times in pushing the patently false narrative that the repeal of the Glass-Steagall Act in 1999 had next to nothing to do with the epic Wall Street collapse of 2008 and the greatest economic calamity since the Great Depression. (See related articles on Krugman and Sorkin below.)

The New York Times has already admitted on its editorial page that it was dead wrong to have pushed for the repeal of Glass-Steagall but now it’s dirtying its hands again by publishing all of these false narratives about what actually happened.

In a July 30 column, Cohan ridicules Senators Elizabeth Warren and John McCain over their introduction of legislation to restore the Glass-Steagall Act to separate insured deposit banks from their gambling casino cousins, Wall Street investment banks. The Senators are being joined in their call to restore Glass-Steagall by a growing number of Presidential aspirants, including Senator Bernie Sanders and former Governor of Maryland, Martin O’Malley, both running as Democrats.

Hillary Clinton, another Democratic presidential hopeful whose husband, Bill Clinton, signed the bill during his presidency that repealed Glass-Steagall, does not see the need to restore Glass-Steagall, leading Cohan to make this observation:

“Mrs. Clinton is right. Despite the relentless rhetoric, the fact that commercial banks are in the investment banking business and investment banks are in the commercial banking business had almost nothing to do with causing the financial crisis of 2008.”

The “almost nothing” Cohan refers to was the colossal collapse of the county’s largest bank at the time, Citigroup, which saw its share price drop to 99 cents (a penny stock) with the taxpayer being forced to infuse the greatest bailout in U.S. history into this bank: $45 billion in equity; over $300 billion in asset guarantees; and a cumulative total of over $2 trillion in super-cheap revolving loans from the Federal Reserve that lasted for years to resuscitate its insolvent carcass.

Cohan sheepishly concedes in his column that Citigroup “while a big commercial bank, would surely have failed without its government rescue, in large part because of the behavior of its investment bankers.”

Insiders in government at the time of the crash believe that Citigroup was at the core of the 2008 crash. According to the regulator of national banks, the Office of the Comptroller of the Currency (OCC), Citigroup’s serious problems began in the summer of 2007. Media reports about its drastic need for a bailout fund, which didn’t fly but was going to be called the SuperSIV, began in the fall of 2007. We wrote extensively about Citigroup’s desperate situation in November 2007...

MORE

mother earth

(6,002 posts)person who is not in their pockets, and he's not getting much attention from MSM.

Demeter

(85,373 posts)Your humble editor and publisher of Wall Street On Parade might have had a little something to do with a growing mutiny in Congress. Back on November 4, 2012 and again on July 25, 2013, we blew the whistle on an obscene, secret entitlement program between the Fed and the too-big-to-fail banks: a century old program where every year, boom or bust, despite the overall level of interest rates in the markets, the Fed pays out a risk-free, guaranteed 6 percent dividend to its member banks. (All Fed member banks get the dividend but the lion’s share goes to the biggest Wall Street banks because their capital dwarfs all other banks.)

Now, after more than a hundred years, there’s a plan in Congress to shrink that payout to 1.5 percent and fix our crumbling roads with the savings. Only banks with $1 billion or more in assets would be affected. The Federal Reserve mandates that its member banks subscribe to “stock” in an amount equal to 6 percent of their capital and surplus. The banks have to post half that amount with the Fed upon becoming a member; the other half is subject to being called upon. The deposited capital translates into a corresponding share of “stock” in one of the 12 regional Fed banks. (The biggest Wall Street banks, of course, prefer holding their shares in their crony New York Fed.) The “stock” then pays out the 6 percent dividend to shareholders, meaning the banks.

If the bank had a hand in crashing the economy twice in the past century, say in 1929 and again in 2008 – like JPMorgan and Citigroup – it gets an extra bonus: its 6 percent dividend is tax-exempt. That’s because the statutes say that if the bank’s shares in the Fed were acquired prior to March 28, 1942 the bank doesn’t have to pay corporate taxes on it. JPMorgan’s roots reach into the eighteenth century while Citibank, part of Citigroup, traces its founding to the City Bank of New York in 1812. CEOs of both banks were shamed before Congress in the 1930s for their role in the crash of ’29 and again following the 2008 Wall Street crash. But these two banks achieved even greater ignominy in May of this year: both pleaded guilty to a felony charge, admitting that they participated in a banking cartel to rig foreign currency trading. In other words, the Fed, the regulator of these banks, is paying this lavish 6 percent dividend to admitted felons while U.S. college students are going without food and heat and opting for prostitution to pay their more than $1 trillion in student debt – much of it saddled on their backs by these same banks.

In our 2012 article, we suggested the following:

The current proposal before Congress to shrink the dividend from 6 percent to 1.5 percent is estimated to raise $17 billion over the next ten years. The concerns coming from community banks could be easily remedied by amending the requirement to include only banks with $10 billion or more in assets. (The biggest Wall Street banks hold $1 to $2 trillion in assets.) Of course, the American Bankers Association was out quickly with its own lobbying effort, writing to Congress:

“We strongly urge you to oppose this proposal. As Senate Banking Chairman Richard Shelby has pointed out, there is absolutely no connection between the Federal Reserve System and the funding for the Highway bill. Furthermore, during testimony before the Senate Banking Committee on July 16th, Federal Reserve Chair Janet Yellen stated: “I would say that this is a change to the law that could conceivably have unintended consequences and I think it deserves serious thought and analysis.”

MORE

The ABA should know better than to make such a dumb, easily discredited statement. America’s crumbling infrastructure is a direct result of our Nation’s debt burden which limits what we can spend to maintain a safe, modern highway system. That massive debt directly results from the stimulus spending necessitated by these same Wall Street banks creating the worst economic collapse since the Great Depression in 2008-2009 and the ensuing subpar 2 percent growth over the past five years.

It’s long past the time to end this big-bank entitlement program.

Demeter

(85,373 posts)Cool, nay, chilly mornings....hot afternoons, early darkness (relatively speaking)...just like the summers of 1969, 1970, etc.

I might step out tonight, and start the Weekend thread late...depends on how tired I am. After a week of hell, getting away for a few hours sounds like a good plan.

Demeter

(85,373 posts)July's Economic Confidence Index averaged minus 12 in July, down from minus 8 in June and the lowest monthly average since October 2014. The drop is attributable chiefly to Americans' increasing view that the economy is getting worse rather than better.

After six consecutive months of improvement beginning in August 2014, the ECI averaged plus 3 in January, the first time it was in positive territory since Gallup began tracking it daily in 2008. However, the index began dropping in February as gas prices start to rise, and dropped further to minus 7 in May after reports of disappointing economic growth in the first quarter.

The U.S. saw still more erosion in Americans' economic confidence in July as the Greek economic crisis played out and the U.S. stock market reacted to it and to drops in the Chinese stock market. Confidence averaged minus 11 during the last week of the month, July 27-August 2. The current conditions component averaged minus 6 in July, slightly below the minus 4 of June. The July average was the result of 25 percent of Americans rating the current economy as "excellent" or "good" and 31 percent rating it as "poor." In July, 39 percent of Americans said the economy was "getting better," while 56 percent said it was "getting worse." This resulted in an economic outlook score of minus 17, the lowest since August 2014.

The 11-point difference between the components is one of the largest Gallup has found since May 2013. Americans briefly rated the outlook for the economy more positively than they viewed the current economy from December 2014 through February 2015. But since March, Americans have grown increasingly negative about the economy's outlook, while their views of current conditions have soured only slightly.

A number of factors may be affecting how Americans view the direction of the country's economy, including unsettled economic conditions in Europe and in China and the volatility of the U.S. stock market. All of these could be making Americans -- particularly those with higher incomes -- more pessimistic. Although upper-income Americans remain more positive than lower- and middle-income earners about the economy, the gap between the two groups narrowed in July as economic confidence among upper-income Americans was negative for the first time in 10 months.

Definition

The Gallup Economic Confidence Index (ECI) is a broad indicator of Americans' confidence in national economic conditions, comparable to the Conference Board's Consumer Confidence Index and the Thomson Reuters/University of Michigan Consumer Sentiment Index.

Demeter

(85,373 posts)VIDEO REPORT AT LINK

http://thehill.com/policy/finance/250322-nasa-signing-490m-contract-with-russia

NASA informed lawmakers on Wednesday that because Congress has failed to fully fund its Commercial Crew Program for the last five years, it is signing a $490 million contract extension with Russia to send Americans to space.

The new contract, running through 2019, means that NASA will continue to depend on Russia to get its astronauts to space even as tensions between Washington and Moscow escalate.

It will put money in Russia’s pockets even as U.S. economic sanctions seek to put pressure on Russian President Vladimir Putin’s government over the conflict in Ukraine.

It will also make the U.S. susceptible to threats from Russia, which in the past has suggested it could stop taking U.S. astronauts to the International Space Station. The U.S. has relied on Russia since retiring its space shuttle program.

***************************************************

In a letter to a key House appropriator on Wednesday, NASA Administrator Charles F. Bolden Jr. also warned that the space program is in danger of missing a 2017 deadline to send U.S. astronauts to space on vehicles created by Boeing and SpaceX.

To meet that deadline, he wrote that Congress needs to meet President Obama’s $1.24 billion budget request for the program.

“The fastest path to bringing these new systems online, launching from America, and ending our sole reliance on Russia is fully funding NASA's Commercial Crew Program in FY 2016,” Bolden wrote in a letter to Rep. John Culberson (R-Texas), who oversees NASA funding in the House.

For the next fiscal year, House Republicans have proposed allocating nearly $250 million less than the request, while Senate Republicans would offer $300 million less.

If Congress doesn’t increase the allocation, Boeing and SpaceX likely will receive orders to immediately suspend all operations either next spring or summer, Bolden said.

And if those orders are issued, Bolden said the existing contracts “may need to be renegotiated, likely resulting in further schedule slippage and increased cost.”

The new contract extension is required because Congress has not fully funded the administration’s budget requests since 2010...

MORE POLITICS AT LINK

Demeter

(85,373 posts)France and Russia have settled compensation issues over helicopter carrier warships that Paris has decided not to deliver to Moscow, President Francois Hollande's office said on Wednesday.

Under the deal, France will repay all advance payments made by Russia and in return will have full freedom to do whatever it wants with the vessels, which contain some Russian technology.

Hollande went back on the order after coming under pressure from his Western allies not to deliver the Mistrals because of Russia's role in the Ukraine crisis.

Fuddnik

(8,846 posts)Kinda reminds me of the South Park episode, where the kids flew the killer whale (back home) to the moon, using the Mexican Space Agency.

MattSh

(3,714 posts)Won't somebody please think of the sanctions?

Demeter

(85,373 posts)Afghanistan has long been known as the “graveyard of empires,” a wild, nigh-unconquerable region in which even the mightiest armies flounder. Nevertheless, when then-president George W. Bush launched the invasion of Afghanistan nearly a decade and a half ago, we were enthusiastically told America would not only win, but also win Afghans’ hearts and minds. Education was to play a major role in this endeavor—in fact, the Bush Institute website still posts about the importance of education in Afghanistan.

Now, there’s no doubt that education is vital to improving quality of life, promoting liberty, and defusing terrorists’ attempts at radicalization. As Thomas Jefferson wrote, “if a nation expects to be ignorant & free, in a state of civilisation, it expects what never was & never will be…where the press is free and every man able to read, all is safe.” But thanks to a comprehensive investigation from Buzzfeed News, we now know that our government has been consistently deceptive about the success of its educational projects in Afghanistan:

USAID claimed for years that it had built or refurbished more than 680, a figure Hillary Clinton cited to Congress in 2010 when she was secretary of state. By 2014, that number had dropped to “more than 605.” After months of pressing for an exact figure, the agency told BuzzFeed News the number was 563, a drop of at least 117 schools from what it had long claimed.

The schools which our government actually did build were of low-quality construction and soon became dangerous for any children using them:

An oft-cited goal of the school construction was more education for girls. So, of course, there are lots of lies about this too:

USAID program reports obtained by BuzzFeed News indicate the agency knew as far back as 2006 that enrollment figures were inflated, but American officials continued to cite them to Congress and the American public.

And obviously all of this cost American taxpayers a lot of money—money that in some cases got funneled directly to the Taliban, making the United States even less popular with the much-abused Afghan people:

Some local officials even allege that those salaries sometimes end up in the hands of the Taliban. Certainly, U.S.-funded school projects have often lined the pockets of brutal warlords and reviled strongmen, which sometimes soured the local population on the U.S. and the Afghan government.

So, there you have it: fewer schools were built than we were told. The ones that were built are dangerous. The numbers of students (especially girls) reported to us are massively inflated. And our government has figured out yet another way to accidentally donate to terrorists while giving Middle Easterners a (very understandable) reason to be angry at us!

Fuddnik

(8,846 posts)A real eye opener on just how extensive and destructive corruption in Afghanistan, most Mideast and African countries, and don't forget the US and its military really is.

It's worse than you can imagine. Our State Dept knows it. Our Joint Chiefs know it. Add in incompetent and corrupt Generals like Petraeus and politicians like Obama and Clinton, and you have the recipe for a continuing catastrophe.

http://www.amazon.com/Thieves-State-Corruption-Threatens-Hardcover/dp/B010WF9N9Q/ref=sr_1_3?s=books&ie=UTF8&qid=1438951942&sr=1-3&keywords=sarah+chayes+thieves+of+state

Demeter

(85,373 posts)President Barack Obama’s plans to modernize the U.S. nuclear arsenal over the next 30 years could cost taxpayers nearly $1 trillion, according to a new study that suggests the project’s long-term price tag will far outpace available Pentagon estimates.

The study, by the Center for Strategic and Budgetary Assessments, a Washington D.C.-based think tank that works closely with the Pentagon, is the latest attempt by independent researchers to determine the actual costs of Obama's ambitious plans for updating the nuclear triad — the intercontinental ballistic missiles (ICBMs), submarines and aircraft capable of delivering nuclear warheads. The White House, which announced plans to replace the aging arsenal in 2013, has to date only released a $73 billion estimate that covers fiscal years 2016 to 2020 — years before the program's costs are projected to spike.

Researchers Todd Harrison and Evan Montgomery found in the study that the actual cost could total $963 billion between 2014 and 2043. “Ultimately, this report finds that the Pentagon will … require as much as $12 to 13 billion per year in additional funding to support nuclear maintenance and modernization during the 2020s, when spending on U.S. nuclear forces will peak,” Harrison and Montgomery wrote.

Their findings are consistent with a widely cited assessment of $1 trillion published last year by the Monterey Institute for International Studies. Previous cost projections for Obama’s nuclear overhaul have varied widely, largely due to methodological differences, but most analysts agree that the official projection inadequately represents the costs because it stops short of the program’s “bow wave” — or peak spending years — in the late 2020s...

MUCH MORE AT LINK

mahatmakanejeeves

(57,460 posts)Source: Department of Labor, Employment and Training Administration

Read More: http://www.dol.gov/opa/media/press/eta/eta20151529.pdf

News Release

TRANSMISSION OF MATERIALS IN THIS RELEASE IS EMBARGOED UNTIL

8:30 A.M. (Eastern) Thursday, August 6, 2015

UNEMPLOYMENT INSURANCE WEEKLY CLAIMS

SEASONALLY ADJUSTED DATA

In the week ending August 1, the advance figure for seasonally adjusted initial claims was 270,000, an increase of 3,000 from the previous week's unrevised level of 267,000. The 4-week moving average was 268,250, a decrease of 6,500 from the previous week's unrevised average of 274,750.

There were no special factors impacting this week's initial claims.

The advance seasonally adjusted insured unemployment rate was 1.7 percent for the week ending July 25, unchanged from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending July 25 was 2,255,000, a decrease of 14,000 from the previous week's revised level. The previous week's level was revised up 7,000 from 2,262,000 to 2,269,000. The 4-week moving average was 2,239,000, a decrease of 18,000 from the previous week's revised average. The previous week's average was revised up by 1,750 from 2,255,250 to 2,257,000.

UNADJUSTED DATA

....

The total number of people claiming benefits in all programs for the week ending July 18 was 2,301,676, an increase of 1,649 from the previous week. There were 2,576,492 persons claiming benefits in all programs in the comparable week in 2014.