Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 4 August 2015

[font size=3]STOCK MARKET WATCH, Wednesday, 5 August 2015[font color=black][/font]

SMW for 4 August 2015

AT THE CLOSING BELL ON 4 August 2015

[center][font color=red]

Dow Jones 17,550.69 -47.51 (-0.27%)

S&P 500 2,093.32 -4.72 (-0.22%)

Nasdaq 5,105.55 -9.84 (-0.19%)

[font color=red]10 Year 2.22% +0.05 (2.30%)

30 Year 2.90% +0.02 (0.69%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Fuddnik

(8,846 posts)Demeter

(85,373 posts)That is Sarah, isn't it? or Sara?

Fuddnik

(8,846 posts)Sara will be 6 on the 23rd.

Demeter

(85,373 posts)Last edited Wed Aug 5, 2015, 07:46 AM - Edit history (1)

How come you don't talk about his that much?

Demeter

(85,373 posts)...as soon as I get some sleep! 4 People, 15 hours each, for 2 votes. It was a college student precinct....and the college students don't get back for a month.

MattSh

(3,714 posts)“You see them on the street. You watch them on TV. You might even vote for one this fall. (Or next fall). You think they’re people just like you. You're wrong. Dead wrong.”—They Live

We’re living in two worlds, you and I.

There’s the world we see (or are made to see) and then there’s the one we sense (and occasionally catch a glimpse of), the latter of which is a far cry from the propaganda-driven reality manufactured by the government and its corporate sponsors, including the media.

Indeed, what most Americans perceive as life in America—privileged, progressive and free—is a far cry from reality, where economic inequality is growing, real agendas and real power are buried beneath layers of Orwellian doublespeak and corporate obfuscation, and “freedom,” such that it is, is meted out in small, legalistic doses by militarized police armed to the teeth.

All is not as it seems.

This is the premise of John Carpenter’s film They Live (1988), in which two migrant workers discover that the world’s population is actually being controlled and exploited by aliens working in partnership with an oligarchic elite. All the while, the populace—blissfully unaware of the real agenda at work in their lives—has been lulled into complacency, indoctrinated into compliance, bombarded with media distractions, and hypnotized by subliminal messages beamed out of television and various electronic devices, billboards and the like.

It is only when homeless drifter John Nada (played to the hilt by the late Roddy Piper) discovers a pair of doctored sunglasses—Hoffman lenses—that Nada sees what lies beneath the elite’s fabricated reality: control and bondage.

When viewed through the lens of truth, the elite, who appear human until stripped of their disguises, are shown to be monsters who have enslaved the citizenry in order to prey on them. Likewise, billboards blare out hidden, authoritative messages: a bikini-clad woman in one ad is actually ordering viewers to “MARRY AND REPRODUCE.” Magazine racks scream “CONSUME” and “OBEY.” A wad of dollar bills in a vendor’s hand proclaims, “THIS IS YOUR GOD.”

When viewed through Nada’s Hoffman lenses, some of the other hidden messages being drummed into the people’s subconscious include: NO INDEPENDENT THOUGHT, CONFORM, SUBMIT, STAY ASLEEP, BUY, WATCH TV, NO IMAGINATION, and DO NOT QUESTION AUTHORITY.

This indoctrination campaign engineered by the elite in They Live is painfully familiar to anyone who has studied the decline of American culture. A citizenry that does not think for themselves, obeys without question, is submissive, does not challenge authority, does not think outside the box, and is content to sit back and be entertained is a citizenry that can be easily controlled.

In this way, the subtle message of They Live provides an apt analogy of our own distorted vision of life in the American police state, what philosopher Slavoj Žižek refers to as dictatorship in democracy, “the invisible order which sustains your apparent freedom.”

We’re being fed a series of carefully contrived fictions that bear no resemblance to reality. The powers-that-be want us to feel threatened by forces beyond our control (terrorists, shooters, bombers). They want us afraid and dependent on the government and its militarized armies for our safety and well-being. They want us distrustful of each other, divided by our prejudices, and at each other’s throats. Most of all, they want us to continue to march in lockstep with their dictates.

Complete story at - http://www.zerohedge.com/news/2015-08-04/they-live-we-sleep-dictatorship-disguised-democracy

DANG! This is the second time this week I've heard a favorable review of this movie, one I had never heard of before. Now I guess I REALLY need to get my hands on this one.

Ghost Dog

(16,881 posts)

Being an 'action movie' for the US market, though, the response comes down to violence. When what's required is pointed to here: http://www.democraticunderground.com/10249212

Saludos.

Edit: Full movie appears to be here:

Demeter

(85,373 posts)“He can’t possibly win the nomination,” is the phrase heard most often when Washington insiders mention either Donald Trump or Bernie Sanders. Yet as enthusiasm for the bombastic billionaire and the socialist senior continues to build within each party, the political establishment is mystified. Political insiders don’t see that the biggest political phenomenon in America today is a revolt against the “ruling class” of insiders that have dominated Washington for more than three decades. In two very different ways, Trump and Sanders are agents of this revolt. I’ll explain the two ways in a moment.

Don’t confuse this for the public’s typical attraction to candidates posing as political outsiders who’ll clean up the mess, even when they’re really insiders who contributed to the mess. What’s new is the degree of anger now focused on those who have had power over our economic and political system since the start of the 1980s. Included are presidents and congressional leaders from both parties, along with their retinues of policy advisors, political strategists, and spin-doctors. Most have remained in Washington even when not in power, as lobbyists, campaign consultants, go-to lawyers, financial bundlers, and power brokers. The other half of the ruling class comprises the corporate executives, Wall Street chiefs, and multi-millionaires who have assisted and enabled these political leaders – and for whom the politicians have provided political favors in return.

America has long had a ruling class but the public was willing to tolerate it during the three decades after World War II, when prosperity was widely shared and when the Soviet Union posed a palpable threat. Then, the ruling class seemed benevolent and wise.

Yet in the last three decades – when almost all the nation’s economic gains have gone to the top while the wages of most people have gone nowhere – the ruling class has seemed to pad its own pockets at the expense of the rest of America. We’ve witnessed self-dealing on a monumental scale – starting with the junk-bond takeovers of the 1980s, followed by the Savings and Loan crisis, the corporate scandals of the early 2000s (Enron, Adelphia, Global Crossing, Tyco, Worldcom), and culminating in the near meltdown of Wall Street in 2008 and the taxpayer-financed bailout. Along the way, millions of Americans lost their jobs their savings, and their homes. Meanwhile, the Supreme Court has opened the floodgates to big money in politics wider than ever. Taxes have been cut on top incomes, tax loopholes widened, government debt has grown, public services have been cut. And not a single Wall Street executive has gone to jail. The game seems rigged – riddled with abuses of power, crony capitalism, and corporate welfare.

In 1964, Americans agreed by 64% to 29% that government was run for the benefit of all the people. By 2012, the response had reversed, with voters saying by 79% to 19% that government was “run by a few big interests looking after themselves.” Which has made it harder for ordinary people to get ahead. In 2001 a Gallup poll found 77 percent of Americans satisfied with opportunities to get ahead by working hard and 22 percent dissatisfied. By 2014, only 54 percent were satisfied and 45 percent dissatisfied.

The resulting fury at ruling class has taken two quite different forms.

Yet despite the growing revolt against the ruling class, it seems likely that the nominees in 2016 will be Jeb Bush and Hillary Clinton. After all, the ruling class still controls America. But the revolt against the ruling class won’t end with the 2016 election, regardless. Which means the ruling class will have to change the way it rules America. Or it won’t rule too much longer.

Demeter

(85,373 posts)Nicole Foss: Our consistent theme here at the Automatic Earth since its inception has been that we are facing a very powerful deflationary depression, following on from the bursting of an epic financial bubble. What we have witnessed in our three decades of expansion and inflation is nothing short of a monetary supernova, and that period has been the just culmination of a much larger upward trend going back many decades at least. We have lived through a credit hyper-expansion for the record books, with an unprecedented generation of excess claims to underlying real wealth. In doing so we have created the largest financial departure from reality in human history.

Bubbles are not new – humanity has experienced them periodically going all the way back to antiquity – but the novel aspect of this one, apart from its scale, is its occurrence at a point when we have reached or are reaching so many limits on a global scale. The retrenchment we are about to experience as this bubble bursts is also set to be unprecedented, given that the scale of a bust is predictably proportionate to the scale of the excesses during the boom that precedes it. We have built an incredibly complex economic system, but despite its robust appearance it is over-extended, brittle and fragile after decades of fuelling its continued expansion by feeding on its own substance.

We come to believe that just this once there might be a free lunch, that we can have something for nothing. We throw ourselves into ponzi finance, chasing the mirage of speculative gains, often through highly questionable and outright fraudulent practices. Enron, Lehman Brothers, and recently MF Global, are but a few egregious examples of what has become an endemic phenomenon.

The increasing focus on chasing speculative profits parasitizes the real economy to a greater and greater extent over time. After all, why work hard for small profits in the real world, when profits on money chasing its own tail are so much greater for so little effort?

Who even notices the hollowing out of the real economy, or the conversion of large amounts of capital into waste, or the often pointless depletion of non-renewable resources, or the growing structural dependency trap, when there is so much short term material prosperity to pursue?

In such times, the expansionary impulse drives the development of multiple engines of credit expansion. The reserve requirements for fractional reserve banking (already a ponzi scheme) are whittled away to almost nothing. Since the reserve requirement effectively determines the money supply multiplier effect, that multiplier becomes almost infinite.

The extension of credit through the shadow banking system removes the semblance of central bank control over monetary expansion. Securitization and financial innovation also create putative wealth from thin air, using underlying collateral to derive layers of additional illusory value. In this way, excess claims to underlying real wealth are created. The connection between the rapidly expanding virtual worth of the derivative instruments and the real value of the underlying collateral becomes ever more tenuous.

http://www.theautomaticearth.com/2011/12/look-back-look-forward-and-look-down-way-down/

Shadow Banking and Phantom Wealth

Since 2011, in our desperate attempt to avoid the consequences of an imploding bubble, we doubled down on the doomed strategy of ponzi credit expansion. In doing so, we have only succeeded in digging ourselves into a deeper hole, and have done so on a massive scale. While the aggregate balance sheet of the world’s central banks grew exponentially from $3 trillion to $22 trillion over the last 15 years, the expansion in the shadow banking sector has been even more dramatic, and its role in fostering the overall credit hyper-expansion has become increasingly clear:

Their client base is predominantly composed of the global finance capital elite – i.e. the roughly 200,000 worldwide ultra and very high net worth individuals with net annual additional income from investment flows of $20 million or more—for whom they invest individually as well as for themselves as shadow bank institutions.

Shadow bank ‘forms’ include private equity firms, hedge funds, asset and wealth management companies, mutual funds, money market funds, investment banks, insurance companies, boutique banks, trust companies, real estate investment trusts – to note just a short list – as well as dozens of other forms and newly emerging initiatives like peer to peer lending networks, online investment funds, and the like.

Shadow banks have been estimated to have investable assets (i.e. relatively short term and liquid) of about $75 trillion globally as of year end 2014, a total that does not include revenue from ‘portfolio’ shadow-shadow banking. That is projected to exceed $100 trillion well before 2020.

http://www.counterpunch.org/2015/01/09/china-and-the-shadow-bankers/

The exponential growth of both central banks and shadow banking during the long global boom constitutes a gargantuan increase in the supply of money plus credit relative to available goods and services, which is inflation by definition. This huge supply of virtual wealth has acted to push up asset prices, creating a plethora of asset price bubbles and a cascade of malinvestment based on those price distortions. The explosive growth of shadow banking in particular, following the 2009 bottom, was accompanied by a return to extreme risk complacency and rock bottom interest rates, leading to a frantic search for investment returns in riskier and riskier places.

Inherently risky emerging markets became a major focus during this time, and the search for outsized returns not only sought out risk, but actively increased it. Volatility provides the momentum that generates trading profits, but it also creates considerable instability. Given that finance is virtual, and that changes in the financial world therefore unfold far more quickly than the real economy can realistically adapt to, large influxes and exoduses of hot money looking for quick profits are very destablizing to target sectors of the real economy, and to entire countries. The phantom wealth generated by the shadow banking bonanza has both created and subsequently fed upon real world destruction:

….Shadow banks and their finance capital elite clients make money when financial asset prices are volatile, i.e. when such prices rapidly rise or fall or both. It is thus in their direct interest to cause asset price volatility and instability—whether in provoking a rapid rise in government bonds rates (Greece), in contributing to the collapse in currencies (Venezuela, Argentina), or in IMF-enforced ‘firesales’ of companies (Ukraine). Their strategy is to exacerbate, or even create, financial price inflation in the targeted market and financial instruments, be they stocks, junk bonds, real estate, foreign exchange, derivatives, etc. That same financial price instability, however, is what causes havoc with the real economies of countries—like those in southern Europe in recent years, in Asia in the late 1990s, Japan in early 1990s, and which led to the global financial crash of 2008-09 itself….

….Shadow banks generate profits from excess lending and debt creation, from financial speculation, and from creating financial asset bubbles that primarily benefit their wealthy investors….Shadow banks add little to the real economy or real economic growth. And in the process of generating excess financial profits for themselves and their finance capital elite, they destabilize economies and can often lead to major financial asset collapses, general credit crunches and at times even credit crashes, that in turn lead to deep recessions and prolonged, difficult recoveries….

….Shadow banks are the preferred institutions of the global finance capital elite. They always work to the benefit of that elite, often at the direct expense of the real economy, including non-financial businesses, and always at the expense of working classes who never share in the capital gains but pay the price in slower economic growth and repeated financial-economic crashes.

http://www.counterpunch.org/2015/01/09/china-and-the-shadow-bankers/

THE ENDGAME EXPLORED IN EXHAUSTIVE DETAIL...READ IT FOR PLANNING PURPOSES!

Demeter

(85,373 posts)Email this to someone

There has been a lot of chatter in recent days about the plunge in commodity prices—–capped off by this week’s slide of the Bloomberg commodity index to levels not seen since 2002. That epochal development is captured in the chart below, but most of the media gumming about the rapidly accelerating “commodity crunch” misses the essential point.

To wit, the central banks of the world have shot their wad. Accordingly, the 12-year round trip depicted in the chart is not about the end of some nebulous “commodity supercycle” that arrived from out of the blue after the turn of the century. Nor, most certainly, is it evidence of the Keynesians’ purported global shortage of “aggregate demand” that can be remedied by an even more extended spree of central bank monetary stimulus.

No, the Bloomberg Commodity index is a slow motion screen shot depicting the massive intrusion of worldwide central bankers into the global economic and financial system. Their unprecedented money printing rampage took the aggregate balance sheet of the world’s central banks from $3 trillion to $22 trillion over the last 15 years.

The consequence was a deep and systematic falsification of financial prices on a planet-wide scale. This unprecedented monetary shock generated a double-pumped economic boom—–first in the form of an artificial debt-fueled consumption spree and then a sequel of massive malinvestment.

Now comes the deflationary aftermath. Soon there will follow a plunge in corporate profits and collapsing prices among the vastly inflated risk asset classes which surfed on these phony booms....

MORE GOOD NEWS TO PONDER AND PLAN

Demeter

(85,373 posts)NEXT? WELL, NO TELLING WHO GOES DOWN NEXT, BUT THE USA IS ANOTHER GREECE IN THE MAKING, THAT MUCH IS CERTAIN

http://www.zerohedge.com/news/2015-08-03/why-us-next-greece-doug-casey-americas-economic-problems

"With these stupid governments printing trillions and trillions of new currency units," warns investor Doug Casey, "it's building up to a catastrophe of historic proportions." In an excellent brief interview with Reason magazine Editor-in-Chief Matt Welch, Casey expounds on the US noting that "as any institution gets larger and older it inevitably becomes corrupt and fails." What to do? "I wouldn't keep significant capital in banks," he exclaimed, "most of the banks in the world are bankrupt. That didn't stop the "brain dead" Greeks who left their money in banks as all the signs were on the wall, he notes as he addresses whether gold is a good investment in 2015, and offers back-handed bright side: Catastrophes create many opportunities to earn a profit.

Demeter

(85,373 posts)Over the weekend Puerto Rico was supposed to make a modest principal and interest payment of some $58 million due on Public Finance Corp. bonds, which however few expected would be satisfied. As a reminder, on Friday, Victor Suarez, the chief of staff for Governor Alejandro Garcia Padilla, said during a press conference in San Juan that the government simply does not have the money.

Moments ago Melba Acosta, president of the Government Development Bank, confirmed as much, when he announced that only $628,000 of the $58 million payment, or just about 1%, had been paid.

Below is the full statement from Acosta on the service of PFC Bonds:

Due to the lack of appropriated funds for this fiscal year the entirety of the PFC payment was not made today. This was a decision that reflects the serious concerns about the Commonwealth's liquidity in combination with the balance of obligations to our creditors and the equally important obligations to the people of Puerto Rico to ensure the essential services they deserve are maintained.

"PFC did make a partial payment of Interest in respect of its outstanding bonds. The partial payment was made from funds remaining from prior legislative appropriations in respect of the outstanding promissory notes securing the PFC bonds. In accordance with the terms of these bonds, which stipulate that these obligations are payable solely from funds specifically appropriated by the Legislature, PFC applied these funds—totaling approximately $628.000—to the August 1 payment."

WSJ adds that the payment to bondholders is the first skipped since Governor Alejandro Garcia Padilla in June said the island’s debts were unsustainable and urged negotiations with creditors in an effort to restructure about $72 billion. "Still, analysts said it isn’t likely to provoke an acute market wide reaction from investors, many of whom have been inching away from the commonwealth for years."

Except for those hedge funds who haven't, and have been BTFD in hopes of another bailout of course.

And confirming that making just 1% of the contractual payment is not the same as making 100% of it, moments ago Moody's confirmed what most had already known:

MOODY'S VIEWS PUERTO RICO IN DEFAULT

More via CNBC:

"This event is consistent with our belief that Puerto Rico does not have the resources to make all of its forthcoming debt payments. This is a first in what we believe will be broad defaults on commonwealth debt," she added.

In other words, small or not, PR has failed a mandatory principal repayment and is now in default under the PFC bonds. Up next, as per Bloomberg's preview "the default promises to escalate the debt crisis racking the island, where officials are pushing for what may be the biggest restructuring ever in the municipal market."

“An event like this is significant enough that it could hurt prices for Puerto Rico bonds,” said Richard Larkin, director of credit analysis at Herbert J Sims & Co. in Boca Raton, Florida. “I can’t believe a default on debt with Puerto Rico’s name will go unnoticed.”

It is unclear if creditors will now threaten the commonwealth with a "temporary" expulsion from the dollarzone as part of their hardball negotiating tactics. Nor is it clear if Schauble is still willing to trade Puerto Rico for Greece. What is clear is that the first default by a US commonwealth is now in the history books.

Demeter

(85,373 posts)Over the few days, we got what was merely the latest confirmation that when it comes to sliding gold prices, consumers of physical gold just can't get enough.

As the Times of India reported over the weekend, India's gold imports shot up by 61% to 155 tonnes in the first two months of the current fiscal year "due to weak prices globally and the easing of restrictions by the Reserve Bank. In April-May of the last fiscal, gold imports had aggregated about 96 tonnes, an official said."

This follows confirmations previously that with the price of gold sliding, physical demand has been through the roof, case in point: "US Mint Sells Most Physical Gold In Two Years On Same Day Gold Price Hits Five Year Low", "Gold Bullion Demand Surges - Perth Mint and U.S. Mint Cannot Meet Demand", "Gold Tumbles Despite UK Mint Seeing Europeans Rush To Buy Bullion" and so on. Indicatively, as of Friday, the US Mint had sold 170,000 ounces of gold bullion in July: the fifth highest on record, and we expect today's month-end update to push that number even higher.

CHART AT LINK

But while the dislocation between demand for physical and the price of paper gold has been extensively discussed here over the years, most recently in "Gold And The Silver Stand-Off: Is The Selling Of Paper Gold And Silver Finally Ending?", something unexpected happened at the CME on Friday afternoon which may be the most important observation yet.

Recall that in the middle of 2013, in an extensive series of articles, we covered what was then a complete collapse in Comex vaulted holding of registered (i.e., deliverable) gold. At the time the culprit was JPM, where for some still unexplained reason, the gold held in the newest Comex' vault plunged by nearly 2 million ounces in just six short months.

More importantly, the collapse in registered Comex gold sent the gold coverage ratio (the number of ounces of "paper" gold open interest to the ounces of "physical" registered gold) soaring from under 20 where, or roughly in line with its long-term average, to a whopping 112x. This means that there were a total of 112 ounces of claims for every ounces of physical gold that could be delivered at any given moment.

Gradually, the Comex raid was relegated to the backburner when starting in 2014 the amount of registered gold tripled from the upper 300k range to 1.15 million ounces one year ago, at which point the slide in Comex registered gold started anew.

Which brings us to Friday afternoon, also known as month end position squaring, when in the latest daily Comex gold vault depository update we found that while some 270K in Eligible gold had been withdrawn mostly from JPM vaults, what caught our attention was the 25,386 ounces of Registered gold that had been "adjusted" out of registered and into eligible. As a reminder, eligible gold is "gold" that can not be used to satisfy inbound delivery requests without it being converted back to registered gold first, which makes it mostly inert for delivery satisfaction purposes...

MORE MONKEY BUSINESS IN THE VAULTS

Demeter

(85,373 posts)After trading limit-down on Monday when Greek stocks opened for trading for the first time since PM Alexis Tsipras called a referendum that would later prove to be a complete waste of time, shares of Greek banks once again flirted with the daily 30% loss limit on Tuesday as there were simply no bids for a set of institutions that everyone knows is insolvent.

The banks, which are only operational because the ECB has decided to keep the ELA liquidity drip on at least until the central bank sees whether or not Greece will be able to make a €3.2 billion bond payment on August 20, are in desperate need of recapitalization, and according to Brussels’ estimates, will need somewhere on the order of €25 billion to stabilize the system.

Of course that total effectively grows by the day, as the collapsing Greek economy (and we mean "collapsing" in the most literal sense of the word after yesterday’s astonishingly bad PMI print) takes its toll, driving up NPLs in a vicious circle wherein capital controls meant to stem the deposit outflow cripple the economy which in turn serves to further cripple the banks.

Speaking of this self-feeding loop, here’s Kathimerini with more on how the banking sector deep freeze has reverberated through the broader economy:

The state’s losses from indirect taxes alone in the first couple of weeks of capital controls and the shuttering of banks is more than half a billion euros, according to a study published on Monday by the Hellenic Confederation of Professionals, Craftsmen and Merchants (GSEVEE).

The drop in consumption in the first two weeks after June 28 amounted to 50 percent, or 3.8 billion euros, with corporate turnover falling 48 percent on average. This meant the state coffers missed out on 570 million euros in taxes.

Nine out of 10 enterprises reported a decline in turnover, with three in 10 seeing a drop of at least 70 percent.

The medium-term impact will be more serious, argued the report, as it is unknown for how long the capital controls will remain in place, and small and medium-sized enterprises are in a difficult position as the measures came during a period when they were completely defenseless.

Meanwhile, Greek FinMin Euclid Tsakalotos is meeting with the country’s creditors today to discuss the recap effort. Here’s Kathimerini with that story (Google translated):

Yes, the final amount will "depend" on a few factors, but as noted above, the situation is deteriorating so rapidly as to make any stress test assumptions obsolete as soon as they are adopted, meaning that as long as the economy remains in free fall, assessing the capital needs of the banking sector will be well nigh impossible, but one thing is for sure, Tsakalotos' €10 billion figure is wildly optimistic.

FINDING OUT WHO IS SWIMMING WITHOUT SHORTS---THE ERA OF TRUE PRICE DISCOVERY COMMENCES

Demeter

(85,373 posts)Oil plunged again on Monday, with West Texas Intermediate down over 4%. At $45.17 a barrel, it’s just a hair away from this year’s oil-bust low. During 8 weeks in a row of relentless declines, WTI had plunged 26%. July’s 21% drop was the largest monthly decline since the Financial Crisis collapse in 2008.

There’s a laundry list of perceived reasons: The rig count has been rising again. Shale oil companies, like Whiting Petroleum, are bragging about “record” production to prop up their shares. Production in Russia has been strong. And OPEC, powered by Saudi Arabia and increasingly Iraq, raised production in July to 32 million barrels per day.

There’s the dreaded surge of Iranian oil onto the world markets. Just this weekend, Iran’s oil minister mused that his country could raise oil production by 500,000 bpd within a week of when the sanctions would be lifted and by 1 million bpd within a month.

It gave oil markets the willies. They were already fretting over the slowdown in China, the crude oil inventories in the US, at a record for this time of the year, the oil inventories in other developed markets, and even oil stored in leased tankers. Oil everywhere, it seems.

Whatever the perceived reasons, the price of oil has gotten re-crushed, and so has the hope a few months ago that this would be over by now...

Demeter

(85,373 posts)It’s the oil crash few saw coming, and few have been spared as it erased $1.3 trillion, the equivalent of Mexico’s annual GDP, in little more than a year.

Take billionaire Carl Icahn. When crude was at its peak in June 2014, the activist investor’s stake in Chesapeake Energy Corp. was worth almost $2 billion. Today, oil has lost more than half its value, Chesapeake is the worst performer in the Standard & Poor’s 500 Index and Icahn has a paper loss of $1.3 billion. The S&P 500, by contrast, is up 6.9 percent in that time.

State pension funds and insurance companies have also been hard hit. Investment advisers, who manage the mutual funds and exchange-traded products that are staples of many retirement plans, had $1.8 trillion tied to energy stocks in June 2014, according to data compiled by Bloomberg.

“The hit has been huge,” said Chris Beck, chief investment officer for small- and mid-capitalization companies for Delaware Investments, an asset management firm in Philadelphia with $180 billion in assets under management. “Everybody was thinking that oil would stay in the $90 to $100 a barrel range.”

The California Public Employees Retirement System, a $303 billion fund that provides benefits to 1.72 million people, owned a $91.8 million slice of Pioneer Natural Resources Co. in June 2014. At the time, Pioneer was a $33 billion company and one of the biggest shale producers in Texas. Today, Pioneer is worth $19 billion and Calpers’ stake has lost about $40 million in market value.

Since June 2014, the combined market capitalization of 157 energy companies listed in the MSCI World Energy Sector Index or the Bloomberg Intelligence North America Independent Explorers & Producers Index has lost about $1.3 trillion.

If crude rebounds, investors may make some of their money back, though values may not recover as quickly as they fell. After the tech bubble burst in 2000, erasing $7 trillion from the Nasdaq Composite Index, it took almost 15 years for the market to return to its pre-crash level.

Oil, which lost more than half its value in the past year, will rise less than $20 through the first quarter of 2016, according to the median estimate compiled by Bloomberg.

Demeter

(85,373 posts)What do you call a country that has grown 4.6 per cent - in total - since it joined the euro 16 years ago? Well, probably the one most likely to leave the common currency. Or Italy, for short.

It's hard to say what went wrong with Italy, because nothing ever went right. It grew 4 per cent its first year or so in the euro, but almost not at all in the 15 years since. Now, that's not to say that it's been flat the whole time. It hasn't. It got as much as 14 per cent bigger as it was when it joined the euro, before the 2008 recession and 2011 double-dip erased most of that progress. But unlike, say, Greece, there was never much of a boom. There has only been a bust. The result, though, has been the same. Greece and Italy have both grown a meager 4.6 per cent the past 16 years, although they took drastically different paths to get there.

Part of it is that Italy, as the IMF points out, has real structural problems. It's hard to start a business, hard to expand one, and hard to fire people, which makes employers wary about hiring them in the first place. That's led to a small business dystopia, where nobody can achieve the kind of economies of scale that would make them more productive. But, at the same time, Italy had these problems even before it had the euro, and it still managed to grow back then. So part of the problem is the euro itself. It's too expensive for Italian exporters, and too restrictive for the government that's had to cut its budget even more than it otherwise would have.

This doesn't make Italy unique -- the euro has hurt even the best-run countries -- but what it does is that Italy's populists have noticed. Why is that? Well, more than anything else, the common currency has given Europe a severe case of cognitive dissonance. People hate austerity, but they love the euro even more -- they have an emotional attachment to everything it stands for.

The problem, though, is that the euro is the reason they have to slash their budgets so much in the first place. So anti-austerity parties have felt like they have to promise the impossible if they want any hope of gaining power: that they can end the budget cuts without ending the country's euro membership.

But as Greece's Syriza party found out, that strategy, if you want to call it one, only gives your people unrealistic expectations and Europe no reason to help you out. The other countries, after all, don't want to reward what, in their view, is bad budgetary behaviour, if not blackmail. And so Greece was all but given an ultimatum: either leave the euro or do even more austerity than it was originally told to do. It chose austerity...

LET THE HUNGER GAMES BEGIN!

MORE AT LINK

Demeter

(85,373 posts)Detectives bugging the phone of a businessman suspected of laundering millions for organised crime gangs heard him romancing the wife of a Bank of England insider to glean highly sensitive information. A BuzzFeed News investigation lifts the lid on a security scandal that the police and MI5 tried to keep secret....The inner sanctum of the Bank of England was penetrated by a “powerful criminal network” linked to money laundering, terrorism, and contract killings, according to explosive intelligence that the police and MI5 tried to keep secret.

The details of the covert operation – which uncovered a suspected gangland plot so audacious detectives feared it could “destabilise” the British economy – are revealed for the first time in secret police files seen by BuzzFeed News and interviews with several well-placed sources.

The infiltration was discovered when detectives tapped the mobile phone of a Ferrari-driving businessman suspected of laundering money “on a vast scale” for organised crime gangs and reported hearing him receiving secrets from inside the Bank.

The major national security breach has been kept tightly under wraps by police chiefs and spies at MI5 for more than 16 years, shielding those implicated in the highly embarrassing scandal from public, parliamentary, and judicial scrutiny.

Although police warned senior bankers that a mole was passing inside information to a businessman connected to organised crime, the leaker was never identified, no one was sacked, and the businessman remains at large....

NATURALLY!

WOULDN'T IT BE A KICK IF THAT WERE THE DONALD? OF COURSE, PEOPLE LIKE HIM ARE A DIME A DOZEN, THESE DAYS...

Demeter

(85,373 posts)

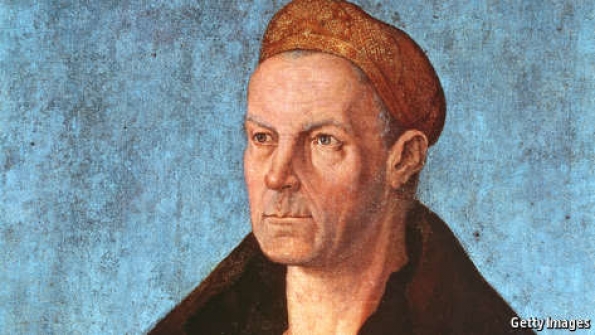

The Richest Man Who Ever Lived: The Life and Times of Jacob Fugger. By Greg Steinmetz. Simon and Schuster; 283 pages; $27.95.

ALBRECHT DÜRER’S portrait of Jacob Fugger shows a man with thin lips and unforgiving eyes. He wears a fine fur tippet about his shoulders and a brown cap; for the time, his dress is strikingly plain. Greg Steinmetz, formerly a journalist with the Wall Street Journal and now a securities analyst in New York, declares that he was the most influential businessman who ever lived. He makes a better case for this extravagant claim than for his assertion that Fugger was also the richest man in history.

A late-medieval banker from Augsburg in southern Germany, Fugger has never been as celebrated as Cosimo de Medici and his Florentine sons and cousins, whose reputation as bankers was burnished by their excellent taste in Renaissance art. But Fugger was the better banker. Were he alive today, he would have cut a swathe through Wall Street and the City, and yet his remarkable history is still little known. Mr Steinmetz’s prose does not always sparkle and some arcane details of banking history are fuzzy, but the tale of Fugger’s aspiration, ruthlessness and greed is riveting.

He was born into a family of well-to-do textile traders and bankers in Augsburg in 1459. He grew rich and powerful by risking his capital and his reputation to finance the territorial ambitions of the Habsburgs. Jacob relished the relationship, which began when Frederick III, the Holy Roman Emperor, was given a loan by Fugger’s brother in spite of a dreadful credit rating. Jacob became principal banker to his son, Emperor Maximilian I, who established the Austro-Hungarian Empire, and to Charles V of Spain, whose victory at the Battle of Pavia entrenched the Habsburgs’ hegemony. His huge loans were backed by collateral, and his Habsburg clients frequently paid them off in kind rather than cash.

Fugger was able to obtain control of commodities such as silver, from Austria, and copper, from Hungary. He built a smelter to refine the copper and traded it himself quite pitilessly. When he joined a cartel of copper producers in Venice they agreed to push up the price by squeezing the supply, but Fugger put pressure on his co-conspirators and rivals instead.

He flooded the market with so much metal that the price collapsed and his competitors were gravely weakened. Subsequently, he helped finance a Portuguese scheme to relocate the pepper and spice trade to Lisbon, a move so successful that it delivered a fatal blow to the commercial stature of Venice. He also had a thirst for information about trade and commerce that led him to create a network of couriers whose reports to Augsburg were printed and distributed to clients in the form of a primitive newspaper. Fugger had invented the world’s first news service....

MORE EXPLOITS AT LINK

Demeter

(85,373 posts)Financial companies are facing extortion threats from hackers who threaten to knock their websites offline unless firms pay tens of thousands of dollars, an FBI agent told MarketWatch Thursday.

More than 100 companies, including targets from big banks to brokerages in the financial sector, have received distributed denial of service threats since about April, says Richard Jacobs, assistant special agency in charge of the cyber branch at the FBI’s New York office. With these types of attacks, known as DDoS, criminals jam websites by flooding them with useless traffic.

The ransom requests typically run in the tens of thousands of dollars and in some cases, the companies have paid up, Jacobs said. If firms have already traced the ultimatums to identify likely culprits, they can determine whether those criminals have historically followed through with threats or backed off if a target doesn’t pay up. In some cases, when companies fork over cash, they end up facing further attacks because they proved they’re willing to engage.

“There are some groups who typically will go away if you don’t pay them, but there’s no guarantee that’s going to happen,” Jacobs says. He says not all targets have experienced actual attacks...

MORE

Demeter

(85,373 posts)The smallest financial institutions across the U.S. share a common struggle with the largest ones: how to best protect against hackers.

Financial institutions are facing an increasing onslaught of cyberattacks. While smaller banks and firms may be forced to combat threats with fewer resources, that smaller size means they might be easier to protect.

“The smaller businesses actually have a solvable problem,” says Pete Petersen, director of technology and chief cybersecurity officer at Causeway Capital Management, an institutional asset manager that focuses on international equities and oversees about $40 billion. “I know what systems need to be patched. I know what systems we’re using. I know everything about this place. You can’t do that at Citibank.”

Institutions with small geographic footprints, little complexity in terms of technology and that outsource critical systems have little or minimal inherent cyber risk, according to a guide released Tuesday by the Federal Financial Institutions Examination Council, an interagency group that includes five U.S. banking regulators.

“It’s one thing to train 50 people on phishing. It’s another thing to train 50,000,” Petersen says.

And a small, community bank may not be as attractive a target...MORE

Demeter

(85,373 posts)Medicare -- signed into law fifty years ago, on July 30, 1965 -- was supposed to be just the first step.

For the fifty years before Medicare's enactment, progressives had fought unsuccessfully for universal, government-provided health insurance. In 1912, President Theodore Roosevelt's Progressive Party platform advocated universal, government-sponsored, health insurance, but he was defeated in his quest for another term as president. In 1917, the California legislature approved universal health insurance, and the governor supported it, but a 1918 ballot resolution defeated the measure after a massive, well-financed business and physician-fueled campaign against it. President Franklin Roosevelt seriously considered including national health insurance in his 1935 Social Security legislation, but decided against it out of fear that it would bring down the entire legislative package. President Harry Truman made universal health insurance a top priority, but got nowhere.

The five-decade long history of defeat convinced activists to shift to an incremental approach. They decided to start with a sympathetic group and debated which one that should be. The top candidates were seniors and children. On the one hand, covering children was relatively inexpensive and could lead to a lifetime of better health. On the other hand, seniors were most in need of health insurance and were already used to and supportive of Social Security's government-sponsored wage insurance. And they voted.

So the decision was made to start with them. The expectation was that, after Medicare was enacted, children and others would be quickly added. And, indeed, just seven years later, in 1972, President Richard Nixon signed into law legislation which extended Medicare to people with serious and permanent disabilities.

But then came Watergate, distrust of government, and President Ronald Reagan's famous declaration, "Government is not the solution to our problem; government is the problem." Expansion of Medicare to children or other demographic groups disappeared from the public agenda. But the need for universal high-quality health care, efficiently provided, did not...

MORE

Demeter

(85,373 posts)British economist Tony Atkinson has been studying inequality — the gap in income and wealth between the top and the bottom — for nearly half a century. Now that the dogma of trickle-down has been exposed as myth, he sees economists, policy-makers and the public finally waking up to the seriousness of the problem. But how to fix it? In his new book, Inequality: What Can Be Done? Atkinson focuses on ambitious proposals that could shift the distribution of income in developed countries...

Q&A INTERVIEW FOLLOWS AT LINK

Demeter

(85,373 posts)Canada, Australia, New Zealand currencies set to plunge, OppenheimerFunds says...

COMPARED TO WHAT? THE PRINTING PRESSES OF THE MIGHTY USA?

...The Canadian, Australian and New Zealand dollars are off to the worst start to a year since the financial crisis. The nations are grappling with a 29 percent drop in raw-material prices amid swelling supplies and slowing demand in China that may wipe out as much as 14 percent of the Canadian dollar's value in the next three years.

Next up, they'll have to contend with the Federal Reserve's plan to raise interest rates this year, which is forecast to boost the U.S. dollar...

I WOULDN'T BET ON IT

``Compared to the U.S. talk about raising rates and tightening policy, the commodity currencies are going in the exact opposite direction,'' Alessio de Longis, a money manager in the Global Multi-Asset Group at OppenheimerFunds, said from New York. ``These currencies are not cheap by any means.''

De Longis, whose company manages $233 billion, projected the Canadian dollar will weaken 14 percent in the next one to three years. He estimated the Aussie will fall in the same timeframe to 60 cents per U.S. dollar and the kiwi to drop to 50 cents.

The Canadian dollar weakened 0.2 percent Thursday to an 11-year low while the kiwi lost 0.5 percent.

Even as the Reserve Bank of Australia held interest rates steady and spurred a currency bounce, de Longis said he expects central banks in the commodity-exporting nations to continue easing monetary policy, sending their currencies tumbling versus the greenback.

MORE SPECULATION (AND THAT'S ALL IT IS, FOLKS, IN ALL MEANINGS OF THE TERM) AT LINK

Demeter

(85,373 posts)Scott Bessent, who’s been overseeing George Soros’s $30 billion fortune for the last four years, will leave at the end of 2015 to start his own hedge-fund firm. Bessent, 52, is forming Key Square Group with a $2 billion investment from Soros, according to a memo sent to employees of Soros Fund Management. That will make his firm one of the largest hedge-fund start-ups ever, even before he begins raising money from other investors.

“Over the past four years, Scott has managed the firm’s assets with skill and dedication,” said Robert Soros, George’s son, in the memo. “He has decided to start his own venture because of the constraints involved in working with a family office structure, which prevent him from raising outside capital.”

Bessent has spent much of his career managing money for Soros, overseeing his European investments for about eight years in the 1990s, and returning to the firm in late 2011. Since then, the family office has made about $10 billion in profit under Bessent as investment chief, or about 13 percent annualized, according to a person familiar with the firm who asked not to be named because it’s private.

Bessent will continue to advise the family office and remains close to Soros and his family, the memo said. After he leaves, the investment strategy and asset allocation will be managed by the existing committees that Robert Soros and Bessent put in place...

MORE

DemReadingDU

(16,000 posts)interviewed by Greg Hunter

8/2/15 Vicious Out of Control Downturn Coming-Chris Martenson

...watch China because the recent signs are not good. Martenson contends, “You get your early signals from the place that is closest to the true economic action, and China is the center of that. So, to me, watching commodities tank first, gyrations in the Chinese stock market second, says third, you better be prepared for a big deflationary event or a big crash. . . . This is the mother of all crashes because the crash of 2008 was actually a side show. . . . We are going to discover that, like all bubbles, you return from where you started. . . . That means $40 trillion will have to get wiped out in the U.S. market alone.”

http://usawatchdog.com/vicious-out-of-control-downturn-coming-chris-martenson/

good video: 35 minutes