Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 8 July 2015

[font size=3]STOCK MARKET WATCH, Wednesday, 8 July 2015[font color=black][/font]

SMW for 7 July 2015

AT THE CLOSING BELL ON 7 July 2015

[center][font color=green]

Dow Jones 17,776.91 +93.33 (0.53%)

S&P 500 2,081.34 +12.58 (0.61%)

Nasdaq 4,997.46 +5.52 (0.11%)

[font color=red]10 Year 2.25% +0.03 (1.35%)

30 Year 3.04% +0.02 (0.66%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

DemReadingDU

(16,000 posts)7/6/15 Health Insurance Companies Seek Big Rate Increases for 2016

Health insurance companies around the country are seeking rate increases of 20 percent to 40 percent or more, saying their new customers under the Affordable Care Act turned out to be sicker than expected. Federal officials say they are determined to see that the requests are scaled back.

Blue Cross and Blue Shield plans — market leaders in many states — are seeking rate increases that average 23 percent in Illinois, 25 percent in North Carolina, 31 percent in Oklahoma, 36 percent in Tennessee and 54 percent in Minnesota, according to documents posted online by the federal government and state insurance commissioners and interviews with insurance executives.

The Oregon insurance commissioner, Laura N. Cali, has just approved 2016 rate increases for companies that cover more than 220,000 people. Moda Health Plan, which has the largest enrollment in the state, received a 25 percent increase, and the second-largest plan, LifeWise, received a 33 percent increase.

A study of 11 cities in different states by the Kaiser Family Foundation found that consumers would see relatively modest increases in premiums if they were willing to switch plans. But if they switch plans, consumers would have no guarantee that they can keep their doctors. And to get low premiums, they sometimes need to accept a more limited choice of doctors and hospitals.

more...

http://www.cnbc.com/id/102811143

Totally outrageous. We're supposed to obtain Obamacare, now who can afford the premiums? Seems more people will become uninsured again.

DemReadingDU

(16,000 posts)7/7/15 Karl Denninger: The Monopolist Robbery In Medicine, Illustrated

All it takes is a company to start doing medicine on a cash, no insurance, no-BS basis to point out the blatant and outrageous overcharging, monopolist robbery and gate-keeping, all of which add up to behavior and pricing that is felonious in virtually any other line of work (and arguably is here too according to 15 USC but is never enforced.)

The Surgery Center of Oklahoma put this in stark relief when they showed up on the scene, offering no-insurance, flat-priced common operations where the price is known before the procedure is undertaken and typically winds up costing 80% less than a hospital charges for the same procedure -- with no surprises.

Now we have Theranos, which has taken advantage of a new Arizona law that allows any person to order their own tests without doctor involvement, reading or gate-keeping. In other words your tests are your tests, as are the records (and results) of same. And their prices?

Anyone can walk into these Wellness Centers at convenient hours and get accurate, rapid lab testing with transparent prices that are always at least 50-80% below Medicare reimbursement rates.

Got that folks?

Medicare is an 80/20 system; that is, you pay 20% of the charge.

Theranos just destroyed any reason to pay for or have Medicare (say much less Obamacare or "private" insurance) when it comes to testing because the full price is approximately equal to your deductible.

I argue this same paradigm in pricing would be the case virtually everywhere in medicine were we to get rid of the monopolists, and I cite as my evidence that every time we get rid of them the same thing happens -- price falls by anywhere from half to more than 80%!

Note that these numbers are from Medicare's reimbursement rates which are typically much lower than what "private" (or Obamacare) insurance pays. In other words the "screaming" from providers that they cannot make a fair profit at Medicare's pricing is a lie; Theranos is willing to run the tests and believes they will make money charging anywhere from 1/5th to half what Medicare pays.

The entire "traditional" model we have for medicine in this country is not just broken it is a cesspool of collusion and activity that, were I to have engaged in any of it when I ran my Internet company, or if the local car dealer engaged in any of it, would land us in prison.

IT IS LONG PAST THE TIME WHEN WE SHOULD BE LOCKING UP MEDICAL PROFESSIONALS, PROVIDERS, INSURANCE EXECUTIVES AND ADMINISTRATORS.

https://market-ticker.org/cgi-ticker/akcs-www?post=230324

Read the comments for helpful links to additional places to go for all kinds of tests that can be done without insurance.

Demeter

(85,373 posts)The Supreme Court’s recent blessing of Obamacare has precipitated a rush among the nation’s biggest health insurers to consolidate into two or three behemoths. The result will be good for their shareholders and executives, but bad for the rest of us – who will pay through the nose for the health insurance we need. We have another choice, but before I get to it let me give you some background.

Last week, Aetna announced it would spend $35 billion to buy rival Humana in a deal that will create the second-largest health insurer in the nation, with 33 million members. The combination will claim a large share of the insurance market in many states – 88 percent in Kansas and 58 percent in Iowa, for example. A week before Aetna’s announcement, Anthem disclosed its $47 billion offer for giant insurer Cigna. If the deal goes through, the combined firm will become the largest health insurer in America. Meanwhile, middle-sized and small insurers are being gobbled up. Centene just announced a $6.3 billion deal to acquire Health Net. Earlier this year Anthem bought Simply Healthcare Holdings for $800 million. Executives say these combinations will make their companies more efficient, allowing them to gain economies of scale and squeeze waste out of the system. This is what big companies always say when they acquire rivals.

Their real purpose is to give the giant health insurers more bargaining leverage over employees, consumers, state regulators, and healthcare providers (which have also been consolidating). The big health insurers have money to make these acquisitions because their Medicare businesses have been growing and Obamacare is bringing in hundreds of thousands of new customers. They’ve also been cutting payrolls and squeezing more work out of their employees. This is also why their stock values have skyrocketed. A few months ago the Standard & Poor’s (S&P) 500 Managed Health Care Index hit its highest level in more than twenty years. Since 2010, the biggest for-profit insurers have outperformed the entire S&P 500. Insurers are seeking rate hikes of 20 to 40 percent for next year because they think they already have enough economic and political clout to get them.

That’s not what they’re telling federal and state regulators, of course. They say rate increases are necessary because people enrolling in Obamacare are sicker than they expected, and they’re losing money. Remember, this an industry with rising share values and wads of cash for mergers and acquisitions. It also has enough dough to bestow huge pay packages on its top executives. The CEOs of the five largest for-profit health insurance companies each raked in $10 to $15 million last year. After the mergers, the biggest insurers will have even larger profits, higher share values, and fatter pay packages for their top brass. There’s abundant evidence that when health insurers merge, premiums rise. For example, Leemore Dafny, a professor at the Kellogg School of Management at Northwestern University, and her two co-authors, found that after Aetna merged with Prudential HealthCare in 1999, premiums rose 7 percent higher than had the merger not occurred.

The problem isn’t Obamacare. The real problem is the current patchwork of state insurance regulations, insurance commissioners, and federal regulators can’t stop the tidal wave of mergers, or limit the economic and political power of the emerging giants. Which is why, ultimately, American will have to make a choice. If we continue in the direction we’re headed we’ll soon have a health insurance system dominated by two or three mammoth for-profit corporations capable of squeezing employees and consumers for all they’re worth – and handing over the profits to their shareholders and executives.

The alternative is a government-run single payer system – such as is in place in almost every other advanced economy – dedicated to lower premiums and better care.

Which do you prefer?

wordpix

(18,652 posts)I got conventional, been-around-for-25 yrs. chemo last year that was "allowed" by my O-care insurance at $23K per round. I found my exact chemo cocktail at an NIH site, priced at $3500 for drugs + admin./round and the drugs cost about half. The drugs for my chemo, OTOH, were charged at about $21K/round.

Now I ask you: WHY would insurance cos. allow a charge of $23K when the price is actually $3500? Either there is price fixing, the insurance cos. are getting kickbacks and/or the insurance cos. charge this much but don't get it in their contracts with providers. Then they can write off the difference as a loss.

Something fishy is going on

wordpix

(18,652 posts)I found out my $23K/per chemo round "allowed charge" actually costs $3500 for drugs + admin. Our gov. is getting totally ripped off if it's paying anywhere near the allowed charge. But someone told me that isn't the real charge b/c the real charges are worked out in agreements with the states and Medicare. So we don't know what our gov is paying out or what the real charges are.

Totally bogus, and I believe strongly after learning what I've learned that there's a lot of illegal scams going on in all related industries. I would not doubt these involve price fixing, sham tax deductions and kickbacks. Why else would insurance cos. be willing to pay 10x the real cost of a treatment?

wordpix

(18,652 posts)I agree---outrageous. Why don't the Congressional fucks look into the price fixing that's going on? My "provider charge" for a round of conventional chemo was $40K---this for an IV drip I mostly took at home. But I was told not to worry about that charge and look at the insurance co's "allowed charge," which was $23K per round. Most of that was for drugs that cost about $1500/round according to NIH.

Oh the poor widdle insurance cos. aren't making enough. Well why are they approving drug and provider charges that are 12x the actual price? Is this a tax deduction scheme or are they taking kickbacks from Big Pharma?

DemReadingDU

(16,000 posts)7/7/15 Ian Welsh: Where Greece Should Go From Here

Let’s cut the crap. Merkel has come back and said that Germany will not allow debt reduction and insists on austerity—and harsh austerity, worse than the last offer. She is backed by most of EU members and the European Central Bank, which has put the screws into Greece so hard that imports are piling up on docks because Greece can’t pay for them.

ENOUGH.

Syriza needs to get its act together. The Euro is a stupid idea, and it always was. It cannot work absent central fiscal policy (aka. national governments reduced to de-facto provinces). It does not allow governments the ability to devalue their currency when they need to increase exports, to print money and so on.

It cannot work. It never could, as designed. It was always a stupid idea. (And yes, I opposed it from the beginning.)

Oh, it could be fudged. They could forgive Greece’s debt (but then would have to expect to forgive a bunch of other countries some of their debt), and money could be funneled to Greece in various ways and so on. But that can’t be done because of neo-liberal doctrine, which insists that debts are sacred and that creditors must never lose money, which is ludicrous and a direct violation of how capitalism works. People who make bad loans MUST lose their money. Without that, it isn’t capitalism and the virtues of capitalism don’t work.

This is not in question. This distribution of money to people who know how to make a profit and not lose it (and thus make “Productive” use of it), is about three-quarters of the pragmatic argument for capitalism.

Austerity is beyond stupid: in order to fix the economy you reduce gross expenditures and expect that tax incomes will increase faster than deficits and the economy will grow as a result. It is so dribblingly inane on its own merits that anyone who believes it either hasn’t spent three second thinking, is an ideologue incapable of thought, or is on the take, expecting that the benefits of austerity will flow to them.

The Euro is moronic as implemented. Austerity does not do what it is sold to do. And neo-liberalism does only one thing more effectively than forms of capitalism which actually work: it transfers money to the rich faster.

Syriza needs to leave the Euro. They are not going to get a good deal, or even a mediocre deal from Europe. They will be better off leaving the Euro. If they do so, they should simply repudiate all debts.

Yes, all of them. Once they leave the Euro, Europe and the neo-liberal order will go all out to crush them. It does not matter what they do, they will be target number one.

They should then cut a deal with Russia for oil and a pipeline, and align solidly with Russia and China, asking for aid from those two countries.

They should cease any attempts to stop refugees from flooding out of Greece into the rest of Europe. Heck, put them on buses and ship them to the border.

They should nationalize the distribution of food grown in Greece. Greece grows enough food: just start delivering it to every household. Saddam did this effectively, Greece can too.

That takes care of oil and food (Greece has plenty of refinery capacity.)

Medicine is the next issue: Greece will have to arrange to get the meds it needs thru Russia and China.

much more, it's a long rant, interesting comments too

http://www.ianwelsh.net/where-greece-should-go-from-here/

Demeter

(85,373 posts)STOLEN FROM mother earth:

MattSh

(3,714 posts)Syriza needs to get its act together.

Know you they remind me of? Yanukovich. Both have/had very clear choices, and both are/were sitting around with their thumbs up their asses while trying to play off both sides against each other. The choice now is choose an alternative, or submit. Failing to choose an alternative is choosing to submit. Simple as that.

Demeter

(85,373 posts)and a great ally, like maybe Russia, or Russia and China together, if you're really feeling alone.

The US didn't go alone...they courted England's rivals: Spain and France; and took in help wherever it came from: like Poland (Tadeusz Kościuszko, Casimir Pulaski) France (Lafayette) even the Hessians, released as prisoners of war to marry American farmers' daughters and actually own land for the first time in their history...

"Commitment!" --John Adams

Demeter

(85,373 posts)In Spain, only Vladmir Putin is more disapproved of than Angela Merkel. Such is the level of polarization that Germany's chancellor has created in Europe that, as WSJ reports, even domestically she is being deriled for saddling Greeks with "soup kicthens upon soup kitchens." As Marcel Fratzscher, head of the German Institute for Economic Research, a leading Berlin think tank notes, "Germany has, at the end of the day, helped determine most of the European decisions of the last five years," and therefore, "what is happening now is a defeat for Germany, especially, far more than for any other country."

"Disapproved"

As The Wall Street Journal reports,

On Friday, Spanish antiausterity leader Pablo Iglesias urged his countrymen: “We don’t want to be a German colony.” On Sunday, after Greece’s result became clear, Italian populist Beppe Grillo said, “Now Merkel and bankers will have food for thought.” On Monday, Ms. Merkel flew to Paris for crisis talks amid signs the French government was resisting Berlin’s hard line on Greece.

“What is happening now is a defeat for Germany, especially, far more than for any other country,” said Marcel Fratzscher, head of the German Institute for Economic Research, a leading Berlin think tank. “Germany has, at the end of the day, helped determine most of the European decisions of the last five years.”

...

In Greece last week, it was the stern face of 72-year-old German Finance Minister Wolfgang Schäuble that appeared on some of the posters urging voters to reject Europe’s bailout offer. “He’s been sucking your blood for five years—now tell him NO,” the posters said.

“They want to humiliate Greece to send a warning to Spain, Portugal and Italy,” Hilario Montero, a pensioner at a pro-Greece demonstration in Madrid recently, said of Berlin and Brussels. “The message is you are not allowed to cross the lines they set.”

And she is left stuck between a rock and hard place...

That is why Europe’s current showdown with Greece is critical for the future of Germany’s place in Europe, analysts say.

If Ms. Merkel approves a new lifeline for Athens after weeks of vitriolic debate, she is likely to face a furor from Germany’s right and stoke the country’s incipient euroskeptic movement.

If Greece careens out of the euro, Ms. Merkel will face blame for an episode that has further polarized Europe at a time when controversies over the U.K.’s EU membership and how to treat migrants and refugees are adding to the tensions wrought by the Ukraine crisis.

Claudia Major, a security specialist at the German Institute for International and Security Affairs, said: “If Greece were to leave the eurozone, this may someday be seen as the beginning of the end of the project of European integration—when the Germans were not in the position, as the leading power in shaping Europe, to be able to resolve things with the Greeks.”

* * *

As they conclude...

The pushback against German power in Europe is likely to grow if the eurozone crisis worsens or if Berlin’s policies grow more assertive.

Demeter

(85,373 posts)JPMORGAN, FOR ALL YOUR BANKSTER NEEDS--IS THERE NO CRIME THEY WILL NOT COMMIT? IT MAKES THE "SUICIDING: OF THEIR LIFE-INSURED EMPLOYEES LOOK MORE AND MORE LIKE PART OF THEIR OVERALL BUSINESS PLAN...

http://www.reuters.com/article/2015/07/08/us-jpmorgan-credit-debt-settlement-idUSKCN0PI00520150708

JPMorgan Chase & Co has agreed to pay at least $125 million to settle probes by U.S. state and federal authorities that the bank sought to improperly collect and sell consumer credit card debt, according to people familiar with the matter. The settlement also includes about $50 million in restitution, the sources said...The U.S. Consumer Financial Protection Bureau (CFPB), 47 states and the District of Columbia are expected to announce the settlements as soon as Wednesday, the people said. The states will split some $95 million, while the CFPB will get $30 million, the people said. JPMorgan Chase and the CFPB did not return calls for comment...

Mississippi and California are not expected to settle at the same time, sources said. Both have lawsuits pending against JPMorgan over debt collection practices....California Attorney General Kamala Harris sued in 2013, claiming the bank engaged in fraudulent and unlawful debt collection practices against 100,000 California credit card borrowers over some three years. The state claims the bank flooded state courts with questionable lawsuits, filing thousands every month, including 469 such lawsuits in one day alone...Mississippi Attorney General Jim Hood's lawsuit filed a similar lawsuit against JPMorgan in 2013. The Mississippi lawsuit said employees described a "chaotic" and "disorganized" workplace marred by "rampant" mistakes, inadequate training, constantly changing policies, high turnover and unrealistic quotas. Rachael Ring, a spokeswoman for the Mississippi attorney general, would only say the lawsuit is pending.

...The nation's largest bank has been accused of relying on robo-signing and other discredited methods of going after consumers for debts they may not have owed and for providing inaccurate information to debt buyers. Robo-signing refers to signing documents in mass quantities without reviewing records...

In September 2013, the U.S. Consumer Financial Protection Bureau ordered JPMorgan to refund $309 million to about 2 million customers for illegal credit card practices, including charging consumers for credit card monitoring services they did not receive. The Office of the Comptroller of the Currency that month also issued a consent order against JPMorgan after identifying unsound practices in connection with the bank's sworn document and collections litigation. The order demanded changes, including to debt sales. At the time, JPMorgan said collection issues affected less than 1 percent of customers and that it stopped filing collection lawsuits in 2011 and stopped enrolling customers in credit monitoring services in 2012.

In 2012, Iowa's Attorney General Miller helped negotiate a $26 billion settlement with the nation's largest banks over mortgage abuses, which also included robo-signing.

Demeter

(85,373 posts)What exactly does it mean for a big Wall Street bank to plead guilty to a serious crime? Right now, practically nothing. But it will if California’s Santa Cruz County has any say.

First, some background: Five giant banks – including Wall Street behemoths JPMorgan Chase and Citicorp – recently pleaded guilty to criminal felony charges that they rigged the world’s foreign-currency market for their own profit. This wasn’t a small heist. We’re talking hundreds of billions of dollars worth of transactions every day. The banks altered currency prices long enough for the banks to make winning bets before the prices snapped back to what they should have been. Attorney General Loretta Lynch called it a “brazen display of collusion” that harmed “countless consumers, investors and institutions around the globe — from pension funds to major corporations, and including the banks’ own customers.”

The penalty? The banks have agreed to pay $5.5 billion. That may sound like a big chunk of change, but for a giant bank it’s the cost of doing business. In fact, the banks are likely to deduct the fines from their taxes as business costs. The banks sound contrite. After all, they can’t have the public believe they’re outright crooks. It’s “an embarrassment to our firm, and stands in stark contrast to Citi’s values,“ says Citigroup CEO Michael Corbat. Values? Citigroup’s main value is to make as much money as possible. Corbat himself raked in $13 million last year. JPMorgan CEO Jamie Dimon calls it "a great disappointment to us,” and says “we demand and expect better of our people.” Expect better? If recent history is any guide – think of the bank’s notorious “London Whale” a few years ago, and, before that, the wild bets leading to the 2008 bailout – JPMorgan expects exactly this kind of behavior from its people. Which helped Dimon rake in $20 million last year, as well as a $7.4 million cash bonus.

When real people plead guilty to felonies, they go to jail. But big banks aren’t people despite what the five Republican appointees to the Supreme Court say. The executives who run these banks aren’t going to jail, either. Apologists say it’s not fair to jail bank executives because they don’t know what their rogue traders are up to. Yet ex-convicts often suffer consequences beyond jail terms. In many states they lose their right to vote. They can’t run for office or otherwise participate in the political process. So why not take away the right of these convicted banks to participate in the political process, at least for some years? That would stop JPMorgan’s Dimon from lobbying Congress to roll back the Dodd-Frank act, as he’s been doing almost non-stop. Why not also take away their right to pour money into politics? Wall Street banks have been among the biggest contributors to political campaigns. If they’re convicted of a felony, they should be barred from making any political contributions for at least ten years.

Real ex-convicts also have difficulty finding jobs. That’s because, rightly or wrongly, many people don’t want to hire them. A strong case can be made that employers shouldn’t pay attention to criminal convictions of real people who need a fresh start, especially a job. But giant banks that have committed felonies are something different. Why shouldn’t depositors and investors consider their past convictions? Which brings us to Santa Cruz County.

The county’s board of supervisors just voted not to do business for five years with any of the five banks felons. The county won’t use the banks’ investment services or buy their commercial paper, and will pull its money out of the banks to the extent it can. “We have a sacred obligation to protect the public’s tax dollars and these banks can’t be trusted. Santa Cruz County should not be involved with those who rigged the world’s biggest financial markets,” says supervisor Ryan Coonerty. The banks will hardly notice. Santa Cruz County’s portfolio is valued at about $650 million. But what if every county, city, and state in America followed Santa Cruz County’s example, and held the big banks accountable for their felonies? What if all of us taxpayers said, in effect, we’re not going to hire these convicted felons to handle our public finances? We don’t trust them. That would hit these banks directly. They’d lose our business. Which might even cause them to clean up their acts. There’s hope. Supervisor Coonerty says he’ll be contacting other local jurisdictions across the country, urging them to do what Santa Cruz County is doing.

Robert B. Reich has served in three national administrations, most recently as secretary of labor under President Bill Clinton. He also served on President Obama's transition advisory board. His latest book is "Aftershock: The Next Economy and America's Future." His homepage is www.robertreich.org.

Demeter

(85,373 posts)The voters said "no" to a campaign of bullying and intimidation...When Greek voters stood up to a campaign of bullying and intimidation by voting "no" to the new round of creditor demands, they were striking a blow both for democracy and for Europe, Paul Krugman writes in today's column. "Even the most ardent supporters of European union should be breathing a sigh of relief," Krugman says....

YOU CAN READ KRUGMAN'S ORIGINAL COLUMN AT: http://www.nytimes.com/2015/07/06/opinion/paul-krugman-ending-greeces-bleeding.html?action=click&pgtype=Homepage&module=opinion-c-col-left-region®ion=opinion-c-col-left-region&WT.nav=opinion-c-col-left-region&_r=0

EXCERPT BELOW:

Europe dodged a bullet on Sunday. Confounding many predictions, Greek voters strongly supported their government’s rejection of creditor demands. And even the most ardent supporters of European union should be breathing a sigh of relief.

Of course, that’s not the way the creditors would have you see it. Their story, echoed by many in the business press, is that the failure of their attempt to bully Greece into acquiescence was a triumph of irrationality and irresponsibility over sound technocratic advice.

But the campaign of bullying — the attempt to terrify Greeks by cutting off bank financing and threatening general chaos, all with the almost open goal of pushing the current leftist government out of office — was a shameful moment in a Europe that claims to believe in democratic principles. It would have set a terrible precedent if that campaign had succeeded, even if the creditors were making sense.

What’s more, they weren’t. The truth is that Europe’s self-styled technocrats are like medieval doctors who insisted on bleeding their patients — and when their treatment made the patients sicker, demanded even more bleeding. A “yes” vote in Greece would have condemned the country to years more of suffering under policies that haven’t worked and in fact, given the arithmetic, can’t work: austerity probably shrinks the economy faster than it reduces debt, so that all the suffering serves no purpose. The landslide victory of the “no” side offers at least a chance for an escape from this trap...

Demeter

(85,373 posts)President Obama is said to be considering an executive order requiring federal contractors to disclose their political spending. He should sign it immediately. But he should go further and ban all political spending by federal contractors that receive more than half their revenues from government. Ever since the Supreme Court’s shameful Citizens United decision, big corporations have been funneling large amounts of cash into American politics, often secretly. Bad enough. But when big government contractors do the funneling, American taxpayers foot the bill twice over: We pay their lobbying and campaign expenses. And when those efforts nab another contract, we pay for stuff we often don’t need.This is especially true for defense contractors – the biggest federal contractors of all.

A study by St. Louis University political scientist Christopher Witko reveals a direct relationship between what a corporation spends on campaign contributions and the amount it receives back in government contracts. A case in point is America’s largest contractor – Lockheed Martin. More than 80 percent of Lockheed’s revenues come from the U.S. government, mostly from the Defense Department. Yet it’s hard to say Lockheed has given American taxpayers a good deal for our money. For example, Lockheed is the main contractor for the F-35 Joint Strike Fighter – the single most expensive weapons program in history, and also one of the worst. It’s been plagued by so many engine failures and software glitches that Lockheed and its subcontractors practically had to start over this year.

Why do we keep throwing good money after bad? Follow the money behind the money. According to the Center for Responsive Politics, Lockheed’s Political Action Committee spent over $4 million on the 2014 election cycle, and has already donated over $1 million to candidates for 2016. The top congressional recipient of Lockheed’s largesse is Mac Thornberry (R-Texas), Chairman of the House Armed Services committee. Second-highest is Rodney Frelinghuysen (R-New Jersey), Chair of the Defense Subcommittee of the House Appropriations Committee. Third is Kay Granger, the Subcommittee’s Vice-Chair. Lockheed also maintains a squadron of Washington lawyers and lobbyists dedicated to keeping and getting even more federal contracts. The firm spent over $14 million lobbying Congress last year. Remarkably, 73 out of Lockheed’s 109 lobbyists are former Pentagon officials, congressional staffers, White House aides, and former members of Congress.

You and I and other taxpayers shouldn’t have to pay Lockheed’s lobbying expenses, but these costs are built into the overhead Lockheed charges the government in its federal contracts. And we shouldn’t foot the bill for Lockheed’s campaign contributions, but these are also covered in the overhead the firm charges – including the salaries of executives expected to donate to Lockheed’s Political Action Committee. The ten largest federal contractors are all defense contractors, and we’re indirectly paying all of them to lobby Congress and buy off politicians. To state it another way, we’re paying them to hire former government officials to lobby current government officials, and we’re also paying them to bribe current politicians – all in order to keep or get fat government contracts that often turn out to be lousy deals for us.

Fifty six years ago, President Dwight Eisenhower warned of the dangers of an unbridled “military-industrial complex,” as he called it. Now it’s a military-industrial-congressional complex. After Citizens United, it’s less bridled than ever. That’s why President Obama shouldn’t stop with an executive order requiring government contractors to disclose their political contributions. He should ban all political activities by corporations getting more than half their revenues from the federal government. That includes Lockheed and every other big defense contractor.

Demeter

(85,373 posts)"It is clear that American citizens are the target of choice of international terrorists. Americans comprise only about 5 percent of the world's population. However, according to State Department statistics, during the decade of the 1990's, 36 percent of all worldwide terrorist acts were directed against U.S. interests." - Attorney General John Ashcroft, 05/09/01

"Quite an experience to live in fear, isn't it. That's what it is to be a slave." - Blade Runner (1982) - Director: Ridley Scott

"There will be no Homeland Security until we realize that the entire planet is our homeland. Every sentient being in the world must feel secure." - John Perkins

Demeter

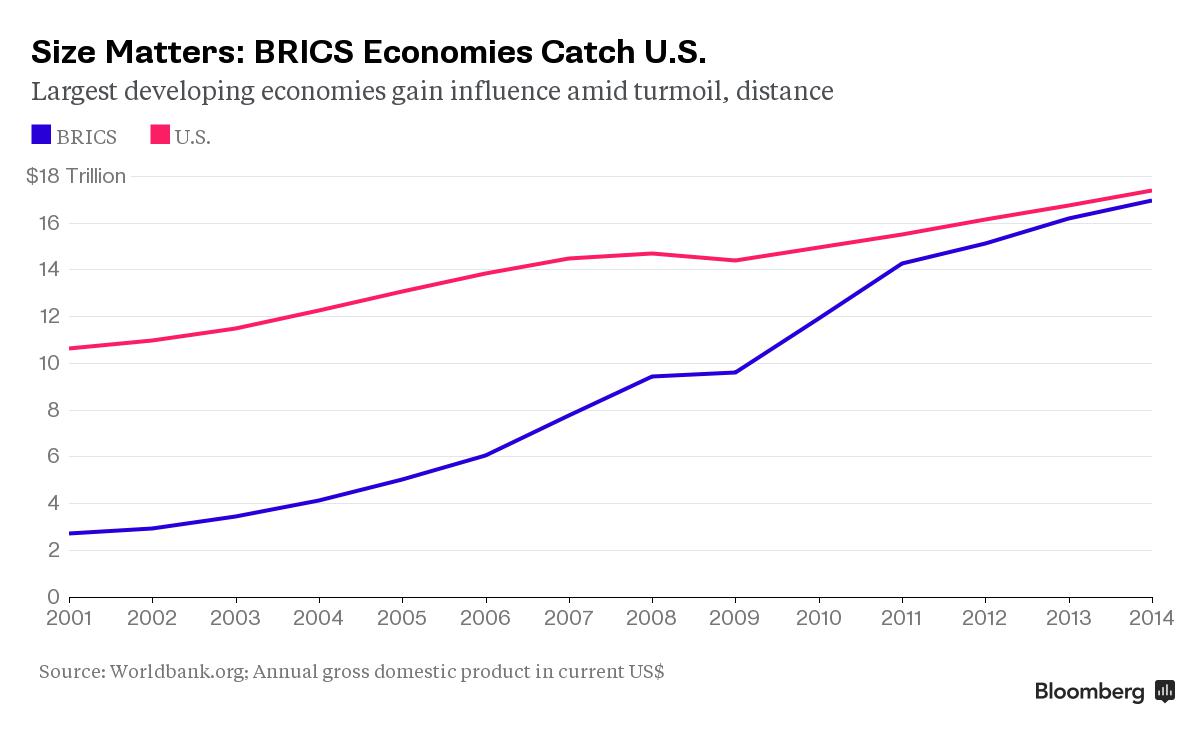

(85,373 posts)Leaders of the so-called BRICS countries are meeting starting Wednesday in Ufa, Russia. Here's what you need to know about these emerging market economies to follow the summit.

1. The BRICS economies are getting very big

The combined economic output last year of Brazil, Russia, India, China and South Africa almost matched the U.S.’s gross domestic product. Back in 2007, the U.S. economy was double the BRICS.

"Despite some disappointments in some of the BRIC economies, led by China and India, their collective weight in global GDP continues to rise and therefore also does their importance," said Jim O’Neill, the former Goldman Sachs Group Inc. chief economist who coined the acronym back in 2001, without South Africa.

2. China wants a bigger stage

For Chinese President Xi Jinping, who has been particularly active in developing ways for his nation and BRICS peers to be more influential, the meeting is a chance to garner support for China's increased role on the world stage.

"Western countries often take a 'with us or against us' attitude to China, but China is neither with nor against western powers," said Zhu Jiejin, a researcher with the Center for BRICS Studies in Fudan University in Shanghai. "China accepts the existing framework while trying to make changes to it. It will be better for China to seek these changes together with India, Russia, Brazil and South Africa than going it alone."

We're already seeing the fruits of closer ties: India and Russia signed up as the next two biggest contributors to the China-led Asian Infrastructure Investment Bank among the 57 member-nations. The U.S. and Japan are absent from the ranks in what’s seen as a rival to the IMF and World Bank.

Additional glue for the BRICS leaders is a $100 billion currency-exchange reserve program discussed at last year’s summit. Then there's the planned BRICS bank, which will be a big part of the agenda this year, along with China's "One Belt One Road" strategy and ways to deepen economic links.

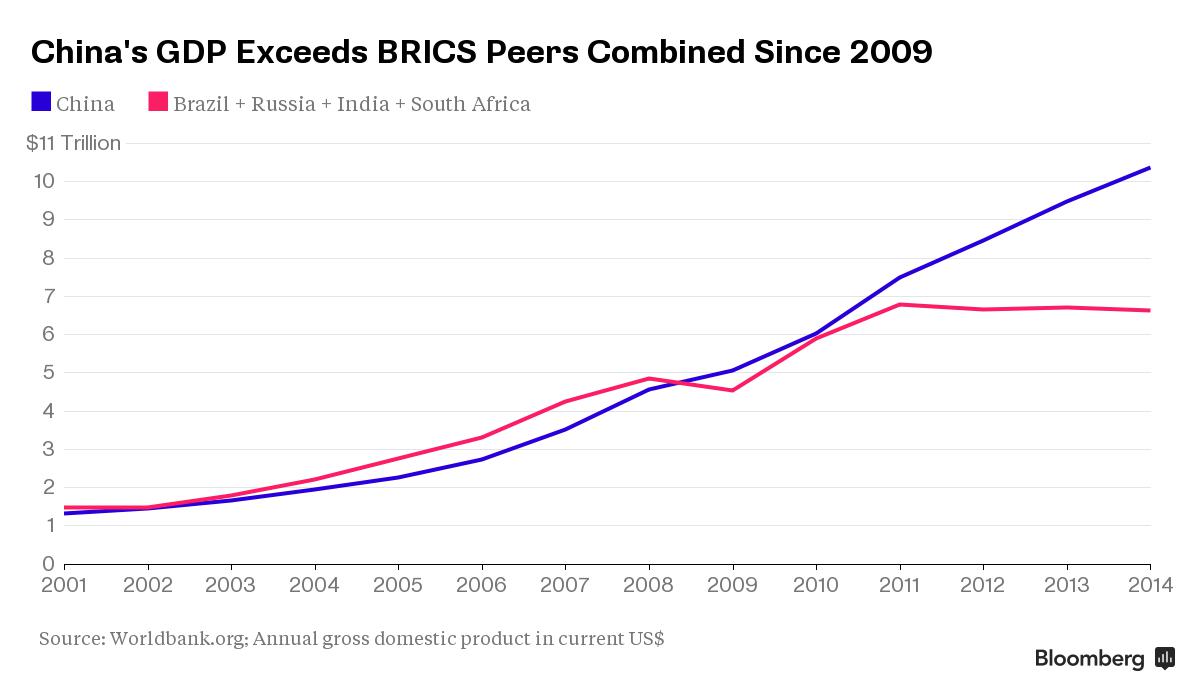

3. But not all have fared as well as China

Since the first official leaders' summit in 2009, China has been the clear breakout economy, with its GDP jumping from about equal to its four peers combined to more than 50 percent larger.

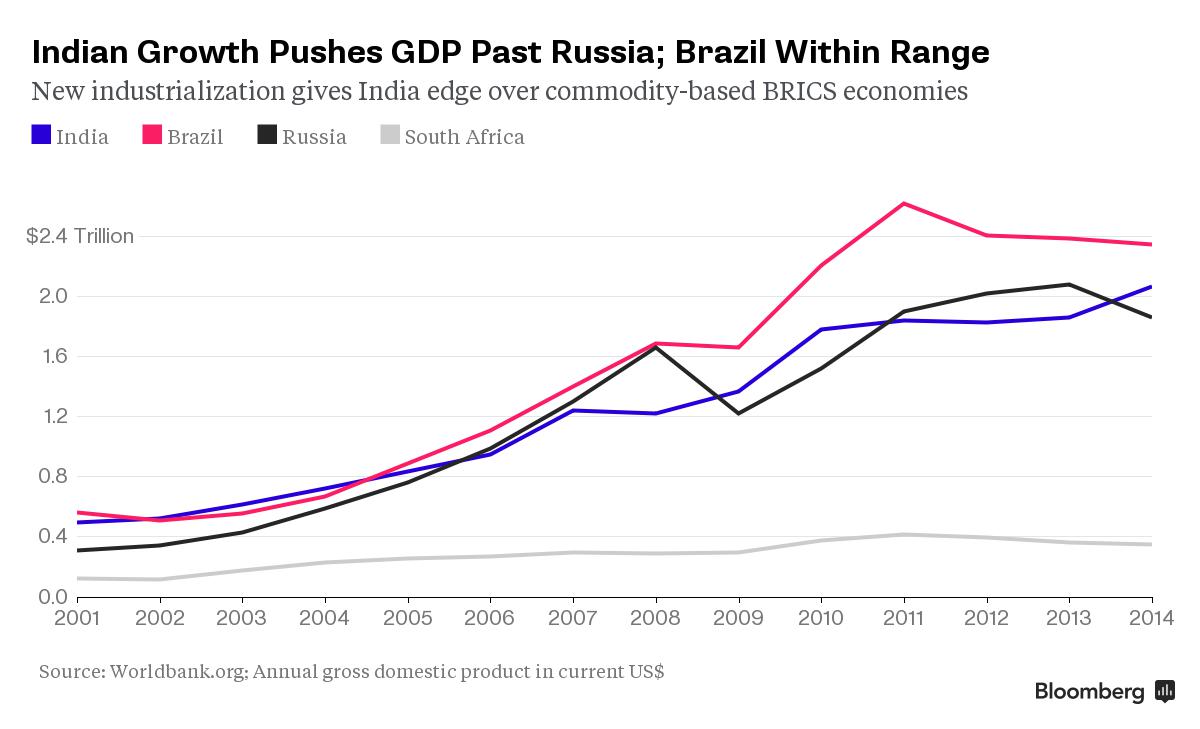

Russia and Brazil, stars in the early BRIC days, have lost their luster more recently as sliding commodity prices and political stresses cloud their outlooks. By contrast, Indian Prime Minister Narendra Modi comes to the summit with his economy in high gear, having eclipsed Russia's and closing in on Brazil’s.

"While China and India are doing relatively better in economic development, it doesn't mean China and India will reduce the voice of the other three members in the group," said Zhu. "The birth mark of BRICS is equality among members."

Demeter

(85,373 posts)After failing to criminally prosecute any of the financial firms responsible for the market collapse in 2008, former Attorney General Eric Holder is returning to Covington & Burling, a corporate law firm known for serving Wall Street clients.

The move completes one of the more troubling trips through the revolving door for a cabinet secretary. Holder worked at Covington from 2001 right up to being sworn in as attorney general in Feburary 2009. And Covington literally kept an office empty for him, awaiting his return.

The Covington & Burling client list has included four of the largest banks, including Bank of America, Citigroup, JPMorgan Chase and Wells Fargo. Lobbying records show that Wells Fargo is still a client of Covington. Covington recently represented Citigroup over a civil lawsuit relating to the bank’s role in Libor manipulation.

Covington was also deeply involved with a company known as MERS, which was later responsible for falsifying mortgage documents on an industrial scale. “Court records show that Covington, in the late 1990s, provided legal opinion letters needed to create MERS on behalf of Fannie Mae, Freddie Mac, Bank of America, JPMorgan Chase and several other large banks,” according to an investigation by Reuters.

The Department of Justice under Holder not only failed to pursue criminal prosecutions of the banks responsible for the mortage meltdown, but in fact de-prioritized investigations of mortgage fraud, making it the “lowest-ranked criminal threat,” according to an inspector general report....

BUT WAIT! THERE'S MORE! THE STENCH IS APPALLING

Demeter

(85,373 posts)http://johnhelmer.net/?p=13712

A putsch in Athens to save allied Greece from enemy Russia is in preparation by the US and Germany, with backing from the non-taxpayers of Greece – the Greek oligarchs, Anglo-Greek shipowners, and the Greek Church. At the highest and lowest level of Greek government, and from Thessaloniki to Milvorni, all Greeks understand what is happening. Yesterday they voted overwhelmingly to resist. According to a high political figure in Athens, a 40-year veteran, “what is actually happening is a slow process of regime change.”

Until Sunday afternoon it was a close-run thing. The Yes and No votes were equally balanced, and the margin between them razor thin. At the start of the morning, Rupert Murdoch’s London Times claimed “Greek security forces have drawn up a secret plan to deploy the army alongside special riot police to contain possible civil unrest after today’s referendum on the country’s future in Europe. Codenamed Nemesis, it makes provision for troops to patrol large cities if there is widespread and prolonged public disorder. Details of the plan emerged as polls showed the ‘yes’ and ‘no’ camps neck and neck.” Greek officers don’t speak to the Murdoch press; British and US government agents do.

“It was neck to neck until 3 pm,” reports the political veteran in Athens, “then the young started voting. “

Can the outcome — the 61% to 39% referendum vote, with a 22% margin for ??? (No) which the New York Times calls “shocking” and a “victory [that] settled little” – defeat Operation Nemesis? Will the new Axis – the Americans and the Germans – attack again, as the Germans did after the first Greek ??? of October 28, 1940, defeated the Italian invasion?

The Kremlin understands too. So when the State Department’s Victoria Nuland (nee Nudelman; lead image, right) visited Athens to issue an ultimatum against breaking the anti-Russian sanctions regime, and the Anglo-American think-tanks followed with warnings the Russian Navy is about to sail into Piraeus, the object of the game has been clear. The line for Operation Nemesis has been that Greece must be saved, not from itself or from its creditors, but from the enemy in Moscow. The Russian line has been to do nothing to give credence to that propaganda; to wait and to watch...MORE

http://www.informationclearinghouse.info/article42318.htm

With a resounding “OXI” = “No” – with 61% the Greek rejected the troika imposed austerity. They joined a majority of economists worldwide, including from the IMF, who also know that austerity doesn’t help recovery – and certainly doesn’t wipe out debt, the noose around a country’s neck. But – what does the decisive no-vote mean for the close to 39% yes-voters? Do they want more of austerity? – Hardly. Or were they manipulated with fear-mongering by the mostly privately owned western media, which also dominate Greece? – Blackmailed by the threats of Brussels? - Were they afraid of what’s next? – Western presstitute media propaganda for a “yes” vote, spiked with fear, threats and purposeful confusion was horrendous.

One of the big misunderstandings among Greek ‘yes’ voters was the uncertainty whether with a ‘no’ Greece could be expelled from Europe. This is simply not possible. Greece is in Europe and stays in Europe, geographically and spiritually. Expulsion from the EU and even the Eurozone is totally illegal. There is no provision in the EU charter – absolutely none – that would allow the European Commission to force-exit a country in ‘arrears’.

Michael Nevradakis, journalist and Fulbright Scholar, says “we Greeks voted “No” to slavery but “Yes” to our chains."

In the meantime the level of Brussels shrewdness has risen a few inches. The Junker’s and Co. of this insane world – the man who has been leading Luxembourg as an international tax haven for the elite and now is leading the EU like his own casino fiefdom – corrupt and abusive to the core – he has the audacity to ask for Yianis Varoufakis, the Minister of Finance’s resignation. And what’s even worse – he and his minions got it...

MORE GOSSIP, SPECULATION AND ADVICE AT LINK FROM

Peter Koenig is an economist and geopolitical analyst. He is also a former World Bank staff and worked extensively around the world in the fields of environment and water resources. He is the author of Implosion – An Economic Thriller about War, Environmental Destruction and Corporate Greed – fiction based on facts and on 30 years of World Bank experience around the globe. He is also a co-author of The World Order and Revolution – Essays from the Resistance.

EU Tells Tsipras the Party’s Over as Euro Exit Door Swings Open

http://www.bloomberg.com/news/articles/2015-07-08/eu-tells-tsipras-the-party-s-over-as-euro-exit-door-swings-open

After five months of drama, false dawns and unpleasant surprises, Europe’s leaders are finally ready to show Alexis Tsipras the exit.

Behind the doors of the Justus Lipsius building in the heart of the political district in Brussels, the euro-region’s leaders rounded on the Greek prime minister for destabilizing the currency union before Germany’s Angela Merkel emerged to deliver an official ultimatum.

In a tense and at times emotional meeting, Tsipras’s European peers told him he’d failed to appreciate the efforts the continent’s voters and taxpayers had made to help the Greek people and blamed him for escalating tensions across the region. Six officials agreed to share their knowledge of the private talks while asking not to be named because of the sensitivity of the historical moment.

“Party time at the expense of others in Greece has come to an end,” Lithuanian President Dalia Grybauskaite said. “Europe and the euro area are surely unprepared to pay for the irresponsible behavior of the new Greek government.”

Afterward in public comments, the leaders competed to find the harshest language to describe Tsipras’s approach and its likely consequences. Dutch Prime Minister Mark Rutte said a “miracle” would be needed to keep Greece in the euro-region, while Malta’s Joseph Muscat said the 40-year-old had created an “enormous trust-gap” with his European counterparts.

“We have a Grexit scenario prepared in detail,” European Commission President Jean-Claude Juncker said, using the shorthand for expulsion from the now 19-nation currency area...MORE

WHAT THE HELL--BREAK ANOTHER EU RULE, WHY DON'T YOU? CONSISTENCY IS THE HOBGOBLIN OF LITTLE MINDS, AFTER ALL...

PRESS CONFERENCE VIDEO AT LINK

http://www.bloomberg.com/news/articles/2015-07-07/greece-must-meet-sunday-deadline-to-reform-or-face-euro-exit

European leaders set a Sunday deadline for Greece to accept a rescue, saying otherwise they’ll take the unprecedented step of propelling the country out of the euro.

At a Brussels summit, Greece’s anti-austerity government was ordered to make new economic reform proposals that could earn it another aid package and head off financial ruin.

“We have only a few days left to find a solution,” German Chancellor Angela Merkel told reporters late Tuesday after euro-area leaders met in Brussels. She conceded that she is “not especially optimistic.”

Sunday now looms as the climax of a five-year battle to contain Greece’s debts, potentially splintering a currency that was meant to be unbreakable and throwing more than half a century of European economic and political integration into reverse....MORE

THESE EUROCLOWNS HAVE JUST SHOT THEMSELVES IN THE FOOT, THROWING OUT THE BABY WITH THE BATHWATER, OR RATHER, THE EUROZONE WITH GREECE....IT WILL BE A WHOLE NEW WORLD COME DECEMBER. JUST IN TIME FOR THE US ELECTIONS OVERTHROWING THE BANKSTERS AND THEIR PUPPETS...

GERMANY CANNOT UNDERSTAND THAT IF THEY WANT TO BE LIKE THE USA, THEY WILL HAVE TO PLAY THE PART OF THE BLUE STATES...SENDING MORE MONEY TO THE FEDS (OTHER PARTS OF EUROPE) THAN THEY GET BACK, TO SUBSIDIZE THE RED STATES...OR STATES IN THE RED.

Demeter

(85,373 posts)LOOKS LIKE THE CHAINS ARE GOING, GREECE...IT'S ALL GOOD, THOUGH

http://www.opednews.com/articles/GREECE-D-We-Voted-No-to-by-Greg-Palast-Austerity_Euro_European-Union_European-Union-150706-62.html

...

Before we explain how the euro is the cause of this horror show, let's clear up one thing right away. All week, worldwide media was filled with news of the Greek "crisis." Yes, the economy stinks, with one in four Greeks unemployed. But two other euro nations, Spain and Cyprus, also are suffering this depression level of unemployment. Indeed, more than 11% of workers in seven euro nations, including Portugal and Italy, are out of work.

- Advertisement -

But unlike Greece, these other suffering nations have quietly acquiesced to their "austerity" punishments. Spaniards now accept that they are fated forevermore to be low-paid servants to beer-barfing British tourists. Spanish prime minister Mariano Rajoy, who has enacted a draconian protest ban at home to keep his own suffering masses at bay, has joined in the jackal-pack rejecting anything but the harshest of austerity terms for Greece.

The difference between these quiescent nations and Greece is that the Greeks won't take it anymore.

What the media call the Greek "crisis" is, in fact, resistance. ...

MUCH MORE

Demeter

(85,373 posts)“Those whom the gods wish to destroy they first make mad” goes a quote wrongly attributed to Euripides. It seems to describe the current state of affairs with regard to the unfolding Greek imbroglio. It is a Greek tragedy all right: we have the various Eurocrats—elected, unelected, and soon-to-be-unelected—stumbling about the stage spewing forth fanciful nonsense, and we have the choir of the Greek electorate loudly announcing to the world what fanciful nonsense this is by means of a referendum.

As most of you probably know, Greece is saddled with more debt than it can possibly hope to ever repay. Documents recently released by the International Monetary Fund conceded this point. A lot of this bad debt was incurred in order to pay back German and French banks for previous bad debt. The debt was bad to begin with, because it was made based on very faulty projections of Greece's potential for economic growth. The lenders behaved irresponsibly in offering the loans in the first place, and they deserve to lose their money. However, Greece's creditors refuse to consider declaring all of this bad debt null and void—not because of anything having to do with Greece, which is small enough to be forgiven much of its bad debt without causing major damage, but because of Spain, Italy and others, which, if similarly forgiven, would blow up the finances of the entire European Union. Thus, it is rather obvious that Greece is being punished to keep other countries in line.

Collective punishment of a country—in the form of extracting payments for onerous debt incurred under false pretenses—is bad enough; but collective punishment of one country to have it serve as a warning to others is beyond the pale. Add to this a double-helping of double standards. The IMF won't lend to Greece because it requires some assurance of repayment; but it will continue to lend to the Ukraine, which is in default and collapsing rapidly, without any such assurances because, you see, the decision is a political one. The European Central Bank no longer accepts Greek bonds as collateral because, you see, it considers them to be junk; but it will continue to suck in all sorts of other financial garbage and use it to spew forth Euros without comment, keeping other European countries on financial life support simply because they aren't Greece. The German government insists on Greek repayment, considering this stance to be highly moral, ignoring the fact that Germany is the defaultiest country in all of Europe. If Germany were not repeatedly forgiven its debt it would be much poorer, and in much worse shape, than Greece. The brazen hypocrisy of all this cannot but have a destabilizing effect on Europe's politics, with the political center cratering and being replaced with radical left-right coalitions. Note how quickly France's right-wing presidential front-runner Marine Le Pen applauded the result of the Greek referendum organized by Greece's left-wing government. The disgust with officialdom that pervades the European Union is beginning to transcend political boundaries, making for strange bedfellows...In the end, finance—at any level—has to be about rules and numbers, or it becomes about nonsense. Break enough of your own rules, and your money turns to garbage, because in a world where money is debt and debt is garbage, money is garbage. But there is a proven method for solving this problem and moving on: it's called national bankruptcy. Greece is bankrupt; if its resolution brings on the bankruptcy of Spain, Italy and others, and if that in turn bankrupts the entire Eurozone, then that's exactly what must happen...

Dmitry Orlov is a Russian-American engineer and a writer on subjects related to "potential economic, ecological and political decline and collapse in the United States," something he has called “permanent crisis”. http://cluborlov.blogspot.com

Punx

(446 posts)Death and destruction follows. People die!

If Nuland and her hubby are meddling in Greece you can bet on it. I warned a Romanian friend of mine who has a relative in an important foreign service position in the Romanian government, to tell him watch out as he was sent there when all of the Ukraine crap was starting.

Demeter

(85,373 posts)Greece is white, it is European, and therefore eyes of entire Western “progressive” world are now directed towards Athens: will its government dare to default, would Greece leave euro-zone and eventually the European Union? As if the answer to this question could change the world; as if Athens is where the fate of humanity will be decided.

Some 10 thousand kilometers away, Ecuador is predominantly indigenous, and therefore, inhabited by ‘un-people’, to borrow from George Orwell’s colorful terminology. Battered by its own, mainly Euro-centric and pale-skinned ‘elites’ who are enjoying extremely close links with both EU and the United States, Ecuador and its determinedly left-wing government can count very little on international solidarity, especially on the camaraderie from ‘so-called progressive’ movements in the West. After all, non-white, non-Western people are expected to suffer. Even the left in the West is ‘accustomed to’ their agony. Frankly, almost nobody in Europe or in the United States wants those left wing governments in Latin America, in Asia or in Africa, to succeed. That is ‘well hidden secret’, or at least ‘an uncomfortable truth’! China, South Africa, Venezuela, Ecuador and other countries all over the world have been addressed and treated in the most despicable, patronizing, and even racist way by so-called left wing individuals and groups in the West...

...And so, while Greece votes on its financial future, Ecuador is facing one of the most vicious subversions in its history. It is facing it alone. It appears that everyone from non-Latin American left who matters is now in Athens. As far as I know, there are no solidarity ‘delegates’ descending on Quito! Ecuador has now been abandoned, not unlike Venezuela was, for already quite some time...

ANOTHER AUTHOR POSITS THAT ECUADOR IS UNDER ATTACK TO OVERTHROW THE CORREA GOVERNMENT TO EVICT JULIAN ASSANGE FROM ITS EMBASSY SO HE CAN BE ARRESTED...

MORE OBAMA CRIMINAL PETTINESS

Demeter

(85,373 posts)Not only is the level of civility down from 10 years ago, so is the level of information, and the principles of democracy are given short shrift.

I thought eventually an equilibrium would be reached again, but I guess I was wrong.

This is a nice little group of people in the classic DU mold, but it would be nice to feel secure in the greater DU.

See you tonight or definitely tomorrow! Have a good one!

Fuddnik

(8,846 posts)Low information isn't the problem, there's a willful ignorance and apologetic s at at work here. Things that would never be tolerated under another Republican administration are whitewashed, supported and praised in this one. Yes, I said another.

I learned yesterday that Ciovington and Burling was a poor little law firm that did nothing but do pro bono work for people on welfare. And Mary Jo White is a working class hero.

Hillary is, and has always been a flame-throwing liberal.

There's something in the water, so I'm sticking to beer.

Fuddnik

(8,846 posts)Bonus interview with encryption expert on govt. spying.

antigop

(12,778 posts)Full title that would not fit in the Reply title:

Obama in Retreat Thanks to Elizabeth Warren-Led Opposition to Plan to Appoint Another Corporate Stooge as SEC Commissioner

http://www.nakedcapitalism.com/2015/07/obama-in-retreat-thanks-to-elizabeth-warren-led-opposition-to-plan-to-appoint-another-corporate-stooge-as-sec-commissioner.html

But Obama appeared ready to restore status quo ante by virtue of having Aguilar’s term expire this year. That would allow him to install a more business-toadying replacement.

Sorry if this has been posted...I've been away.

I didn't realize the guy was from Covington and Burling, but I haven't been able to keep up lately.

Fuddnik

(8,846 posts)antigop

(12,778 posts)wordpix

(18,652 posts)geesh. Why doesn't he listen to Warren and Robert Reich?

Fuddnik

(8,846 posts)It wasn't all Mark Rudd and Bernadine Dohrn. There were the Pritzkers, et al.

A friend of mine was a delegate to the 2004 Dem Convention in Boston. She talked about all the parties and food and drinks flowing after hours. But they all came with a donation to whatever candidates and had a cash bar.

They went to one party, in a three story 4 star restaurant, that had all kinds of great food, and an open bar. Everything was free. When they asked who the party was for, they were told Barack Obama. They asked, who the hell is he? Nobody had ever heard of him.

That was BEFORE he delivered his attention grabbing keynote speech.

Somebody paid for all that.

Fuddnik

(8,846 posts)Microsoft Corp. announced plans Wednesday cut up to 7,800 positions and take a $7.6 billion write-down on its Nokia business amid efforts to restructure its struggling phone hardware business.

The technology company also said it would take a restructuring charge of $750 million to $850 million.

"We are moving from a strategy to grow a standalone phone business to a strategy to grow and create a vibrant Windows ecosystem including our first- party device family," CEO Satya Nadella wrote in an email to employees. "In the near-term, we'll run a more effective and focused phone portfolio while retaining capability for long-term reinvention in mobility."

The layoffs come a year after the Redmond-Wash., based software and hardware maker said it planned to let go roughly 18,000 employees.

http://www.nbcnews.com/business/business-news/microsoft-shed-7-800-jobs-mostly-phone-business-n388606

antigop

(12,778 posts)Punx

(446 posts)Just speculation on my part.

http://www.zerohedge.com/news/2015-07-08/what-first-world-cyber-war-looks-global-real-time-cyber-attack-map

Warpy

(111,267 posts)Last edited Wed Jul 8, 2015, 04:12 PM - Edit history (1)

Something very strange is going on and has the distinct smell of a cyber war.

ETA: DDOS attacks against St. Louis have been going on forever, mostly originating in China.