Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 4 June 2015

[font size=3]STOCK MARKET WATCH, Thursday, 4 June 2015[font color=black][/font]

SMW for 3 June 2015

AT THE CLOSING BELL ON 3 June 2015

[center][font color=green]

Dow Jones 18,076.27 +64.33 (0.36%)

S&P 500 2,114.07 +4.47 (0.21%)

Nasdaq 5,099.23 +22.71 (0.45%)

[font color=red]10 Year 2.36% +0.08 (3.51%)

30 Year 3.10% +0.07 (2.31%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Tansy_Gold

(17,862 posts)

Demeter

(85,373 posts)

Demeter

(85,373 posts)THE FIFA TEMPEST IN A TEAPOT---IS THERE A MORE USELESS ORGANIZATION?

FIFA WANTED TO BAN ISRAEL FOR SHOOTING TO CRIPPLE PALESTINIAN PLAYERS, SO THEY LOST ISRAEL. FIFA AWARDED 2018 TO RUSSIA, AND SO LOST THE EMPIRE--AKA AMERICAN HEGEMONY. THE REST OF THE WORLD DIDN'T MATTER....AND THE FBI COULDN'T BE BOTHERED TO INVESTIGATE CORRUPTION CLOSER TO HOME, SO HERE WE ARE! QATTAR IS JUST THE WINDOW-DRESSING.

http://www.theguardian.com/commentisfree/2015/may/31/fifa-corruption-crisis-global-monopoly

At the start of the global era it was assumed most countries would become more democratic, but the world’s elite are fairly happy with corruption and prepared to see it rise...You don’t have to get many belts in taekwondo to realise the most intense fighting is actually going on between men in blazers. Back in the 1980s there were only two rival international federations governing the Korean martial art. Today, as with Trotskyism, even more splinter groups have proliferated. Meanwhile in boxing there are at least four separate organisations that can dub you “world champion”.

So Fifa, before it descended into crisis, was that rare thing: a world sporting body with no refuseniks. Thanks to the largesse of its executive – recycling sponsorship money to small national associations that would remain loyal to the centre – it became the perfect global monopoly. It was, until last Wednesday, seemingly above national jurisdiction. Though headquartered in Geneva, Fifa – like globalisation itself – seemed really to be domiciled in a first-class cabin, 32,000ft above the earth.

Any mere government uppity enough to suggest it was corrupt, or overpowerful, could have its representatives threatened with expulsion. But it turns out Fifa is, after all, subject to national laws and it is possible – whatever the outcome of individual corruption allegations – that once applied, these laws will lead to its breakup. And if it falls apart, it will do so along the same faultlines that are tearing the global political order apart.

Russia’s immediate condemnation of the FBI’s swoop on Fifa set the tone. Perhaps, mused Vladimir Putin’s many fans on Twitter, the Russian secret police should now investigate Nato. When it came to the vote, on Friday, over Sepp Blatter’s leadership, it was done as a blatant piece of east-west geopolitics, with the emerging world lined up, much as it was in the cold war, between the different sides...

Demeter

(85,373 posts)...The criminal indictments announced on May 27 by US Attorney-General Loretta Lynch are focused for the most part on US evidence of US citizens conducting corrupt business on US territory. The Department of Justice release, detailing the 14 indictments and five guilty pleas and convictions, carries the qualifier: “The charges in the indictment are merely allegations, and the defendants are presumed innocent unless and until proven guilty.”

There is no reference in Lynch’s press conference, or in the Justice Department’s resume of the prosecution’s case, to the award of the World Cup to Russia, and no hint of a claim against Russians.

Lynch’s statement focuses on corruption in the marketing of broadcast, brand-name and other rights. “FIFA and the regional bodies under its umbrella make money, in part, by selling commercial rights to their soccer tournaments to sports marketing companies, often through multi-year contracts covering multiple editions of the tournaments. The sports marketing companies, in turn, sell those rights downstream to TV and radio broadcast networks, major corporate sponsors and other entities for significant sums of money.” The accused names, according to Lynch, “used their positions of trust within their respective organizations to solicit bribes from sports marketers in exchange for the commercial rights to their soccer tournaments. They did this over and over, year after year, tournament after tournament.”

Also, the Attorney-General explicitly charged corruption in the award in 2004 of the World Cup for 2010 to South Africa, defeating Morocco; the 2011 FIFA presidential election, which Joseph (Sepp) Blatter won; sponsorship of the Brazilian national soccer team by a US sportswear company; and the Copa America, a US tournament scheduled for 2016. For details of the indictments and the preceding convictions, read the official document carefully. For those who want to study the territorial, jurisdictional, and US law claims in the case for a racketeering conspiracy, and compare the geography of the prosecutors’ evidence between the US and offshore, here is the 161-page indictment. Russia does not appear.

In winning the 2018 tournament, Russia defeated bids from England, and the combinations of Spain with Portugal, and the Netherlands with Belgium. In the competition for the 2022 tournament, also announced with the Russian award on December 2, 2010, Qatar defeated the US, Japan, South Korea, and Australia. The US had originally opened its bidding for the 2018 tournament, then withdrew to concentrate on 2022. The US hosted its first World Cup in 1994.

Blatter claimed in his press conference last Friday: “No one is going to tell me that it was a simple coincidence, this American attack two days before the elections of Fifa. It doesn’t smell right. The Americans were the candidates for the World Cup of 2022 and they lost. The English were the candidates for 2018 and they lost, so it was really the English media and the American movement.”

STILL MORE

Demeter

(85,373 posts)Well, at least the vegetation is enjoying itself...

Frost to summer flowers in 24 hours.

Fuddnik

(8,846 posts)They were beautiful.

I got a late start on the garden this year, but the tomatoes and peppers are exploding now.

Demeter

(85,373 posts)The former secretary of labor on specialized tax breaks -- and why we need to get our corporations off the dole

Corporations aren’t people, despite what the Supreme Court says, and they don’t need or deserve handouts. When corporations get special handouts from the government – subsidies and tax breaks – it costs you. It means you have to pay more in taxes to make up for these hidden expenses. And government has less money for good schools and roads, Medicare and national defense, and everything else you need. You might call these special corporate handouts “corporate welfare,” but at least welfare goes to real people in need. In the big picture, corporate handouts are costing tens of billions of dollars a year. Some estimates put it over $100 billion – which means it’s costing you money that would otherwise go to better schools or roads, or lower taxes.

Conservatives have made a game of obscuring where federal spending actually goes. In reality, only about 12 percent of federal spending goes to individuals and families, most in dire need. An increasing portion goes to corporate welfare.

Other examples: The oil, gas, and coal industries get billions in their own special tax breaks. Big Agribusiness gets farm subsides. Big Pharma gets their own subsidy in the form of a ban on government using its bargaining power under Medicare to negotiate lower drug prices. And hedge-fund and private-equity managers get a special tax loophole that treats their income as capital gains, at a lower tax rate than ordinary income.

The real issue isn’t the government’s size. It’s whom government is for. Much of government is no longer working for the vast majority it’s intended to serve. If government were responding to the public’s interest instead of the moneyed interests, it would be providing more support for communities, families, and individuals who need it the most.

There’s no reason any corporations should be on the dole, or that your hard-earned dollars should be going to them for no reason but their political clout. So we have to demand an end to corporate welfare. No more handouts to particular corporations and industries simply because they’re big enough and powerful enough to get them. No more specialized tax breaks. No more exemptions or special treatment. No more crony capitalism.

THIS IS REVOLUTIONARY! THIS IS A GOOD PLATFORM FOR BERNIE!

Demeter

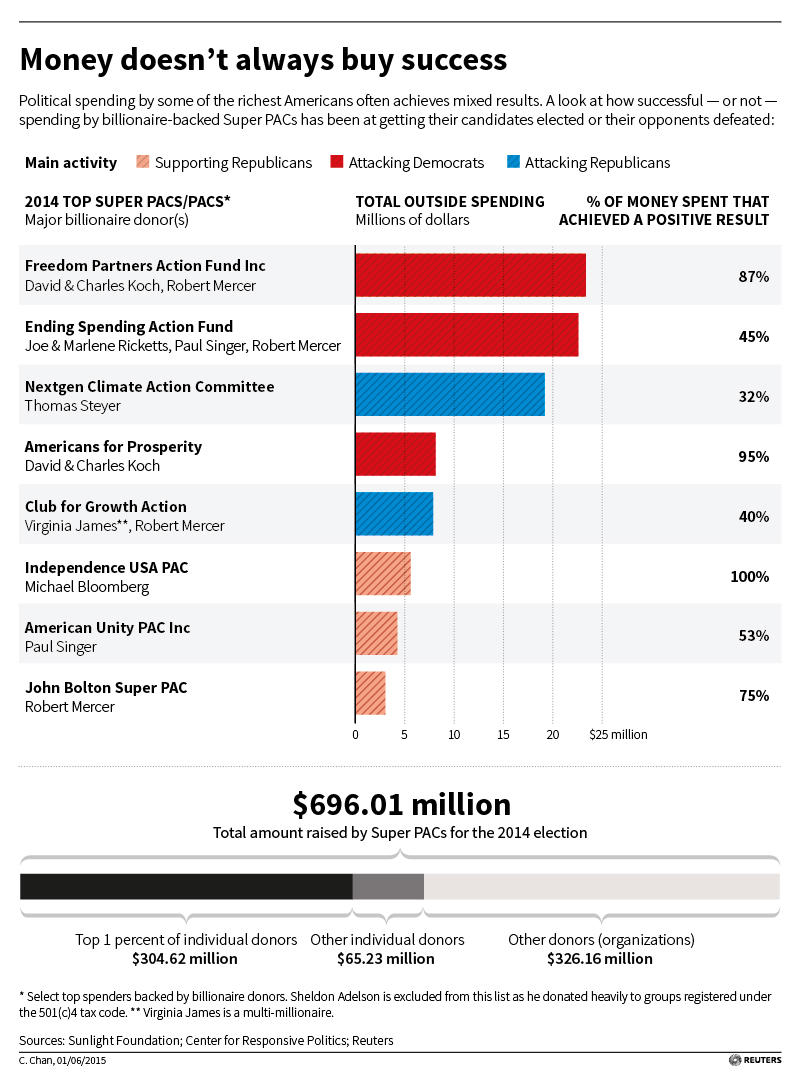

(85,373 posts)Florida Senator Marco Rubio has one; Texas Senator Ted Cruz has one; even former Pennsylvania Senator Rick Santorum, considered a longshot for the Republican presidential nomination in 2016, has a billionaire in his corner. Wisconsin Governor Scott Walker has two. Campaign finance watchdog groups fear heavy spending by these ultra-rich Americans will warp the election - already expected to be the most money-soaked in history. The idea that billionaires can buy elections has taken root in the public imagination.

Those billionaires are now seeing small, early signs of a pushback. Whether these are the beginning of a new trend is far too soon to say, but polls show there is wider discontent about the perceived influence of big money in U.S. politics and a growing gulf between the country's very rich and very poor. These nascent rumblings - along with evidence that the super-rich are inefficient political spenders - raise questions about how effective billionaires will be in the 2016 elections.

Some voters in Philadelphia, for example, were turned off by the billionaires backing a top candidate in the city's May 19 mayoral race. And a Silicon Valley startup, Crowdpac, is hoping to bank on public ire against big political spenders to attract small donations to its new for-profit election campaign crowdfunding platform.

"There's growing public awareness about rich people trying to buy elections and that makes the task of winning all the more difficult," said Darrell West, the author of "Billionaires: Reflections on the Upper Crust," and the director of governance studies at the Brookings Institution think tank.

Potential big donors dispute the notion they are trying to buy elections and say they are simply using their positions to try to influence the future of the country in a positive way.

"I do believe – and I’ve told my kids this - that I can do more for them by giving money to the right presidential candidate in 2016 than by leaving them double that amount in my will," said David Walsh, a retired investor living in Jackson, Wyoming, who would not disclose his net worth but has given several multi-million dollar gifts to charitable causes and said he planned to donate heavily to candidates in 2016.

LARGE EDIT--HISTORICAL DETAIL

Studies of the 2012 and 2014 elections by the Sunlight Foundation, a Washington-based non-profit that tracks political spending, show most groups backed by billionaires had less success swaying election outcomes than groups controlled by trade organizations or professional political strategists. The Sunlight study does not offer any explanation for this difference.

MORE AT LINK, PLUS

VIDEO CLIP NEWS REPORT AT LINK SUPPORTING THESIS

Demeter

(85,373 posts)A corporate dagger is now aimed at the heart of our democracy. It has been well concealed by the noise of battle. Washington is once again fighting about trade. Once more we see most economists lined up in favor of trade along with the global corporations and opposed by the labor unions. All this sound and fury creates a gripping, reportable narrative of ongoing battle. But that narrative distracts from what is really going on; the most dangerous part of these new trade pacts is only rarely mentioned. This part is called ISDS.

The initials ISDS are unfamiliar to most people. They stand for Investor State Dispute Settlement. ISDS is a massive expansion of dispute settlement clauses that appear in other trade treaties like the World Trade Organization (WTO) agreement. That agreement gave a complaining nation the right to bypass another nation’s court system and bring their claim of economic harm to a panel of international decision-makers. These arbitrators have tremendous leeway in how they interpret the WTO agreement and their decisions have been contentious. The U.S., for example, recently lost to Canada and Mexico under this arbitration clause. We are now busy repealing our own laws, which require country of origin labeling (COOL) for beef. We will no longer be allowed to know what country our beef is coming from.

Other treaties have widely extended these WTO provisions and given corporations – in addition to foreign governments – the right to sue. ISDS allows corporations to sue any nations in which it does business. Under these treaties, corporations can take a claim of injured profitability to binding arbitration. There is no shortage of such claims. Philip Morris, for example, has sued Uruguay for its anti-smoking legislation and Australia for restricting cigarette advertising. Under NAFTA, the American mining company Bilcon successfully sued the Canadian government when Bilcon was forbidden to develop a mine. The Canadian government’s study of the proposal had concluded there was harm to the nature of the surrounding communities, but the arbitrators rejected their decision. The company is suing for $300 million in damages.

These examples illustrate the crux of the matter. Which do we want to prevail in our country, the laws and standards of our elected government or those of arbitrators? Do we want to substitute binding arbitration for democracy?

Furthermore, nations can be sued for the actions of their states and cities. If ISDS goes through in its present form and Los Angeles raises its minimum wage, the U.S. can be sued by foreign businesses operating there because of the impact on their profitability.

Is this what we want? Do we want to give corporations the right to sue governments to protect their profitability, or do we want to leave to our legal and democratic processes the business of balancing the harms against the gains? The history of ISDS suits shows that corporations can use the ISDS process to contest a virtually unlimited range of actions. These include, among many others, measures relating to taxation, environmental regulation, rates for water and electricity, health insurance regulation, and safety regulations for pharmaceutical imports. And what a process it is. Unlike our national courts that can judge a case against a body of law, there is no such body of law; instead, the arbitrators are allowed enormous scope. The Columbia Center on Sustainable Investment gives a compelling and authoritative review of ISDS’s functions and consequences in its policy paper, “Investor – State Dispute Settlement, Public Interest and U.S. Domestic Law.”

And there will be a chilling effect. In considering any law or action a legislature or local government will need to consider the possibility of an ISDS suit against it. Do we want these possibilities to shape our every action? From the corporate point of view, the importance of “fast track” legislation is that it ties together the trade and ISDS parts of the TPP. With “fast track,” our Senate and House can only accept or reject both parts; with that restriction, their vote may well be shaped by their familiar and visible positions on trade. We must separate this ungainly bundle into a trade part and an ISDS part and consider them separately. Once out in the light of day ISDS will perish. This is the outcome that “fast track” seeks to avoid. We have here a dagger aimed at the very heart of democracy. We should not give up our national system of laws based on a constitution and a long legal history. We should reject “fast track,” and if we fail at that we should fight on and reject TPP. TPP ties together a contentious trade pact with a process to protect corporate profits that is above our democratic processes. We should stand up for democracy.

Gomory is a research professor at New York University’s Stern School of Business and a recipient of the National Medal of Science. He is a former president of the Alfred P. Sloan Foundation and former director of research at IBM.

I'D RATHER CANCEL THE WHOLE THING, PERSONALLY, NOT PICK IT TO PIECES. EVEN THE "GOOD" PIECES ARE EVIL.

Punx

(446 posts)But the ISDS part is clearly designed to do an end run around Democracy and enable Corporate Rule. Appears that profit is the most desirable thing for society and everything else is subservient to it, including life and death as I've mentioned in other forums.

One question, does anyone have any idea as to how the arbitration decisions would be enforced? What if that Canadian province just refused to pay the judgement, or a state in the US? Or say Seattle loses and refuses to lower the $15 minimum wage requirement. Would the Federal governments come in and seize assets, withhold Fed $. I have no doubt that our bought and paid for Federal government would enforce agreements against cities or counties that refused to pay. I suspect all banking privileges would be revoked for starters. Could be very ugly in the short term but might really wake people up as well.

I'm infuriated with Senator Wyden and my local rep over this.

p.s. I’ve been around DU for years and only discovered the Economic forum in the last couple of weeks. I really like what you are doing. Thanks to you and Tansy for your efforts here.

Demeter

(85,373 posts)Post for us!

Demeter

(85,373 posts)We are delving into Flamenco. It's a passionate interest of mine, and I hope you will enjoy it, as our artistic component has been rather meager of late...

Also, the stomping and banging and howling are a good release for the over-tensioned body and mind.

There will be some economic and political stuff, too. Unfortunately, but that's the problem with posting in this group.

I'm going to be starting either early (before 5PM or late...depending on how Friday goes. Stepping out for the evening, since the weather is supposed to be fine.

mahatmakanejeeves

(57,493 posts)Source: Department of Labor, Employment and Training Administration

Read More: http://www.dol.gov/opa/media/press/eta/eta20151103.pdf

Connect with DOL at http://blog.dol.gov

TRANSMISSION OF MATERIALS IN THIS RELEASE IS EMBARGOED UNTIL 8:30 A.M. (Eastern) Thursday, June 4, 2015

UNEMPLOYMENT INSURANCE WEEKLY CLAIMS

SEASONALLY ADJUSTED DATA

In the week ending May 30, the advance figure for seasonally adjusted initial claims was 276,000, a decrease of 8,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 282,000 to 284,000. The 4-week moving average was 274,750, an increase of 2,750 from the previous week's revised average. The previous week's average was revised up by 500 from 271,500 to 272,000.

There were no special factors impacting this week's initial claims.

The advance seasonally adjusted insured unemployment rate was 1.6 percent for the week ending May 23, a decrease of 0.1 percentage point from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending May 23 was 2,196,000, a decrease of 30,000 from the previous week's revised level. This is the lowest level for insured unemployment since November 11, 2000 when it was 2,161,000. The previous week's level was revised up 4,000 from 2,222,000 to 2,226,000. The 4-week moving average was 2,214,250, a decrease of 8,250 from the previous week's revised average. This is the lowest level for this average since November 25, 2000 when it was 2,211,250. The previous week's average was revised up by 1,250 from 2,221,250 to 2,222,500.

....

UNADJUSTED DATA

....

The total number of people claiming benefits in all programs for the week ending May 16 was 2,127,150, a decrease of 735 from the previous week. There were 2,513,378 persons claiming benefits in all programs in the comparable week in 2014.