Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 27 February 2015

[font size=3]STOCK MARKET WATCH, Friday, 27 February 2015[font color=black][/font]

SMW for 26 February 2015

AT THE CLOSING BELL ON 26 February 2015

[center][font color=red]

Dow Jones 18,214.42 -10.15 (-0.06%)

S&P 500 2,110.74 -3.12 (-0.15%)

[font color=green]Nasdaq 4,987.89 +20.75 (0.42%)

[font color=red]10 Year 2.03% +0.06 (3.05%)

30 Year 2.62% +0.06 (2.34%)[font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Fresh out of everything.

Looked up the day and found somebody's having a birthday....we'll do that, if nothing else comes to mind.

Went to budget and finance committee meeting Thursday night. The whole world has changed for us, now that our new management company has fired us...going self-managed is a challenge...lots of hurdles and policies and procedures need to be taken down and put in place overnight. Good thing we've been working on it for 6 years...

Demeter

(85,373 posts)and lots of news, analysis and commentary.

DemReadingDU

(16,000 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)We are all being "Uberized" out of economic security.

GM is worth around $60 billion, and has over 200,000employees. Its front-line workers earn from $19 to $28.50 an hour, with benefits. Uber is estimated to be worth some $40 billion, and has 850 employees. Uber also has over 163,000 drivers (as of December – the number is expected to double by June), who average $17 an hour in Los Angeles and Washington, D.C., and $23 an hourin San Francisco and New York. But Uber doesn’t count these drivers as employees. Uber says they’re “independent contractors.”

What difference does it make?

For one thing, GM workers don’t have to pay for the machines they use. But Uber drivers pay for their cars – not just buying them but also their maintenance, insurance, gas, oil changes, tires, and cleaning. Subtract these costs and Uber drivers’ hourly pay drops considerably.

For another, GM’s employees get all the nation’s labor protections.

These include Social Security, a 40-hour workweek with time-and-a-half for overtime, worker health and safety, worker’s compensation if injured on the job, family and medical leave, minimum wage, pension protection, unemployment insurance, protection against racial or gender discrimination, and the right to bargain collectively. Not to forget Obamacare’s mandate of employer-provided healthcare. Uber workers don’t get any of these things. They’re outside the labor laws. Uber workers aren’t alone. There are millions like just them, also outside the labor laws — and their ranks are growing. Most aren’t even part of the new Uberized “sharing” economy. They’re franchisees, consultants, and free lancers. They’re also construction workers, restaurant workers, truck drivers, office technicians, even workers in hair salons.

What they all have in common is they’re not considered “employees” of the companies they work for. They’re “independent contractors” – which puts all of them outside the labor laws, too. The rise of “independent contractors” Is the most significant legal trend in the American workforce – contributing directly to low pay, irregular hours, and job insecurity. What makes them “independent contractors” is mainly that the companies they work for say they are. So those companies don’t have to pick up the costs of having full-time employees. But are they really “independent”? Companies can manipulate their hours and expenses to make them seem so.

THE CASE OF FED EX, AND REICH'S SOLUTIONS TO THIS GROWING PROBLEM, AT LINK

Demeter

(85,373 posts)Regular readers know that I sometimes mock “very serious people” — politicians and pundits who solemnly repeat conventional wisdom that sounds tough-minded and realistic. The trouble is that sounding serious and being serious are by no means the same thing, and some of those seemingly tough-minded positions are actually ways to dodge the truly hard issues. The prime example of recent years was, of course, Bowles-Simpsonism — the diversion of elite discourse away from the ongoing tragedy of high unemployment and into the supposedly crucial issue of how, exactly, we will pay for social insurance programs a couple of decades from now. That particular obsession, I’m happy to say, seems to be on the wane. But my sense is that there’s a new form of issue-dodging packaged as seriousness on the rise. This time, the evasion involves trying to divert our national discourse about inequality into a discussion of alleged problems with education. And the reason this is an evasion is that whatever serious people may want to believe, soaring inequality isn’t about education; it’s about power.

Just to be clear: I’m in favor of better education. Education is a friend of mine. And it should be available and affordable for all. But what I keep seeing is people insisting that educational failings are at the root of still-weak job creation, stagnating wages and rising inequality. This sounds serious and thoughtful. But it’s actually a view very much at odds with the evidence, not to mention a way to hide from the real, unavoidably partisan debate. The education-centric story of our problems runs like this: We live in a period of unprecedented technological change, and too many American workers lack the skills to cope with that change. This “skills gap” is holding back growth, because businesses can’t find the workers they need. It also feeds inequality, as wages soar for workers with the right skills but stagnate or decline for the less educated. So what we need is more and better education...My guess is that this sounds familiar — it’s what you hear from the talking heads on Sunday morning TV, in opinion articles from business leaders like Jamie Dimon of JPMorgan Chase, in “framing papers” from the Brookings Institution’s centrist Hamilton Project. It’s repeated so widely that many people probably assume it’s unquestionably true. But it isn’t.

For one thing, is the pace of technological change really that fast? “We wanted flying cars, instead we got 140 characters,” the venture capitalist Peter Thiel has snarked. Productivity growth, which surged briefly after 1995, seems to have slowed sharply. Furthermore, there’s no evidence that a skills gap is holding back employment. After all, if businesses were desperate for workers with certain skills, they would presumably be offering premium wages to attract such workers. So where are these fortunate professions? You can find some examples here and there. Interestingly, some of the biggest recent wage gains are for skilled manual labor — sewing machine operators, boilermakers — as some manufacturing production moves back to America. But the notion that highly skilled workers are generally in demand is just false.

Finally, while the education/inequality story may once have seemed plausible, it hasn’t tracked reality for a long time. “The wages of the highest-skilled and highest-paid individuals have continued to increase steadily,” the Hamilton Project says. Actually, the inflation-adjusted earnings of highly educated Americans have gone nowhere since the late 1990s. So what is really going on? Corporate profits have soared as a share of national income, but there is no sign of a rise in the rate of return on investment. How is that possible? Well, it’s what you would expect if rising profits reflect monopoly power rather than returns to capital.

As for wages and salaries, never mind college degrees — all the big gains are going to a tiny group of individuals holding strategic positions in corporate suites or astride the crossroads of finance. Rising inequality isn’t about who has the knowledge; it’s about who has the power.

HE HAS SOLUTIONS, TOO!

Demeter

(85,373 posts)NET NEUTRALITY WILL LET MORE BE BUILT

Demeter

(85,373 posts)U.S. regulators on Thursday approved the strictest-ever rules on Internet providers, who in turn pledged to battle the new restrictions in the courts and Congress, saying they would discourage investment and stifle innovation. The rules, which will go into effect in coming weeks, are expected to face legal challenges from multiple parties such as wireless, cable and other broadband companies and trade groups that represent them. Experts expect the industry to seek a stay of the rules, first at the FCC and then in courts, though the chances for success of such an appeal is unclear.

The new regulations come after a year of jostling between cable and telecom companies and net neutrality advocates, which included web startups. It culminated in the FCC receiving a record 4 million comments and a call from President Barack Obama to adopt the strongest rules possible. The agency's new policy, approved as expected along party lines, reclassifies broadband, both fixed and mobile, as a more heavily regulated "telecommunications service," more like a traditional telephone service.

In the past, broadband was classified as a more lightly regulated "information service," which factored into a federal court's rejection of the FCC's previous set of rules in January 2014. The shift gives the FCC more authority to police various types of deals between providers such as Comcast Corp (CMCSA.O) and content companies such as Netflix Inc (NFLX.O) to ensure they are just and reasonable for consumers and competitors.

Internet providers will be banned from blocking or slowing any traffic and from striking deals with content companies, known as paid prioritization, for smoother delivery of traffic to consumers. The FCC also expands its oversight power to so-called interconnection deals, in which content companies pay broadband providers to connect with their networks. The FCC would review complaints on a case-by-case basis.

Republican FCC commissioners, who see the new rules as a government power grab, delivered lengthy dissents. Their colleagues in Congress hope to counter the new rules with legislation. All five FCC members are expected to testify in the Senate on March 18.

Large Internet providers say they support the no-blocking and no-discrimination principles of the new rules but that the FCC's regulatory path will discourage investment by lowering returns and limiting experimentation with services and business plans....

Demeter

(85,373 posts)JPMorgan executives are the latest top bankers to claim they want to be more George Bailey than, well, J.P. Morgan. These days, JPMorgan is emphasizing dog treats over derivatives. On Tuesday, at the bank’s annual investor day, when CEO Jamie Dimon took the mic, one of the first things he told investors to do was check out one of the bank’s branches. “Around the country, people bring in their dogs and sit around for social reasons,” said Dimon. “We give out little doggie bones.”

The bank said it will cut $2.8 billion in expenses from its investment banking division in the next three years. About $1.5 billion of those cost reductions will come from “business simplification.” JPMorgan JPM has long had one of the largest financial derivatives operations on Wall Street. The bank invented the securities that were used to bet on—and eventually against—the mortgage market. On Tuesday, Daniel Pinto, the head of JPMorgan’s investment bank, emphasized how the bank was looking to reduce its activity in one of the most complex areas of finance. Pinto said the bank would either exit or dramatically scale back its processing of over the counter derivatives transactions for clients. He said the bank also plans to “rapidly compress” its own derivatives exposure. JPMorgan said it was reducing its derivatives operations on account of new regulations that would require the bank to set aside more capital. Also, if you want to be known as a simpler bank, derivatives is probably not the place you want to be.

The bank on Tuesday said it was looking to reduce the amount of deposits it holds for other businesses by $100 billion, cut back on the amount of lending it does to hedge funds and even close about 300 of its dog-friendly bank branches. All of this comes as an olive branch of sorts to JPMorgan’s critics, who say the bank is too big. Last month, Goldman Sachs issued a report that said JPMorgan would be worth more if it were split up. On Tuesday, though, Jamie Dimon, JPMorgan’s CEO, said he has no plans to do that. “We’re not going to give up investment banking for anyone, not even Richard Ramsden,” said Dimon, referring to the Goldman analyst who wrote the report.

Wall Streeters typically say they are in the business of helping clients manage sophisticated risks and transactions. Stressing simplicity is an odd sales pitch for a large bank like JPMorgan. But the problem Dimon and other top bankers have is that investment banking—in part because of new regulations and also on account of the fact that the business has change—is not as profitable as it used to be. Just four years ago, the return on equity of JPMorgan’s investment bank was nearly 20%. Now, it is half that. Investors may accept lower return businesses as long as they are convinced that they are lower risk as well. Shares of Morgan Stanley MS -1.45% , for instance, have outperformed rivals recently, as CEO James Gorman has emphasized lower risk businesses like asset management.

Dimon seems to be getting the message. On Tuesday, he said JPMorgan was really no different than the average regional bank, just, ya know, bigger. In fact, he said this twice. For a bank that still has a derivatives book with a notional value of $65 trillion, that statement is a stretch. But even as large as it is, JPMorgan is probably far less risky and complex than its detractors would have you believe. Nevertheless, the notion that JPMorgan is just too big to work seems to be gaining momentum. So, if Dimon wants JPMorgan to remain in investment banking, and all of the many businesses it is in, he needs to sell simplicity. He’s trying his best.

Demeter

(85,373 posts)Global regulators have issued dozens of rules aimed at making the biggest banks safer. That’s leading to another result some wanted: making them shrink. HSBC Holdings Plc, Europe’s biggest bank by market value, said this week it’s considering “extreme solutions” for some of its units. Royal Bank of Scotland Group Plc is reducing its U.S. trading staff and getting out of two-thirds of the countries where it operates. JPMorgan Chase & Co. is closing branches, raising fees on some institutional deposits and looking for ways to shrink its trading businesses...Deutsche Bank AG is weighing job cuts, winding down business lines at its investment bank and selling assets, including consumer-lending unit Postbank in Germany, as part of a strategy review at the Frankfurt-based lender, a person with knowledge of the matter said last month...

Increasingly strict capital rules over the past three years may be forcing the breakup of the financial supermarkets built in the decade before the financial crisis. Lenders, unable to use borrowed money to fund as much of their business as they once did, have cut profitability targets and are weighing more drastic actions to meet them.

“We’re beginning to see discussions that these capital charges are sufficiently large it’s causing those firms to think seriously about whether or not they should spin off some of their enterprises to reduce their systemic footprint,” Federal Reserve Chairman Janet Yellen told the House Financial Services Committee on Wednesday. “And frankly, that’s exactly what we want to see happen.”

Bank Capitulation

Banks have been cutting assets since the financial crisis, selling smaller units and unwinding derivatives that carried high capital charges. The latest moves represent a capitulation in which many of the largest banks may be ending their ambitions of offering all services in all regions.

Regulators’ tools have included minimum capital ratios, stress tests and demands that more bank assets be the types that are easy to sell in a crisis. That combination, along with tepid economic growth and low trading levels, drove return on equity, a measure of profitability, to an average of 3.3 percent last year at 10 of the largest banks from 17 percent in 2006.

“Banks certainly anticipated the direction of travel on capital rules, but with hindsight not the severity, which is why combined with low economic growth we are seeing repeated changes to strategies to try to improve return on equity,” Jon Peace, an analyst at Nomura Holdings Inc., wrote in an e-mail.

While RBS’s decisions were driven by seven straight annual losses, other banks may face pressure to downsize based on profits that aren’t high enough to meet investors’ demands. Bank of America Corp. and Citigroup Inc., each with more than $1.8 trillion in assets, haven’t topped a 7 percent return on equity since the financial crisis.

POOR BABIES!

‘Intense Pressure’

“In 18 to 36 months, there will be a much more intense pressure on some number of banks to break up,” Lazard Ltd. Vice Chairman Gary Parr said in an interview last month with Bloomberg TV. “It’s a Darwinian exercise, and what’s fascinating to me is how slowly it’s going.”

MORE--AND IT'S ENTERTAINING!

Demeter

(85,373 posts)Austria's Raiffeisenbank will close its branches in Russia's far east to improve efficiency after they generated little income and had few opportunities for growth, a move which shows the impact of Russia's economic crisis on the sector... Raiffeisenbank said the decision to close seven branches in six of the far east's main cities was taken because of the low potential for developing its customer base in the region, which is sparsely populated and largely served by Russian banks... Raiffeisenbank said it was considering the possible sale of its loan portfolio and customer segment of small and micro businesses, and was doing all it could to support its customers...

"In the current environment, it is important to be efficient and profitable," the bank said in a statement. "In the development of our sales network, we will focus on those cities where our offices show sufficient profitability."

Foreign banks have been cutting their exposure to Russia, once considered one of the world's fastest growing banking markets, since the crisis hit last year, driving the rouble down against the dollar and fuelling capital flight...Banks are suffering from higher bad loan provisions and lower profits because of the crisis, deepened by Western sanctions over Moscow's role in the Ukraine conflict and lower oil prices...

On Thursday, Standard & Poor's rating agency said the Russian banking system could see its bad loans rise to 17-23 percent this year from around 8 percent last year, and that profit for the sector was seen at close to zero.

Russia has been forced to support many of its banks with capital injections and other measures after its largest lenders were all but cut off from global financial markets by European Union and U.S. sanctions.

Demeter

(85,373 posts)WHOODA THUNK IT? VERY FEW PEOPLE ARE HAPPY IN CELLS THAT HAVE NO ROOM TO GROW IN

http://www.huffingtonpost.com/2015/02/26/your-house-is-too-small_n_6762938.html?utm_hp_ref=business&ir=Business

Demeter

(85,373 posts)European Central Bank policymaker Ewald Nowotny has warned against kicking Russian banks out of the SWIFT payments transfer system as part of tighter sanctions on Moscow, the Austria Press Agency quoted him as saying on Thursday.

Such a move "we would see as very problematic because it could perhaps undermine confidence in this system", the governor of Austria's central bank told reporters in Brussels after meeting European Commissioner Pierre Moscovici.

Russia has drafted a law to regulate a local equivalent to SWIFT in response to concerns that the Belgian-based system, the world's biggest for electronic payments, could be a focus of Western sanctions against Moscow over the Ukraine crisis.

In 2012, SWIFT cut off Iranian banks that were the subject of EU sanctions over Iran's nuclear program - a step that shut down a major avenue through which Iran did business with the rest of the world. APA quoted Nowotny as saying Austria would not be immediately affected should Russian banks be excluded from SWIFT, but that Russia could retaliate, "and this could of course affect all companies that do business in Russia". He reiterated that Austrian banks had no plans to leave Russia because they had proven themselves to be an element of stability in the latest economic crisis. Raiffeisen Bank International (RBIV.VI) and Bank Austria (CRDI.MI) are active there.

Demeter

(85,373 posts)...David Ganek, a Manhattan socialite and art collector whose $4 billion Level Global was one of the funds raided (BY FBI), sued Mr. Bharara on Thursday, claiming that the government violated his constitutional rights by fabricating accusations against him. The lawsuit against Mr. Bharara, the United States attorney in Manhattan, also named as defendants the federal prosecutors and F.B.I. agents who orchestrated the raid...

Demeter

(85,373 posts)IF IT KEEPS THE CALIFORNIANS OUT OF THE GREAT LAKES

http://www.wired.com/2015/02/california-pipe-water-alaska/

Californians are desperate for water, so you can’t blame them for greedily eyeing the storm-sodden east. Look at all that snow! That’s just frozen water, right? But seriously, trucking snow from Boston over the Rockies is a pipe dream. Or…not the right kind of pipe, anyway.

But what about Alaska? The state is weeping snowmelt into the North Pacific. Nobody’s using it. It’s close to California, relatively speaking. And a pipe wouldn’t have to cross over any continental divides. It’s so crazy it just might work!

Or is it? Hare-brained schemes to bring out-of-state water to California are nothing new, and this idea doesn’t come from nowhere. It was born in the late 1980s by Alaskan governor Wally Hickel, who was always exuberant about selling his state’s resources. The original plan called for four 14-foot diameter pipes running at least 1,400 miles from the mouth of one of southeast Alaska’s monster rivers to one of California’s reservoirs. These would deliver about 1.3 trillion gallons of water a year. (California is currently about 11 trillion gallons of water in deficit.) Either of the Alaskan rivers under consideration—the Copper and the Stikine—have outflows more than double the combined flow of the Sacramento/San Joaquin rivers, California’s largest watershed. So it’s not like Alaska would miss the water. “If you’re going to put this symbolically, this project holds a lot of water,” says Don Kash, an emeritus tech policy researcher at George Mason University and the chair of a two-day meeting in 1991 that discussed the pipeline’s potential.

But water never comes for free. Laying pipeline on the continental shelf is tricky business and would require armies of surveyors (and navies of pipe-laying ships). And Alaska is north, but not uphill. The pipeline would need pumping stations every 150 miles to keep the water flowing. In 1991, the now-defunct congressional Office of Technology Assessment calculated that the water pipeline would cost $110 billion dollars and take up to 15 years to complete. In the same paper, they compared the project to the Panama Canal, the Trans-Alaska Pipeline, and the English Channel Tunnel in terms of cost and complexity. All of which, they added, went way over budget. On the other hand, if it had taken 15 years to build in 1991, Californians would have been drinking Alaska’s Finest H20 since Justin Timberlake started bringing sexy back.

So yeah, this wouldn’t be a cheap fix....

Demeter

(85,373 posts)Last week, after much drama, the new Greek government reached a deal with its creditors. Earlier this week, the Greeks filled in some details on how they intend to meet the terms. So how did it go? Well, if you were to believe many of the news reports and opinion pieces of the past few days, you’d think that it was a disaster — that it was a “surrender” on the part of Syriza, the new ruling coalition in Athens. Some factions within Syriza apparently think so, too. But it wasn’t. On the contrary, Greece came out of the negotiations pretty well, although the big fights are still to come. And by doing O.K., Greece has done the rest of Europe a favor. To make sense of what happened, you need to understand that the main issue of contention involves just one number: the size of the Greek primary surplus, the difference between government revenues and government expenditures not counting interest on the debt. The primary surplus measures the resources that Greece is actually transferring to its creditors. Everything else, including the notional size of the debt — which is a more or less arbitrary number at this point, with little bearing on the amount anyone expects Greece to pay — matters only to the extent that it affects the primary surplus Greece is forced to run.

For Greece to run any surplus at all — given the depression-level slump that it’s in and the effect of that depression on revenues — is a remarkable achievement, the result of incredible sacrifices. Nonetheless, Syriza has always been clear that it intends to keep running a modest primary surplus. If you are angry that the negotiations didn’t make room for a full reversal of austerity, a turn toward Keynesian fiscal stimulus, you weren’t paying attention. The question instead was whether Greece would be forced to impose still more austerity. The previous Greek government had agreed to a program under which the primary surplus would triple over the next few years, at immense cost to the nation’s economy and people.

Why would any government agree to such a thing? Fear. Essentially, successive leaders in Greece and other debtor nations haven’t dared to challenge extreme creditor demands, for fear that they would be punished — that the creditors would cut off their cash flow or, worse yet, implode their banking system if they balked at ever-harsher budget cuts. So did the current Greek government back down and agree to aim for those economy-busting surpluses? No, it didn’t. In fact, Greece won new flexibility for this year, and the language about future surpluses was obscure. It could mean anything or nothing. And the creditors did not pull the plug. Instead, they made financing available to carry Greece through the next few months. That is, if you like, putting Greece on a short leash, and it means that the big fight over the future is yet to come. But the Greek government didn’t succumb to the bum’s rush, and that in itself is a kind of victory.

Why, then, all the negative reporting? To be fair, fiscal policy isn’t the only issue. There were and are also arguments about things like privatization of public assets, where Syriza has agreed not to reverse deals already made, and labor market regulation, where some of the “structural reform” of the austerity era will apparently stand. Syriza also agreed to crack down on tax evasion, although why collecting taxes is supposed to be a defeat for a leftist government is a mystery to me. Still, nothing that just happened justifies the pervasive rhetoric of failure. Actually, my sense is that we’re seeing an unholy alliance here between left-leaning writers with unrealistic expectations and the business press, which likes the story of Greek debacle because that’s what is supposed to happen to uppity debtors. But there was no debacle. Provisionally, at least, Greece seems to have ended the cycle of ever-more-savage austerity.

And, as I said, in so doing, Greece has done the rest of Europe a favor....

SEE LINK FOR MORE

xchrom

(108,903 posts)Good morning! Here's what you need to know for Friday.

1. Hundreds of Greeks demonstrated in Athens against the new radical government for going back on pre-election promises.

2. The British Islamic State militant known as "Jihadi John," believed to be responsible for multiple executions of Western hostages, has been identified as 26-year-old Mohammed Emwazi.

3. Russia has agreed to attend talks with the European Union and Ukraine after Moscow threatened to cut off gas supplies to Europe.

4. Lloyds banks announced it will restart dividend payments to shareholders in 2015 after posting a massive surge in profits.

5. The German parliament will vote on a plan to extend aid to Greece by another four months.

Read more: http://www.businessinsider.com/the-10-most-important-things-in-the-world-right-now-feb-27-2015-2#ixzz3SwatRSRr

Demeter

(85,373 posts)...The separatist war in the east has complicated efforts to stabilize an economy on the verge of bankruptcy, and the hryvnia currency has lost more than half its value so far this year after halving during all of 2014. With the hryvnia currency in free fall as investors fled, the central bank halted nearly all commercial currency trading until the end of the week. Hours later, the bank reversed the decision, giving no explanation for the abrupt change in policy. But it came after a sharp rebuke from Prime Minister Arseny Yatseniuk, who said the move was bad for the economy... Ukraine came under greater economic pressure after unexpectedly banning most currency trading and then abruptly reversing course, wreaking havoc on the hryvnia, just as a truce in the east took hold on Wednesday with no combat fatalities reported....The ban had put the currency's true value in limbo, with little or no trading taking place to set a price, before the bank jumped in to buy $80 million at an official rate of 28.046 to the dollar, close to the rate at the start of the week and 12.8 percent higher than the close after a plunge on Tuesday. Exchange booths in Kiev were selling limited amounts of dollars for 39 hryvnias, around 20 percent worse than rates advertised in the windows of commercial banks where dollars were not available. A construction worker exchanging dollars at a kiosk in a grocery shop in return for a bag filled with thousands of hryvnia laughed and told shoppers, "Soon we will have to walk around with suitcases for cash, like in the 1990s."

Clearly concerned about the developments, the International Monetary Fund said on Wednesday it was ready to help Ukraine with its foreign currency issues.

THAT'S ALL THEY NEED...HELP FROM THE IMF!

"IMF staff are in close contact with the National Bank of Ukraine and stand ready to assist in designing measures that will address excessive and temporary imbalances in the supply and demand for foreign exchange," an IMF spokeswoman said in a statement released in Washington.

...With the long-awaited ceasefire coming into force, Russian President Vladimir Putin once again threatened gas supplies for the fourth time in a decade if Moscow did not receive advance payment...In a potential new blow, the Kremlin warned that Russia could halt gas supplies to Ukraine, which could disrupt flows to Europe, which receives around a third of its gas from Russia with 40 percent shipped via Ukraine. Last year Russia cut off gas to Ukraine for six months without affecting Europe. Criticizing Ukraine for cutting off gas to eastern regions controlled by pro-Russian separatists, Putin said, "Imagine these people will be left without gas in winter. Not only that there is famine ... It smells of genocide."

"We hope ... that gas supplies will not be interrupted. But this does not depend only on us, it depends on the financial discipline of our Ukrainian partners," Putin said.

MORE

xchrom

(108,903 posts)Demeter

(85,373 posts)YEAH, SOME OF THE FROGS MIGHT HOP OUT OF THE BOILING POT...

http://www.nytimes.com/2015/02/26/business/mario-draghi-warns-of-risky-future-for-eurozone.html

In a contentious appearance before the European Parliament on Wednesday, the president of the European Central Bank said that the future of the eurozone was at risk unless member countries gave up some independence and created more Pan-European government institutions.

“We have not yet reached the stage of a genuine monetary union,” the central bank president, Mario Draghi, said in a speech to the European Parliament in Brussels. Failure of eurozone countries to harmonize their economies and create stronger institutions, he said, “puts at risk the long-term success of the monetary union when faced with an important shock."

GIVE IT UP, MARIO! THIS ISN'T A MONETARY UNION, IT'S A SUICIDE PACT!

Mr. Draghi has often urged eurozone governments to do more to improve their economic performance, for example by overhauling restrictive labor regulations. But it was unusual for him to suggest that the future of the eurozone could depend on whether countries heed his advice. Although in his prepared remarks Mr. Draghi did not mention Greece, his speech came as turmoil in that country is again preoccupying policy makers and threatening to again create a crisis for the currency union. During lawmakers’ responses to Mr. Draghi’s remarks, a Greek parliamentarian suggested that the European Central Bank was profiting from its holdings of Greek government bonds. Mr. Draghi pointed out that interest from the bonds, acquired beginning in 2010 in an effort to hold down Greece’s borrowing costs, is passed back to the Athens government. The answer prompted the Greek legislator, Notis Marias, to begin shouting from his seat, drawing a rebuke from Mairead McGuinness, a vice president of Parliament who was presiding over the session. Mr. Draghi said that the European Central Bank would accept Greek government bonds as collateral again in extending loans to banks, if the country shows that it is willing to stick to the conditions of its bailout. The central bank stopped accepting Greek bonds early this month, a blow to banks which have used their holdings of Greek government bonds to borrow from the central bank at a cheap interest rate of 0.05 percent. Since then the banks, facing signs of a capital flight, have relied on emergency cash from another central bank program that carries a higher interest rate.

Mr. Draghi in his speech also noted that eurozone countries have made progress in centralizing tasks like bank regulation. But without naming other specific examples, he said more institutions need to be created to make sure that eurozone countries follow their own rules. Members of the currency bloc have often violated guidelines on public spending and debt.

“In the medium to longer term, we need to move from a system of rules and guidelines for national economic policy making to a system of further sovereignty sharing within common institutions so as to strengthen our economic policy governance,” Mr. Draghi said. “A common rule is only as strong as the common institution that can enforce it.”

Mr. Draghi also used the appearance at Parliament to defend the central bank’s decision last month to begin buying government bonds as a way of arresting an alarming decline of eurozone inflation to levels considered bad for growth. But he said the so-called quantitative easing would work much better if countries did their part, for example by removing lengthy approvals and fees required to set up a business. After he was done speaking and while the parliamentary debate was still underway, Mr. Draghi departed, citing other commitments. Several members of Parliament expressed dismay over his early exit. David Coburn, a Scottish member of Parliament from the right-wing United Kingdom Independence Party, said Mr. Draghi’s behavior “would never be allowed in the House of Commons.” Bernd Lucke, leader of the right-wing Alternative for Germany party and normally no fan of Mr. Draghi’s, gestured to the large number of empty seats in the chamber and noted that most members of Parliament had also not bothered to show up.

Demeter

(85,373 posts)AND THAT'S THEIR SELLING POINT? SHEESH....

http://www.reuters.com/article/2015/02/27/us-usa-trade-tpp-idUSKBN0LU2J720150227

The Obama administration is confident lawmakers will warm up to a proposed Pacific free trade deal on the grounds it is a chance for the United States, rather than China, to dictate the rules of Asian trade, a top official said on Thursday.

"It's a choice between us writing it and, frankly, China writing it, which I think is very compelling to many members of Congress," Deputy Secretary of Commerce Bruce Andrews said during a call to announce more support for rural exporters, such as by promoting more trade shows and workshops. The White House is lobbying hard to win support for trade in Congress, particularly among Democrats worried about the impact of trade deals on U.S. jobs.

Andrews said the 12-nation Trans-Pacific Partnership, or TPP, deal was a chance to get an agreement with Mexico on new labor and environmental standards that were not part of the North American Free Trade Agreement. But some Democrats are not convinced, with eight senators taking to the Senate floor later to raise concerns about trade.

"The proposed TPP trade deal should be judged by whether it creates good-paying American jobs, or destroys those jobs," said Oregon Senator Jeff Merkley. "Too often, trade deals with low-income nations have destroyed jobs."

Washington views China, the United States' second-biggest trading partner, with concern since the Asian giant has inked major trade agreements in the past year and also favors an Asia-Pacific free trade zone some see as a rival to the TPP.

China is not a party to the TPP talks but could join later.

President Barack Obama used China as the main argument in his State of the Union pitch on trade in January. On Thursday, Obama took the message outside of Washington in interviews with local television stations.

“If we don't do this, China is essentially going to be writing the rules in the largest market in the world," Obama told KMBC-TV of Kansas City, Missouri.

Many lawmakers view China as an adversary and are alarmed by America's rising trade deficit with the Asian powerhouse. Lawmakers are expected to introduce legislation soon to streamline the passage of trade deals in Congress, which majority Republicans see as contingent to their support for the TPP. Acting Deputy U.S. Trade Representative Wendy Cutler said Thursday that movement in Congress gave momentum to narrowing the list of outstanding TPP issues.

"There are fewer issues but they are really, really tough, that's what we are increasingly focused on," she said.

Demeter

(85,373 posts)JUST A GUESS OFF THE TOP OF MY HEAD: HEATING BILLS, LEAKING ROOFS, AND OBAMACARE TAX SNAFUS. PLUS, IT'S TOO DAMN COLD TO GO SHOPPING!!

http://www.nakedcapitalism.com/2015/02/wolf-richter-heck-suddenly-hit-american-consumers.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

...

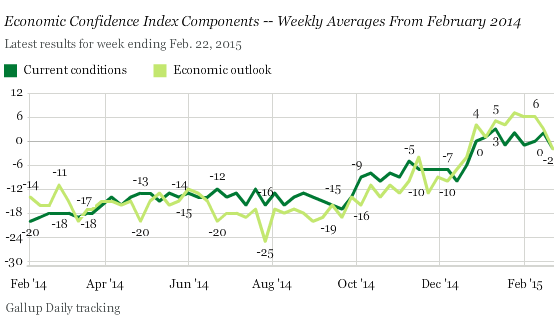

Gallup developed its Economic Confidence Index in 2008 during the Financial Crisis. Not surprisingly, given what most consumers face, the weekly index has been deeply in the negative throughout its life. Well almost. In 2014, it still ranged from -14 to -21, despite other consumer confidence indices that were soaring. But late in the year, perhaps as the plunge in gasoline prices was doing its magic, it began to rise. And in late December, the index made it all the way into positive territory, for the first time ever – and inched up further in 2015.

Until now. For the week ending February 22, it fell 5 points to -2, the largest drop since July, and once again back in the negative. Gallup explains that the index is “usually fairly stable, not changing more than a couple of points unless there is some significant event.”

The index is composed of two components: “how Americans rate current economic conditions and whether they say the economy is getting better or getting worse.” This year, unlike prior years, the economic outlook index was consistently above the current conditions index, ranging in positive territory between +2 and +6. The current conditions index ranged between -1 and +1. Now both have dropped to -2. Over the past two weeks, the outlook index dropped from +6 to -2, down 8 points.

In the latest week, 27% of Americans said the economy was “excellent” or “good,” while 29% said it was “poor.” Hence the current conditions value of -2. And 47% of Americans said the economy is “getting better” while 49% said it is “getting worse.” Hence the economic outlook value of -2. And the “significant event” that could have triggered the decline? Gallup explains:

Americans’ lower confidence in the economy last week is most likely a reaction to the rise in gas prices. Even though gas prices remain well below where they were a year ago, the recent increase has been fairly sharp – though perhaps less than the normal late winter increase – and the shift from declining to rising prices may simply be discouraging to consumers.

And so, “if gas prices continue to rise and the weather” – again, the weather – “ends up adversely affecting first quarter economic growth, economic confidence could struggle to get back into positive territory.” And then that would be it for American consumers? After years of post-financial-crisis struggles, finally some light at the end of the tunnel and a few weeks of positive economic outlook in early 2015, caused by plunging gas prices, according to Gallup, before it all starts to crumble again...