Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 13 February 2015

[font size=3]STOCK MARKET WATCH, Friday, 13 February 2015[font color=black][/font]

SMW for 12 February 2015

AT THE CLOSING BELL ON 12 February 2015

[center][font color=green]

Dow Jones 17,972.38 +110.24 (0.62%)

S&P 500 2,088.48 +19.95 (0.96%)

Nasdaq 4,857.61 +56.43 (1.18%)

[font color=green]10 Year 1.99% -0.01 (-0.50%)

[font color=red]30 Year 2.58% +0.01 (0.39%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Demeter

(85,373 posts)http://www.vice.com/en_uk/read/the-frog-who-crushed-the-world

You just knew it had to be one of those brie-biting, Sartre-spewing, overly-garlicked Frenchmen who pushed the Earth's finance system over a cliff.

This week, US prosecutors finally began the trial of the only person on the entire planet whom they have charged with the financial crimes that sank worldwide stock markets by trillions in 2008 and left millions homeless and jobless, from Detroit to Manchester.

Amazingly, say prosecutors, it all came down to a single Frenchman, Fabrice "Fabulous Fab" Tourre, only 29 years old at the time. Even Julius Caesar waited until he turned 51 to bring the known world to its knees....

...JOHN PAULSON, GOLDMAN SACHS, LLOYD BLANKFEIN, ROYAL BANK OF SCOTLAND...

Government watchdogs hunted for the financial crimes perpetrators, and, discovering the Goldman/Paulson fraud, brought charges against... the French kid. Goldman had lent Fabrice Tourre to Paulson to take on flunky tasks, including putting together a 28-page "flip book" to lure European banks into the scam.

In a text message discovered by investigators, Fabrice admitted to a friend that he couldn't understand the insanely complex derivatives Paulson had crafted with Tourre's bosses at Goldman. He did, though, grasp that the strange securities were, he wrote, "monstrosities". A collapse was coming that would "bring down the whole house", leaving Fabrice standing in a ruined planet – with a fat bonus.

What did the Feds do to Paulson? He received... a special tax break.

The Confidential Memo at the Heart of the Global Financial Crisis August 22, 2013

http://www.vice.com/en_uk/read/larry-summers-and-the-secret-end-game-memo

When a little birdie dropped the End Game memo through my window, its content was so explosive, so sick and plain evil, I just couldn't believe it.

The Memo confirmed every conspiracy freak’s fantasy: that in the late 1990s, the top US Treasury officials secretly conspired with a small cabal of banker big-shots to rip apart financial regulation across the planet. When you see 26.3 percent unemployment in Spain, desperation and hunger in Greece, riots in Indonesia and Detroit in bankruptcy, go back to this End Game memo, the genesis of the blood and tears.

The Treasury official playing the bankers’ secret End Game was Larry Summers...(WHO) should be serving hard time in some dungeon reserved for the criminally insane of the finance world....It's not the little cabal of confabs held by Summers and the banksters that’s so troubling. The horror is in the purpose of the "end game” itself.

Let me explain:

The year was 1997. US Treasury Secretary Robert Rubin was pushing hard to de-regulate banks. That required, first, repeal of the Glass-Steagall Act to dismantle the barrier between commercial banks and investment banks. It was like replacing bank vaults with roulette wheels.

Second, the banks wanted the right to play a new high-risk game: “derivatives trading”. JP Morgan alone would soon carry $88 trillion of these pseudo-securities on its books as “assets”.

Deputy Treasury Secretary Summers (soon to replace Rubin as Secretary) body-blocked any attempt to control derivatives.

But what was the use of turning US banks into derivatives casinos if money would flee to nations with safer banking laws?

The answer conceived by the Big Bank Five: eliminate controls on banks in every nation on the planet -- in one single move. It was as brilliant as it was insanely dangerous.

How could they pull off this mad caper? The bankers' and Summers' game was to use the Financial Services Agreement (or FSA), an abstruse and benign addendum to the international trade agreements policed by the World Trade Organisation.

Until the bankers began their play, the WTO agreements dealt simply with trade in goods – that is, my cars for your bananas. The new rules devised by Summers and the banks would force all nations to accept trade in "bads" – toxic assets like financial derivatives.

Until the bankers’ re-draft of the FSA, each nation controlled and chartered the banks within their own borders. The new rules of the game would force every nation to open their markets to Citibank, JP Morgan and their derivatives “products”.

And all 156 nations in the WTO would have to smash down their own Glass-Steagall divisions between commercial savings banks and the investment banks that gamble with derivatives.

The job of turning the FSA into the bankers’ battering ram was given to Geithner, who was named Ambassador to the World Trade Organisation.

MORE

http://www.gregpalast.com/larry-summers-goldman-sacked/

Joseph Stiglitz couldn't believe his ears. Here they were in the White House, with President Bill Clinton asking the chiefs of the US Treasury for guidance on the life and death of America's economy, when the Deputy Secretary of the Treasury Larry Summers turns to his boss, Secretary Robert Rubin, and says, "What would Goldman think of that?"

Huh?

Then, at another meeting, Summers said it again: What would Goldman think?A shocked Stiglitz, then Chairman of the President's Council of Economic Advisors, told me he'd turned to Summers, and asked if Summers thought it appropriate to decide US economic policy based on "what Goldman thought." As opposed to say, the facts, or say, the needs of the American public, you know, all that stuff that we heard in Cabinet meetings on The West Wing.

Summers looked at Stiglitz like Stiglitz was some kind of naive fool who'd read too many civics books.

R.I.P. Larry Summers

On Sunday afternoon, facing a revolt by his own party's senators, Obama dumped Larry as likely replacement for Ben Bernanke as Chairman of the Federal Reserve Board.

Until news came that Summers' torch had been snuffed, I was going to write another column about Larry, the Typhoid Mary of Economics. (My first, in The Guardian, 15 years ago, warned that "Summers is, in fact, a colony of aliens sent to Earth to turn humans into a cheap source of protein."

But the fact that Obama even tried to shove Summers down the planet's throat tells us more about Obama than Summers—and whom Obama works for. Hint: You aren't one of them....

TO REFRESH YOUR MEMORIES...AS WE FACE ANOTHER FORCED CHOICE ELECTION. NASTY LITTLE STORY HOW OBAMA BECAME PRESIDENT IN THERE.

Demeter

(85,373 posts)By picking a banker instead of an oil executive to run Petrobras, Brazilian President Dilma Rousseff appears to have recognized that the state-run company's biggest priority is to clean up its books and acknowledge how many billions of dollars it lost to a corruption scheme in recent years. Yet her choice on Friday of confidant Aldemir Bendine also signals that Rousseff wants to maintain tight control over the company, which investors fear could prevent it from releasing a fully realistic estimate of graft-related losses.

With the economy sputtering, inflation above 7 percent and Brazilians preparing for increasingly likely electricity and water rationing this year, Rousseff's approval rating is already the lowest of her presidency. Having Petrobras (PETR4.SA) recognize as much as $22 billion in losses stemming from the price-fixing, bribery and political kickback scandal, the extent of which prosecutors began to reveal last year, is likely to increase Brazilian anger at government mismanagement, analysts say.

While some voice respect for Bendine, who was previously chief executive for state-run bank Banco do Brasil SA (BBAS3.SA), they expect he will lack the independence to break free of the politics surrounding the company's accounting.

"A big loss would please the market but hurt Rousseff," said Reginaldo Gonçalves, a professor of accounting at Faculdade Santa Ursula, a Sao Paulo university. "I don't see getting a reliable (estimate of the loss) anytime soon."

MORE SCANDAL IN RIO FOR MARDI GRAS...THEY CANCELED IT BECAUSE OF DROUGHT!

Demeter

(85,373 posts)I JUST LOVE WATCHING BASTARDS SWEAT WHEN THEIR CRIMES ARE REVEALED AND THEIR CONS EXPLODE IN THEIR FACES...

http://www.irishtimes.com/news/politics/deal-on-greek-debt-will-not-benefit-ireland-say-eu-ministers-1.2097557

Euro-zone finance ministers reject IRISH Republic’s appeal for further debt concessions...Calls by members of the Government for further debt concessions for Ireland in the event of a renegotiation of the Greek bailout have been dismissed by the powerful euro group of euro-zone finance ministers ahead of a key meeting in Brussels on Wednesday. Comments by Minister for Agriculture Simon Coveney suggesting that Ireland should get similar treatment to Greece in terms of debt concessions provoked a strong reaction in Brussels on Monday, with senior euro zone sources telling The Irish Times that a deal for Ireland was not on the table. A senior euro zone source said the prospect of a renegotiated deal for Ireland was being “excluded” from ongoing negotiations on the stalled Greek bailout.

Different standards

Speaking to The Irish Times in New York, Minister for Agriculture Simon Coveney reiterated his view that different standards should not be applied to Greece from those applied to other countries that have gone through similar economic difficulties, including Ireland.

“Everybody wants to be helpful to Greece here, but we can’t apply a different standard to Greece just because they have a new government who are making demands,” Mr Coveney said.

“What we are saying is let’s be realistic about what is possible. Ireland like other countries will try and be helpful as we can but I think we have to be firm that the same approach and the same standards have to apply to Greece as to every other country that has found themselves in difficulty over the last number of years.”

The Minister urged Greece to follow a strategy similar to Ireland’s renegotiations on reducing the country’s debt burden. “The example of how the world views Ireland’s debt management now is in the cost of funds for us,” he said.

“I think we are in a very good place, so the approach that Greece should take should be along those lines.”

Mr Coveney said that he had absolute faith in Minister for Finance Michael Noonan “to be helpful but at the same time to operate within acceptable parameters”.

YUP. LET THE WHOLE DAMN FRAUD UNRAVEL...MORE

HAVE YOU NOTICED HOW THE UKRAINIAN GOVERNMENT IS THE "GOOD CHILD" WHILE THE GREEK GOVERNMENT IS THE "BAD CHILD" IN THE IMF REPORTS?

I FULLY EXPECT TO SEE LAGARDE HANGING FROM A LAMP POST, IN THE NEAR FUTURE.

DemReadingDU

(16,000 posts)I doubt anyone will be hanging from lamp posts, for a long while.

Demeter

(85,373 posts)and it's coming closer every day. Look what they did to old Dominique!

Demeter

(85,373 posts)YVES SMITH REPORTS ON A GROWING, INTERNATIONAL FIGHT BACK AGAINST BLACKSTONE, THE WORST HEDGE FUND/LANDOWNER IN THE WORLD...

Demeter

(85,373 posts)By Arthur Berman, a petroleum geologist with 36 years of oil and gas industry experience. He is an expert on U.S. shale plays and is currently consulting for several E&P companies and capital groups in the energy sector. Berman is an associate editor of the American Association of Petroleum Geologists Bulletin, and was a managing editor and frequent contributor to theoildrum.com. He is a Director of the Association for the Study of Peak Oil, and has served on the boards of directors of The Houston Geological Society and The Society of Independent Professional Earth Scientists. Originally published at OilPrice

...I believe that oil prices will increase strongly before the end of 2015 but there has to be a reason. Budget cuts and falling rig counts may create a feeling that production will fall but markets don’t move far or for long based on feelings.

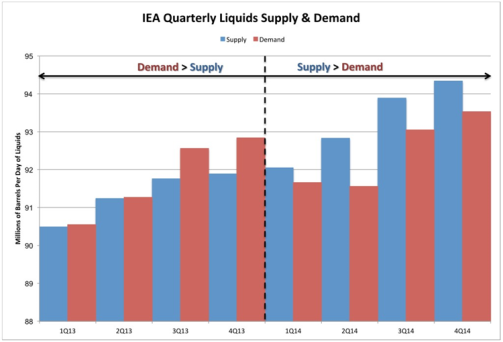

With that out of the way, let’s look at the facts. Two charts are all we need. Both IEA and EIA (U.S. Energy Information Administration) released new data on February 10, 2015. I used IEA quarterly oil supply and demand data to make the following chart.

The chart shows that demand exceeded supply through the 4th quarter of 2013. That’s why oil prices were high in much of 2013 and in the first half of 2014. Supply has exceeded demand for all of 2014. That’s why oil prices fell (a lag before the market reacts to a change in supply-demand balance is common).

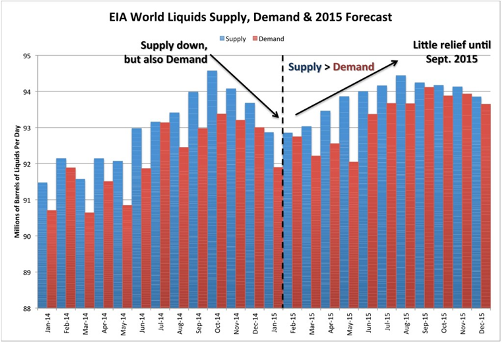

World monthly liquids supply, demand and 2015 forecast. Data to the right of the vertical dashed line is an estimate. Source: EIA

MORE

kickysnana

(3,908 posts)Demeter

(85,373 posts)xchrom

(108,903 posts)While the economy shrank 0.1% in the third quarter, the economy gained momentum in the fourth quarter, the Federal Statistical Office said.

Domestic demand drove growth in the fourth quarter, it said.

An analyst described Germany's growth as "a thunderbolt", with recovery starting earlier than expected.

However, France's economy grew by just 0.1% in the fourth quarter, with the economy expanding by just 0.4% over 2014 as a whole.

"It's obviously still too weak, but the conditions are ripe to permit a cleaner start of activity in 2015," said French Finance Minister Michel Sapin.

xchrom

(108,903 posts)An email which the whistleblower at the centre of an HSBC tax-dodging scandal says he sent to HM Revenue and Customs in 2008 has been uncovered by a French newspaper.

Herve Falciani said he had offered HMRC information on bank account holders in Switzerland.

HMRC, which has been accused of failing to act on the 2008 offer, said it had no record of the email.

Le Monde has since uncovered the email and shown it to the BBC.

xchrom

(108,903 posts)German Chancellor Angela Merkel has said a compromise is possible in the stand-off with Greece over its bailout terms.

But Mrs Merkel told reporters as she arrived for a conference with other EU leaders that "Europe's credibility depends on us sticking to rules".

Greece opposes extending its bailout deal, saying it is damaging their economy.

On Wednesday, talks with other eurozone members failed to reach an agreement.

xchrom

(108,903 posts)Falling petrol and car sales led to a 0.8% drop in overall sales compared to the previous month, the figures show, despite the fall in oil prices.

Excluding those more volatile factors, sales ticked up by 0.1% in January.

Economists said they were disappointed by the numbers and that it could lead to weaker growth. Spending accounts for two-thirds of the US economy.

"With lower gasoline prices leaving households with more to spend... the labour market on fire and consumer confidence back at its pre-recession level, we had hoped to see a much stronger performance," Paul Ashworth, an economist at Capital Economics, said in a note to clients

xchrom

(108,903 posts)In the aerospace and defence giant's full year results, Rishton said 2014 was a "mixed year."

Well, you could say that, considering the over 23% drop in the stock price, underlying revenue dropping for the first time in 10 years and a major restructuring of its aerospace division.

Oh, and EPS dropped 95% year on year, too. The company iced the cake with lower guidance for the coming year.

Investors seem to think it was a little worse than a "mixed year," as well:

Read more: http://www.businessinsider.com/rolls-royce-ceo-john-rishton-mixed-year-stock-slump-2015-2#ixzz3RcTYZ0yu

xchrom

(108,903 posts)European stocks are currently hitting their highest levels since 2008.

The Eurostoxx 50, an index that covers the 50 biggest and most traded public companies in the eurozone, is up 0.90% today. It's up 10% on this time last year, and up nearly a third in the last two years.

Here's how it looks:

Read more: http://www.businessinsider.com/eurozone-stocks-are-hitting-their-highest-levels-since-2008-2015-2#ixzz3RcUEmlq0

xchrom

(108,903 posts)1. Greece will meet with Europe's finance ministers again on Monday in a last bid to end the debt standoff.

2. The European Union has threatened Russia with more sanctions if the Ukraine ceasefire deal fails.

3. UN Secretary General Ban Ki-moon called for action to prevent Yemen from collapsing after Shiite militiamen seized the capital in September and the government collapsed last week.

4. Germany's economy grew twice as fast as expected, sending stock markets soaring.

5. New York Times media columnist David Carr died on Thursday at age 58.

Read more: http://www.businessinsider.com/the-10-most-important-things-in-the-world-right-now-feb-13-2015-2#ixzz3RcZIXHXU

xchrom

(108,903 posts)Century-old American companies like General Electric and Ford appear ancient when viewed alongside modern upstarts like Google and Facebook. But there are a number of Japanese firms—some of which have been around for more than a millennium—that exist on another scale of time entirely. Japan is home to some of the oldest continuously operating businesses in the world, among them a 1,300-year-old inn and a 900-year-old sake brewer.

While this longevity is not confined to East Asia—the Italian gun manufacturer Beretta has operated since at least 1526 and the cymbal maker Zildjian was founded in 1623 in Turkey—these Sequoia-like firms are relatively common in Japan. The country is currently home to more than 50,000 businesses that are over 100 years old. Of those, 3,886 have been around for more than 200 years. As a point of comparison, only one in every four U.S. companies founded in 1994 was still operating in 2004, according to the Bureau of Labor Statistics.

But in the past decade, some of Japan’s oldest businesses have finally shut their doors. Last month, the roughly 465-year-old seafood seller Minoya Kichibee filed for bankruptcy, which came after the news last year that the 533-year-old confectioner Surugaya met a similar fate. In 2007—after 1,429 years in business—the temple-construction company Kongo Gumi ran out of money and was absorbed by a larger company. Three companies going bust doesn’t quite make a trend, but it seems like there has to be something larger going on if a company that's been around for more than a millennium suddenly blinks out of existence.

The first question to ask about a company like Kongo Gumi is why it stuck around so long in the first place. For one thing, these companies tend to be clustered in industries that never really go out of style. Kongo Gumi specialized in building Buddhist temples—a pretty dependable bet in nation with a strong Buddhist history. The company's first temple, near Osaka, was completed in 593, and has been rebuilt six times since then (by Kongo Gumi, of course). “There’s a pattern,” William O’Hara, the author of Centuries of Success, told The Wall Street Journal in 1999. “The oldest family businesses often are involved in basic human activities: drink, shipping, construction, food, guns.”

xchrom

(108,903 posts)BRUSSELS (AP) -- Greek stocks led a European market rally on Friday amid hopes that the new government is inching its way to a debt compromise deal with its creditors in the 19-country eurozone.

The main stock index in Athens was up almost 5 percent in midday trading, with bank shares leading the charge, as investors grew optimistic that a deal is possible on Greece's demand to lighten the load of its bailout after European leaders took conciliatory steps at a summit.

The brighter mood buoyed European markets across the board, with Germany's index at a record high.

At the summit in Brussels, Greece and its creditors sought to bridge their differences, though much work remains if a deal is to be clinched on Monday, when eurozone finance ministers meet to discuss the issue.

xchrom

(108,903 posts)KEEPING SCORE: France's CAC 40 edged up 0.7 percent to 4,758.18. Germany's DAX added 0.6 percent to 10,987.43 and Britain's FTSE 100 gained 0.7 percent to 6,878.58. U.S. shares were set to rise with Dow futures gaining 0.2 percent to 17,963. S&P 500 futures were up 0.1 percent to 2,086.30.

GREECE FACTOR: Greece and its creditors in the 19-country eurozone took visible, if modest, steps to bridge their differences over Athens' demands to lighten the load of its bailout. But a deal is still some way off. Following weeks of haggling, the two sides made a series of encouraging noises at a summit of European Union leaders and even agreed to start technical discussions to inform a meeting of the eurozone's finance ministers Monday. Investors are hopeful that a deal will be reached to avoid Greece's exit from the euro.

GERMAN GROWTH: Data out Friday showed the German economy, Europe's biggest, picked up speed in the fourth quarter to grow by a better-than-expected 0.7 percent. October-December growth was powered partly by household spending, which got a perk from lower oil prices. Both exports and imports rose. Growth figures for euro nations as a whole are due for release during the day.

THE QUOTE: "The global market rally seems to be back on, aided by some optimism on the European front," IG strategist Stan Shamu said in a market commentary. "It seems markets are starting to price in a positive/perfect outcome from the Greece negotiations," he said. "While everything is looking very positive now, this could all change very swiftly come Monday when leaders reconvene."

ASIA'S DAY: Hong Kong's Hang Seng jumped 1.1 percent to 24,682.54 and South Korea's Kospi rose 0.8 percent to 1,957.50. China's Shanghai Composite climbed 1.0 percent to 3,203.83. Australia's S&P/ASX 200 surged 2.3 percent to 5,877.50 on expectations the central bank will lower interest rates again. Japan's Nikkei 225 dropped 0.4 percent to 17,913.36 as the dollar weakened a little against the yen.

xchrom

(108,903 posts)TOKYO (AP) -- Japan and the U.S. are moving closer to reaching agreement on market opening measures needed to conclude a Pacific Rim trade pact, a top U.S. envoy said Friday, urging Japanese business leaders to help bridge the last, difficult disagreements.

U.S. Deputy Secretary of State Antony J. Blinken urged members of the Japan Association of Corporate Executives to "pick up your phones" and use their influence to convince officials to work toward a final consensus on the Trans-Pacific Partnership, or TPP.

"The contours of a final agreement are coming into focus," Blinken said. "We need you to make the calls, convene the meetings and remind the officials of the benefits this agreement will bring."

Agreement between Japan and the U.S. is essential for forging the free-trade arrangements among the dozen nations involved in the U.S.-led effort. Both sides say they are close to an accord, but that key gaps remain. America's great rival for influence in Asia - China - is not part of the Pacific rim trade talks.

xchrom

(108,903 posts)(Bloomberg) -- Greece is seeking a “new contract” with the euro area on how to continue its bailout, as talks resume and both sides signal willingness to compromise, according to government officials taking part in the talks.

Greek Prime Minister Alexis Tsipras met his European Union peers at a summit for the first time Thursday and said afterwards he sees political will to agree on what happens after the current aid program expires this month. Greece’s goal remains a six-month bridge agreement that would lead to a new deal with euro-area authorities, he told reporters.

German Chancellor Angela Merkel urged Greece to move swiftly with its next request, which she portrayed as a follow-on to the current bailout program. She said her first meeting with Tsipras was “very friendly” and cited ability to compromise as one of Europe’s strengths.

“I would like them to apply for the extension as soon as possible,” Merkel said at a news conference in Brussels. “And if the goal is to fulfill it by the end of February, then I’d like the intention to fulfill it to be announced soon.”

xchrom

(108,903 posts)(Bloomberg) -- When Group of 20 finance ministers this week urged the Federal Reserve to “minimize negative spillovers” from potential interest-rate increases, they omitted a key figure: $9 trillion.

That’s the amount owed in dollars by non-bank borrowers outside the U.S., up 50 percent since the financial crisis, according to the Bank for International Settlements. Should the Fed raise interest rates as anticipated this year for the first time since 2006, higher borrowing costs for companies and governments, along with a stronger greenback, may add risks to an already-weak global recovery.

The dollar debt is just one example of how the Fed’s tightening would ripple through the world economy. From the housing markets in Canada and Hong Kong to capital flows into and out of China and Turkey, the question isn’t whether there will be spillovers -- it’s how big they will be, and where they will hit the hardest.

“Liquidity conditions globally will start to tighten,” said Paul Sheard, chief global economist at Standard & Poor’s in New York. “Emerging markets won’t be the only game in town. You will have a U.S. economy that is growing more strongly and also offering rising interest rates and a return on capital that is starting to vie for new investment opportunities around the world.”

xchrom

(108,903 posts)People have been preaching austerity for a very long time. Ancient Greek philosophers, Jesus's disciples, Benjamin Franklin—they're all part of a chorus of voices over the centuries who've warned us against the dangers of debt and profligate spending.

Fiscal austerity, though, is a modern invention. It wasn't until after World War I that governments started making serious efforts to address debt and other problems by cutting their spending. One reason is that, until the early 20th century, most countries had such small budgets that there wasn't much to cut. (The U.S. federal budget on the eve of World War I equalled about 2.5 percent of the national economy; now, it's around 20 percent, and that in turn is much lower than the figure in some other countries.)

Nowadays, fiscal austerity is often associated with the International Monetary Fund, which has required budget cutting as a condition for bailouts in scores of troubled economies. In other cases, though, governments have embraced austerity for reasons of their own, such as fighting inflation or repaying foreign debt.

Some of these efforts—such as Germany's and Japan's in the 1930s and Romania's in the 1980s—were catastrophic failures. Elsewhere, the record has been less clear-cut. The British are still debating the impact of Prime Minister Margaret Thatcher's budget cuts in the early 1980s. Some countries have recovered fairly quickly after taking IMF-prescribed austerity medicine, while others suffered prolonged economic misery.

xchrom

(108,903 posts)At times the conflict between Greece and the rest of the Eurozone looks like a duel to the death. Last night, a seven-hour meeting of Europe’s finance ministers about Greece’s immediate funding needs ended in tetchy silence. There was no common statement; there wasn’t even (to borrow Greek Finance Minister Yanis Varoufakis’s phrase after his meeting last week with Germany’s Wolfgang Schaeuble) an agreement to disagree. On Twitter, Greece-watchers tried to come up with ways to marry Greece’s request for a bridge loan with the Eurozone’s insistence on an extension to the bailout memorandum, which the new governing party Syriza has promised to repudiate. Pier? Pontoon? Causeway? Schrödinger’s memorandum, simultaneously dead and alive?

Semantics will play an important part in any eventual solution, which will involve compromises and face-saving wording for both sides. But semantics can’t be all of it—something the Eurozone ministers may not yet have understood. The Syriza government is not just pushing for a better deal—they’re refusing to keep on playing the same self-destructive game, piling debt on unpayable debt tied to impossible conditions. The aim is to reclaim democracy and political possibility—and with them, human lives—from the failed and fatal dogmas of austerity. In this they are backed by 70 percent of the Greek people, twice the proportion that voted for them. Eighty percent also want to stay in the eurozone. The desire—perhaps quixotic, perhaps grandiose, but born of suffering and necessity—is not to abandon Europe but to change it.

Like well-trained organizers, Syriza’s leaders are being the change they want to see. Their sartorial rebellion signals urgency, the rejection of business as usual, a commitment to fundamentals over precedent and procedure. The disjunction between their language and that of the old politicians is startling and refreshing. In Berlin on Thursday, Finance Minister Schaeuble spoke of rules and tax inspectors; Varoufakis, tieless as usual, addressed Europe’s post-war project, offering “a frenzy of reasonableness” and deep reform at home, while describing the damage done to Europe, as well as to Greece. Germany, he said, more than any other nation, must understand how “a severely depressed economy, combined with a ritual national humiliation and unending hopelessness,” can hatch the serpent’s egg: the third-largest party in the Greek parliament is now a Nazi party. Speaking as an equal partner, he requested not money and indulgence but political space and time.

In Greece, too, political reality seems to have been stood on its head. In a parliament presided over by a young female speaker, Syriza’s new ministers put forward ambitious programs as if no storm was raging in the capitals of the north, threatening bankruptcy. Immediate help for families worst hit by the depression, an end to the culture of corruption and clientelism, investigation of tax evaders, a new public broadcaster funded from tax receipts, collective bargaining restored with help from the International Labour Organization, a new ministry for migration and citizenship for second-generation immigrants, civil partnerships for gay couples, a reformed, independent justice system… the lists went on, as if to say, whatever Europe does or doesn’t do, we are now resolved to determine our own fate.

Demeter

(85,373 posts)Yves here. Helmer’s deep dives into Ukraine’s corruption are a cross between Graham Greene underworldliness with a contemporary veneer of financial wheeling and dealing, plus lots of think tank laundered influence peddling. For those not up on the dramatis personae in Ukraine, Igor (also spelled Ihor) Kolomoisky is one of the wealthiest men in Ukraine.

By John Helmer, the longest continuously serving foreign correspondent in Russia, and the only western journalist to direct his own bureau independent of single national or commercial ties. Helmer has also been a professor of political science, and an advisor to government heads in Greece, the United States, and Asia. He is the first and only member of a US presidential administration (Jimmy Carter) to establish himself in Russia. Originally published at Dances with Bears

Polish figures and former officials who have been leading the campaign for Polish financial and military aid to the Ukrainian Government in Kiev may have been lobbyists for Igor Kolomoisky’s PrivatBank, when he was trying to obtain a Polish banking licence. Documents sent and received by PrivatBank, just published in Warsaw, reveal that Kolomoisky’s bank engaged a law firm in Warsaw to direct the lobbying campaign. The documents claim the campaign involved Polish academic and finance official, Marek Dabrowski, in an attempt to lobby his friend, Leszek Balcerowicz, when Balcerowicz was President of the National Bank of Poland (NBP). According to sources with direct knowledge of what happened, when the Polish secret services recommended against licensing Kolomoisky’s bank, Dabrowski and Balcerowicz were invited to endorse an indirect plan for Kolomoisky to acquire control of Bud-Bank (Bank Budownictwa Mieszkaniowego), a small, state-owned Polish institution which was already licenced.

The documents released to date suggest that current links between the Polish names and current members of the Ukrainian war party may have started as business links between them a decade ago. Dabrowski categorically denies involvement in, or knowledge of the licence process or of the lobbying campaign. The documents substantiate no wrongdoing by the Poles or Ukrainians engaged in PrivatBank’s bid, which ultimately failed to win Polish approval.

Olexandr-DubiletThe Polish law firm was Soltysinski Kawecki & Szlezak (SKS). The PrivatBank executives instructing the lawyers were Natalya Armashova and Andrey Masko; they reported to Olexandr Dubilet, then chief executive and currently board chairman of PrivatBank. Picture at right shows Dubilet with Kolomoisky in April 2003. Emails of their communications during the licence lobbying campaign have been released in recent days. They date from 2004 and 2005.

One of the documents authored by Masko of PrivatBank, directed to the lawyers in Warsaw, says: “PrivatBank have a good relations with prof. Marek Dabrowski. He is good friend and companion-in-arms of Leszek Balcerowicz (he was his First Deputy when Balcerowicz was Ministry of Finance). He was Supervisory Board Member of NBP for a long period. Tomorrow Mr. Dabrowski will meet Mr. Balcerowicz for business purposes and can discuss with him something regarding PrivatBank. Please advise what issues regarding PrivatBank can be discussed on the meeting and what can we ask from Mr. Balcerowicz. Please give your proposals before noon today.” The authenticity of the email has been checked and confirmed by the recipients...Masko is no longer contactable at Privatbank. Armashova has moved to an investment firm in Cyprus connected to the Privat group. At group headquarters in Ukraine, Dubilet refused to respond to requests to confirm his subordinates’ record of the Polish bank licence campaign. Dubilet said through a spokesman:: “About work in Poland, a few years ago, we have studied the possibility of opening a branch in Poland, as well as other EU countries, where there are a lot of workers or tourists from Ukraine. Today our bank is operating in Latvia, Portugal, Italy. We have decided not to receive a license in Poland not because of ‘special services’, but because of the high overhead costs in managing the bank in Poland and the highly competitive market.”

SCRATCH A NATION'S TURMOIL, AND YOU'LL FIND A BANKSTER...

I AM RELIEVED TO FIND THAT POLAND IS IN THE GRIPS OF BANKSTERS, AS OPPOSED TO THE ENTIRE POPULATION BEING OFF THEIR ROCKERS, AS I HAD FEARED. SEEMS AS THOUGH THERE'S EVEN SOME ORGANIZED GOVERNMENTAL OPPOSITION TO THIS PARTICULAR BANKSTER, EVEN!

Demeter

(85,373 posts)AN UPDATE FROM NAKED CAPITALISM ON THAT OTHER FESTERING BOIL ON THE PLANET....READ-WORTHY, INCLUDING EXTENSIVE COMMENTARY

antigop

(12,778 posts)Last edited Fri Feb 13, 2015, 11:08 AM - Edit history (1)

http://www.wsj.com/articles/ruchir-sharma-the-middle-class-comeback-is-under-way-1423785514The Middle-Class Comeback Is Under Way

Mr. Sharma is the head of emerging markets and global macro at Morgan Stanley Investment Management and the author of “Breakout Nations: In Pursuit of the Next Economic Miracles” (Norton, 2012).

Demeter

(85,373 posts)Cause it sure wasn't the USA.