Economy

Related: About this forumWeekend Economists Hail to the King January 9-11, 2015

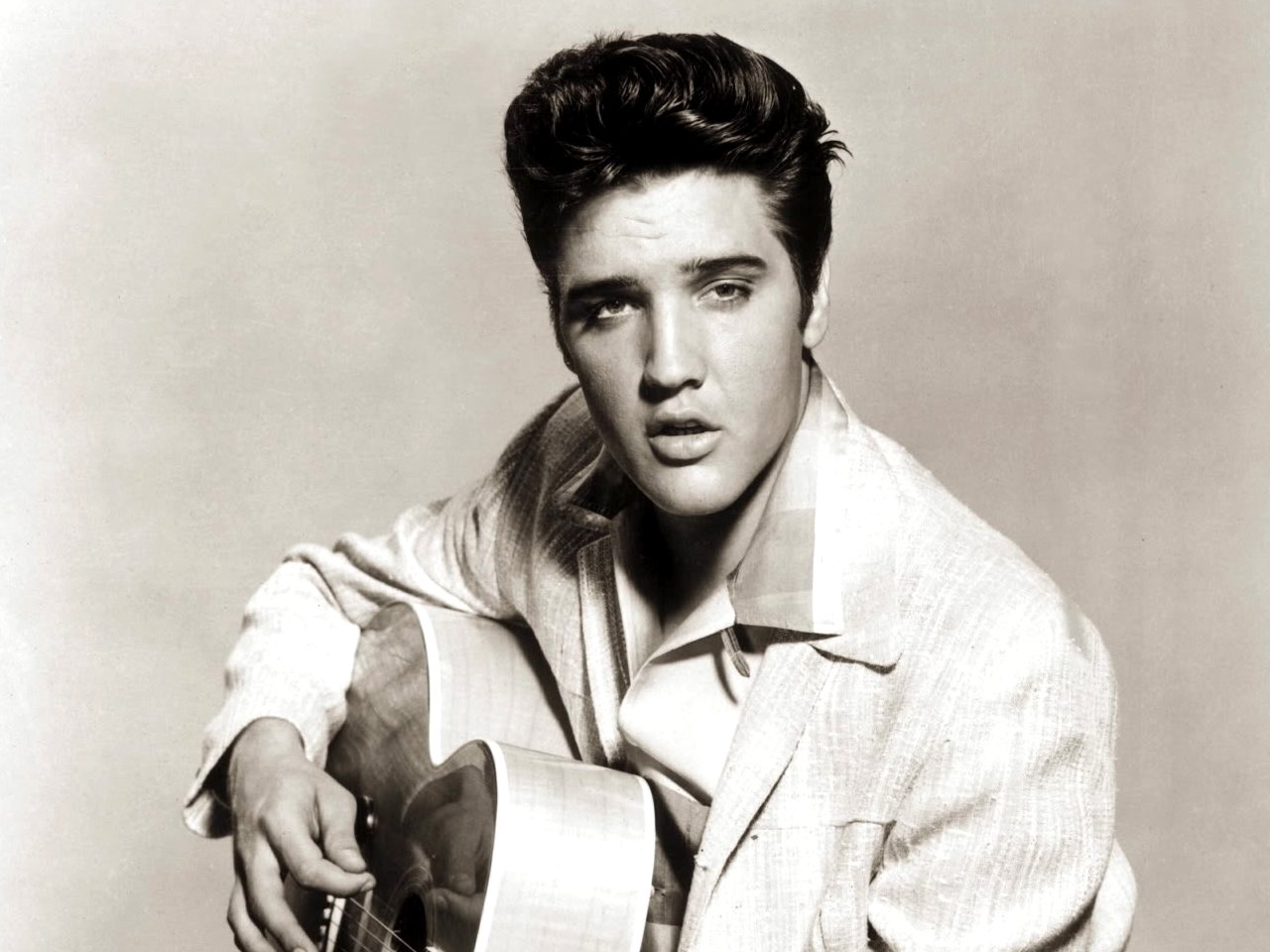

Born in Tupelo, Mississippi, when Presley was 13 years old he and his family relocated to Memphis, Tennessee. His music career began there in 1954, when he recorded a song with producer Sam Phillips at Sun Records. Accompanied by guitarist Scotty Moore and bassist Bill Black, Presley was an early popularizer of rockabilly, an uptempo, backbeat-driven fusion of country music and rhythm and blues. RCA Victor acquired his contract in a deal arranged by Colonel Tom Parker, who managed the singer for more than two decades. Presley's first RCA single, "Heartbreak Hotel", was released in January 1956 and became a number-one hit in the United States. He was regarded as the leading figure of rock and roll after a series of successful network television appearances and chart-topping records. His energized interpretations of songs and sexually provocative performance style, combined with a singularly potent mix of influences across color lines that coincided with the dawn of the Civil Rights Movement, made him enormously popular—and controversial.

In November 1956, he made his film debut in Love Me Tender. In 1958, he was drafted into military service: He resumed his recording career two years later, producing some of his most commercially successful work before devoting much of the 1960s to making Hollywood movies and their accompanying soundtrack albums, most of which were critically derided. In 1968, following a seven-year break from live performances, he returned to the stage in the acclaimed televised comeback special Elvis, which led to an extended Las Vegas concert residency and a string of highly profitable tours. In 1973, Presley was featured in the first globally broadcast concert via satellite, Aloha from Hawaii. Several years of prescription drug abuse severely damaged his health, and he died in 1977 at the age of 42.

Presley is one of the most celebrated and influential musicians of the 20th century. Commercially successful in many genres, including pop, blues and gospel, he is the best-selling solo artist in the history of recorded music, with estimated album sales of around 600 million units worldwide. He was nominated for 14 competitive Grammys and won three, also receiving the Grammy Lifetime Achievement Award at age 36, and has been inducted into multiple music halls of fame.

https://en.wikipedia.org/wiki/Elvis_Presley

IN MEMORY ON THE 80TH ANNIVERSARY OF HIS BIRTH, WEE DEDICATES THIS WEEKEND TO REMEMBERING AND CELEBRATING ELVIS PRESLEY.

Demeter

(85,373 posts)MattSh

(3,714 posts)

Fuddnik

(8,846 posts)But, you're right.

Demeter

(85,373 posts)But it seems we don't do DUZIES any more on DU.

Fuddnik

(8,846 posts)Unless their idea of a joke is tearing down Elizabeth Warren, and other liberals.

Demeter

(85,373 posts)Yves here. This post confirms what readers know all too well, that Obama will use every opportunity to sell out the middle class to corporate interests.

One thing to bear in mind is that opposition to the Trans-Pacific Partnership, and its ugly sister, the Transatlantic Trade and Investment Partnership, do not split on simply party lines. This fall, when Obama was unable to get enough votes to get “fast track” approval, which the Executive Branch uses to force an up-down vote on a final trade deal, denying Congress the opportunity to influence its contents, whip counts showed that nearly 40 Republicans in the House were prepared to join Democrats in opposing it. How the numbers would break now is an open question, but that means it is worth your time and effort to call your Congressman and let them know you are firmly opposed to these toxic trade deals.

By Bill Black, the author of The Best Way to Rob a Bank is to Own One and an associate professor of economics and law at the University of Missouri-Kansas City. Jointly published with New Economic Perspectives

The banksters have given Obama an important political opportunity – which he has spurned.

The very first thing the new Republican majorities sought to do with their power was to use the Omnibus bill to extort the first of many cuts designed to destroy the Volcker rule. Naturally, Obama agreed and wouldn’t join the Democratic wing of the Party when they could have easily stopped the giveaway if they had received even mild help from the administration. Instead, the administration lobbied hard for the Omnibus bills’ Christmas gift to banksters.

Next, the Republicans sought to slip another big delay in the effective date of provisions of the Volcker bill through Congress. Progressive Democrats killed that attempt. The Obama administration couldn’t even bring itself to feign rage at the effort to gut the Volcker rule.

These Republican efforts were (a) substantively awful, (b) designed to eviscerate the key Dodd-Frank provision purportedly supported by Obama as a vital reform, and (c) would have been incredibly unpopular with the public and the Tea Party – if Obama had stirred himself to mount a public campaign opposing them ala Elizabeth Warren. But Obama never misses an opportunity to miss an opportunity to side with the American people against the banksters.

The Travesty Known as the Trans-Pacific Partnership

The third strike is that Obama has decided to ally with the Chamber of Commerce, the perennial ally of the Koch Brothers – the people that have demonized Obama and Democrats for seven years – to get “fast track” authority approved so he can pass one of the plutocrats’ great dreams – the Trans-Pacific Partnership (TPP). Obama has also allied himself with the Business Roundtable, the CEOs of the 100 largest U.S. corporations. The Business Roundtable is also a bitter opponent of Democrats and Obama’s health policies. Obama has shaken off his torpor to energetically lobby the business lobbyists to pressure Democratic members of Congress to support TPP.

The obvious conclusion is that Obama’s paramount goal is to remain BFFs with the banksters. As those who listened to Senator Elizabeth Warren’s famous denunciation of the effort to use the Omnibus bill to begin to gut the Volcker rule will recall, Obama has brought the bankers inside the tent to rig the system against the workers. As she explained, Obama is notorious for placing wealthy Citigroup officials inside the government where they set key government economic policies. One of those wealthy and powerful Citigroup officials is Michael B. Froman, who is also a Robert Rubin protégé. It just gets better and better. Froman is Obama’s top trade negotiator, which helps explain why TPP is such a substantive disgrace that Froman is desperate to prevent the American people from knowing what is about to be done to them. Froman has deliberately made it impossible for members of Congress to understand TPP’s provisions by not allowing them and their staff to have copies of the documents, which are very long, complex, and full of arcane legalese. The drafts also cannot be fully understood without knowing which corporate lawyers secretly drafted them with the intent of aiding their corporate clients by disadvantaging competitors and workers.

At this juncture, if you’re not already familiar with TPP you should be asking yourself, “if the draft agreement is so secret that members of Congress are not permitted to have copies of it, how did the corporations and their attorneys not only get copies of the drafts, but actually craft the drafts for the private benefit of their clients?” You also should be appalled. Obama and Froman’s TPP is being designed and handled in a fashion that reads like the playbook was designed by someone who was trying to take all the worst aspects of crony capitalism and use them to loot the public for the benefit of the world’s most rapacious and politically powerful plutocrats. Obama and Froman aren’t dumb, they know that their natural allies on TPP are the Chamber of Commerce, big pharma, and the Business Roundtable who are salivating at the prospects of what their lawyers secretly drafted becoming law. To compound the disaster, Obama and Froman are demanding that Congress adopt TPP under “fast track” procedures in which no amendments to delete or rectify even the worst abuses emerging from the plutocrats’ plundering of America via the secret (from the public) drafting process are permitted. The members of Congress would be allowed only a single up or down vote on the entire package with minimal time for consideration and debate. When Warren aptly describes the system as being rigged against ordinary Americans she is talking about scandals like the TPP.

The TPP Can be Stopped

Larry Summers is not the Chairman of the Federal Reserve because progressives stopped Obama’s effort to please the banksters. Progressives blocked TPP last year. The New York Times reported on January 8, 2015 that progressives are gearing up to do the same the same to the TPP, and this is an issue on which most Americans oppose the TPP and Obama’s latest secret giveaway to the plutocrats.

As Mr. Obama works to secure the so-called trade promotion authority, a coalition of Democratic lawmakers and activists from organized labor, environmental, religious and civil rights groups is stepping up efforts to stop him.

“This is one of the broadest advocacy coalitions that we’ve had,” said Representative Rosa DeLauro, a Connecticut Democrat who is leading the opposition. “There is no reason why we should exacerbate the loss of jobs or lower wages in the United States.

They argue that the president is asking for carte blanche to hammer out trade deals that would cost American jobs, weaken food safety and financial regulations, and undermine environmental and labor standards.

The same article demonstrated that the Obama administration is so blind to the interests of the American people that it doesn’t yet understand how to try to defend TPP without exposing its folly. This is the administration’s incredible response to criticisms of the TPP.

Thanks Josh, it reaffirms my faith in America’s corporate lawyers to hear you confirm that letting them have access to secret trade documents so that they could secretly draft those trade documents to benefit their corporate clients results in documents that will be “beneficial to American companies” (or more precisely their CEOs) that those lawyers represent. Thank heavens the corporations won’t have to bring malpractice suits against their lawyers. After all, if you can’t benefit the CEO when you get to secretly draft the deal to favor the CEO then you must be an immensely incompetent lawyer. As a law professor, married to law professor, I am pleased to hear that our graduates can succeed in making their plutocrat clients even wealthier when they are engaged in the legal drafting equivalent of shooting fish in a very small barrel with a double-barreled shotgun.

I hope you are sitting down when you read this Josh, because it will obviously come as a shock to you, but the problem is that what is “beneficial to” the corporate CEOs will often be harmful to American consumers, workers, and investors. When you are trying to defend the TPP you need to resist these tendencies towards honesty. You’re not supposed to admit that you know that the TPP is designed to enrich the Nation’s largest corporations and wealthiest CEOs. Josh, though I have never had a job as a shill, I consider it likely that your boss thinks that your job is to make it appear that the administration drafted the TPP to help the American people. Indeed, while I recognize that Obama has said that he is “at heart” a “blue-dog Democrat,” I am fairly sure that a president of the Democratic Party is supposed to make it appear that the TPP was drafted to help American workers. I know, that’s a lot of hypocrisy to spout, but I’m inclined to believe that your job is claim that a trade deal that will be (net) terrible for American workers is a fabulous deal for American workers

.

Alternatively, given that the big automobile companies (two-thirds of which were bailed out by the Treasury) were the second biggest spenders on lobbying to pervert the TPP into a means to further enrich their CEOs, you could simply channel your inner Charlie Wilson and declare that you have always thought that what was “good for our country was good for General Motors, and vice versa.”

Here are the two basic problems with channeling Charlie Wilson. First, when you are negotiating a deal to help the American people and workers, rather than the corporation and CEO, you have no reason to conceal the terms from Congress and the public. You do the opposite, you solicit the views of Congress and the public and ensure that they have complete access to the drafts. We have known for thousands of years that “All those that doeth evil hateth the light.” Justice Brandeis was correct that “sunlight is … the best of disinfectants.” TPP cannot survive sunlight, which is why Froman and Obama settled on a strategy of hiding the TPP’s terms in the deepest of shadows.

Second, you would never allow corporate lobbyists and lawyers to secretly craft a trade deal. If you do let them craft the deal they will, 100 percent of the time, favor the interests of the CEOs at the expense of the public, consumers, and investors.

Obama is Manipulated Again by Big Business’ Siren Song of a “Legacy”

Obama sought, for years, to negotiate a “Grand Bargain” with the Republicans to attack the safety net and inflict austerity on the United States. This was economically illiterate, a betrayal of his campaign promises, vicious to those in need, and politically suicidal. (In short, it was just like the TPP.) As I explained in several prior articles, Obama’s efforts to commit what was really the “Grand Betrayal” would have made him a one-term President. The siren song that Timothy Geithner and Bill Daley used to convince Obama to commit this betrayal was the promise that by betraying his supporters he would establish a “legacy” as a “statesman.” Even though it should be obvious to Obama by now that Geithner and Daley were conning him by appealing to his vanity, the sad truth is that the same tactics have proven successful with Obama on the TPP. Consider this gem from the Washington Post:

The search for a “legacy” near the end of a term of office is a well-known Washington disease that Ecclesiastes 2 warned against – vanity. Lobbyists sing the siren song of “legacy” to induce behavior in lame duck leaders that is otherwise inexplicable. Note that the Washington Post, in a purported news story, treats it as if it were fact that betraying his promises and giving business lobbyists and lawyers the ability to secretly draft deals that will make corporate CEOs wealthy at the expense of the American people would be “a legacy-burnishing achievement” for Obama. I still hope we live in a Nation in which Presidents who betray their word and the people of our Nation in the vain pursuit of creating a “legacy” actually produce a legacy of shame. It will help the reader to know that the paper’s leadership pushes relentlessly in favor of the TPP.

Demeter

(85,373 posts)diptherio January 9, 2015 at 10:55 am

There was a spontaneous parade in my little town when the 2008 results came in. Bunch of college students and Dems all cheering and delirious. I just watched the commotion from my apartment window and thought, “suckers.”

Obama’s presidency has been the major force for disenchantment for my generation. Most people in their early-mid 30s (at least in my circle) thought Clinton was mostly alright and actually believed that electing a “black community organizer” was going to turn this country around. As an anarchosyndaclist type, I almost have to thank the man for driving so many of my cohort to increased radicalism. If Obama had actually prosecuted a few banksters, Occupy would probably never have happened, or at least not spread so far and fast.

The neo-libs/cons are over-playing their hand, methinks, and are making eventual blowback by the population at large increasingly likely.

Jason Ipswitch January 9, 2015 at 1:45 pm

The elites think they can handle the blowback when it eventually happens. Thats what the domestic surveillance, “terrorism”, and militarized police are all about. But it appears to me that crushing domestic dissent is a backup. I suspect their primary plan is to start a war as a distraction.

Demeter

(85,373 posts)In November, the American Bar Association issued a formal opinion that it was unethical for prosecutors to allow debt collectors to use prosecutorial letterhead when no member of the prosecutor's staff reviews the file to determine if it is likely a crime has been committed. The most amazing thing about the opinion is that it had to be said at all.

I missed the story when it first came out, but Deepak Gupta was all over it at the Consumer Law & Policy Blog with a post and some screen shots of what these letters look like. Also, the ABA Journal has a story about the ethics opinion.

SEE LINK: http://pubcit.typepad.com/clpblog/2014/11/aba-issues-formal-ethics-opinion-on-prosecutors-who-rent-out-their-letterhead-to-debt-collectors.html

haikugal

(6,476 posts)I appreciate the information. The TPP has to be stopped and keeping abreast of the secrets and understanding how O is selling us out is distressing. Keep up the good work, we need it here!

Demeter

(85,373 posts)You'll find more information than you can handle, here and on Tansy Gold's daily Stock Market Watch. We aggregate REAL news that matters--and some truly scurrilous gossip, if it ties into the topics of politics/economics, and some humor--either bitter or truly comic--just to lighten the load.

You are with friends here. Come back often. Bring along your posse! We are taking back and Occupying DU (but don't tell anybody, it's a secret).

That's so exciting! I've been here a very long time but lost my first name when I quit DU sometime around 2005/6, I think. DU was such a different place back then.... Even so I don't post often. I've always read your posts and most of Tansy Gold's but I didn't know about this group, wonderful...I'm glad you're still here occupying DU and I agree we need to take it back! Thanks again for sharing your good information!

kickysnana

(3,908 posts)When Elvis was not in residence.

Mom's cousin retired from working at the Opry, clerical only and she kept threatening to take me back stage there when I was visiting in 1999. Might have been interesting but I was more interested in the music than the glitz and I was down doing genealogy and had no mad money with me. My mother's first cousin was Elvis before this Elvis and his father also was from Mississippi but our Elvis went by Al.

I ordered a subcompact car while I was there and they auto upgraded me to a brand new red convertible. I made them change it out because doing genealogy is more of a laid back thing and new red convertibles do not fit that description.

We made a stop at the tiny town where my grandfather was born at home and checked out the cemetery. Later we were told that it was a good thing we were there on on a Weekday because on weekends the local militia trained there. Also what I was looking for was in the "old cemetery" through the trees, poison ivy, hornets and snakes. The distant was going to try to go back there after a frost but before snowfall but we lost contact. We both moved about the same time.

I did get a marriage proposal while I was down there in 1999. Pretty good adventure come to think of it.

Demeter

(85,373 posts)In courtrooms across New York State, lawsuits poured in by the hundreds as if manufactured on an assembly line. Some included generic testimony, others relied on bogus affidavits, churned out so rapidly that they were seldom viewed for accuracy. Sound familiar? The same problems that dogged the foreclosure of homes — and prompted public outcry and a multibillion-dollar settlement by some of the nation’s biggest banks — are increasingly showing up in the practices of large buyers of bad consumer debt. The companies, which buy huge swaths of soured bills from lenders for pennies on the dollar, are deluging the courts with shoddy lawsuits, according to a review of debt collection lawsuits along with interviews with state judges and prosecutors. As part of an effort to stamp out such practices, New York’s state attorney general, Eric T. Schneiderman, reached a settlement on Friday with a debt buyer, the Encore Capital Group, over concerns that the company filed thousands of flawed debt collection lawsuits against state residents.

“New York has laws in place to ensure no one can prey on consumers, and debt collectors are required to follow those rules,” said Mr. Schneiderman. He added that “today’s settlement ensures that thousands of New Yorkers will see millions in relief from debts that were not enforceable in the first place.”

The settlement, which requires Encore to pay a $675,000 penalty and vacate more than 4,500 court judgments against borrowers — is part of a broader push by state and federal authorities to root out questionable debt collection practices that can stymie vulnerable borrowers just as they are trying to dig out from the financial crisis.

“We are pleased to have addressed and resolved the attorney general’s concerns in a manner that supports consumers’ interests,” said Lisa Margolin-Feher, a spokeswoman for Encore Capital, adding that the company was committed to “treating consumers fairly and with respect.” That commitment, she said, was demonstrated when it created “the industry’s first consumer bill of rights.”

The action against Encore Capital, which is based in San Diego, is the latest in a series of enforcement actions Mr. Schneiderman has brought against debt buyers. In May, he reached agreements with two other large buyers of stale consumer debts, the PRA Group in Norfolk, Va., and the Sherman Financial Group, based in New York. Under those deals, the companies agreed to nullify judgments, valued at more than $16 million, against New York residents. Together, the settlements take aim at the booming world of buying consumer debt, an industry that scoops up billions of dollars in long-overdue credit card bills, auto loans and other debt from lenders. The sums are vast. Between 2006 and 2009, the top nine debt buyers purchased 90 million consumer accounts valued at about $143 billion, according to the Federal Trade Commission. While the total amount of bad debt has shrunk as the financial crisis recedes, one in seven adults in the United States is being pursued by debt collectors, according to the Federal Reserve Bank of New York.

To obtain payments on some of that debt, buyers like Encore Capital often turn to the courts in a practice that some state authorities say effectively turns the civil court system into a debt collection arm. In New York State alone, according to a tally by Mr. Schneiderman’s office, Encore Capital and its subsidiaries filed more than 239,000 lawsuits from 2007 to 2012. Encore Capital collected $564.7 million in legal collections in 2013, according to a regulatory filing, up more than 49 percent from those in 2011. The PRA Group brought in roughly $80.2 million through legal collections in the last three months of 2013, up roughly 22 percent from a year earlier, according to a regulatory filing. Some of those lawsuits deluging the courts are marred by errors, according to the interviews. A review by The New York Times of court records shows that some lawsuits include fabricated credit card statements created years after borrowers stopped paying their bills.

The concerns about erroneous documents recall those that arose after the 2008 mortgage crisis, when banks were accused of robo-signing — a process of producing similar documents by the hundreds without reviewing them for accuracy. But unlike mortgage foreclosure lawsuits, consumer debt collection cases often play out far from public view, consumer lawyers say, because borrowers seldom show up in court to contest the suits. As a result, an estimated 95 percent of debt collection lawsuits result in default judgments against borrowers, an automatic victory for the debt buyers that enables them to garnishee consumers’ wages or freeze bank accounts.

MORE CHICANERY

Demeter

(85,373 posts)At long last, the United States is showing signs of recovery from the crisis that erupted at the end of President George W. Bush’s administration, when the near-implosion of its financial system sent shock waves around the world. But it is not a strong recovery; at best, the gap between where the economy would have been and where it is today is not widening. If it is closing, it is doing so very slowly; the damage wrought by the crisis appears to be long term. Then again, it could be worse. Across the Atlantic, there are few signs of even a modest US-style recovery: The gap between where Europe is and where it would have been in the absence of the crisis continues to grow. In most European Union countries, per capita GDP is less than it was before the crisis. A lost half-decade is quickly turning into a whole one. Behind the cold statistics, lives are being ruined, dreams are being dashed, and families are falling apart (or not being formed) as stagnation – depression in some places – runs on year after year.

The EU has highly talented, highly educated people. Its member countries have strong legal frameworks and well-functioning societies. Before the crisis, most even had well-functioning economies. In some places, productivity per hour – or the rate of its growth – was among the highest in the world. But Europe is not a victim. Yes, America mismanaged its economy; but, no, the US did not somehow manage to impose the brunt of the global fallout on Europe. The EU’s malaise is self-inflicted, owing to an unprecedented succession of bad economic decisions, beginning with the creation of the euro. Though intended to unite Europe, in the end the euro has divided it; and, in the absence of the political will to create the institutions that would enable a single currency to work, the damage is not being undone. The current mess stems partly from adherence to a long-discredited belief in well-functioning markets without imperfections of information and competition. Hubris has also played a role. How else to explain the fact that, year after year, European officials’ forecasts of their policies’ consequences have been consistently wrong?

These forecasts have been wrong not because EU countries failed to implement the prescribed policies, but because the models upon which those policies relied were so badly flawed. In Greece, for example, measures intended to lower the debt burden have in fact left the country more burdened than it was in 2010: the debt-to-GDP ratio has increased, owing to the bruising impact of fiscal austerity on output. At least the International Monetary Fund has owned up to these intellectual and policy failures. Europe’s leaders remain convinced that structural reform must be their top priority. But the problems they point to were apparent in the years before the crisis, and they were not stopping growth then. What Europe needs more than structural reform within member countries is reform of the structure of the eurozone itself, and a reversal of austerity policies, which have failed time and again to reignite economic growth.

Those who thought that the euro could not survive have been repeatedly proven wrong. But the critics have been right about one thing: unless the structure of the eurozone is reformed, and austerity reversed, Europe will not recover...The drama in Europe is far from over. One of the EU’s strengths is the vitality of its democracies. But the euro took away from citizens – especially in the crisis countries – any say over their economic destiny. Repeatedly, voters have thrown out incumbents, dissatisfied with the direction of the economy – only to have the new government continue on the same course dictated from Brussels, Frankfurt, and Berlin...The issue is not Greece. It is Europe. If Europe does not change its ways – if it does not reform the eurozone and repeal austerity – a popular backlash will become inevitable. Greece may stay the course this time. But this economic madness cannot continue forever. Democracy will not permit it. But how much more pain will Europe have to endure before reason is restored?

Joseph E. Stiglitz

Joseph E. Stiglitz, a Nobel laureate in economics and University Professor at Columbia University, was Chairman of President Bill Clinton’s Council of Economic Advisers and served as Senior Vice President and Chief Economist of the World Bank. His most recent book, co-authored with Bruce Greenwald, is Creating a Learning Society: A New Approach to Growth, Development, and Social Progress.

Demeter

(85,373 posts)Presley was born on January 8, 1935, in Tupelo, Mississippi, the son of Vernon Elvis Presley (April 10, 1916 – June 26, 1979) and Gladys Love Presley (née Smith, April 25, 1912 – August 14, 1958), in the two-room shotgun house built by Vernon's father in preparation for the child's birth. Jesse Garon Presley, his identical twin brother, was delivered stillborn 35 minutes before him. As an only child, Presley became close to both parents and formed an unusually close bond with his mother. The family attended an Assembly of God church, where he found his initial musical inspiration.

Presley's ancestry was primarily a Western European mix: on his mother's side, he was Scots-Irish, with some French Norman; one of Gladys' great-great-grandmothers was Cherokee. Presley's father's forebears were of Scottish and German origin. Gladys was regarded by relatives and friends as the dominant member of the small family.

Vernon moved from one odd job to the next, evidencing little ambition. The family often relied on help from neighbors and government food assistance. The Presleys survived the F5 tornado in the 1936 Tupelo-Gainesville tornado outbreak. In 1938, they lost their home after Vernon was found guilty of kiting a check written by the landowner, Orville S. Bean, the dairy farmer and cattle-and-hog broker for whom he then worked. He was jailed for eight months, and Gladys and Elvis moved in with relatives.

In September 1941, Presley entered first grade at East Tupelo Consolidated, where his instructors regarded him as "average". He was encouraged to enter a singing contest after impressing his schoolteacher with a rendition of Red Foley's country song "Old Shep" during morning prayers. The contest, held at the Mississippi-Alabama Fair and Dairy Show on October 3, 1945, was his first public performance: dressed as a cowboy, the ten-year-old Presley stood on a chair to reach the microphone and sang "Old Shep". He recalled placing fifth.

A few months later, Presley received his first guitar for his birthday; he had hoped for something else—by different accounts, either a bicycle or a rifle. Over the following year, he received basic guitar lessons from two of his uncles and the new pastor at the family's church. Presley recalled, "I took the guitar, and I watched people, and I learned to play a little bit. But I would never sing in public. I was very shy about it."

Entering a new school, Milam, for sixth grade in September 1946, Presley was regarded as a loner. The following year, he began bringing his guitar in on a daily basis. He played and sang during lunchtime, and was often teased as a "trashy" kid who played hillbilly music.

The family was by then living in a largely African-American neighborhood. A devotee of Mississippi Slim's show on the Tupelo radio station WELO, Presley was described as "crazy about music" by Slim's younger brother, a classmate of Presley's, who often took him into the station. Slim supplemented Presley's guitar tuition by demonstrating chord techniques. When his protégé was 12 years old, Slim scheduled him for two on-air performances. Presley was overcome by stage fright the first time, but succeeded in performing the following week.

Teenage life in Memphis

In November 1948, the family moved to Memphis, Tennessee. After residing for nearly a year in rooming houses, they were granted a two-bedroom apartment in the public housing complex known as the Lauderdale Courts.

Enrolled at L. C. Humes High School, Presley received only a C in music in eighth grade. When his music teacher told him he had no aptitude for singing, he brought in his guitar the next day and sang a recent hit, "Keep Them Cold Icy Fingers Off Me", in an effort to prove otherwise. A classmate later recalled that the teacher "agreed that Elvis was right when he said that she didn't appreciate his kind of singing."

He was usually too shy to perform openly, and was occasionally bullied by classmates who viewed him as a "mama's boy". In 1950, he began practicing guitar regularly under the tutelage of Jesse Lee Denson, a neighbor two-and-a-half years his senior. They and three other boys—including two future rockabilly pioneers, brothers Dorsey and Johnny Burnette—formed a loose musical collective that played frequently around the Courts. That September, he began ushering at Loew's State Theater. Other jobs followed, including Precision Tool, Loew's again, and MARL Metal Products.

During his junior year, Presley began to stand out more among his classmates, largely because of his appearance: he grew out his sideburns and styled his hair with rose oil and Vaseline. On his own time, he would head down to Beale Street, the heart of Memphis's thriving blues scene, and gaze longingly at the wild, flashy clothes in the windows of Lansky Brothers. By his senior year, he was wearing them.

Overcoming his reticence about performing outside the Lauderdale Courts, he competed in Humes's Annual "Minstrel" show in April 1953. Singing and playing guitar, he opened with "Till I Waltz Again with You", a recent hit for Teresa Brewer. Presley recalled that the performance did much for his reputation: "I wasn't popular in school ... I failed music—only thing I ever failed. And then they entered me in this talent show ... when I came onstage I heard people kind of rumbling and whispering and so forth, 'cause nobody knew I even sang. It was amazing how popular I became after that."

Presley, who never received formal music training or learned to read music, studied and played by ear. He also frequented record stores with jukeboxes and listening booths. He knew all of Hank Snow's songs, and he loved records by other country singers such as Roy Acuff, Ernest Tubb, Ted Daffan, Jimmie Rodgers, Jimmie Davis, and Bob Wills. The Southern Gospel singer Jake Hess, one of his favorite performers, was a significant influence on his ballad-singing style. He was a regular audience member at the monthly All-Night Singings downtown, where many of the white gospel groups that performed reflected the influence of African-American spiritual music. He adored the music of black gospel singer Sister Rosetta Tharpe. Like some of his peers, he may have attended blues venues—of necessity, in the segregated South, on only the nights designated for exclusively white audiences. He certainly listened to the regional radio stations, such as WDIA-AM, that played "race records": spirituals, blues, and the modern, backbeat-heavy sound of rhythm and blues. Many of his future recordings were inspired by local African-American musicians such as Arthur Crudup and Rufus Thomas. B.B. King recalled that he had known Presley before he was popular, when they both used to frequent Beale Street. By the time he graduated from high school in June 1953, Presley had already singled out music as his future.

Presley's birthplace in Tupelo, Mississippi

Demeter

(85,373 posts)Demeter

(85,373 posts)If you do have a few million lying around, a piece of these fortified silos can be yours...Without the savvy to live off the land that we associate with survivalists, how are the one-percenters supposed to get through the apocalypse? It’s tough to envision the well-heeled skinning deer to feed their Wall Street dinner party guests. But now the elite have another option. Instead of handing the future to bearded crackpots building sandbag barricades on rural compounds, the rich can score a luxury underground Survival Condo nice enough to remind them of the one they left in Manhattan. Built in two underground missile bunkers at an undisclosed location in Kansas, the units run from $1.5 to $.4.5 million and typically can’t be financed—so that sum’s got to be paid up front. But if you do have a few million lying around, a piece of these fortified underground silos can be yours. So far, there’s no shortage of takers. The first silo is reportedly sold out, and the second is currently accepting contracts.

It would likely take a serious cataclysm to drive posh coasties to the Kansan underworld, and you can’t sell these things without also selling fear. In fact, the project’s website includes a photo of a colorless DC skyline ravaged by an implied nuclear holocaust, complete with a bombed-out capitol building. (Another page includes an illustration of the Statue of Liberty nearly submerged by stormy seas, with nary an ape in sight.) But project manager Larry Hall rejects the notion that these units are for tinfoil hat types: “There is a stereotype of some survivalists as being single-minded—that they spend virtually all of their time doing just survival activities with no other activities,” he wrote to me in an email. This survivalist subculture is indeed fixated, as any viewer of A&E’s hit reality series “Doomsday Preppers” would attest. But Hall says those aren’t his customers. “We are not like that. Most of our clients are professional people who run businesses and have diversified interests. The involvement in the survival condo project is a recognition that there are a lot of potential threats that could disrupt their normal lives, and they want to have a plan for that possibility.”

The luxury Survival Condos are the product of meticulous labor and forethought. Someone had to dream up and execute the three separate water supplies, dog parks, a library and classroom, food production facilities, and a general store that will presumably recognize a currency severely disrupted by all the doom raging outside. The marketing literature correctly contends that strategizing the logistics of survival beneath the clattering hooves of the Four Horsemen would be a massive drain on one’s energy. Survival Condos caters to customers rich enough to outsource those obsessive measures. But there’s not much that ideologically distinguishes buyers of luxury Survival Condos from so-called preppers: both activities are rooted in a reactionary desire to maintain the status quo, even as the world crumbles.

When I asked Hall about the likelihood of a disruptive, mass-scale disaster that would necessitate these measures, he responded with the cliche endemic to all rhetoric about things that scare us: “it’s not a matter of if, it’s a matter of when.” It was the same mantra guiding Cold War-era families to build bomb shelters under their kitchens, and that inspired the government to commission the very subterranean self-preservation tanks now hosting Hall’s project. The “if, not when” survivalist ethos is the cornerstone of every episode of “Doomsday Preppers.” Each episode profiles families across the country gearing up for their own nightmare scenario. They learn hand-to-hand combat, hoard canned produce and teach their kids to fire rifles to mow down eventual intruders from the wrong side of dystopia.

THE REST IS A MORAL PHILOSOPHY EXERCISE...

Demeter

(85,373 posts)This episode provides updates on rising health insurance costs, rebel economists and Senate costs. We also respond to questions on the Greek crisis, falling school funding and the wealth inequality in the US that blocks "recovery." Finally, we interview London economics professor John Weeks...

PODCAST AT LINK: http://www.truth-out.org/news/item/28444-economic-update-real-vs-fakenomics

Demeter

(85,373 posts)...There’s another group of Americans, however, with a different agenda for the future of banking—people who are also pushing hard for policy change. They’re advocates of public banking, and they want to see new banks created that would be owned and operated by the government, usually at the state or city level. (This would greatly increase the amount of investment capital available for small business development, local infrastructure, and affordable public transportation, none of which are much favored by private banks seeking a high return on investment.) Gwendolyn Hallsmith is one of those advocates. She’s currently the executive director of the Public Banking Institute, but she worked previously as a public servant in Montpelier, Vermont, where she resides with her husband and son, and ran for mayor in 2014... To Hallsmith, the main advantage of a public bank is lower-cost financing, which can enable the state to pay for things like building affordable housing, repairing infrastructure, and expanding educational opportunities. And each of these projects creates jobs. Public banks “allow cities, counties, and states to finance important public priorities without needing to rely on Wall Street and pay the hidden interest tax that Wall Street imposes on all our money,” Hallsmith said.

The quest to achieve public banking at the state and local level has been a long slog. Until quite recently, you had to go back almost 100 years to find the last major victory: the founding of the bank of North Dakota, the only state-run public bank in the United States, which was established in 1919. But interest has been picking up around the country. Santa Fe, New Mexico, voted in October to conduct a study on the feasibility of a city-run public bank. And in December, the Seattle City Council’s finance committee hosted experts in public banking to explore the topic. But nowhere have the steps toward public banking been more successful than in the state of Vermont. There, Hallsmith and other advocates won a small victory against Wall Street through an effort so relentless and strategic that it would have made any banking lobbyist proud. They combined savvy organizing with data-driven reports and policy briefs to prove the benefits of a public bank—like avoiding fat interest payments to Wall Street banks—for the state’s economy. And because the original bill put forward by Vermont state Senator Anthony Pollina and others included multiple demands—create a public bank, direct 10 percent of the state’s reserves to initially fund it, and establish an advisory committee on how best to invest locally—advocates won a decent compromise in the end.

They may not have gotten the state bank they wanted, but they were able to pass new rules that make the Vermont state treasury’s cash balances available for low-cost loans to local projects. The step Vermont took is called “10 Percent for Vermont.” Under this law, passed in June, up to 10 percent of the state treasury’s cash balance—which as of November was about $350 million—can be used for lending and investment within the state. The law also created a Local Investment Advisory Committee to advise the treasurer on “funding priorities” and “mechanisms to increase local investment.”...The final version of the 10 Percent for Vermont program did not create a public bank. But it helped to accomplish some of the same goals, like providing low-cost financing for state projects that might otherwise not be able to secure affordable or long-term funding. It’s not new for Vermont to enable its treasurer to lend locally—the state has had several similar programs in place since 2012. But typically, according to Hallsmith, the state would “borrow the money from Wall Street to do it.” Now, state officials can use the money from the state treasury’s deposits to do this kind of lending directly.

In 2014, the treasurer’s office made several local investments that counted toward the “10 Percent” total, but were authorized under previous laws. One example is the Vermont Clean Energy Loan Fund, which allocated $6.5 million in loans to encourage energy efficiency in residential home projects in the state, such as in Shelburne and Rutland counties. Another is a $2.8 million loan to Vermont’s Housing Finance Agency to support 111 units of multifamily affordable housing. A third is a loan fund approved in June that allocated $8 million for improved energy efficiency in state government buildings, with the goal of reducing their energy use by at least 5 percent (the state currently spends $14 million a year on energy bills). All told, in 2014, Vermont’s treasury lent out $24.5 million to local projects. Even though this money was authorized by prior legislation, it still counts toward the 10 percent of the state’s cash balance—that is, $35 million—that the treasury may lend to the community. That means there is still approximately $10 million in additional funds available for local investment—money that the treasurer would not have been able to lend were it not for the 10 percent program.

AND THE STRUGGLE FOR A PUBLIC BANK GOES ON...MORE AT LINK

Alexis Goldstein is a former wall street professional and current Occupy Wall Street activist

Demeter

(85,373 posts)Michael Nevradakis: In light of the upcoming elections, Greece at the present time has unemployment that has surpassed 27 percent, youth unemployment at around 60 percent, hundreds of thousands of Greeks who have migrated abroad, a social state in shambles, and a government in the process of selling off key state industries, public lands and utilities. What is your take on the current economic situation in Greece?

Greg Palast: Well, it's fascinating, because if you read the Western press, Greece is now a "success story." By success meaning you're paying off your creditors; your stock market has recovered and the bond market has recovered somewhat. So as far as most of the press is concerned, everything is fine in Greece. The fact that people are unemployed, that people are still losing their homes and livelihoods, doesn't mean much to the press, because all that matters is the stock market and your creditors. I've been investigating the causes of Greece's collapse; it's a crime scene; it's not something that was a matter of Greeks living beyond their means or being lazy, olive pit-spewing slackers, as the Germans would have it. In fact, I actually looked it up: The average Greek worker works 400 hours more a year than the average German worker. It's a hard-working nation. In fact, I think Greeks are harder on themselves than even the Germans are. It's a hard-working nation, a successful nation, and what happened was your economy was stolen from you.

Continuing this narrative of Greece being a so-called success story: After so many years of IMF and troika involvement in Greece, there are many who still maintain that Greece has no other choice but to continue along this path. You've done a lot of investigating into what entities such as the IMF and the World Bank have done elsewhere, in Latin America and in Asia. What has been the impact of IMF involvement and austerity policies in these other regions?

Well, as my fellow economists Paul Krugman and Joe Stiglitz have noted, the austerity programs are like medieval bloodletting. If you're sick, they would drain the blood from you, and if you didn't get better, they would say "oh, the problem is that we didn't drain enough blood" and they would bleed you some more. That's how austerity works....No one has yet beaten Keynes' formula, which is that when there's no demand for products, your economy is going to fall apart. Rebuilding demand is the opposite of austerity. This is when you need to borrow; this is when you need to go into deficit. This is when you need to devalue your currency so you can once again export. But you are chained like a prison sentence to the Deutsche mark, which is called the euro right now. You are forced to accept Germany's currency, which makes Greece and its economy overpriced. So the way that your economy is balanced is by reducing wages rather than by reducing the value of your currency, and that's disastrous in many ways, because it's a death spiral. The fact that money is being sliced out of your gut to pay off bondholders - to me that is not a sign of health, that is not a sign of recovery: that's a sign of jackals and vultures chewing at the national economic corpse.

Greg, the main opposition party, Syriza, is currently leading in the polls. Syriza's economic program does not mention anything about a departure from the eurozone or a unilateral stoppage of payments or even a write-down of Greece's debt. Instead, it calls for a renegotiation of the debt load within the confines of the eurozone. What is your reaction to such proposals?

We know which economies have succeeded, that ran into these crises when there was an attack by international financiers. You've had Argentina, you've had Brazil, you've had Ecuador, and the way that they have recovered is, you have to tell these creditor nations and the IMF you're not going to pay. What is the reason that they would renegotiate, what fantasy world do you live in if you're going to say "well, we'll stay in the eurozone, we'll keep paying, but we're begging you to give us a break"? I remember speaking with the president of Ecuador, Alfredo Palacio, many years ago when he went into office and Ecuador was on its back financially. The IMF was dictating the terms of its economy - it was suffering from austerity - and he said he was going to go and try to speak to then-president George Bush and the IMF in Washington and explain to them that if you kill us, if our nation dies economically, we can't pay you: Dead people can't pay off a debt. But unfortunately, the idea of using reason and getting sympathy didn't work at all, so his successor, Rafael Correa, who I also spoke with, said something simple: we're not paying. We're not going to pay this serious interest; we're not going to pay vulture funds; we're not going to pay ransom for our own economy - and the result was that Ecuador has grown enormously by saying no, and the same with Brazil, which threatened default, and same with Argentina, which did the same thing that Greece should do, which is get rid of the euro....Argentina was tied to the dollar. Right now they're going through another fight with international financial vultures, and they're holding strong, and their economy has not only recovered, but they've roared ahead like a rocket, with high employment, and huge increases in national wealth and huge increases in salary in the past decade and a half while they were resisting the IMF diktats. So that's the path for Greece, I mean: Follow Brazil; follow Argentina; follow Ecuador. They did it, they said no. You can't beg your way out of this problem.

Sticking with what you've just said about Argentina in particular, you've done extensive investigative reporting on the activities of so-called vulture funds and how they have targeted countries such as Greece or such as those in Latin America or Africa. One individual in particular, Paul Singer, has been at the heart of your investigations, and is tied both to Greece and to Argentina. Who is Paul Singer and what does he have to do with the cases of these two countries?

Well, if you read my book Vulture's Picnic, which should be coming out in Greek quite soon, these vulture funds - and I didn't give them the name vulture funds, that's what they called themselves for many years - they buy up debts of nations-when there's a crisis like in Greece, when you can buy up the debts at pennies at the dollar, at a fraction of their face value, and then after a deal has been worked out with everyone else, they are the final holdouts and they demand, in the case of Greece for example, you had creditors who accepted a large cut in the principal of the bonds; the bonds were revalued downward, interest rates were cut - Singer and one of his associates were the holdouts, and they not only didn't take a loss on their bonds, they were paid multiples and earned something in the area of 200 to 300 percent profit on their bonds. The Greek government made exceptions and paid them additional money.

What they do is they hold your nation ransom. They're doing the same thing in Argentina, but Argentina has said, the president of Argentina Christina Fernandez Kirchner, said "I do not pay ransom, I will not pay vultures." And they are simply refusing to pay these creditors. They're simply not going to pay ransom. Other nations have fought these vultures, and in fact, their activities. The people who have been attacking Greece like Paul Singer, the vulture, his activities have been outlawed in, for example, the British Commonwealth . . . England, Canada, and throughout the British Commonwealth. These are rogue financiers, their activities are banned and are criminal or quasi-criminal in some parts of the world, but these are the people who are dictating to your economics ministers.

MORE ON GREECE, VULTURES, REAGAN AND THATCHER AND THE EURO, AT LINK

Demeter

(85,373 posts)In August 1953, Presley walked into the offices of Sun Records. He aimed to pay for a few minutes of studio time to record a two-sided acetate disc: "My Happiness" and "That's When Your Heartaches Begin". He would later claim that he intended the record as a gift for his mother, or that he was merely interested in what he "sounded like", although there was a much cheaper, amateur record-making service at a nearby general store. Biographer Peter Guralnick argues that he chose Sun in the hope of being discovered. Asked by receptionist Marion Keisker what kind of singer he was, Presley responded, "I sing all kinds." When she pressed him on who he sounded like, he repeatedly answered, "I don't sound like nobody." After he recorded, Sun boss Sam Phillips asked Keisker to note down the young man's name, which she did along with her own commentary: "Good ballad singer. Hold."

In January 1954, Presley cut a second acetate at Sun Records—"I'll Never Stand In Your Way" and "It Wouldn't Be the Same Without You"—but again nothing came of it. Not long after, he failed an audition for a local vocal quartet, the Songfellows. He explained to his father, "They told me I couldn't sing." Songfellow Jim Hamill later claimed that he was turned down because he did not demonstrate an ear for harmony at the time. In April, Presley began working for the Crown Electric company as a truck driver. His friend Ronnie Smith, after playing a few local gigs with him, suggested he contact Eddie Bond, leader of Smith's professional band, which had an opening for a vocalist. Bond rejected him after a tryout, advising Presley to stick to truck driving "because you're never going to make it as a singer".

Phillips, meanwhile, was always on the lookout for someone who could bring to a broader audience the sound of the black musicians on whom Sun focused. As Keisker reported, "Over and over I remember Sam saying, 'If I could find a white man who had the Negro sound and the Negro feel, I could make a billion dollars.'" In June, he acquired a demo recording of a ballad, "Without You", that he thought might suit the teenage singer. Presley came by the studio, but was unable to do it justice. Despite this, Phillips asked Presley to sing as many numbers as he knew. He was sufficiently affected by what he heard to invite two local musicians, guitarist Winfield "Scotty" Moore and upright bass player Bill Black, to work something up with Presley for a recording session.

The session, held the evening of July 5, 1954, proved entirely unfruitful until late in the night. As they were about to give up and go home, Presley took his guitar and launched into a 1946 blues number, Arthur Crudup's "That's All Right". Moore recalled, "All of a sudden, Elvis just started singing this song, jumping around and acting the fool, and then Bill picked up his bass, and he started acting the fool, too, and I started playing with them. Sam, I think, had the door to the control booth open ... he stuck his head out and said, 'What are you doing?' And we said, 'We don't know.' 'Well, back up,' he said, 'try to find a place to start, and do it again.'" Phillips quickly began taping; this was the sound he had been looking for. Three days later, popular Memphis DJ Dewey Phillips played "That's All Right" on his Red, Hot, and Blue show. Listeners began phoning in, eager to find out who the singer was. The interest was such that Phillips played the record repeatedly during the last two hours of his show. Interviewing Presley on-air, Phillips asked him what high school he attended in order to clarify his color for the many callers who had assumed he was black. During the next few days, the trio recorded a bluegrass number, Bill Monroe's "Blue Moon of Kentucky", again in a distinctive style and employing a jury-rigged echo effect that Sam Phillips dubbed "slapback". A single was pressed with "That's All Right" on the A side and "Blue Moon of Kentucky" on the reverse.

Demeter

(85,373 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)Elvis Presley.... Thats Alright (Mama)- First Release - 1954

Blue Moon of Kentucky

DemReadingDU

(16,000 posts)He had so many songs, albums, even movies.

He died too young.

![]()

Demeter

(85,373 posts)xchrom

(108,903 posts)WASHINGTON (AP) -- In a double blow, the newly empowered Republican-led Congress and the Nebraska Supreme Court on Friday undercut President Barack Obama's opposition to the long Keystone XL oil pipeline.

But the White House, which issued a veto threat earlier in the week, said its "position and posture" remained unchanged, and environmentalists said Obama should kill what would amount to "a global warming disaster."

The House voted 266-153 to approve a bill authorizing construction of the Canada-to-Texas pipeline, with 28 Democrats joining majority Republicans in support. It was one of the first pieces of legislation considered by the new, GOP-controlled Congress, which has made approval of the pipeline a top priority and has long been headed for a confrontation with Obama on the issue.

The Republican cause was emboldened Friday, when Nebraska's highest court tossed out a lawsuit challenging the pipeline's route, an obstacle the White House said must be removed before it could decide whether the huge cross-border project was in the national interest and the administration could proceed with its own review.

Demeter

(85,373 posts)I think that for the sake of everyone on the planet AS WELL AS the US economy, the pipeline should be killed....

but this is Obama, who takes a perverse delight in screwing real people so that the Corporations get their way....maybe the Koch Bros. have ticked him off and he won't buckle?

...the suspense is agonizing....

xchrom

(108,903 posts)does the beltway including obama feel the same?

the magic 8 ball is doubtful.

Demeter

(85,373 posts)Demeter

(85,373 posts)if you're going for nostalgia, go all the way, I always say.

Demeter

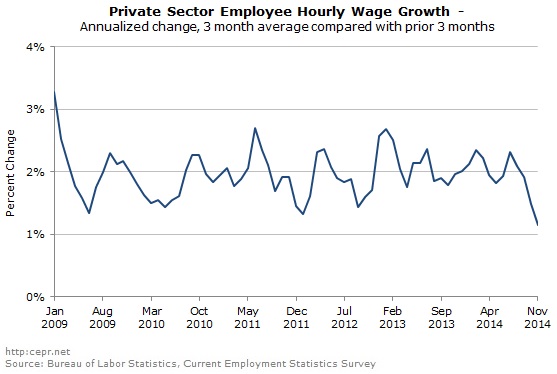

(85,373 posts)The unemployment rate edged down to 5.6 percent in December from 5.7 percent in November (revised from an earlier reported 5.8 percent), the Labor Department reported today. However, the main reason was that 273,000 workers reportedly left the labor force. The employment-to-population ratio (EPOP) was unchanged at 59.2 percent, roughly 4.0 percentage points below the pre-recession level.

The establishment survey showed the economy adding 252,000 jobs in December. With upward revisions to the prior two months’ data, this brings the three-month average to 289,000. Some of the job growth in December was likely attributable to better than usual weather for the month. For example, construction reportedly added 48,000 jobs; restaurant employment rose by 43,600. But even without these strong gains, there was still healthy job growth. Manufacturing added 17,000 jobs, finance added 10,000, and professional and business services added 52,000. Unlike prior months, the jobs in this sector were mostly (35,200) in the less well-paying administrative and waste services category. The health care sector added 34,100 jobs. Job growth in this sector has accelerated sharply, averaging 36,500 over the last three months. By comparison, it averaged just 21,200 in the year from September 2013 to September 2014. Retail added just 7,700 jobs. This reflects the earlier than usual Christmas hiring, which added 88,300 jobs the prior two months.

The story on wages is less encouraging. The widely touted November jump in wages was almost completely reversed, with the December data showing a 5-cent drop from a downwardly revised November figure. The average over the last three months grew at a 1.1 percent annual rate compared with the average of the prior three months, down from a 1.7 percent growth rate over the last year. This may be due in part to a shift to lower paying jobs in restaurants, retail, and the lower-paying portions of the health care industry. However, it is also possible that we are just seeing anomalous data. Nonetheless, the claims of accelerating wage growth have no support in the data.

Interestingly, there seems to be some shift to generally less-skilled production and non-supervisory workers. The index of weekly hours for these workers is up 3.6 percent from its year-ago level. By contrast, the index for all workers is up by just 3.3 percent. Since the former group is more than 80 percent of the payroll employees, hours for supervisory workers would have risen by just 2.5 percent. This is consistent with employment data showing much sharper employment gains for workers with high school degrees or less than for college grads. The EPOP for college grads is actually down by 0.2 percentage points over the last year...Other data worth noting in the household survey include a rise in the employment-to-population ratio for African Americans of 1.8 percentage points over the last year and for African-American men of 2.2 percentage points. The EPOP for African Americans is up by 3.9 percentage points from its low in 2011, although it is still down by 4.0 percentage points from pre-recession levels. The 10.4 percent December unemployment rate for African Americans is down from a recession peak of 16.8 percent.

This report shows some evidence of the labor market effects of the Affordable Care Act. While the number of people choosing to work part-time was down slightly from its November level, it is still 1.1 million above its year-ago level. The number of people who are self-employed is also up from its year-ago level. Averaging the last three months, the number of self-employed workers is up by 480,000 (3.5 percent) from the same months of 2013. (It had been dropping in 2013.) Also, the over-55 age group comprised just 37.6 percent of employment growth in 2014, compared to an average of 65.3 percent in the prior two years. This could indicate that many pre-Medicare age workers now feel they can retire since they can get insurance through the exchanges. On the whole, this is clearly a very positive report with the strong December jobs number (even if inflated by weather) coupled with upward revisions to the prior two months. However, quit rates are still very low and wage growth remains weak. This should remind the public of how far the labor market has to go before making up the ground lost in the recession.

Demeter

(85,373 posts)How does the right justify the kind of action Congress took this week, when it moved to cut disability benefits for millions of people by 20 percent? Answer #1: With buzzwords and rhetorical dodges. Answer #2: Not very well.... Republicans moved to cut Social Security disability benefits by blocking a routine reallocation of funds. That’s bad enough, but their end game is even worse: broad Social Security cuts and the privatization of the entire program. That would be bad for most Americans, but great for the people who finance the Republican Party – and think tanks like Heritage. There would be less pressure to increase taxes on billionaires. Wall Street would have more money under its control. And the far right’s antigovernment ideology would have claimed another scalp.

Heritage’s defense of the House is a good example of the right’s time-worn strategies for concealing – perhaps, at times, even from itself – the moral and human implications of its actions. It’s written by Romina Boccia, the “Grover M. Hermann fellow in federal budgetary affairs in the Roe Institute for Economic Policy Studies at The Heritage Foundation” – (now there’s a title!) – and is called “The House Just Made It Harder for Politicians to Steal From Social Security Retirement Fund.”--See what they did there, before we’ve even read the text? They changed the subject from “disabled Americans” to “politicians.” (People hate “politicians,” right?) But the money wouldn’t go to “politicians,” who have generous retirement and disability plans. It would go to the disabled. And it wouldn’t be “stolen.” It would be borrowed – from the same payroll tax which funds retirement benefits. The Heritage piece is a compendium of right-wing Social Security feints, many brewed up in the manifold organizations funded by anti-government hedge fund billionaire Pete Peterson. We’re told, for example, that the House’s parliamentary move “set the stage for long-overdue Social Security reforms to protect disabled Americans and seniors from indiscriminate benefit cuts” –

(As opposed to ‘discriminate’ benefit cuts?)

– and that it “strengthens the integrity of Social Security’s separate trust funds” by “prevent(ing) lawmakers from raiding retirement funds to shore up the bleeding disability trust fund.” (Emphases mine.)

“Strengthen.” “Integrity.” Raiding.” “Bleeding.” These are code words designed to fire neurons in the lizard brain. Take them away and what’s left? The distasteful sight of prosperous Republican House members cutting disabled people’s already meager benefits. As for the transfer of funds, Ms. Boccia doesn’t mention that Congress has made this very minor adjustment 11 times in the past. She makes it sound as if President Obama and Treasury Secretary Jack Lew are proposing something novel, strange – even dangerous. She even throws in a scare paragraph from a fellow Heritage employee suggesting that the entire program is in danger and warning of the “destitution” that might ensue. Then she tips her organization’s hand:

“This change,” Ms. Boccia writes of the House’s move, “sets the stage for comprehensive Social Security reform in the 114th Congress.”

Well, of course it does. Disability benefits are just the prelude. They’re after bigger game. The right wants what it has wanted ever since Social Security was first created: its dismantlement.

MORE AT LINK

Demeter

(85,373 posts)The United States could create up to 5.8 million new jobs, reduce our trade deficits by up to $500 billion per year by 2015 and increase U.S. gross domestic product by up to $720 billion per year if we act to end global currency manipulation. Simple as that. Currency manipulation makes the U.S. dollar more expensive than it would be in a free currency market. This means that products made and services performed in the U.S. cost more than products made and services performed in other countries. Business migrates to companies located in the manipulators’ countries, which costs U.S. jobs and increases the trade deficit. A report released today by the Economic Policy Institute (EPI), titled “Stop Currency Manipulation and Create Millions of Jobs,” shows how currency manipulation by China and others are costing the United States between 2.3 million to 5.8 million jobs.

According to the report, realigning exchange rates could:

Reduce U.S. trade deficits by up to $500 billion per year by 2015;

Increase U.S. GDP by up to $720 billion per year (a 4.9 percent increase);

Support creation of up to 5.8 million jobs (a 4.1 percent increase); and,

Increase manufacturing jobs by up to 2,337,300 jobs (a 15.9 percent increase).

Also, increased tax revenues and reduced safety net expenditures would reduce the 2015 federal budget deficit by up to $266 billion, up to an 86.1 percent decline in the projected federal deficit.

From the report:

Rep. Sander Levin (D-Mich.) said on a press call about the report, “This report so clearly outlines that currency manipulation has such an impact on jobs and workers, it is a key part of the trade imbalance.” Levin also said that the “TPP [Trans-Pacific Partnership] has to address this currency issue.”

The Obama administration doesn’t label countries like China as currency manipulators with the “intent” of being more competitive (a requirement of the current law), likely because the administration wants China’s cooperation in dealing with countries like North Korea. (Coincidentally, it seems that when pressure to confront China over currency increases, tensions with North Korea increase, and pressure over currency is dropped.) A bill that would force action on currency manipulation has passed the Senate, but as is so often the case, the Republican House leadership is obstructing a vote.

Currency manipulation is a very big deal. It isn’t complicated; it’s one more way we allow other countries to take our jobs, factories and money. There are people making vast fortunes from this, and those fortunes make them very powerful enough politically to purchase congressional obstruction. Call your senators and your representative and let them know you are paying attention to this.

FUNNY, I HAVE NOTICED THAT THE US IS ALWAYS TRYING TO BOOST THE DOLLAR. WOULDN'T THAT COUNT AS CURRENCY MANIPULATION, TOO?

xchrom

(108,903 posts)Russia’s credit rating was cut to the lowest investment grade by Fitch Ratings after plummeting oil prices and the conflict over Ukraine triggered the worst currency crisis since the country’s 1998 default.

Fitch, which last downgraded Russia in 2009, cut the sovereign one step to BBB-, according to a statement issued Friday in New York. The grade, on par with India and Turkey, has a negative outlook.

“The economic outlook has deteriorated significantly since mid-2014 following sharp falls in the oil price and the ruble, coupled with a steep rise in interest rates,” Fitch said in the statement. “Plunging oil prices have exposed the close link between growth and oil.”

The world’s biggest energy exporter is on the brink of a recession after crude fell more than 50 percent since June and the U.S. and its allies imposed sanctions following President Vladimir Putin’s annexation of Crimea from Ukraine in March. The penalties have locked Russian corporate borrowers out of international debt markets and curbed investor appetite for the ruble, stocks and bonds.

Demeter

(85,373 posts)Fitch has a lot of nerve.

Fuddnik

(8,846 posts)I've been seeing a lot of properties, and office buildings around here lately, with Berkshire-Hathaway signs on them.

Never saw them before, until recently.

Demeter

(85,373 posts)I expect Russia's economy will recover long before the US's economy. Either they take the screws off Mother Russia, or the whole West comes tumbling down...because the Eurozone is screaming for mercy, and Europe is our biggest trading partner.

xchrom

(108,903 posts)Bill Gross said growth in wages lagging behind increases in U.S. employment gains makes it difficult to maintain the economic expansion at a pace that the Federal Reserve would like to see to raise interest rates.

“It’s about wages” as to why the U.S. 10-year note yield is so low, Janus Capital Group Inc. (JUCIX)’s Gross said in a radio interview on “Bloomberg Surveillance” with Tom Keene and Mike McKee. “The market is conflicted over what the Fed will do.’

Employment rose a more than forecast 252,000 positions in December and the jobless rate declined to 5.6 percent, a Labor Department report showed. The report wasn’t all good news as earnings unexpectedly declined 0.2 percent from a month earlier.

‘‘We are creating a lot of jobs, part of it may be part-time,” said Gross, who used to run the world’s biggest bond fund before joining Janus in September. “The creation of jobs is one thing, the creation of wages is another. Minus 0.2 percent in the month and a 1.7 percent annual hourly increase, just isn’t enough to sustain a U.S. economy.”

xchrom

(108,903 posts)After six straight months of plunging oil prices, U.S. shale drillers have sent the clearest signal to date that they’re retreating.

Thirty-five horizontal rigs, their weapon of choice for reaching oil deposits in tight-rock formations such as North Dakota’s Bakken shale and Texas’s Permian Basin, were idled last week alone. It was the biggest single-week drop since a drilling boom touched off six years ago that propelled domestic production to the highest level in three decades and eventually helped trigger the global price war that the U.S. and OPEC find themselves in today.

The decline, the largest in a decade and the seventh in a row, threatens to halt U.S. oil production growth by slowing drilling in tight-oil plays that make up virtually all of the nation’s new output. Bending to the pressure of crude below $50 a barrel, the country’s explorers idled the most rigs last quarter since 2009.

“The message from the market, that drillers need to start changing their behavior, has now been received by the big boys in the shale plays,” Harold York, vice president of integrated energy at consulting company Wood Mackenzie Ltd., said yesterday by telephone from New York. “The tight-oil players have received the message, and they’re taking action.”

Fuddnik

(8,846 posts)We have tickets to see "Book of Mormon" in 2 weeks, and want to be prepared in case the Mormons get their magical underwear all twisted up in a knot.

Demeter

(85,373 posts)Everything I've heard of that show make me determined NOT to see it, ever...

How's the -rent situation?

It's incredibly cold and brightly sunny. I would be content just to stay in and drowse in the sun, by the monitor, but the Kid wants out (she was sick all week and is now going stir-crazy). They are showing the Wizard of Oz (restored, I hope) at the cinema. That's more my speed, and hers.

Wow! We're up to 7F! They said earlier it wouldn't get above zero today....and we are up to maybe 5-6 inches of snow on the ground. It falls in half-inch to one inch amounts, once or twice a day.

I came in fourth out of 7 at euchre, last night. The cards weren't with me, and I had a partner that never let me bid...whenever I had a good hand. Sigh. Partners are assigned by lot.

I am slowly recovering from LAST winter. Every day I wake up and smile and say: "I don't have to go out and throw the papers today!" It's amazing how much that took out of me last year.

We had two huge crashes yesterday: highway 23 was closed about 7 miles south of here for 12 hours in both directions.

94 was closed around Kalamazoo, reportedly fireworks were involved.

Both sides of I-94 in southwestern Michigan remain closed as crews remove acid and tow away vehicles stuck in an extraordinary pileup on the snowy highway.

The number of vehicles involved in a series of crashes Friday in Kalamazoo County has fluctuated. State police now say there were 193, including dozens of semis.

A truck carrying fireworks caught fire, triggering a spectacular explosion of the cargo. A 57-year-old truck driver from Ottawa, Canada, was killed and about two dozen people were taken to hospitals — including two firefighters who were injured while attempting to extinguish fires from vehicles.

Police said approximately 50 cars and trucks remained in westbound lanes Saturday morning and four trucks are in eastbound lanes.

“One of the things that is slowing down the cleanup is having to transfer the chemicals from the one damaged trailer to another damaged trailer,” State Police Sgt. Scott Leroy told WWJ’s Lauren Barthold. “At this point, there is still no estimate as to when the roads are going to be reopened.”

Work to clear the scene has been described as “brutal,” especially with temperatures barely above zero.

?w=620&h=349&crop=1

?w=620&h=349&crop=1

http://detroit.cbslocal.com/2015/01/10/i-94-still-closed-after-massive-193-vehicle-pileup/

There are more crashes today...people are nuts, driving like the Speedway on glaze ice.

Fuddnik

(8,846 posts)It's been crazy here. We went up to SC and brought my dad back over xmas. What is normally an 8 1/2 -9 hour drive, became almost 14. All the delays in SC.

He had his meds all screwed up, and couldn't remember taking or not taking anything. And he wouldn't eat or drink hardly anything, so he got dehydrated again, and I put him in the hospital on Jan. 2. He's still there, and may get out on Monday, and go into rehab for PT. Then find him a home.

The only good thing is, he's too weak to walk to his car, so the public is a little safer.

Demeter

(85,373 posts)It seems like this is the hardest time in the life cycle...can you actually get him to go along with your plan for his care? That's the hardest part. The standards for competence are laughably low.

MattSh

(3,714 posts)President’s Aide Says Far Right Refuses to Obey the President