Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday, 9 September 2014

[font size=3]STOCK MARKET WATCH, Tuesday, 9 September 2014[font color=black][/font]

SMW for 8 September 2014

AT THE CLOSING BELL ON 8 September 2014

[center][font color=red]

Dow Jones 17,111.42 -25.94 (-0.15%)

S&P 500 2,001.54 -6.17 (-0.31%)

[font color=green]Nasdaq 4,592.29 +9.39 (0.20%)

[font color=red]10 Year 2.47% +0.05 (2.07%)

30 Year 3.23% +0.04 (1.25%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

http://tools.investing.com/market_quotes.php?

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

xchrom

(108,903 posts)xchrom

(108,903 posts)xchrom

(108,903 posts)xchrom

(108,903 posts)The big news at the moment is in the UK, where it looks like there's a real chance that Scotland might vote to leave Great Britain in a referendum that's coming up on Sept. 18. Up until very recently, the conventional wisdom was that it would be a fairly close vote, but that really the pro-independence campaign had very little shot. Now people are treating it more like a coin flip.

But you shouldn't let the possible breakup of the Sterling-zone distract you from the mess elsewhere.

In France, a new poll shows that Marine Le Pen is the current favorite in the 2017 Presidential elections. 2017 is a long time from now, but for those who don't know, Le Pen is the head of France's ultra-right National Front party, which was founded by her anti-Semitic, Holocaust-denying father Jean-Marie Le Pen. Marine is not as extreme as her father, but she's sharply anti-eurozone and holds other right-wing views.

Meanwhile in Germany, the anti-eurozone party AfD (Alternative For Deutschland) won a shocking 10% of the vote in the Eastern German state of Saxony. It became the first anti-eurozone party to win a seat in a regional parliament, according to the BBC.

Read more: http://www.businessinsider.com/europe-is-coming-apart-2014-9#ixzz3Co9mDvEQ

xchrom

(108,903 posts)1. Apple is expected to unveil the iPhone 6 and other new products in a mega-event on Tuesday. Haven't heard about the iPhone 6? Read all about it here.

2. The Dutch Safety Board will publish a preliminary report on the investigation into the crash of flight MH17 over eastern Ukraine in July. According to the safety board website: "The investigation team collected information from various sources, such as the Cockpit Voice Recorder, the Flight Data Recorder, satellite and other images, and radar information."

3. The pound has taken a huge hit following a surge in support for Scottish independence.

4. Speaking of Scottish independence, former British prime minister Gordon Brown has entered the political arena again as part of a speaking tour to gain support for the No vote, in what many see as a last-minute attempt to save the union.

5. Baltimore Ravens running back Ray Rice was suspended indefinitely by the NFL on Monday after video released by TMZ showed Rice knocking his fiancee unconscious in an elevator.

6. The World Health Organization warned on Monday that thousands of new cases of Ebola are expected in Liberia over the next three weeks. "The number of new cases is moving far faster than the capacity to manage them in Ebola-specific treatment centers," WHO said in a statement.

Read more: http://www.businessinsider.com/10-most-important-things-in-the-world-right-now-september-9-2014-2014-9#ixzz3CoAE3yvZ

xchrom

(108,903 posts)Sydney (AFP) - The world is facing a global jobs crisis that is hurting the chances of reigniting economic growth and there is no magic bullet to solve the problem, the World Bank warned on Tuesday.

In a study released at a G20 Labour and Employment Ministerial Meeting in Australia, the Bank said an extra 600 million jobs needed to be created worldwide by 2030 just to cope with the expanding population.

"There's little doubt there is a global jobs crisis," said the World Bank's senior director for jobs, Nigel Twose.

"As this report makes clear, there is a shortage of jobs -- and quality jobs.

Read more: http://www.businessinsider.com/afp-world-bank-warns-of-global-jobs-crisis-2014-9#ixzz3CoAmw37P

Demeter

(85,373 posts)The 1% is pro-slavery.

xchrom

(108,903 posts)LONDON/MOSCOW (Reuters) - The Kremlin's prized oil firm Rosneft is cutting staff and production and selling stakes in Siberian fields in the strongest evidence to date that Western sanctions are hurting what was the world's fastest growing oil firm in recent years.

The sanctions imposed on Russia by the United States and Europe in response to its military action in Ukraine have cut Rosneft's <rosn.mm> access to Western financing and technology, complicating the servicing of its $55 billion debt and closing the way to cutting-edge industrial science it needs to keep developing its energy resources.

Few doubt that Rosneft will be able to withstand the pressure medium-term - its earnings amount to $30 billion a year and billions more are still available via Chinese credit lines and Russian state coffers in case of emergency.

But the world's biggest listed oil producer - which produces more oil than OPEC members Iraq or Iran - faces unprecedented challenges to its long-term expansion and modernization plans.

Read more: http://www.businessinsider.com/r-rosneft-struggles-to-grow-as-sanctions-hit-russias-oil-champion-2014-9#ixzz3CoHZIlfs

Demeter

(85,373 posts)because seducing Ukraine into NATO never made a bit of sense, other than baiting the Russian Bear and trying to steal the warm water port away, which still doesn't make sense and seems suicidal.

xchrom

(108,903 posts)NEW YORK (Reuters) - Morgan Stanley <ms.n> has agreed to pay $95 million to resolve a lawsuit accusing the Wall Street bank of misleading investors in mortgage-backed securities in the run up to the 2008 financial crisis.

The settlement, disclosed in court papers filed Monday in New York federal court, follows years of litigation by investors over allegedly false and misleading statements over the soured securities.

The deal stemmed from a lawsuit pursued by the Public Employees' Retirement System of Mississippi (MissPERS) and the West Virginia Investment Management Board.

The plaintiffs accused Morgan Stanley of violating U.S. securities law in packaging and selling mortgage backed securities in 13 offerings in 2006 and 16 offerings in 2007.

Read more: http://www.businessinsider.com/r-morgan-stanley-to-pay-95-million-in-us-mortgage-debt-settlement-2014-9#ixzz3CoI2SgJv

xchrom

(108,903 posts)Big Banks Fined Mega-Billions; CEOs Remain Untouched, Above the Law

http://www.nationofchange.org/big-banks-fined-mega-billions-ceos-remain-untouched-above-law-1410103896

Get arrested for robbing a bank or shoplifting and you will go to prison. Get caught selling cocaine or steal a car and you will do jail time. But if you are a CEO of one of the biggest banks in America and that bank is fined mega-billions for fraudulent practices you need not worry because the U.S. Justice Department will give you a free pass; you are, in effect, above the law.

That is beyond comprehension, a clear travesty of justice, but it has become commonplace in America. Just look at the following list of U.S. and some foreign banks that have been fined billions of dollars. Not one of their top executives has been prosecuted in connection with the violations of the law that led to these fines:

$25 billion - Wells Fargo, J.P. Morgan Chase, Citigroup, Bank of America, BAC, and Ally Financial - 2012

$13 billion - J.P. Morgan Chase & Co. — 2013:

$9.3 billion - Bank of America, Wells Fargo, J.P. Morgan and 10 others — 2013:

$8.5 billion - Bank of America – June 2011:

$2.6 billion - Credit Suisse AG – May 2014:

1.9 billion - HSBC Holdings, HSBA - 2012

$1.5 billion – UBS, AGUBSN - 2012

$1.4 billion - 10 Wall Street firms including Goldman Sachs, Morgan Stanley, and J.P. Morgan – 2003

What fraudulent practices brought on these massive fines? They involved mortgage foreclosure processing abuses, claims over residential-backed mortgage securities, deceptive mortgage loan application processes, associated tax evasion, manipulated interbank lending rates, and conflicts of interest between research and investment banking sectors.

xchrom

(108,903 posts)Geneva (AFP) - Surging levels of carbon dioxide sent greenhouse gases in the atmosphere to a new record in 2013, while oceans, which absorb the emissions, have become more acidic than ever, the UN said on Tuesday.

"We know without any doubt that our climate is changing and our weather is becoming more extreme due to human activities such as the burning of fossil fuels," said Michel Jarraud, the head of the World Meteorological Organization (WMO) that released a report on the issue on Tuesday.

"We must reverse this trend by cutting emissions of CO2 and other greenhouse gases across the board," Jarraud said in a statement.

"We are running out of time," he warned.

Read more: http://www.businessinsider.com/afp-greenhouse-gas-levels-in-atmosphere-hit-new-high-un-2014-9#ixzz3CoImzAXl

xchrom

(108,903 posts)A "Yes" vote in the Scottish Independence Referendum would radically reshape politics on both sides of the British border — and it's now looking like it might happen.

Until recently, the "No" campaign enjoyed a comfortable lead in the polls. Few people in England, Wales and Northern Ireland fully appreciated the impact that a Yes vote could have on the face of British politics. As that lead is fast evaporating, perhaps it is time they did.

If Scotland leaves Britain, it will reshape Britain completely, turning it into a country with virtually permanent Conservative Party control of the government in Westminster.

Yet another poll released Monday showed the Yes and No campaigns are neck and neck heading into the final stretch before the September 18th vote. It provides further support to findings in previous polls showing the pro-independence camp gaining momentum and will no doubt continue to weigh on financial markets, which have finally woken up to the risk of breaking up the union. The pound is already being sold off in international currency markets.

With the prospect of an independent Scotland looming ever larger left-leaning voters in Britain also have something to worry about, however. A vote to break up the union would see the Labour Party lose its 41 Scottish MPs, meaning the hurdle for the party to gain and maintain a majority could be about to get much higher.

To put this problem in perspective: Of the 11 Labour-led administrations since the 1920s, only six would have been likely without Scottish MPs. Indeed without Scotland, Labour could have been in power only once in the first half of the century.

Read more: http://www.businessinsider.com/scottish-independence-and-conservative-control-2014-9#ixzz3CoLJYPVp

Demeter

(85,373 posts)If they go Permanently Conservative, they will serve as a model of what not to do for the world.

They might also spark a wave of political awakening and revolt.

In any event, England will have far less consequence. Already the City of London, that hub of financial chicanery, is being dismantled by lawsuits, economic adversity, and public distrust.

xchrom

(108,903 posts)Stunning developments over the weekend have made Scottish independence — which is set for a Sept. 18 vote — a very real possibility.

The Scots will vote next Thursday on whether they will seek independence from England, Wales, and Northern Ireland. New polls showing a recent shift in public opinion has suddenly made independence much more plausible.

And if Scotland does vote for independence, it could be the start of a domino effect for similar situations throughout Europe, analysts say.

Other areas have been seeking to hold independence referendums — Spain, for example, is worried that Scotland's situation could embolden separatists in the Catalonia region, though a tentatively scheduled referendum set for Nov. 9 in Catalonia has been ruled unconstitutional by Spanish courts.

Read more: http://www.businessinsider.com/scottish-independence-vote-scotland-cotagion-catalonia-2014-9#ixzz3CoO9wImm

Demeter

(85,373 posts)xchrom

(108,903 posts)BERWICK-UPON-TWEED, England (AP) -- All Gavin Jones has to do is scan the shelves of his impossibly quaint shop on England's border with Scotland to know he'll have a big problem if the Scots declare independence next week.

There are teddy bears in Campbell clan tartans and shelves of shortbread from Scotland - just above the red jams made in England. After independence, the Scottish goods would be subject to import duties, and customers would likely pay in two different currencies. Business in Berwick-upon-Tweed, England's northernmost town, could soon be crushed by bank transaction costs.

"If Scotland chooses independence, it changes our concept of local," he said. "There are then barriers put in place."

Berwickers like to think of themselves as neither English nor Scottish. Little wonder: this enclave has changed hands 13 times over the centuries. But there is no getting away from the fact that the locals in Berwick (pronounced BEAR-ick) could be dramatically affected by the Sept. 18 referendum.

Demeter

(85,373 posts)The outrage of the 1%. Wholly unjustified, hugely out of proportion. No Remorse, No Restitution, No Hope No Change.

Demeter

(85,373 posts)The U.S. Department of Commerce released the July U.S. trade figures this morning. We reached a new job-sucking record with China. If you are a Wall Street or Chinese billionaire it’s an occasion to break out the champagne.

However, if you are not a Wall Street or Chinese billionaire this is an occasion to get in line to beg for a job serving champagne. Because trade deficits like this means that at some point that is just about the only job that will be left in our economy.

The overall U.S. international goods and services trade deficit declined slightly from (revised) $40.8 billion in June to $40.5 billion in July. So the trade deficit “only” sucked $40.5 billion of jobs, factories and wealth out this month.

However the monthly U.S. goods deficit with China reached a record level $30.9 billion, up from $30.1 billion in June...The overall trade deficit is down just a bit. Exports are up a bit. The trouble is that we still import so much more than we export. That means a net loss of jobs and decline in living standards, month after month, year after year.

xchrom

(108,903 posts)

WASHINGTON (AP) -- The U.S. job market has steadily improved by pretty much every gauge except the one Americans probably care about most: Pay.

The unemployment rate has sunk to a nearly normal 6.1 percent. Employers have added a robust 2.5 million jobs the past 12 months. Layoffs have tumbled.

Yet most people are still waiting for a decent raise. Friday's August jobs report confirmed that average hourly pay has crept up only about 2 percent a year since the recession ended five years ago - barely above inflation and far below the gains in most recoveries.

Just why pay has been so weak and when it might strengthen are key issues for the Federal Reserve in deciding when to raise interest rates.

The trend has mystified analysts.

Demeter

(85,373 posts)As the SEC, reporters, and analysts dig into the operations of private equity firms, it is becoming obvious that one of the reasons that these financiers have cornered the best legal talent in America is for the express purpose of better fleecing their investors. A prime example comes up in the use of clawbacks in private equity agreements. For those new to private equity, the clawback provisions are meant to assure that the private equity fund managers do not receive fees meant to reward good performance when the performance was no good. The prototypical fee structure for a private equity fund is an annual management fee of 2% of assets under management plus 20% of the profits. The majority of funds stipulate that that 20% upside fee (called “carried interest”) kicks in only after a certain rate of return (the “hurdle rate”) has been surpassed. The typical hurdle rate is 8%.

But remember how private equity funds work. Each fund buys a portfolio of companies, and then over time sells them, hopefully at a profit. While some fund agreements provide that no upside fees are paid until the end of the fund’s life, most funds in the US allow the managers (who are members/owners of an entity that serves as general partner) to pay themselves a share of the profits in excess of any hurdle rate on each deal based on the sales price of that portfolio company. Since the most lucrative deals are generally sold early in the fund’s life, and the dogs linger, this raises the possibility that the so-called success fees that the managers pay themselves on those early winners are offset partly or in total by the underperformance of companies sold later.

The famed “clawback” provisions in the limited partnership agreements that govern these deals are meant to remedy that by requiring that the fund managers, who are general partners, settle up with the limited partners at the end of the fund’s life and return any overpayment of profits ultimately washed out by losses. Now of course, if the limited partners had any spine, they’d dispense with this arrangement and insist that the managers receive no incentive compensation until the funds were wound up, or that the distributions were so large that even if the remaining deals were total losses, the managers would still be entitled to a profit participation. But the tide if anything is going the other way. Eileen Appelbaum and Rosemary Batt report in their new book Private Equity at Work that more and more funds are going to the “pay as you go along” model, which means investors are giving ground on this issue...

xchrom

(108,903 posts)NEW YORK (AP) -- An Ivy League-educated ex-portfolio manager convicted of enabling his firm to earn more than a quarter-billion dollars through insider trading on a promising Alzheimer's drug trial was sentenced Monday to nine years in prison by a judge who said the "staggering" fraud deserved lengthy incarceration.

Mathew Martoma, his face drawn, left Manhattan federal court holding his wife's hand after Judge Paul Gardephe ordered him to report to prison in November following his February conviction for conspiracy and securities fraud.

A jury found Martoma, of Boca Raton, Florida, had flattered and enriched two medical doctors to elicit the secret results of an Alzheimer's drug trial so he could trade ahead of public announcements, enabling his Stamford, Connecticut-based employer, SAC Capital Advisors, to earn more than $275 million illegally. His firm, headed by billionaire Steven A. Cohen, then rewarded him with more than $9 million in bonuses.

The judge ordered Martoma, 40, to forfeit $9.3 million, including his home and banks accounts holding millions of dollars.

xchrom

(108,903 posts)Despite steady job growth and a drop in the unemployment rate from 10 percent during 2009 to 6.1 percent in August, most Americans have received little increase in pay.

Average wages, before inflation, have risen only about 2 percent a year since the downturn ended five years ago. That's far below the 3.5 percent to 4 percent that's typical of healthier recoveries.

Just why pay has been so weak and when it might strengthen are key issues for the Federal Reserve in deciding when to raise interest rates.

Still, some industries have fared better, particularly financial services. Average pay in that industry - which includes banking, insurance and Wall Street traders - has risen 16.2 percent over the past five years. That's better than the 10.2 percent average for private-sector employees overall.

Here are the average hourly wages earned in 12 large industries tracked by the government:

August 2009 August 2014 Change

Total $22.26 24.53 10.2%

Mining, logging 27.42 31.10 13.4%

Construction 24.90 26.72 7.3%

Manufacturing 23.13 24.93 7.8%

Wholesalers 25.73 28.20 9.6%

Retailers 15.54 17.06 9.8%

Transportation, warehousing 20.45 22.97 12.3%

Utilities 32.82 35.43 8.0%

Data analytics, film, broadcasting 29.65 34.08 14.9%

Financial services 26.60 30.90 16.2%

Professional services 27.05 29.26 8.2%

Education and health 22.27 24.76 11.2%

Restaurants, hotels, entertainment 13.00 13.95 7.3%

Includes engineers, architects, accountants

Source:

Bureau of Labor Statistics

xchrom

(108,903 posts)Standard & Poor’s (MHFI)’ chances of settling the government’s lawsuit over mortgage-bond ratings for less than $1 billion may have slipped away after Bank of America Corp.’s Countrywide unit was socked with a $1.3 billion fine.

The Countrywide ruling was the first to lay out what penalties financial institutions could face under a 1989 bank-fraud law the Obama administration is using against alleged culprits of the subprime mortgage crisis. It has boosted the government’s hand against McGraw Hill Financial Inc.’s S&P, said Peter Henning, a law professor at Wayne State University.

“If the starting negotiation point for the Justice Department to settle was $1 billion before, that number has just gone up,” Henning said in a phone interview.

The U.S. sued S&P and Countrywide under the Financial Institutions Reform, Recovery and Enforcement Act, a law passed by Congress in the wake of the savings and loan crisis of the 1980s. The administration, which seeks as much as $5 billion from S&P, is using the law to punish alleged misconduct in the creation and sale of residential mortgage-backed securities blamed for the financial crisis two decades later.

xchrom

(108,903 posts)Trump Entertainment Resorts Inc., the company founded by Donald Trump, will file for bankruptcy again this week, people with knowledge of the situation said, putting a fifth Atlantic City casino in danger of closing.

The company owns two properties in the struggling New Jersey resort town. Trump Plaza is set to cease operations on Sept. 16, and the Trump Taj Mahal may also shut in November, the people said. Three other casinos have closed in the city this year, including Caesars Entertainment Corp.’s Showboat and the Revel Casino Hotel last week.

A Taj Mahal shutdown would put another 2,800 employees out of work in a city already losing 5,200 casino jobs this month. Moody’s Investors Service cut the municipality’s bond rating by two steps on July 23 to Ba1, the highest speculative standing. Governor Chris Christie and other local leaders held a summit yesterday to discuss Atlantic City’s future after an expansion of gambling in neighboring states ate into what was once the only legal market on the East Coast.

“What happened to Atlantic City, there’s a lot of competition from a lot of other locations,” Trump said in a telephone interview yesterday. “It’s happening all over.”

xchrom

(108,903 posts)U.K. taxpayers are seeing the chance of recouping their money from the world’s biggest bank bailout recede as Scottish voters stand on the brink of dissolving the 307-year-old union with England.

Royal Bank of Scotland Group Plc shares have erased most of the gains made this year amid a surge in support for nationalists wanting to quit the U.K. The cost of insuring RBS bonds against default rose 7 basis points to 80 yesterday, the worst performer in the Markit iTraxx Senior Financial Index, after a weekend survey showed the Yes campaign overtaking the No side for the first time this year. The spread climbed 3.5 basis points today.

Investors are becoming increasingly concerned about the outcome of the Sept. 18 referendum as RBS, 80 percent owned by the government, is the second-largest lender in Scotland behind Lloyds Banking Group Plc (LLOY), analysts estimate. While the U.K. government has sold 7.4 billion pounds ($12 billion) of Lloyds shares, it has been unable to sell its stake in RBS as the stock remains below the price where taxpayers will break even on their 45 billion-pound bailout in 2008.

Shares Decline

“If there’s a Yes vote it will undoubtedly have to defer the timeframe for the stake being placed until things become clearer about the future of Scotland and the shape and structure of RBS,” said Simon Willis, an analyst at Daniel Stewart Securities Plc in London. “Equally, it’s difficult to believe investors would be happy to take part in a further placing of Lloyds with their future being very uncertain.”

Demeter

(85,373 posts)Lambert Strether of Corrente: Just let me repeat my basic perspective once again. From ObamaCare and Its Opportunity Costs:

Fun with The IRS

It looks as though dealing with ObamaCare’s tax consequences — remember when only people with money had “tax consequences”? — is going to be just as fun as dealing with healthcare.gov was. Since ObamaCare grants subsidies based on your estimated income, it then must recalculate your subsidies at tax time based on your actual income, and then either give you money back, or take money from you. And who doesn’t enjoy a big fat crapshoot at tax time? Especially when the recalculation demands a shit ton of complicated forms that have never been used before. Politico describes step one, sending out plan details:

At this point, the new forms look “very daunting” for taxpayers, said Mark Ciaramitaro, vice president of health care services at H&R Block. “Overall, we expect the complexity level is just going to go up for a significant group of moderate- to low-income people, whether they got insurance through the marketplace or they didn’t.”

Just going into “fixed it for ya” mode here for an instant, by “said Mark Ciaramitaro” the writer surely must have meant something like “said Mark Ciaramitaro, extruding his feeding tube,” since tax preparers like H&R Block will be the parasitical rent-seeking siphonoptera profiting from ObamaCare’s complexity. But I digress. Then step two, the new form 1095A:

What could go wrong? And then there’s step three, the 1040 itself. Remember that, incredible as it may seem, that although there is a mandate to purchase health insurance under ObamaCare, and even a penalty, the IRS can’t put a lien or a levy on you for not paying it. So people who just skipped all the hassle could end up being better off than people who tried to comply, but got hung up in the complexity:

“You’re at much greater risk for having things gummed up if you’ve done what you’re supposed to do,” [another minefield!] Brandes said. “We’re not name calling here — it’s just sort of a recognition of the reality of how this is going to work.”

Tax Foundation economist Alan Cole agrees and, like many experts, doesn’t expect the IRS to vigorously enforce the law’s individual mandate in its first year, using this upcoming filing season more as a trial run.

So, once again, ObamaCare nudges you into a minefield without any signage. (And just be sure to record everything if you can. It’s your only protection.) But it’s an ill Rube Goldberg device that blows nobody good! From American Public Media’s Marketplace:

The source of their optimism is the Affordable Care Act, thanks, says George Brandes with Jackson Hewitt, to the tax-prep business truism: “Complicated taxes equals more people needing help.”

The IRS says 140 million people file tax returns every year, with about 60 percent being done by professionals. Northcoast Research analyst Kartik Mehta expects that percentage to increase.

“We haven’t seen this type of a complication to the tax return in a long, long time,” he says.

Mehta says the real winners will be the brand-name preparers who can afford to blitz the airwaves come tax time.

With the H&R Block example, the rent-seeking from ObamaCare’s complexity is of crystalline clarity; it’s like when some entity decides to dump stuff (say, three dozen armored personnel carriers) into the ocean instead of a landfill, and then call it an artificial reef, and in fact you do end up with an ecosystem of sorts. Well, ObamaCare is the artificial reef, and H&R Block are artificial fish living in that reef. But so are they all, all artificial fish: The web developers, the navigators, the consultants, the trainers, the marketing weasels, the CEOs, etc., etc. None of them should exist in the first place. And never mind the toxicity as the APCs rust out, eh?

The Auto-Renewal Trap

From Kevin Drum, the setup:

National Journal gives the detail:

As cheaper plans come into the marketplace, millions of consumers will see the cost of keeping their plan rise. But they might not know it.

HealthCare.gov isn’t able to automatically recalculate the subsidies existing consumers are eligible for. [Who wrote the spec for this turkey?] So, while the dollar value of your financial assistance drops, you can only find out that’s happening by going back into the system and asking for a redetermination as part of the shopping process.

Consumers who auto-renew their policies will get the same dollar value of subsidies they got last year—even though changes in the marketplace all but guarantee that will no longer be the right subsidy amount for millions of people.

“That’s the totally crazy part,” Pearson said. “They’re basically going to send them what they know to be the wrong subsidy.”

The IRS will eventually {and, apparently, spontaneously] figure out how much financial assistance you should have received, and will reconcile the difference on your taxes {and pay you the interest on the money you paid that you didn't have to. Not].

Remember Cass Sunstein, genius, and his “nudge theory”? Where “choice architectures” set default options so that they “nudge” people to more socially desirable outcomes? Well, Obama set the default for ObamaCare to autorenewal, right? Back to Drum, who describes the result:

So, that’s the outcome that Obama regards as socially desirable. I keep saying ObamaCare is a minefield without any signage; auto renewal is a fine example of such a minefield. You auto-renewed, then? Blam!

Second-Class Citizens Wherever You Look

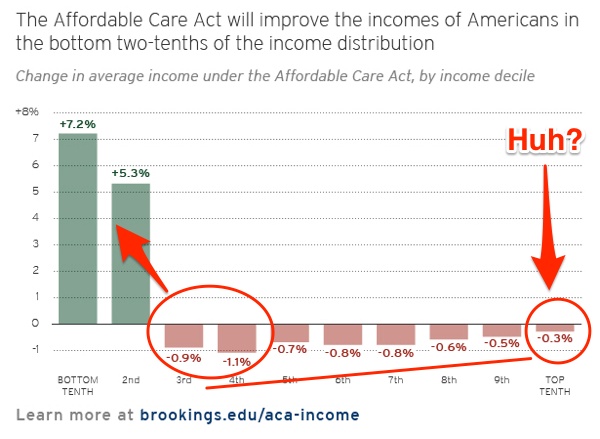

Two figures tell the tale. First, ObamaCare takes from the almost-poor and gives to the poor. From the Brookings Institute:

It’s like reverse noblesse oblige, isn’t it? The more you make, the less you give! (Granted, in percentage terms. But ya know, redistribute a yacht cover or two and bale of Hermes scarves from the Top Tenth (first class) versus redistribute the kids’ college fund or repairing those shock absorbers or a few nights out at the Olive Garden (second class), all so some poor shrub doesn’t keel over and die for lack of care, and who wants that… Who feels it more, modulo the ol’ ego mego way up there at the top of Maslow’s hierarchy (“self actualization”)?

And then there’s this, the kind of

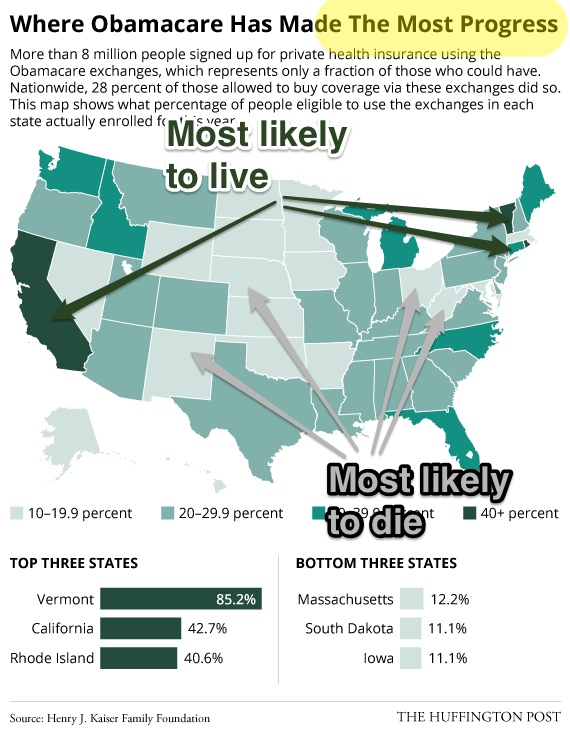

Again, it’s the topsy turvy world of ObamaCare advocacy. The headline: “Where Obamacare Has Made The Most Progress.” But that’s not what the map is really telling you, is it? If you accept that lack of health insurance leads to excess deaths, then there are excess deaths in every state except the three top states: Vermont, California, and Rhode Island. (I’m being charitable; even those three have excess dates.) Why is this anything other than a miserable failure?

Single payer would save those lives. Everybody in the country would have equal access to health care, simply by virtue of being a citizen. Any other solution on the table — see “Neoliberalism Expressed as Simple Rules” for the policy parameters — means that people live and die at random, by accident, simply because of whatever state or city or county they ended up in. Those in first class (dark green arrows) go to Happyville. Those in second class (light grey arrows) go to Pain City. It’s a crap shoot, the luck of the draw. This is life and death! How is this in any way acceptable? It baffles me that “progressives” — do note the “progress” in the headline — don’t see the moral issue here.

*************************************************************

TROLL PROPHYLACTIC It may be that you personally have benefited from ObamaCare. In a program of ObamaCare’s size, it’s only natural that some would benefit. My question for you is this: Do you think that all should benefit as you have, and if so, what are you doing about it? The same reasoning applies to those who say that ObamaCare has benefited X millions of people. Why should not all benefit as some do?

WELL SAID, SIR!

xchrom

(108,903 posts)The Federal Reserve is planning risk-based capital standards for banks that are tougher than those developed by their international counterparts, Fed Governor Daniel Tarullo will tell lawmakers today.

The U.S. capital surcharge for large banks will be higher than the level required by the 27-nation Basel Committee on Banking Supervision, Tarullo said in testimony for the Senate Banking Committee. The surcharge formula will take into account U.S. banks’ reliance on short-term wholesale funding, he said.

“The financial crisis made clear that policy makers must devote significant attention to the potential threat to financial stability posed by our most systemic financial firms,” he said in his statement.

Tarullo, the Fed governor responsible for financial regulation, will testify alongside top officials from five other agencies at a hearing on their implementation of the Dodd-Frank Act. His comments reflect regulators’ focus on the largest, most systemically important companies as they near completion of rulemaking required by the 2010 law.

Demeter

(85,373 posts)...

To over-simplify: If you’re filling out a 1099 when you should be filling out a 1040, that’s misclassification. There are regulations to detect misclassification, and it is, in fact, illegal, as we see. McClatchy conceptualizes the problem as a “broken pipeline,” listing a series of steps:

PRIVATE COMPANIES. Developers leverage money for financing to build housing, roads and bridges; general contractors are hired to execute developers’ plans.

(Where it leaks.) SUBCONTRACTORS. Subcontracting firms are hired to paint, lay bricks, hang drywall. Some follow the law and treat workers as employees; those companies collect and pay nearly all the taxes owed to Uncle Sam. Other companies treat workers as independent contractors, leaving it to them to settle their taxes.

(Where it leaks.) WORKERS. Workers treated as independent contractors report only a fraction of their pay to the government. And, the companies that hire them don’t pay unemployment taxes or the share of payroll taxes employers owe.

The “leaks” happen when subcontractors misclassify workers. (Obviously, the workers can’t misclassify themselves.) While theoretically, only the Federal government can classify workers, in practice the subcontractors are unregulated, so if they write “1099? on a worker’s contract, that’s how the worker is classified, and that’s what the subcontractor reports to the government. Why is this important? Because misclassification creates a Gresham’s dynamic among the subcontractors:

And Domando says she knows why: “We were getting underbid by companies that were cheating.”

The scheme is simple: Instead of treating workers as regular employees, companies classify them as independent contractors. That way, the companies don’t have to withhold income taxes from their workers’ wages or file unemployment taxes. Their labor costs are significantly lower than companies like Domando’s that obey the law.

How significantly?

That’s a lot! And the key point:

So that’s the Gresham’s dynamic; cheaters prosper. McClatchy frames the consequences of misclassification “leaks” in two ways. First, workers are gouged:

“Generally, violations do not occur in isolation,” said Julie Su, the California labor commissioner. “You uncover one violation and it’s often a doorway into multiple violations.”

McClatchy’s review of payroll records shows immigrants are most susceptible to misclassification and other exploitation. Using the records as a starting point, McClatchy found and interviewed hundreds of laborers and tradesmen. Many, in addition to being misclassified, told unsettling stories of mistreatment:

Companies refusing to provide tax forms that allowed workers to file tax returns.

Bosses forcing workers to pay a fee to use protective gear such as hard hats and steel-toe boots.

Bosses refusing to settle up on days’ or weeks’ worth of pay.

A workplace injury without any insurance to take care of it.

“It makes me feel invisible,” said Camilo Loyola, a Mexican immigrant who moved to North Carolina more than 20 years ago. During two decades in the construction industry, Loyola has been shortchanged on wages and deprived of tax forms, he said. In 2011, he worked on a government-financed project in Raleigh and was improperly treated as an independent contractor. He knew it was wrong, but he needed to keep the money flowing for his family.

Second, taxes are not collected that should be:

Construction workers don’t make much money, and one by one their tax evasion doesn’t amount to much. But misclassification has become an industry standard, McClatchy found, and the associated cost is staggering.

Nationally, the tax losses amount to billions. If just 20 percent of the 10 million construction workers in the U.S. are misclassified, that tops $8.5 billion each year in federal payroll and income taxes and unemployment taxes, McClatchy estimates.

Those are serious effects, to be sure. But how would they affect the stimulus? Here, as far as data goes, we’re in uncharted waters (again!!!). But we can proceed from the general idea that a stimulus is meant to stimulate, and that it does so by getting money into the hands of people who will spend it as rapidly as possible, and on items that are likely to benefit the real economy. For example, if we give a wealthy person a check for $1,000, he might throw it in his desk drawer — since the amount is trivially small — where it might languish for a few months until his personal assistant finds it, and puts it toward an Hermés yacht cover or a Jeff Koons painting. Not that there’s anything wrong with that. (This same process would apply to even a smallish subcontractor, simply because they’re unlikely to be as desperate as out-of-work construction workers, and can hold back their spending until they consider what to do, and will probably not spend on necessities.) But if we give a poor person that same check, they’ll spend it right away at the grocery store, at the auto repair shop, and maybe even on a movie or a meal. Who stimulates the economy more, and faster? (This parable is, I believe, called “the marginal propensity to consume.”) The exception here would be the immigrant (documented or not) who would be likely to send a portion of that check out of the country, to be spent at groceries and auto repair shops, just not here.

So, “misclassification” must have made Obama’s stimulus spending less effective that it would otherwise have been for two reasons:

1) Spending was skewed toward owners, who have a lower marginal propensity to consume. I believe this would be true for two reasons: First, in an environment successfully regulated by Davis-Bacon, the workers get a larger slice of the pie. Second, where misclassification occurs, the social dynamics between boss and owner are such that other violations, like wage theft and kickbacks, follow, and these practices transfer income from workers to owners (“primitive accumulation”).

2) Spending was skewed toward immigrants, who have a tendency to send money out of the country. Here again social dynamics favor those willing to work off-the-books or under the table, for the minimum that desperation demands, and sadly, such workers are disproportionately immigrants.

I don’t think we can quantify these effects, but the order of magnitude from the uncollected taxes would lead us to think in terms of billions of unstimulating stimulus, like a multiplier effect but with one of the terms set to zero. Not trivial!

*****************************

NOTES

1) If the effects had been strong, we wouldn’t even be arguing about them.

xchrom

(108,903 posts)Democrats are wagering that women candidates will help them make a comeback in the South.

It worked six years ago when the party recruited Kay Hagan to defeat Republican Senator Elizabeth Dole in North Carolina and Senator Mary Landrieu won a third term in Louisiana, both with outsized support from women voters.

Now Democrats are applying that model in Kentucky, where Alison Lundergan Grimes is trying to oust Senate Minority Leader Mitch McConnell, and Georgia, where Michelle Nunn is seeking to replace retiring Republican Senator Saxby Chambliss. Both have made an appeal to women voters a centerpiece of their campaigns.

Across the South, Democrats have struggled with an inability to attract white, male voters, said Merle Black, a political science professor at Emory University in Atlanta. “It may be that a female Democratic candidate can do better with female voters than a male candidate can,” he said.

Mark Pryor, who is seeking a third term in Arkansas, is the only white, male Democratic senator representing a state in the Deep South. Three others -- Senators Mark Warner and Tim Kaine of Virginia and Bill Nelson of Florida -- represent presidential battleground states with Democratic-leaning urban centers.

Demeter

(85,373 posts)Demeter

(85,373 posts)Mathew Martoma, a former portfolio manager at billionaire Steven A. Cohen's SAC Capital Advisors LP hedge fund, was sentenced on Monday to nine years in prison for engaging in what authorities called the most lucrative insider trading scheme in U.S. history.

U.S. District Judge Paul Gardephe in New York said he had to account for the "enormous" $275 million gain SAC obtained as a result of illegal trades in pharmaceutical stocks. Prosecutors said the trades were based on tips Martoma received about a clinical trial for an Alzheimer's drug.

"I cannot and will not ignore that the gain is hundreds of millions of dollars more than ever seen in an insider trading prosecution," Gardephe said.

The sentence came despite appeals for leniency by Richard Strassberg, Martoma's lawyer, who cited "fragile family circumstances." Gardephe also ordered Martoma to forfeit $9.3 million, including his Boca Raton, Florida, home. While Martoma, 40, faced up to 19-1/2 years in prison under federal sentencing guidelines, Gardephe said such punishment should be reserved for repeat offenders or criminal enterprise leaders. But the judge said a severe sentence was nonetheless necessary, saying "there was nothing accidental about Mr. Martoma's conduct or the gain realized."

...The nine-year sentence is among the longer prison terms in U.S. insider trading cases, reflecting a trend of increasingly lengthy sentences in recent years....

Demeter

(85,373 posts)A group of pension funds has joined with the city of Providence in a lawsuit contending that major stock exchanges improperly favored high-frequency traders at the expense of other investors.

The pension funds, including one in Stockholm and the State-Boston Retirement System in Massachusetts, have joined a lawsuit originally filed by Providence in April, according to a filing in US District Court in New York last week. They are taking aim at the New York Stock Exchange, Nasdaq, and BATS Global Markets — as well as the investment bank Barclays, which operates a private stock trading venue known as a dark pool.

Their legal action comes during a period of heightened scrutiny for high-frequency traders, which use computer algorithms to buy and sell shares in milliseconds. In recent months, Washington lawmakers have summoned financial executives to testify about such trading, the Securities and Exchange Commission has stepped up its scrutiny of the practice, and the New York attorney general, Eric T. Schneiderman, has sued Barclays over traders in its dark pool.

The pension funds and Providence, which are seeking class-action status, say the exchanges provide certain advantages to high-frequency traders, “diverting billions of dollars annually from buyers and sellers of securities and generating billions more in ill-gotten kickback payments.” They are seeking an unspecified amount of damages.

Demeter

(85,373 posts)

DemReadingDU

(16,000 posts)9/8/14 Steve Cohen Money Manager Exits After McLaren Reckless-Driving Arrest

Paul Orwicz, a longtime money manager at billionaire Steven A. Cohen’s Point72 Asset Management LP, departed the investment firm a week after he was arrested for reckless driving in his McLaren supercar in Connecticut.

Orwicz, 46, said in a telephone interview that he resigned last week after his two-year contract with the firm, which manages Cohen’s fortune, lapsed and he’s now pursuing other opportunities within the hedge-fund industry. He said the driving incident was an “unfortunate coincidence” with his exit from Point72, and that he hoped to resolve the matter with the authorities.

Orwicz was arrested Aug. 28 on charges of reckless driving, improper passing and disobeying a police officer signal while behind the wheel of the yellow McLaren in New Canaan, Connecticut, New Canaan News said on its website. An officer at the New Canaan police department said nobody was available to comment on the incident.

“We do not comment on internal personnel matters,” said Jonathan Gasthalter, a spokesman for Point72. “The management of Point72 expects our employees, at every level of the organization, to act with professionalism and integrity at all times.” He also declined to discuss Orwicz’s departure.

more...

http://www.bloomberg.com/news/2014-09-08/point72-manager-exits-after-reckless-driving-arrest.html

DemReadingDU

(16,000 posts)9/8/14 CFTC Said to Alert Justice Department of Criminal Rate Rigging

Derivatives regulators told the U.S. Justice Department they’ve found evidence of criminal behavior following an investigation into banks’ alleged manipulation of ISDAfix, a benchmark used to set rates for trillions of dollars of financial products.

The U.S. Commodity Futures Trading Commission, which first sent subpoenas to the world’s largest banks in November 2012 to determine whether ISDAfix was rigged, has flagged its findings to prosecutors, according to a person familiar with the matter. The CFTC’s enforcement powers are confined to bringing civil, not criminal, cases. It isn’t clear who the CFTC suspects broke the law.

Benchmarks like ISDAfix, which is used to track prices on interest-rate swaps, serve as the foundation of global finance, helping pension funds determine their future obligations and lenders decide how much to charge borrowers. Regulators around the world are probing allegations that measures used to set prices in gold, oil, interest rates and currencies were rigged by banks and brokers wanting to pad their profits while cheating their clients and other investors.

Last week, the Alaska Electrical Pension Fund accused 13 banks including Barclays Plc (BARC), Bank of America Corp. and Citigroup Inc. (C) as well as broker ICAP Plc (IAP) of conspiring to manipulate ISDAfix. The U.K. Financial Conduct Authority is also looking into allegations of wrongdoing involving the benchmark.

Representatives of the Justice Department, CFTC, Barclays, Bank of America, Citigroup and ICAP declined to comment.

.

.

The pension fund is seeking to represent all investors that took part in interest rate derivative transactions tied to ISDAfix from January 2006 to January 2014. It’s seeking unspecified damages, which may be tripled under U.S. antitrust law. The fund also named as defendants Deutsche Bank AG (DBK), BNP Paribas SA (BNP), HSBC Holdings Plc (HSBA), Royal Bank of Scotland Group Plc, Credit Suisse Group AG (CSGN), UBS (UBSN), Goldman Sachs Group Inc. (GS), Nomura Holdings Inc. (8604), Wells Fargo & Co. (WFC) and JPMorgan Chase & Co. (JPM) and ICAP.

more...

http://www.bloomberg.com/news/2014-09-08/cftc-said-to-alert-justice-department-of-criminal-rate-rigging.html

Crewleader

(17,005 posts)