Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 28 August 2014

[font size=3]STOCK MARKET WATCH, Thursday 28 August 2014[font color=black][/font]

SMW for 27 August 2014

AT THE CLOSING BELL ON 27 August 2014

[center][font color=green]

Dow Jones 17,122.01 +15.31 (0.09%)

S&P 500 2,000.12 +0.10 (0.00%)

[font color=red]Nasdaq 4,569.62 -1.02 (-0.02%)

[font color=black]10 Year 2.35% 0.00 (0.00%)

[font color=green]30 Year 3.10% -0.03 (-0.96%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

http://tools.investing.com/market_quotes.php?

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)I haven't been first in a long, long while!

Demeter

(85,373 posts)Hotler

(11,428 posts)Morning Demeter

If ever there was a time in this country's history when millions of people should have been in the streets throwing rocks at those fuckers like a Palestinian it was then.

Demeter

(85,373 posts)Hold onto those rocks. They may come in handy later.

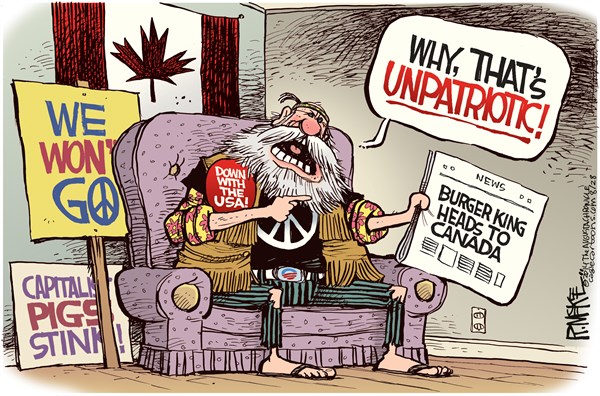

Crewleader

(17,005 posts)

Demeter

(85,373 posts)between fleeing conscription into an illegal and immoral war for corporations, based on fraud, greed for oil, and hubris;

and shuffling paperwork to avoid paying taxes to the people who made you what you are today,

with the infrastructure they paid for

and the custom they gave you:

profitable.

xchrom

(108,903 posts)1. The Qantas horror show. Massive write-downs have contributed to an eye-watering A$2.8 billion statutory loss for Australia’s national airline in its results announced this morning. The underlying loss of A$646 million was a big beat on the market’s expectation of A$750 million. Profit at the domestic arm was shredded to just A$30 million in EBIT, compared to A$365 million the year before. The group confirmed a decision to keep its frequent flyer program, Qantas Loyalty, in-house. With half of the 5,000 redundancies now in place and a rapid return to profitability expected, CEO Alan Joyce says the “worst is behind us”. Not to put too fine a point on it, but it had better be.

2. Markets did nothing in the US session with the major bourses all almost dead flat in the absence of major data. The big talking point in global markets though is the continuing bond rally which is pushing global rates to record lows.

3. A five-year low for the iron ore price could make for a different story on the Australian market today. Smaller miners will be the ones to watch. Futures were 19 points lower ahead of the start of trade. There’s also capex data out from the ABS at 11.30am AEST with the market expecting a fall of 0.9% for Q2.

4. ISIS is not just murderous, it’s also very rich. The terrorist group which has taken over large parts of Iraq and Syria pulls in millions of dollars a day from illegal oil sales, as well as around $US12 million a month from extortion. Australia is now in the box seat to contribute to a widened US-led military campaign, probably taking the form of airstrikes, in Iraq and Syria.

5. The number of Australians fighting for ISIS are well up the list of Western additions to the terrorist group. Leading the pack on a per capita basis is Belgium, which supplies 250 fighters from its 11 million population. Australia’s count is at 200 but France is well beyond everyone, contributing 700.

6. Jessica Alba’s startup is valued at a billion dollars. Her company makes eco-friendly baby products, and 80% of the revenue comes from customers who get monthly deliveries of nappies. It’s just received series C funding of $US70 million from a group of VC companies. It’s expected to do $US150 million in revenue this year, triple what it did last year, and there are some tentative moves for an IPO.

Read more: http://www.businessinsider.com.au/10-things-you-need-to-know-this-morning-in-australia-v19-2014-8#ixzz3BfuFtNyk

xchrom

(108,903 posts)

This is the Pharaoh's Chicken.

Finance is a strange industry. There's nothing else like it.

I can't think of another industry in which there is so much ignorance around costs. Nearly all financial fees are deducted from assets automatically, rather than clients receiving and paying an invoice. This makes them out of sight, out of mind. Ask someone how much their cell phone bill is, or how much a gallon of gas costs, and they can tell you down to the penny. But ask them how much they pay in advisory fees, and they may have no clue whatsoever.

The irony is that if you are moderately wealthy, advisory fees might be your single largest annual expense -- and you're probably oblivious to them. You diligently include an $8.99 Netflix subscription in your monthly household budget, but have no idea you're paying 50 times that much to your 401(k) adviser. No other industries work like this.

I can't think of another industry in which people capable of doing so much harm don't need credentials. Doctors must attend medical school. Lawyers must pass the bar. Hairstylists and manicurists need licenses. Becoming a London taxi driver requires passing a test that can take years of practice.

But managing money requires little more than the desire to manage money. If I want to be a firefighter, I need extensive training. If I want to manage the firefighters' retirement fund, I need a nice suit and a sales pitch.

Read more: http://www.fool.com/investing/general/2014/08/27/finance-is-a-strange-industry.aspx#ixzz3BfwFQSU0

xchrom

(108,903 posts)BERLIN (Reuters) - German unemployment posted a small but unexpected increase in August but the jobless rate held steady at just 6.7 percent, the Labour Office said on Thursday, suggesting the job market in Europe's largest economy remains intact.

The number of people out of work increased by 1,000 to 2.901 million, seasonally-adjusted data showed. The mid-range forecast in a Reuters poll had been for a drop of 5,000.

Read more: http://www.businessinsider.com/r-german-joblessness-up-slightly-in-august-rate-steady-at-67-percent-2014-8#ixzz3Bg2mPu7Y

xchrom

(108,903 posts)A think tank called CNA recently issued a 140-page report titled "China versus Vietnam: An Analysis of the Competing Claims in the South China Sea" authored by Raul (Pete) Pedrozo. [1] It provides a further legal rationale for growing US efforts to inject itself into South China Sea exclusive economic zone (EEZ) disputes on behalf of Vietnam and against the People's Republic of China.

A few reasons why attention should be paid.

First, the institution.

CNA is described as a non-profit corporation. A fuller description would be a "US Navy analytic division dating to 1942 that works

exclusively for and is funded exclusively by the US government but was corporatized in the 1990s so it could dip its beak into non-DoD government work through a division called the Institute for Public Research".

You could say that "CNA" stands for "Center for Naval Analyses", the name of its antecedent organization. But you'd be wrong, according to CNA, in a "note to reporters and editors": CNA is not an acronym and is correctly referenced as "CNA Corporation, a non-profit research and analysis organization located in Arlington, VA.

So, consider CNA a meaningless collection of letters for a center that does analyses for the Navy and Marine Corps, whose main job is studying systems, tactical, and strategic issues for the USN and USMC. It has one unique regional focus, a "China Studies" division of 20 or so in-house analysts buttressed by "an extensive network of subject-matter experts from universities, government, and the private sector from around the world".

Second, the author, a "subject-matter expert", Captain Pedrozo:

Captain Raul (Pete) Pedrozo, US. Navy (Ret.). Former Professor of International Law, US. Naval War College; Staff Judge Advocate, US Pacific Command; and Special Assistant to the Under Secretary of Defense for Policy.

xchrom

(108,903 posts)In January 2012, as polls showed the French presidential race too close to call, Emmanuel Macron was leading a double life.

By day, Macron, just turned 34 and on a high six-figure salary at Rothschild & Cie, was working with a pool of bankers to advise Nestle SA on what became an $11.9 billion purchase of Pfizer Inc.’s Wyeth infant nutrition business.

By night, he worked as an unpaid adviser to the Socialist candidate, Francois Hollande, writing the future president’s economic platform pledging to eliminate the deficit by 2017.

Macron’s background and closeness to Hollande explain his appointment to the cabinet yesterday as France’s economy and industry minister in place of Arnaud Montebourg. It also shows the gulf between rank-and-file members of Hollande’s Socialist Party and the competing visions of France’s economic future.

xchrom

(108,903 posts)In Australia’s remote top end U.S. fighter pilots are engaged in combat drills, while Marines sip beers at night in pubs in the tropical city of Darwin. Thousands of kilometers to the north, the U.S. finds itself in increasingly real standoffs with China’s air force.

“The planes are noisy but they’re just a part of life,” said Rachael Molloy, 24, who sells crocodile skin whips at the evening beach markets in Darwin, which plays host to the 22-day exercises where jets roar overhead until late at night. “They’re massive, beautiful planes.”

Pitch Black, held every two years, serves as a reminder of Australian and U.S. military heft as China presses its claims to the South China Sea, where shipping lanes carry more than $5 trillion in goods each year. While the U.S. touts its role in Asia as a counterpoint to China, it is also seeking to minimize the risk from militaries operating in greater proximity, highlighted when a Chinese fighter buzzed within 20 feet of a U.S. surveillance plane in international waters on Aug. 19 and did a barrel roll over it.

More than 4,200 kilometers from the southern Chinese island of Hainan, Australia’s gateway to Asian nations such as Indonesia and Singapore offers the U.S. an advantage: It is distant enough from China to avoid the appearance of a major threat, and close enough to Southeast Asia to offer a bulwark against China’s rise.

xchrom

(108,903 posts)German unemployment unexpectedly rose in August as a stagnating euro-area recovery and tension with Russia darkened the outlook for Europe’s largest economy.

The number of people out of work climbed a seasonally adjusted 2,000 to 2.901 million in August, the Nuremberg-based Federal Labor Agency said today. Economists forecast a decline of 5,000, according to the median of 30 estimates in a Bloomberg News survey. The adjusted jobless rate was unchanged at 6.7 percent, the lowest level in more than two decades.

Germany’s economy shrank last quarter and the strength of any rebound is critical for the 18-nation euro area. The region’s stalling recovery and weakest inflation since 2009 has prompted European Central Bank President Mario Draghi to signal that he could step in with quantitative easing.

“The German economy is not in as good a shape as it was at the beginning of the year,” said Michael Holstein, an economist at DZ Bank AG in Frankfurt. “The labor market is still strong but if the economic outlook worsens further, we’ll see the effect on employment later in the year.”

xchrom

(108,903 posts)Italy’s four biggest banks are seeking to borrow as much as 27 billion euros ($36 billion) in the European Central Bank’s first auction of cheap cash designed to boost loans to companies and individuals, according to people with knowledge of the plans.

UniCredit SpA (UCG), the nation’s largest lender, is asking for 7 billion euros in the September auction, said one of the people, who asked not to be identified because the information isn’t public. Banca Monte dei Paschi di Siena SpA, Italy’s third-largest lender, will bid for 3 billion euros, about half of the total it’s targeting this year, another person said.

The loans, known as targeted longer-term refinancing operations, or TLTROs, are part of a historic package of ECB measures to expand credit to businesses and households and revive growth. The ECB’s previous injection of long-term funds in 2011 and 2012 failed to boost lending because banks invested in sovereign bonds instead. The euro area posted zero growth in the second quarter as its three biggest economies -- Germany, France and Italy -- didn’t expand or contracted.

xchrom

(108,903 posts)Chancellor Angela Merkel urged French President Francois Hollande to press ahead with economic reforms, while hinting he has flexibility in the pace of deficit reduction.

The German chancellor cited the risk to market confidence when governments “always” run deficits and the need to recognize “that higher spending doesn’t create growth,” her first comments on France since Hollande purged cabinet ministers who opposed spending cuts.

“We can talk about the question of whether you have a 2 percent deficit or 3 percent, or 1 percent, or a balanced budget like us,” Merkel said during a panel discussion with reporters in Berlin today. “What’s at issue in France is to really do those structural reforms. And the French president has announced them.”

It’s “very important that we support each other on such reforms,” said Merkel, whose austerity-led policies in response to the euro area’s debt crisis have grated on policy makers across much of the currency bloc.

Demeter

(85,373 posts)I would not like you to think that your current lack of a deficit is 1) permanent 2) healthy 3) desirable 4) maintainable 5) meighborly and peace-supporting

for you will be grieved and surprised very shortly.

xchrom

(108,903 posts)Russian hackers attacked JPMorgan Chase & Co. (JPM) and at least four other banks this month in a coordinated assault that resulted in the loss of gigabytes of customer data, according to two people familiar with the investigation.

At least one of the banks has linked the breach to Russian state-sponsored hackers, said one of the people. The FBI is investigating whether the attack could have been in retaliation for U.S.-imposed sanctions on Russia, said the second person, who also asked not to be identified, citing the continuing investigation.

The attack led to the theft of account information that could be used to drain funds, according to a U.S. official and another person briefed by law enforcement who said the victims may have included European banks. Hackers also took sensitive information from employee computers.

xchrom

(108,903 posts)For years, Mainstreet Guns & Range couldn’t sell assault rifles fast enough.

About the time President Barack Obama took office, buyers flocked to the store in Lilburn, Georgia, to stock up because of concern that federal lawmakers would tighten gun laws, a worry that only grew after the 2012 Connecticut school massacre. Now, with the political impetus waning for new restrictions, the rush for firearms is ebbing too.

“Assault-rifle sales stopped in their tracks,” Jim Hornsby, owner of the suburban Atlanta store, said as muffled gunfire popped off from the attached shooting range. He estimated sales of the long guns are off 70 percent from last year. “It’s hard to give an AR away.”

Plummeting sales of assault-style weapons, also known as modern sporting rifles or “black rifles,” has led to an oversupply of unsold guns and is hitting the bottom lines of the big arms producers. Smith & Wesson Holding Corp. (SWHC) shares yesterday fell the most in more than two years after the Springfield, Massachusetts-based gunmaker slashed its full-year sales and profit forecasts.

xchrom

(108,903 posts)A gauge of government bonds around the world approached a record high on speculation the European Central Bank is preparing to buy debt to combat disinflation.

Bank of America Merrill Lynch’s Global Broad Market Sovereign Plus Index rose to within half a percent of its all-time high yesterday based on prices, according to data starting in 1996. As yields in Europe plunge, investors are snapping up government securities from the U.S. to Australia in search of higher interest payments. Bonds in the index have returned 5.6 percent in 2014, headed for the biggest gain since 2011.

“The global bond rally has gone a long way in quite a short period of time, obviously driven by Europe and increased speculation over measures from the ECB,” said Su-Lin Ong, head of Australian economic and fixed-income strategy at Royal Bank of Canada in Sydney. “A discussion over both timing and what exactly those measures are going to be has dominated markets and set the tones for all markets globally.”

The U.S. 10-year yield was little changed at 2.35 percent at 6:51 a.m. in London, Bloomberg Bond Trader data show. It has fallen from 3.03 percent at the end of 2013. The price of the 2.375 percent note due August 2024 was 100 1/4. Thirty-year yields dropped to 3.09 percent, the lowest since May 2013.

xchrom

(108,903 posts)The U.S. Securities and Exchange Commission, while expanding disclosure requirements for one set of asset-backed securities, has stepped back from a plan to shed more light on a major part of the market.

The five SEC commissioners unanimously approved a rule yesterday to offer investors more details on bonds backed by assets such as mortgages and car financing, including specific data on individual loans, and new practices such as a cooling-off period to review documents before certain bond sales.

Dropped from the rules: a requirement that issuers of private securities be ready to furnish to buyers the same type of information that’s available for publicly registered debt. The SEC said in a Federal Register posting proposing the rule in 2010 that such a step would bring “transparency to formerly opaque” markets.

“It’s a massive hole,” said David Jacob, the former global head of structured finance at Standard & Poor’s. “Most of the asset-backed market is a private market.”

xchrom

(108,903 posts)Mortgage-burning parties in the U.S. may be going the way of home milk deliveries and polyester leisure suits.

A growing number of homeowners are reaching retirement age still owing money on their houses. The share of Americans 65 and older with mortgage debt rose to 30 percent in 2011 from 22 percent in 2001, according to a May analysis by the Consumer Financial Protection Bureau based on the latest available figures. Loan balances also increased, with the median amount owed climbing to $79,000 from $43,400 after adjusting for inflation, the data showed.

“There were old-fashioned beliefs probably 30 years ago” that included “you should pay off your house before you retire,” said Olivia Mitchell, executive director of the Pension Research Council at the University of Pennsylvania’s Wharton School in Philadelphia. “This is no longer the case.”

The increase in mortgage debt may influence labor-force dynamics as some older Americans find they’re unable to completely retire, needing extra cash to keep up monthly payments. It also diminishes home equity and wealth, making these households more susceptible to swings in the economy and curbing spending on things such as vacations and visits to grandchildren.

xchrom

(108,903 posts)Investors are dumping the world’s cheapest euro-denominated corporate bonds as New World Resources Plc seeks a deal with creditors this week to avert bankruptcy.

The Czech coal company’s unsecured debt due January 2021, which is in default after a missed coupon payment in July, fell to a record 8.5 cents on the euro two days ago. The 275 million-euro ($363 million) Eurobond traded at 12 cents today by 9:57 a.m. in Prague, the cheapest of the 453 notes in the Bloomberg Euro High-Yield Corporate Bond Index, followed by NWR’s 500 million-euro secured May 2018 note, at 64.4 cents.

Bondholders meeting in London tomorrow will probably approve the management’s restructuring plan as its rejection would spur an immediate insolvency and may leave some creditors with nothing, NWR Chief Financial Officer Marek Jelinek said in an Aug. 21 interview. The company may keep losing money even with a revamp as coal prices are falling for a third year amid oversupply, Moody’s Investors Service said on the same day.

“The market expects the new instruments coming out of the restructuring, if it happens, to trade at a big discount,” Lutz Roehmeyer, a money manager overseeing $1.1 billion of debt in emerging markets at LBB Invest in Berlin, said by phone on Aug. 28. “Even a restructured NWR is unattractive as the business outlook doesn’t bode well for the company’s future.”

xchrom

(108,903 posts)Ukrainian President Petro Poroshenko has cancelled a visit to Turkey, citing "Russian troop deployments" in the east of the country.

Mr Poroshenko said his place was in Kiev in view of a sharp deterioration in the situation in Donetsk region.

His announcement came as pro-Russian rebels captured the seaside town of Novoazovsk and threatened to take the strategic port city of Mariupol.

The rebel successes constitute the opening of a new front in the conflict.

xchrom

(108,903 posts)French authorities have formally opened a negligence investigation into Christine Lagarde, the head of the International Monetary Fund (IMF).

She has been questioned about her role in awarding 400m euro (£318m; $527m) in compensation to businessman Bernard Tapie in 2008. She denies wrongdoing.

Ms Lagarde, 58, was finance minister in President Nicolas Sarkozy's government at the time of the award.

Mr Tapie supported Mr Sarkozy in the 2007 presidential election.

xchrom

(108,903 posts)The number of people looking for work in France rose 0.8% in July to a new record of 3,424,400.

The sharp rise confirms a longer term trend with the number of jobless rising 4.3% over the last year.

President Francois Hollande has promised to kick start growth and create jobs.

But the economy has floundered, prompting a revolt against austerity by three left-wing ministers. Mr Hollande replaced them and named a new cabinet.

xchrom

(108,903 posts)PARIS (AP) -- Facing pitiful poll numbers, Francois Hollande has cast his lot: The French president who once decried global finance and vowed a 75-percent tax on millionaires has quashed dissent from his Socialist government's left flank and appointed a well-heeled former investment banker as his new point man on the economy.

Several left-leaning critics were sent packing in a Cabinet shakeup that sent a message to international investors, European allies and millions of French: France is willing to embrace more free market policies and often unpopular reforms to tackle double-digit unemployment and zero economic growth.

The spirit of Hollande's new focus was summed up in a speech by his prime minister, Manuel Valls, who put together a new Cabinet this week that includes former banker Emmanuel Macron as economy minister.

"I like companies," he said to a standing ovation from a gathering of the country's main employers lobby, which is reviled by many on the left, including in the Socialist party.

Demeter

(85,373 posts)xchrom

(108,903 posts)WASHINGTON (AP) -- Americans are more anxious about the economy now than they were right after the Great Recession ended despite stock market gains, falling unemployment and growth moving closer to full health.

Seventy-one percent of Americans say they think the recession exerted a permanent drag on the economy, according to a survey being released Thursday by Rutgers University. By contrast, in November 2009, five months after the recession officially ended, the Rutgers researchers found that only 49 percent thought the downturn would have lasting damage.

And that was when the unemployment rate was 9.9 percent, compared with the current 6.2 percent.

"They're more negative than they were five years ago," said Rutgers public policy professor Carl Van Horn.

xchrom

(108,903 posts)TEWKSBURY, Mass. (AP) -- A New England supermarket chain that has been in turmoil for weeks over a workers' revolt and customer boycott has announced that the former CEO is buying the company from rival relatives.

Market Basket said in a statement late Wednesday that former CEO Arthur T. Demoulas would be returning to the company and that he and his management team would handle day-to-day operations while the purchase is completed.

Arthur T. Demoulas has reportedly made a $1.5 billion offer to buy out the part of the company controlled by his cousin, Arthur S. Demoulas.

The company's two current CEOs, Felicia Thornton and Jim Gooch, are to remain in place until the deal is closed, the statement said. The closing is expected in the "next several months."

Hotler

(11,428 posts)"Should Mitt Romney run in 2016?"

![]()

Demeter

(85,373 posts)mahatmakanejeeves

(57,514 posts)Source: Department of Labor, Employment and Training Administration

Read More: http://www.dol.gov/opa/media/press/eta/ETA20141624.pdf

UNEMPLOYMENT INSURANCE WEEKLY CLAIMS SEASONALLY ADJUSTED DATA

In the week ending August 23, the advance figure for seasonally adjusted initial claims was 298,000, a decrease of 1,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 298,000 to 299,000. The 4-week moving average was 299,750, a decrease of 1,250 from the previous week's revised average. The previous week's average was revised up by 250 from 300,750 to 301,000.

There were no special factors impacting this week's initial claims.

The advance seasonally adjusted insured unemployment rate was 1.9 percent for the week ending August 16, unchanged from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending August 16 was 2,527,000, an increase of 25,000 from the previous week's revised level. The previous week's level was revised up 2,000 from 2,500,000 to 2,502,000. The 4-week moving average was 2,524,250, a decrease of 3,750 from the previous week's revised average. The previous week's average was revised up by 500 from 2,527,500 to 2,528,000.

....

The total number of people claiming benefits in all programs for the week ending August 9 was 2,466,791, a decrease of 50,674 from the previous week. There were 4,460,830 persons claiming benefits in all programs in the comparable week in 2013.