Prelude to a Crash by Mike Whitney

February 03, 2014

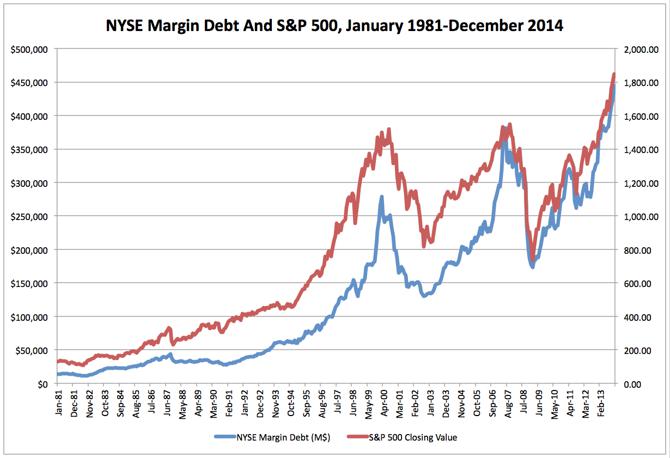

Margin Debt Hits All-Time High in December

by Mike Whitney

The Fed’s easy money policies have pushed margin debt on the New York Stock Exchange (NYSE) to record levels laying the groundwork for a severe correction or another violent market crash.

In December, margin debt rose by $21 billion to an all-time high of $445 billion.

Buying equities on margin, that is, with loads of borrowed cash, is a sign of excessive risk taking the likes of which invariably takes place whenever the Central Bank creates subsidies for speculation by keeping interest rates pegged below the rate of inflation or by pumping trillions of dollars into the bloated financial system through misguided liquidity programs like QE.

Investors have shrugged off dismal earnings reports, abnormally-high unemployment, flagging demand, droopy incomes, stagnant wages and swollen P/E ratios and loaded up on stocks confident that the Fed’s infusions of liquidity will keep prices going higher. It’s only a matter of time before they see the mistake they’ve made.

The chart below illustrates how zero rates and QE lead to excessive risk taking. The correlation between the stratospheric rise of margin debt and the Fed’s destabilizing monetary policy is hard to avoid. This is what bubblemaking looks like in real time.

http://www.counterpunch.org/2014/02/03/prelude-to-a-crash/

http://www.counterpunch.org/2014/02/03/prelude-to-a-crash/