Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday, 19 November 2013

[font size=3]STOCK MARKET WATCH, Tuesday, 19 November 2013[font color=black][/font]

SMW for 18 November 2013

AT THE CLOSING BELL ON 18 November 2013

[center][font color=green]

Dow Jones 15,976.02 +14.32 (0.09%)

[font color=red]S&P 500 1,791.53 -6.65 (-0.37%)

Nasdaq 3,949.07 -36.90 (-0.93%)

[font color=green]10 Year 2.66% -0.03 (-1.12%)

30 Year 3.76% -0.03 (-0.79%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Tansy_Gold

(17,860 posts)Have we done King Arthur for WEE? Probably. . . . .

I don't think there was a Camelot 50 years ago. I think the castle has been empty for centuries, or maybe it's never been occupied.

We look for heroes, never realizing that we must be our own heroes. We must be our own hope and change, and not rely on the stuff of dreams. Especially dreams that end upon waking and leave no trace. Especially dreams that linger to infect our waking moments with seductive longing and unrequited love. Especially dreams that come true as nightmares from which there is no escape.

Demeter

(85,373 posts)In any event, Richard Harris is gone, too.

I went looking for a hero today, but I didn't want it on whole wheat....I got cat food on sale, but they were all out of the cat litter....meaning I have only half a solution...

Demeter

(85,373 posts)Berkshire Hathaway Inc. reported a stake in Exxon Mobil Corp. valued at about $3.7 billion as Warren Buffett’s company disclosed its largest new holding since adding International Business Machines Corp. in 2011. Buffett’s company owned 40.1 million shares of Exxon on Sept. 30, Omaha, Nebraska-based Berkshire said today in a regulatory filing. The world’s biggest oil company by market value closed at $93.22 today in New York. It rose to $93.90 in extended trading at 5:14 p.m., after the filing.

Berkshire has benefited this year as its stock picks rallied along with the broader market, affirming a strategy of favoring equities instead of bonds amid near record-low interest rates. Buffett has tracked Exxon and bought its stock in the past, holding a stake in the Irving, Texas-based energy producer as recently as 2011.

Exxon Mobil “is undervalued, in his opinion, and pretty much being ignored by the market,” said David Kass, a professor at the University of Maryland’s Robert H. Smith School of Business who has taken students to meet Buffett in Omaha. “He knows the company. He knows it well.”

About three-quarters of the Exxon holding was added in the three months ended June 30, according to a separate filing today. Berkshire requested confidential treatment in an August filing listing its holdings at the end of the second quarter. The U.S. Securities and Exchange Commission sometimes allows companies to withhold information from the public to limit copycat investing while they build or cut a position....MORE

Demeter

(85,373 posts)Morgan Stanley (MS) is seeking regulatory approval to make financial advisers dual employees of its bank subsidiary in addition to the broker-dealer as the firm increases mortgage lending, a person briefed on the matter said.

The move would allow the advisers to get a national charter for mortgage lending rather than state registration, said the person, who asked not to be identified because a decision hasn’t been made. That would allow them to originate mortgages for clients in multiple states without having to register in each state individually...The request for dual status, already used by other retail brokerages including Bank of America Corp.’s Merrill Lynch, is seeking clearance from the U.S. Office of the Comptroller of the Currency, the person briefed on the matter said. ...

Morgan Stanley has said it wants to lend to 10 percent of its individual customers, double the current 5 percent and matching the industry average. The bank is targeting a loan-to-deposit ratio of about 70 percent in 2015, compared with about 55 percent last year, Porat said in September.

Morgan Stanley already has about 200 private bankers to help financial advisers lend to clients. The firm primarily makes floating-rate mortgages with an average loan-to-value ratio of 60 percent, Porat, 55, said in September.

MORE

Demeter

(85,373 posts)The U.S. will surpass Russia and Saudi Arabia as the world’s top oil producer by 2015, and be close to energy self-sufficiency in the next two decades, amid booming output from shale formations, the IEA said.

Crude prices will advance to $128 a barrel by 2035 with a 16 percent increase in consumption supporting the development of so-called tight oil in the U.S. and a tripling in output from Brazil, the International Energy Agency said today in its annual World Energy Outlook. The role of the Organization of Petroleum Exporting Countries will recover in the middle of the next decade as other nations struggle to repeat North America’s success with exploiting shale deposits, the agency predicted...

MORE

Demeter

(85,373 posts)n my previous post, I summarized Judge Jed Rakoff's objections to all the reasons federal prosecutors have given for failing to charge top financial executives with criminal wrongdoing. So, what explains the hesitance to bring to justice those who contributed to the worst economic crisis since the Great Depression? In his speech before New York securities lawyers last week, Rakoff, the outspoken federal judge, laid out a few theories.

Notably, he doesn't suspect the infamous "revolving door" -- the idea that bureaucrats are simply positioning themselves to move to cushy private-sector jobs. Prosecutors, he said, want to make a name for themselves. The easiest way to do that is by bringing cases against high-level people, and the prospect of eventually going to work for a Wall Street firm isn't a deterrent.

Here, rather, is where Rakoff believes the real culprits lie:

Theory 2: Law enforcement agencies have had to compete for a shrinking pot of money from Congress, and the best way to do that is by beefing up their statistics with smaller, easier cases and avoiding the years-long financial fraud probes that may turn up nothing. The Manhattan U.S. attorney, moreover, has been preoccupied with the sprawling insider-trading case against hedge-fund owner Raj Rajaratnam. Tapes of his conversations have been a gold mine -- resulting in slam-dunk cases that have led to numerous convictions -- for Manhattan prosecutors who previously would have focused on bank fraud.

Theory 3: The federal government's involvement in the mid-2000s bubble -- encouraging more people to buy homes, deregulating the financial industry, keeping interest rates low and giving Fannie Mae and Freddie Mac way too much leeway -- may also have given prosecutors pause.

Theory 4: The U.S. has shifted over the last 30 years from prosecuting high-level individuals to using delayed-prosecution agreements to settle cases against entire companies. That shift “has led to some lax and dubious behavior on the part of prosecutors," Rakoff said, including allowing managers to sweep crimes under the rug.

MORE

Demeter

(85,373 posts)WITH WHAT MONEY, ONE MIGHT ASK?

http://www.reuters.com/article/2013/11/18/us-cftc-mfglobal-court-idUSBRE9AH0SB20131118

A federal judge in New York has ordered MF Global Inc to return more than $1 billion to harmed customers and pay an additional $100 million penalty as part of a civil settlement with U.S. derivatives regulators.

The November 8 court order by U.S. District Judge Victor Marrero for the Southern District of New York was announced by the Commodity Futures Trading Commission on Monday in a press release.

The approval by the judge marks the end of the CFTC's litigation initiated in June against MF Global Inc over the brokerage's October 2011 collapse and loss of more than $1 billion in customer money.

The CFTC's civil case against defendants MF Global Holdings Ltd, former Chief Executive Officer Jon Corzine and former Assistant Treasurer Edith O'Brien, however, is still ongoing.

Demeter

(85,373 posts)ISN'T THAT SPECIAL!

http://ca.reuters.com/article/businessNews/idCABRE9A41BN20131105

The trustee of MF Global's defunct brokerage received approval from a bankruptcy judge on Tuesday for a plan that will repay its former commodity trader customers in full.

The move, approved by Judge Martin Glenn at a hearing in U.S. Bankruptcy Court in Manhattan, will repay customers by reallocating to them some funds initially earmarked for non-customer unsecured creditors, Kent Jarrell, the trustee's spokesman, said on Tuesday.

The ruling comes just after the two-year anniversary of the $40 billion collapse of MF's parent company, which was run by former New Jersey Governor and ex-Goldman Sachs (GS.N: Quote) chairman Jon Corzine. It was the eighth-largest Chapter 11 bankruptcy...

MORE HISTORY

Demeter

(85,373 posts)U.S. Internal Revenue Service officials fretted on Monday about an idea being pushed by some businesses to expand the ubiquitous W-2 tax form to include more healthcare data in an effort to avoid the creation of a new IRS form...Stephen Tackney, an IRS lawyer working on new agency rules to implement President Barack Obama's healthcare law... said: "We're a little concerned ... those (W-2) instructions are going to start getting a little confusing for people."

At issue is the IRS's need for more information from large businesses on whether they are offering affordable and minimum essential coverage to employees, as Obamacare mandates. Providing data of this sort means more red tape and higher compliance costs. To minimize that, some companies are saying the W-2 should be used. The compact, one-page W-2 form already reports basic data on employees such as wages, federal income tax, Social Security tax and Medicare wage tax withheld.

Employees get the W-2 from their employer each year no later than January 31 and file it with the forms they use to pay taxes.

"There is a view among employers that if they could get it on the W-2 in a simple manner that this would actually aid tax reporting," said Seth Perretta, a tax lawyer with Crowell & Moring, representing the American Benefits Council, a corporate lobbying group focused on employee benefits, at the hearing. Businesses want to use the W-2 to tell the IRS, for instance, when an employee was offered healthcare coverage during the year, or any changes in healthcare coverage for employees' children, he said.

THEY ARE SO CONCERNED THAT THE LITTLE PEOPLE WILL BE "CONFUSED"---AIN'T THAT SWEET!

Demeter

(85,373 posts)Allowing canceled plans to be renewed destabilizes risk pools, shifts blame to health care insurers...President Obama's attempt Thursday to make good on his promise to let people keep their health insurance policies was politically inevitable. With the public howling, Democrats defecting and Republicans planning a vote today to let insurers keep selling insurance that doesn't comply with the Affordable Care Act's tough new standards, he had to do something.

But political necessity doesn't guarantee good policy, and the president's plan is less a solution than it is a punt. Obama announced that the administration would allow canceled plans to be renewed for at least a year, which will probably ease the complaints of more than 4 million people in the individual market who've received cancellation notices since the Obamacare online marketplaces opened on Oct. 1. But there will be a dangerous rebound effect.

Here's why: People in the individual market now tend to be healthy because insurers typically reject applicants with pre-existing conditions or other health risks. Premiums for the new health marketplaces were based on the expectation that those healthy people would move to the exchanges.

If, however, many healthy people elect to keep their existing policies, premiums could spike next year. The White House insists the law provides two separate funding streams to help offset insurer losses and keep the exchanges sound, but the insurance industry doesn't seem to be buying it, probably because when the price increases come, insurers will unjustifiably get the blame....

IT DOESN'T BEAR THINKING ABOUT

Demeter

(85,373 posts)Jay Inslee, a Democrat, is governor of Washington. Steve Beshear, a Democrat, is governor of Kentucky. Dannel P. Malloy, a Democrat, is governor of Connecticut.

In our states — Washington, Kentucky and Connecticut — the Affordable Care Act, or “Obamacare,” is working. Tens of thousands of our residents have enrolled in affordable health-care coverage. Many of them could not get insurance before the law was enacted.

People keep asking us why our states have been successful. Here’s a hint: It’s not about our Web sites. Sure, having functioning Web sites for our health-care exchanges makes the job of meeting the enormous demand for affordable coverage much easier, but each of our state Web sites has had its share of technical glitches. As we have demonstrated on a near-daily basis, Web sites can continually be improved to meet consumers’ needs.

The Affordable Care Act has been successful in our states because our political and community leaders grasped the importance of expanding health-care coverage and have avoided the temptation to use health-care reform as a political football...

BASICALLY, THEY SIGNED EVERYONE UP FOR MEDICAID, THAT'S HOW!

jtuck004

(15,882 posts)Demeter

(85,373 posts)Recent revelations about NSA spying have given fresh impetus to the dream of a purely German Internet. Deutsche Telekom believes it could introduce a system safe from prying foreign surveillance, but some criticize the plan as pointless...Even before it emerged that the National Security Agency had wiretapped her mobile phone, German ChancellorAngela Merkel was calling for the Internet to have something like Airbus -- a joint European initiative able to compete with the dominance of American and Chinese high-tech companies, just as Airbus does with the US aerospace giant Boeing.

Currently, the global market for software and online services is firmly in American hands. What's more, American corporations, such as Google, are subject to the Patriot Act, which requires them to allow American intelligence agencies access to their data centers.

On the other hand, the equipment that directs traffic on the Internet often comes from China -- for example, routers made by Huawei. "No one can be certain that there isn't spying technology built in there as well," warns Norbert Pohlmann, chair of the IT Security Association Germany (TeleTrust).

The new plan would foster more than just German IT start-ups. The simple message politicians and businesses are selling to the general public is that, in the best-case scenario, data shouldn't leave its home country at all, so as not to be susceptible to monitoring or interception by foreign powers. However, at the moment, only around 40 percent of German Internet traffic is conducted between domestic computers. The infrastructure for this traffic is provided by German telecommunication companies such as 1&1 and Deutsche Telekom. But some Internet service providers also use American providers, such as Level 3 Communications, for data transfer. That means that even if the actual bits never leave Germany's borders, the NSA could still access them, although the company vehemently denies this. "Around 30 percent of domestic German Internet traffic is susceptible to surveillance," Pohlmann estimates.

MORE

I GUESS IT DEPENDS WHAT YOU WANT TO USE THE INTERNET FOR

Demeter

(85,373 posts)German parties discussing policies for a coalition government are urging the rapid implementation of a financial transactions tax among EU countries, covering stocks, bonds, currencies and derivative contracts, according to a document seen by Reuters.

"We want to swiftly introduce a financial transactions tax that has a broad basis at a low tax rate as part of strengthened cooperation within the EU," the document, prepared by a working group on Europe and banking regulation reads.

"This tax should cover all financial instruments, especially stocks, bonds, investment assets, foreign exchange transactions and derivative contracts."

Merkel's outgoing centre-right government supported the idea of an FTT as a way of making banks contribute to the cost of cleaning up after the financial crisis, but fewer than half of the EU's 28 members back such a move...MORE

Demeter

(85,373 posts)THIS IS A SOMEWHAT EARLIER NEWS BIT

http://www.reuters.com/article/2013/11/09/germany-coalition-tax-idUSL5N0IU06C20131109

An influential regional leader in Chancellor Angela Merkel's conservative party said he does not believe a financial transaction tax (FTT) will be enacted in Germany even though coalition negotiators have agreed to push for the tax.

Merkel's CDU and the Social Democrats said last Wednesday they agreed to renew a push for an FTT, which would tax banks in 11 EU states about 35 billion euros ($45 billion) a year, partly in return for taxpayers' help over the financial crisis.

They face stiff opposition from other EU states, and EU lawyers say the FTT exceeds member states' jurisdiction for taxation, could damage non-participating EU countries and would obstruct free movement of capital and services in the bloc.

"I don't see us introducing a financial transaction tax," said Hesse state premier Volker Bouffier, a deputy party leader to Merkel, in an interview with Die Welt newspaper on Saturday. His state includes Germany's financial capital of Frankfurt.

"A unilateral move with that would have devastating consequences for the financial centres in the Rhine/Main River regions," he said. "And it's not very likely that there will be an international resolution (for a transaction tax)."

Banks have lobbied furiously against the plan, which may be scaled back by lowering the standard tax rate on transactions from the 0.1 percent laid out in the original blueprint drafted by Brussels, and by introducing it more gradually.

Demeter

(85,373 posts)In every country I can think of, the sovereignty and wealth of the Nation, which was once the embodiment of the power and will of the people, is being butchered and sold to the highest bidder. Everywhere, the Nation and the people within it, are under attack. Not from without by terrorists but from within. Because in every country the people who run the State have largely decided they no longer wish to serve the people but prefer instead to serve the interests of a Global Over-Class....they tell us that whole functions of our nation which we built and treasure, are no longer viable because they are at odds with the ‘realities’ of a global economy. The more ideological of them proclaim that the state, whenever and wherever it tries to do good, will always and by necessity do harm. The more ‘realist’ among them tell us that once inalienable liberties must now be curtailed or suspended in the name of defending the ‘nation’ from outside enemies. And yet I want to argue it is now, not ever us or the nation that is being defended or empowered. It is always and everywhere a small elite who own and control both the State and the Markets who are being defended.

In my view, we are, in most industrialized countries, watching the machinery of the State being used to betray the Nation in favour of global finance and the elite who own it. It is a familiar betrayal in the third world. One we have all watched with sordid complacently as the wealth of nation after nation is gutted for the benefit of the few. The disease is now with us...I think that great ideal of government by and for the people is being butchered – for profit. The Nation-State is dying, because any given arrangement of power can be corrupted and will be, by those who benefit from it most – those who hold its powers – in this case the powers of the State - IF people cringingly let them. And that it what we are doing.

We are allowing the elite of the State, to convince us that we are ‘all in it together’, and to claim that our interests and their interests are still one and the same. But they are not. And we must come to see this clearly – and soon. As long as we deny the truth, that they are not standing ‘with us’, and do not have our best interests at heart – until we can face these self evident but chilling truths, then we are never going to see them for what they have become nor see their actions for what they are...

MORE AT LINK, AND MORE TO COME

Demeter

(85,373 posts)The following is an excerpt from Thom Hartmann's new book, THE CRASH OF 2016: The Plot to Destroy America--and What We Can Do to Stop It (Twelve Books, 2013).

There are very few Americans still alive who heard President Franklin D. Roosevelt, in March 1933, address the nation as he was being sworn into office. Which is why many Americans today believe that when FDR famously said, “The only thing we have to fear is fear itself,” he was talking about World War II. But Roosevelt said that long before Hitler had even fully consolidated his own power in Germany.

Instead, the fear—and the war—was here in America. He was speaking of the Great Depression.

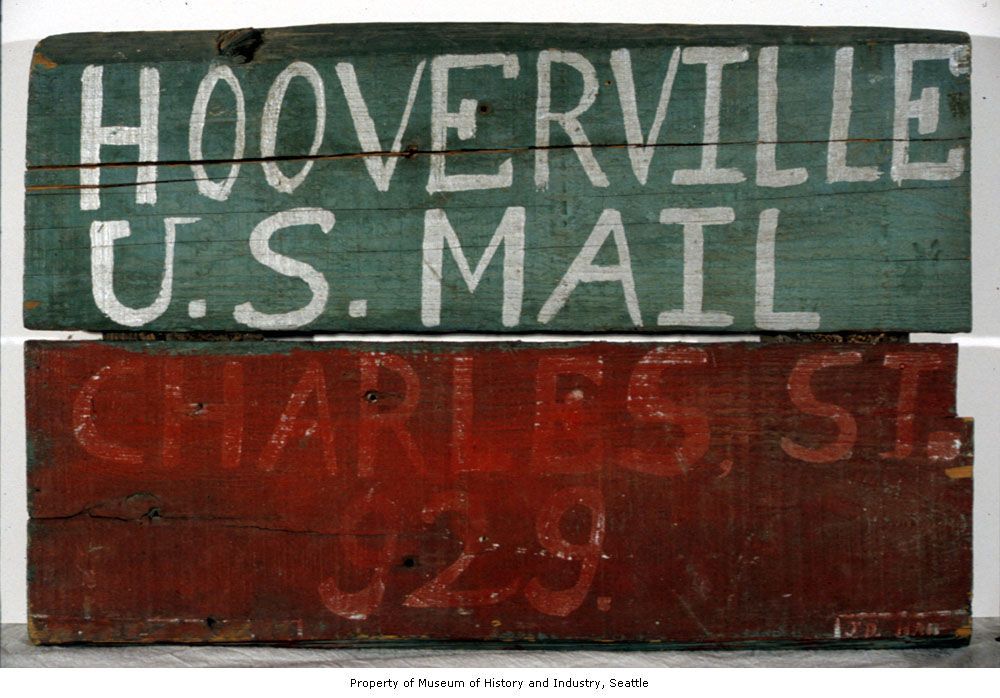

The week of his inauguration, every state in the country closed their banks. The federal government couldn’t make its own payroll. A quarter of working-age Americans were unemployed— some measurements put it at a third— and unemployment in minority communities was off the scale.

While Herbert Hoover, when campaigning against Roosevelt in 1932, had denied there was hunger in America, and said, “Even our hoboes are well fed,” the truth was that the single largest “occupation” at the time among Americans was “scavenger”: people following food trucks and trains, catching the bits that fell off, or doing what we today call “Dumpster diving.”

MORE AT LINK

Demeter

(85,373 posts)IT IS FAILING THE PEOPLE, SURELY. IT IS FAILING THE NATION, INDUBITABLY.

IS IT FAILING THE STATE? I THINK SO. IS IT FAILING THE STATELESS ELITE? NOT AT ALL!

...If this sounds too gloomy, consider Mr Obama’s second term record to date. With the exception of having stared down Republicans last month over their threat of a default, he has fallen at almost every hurdle. This year began with attempts to impose tougher checks on gun buyers following the massacre of 20 children in a Connecticut school. When the initiative began to falter, Mr Obama put his authority on the line. The bill was defeated. It has been much the same ever since, from his request for authority to strike Syria to prospects of a fiscal deal. Talk of an initiative on climate change is a memory...

THE POST-MORTEM IS IN FULL SWING.

Demeter

(85,373 posts)Banks will next week return 3.59 billion euros ($4.8 billion) of crisis loans early to the European Central Bank, the ECB said on Friday, a lower than expected total as a recent rate cut makes it more attractive to hold on to the funds for now. The ECB cut its main refinancing rate to a record low of 0.25 percent, automatically reducing the interest rate banks have to pay on the three-year loans. Next week's repayments fell short of estimates in a Reuters poll of euro money market traders, which had expected them to return 4 billion euros.

By repaying the ECB's crisis funds early, banks are further reducing the level of excess liquidity - cash beyond what lenders need to cover their day-to-day operations - in the system, from 169 billion euros currently. Short-term money market rates are seen rising closer to the ECB's main refinancing rate once excess liquidity falls below a threshold estimated to be in the range of 100 billion to 200 billion euros.The ECB is monitoring this development as higher bank-to-bank borrowing costs could undermine the euro zone's fragile recovery. The ECB last week extended the timeframe during which it will provide banks with all the cash they request in liquidity operations at least until July 2015 and left the door open for further rate cuts and other steps.

Fourteen of 19 money-market traders expect the ECB to conduct another long-term refinancing operation (LTRO), probably with a maturity of three years, a Reuters poll showed earlier this week. Eight of those 14 said the ECB would do so in the first quarter of next year, one said it would be earlier than that and four said later. The ECB flooded the market with more than 1 trillion euros in two LTROs in December 2011 and February 2012 to ease banks' funding strains.

The three-year loans from the ECB will mature in early 2015 and banks now have the option to repay them early. They have already returned about a third of the money. On Friday, the ECB said five banks would repay 3.155 billion euros from the first LTRO on November 20, and three banks will pay back 0.431 billion euros from the second LTRO.

($1 = 0.7430 euros)

Demeter

(85,373 posts)After proposing a development bank, the BRICS countries are preparing to strike out on their own in reinsurance as well. India has suggested to other BRICS members (Brazil, Russia, China and South Africa) that a reinsurer will cover large infrastructure projects that the emerging economies are focused on and counter sanctions imposed by western countries such as those related to Iran, which is a key oil supplier to India and other countries...

The move comes close on the heels of the BRICS Development Bank. In September, the countries decided to capitalise the bank with $50 billion. This is part of the $100-billion foreign exchange reserve pool, to which Russia, Brazil and India will contribute $18 billion each, South Africa $5 billion and China, the largest amount at $41 billion. "There is no timeline on this (reinsurance firm). It has been almost a year since the idea of the development bank has been mooted but there are more regulatory issues with the bank. So, if the bank is finalised, this should follow soon," the official added.

The proposed reinsurance firm will pool resources to diversify risk and cover large infrastructure and sustainable development projects. According to a report by PwC, the value of insurable plant and infrastructure in China, India and Brazil has surged since 2005 on the back of nearly $20 trillion of investment. "Besides, such a firm can provide reinsurance cover in cases similar to oil import sanctions from Iran," the official said. Because of the US and EU-led sanctions on oil imports from Iran, global insurers provide reinsurance to crude shipments from the country with a "sanction clause", which limits the amount they would pay should a claim arise....

THE BATTLE LINES ARE DRAWN

Demeter

(85,373 posts)China will allow private investors to buy up to 15 percent stakes in state-own enterprises (SOEs), the official China Daily reported, as Beijing moves to leverage private funds to avoid having to bail out heavily indebted state owned firms.

Chinese leaders are gathered in Beijing this week to establish the economic blueprint for the next 10 years and the State-owned Assets Supervision and Administration Commission (SASAC), which administers more than a hundred of China's biggest state-owned companies, has said reform of SOEs as a major area of focus....

Private investors are already allowed to purchase shares in major state-owned enterprises listed on domestic stock exchanges, but state-owned entities usually retain a controlling interest. Private and state-owned firms can currently create joint ventures in which the private share is higher than 15 percent. The report cited a joint venture between privately held industrial conglomerate Fosun Group and state-owned China National Medicine Corp in 2003, in which Fosun owned 49 percent, but described it as a "rare exception."

In June the official Xinhua news service reported that public utilities would be opened up to private investment...MORE

xchrom

(108,903 posts)

More U.S. companies are luring top executives with multimillion-dollar “golden hello” signing bonuses, undeterred even as high-profile flameouts such as Ron Johnson’s short tenure at J.C. Penney Co. expose the risks.

The number of companies making upfront payments surged to more than 70 this year from 41 in all of 2012, according to governance-advisory firm GMI Ratings Inc. J.C. Penney fired Johnson in April, 17 months after giving him a signing bonus of $52.7 million in shares to recruit him from Apple Inc.

J.C. Penney highlights the pitfalls of a practice that can reward executives who haven’t done any work yet to the detriment of shareholders. Golden hellos, mostly paid in options and stock grants, got costlier amid rising stock markets after the recession ended in 2009. Among the biggest this year: Zynga Inc.’s $45 million package to attract game-industry veteran Don Mattrick as chief executive officer.

“Investors should be skeptical of golden hellos, which represent pay decoupled from performance and provide no retention incentives,” said Lucian Bebchuk, a Harvard Law School professor in Cambridge, Massachusetts, who has researched CEO pay. “Equity incentives that have not vested yet should best be viewed as ones that have not been earned yet.”

xchrom

(108,903 posts)British regulators expanded their probe into the manipulation of global currency markets by asking banks to examine foreign-exchange traders’ personal transactions, said a person with knowledge of the matter.

The Financial Conduct Authority is focusing on “personal account dealing” by traders who may have placed bets for their own benefit based on knowledge of customer currency orders, said the person, who asked not to be identified because the request hasn’t been made public.

Regulators in the U.K., Switzerland, the U.S. and Asia are probing the $5.3 trillion-a-day foreign-exchange market after Bloomberg News reported possible misconduct in June. Dealers said they had been front-running client orders and trying to rig the benchmark WM/Reuters rates by colluding with counterparts and pushing through trades before and during the 60-second windows when the figures are set, Bloomberg reported.

Britain’s markets regulator asked traders to come in for interviews in recent weeks, two people with knowledge of the inquiry said last week.

xchrom

(108,903 posts)The largest Wall Street banks are mobilizing to fight a new policy by the U.S. Commodity Futures Trading Commission that gives the regulator broader authority in overseas derivatives deals.

The policy, issued Nov. 14, negates a legal interpretation that banks have been using to keep some swaps trades off electronic platforms and away from CFTC rules enacted to make the market less opaque. The companies and their lawyers say the announcement, which the agency published as a “staff advisory,” is written so broadly it could expose their overseas deals to even more U.S. regulation.

Within hours of its release, bank lobbyists met to discuss possible legal action against the agency and began contacting members of Congress, according to people involved in the pushback. The next day, CFTC Chairman Gary Gensler began receiving letters from lawmakers saying he was upsetting the $693 trillion market by issuing policy with little consultation.

“These uncertainties are causing, and will continue to cause, disruptions in the OTC derivatives market,” the top Republican senators on the banking and agriculture committees, Mike Crapo of Idaho and Thad Cochran of Mississippi, wrote to Gensler on Nov. 15.

Demeter

(85,373 posts)The U.S. derivatives regulator on Tuesday reintroduced a plan to curb commodity market speculation, reviving a crucial Wall Street reform after a judge knocked down an earlier version of its rules on position limits.

The Commodity Futures Trading Commission proposal will set caps on the number of contracts that a single trader can hold in energy, metal and agricultural markets, a measure aimed at capping speculation that some blamed for the spike in raw material and food prices prior to the 2008 financial crisis.

The redrafted rules sought to answer some of the deficits that a judge pointed out last year. The agency cited two of the biggest cases of market manipulation in history - the Hunt Brothers' silver corner and hedge fund Amaranth natural gas bet - as evidence of why curbs were necessary.

The new rules will also make it easier for big banks such as Goldman Sachs Group Inc and Barclays PLC to remain in the market by allowing them to exclude positions held by entities in which the banks own minority stakes - a key trigger for the banks to sue the agency...

ALL CORPORATIONS ARE EQUAL, BUT SOME ARE MORE EQUAL THAN OTHERS!

http://3.bp.blogspot.com/-Ny6Rpvrpdcc/TrkY1xspVTI/AAAAAAAABIk/BBcTXawXPQo/s1600/Animal+Farm+Card+001.jpg

Demeter

(85,373 posts)A job after graduation. It’s what all parents want for their kids. So, what’s the smartest way to invest tuition dollars to make that happen?

NEPOTISM...TRIED AND TRUE FOR MILLENIA. ASK W!

xchrom

(108,903 posts)

An employee hones a bell in the workshop at Fonderia Pontificia Marinelli foundry in Agnone.

The process of making bronze bells hasn’t altered much in 1,000 years at the Pontifical Marinelli Foundry. What’s changing is where they chime, as Italy’s oldest family business looks abroad to dodge the economy at home.

The company in Agnone, a small town about 220 kilometers (137 miles) southeast of Rome, has increased exports to 20 percent of its revenue, four times the proportion a decade ago. With the Italian economy entering a third year of recession, reliance on sales abroad is only going to get greater, said Pasquale Marinelli, who owns the foundry with his brother.

“In Italy, any decisions about spending, including ones for bells like ours, are on hold until better times,” said Marinelli, 43, whose company’s bells hang in the United Nations building in New York, the Vatican and Leaning Tower of Pisa. “The orders from abroad allow us to work all year round.”

Italy is enduring its longest economic slump since records began after World War II. In the past five years, at least 37,000 Italian family companies have closed, according to the CGIA association of small businesses.

xchrom

(108,903 posts)The Organization for Economic Cooperation and Development cut its global growth forecasts for this year and next as emerging-market economies including India and Brazil cool.

The world economy will probably expand 2.7 percent this year and 3.6 percent next year, instead of the 3.1 percent and and 4 percent predicted in May, the Paris-based OECD said in a semi-annual report today.

“Most of the emerging economies have underlying fragilities that mean they cannot continue growing as they used to,” OECD Chief Economist Pier Carlo Padoan said in an interview. “They used to be an important support engine for global growth in bad times. Now the reverse is true and advanced economies can’t be said to be in very good times again.”

The reduced growth prospects underline how the global economy remains vulnerable five years after the collapse of Lehman Brothers Holdings Inc. While the euro-area has exited a recession, the OECD said the European Central Bank should look at ways to ease policy further and the Federal Reserve must keep an accommodative stance for some time before it begins tapering its stimulus.

xchrom

(108,903 posts)Banks that best adapt to “relentless waves” of new rules from global regulators have the greatest chance of remaining competitive, according to Boston Consulting Group Inc.

Regulatory reform has added a multitude of complex and costly rules since the financial crisis, creating barriers banks must break to remain profitable, BCG said in a report released today. Lenders that are able to “categorize, prioritize and execute” against the rules, which include higher capital requirements and leverage ratios, will have the advantage, according to the report.

“It is very much a one bank versus the other issue,” Thomas Garside, a BCG partner based in London, said yesterday in a phone interview. “Everyone has experienced their regulatory and compliance costs going up.”

Global banking has diverged into a “three-speed world,” BCG said, with emerging markets and the U.S. returning to profitability, while European banks suffer their worst year since the start of the crisis. The findings are based on data from 318 retail, commercial and investment banks representing 90 percent of worldwide industry assets.

xchrom

(108,903 posts)Sarah Benzing is opening a small business that needs to raise more than $10 million in a year and spend almost all of it in less time than that.

She’s one of a rising class of professional campaign managers who, like polling experts and ad makers, are vital to winning statewide contests driven by data rather than the hunches of political veterans.

“It is about managing a complex organization that is the equivalent of a multimillion startup that is going to exist over a limited amount of time and you are going to be judged on a single day,” said Guy Cecil, executive director of the Democratic Senatorial Campaign Committee.

Benzing and her fellow managers on both sides of the political aisle are on the front lines of state races that will determine which party wins a U.S. Senate majority in 2014.

xchrom

(108,903 posts)WASHINGTON (AP) -- The Justice Department and JPMorgan Chase & Co. have settled all issues and could sign a $13 billion agreement as early as Tuesday that would be the largest settlement ever reached between the government and a corporation, a person familiar with the negotiations says.

The deal is the latest chapter in the bursting of the housing bubble in 2007, when JPMorgan and others among the nation's largest banks sold low-quality, mortgage-backed securities that collapsed in value. Investors were left with billions of dollars in losses.

In blunt criticism of those banks, the Justice Department's No. 2 official said Monday that too many financial institutions had failed in their duty to ensure that their businesses were run cleanly.

Recounting the conduct that JPMorgan and other banks engaged in, Deputy Attorney General James Cole told the American Bankers Association that too many supervisors incentivized excessive risk taking, knowing that risky products "could be unloaded down the road, ... leaving someone else to deal with the consequences."

DemReadingDU

(16,000 posts)but no one did anything wrong

xchrom

(108,903 posts)FRANKFURT, Germany (AP) -- A key index of optimism about the German economy rose more than expected in November.

The ZEW index rose to 54.6 points from 52.8 points in October. That is more than the 54.0 expected on average by analysts, and well above the index's long-term average of 24.1.

Clemens Fuest, who heads the ZEW or Center for European Economic Research, said Tuesday that "the slightly improved economic growth in the eurozone likely contributed to this."

The overall economy of the 17 countries that use the euro currency have shown modest growth for two quarters in a row after a long period of declining output.

jtuck004

(15,882 posts)Demeter

(85,373 posts)Oh, I know!

Baracks!

This is an actual historical photo of a Civilian Conservation Corps (CCC) barracks. These teams went around building national parks, planting trees, etc. My grandfather was employed by one, planting trees in Grayling, Michigan....

Tansy_Gold

(17,860 posts)Our Camelot.

![]()

Demeter

(85,373 posts)

jtuck004

(15,882 posts)xchrom

(108,903 posts)NEW YORK (Reuters) - As the United States threatened to default on its debt last month, major U.S. banks set up war rooms, spent many millions of dollars on contingency planning and, in some cases, even prepared to underwrite federal government benefits.

In a series of interviews with top bank executives, new details emerged about the extent of the contingency planning that was undertaken before and during the 16-day government shutdown and as a potential default loomed.

The planning for worst-case scenarios didn't come cheap. JPMorgan alone has spent more than $100 million on contingency planning for U.S. budget crises in recent years including this one, sources close to the bank say. It has reviewed and analyzed thousands of trading contracts, updated computer systems to handle fiscal emergencies, hired consultants, and built new models to figure out what might happen to securities prices.

It may not go to waste. The temporary budget agreement that President Barack Obama signed shortly after midnight on October 17 to end the shutdown and lift the default threat, authorizes government spending through January 15 and eases enforcement of the debt limit until February 7, creating the potential for another budget crisis early next year, even as some Republicans vow they will avoid it.

Read more: http://www.businessinsider.com/major-us-banks-set-up-war-rooms-for-default-2013-11#ixzz2l5jalJKn

Demeter

(85,373 posts)Steven A. Cohen faces an abrupt end to his career as one of the world's most successful traders after his SAC Capital Advisors became the largest Wall Street firm in years to agree to plead guilty to criminal charges of insider trading, and pay $1.2 billion in fines.

But Cohen, a multi-billionaire and renowned modern art collector, has not been personally charged with any crime and will likely continue managing some $9 billion of his own money through a lightly regulated family office once the hedge fund's plea deal is approved by the courts.

The winding down of the hedge fund's advisory business, which began returning billions of dollars to investors earlier this year as a criminal investigation heated up, requires SAC to install an independent compliance monitor if it continues to trade in the near term, something that will be a big change for Cohen who is known to be a micro-manager.

SAC's guilty plea and fine, announced by prosecutors on Monday, is in addition to a $616 million settlement with the U.S. Securities and Exchange Commission.

MUCH MORE AT LINK

Demeter

(85,373 posts)How about the future? We seem to be setting ourselves up to repeat the past.

GRATUTIOUS GEITHNER BASHING AND BLATHER.

DemReadingDU

(16,000 posts)11/18/13 Pentagon forged financial documents amid failure to manage budget

A new report has revealed the Pentagon to be fundamentally incapable of managing its own books, with money and supplies unaccounted for and doctored ledgers masking billions of dollars of wasted spending. An investigation by Reuters found that since 1996, the $8.5 trillion dollars of taxpayer money that Congress has allocated towards the US Department of Defense has never been accounted for.

According to those responsible for inserting the numbers into the books at the Defense Finance and Accounting Services (DFAS), military agencies failed to supply a clear monthly account of the money they spent. In a flurry of activity, DFAS would contact the appropriate personnel in order to record accurate data, but many numbers remained a mystery.

At this point, employees would be ordered to enter fake numbers, or “plugs,” that would match up accordingly with what the Treasury department expected to see. “A lot of times there were issues of numbers being inaccurate," said former DFAS employee Linda Woodford to Reuters. "We didn't have the detail...for a lot of it."

While plugging the books was standard procedure at DFAS, Reuters’ investigation determined that of the $565 billion Congress budgeted for the Pentagon in 2012, it is “impossible to determine” how much of that money was spent the way it was intended to be.

more...

http://rt.com/usa/pentagon-numbers-doctored-treasury-922/

Tansy_Gold

(17,860 posts)DemReadingDU

(16,000 posts)11/18/13 The October 2012 Pre-Election Jobs Report Was Faked

On Friday October 5, 2012, the BLS released what was arguably the most important report of Obama's first term: the final jobs number, and unemployment rate before the November 2012 presidential election. As so many predicted, it "plunged" from 8.1% to 7.8% allowing the president to conduct countless teleprompted speeches praising the success of his economic recovery. It also served as the basis for the infamous Jack Welch tweet: "Unbelievable jobs numbers..these Chicago guys will do anything..can't debate so change numbers" and prompted the pro-Obama media to quickly brand all those who questioned it as conspiracy theorists. The Atlantic did perhaps the most exemplary job in its task to discredit the "random anonymous cranks" who challenged the bullshit spewed by the administration's manipulative economic data reporting apparatus.

more...

http://www.zerohedge.com/news/2013-11-18/october-2012-pre-election-jobs-report-was-faked

Tansy_Gold

(17,860 posts)DemReadingDU

(16,000 posts)One day it'll implode from the weight of all the fraud and corruption

Demeter

(85,373 posts)Why should anyone believe anything this government tells them? Its credibility gap is larger than the Grand Canyon.

Demeter

(85,373 posts)JP Morgan and HSBC topped the list of the world's top 29 banks that must hold extra capital from 2016 because of their size and reach, the Financial Stability Board said on Monday. The two banks are in the top "bucket" and will have to hold an extra 2.5 percent of risk-weighted core capital on top of the 7 percent minimum all banks across the world must hold by 2019 under the Basel III accord.

The FSB was publishing an annual update of its list of globally systemic banks with no bank occupying the top "bucket" with a 3.5 percent capital buffer. Next year's list from the FSB in November will determine which banks will actually have to comply with the new surcharge rule from 2016.

Barclays, BNP Paribas, Citigroup and Deutsche Bank have been placed into the 2 percent surcharge bucket -- the latter two dropping from the 2.5 percent band last year. Bank of America, Credit Suisse, Goldman Sachs, Credit Agricole, Mitsubishi UFJ, Morgan Stanley and Royal Bank of Scotland and UBS face a 1.5 percent surcharge.

The following banks were listed under the 1 percent surcharge "bucket": Bank of China, Bank of New York Mellon, BBVA, Groupe BPCE, Industry and Commercial Bank of China, ING, Mizuho, Nordea, Santander, Societe Generale, Standard Chartered, State Street, Sumitomo Mitsui, Unicredit and Wells Fargo.

Demeter

(85,373 posts)Lael Brainard, a top economic diplomat at the U.S. Treasury, will step down from her post on Friday, a Treasury official said, amid reports she is under consideration for a seat on the Federal Reserve Board. As undersecretary of the Treasury for international affairs since 2010, Brainard has played a key role in pushing China toward a flexible currency and pressing Europe to tackle its debt crisis more aggressively.

The Washington Post and the Wall Street Journal have reported that Brainard is under consideration to fill a vacancy at the Fed. The Treasury official, who spoke on Monday on condition of anonymity, did not disclose the reason for the departure and a White House spokeswoman declined to comment.

Brainard cut her policymaking teeth during the Clinton administration, working alongside many officials who later ended up serving under President Barack Obama, including top White House economic adviser Gene Sperling and Treasury Secretary Jack Lew. Brainard, who has a doctorate in economics from Harvard University, served as deputy director of Clinton's National Economic Council, where she focused on international trade and financial policy. She was also the U.S. representative to the meetings of the Group of Eight industrialized nations. The Senate took more than a year to confirm Brainard for her current post, slowed by a committee probe into her personal taxes. In recent months, she has been seen as a steady hand on international economics for Lew, who became the top Treasury official in February and who had focused mainly on budget issues during his long career in government.

Obama is likely to need to fill several seats on the Fed's seven-person board in the coming months. Fed Governor Elizabeth Duke stepped down in August; Fed Chairman Ben Bernanke is expected to give up his board seat when his term as chairman expires at the end of January; and Obama has nominated Fed Governor Sarah Raskin for a top Treasury post. In addition, Fed Governor Jerome Powell's term expires in January, although Obama is expected to renominate him.

MORE PRAISE

Demeter

(85,373 posts)Must be nice.

Tim Geithner, of course, has no experience as a banker, an investor, a trader, a venture capitalist, a speculator, or businessman of any sort. So naturally he will be boss of those that actually do. No no. He has been, all his life, that special breed of person known as the Ivy League Economist. He's worked at think tanks, in government, and for the Federal Reserve. He comes from a Mayflower family. His education has been mostly the study of Asia.

It is from these credentials that he now, following his mentor Larry Summers, proceeds in heading up the private equity branch of one of the world's most storied banking families. He is certain, like Summers, to become very, very rich doing...something that almost certainly is not work. Instead, he will most likely make a bundle on carried interest, which is how private equity executives avoid paying taxes like the rest of us.

The American elite establishment ladies and gentleman, for your viewing pleasure. From being asleep at the wheel as a banking regulator during the worst financial crash since the Depression, to wealthy millionaire banker.

Failing Up. Its the new American way.

Demeter

(85,373 posts)Timothy Geithner has joined a private-equity fund where he presumably will make boatloads of money, igniting a spasm of complaints about the former Treasury secretary cashing in on his public service.

The new career path of Geithner is not unusual. Countless ex-government officials have found lucrative work after leaving office. Treasury secretarys are especially valued in the financial and corporate worlds for their ability to bridge the wide gap between Wall Street and Washington.

It wasn’t always that way. Until the early 1900s, every Treasury secretary was a lawyer or politician. Most went back into law or government after serving and lived out relatively quiet lives. Things started to change after th

e financial panic of 1907. The world of finance was growing more complicated and presidents began to seek out men — there’s never been a women Treasury secretary — of greater economic acumen. And most have gone back into the private sector afterward.

Uber-wealthy banking magnate Andew Mellon, who became secretary in 1921, launched the modern era of Treasury’s Men of Influence. Here’s a look at Mellon and some of his most notable successors:

STUNNING LIST, ISN'T IT?

Demeter

(85,373 posts)A respected security expert will warn Congress on Tuesday that the Obama administration's healthcare website has security flaws that put user data at a "critical risk," despite recent government assurances the data is safe.

"There are actual live vulnerabilities on the site now," David Kennedy, head of computer security consulting firm TrustedSec LLC, told Reuters ahead of his testimony at a Congressional hearing on the topic "Is My Data on HealthCare.gov Secure?"

Kennedy, a former U.S. Marine Corps cyber-intelligence analyst, said his firm has prepared a 17-page report describing some of the problems. It does not go into specifics in some areas, he said, because that could provide criminals with a blueprint for launching attacks.

"There is a lot of stuff that we are not publicly disclosing because of the criticality of the findings," he said. "We don't want to hurt people."

MORE

Tansy_Gold

(17,860 posts)to be followed by a Dilbert 'toon.

![]()

Demeter

(85,373 posts)I'm sure Scott Adams will get to it, once his product line moves forward...

Right now, he's riffing off an old theme of his:

Demeter

(85,373 posts)Based on the public acrimony by well-known personalities posted just today: murder, suicide, assault....

doesn't even look like there will be a Thanksgiving. Things are really bad, and getting worse. And there's little a person can do, except keep his/her little corner clean and calm, and be prepared to offer assistance. And watch out for scammers!

antigop

(12,778 posts)Last edited Tue Nov 19, 2013, 04:58 PM - Edit history (1)

http://www.nakedcapitalism.com/2013/11/another-lurking-obamacare-problem-balance-billing.htmlSay you have a scheduled procedure, like getting a stent. Like most Americans who have health insurance, you are in an HMO or a PPO. Your doctor, who is in your network, schedules you for the operation at a hospital in your network. You assume the only thing you need to worry about is a fairly minor co-pay and recovery.

But weeks later, you find that the anesthesiologist wasn’t in your network, and you are hit with a $12,000 bill for his services. And this sort of scamming (hospitals knowingly putting people on a surgical team that they can bill at huge premiums to negotiated rates) is routine. And of course, if the ambulance takes you to an emergency room that is not in your network, the outcome can be catastrophic.

....

When we’ve described some of the problems with Obamacare, some readers have piped up and insisted, “Oh, but you forget, those costly plans are still really valuable! The most you can pay in 2014 is $6,350 if you are an individual and $12,700 for a family of two or larger.”

That is just not true. Those limits apply ONLY to in-network services. All Obamacare does is nibble around the edges of the balance billing abuse

http://www.nytimes.com/2013/10/19/your-money/out-of-network-not-by-choice-and-facing-huge-health-bills.html

No wonder networks are limited:

http://www.cnn.com/2013/10/29/health/obamacare-doctors-limited/

Harte is an insurance broker. He still has his share of frustrations with the marketplace websites, but the growing number of complaints he hears come from clients and fellow brokers who have seen the policies these marketplaces offer.

Nationally the marketplaces offer tens of thousands of different policies with a wide variety of coverage, but Harte has noticed many have one thing in common: They cover a narrow network of doctors and hospitals.

Demeter

(85,373 posts)Can you sue the govt for fraud?

antigop

(12,778 posts)DemReadingDU

(16,000 posts)Many seniors love those Medicare Advantage plans because they are cheap, sometimes $0. But one is limited to a small network of doctors and hospitals, or the entire bill is left to the senior to pay.

In Ohio, UnitedHealthCare just dropped hundreds of doctors from the Medicare Advantage plan, forcing thousands of seniors to enroll in a different plan that their doctors will be in network.

Interesting that a new plan, MediGold, has been trying to sign up seniors in our area. One wonders how long MediGold will be contracting with doctors, hospitals, medical suppliers, before they too will be dropped.

kickysnana

(3,908 posts)A 74 year old superstar OBGYN planning to retire was gunned down in his home by a 30 year old brand new lawyer that lived about a mile from me in a upper middle class suburb. One report said that the Dr assisted with his delivery. A family member has said that the young man had been recently upset and obsessed with blaming this doctor for his birth defects on his hands and feet, but obviously not enough to keep him from getting to the scene and shooting a gun, graduating from one of our top three Law Schools in 2009 and passing the bar this October. Lawyer jobs are scarce but with the changes made at the Federal and State level I think Minnesota will start doing better. It is not like he is the only person his age to have trouble getting his feet on the bottom rung of this messed up country. Friends, teacher, and family were totally shocked at what happened and of course expressed their regrets to the Dr's family. He was killed at the scene by Orono police.

This was not about abortion, thankfully but it seems likely that our broken mental health system has experienced another catastrophic failure. ![]()

Demeter

(85,373 posts)People are wigging out all over. Even my Kid...although I doubt that she's aware of the economy.

could it be the weather?

mahatmakanejeeves

(57,465 posts)http://www.theguardian.com/business/2013/nov/19/nokia-shareholders-approve-sale-microsoft

Juliette Garside, telecoms correspondent

The Guardian, Tuesday 19 November 2013 14.52 EST

Nokia shareholders have approved the sale of its mobile phone division to Microsoft after some 5,000 people braved icy rain in Helsinki to cast their vote and pay their last respects to a business that once dominated European phone manufacturing.

In the capital's Ice Hall, usually home to the national ice-hockey team, crowds witnessed a landmark moment in Finnish history. By a 99% majority, the emergency general meeting ratified the €5.44bn (£4.6bn) sale of Nokia's handset division. Nokia's chairman, Risto Siilasmaa, said he was aware the sale "would raise deep feelings" among Finns.

"On the board of directors we understood that, as the decision-makers, we would also be heavily criticised. However, we are convinced that continuing with the old strategy would have most likely led to great difficulties for Nokia, its shareholders and employees," Siilasmaa said.

When the sale concludes early next year, Nokia will be left with a telecoms network equipment business, its online mapping division, and a trove of valuable patents, only 10% of which have been licensed, according to executives. The company will continue to employ 6,000 people in Finland.

Oh, boy, did I ever lose money on that stock.