Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 6 March 2013

[font size=3]STOCK MARKET WATCH, Wednesday, 6 March 2013[font color=black][/font]

SMW for 5 March 2013

AT THE CLOSING BELL ON 5 March 2013

[center][font color=green]

Dow Jones 14,253.77 +125.95 (0.89%)

S&P 500 1,539.79 +14.59 (0.96%)

Nasdaq 3,224.13 +42.10 (1.32%)

[font color=red]10 Year 1.90% +0.01 (0.53%)

30 Year 3.12% +0.01 (0.32%)[font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Tansy_Gold

(17,863 posts)I guess it all depends on who they think the damsel in distress is, and what the "best" way to save her is.

Some of us are old enough to find the notion of "we have to kill the economy to save it" oddly familiar.

Demeter

(85,373 posts)“Was mich nicht umbringt macht mich stärker.”

Friedrich Nietzsche (1844-1900)

German philosopher

His famous maxim in Twilight of the Idols (1888)

Much more of this adversity, and I'll be invincible (or dead).

tclambert

(11,087 posts)With a few tackles, Nitschke could have put Nietzsche into a persistent vegetative state.

Demeter

(85,373 posts)feeling a bit under the weather and overwhelmed....

Hugin

(33,167 posts)I just now read it's none other than, Paul Ryan. ![]()

Paul Ryan's New Budget Promises Don't Add Up

By Elspeth Reeve Atlantic Wire March 5, 2013

Paul Ryan made two promises, but he can only keep one. As Ryan finishes up the new House Republican budget before he presents it to reporters Wednesday, he's confronting a last-minute problem on Medicare, Politico's Jake Sherman and Jonathan Allen report. He's promised House Republicans that his budget will balance itself in a decade — instead of three, as his earlier budgets did. But he's also promised that his plan to turn Medicare into a voucher system wouldn't effect anyone over the age of 55. Paul Ryan simply cannot do both of those things.

Ryan "has privately been floating the idea" of privatizing Medicare for people under 56, Politico reports. Because Ryan's previous budget for the House GOP did not cut Social Security or defense spending, it did not balance until 2040. And it required huge cuts to everything else — discretionary spending would drop from 12.5 percent of GDP to 3.25 percent by 2050. But House Speaker John Boehner promised conservatives that this time, the budget would balance in 10 years. "It's not going to be that much different, except for the fact that it will balance in 10 years," Majority Whip Kevin McCarthy told Politico. But it seems like the difference between 10 years and 30 years might be a big difference. Balancing in 10 years is hard to imagine without cutting Medicare, Alan Auerbach, an economist and budget expert at the University of California, Berkeley, told Talking Points Memo's Sahil Kapur. "It is possible in terms of arithmetic," Auerbach said, "But it is also implausible." If there aren't bigger Medicare cuts, then Ryan would have to cut Social Security and defense spending.

More here, if you can stand it: http://www.govexec.com/management/cutting-costs/2013/03/paul-ryans-new-budget-promises-dont-add/61689/?oref=river

A bad penny simply won't go away.

Tansy_Gold

(17,863 posts)Like Mr. Potato Heads or Crazy Ikes or Tinkertoys. Boehner, Cantor, Reid, Obama, Kerry, Ryan, Lew, Geithner. Throw all their names in a hat and pull 'em out at random to fill the office, nothing would change. They're all puppets, and the electorate is all suckers.

bread_and_roses

(6,335 posts).... that the interests of the 1% have no relationship to the interests of the other 99% of us. WIC, which already cannot serve the number of infants, children, and poor pregnant women who are eligible, is being cut. Taking - literally - food out of the mouths of babes. And the Market hits an all-time high. Happy days. The destruction of the Commons proceeds apace. Our Corporate Master rejoice.

Tansy_Gold

(17,863 posts)I absolutely hate when I get behind a woman with WIC vouchers in the grocery checkout line. It always takes a long time, and often there's something wrong and it takes even longer to get it fixed. And when it's finally done, to add insult to injury, the cashier always turns to me and apologizes. . . . . . to me! . . . . for taking so long.

Excuse me, but why aren't you apologizing to the woman who can't afford to feed herself and her children, apologizing for this miserable "economy" that gorges the whining, moaning, slavering 1% on wealth beyond imagining, but children go hungry?

I've been a grocery cashier. I know the strict limitations on WIC vouchers. I never ever ever complain when I get in the line with a WIC customer. I just wish there were more for her.

![]()

Warpy

(111,282 posts)and that I'm glad women with little kids get to feed them.

WIC is one of the biggest success stories of the whole social net, markedly reducing mental retardation rates from the beginning.

Taking food out of the mouths of babies now is going to result in huge costs for the damaged citizens early starvation produces.

Republicans: now bringing us the ultimate in both stupidity and cruelty.

everytime I read this kind of stuff I cry.

what kind of fucking monsters are they?

don't answer that -- i don't want to know.

Demeter

(85,373 posts)Somebody's been pushing it down.

There was a big bet on the DOW, I'll wager....

Partly, it's glee over sequestration, taking food from the mouths of babes, and Chavez' death.

Demeter

(85,373 posts)I will be posting much later....sleep well, everyone!

Demeter

(85,373 posts)Everyone wants the Federal Reserve to say how it will unwind the $3 trillion balance sheet amassed from years of quantitative easing.

Indeed, this was something of a hot topic in Fed Chairman Ben Bernanke's testimony before Congress last week.

One of the big issues the central bank faces is the inevitable loss it will have to take when interest rates rise and the value of the Fed's bond portfolio declines.

Although not an economic problem — as "losses" for a central bank are more of an accounting issue — there could be a PR problem when the Fed stops making payments to the Treasury from the interest income it receives on its bond portfolio...

Read more: http://www.businessinsider.com/fed-remittances-to-treasury-to-decline-2013-3#ixzz2MikFu3GV

Ghost Dog

(16,881 posts)Australian shares have closed at new four and a half year highs as local investors joined in the global buying spree.

The benchmark S&P/ASX200 surged 0.8 per cent on Wednesday to close at its highest level since September 2008, beating the recent high from late February.

CMC Markets senior trader Tim Waterer said share markets in Australia and elsewhere in the Asian region ‘‘revelled’’ after the historic session on Wall Street, where the Dow posted an all-time high.

‘‘Traders on the Australian market did not need a second invitation to join in on the proceedings, with the ASX200 surging through 5,100 with aplomb,’’ Mr Waterer said in a research note.

The local rally was mirrored around Asia, with markets in Shanghai, Hong Kong and Tokyo also higher in afternoon trade.

/... http://www.smh.com.au/business/markets/us-leads-take-local-shares-higher-20130306-2fjrd.html#ixzz2Mkg3YYwr

Demeter

(85,373 posts)So that means it's almost over....in 5..4..3...

Ghost Dog

(16,881 posts)BEIJING - Few doubt that growth in China's economy will grind to a halt in the next few years. Many believe there will be a significant slowdown from the double-digit development of the past three decades. Premier Wen Jiabao in his last speech at the opening session of the National People’s Congress on Sunday announced a 7.5% target for 2013. But the major concerns are about the third decade of the century, when China's gross domestic product could overtake American GDP. Then, many believe China’s economy could fall into some form of stagnation, like that on Japan after the 1980s.

Chinese leaders love to think long-term, and so were trying to address also this issue when planning a gigantic development program of 40 trillion yuan (US$6.4 trillion) for the urbanization of 400 million people in the next 10 years.

Such movement is something unprecedented in human history in terms of the resources and number of people involved. It is something bound to dramatically change China, economically, socially, culturally and also politically, and thus it will have a huge impact on the rest of the world. If China succeeds, the transition will open a fast-track for development during the 2020s. If it fails, the spillover effects from a struggling economy rivaling the US in size will be equally global, and could trigger wider financial and economic crisis.

The mammoth urbanization plan will be concentrated mainly in small and medium cities with less than 2 million residents, with the 40 trillion yuan investment financed by a massive issuance of bonds in the next 10 years, something that will change the financial structure of the country in the longer term. The medium-term goal is to spur China's development by steadily bringing into the cities the 400 million people who now live part of the year, or year-round, in the countryside.

These people will be brought from a rural existence that in some respects resembles the Middle Ages into a present that resembles the science fiction of Blade Runner...

/... http://www.atimes.com/atimes/China/CHIN-02-060313.html

... "A 10 or 20-year program is unthinkable in the West, and that sort of ability to plan appears to provide China with a competitive advantage over the kind of political landscape that in America and Europe is mired in short-term programs driven by the view to elections within a one or two-year timeframe. " ...

Demeter

(85,373 posts)and keep themselves on track for another 50 years, easy.

bread_and_roses

(6,335 posts)by Dave Johnson

I was doing research, gathering headlines for a post. But the headlines told a story of their own. So here they are:

2010

November 2010, Corporate Profits Hit New Record, U.S. Workers Still Struggling

2011

January 2011, Profits Are Booming. Why Aren’t Jobs?

May 2011, Corporate Profits At All-Time High As Recovery Stumbles

June 2011, Since 2009, 88 Percent Of Income Growth Went To Corporate Profits, Just One Percent Went To Wages

... more

2012

February 2012, Corporate Margins And Profits Are Increasing, But Workers’ Wages Aren’t

... more

2013

March 4, 2013, Corporate Profits Have Risen Almost 20 Times Faster Than Workers’ Incomes Since 2008

You get the picture

Demeter

(85,373 posts)Demeter

(85,373 posts)

Demeter

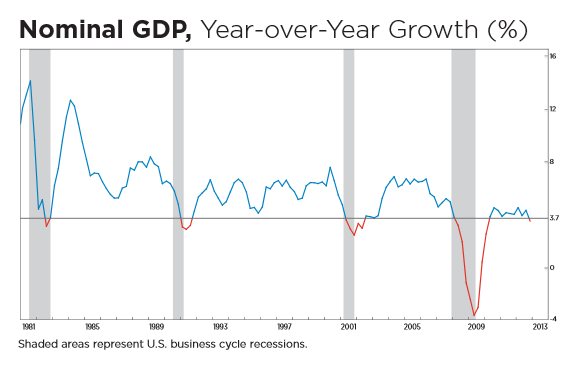

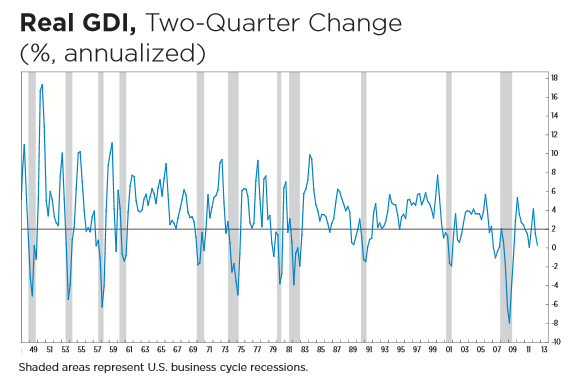

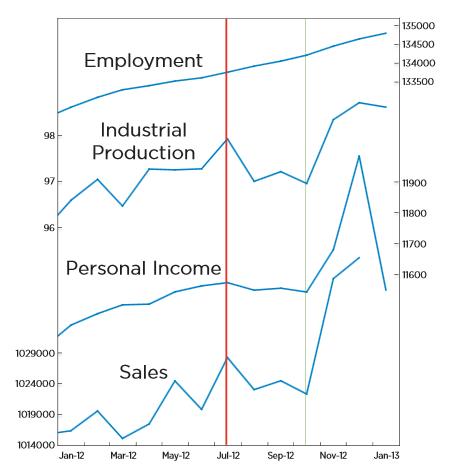

(85,373 posts)Summary: In September 2011 the Economic Cycle Research Institute (ECRI) made a bold forecast of a recession in 2012 for the US economy, unlike the late 2012 boom expected by most economists. The boom never arrived, but perhaps neither did the recession. Today ECRI updates their forecast. Much depends on what the US economy does in 2013.

SEE LINK

?w=600

?w=600

?w=600

?w=600

?w=600

?w=600

Conclusions

xchrom

(108,903 posts)

Traders on the Dow floor. The Dow has risen for four of the past five trading days. Photograph: Justin Lane/EPA

The Dow Jones Industrial Average on Tuesday surged to its highest closing level ever, erasing the index's loses during the financial crisis even as Washington fights over its debts and Main Street seems far from mended.

The Dow closed at 14,254, passing its previous high of 14,164.52 in

October 2007.

Better-than-expected news from the service sector bolstered the rally that had begun even before the market opened. Dow futures, a somewhat unreliable indication of the direction the market is likely to take, pushed the index higher before the opening bell as investors absorbed better-than-expected retail figures from Europe.

On Monday, the Dow closed at 14,127.82, up 38.16 points, or 0.27%, a 52-week high. The index has risen for four of the past five trading days

xchrom

(108,903 posts)Glencore boss Ivan Glasenberg boasted that he was one of the lowest paid chief executives in the FTSE 100 – as he paid himself a dividend of $172m (£113m) for the year.

His comments are likely to fuel anger over executive pay, which prompted Swiss voters in a weekend referendum to approve measures to clamp down on multimillion-pound payouts to company bosses.

Although its headquarters are in Switzerland, commodity trader Glencore is listed in the UK so would not be subject to the new rules. Still, Glasenberg said on Tuesday: "The Swiss would love me because I don't take a bonus and am one of the lowest paid CEOs in the FTSE 100. I am a large shareholder; I do get dividends. It is not necessary for me to take a bonus."

Glasenberg took home $1.5m in pay and benefits in 2011, but $109m in dividends, catapulting him into the ranks of the highest paid executives around the world. This year, his salary is expected to be more or less the same but his shareholder payout will grow, after the company approved a 5% increase in the full-year dividend despite a 75% plunge in net profits.

xchrom

(108,903 posts)Just over two years since Egypt's dictator President Hosni Mubarak resigned , little has changed. Cairo's infamous Tahrir Square has remained a continual site of clashes between demonstrators and security forces, despite a newly elected president. It's the same story in Tunisia, and Libya where protests and civil unrest have persisted under now ostensibly democratic governments.

The problem is that the political changes brought about by the Arab spring were largely cosmetic. Scratch beneath the surface, and one finds the same deadly combination of environmental, energy and economic crises.

We now know that the fundamental triggers for the Arab spring were unprecedented food price rises. The first sign things were unravelling hit in 2008, when a global rice shortage coincided with dramatic increases in staple food prices, triggering food riots across the middle east, north Africa and south Asia. A month before the fall of the Egyptian and Tunisian regimes, the UN's Food and Agriculture Organisation (FAO) reported record high food prices for dairy, meat, sugar and cereals.

Since 2008, global food prices have been consistently higher than in preceding decades, despite wild fluctuations. This year, even with prices stabilising, the food price index remains at 210 – which some experts believe is the threshold beyond which civil unrest becomes probable. The FAO warns that 2013 could see prices increase later owing to tight grain stocks from last year's adverse crop weather.

xchrom

(108,903 posts)German opposition to the EU's proposed gender quota for the non-executive boards of stock market-listed companies has reportedly reached a new level, following reports that Berlin is to begin actively lobbying other countries to vote against the plan.

The Munich-based Süddeutsche Zeitung reported Wednesday that the German representation in Brussels had been ordered to "immediately -- and on diplomatic levels -- promote the German position." The directive quoted by the newspaper used blunt language, saying that the goal of negotiations should be the outright "rejection of the proposed guidelines."

Germany opposes the mandatory, EU-wide requirements in favor of individual nations coming up with their own strategies to increase women in leadership positions. Family Minister Kristina Schröder and Foreign Minister Guido Westerwelle have warned against "overregulation."

The newspaper also reported there was a rift in the German cabinet on the issue, with the Federal Labor Ministry, headed by Ursula von der Leyen, having no objections to an EU-wide gender quota. Von der Leyen was reportedly pressured by the chancellery to stay quiet on the issue.

xchrom

(108,903 posts)Back in 2011, Arwen Colell was finishing up an undergraduate degree in political science and thinking about what to do next when her friend Luise Neumann-Cosel had an idea. They had met in a youth choir in Berlin and the friendship had blossomed through a shared passion for environmental issues. "She called me up and said, 'We should buy the grid,'" Colell said in a phone interview. Colell didn't have to think long before responding: "Sounds like a good idea."

Neumann-Cosel was referring to Berlin's energy grid, up for sale next year. Consisting of some 35,000 kilometers of underground cable, 8,000 medium- to low-voltage substations and 80 high-voltage substations that feed electricity to 2.3 million customers, the grid is a heavily-regulated monopoly that is available for purchase as a concession every 20 years. Depending on who you ask, it is worth somewhere between €1 billion and €3.1 billion.

In anticipation of the auction in 2014, the two founded a group called BürgerEnergie (People's Energy), which has raised €3 million in its drive to take the grid from Vattenfall, the Swedish company that currently owns the concession. It's an impressive amount of money for such a small initiative, but a far cry from what they would need to make a serious bid.

BürgerEnergie isn't the only group targeting the sale, though. A second citizen's group, called Berliner Energietisch (Berlin Energy Table), has undertaken a drive to re-communalize the grid. Their plan is to gather enough signatures to put the issue onto the ballot in hopes of forcing the city-state of Berlin to buy back the grid with public funds. There are also six other bidders, including Vattenfall. But these two citizen-based groups have created an unusual movement by politicizing something most people take for granted.

xchrom

(108,903 posts)

Every day, in every way, things are getting better and better. The iPhone 6 will dispense with the annoying home button and feature a 4.8-inch screen and quad-core processor. Google is developing Google Glass, which will allow users to text, take pictures and videos, perform Google searches, and execute other essential functions of contemporary life simply by issuing conversation-level spoken commands to a smart lens attached to a lightweight frame worn above the eyes.

Yelp has a hundred million unique monthly visitors, up from seventy million at this time last year. The Dow Jones average just reached an all-time high, having passed 14,000 last week, while, according to the Times, corporate profits are enjoying “a golden age”; as a share of national income, they are at their highest point since 1950.

Day by day, problem by problem, American life is being fine-tuned to the point where experts now confidently predict a state of near-complete perfection by Season Five of “Girls.”

In other news, America’s economic and social decline continues. The percentage of corporate profits going to employees is at its lowest level since 1966. Unemployment remains stuck around eight per cent, and the long-term jobless make up almost forty per cent of the total—historically high figures that continue to baffle economists. “We have an unemployment crisis and only a debt problem,” says Peter Diamond, a Nobel laureate at M.I.T. The concentration of wealth at the top grows ever more pronounced. From 2009 to 2011—the years of the financial crisis and the recovery—the income of the top one per cent rose 11.2 per cent. The income of the bottom ninety-nine per cent actually shrank 0.4 per cent.

Read more: http://www.newyorker.com/online/blogs/comment/2013/03/technological-perfectionism-and-income-inequality.html#ixzz2MlmJtW5Z

Demeter

(85,373 posts)If that's the way the 1% wants it...who are we to contradict them?

Riots often occur in reaction to a perceived grievance or out of dissent. Riots may be the outcome of a sporting event, although many riots have occurred due to poor working or living conditions, government oppression, conflicts between races or religions.

Rapid urbanization has led to the rise of urban riots, often inner city. John F. McDonald and Daniel P. McMillen have identified the Watts Riots, Los Angeles, 1965, as the first "urban riots" in the United States. The analyses of urban riots in terms of urban conditions influenced the emerging field of urban economics in the 1960s...

...scholars, commentators and commissions have sought to identify the deeper reasons and have identified a number of urban conditions that may underline urban riots. These urban conditions are often associated with urban decay more generally and may include: discrimination, poverty, high unemployment, poor schools, poor healthcare, housing inadequacy and police brutality and bias...

1960s

Rochester 1964 race riot

24–26 July 1964[6]

Philadelphia 1964 race riot

28–30 August 1964, Philadelphia, Pennsylvania, USA, Allegations of police brutality sparked the Columbia Avenue race riots.[6]

Watts Riots

11 August 1965, Los Angeles, California, USA, The McCone Commission investigated the riots finding that causes included poverty, inequality, racial discrimination and the passage, in November 1964, of Proposition 14 on the California ballot overturning the Rumford Fair Housing Act, which established equality of opportunity for black home buyers.[7]

Hough Riots

18 July 1966, Cleveland, Ohio, USA, The underlying causes of the riots may found in the social conditions that exist in the ghettos of Cleveland.[8]

Racial tension in Omaha, Nebraska

5 July 1966, North Omaha, Nebraska, USA, More than 500 black youth gathered to protest the absence of recreation programs and jobs storm a local business district, throwing rocks and bricks at Jewish-owned businesses in the area. The National Guard is called in after three days of random violence and organized raids.[9]

1967 Newark riots

12 July 1967, Newark, New Jersey, USA, Factors that contributed to the Newark Riot: police brutality, political exclusion of blacks from city government, urban renewal, inadequate housing, unemployment, poverty, and rapid change in the racial composition of neighborhoods.[10]

1967 Plainfield riots

14 July 1967, Plainfield, New Jersey, USA

12th Street riot

23 July 1967, Detroit, Michigan, USA, The origins of urban unrest in Detroit were rooted in a multitude of political, economic, and social factors including police abuse, lack of affordable housing, urban renewal projects, economic inequality, black militancy, and rapid demographic change.[11]

Minneapolis-Saint Paul

USA, Fall 1967. Racial tensions boil over in North Minneapolis as whites continue to leave the decaying core of the inner city bound for the suburbs.

1968 Chicago, Illinois riots

4 April 1968 Violence erupted in Chicago's black ghetto on the west side, eventually consuming a 28-block stretch of West Madison Street. Looting and arson took place primarily in the corridor between Roosevelt Road on the south and Chicago Avenue on the north.

1968 Washington, D.C. riots

4 April 1968, Washington, D.C., USA, A report from National Advisory Commission on Civil Disorders identified discrimination and poverty as the root causes of the riots that erupted in cities around the nation during the late 1960s and in Washington, DC in April 1968[12]

Baltimore riot of 1968

4 April 1968, Baltimore, Maryland, USA

Glenville Shootout

23 July 1968, Cleveland, Ohio, USA, Shootout between black militant organization led by Ahmed Evans and Cleveland Police Department attracted large and hostile black crowds that caused a 4 day long riot

Stonewall riots

June 1969, New York, New York, a turning point for the modern gay rights movement

1969 North 24th Street Riots

24 June 1969, North Omaha, Nebraska USA, An Omaha police officer fatally shoots a teenager in the back of the head during a gathering of youth in local public housing projects. Many youth and adults from the local African American community gather in the local business district, routinely burning and otherwise destroying non-Black-owned businesses.

---http://en.wikipedia.org/wiki/Urban_riots

SO MANY MORE--http://en.wikipedia.org/wiki/List_of_riots

LUCKY US, WE GET TWO OPPORTUNITIES...THIS TIME, WE WHITES CAN JOIN IN!

Demeter

(85,373 posts)The President’s “sequester” offer slashes non-defense spending by $830 billion over the next ten years. That happens to be the precise amount we’re implicitly giving Wall Street’s biggest banks over the same time period.

We’re collecting nothing from the big banks in return for our generosity. Instead we’re demanding sacrifice from the elderly, the disabled, the poor, the young, the middle class – pretty much everybody, in fact, who isn’t “too big to fail.”

That’s injustice on a medieval scale, served up with a medieval caste-privilege flavor. The only difference is that nowadays injustices are presented with spreadsheets and PowerPoints, rather than with scrolls and trumpets and kingly proclamations.

And remember: The White House represents the liberal side of these negotiations.

AND IT JUST GETS BETTER FROM THEN ON....

xchrom

(108,903 posts)U.S. stocks advanced, extending a record high for the Dow Jones Industrial Average, after a private jobs report showed companies took on more workers than estimated in February.

The Standard & Poor’s 500 Index added 0.3 percent to 1,544.02 at 9:31 a.m. in New York. The Dow rose 41.70 points, or 0.3 percent, to 14,295.47. The gauge advanced to a record yesterday, erasing losses from the financial crisis after a four-year rally fueled by the fastest profit growth since the 1990s and monetary stimulus from the Federal Reserve.

“We’re still bullish on the U.S.,” said Tom Elliott, London-based global markets strategist at JPMorgan Asset Management, which oversees about $1.4 trillion globally. “The U.S. market has a pull factor -- out of the major developed economies, it’s the only one that’s growing. If you’ve got rising employment and house prices, and American banks lending out once again, that supports a rise in consumer spending and is a big drive for the market.”

Companies added 198,000 workers in February, according to a private report based on payrolls. The increase in employment followed a revised 215,000 gain the prior month, figures from the Roseland, New Jersey-based ADP Research Institute showed today. The median forecast of 41 economists surveyed by Bloomberg called for an advance of 170,000.

xchrom

(108,903 posts)Companies added more workers than projected in February, indicating the U.S. job market will keep expanding this year, according to a private report based on payrolls.

The 198,000 increase in employment followed a revised 215,000 gain the prior month that was more than initially estimated, figures from the Roseland, New Jersey-based ADP Research Institute showed today. The median forecast of 41 economists surveyed by Bloomberg called for an advance of 170,000.

Sustained hiring by businesses, even as lawmakers in Washington were sparring over budget reductions, signals there is enough demand to support consumer spending, the biggest part of the economy. A Labor Department report this week may show private payrolls rose by 167,000 last month, according to the Bloomberg survey median.

“The job market remains sturdy in the face of significant fiscal headwinds,” Mark Zandi, chief economist at Moody’s Analytics Inc., said in a statement. Moody’s produces the figures with ADP. “Businesses are adding to payrolls more strongly at the start of 2013 with gains across all industries and business sizes. Tax increases and government spending cuts don’t appear to be affecting the job market.”

xchrom

(108,903 posts)AMSTERDAM (AP) -- The European Union has fined Microsoft (EURO)561 million ($733 million) for breaking a pledge to offer personal computer users a choice of Internet browsers when they install the company's flagship Windows operating system.

The penalty imposed by the EU's executive arm, the Commission, is a first for Brussels: no company has ever failed to keep its end of a bargain with EU authorities before.

In 2009, Microsoft Corp. struck a broad settlement with the Commission to resolve disputes over Microsoft's abuse of the dominance of Windows, which had spanned more than a decade.

The company agreed to pay (EURO)860 million and promised to give Windows users the option of choosing another browser rather than having Microsoft's Internet Explorer automatically installed on their machines.

xchrom

(108,903 posts)xchrom

(108,903 posts)WARSAW, Poland (AP) -- The National Bank of Poland has lowered its key interest rate by half a percentage point to a record low of 3.25 percent, a surprise move given that many economists had predicted a cut of a quarter point and others expected no cut at all.

The move Wednesday comes as the country has seen its once strong growth slow, with domestic demand down sharply and problems in the eurozone cutting demand for Polish goods.

The central bank faced some criticism last year for moving slowly on interest rate cuts despite decelerating growth. But it has made monthly rate cuts since November, helped in part by a drop in inflation to below the official target.

There are signs that an economic recovery could start in the second quarter.

xchrom

(108,903 posts)Paul Smith moved from London to Hong Kong to work in Asia’s hedge-fund industry almost 17 years ago, and he rode the boom to its peak. Last year, like other industry veterans, he quit.

“I decided not to wait the cycle out but to do something more productive with my time,” said Smith, 53, who remains in the city heading the Asia-Pacific office of the nonprofit CFA Institute, the global association of chartered financial analysts. “The hedge-fund industry in Asia will continue to struggle to raise funds for the next few years as banks continue to have liquidity issues.”

Hedge-fund managers, traders and analysts in Asia are quitting as assets have failed to recover after the 2008 global financial crisis, and trading losses have left a majority of funds unable to collect performance fees. They’re moving to mutual funds, endowments, consulting firms and companies outside of the money-management business, often at a cut in pay.

Asian hedge-fund assets are 28 percent below their 2007 peak, according to data provider Eurekahedge Pte. Globally, money overseen by the funds increased 21 percent since 2007 to a new high of $2.3 trillion as of December, data from Chicago- based Hedge Fund Research Inc. show.

xchrom

(108,903 posts)Orders to U.S. factories fell in January by the most in five months, weighed down by a slump in demand for military hardware and commercial aircraft.

Bookings dropped 2 percent after a revised 1.3 percent increase in December, figures from the Commerce Department showed today in Washington. Economists projected a 2.2 percent decline, according to the median forecast in a Bloomberg survey. Demand for durable goods decreased 4.9 percent, little changed from the 5.2 percent drop estimated last week, while non- durables climbed 0.6 percent on gains in petroleum and chemicals.

Growing demand for machinery including construction equipment and generators is helping boost manufacturing. A pickup in business spending indicates companies are looking beyond the fiscal-policy battles in Washington as sales improve.

“Manufacturing is looking a bit stronger than it was in the second half of last year,” Robert Mellman, senior economist at JPMorgan Chase & Co. in New York, said before the report. “Housing is going gangbusters, other parts of the economy are doing better, and the inventory cycle has turned positive. Foreign demand in some places might start to pick up.”

xchrom

(108,903 posts)Pier Luigi Bersani, whose leadership is in question after he admitted defeat in Italy’s general election last week, pledged to reverse the country’s budget rigor as he renewed his pitch to form a government.

“The vicious link between austerity and recession puts representative democracy at risk and renders it ungovernable,” Bersani said in Rome today in an address to officials of his Democratic Party. “Out of the austerity cage,” he said, as he outlined an eight-point plan for unity.

Bersani, 61, is reversing his prior backing for Prime Minister Mario Monti’s budget policy to consolidate party support and appeal to rivals like Beppe Grillo, who won a blocking minority in parliament with an anti-austerity push.

The Democratic Party leader’s plan won backing from members including Bari Mayor Michele Emiliano, while Naples City Councilor Umberto Ranieri called on Italian President Giorgio Napolitano to step in and set the agenda.

xchrom

(108,903 posts)The pro-independence government of Artur Mas on Tuesday began organizing a nationalist front to demand that voters in Catalonia be allowed to hold a referendum on its status within Spain next year.

The ruling Catalan CiU nationalist bloc has proposed holding a vote in the regional parliament on the enabling law, which was rejected last week in Congress, that would allow for the referendum to be held. In two weeks the resolution will be presented in the regional assembly, supported by a majority of the local parties, including the Republican Left (ERC), the Catalan Socialists (PSC), and ICV green coalition.

The move is designed to put pressure on Prime Minister Mariano Rajoy, whose government has decided to take the Catalan government to the Constitutional Court over its sovereignty declaration.

The State Council had advised the prime minister that there were enough legal grounds to dispute the Catalonia assembly’s declaration passed on January 23 that identifies the region as a “sovereign political and legal entity.”

xchrom

(108,903 posts)The European Commission on Tuesday gave Spain a pass mark for its compliance with the terms of the bailout it received to clean up its banking sector, but Brussels insisted more had to be done on the reform front.

“In general, the mission found that the policy conditionality of the program has so far been met and the program, and more widely the recapitalization and reform of the financial sector, is on track,” the Commission said in a report on the joint EC/European Central Bank mission to Madrid in the period January 28 - February 1.

Brussels noted that the financial markets have stabilized and that the liquidity problems of the Spanish banks have eased. However, it added the following rider. “In order to build on this momentum, it will be important to maintain the pace of reforms in order to overcome the still significant challenges and conclude successfully the program.”

The report concluded that there is no apparent need to disburse further funds to Spain other than the 41.4 billion euros it has already received to recapitalize the banks that have been nationalized and to inject capital into the asset management fund Sareb, the so-called bad bank that is absorbing the toxic property assets of the sector.

Demeter

(85,373 posts)Congress is moving rapidly to pass legislation funding the federal government through September 30, as Senate leaders on Tuesday expressed eagerness to avoid any threat of agency shutdowns when money runs out on March 27.

"I'm cautiously optimistic we're going to reach a solution before we leave here for the Easter recess," which is scheduled to begin on March 23, Senate Majority Leader Harry Reid told reporters on Tuesday.

Reid's Republican counterpart, Senator Mitch McConnell, gave a similarly upbeat assessment, telling reporters, "There seems to be no interest on either side in having a kind of confrontational government shutdown scenario."

Their comments follow Republicans' introduction of a new funding bill in the House of Representatives that will keep in place $85 billion worth of controversial, across-the-board spending cuts triggered on Friday. The House measure, expected to win passage on Wednesday, aims to partially shield some defense and veterans' programs from the indiscriminate cuts by including two updated military-related spending bills. It also will shift some funds to security-related efforts such as border and embassy security, prisons and FBI operations. Senator Barbara Mikulski, the Democrat who chairs the Senate Appropriations Committee, expressed frustration with the lack of flexibility for domestic programs such as education in the Republican plan.

"It's only guns. We need butter," Mikulski told reporters.

The White House also said it was concerned that domestic agencies would be forced to operate under older, more restrictive spending. In a statement, it said it would work with Congress to "refine the legislation" and would keep pressing lawmakers for a replacement to the automatic sequester cuts. Next week, Senate Democrats will move their version of the bill for a vote and are likely to add funding flexibility for some domestic programs, party aides said.

Both the House and Senate versions are expected to cap discretionary spending at $1.043 trillion for the full 2013 fiscal year, but this would be reduced to around $982 billion if the sequester cuts remain in place.

MORE

LOOKS LIKE THE GOP IS REALLY PROUD OF THE SEQUESTER...THEY CAN OWN IT, IMO.

Demeter

(85,373 posts)The Obama administration has asked Congress for authority to implement historic voting reforms in the International Monetary Fund that boost the influence of emerging economies like China in the global financial institution, sources said on Tuesday. But the plan faces an uphill battle for passage in a tense U.S. budget environment marked by the launch of $85 billion in automatic spending cuts on Friday that hit both the U.S. military and domestic programs hard.

The Treasury Department submitted the request as a provision to be inserted into pending legislation to keep the U.S. government funded through September 30 this year, congressional aides said. The Treasury sought authority to shift $65 billion in U.S. funding from an IMF crisis fund into U.S. quotas, which determine voting power in the Fund. The United States is the IMF's largest member country and has veto power over decisions.

The vote reforms were approved by the IMF in 2010, making China the third-largest voting member in the Fund and revamping the IMF's board to reduce Western Europe's dominance...The U.S. request would not require any new funds to be appropriated by Congress because it simply shifts money from one IMF account within the U.S. budget to another, a Senate Democratic aide said.

The Republican-controlled House of Representatives has already rejected the request to include it in legislation scheduled for a vote on Tuesday that would avoid a March 27 government shutdown. A House Republican aide said House Appropriations Committee Hal Rogers chose to limit such so-called "anomalies" for targeted adjustments to the funding extension bill. No decision has been made yet by Democrats, who control the Senate, on whether to include the IMF request in the Senate version of the funding bill, expected to be introduced later this month. Approval by the Senate would give it a good chance to be included into the final bill after the two chambers work out differences...

MORE

Demeter

(85,373 posts)WHEN MAUREEN GETS HER TEETH INTO SOMETHING MEATY, IT'S WORTH IT...SHE EVISCERATES HIM!

http://www.nytimes.com/2013/03/06/opinion/dowd-repent-dick-cheney.html?_r=0

...In a documentary soon to appear on Showtime, “The World According to Dick Cheney,” America’s most powerful and destructive vice president woos history by growling yet again that he was right and everyone else was wrong. R. J. Cutler, who has done documentaries on the Clinton campaign war room and Anna Wintour’s Vogue war paint room, now chronicles Cheney’s war boom.

“If I had to do it over again,” the 72-year-old says chillingly of his reign of error, “I’d do it over in a minute.”

...The documentary doesn’t get to the dark heart of the matter about the man with the new heart. Did he change, after the shock to his body of so many heart procedures and the shock to his mind of 9/11? Or was he the same person, patiently playing the courtier, once code-named “Backseat” by the Secret Service, until he found the perfect oblivious frontman who would allow him to unleash his harebrained, dictatorial impulses? Talking to Cutler in his deep headmaster’s monotone, Cheney dispenses with the fig leaf of “we.” He no longer feigns deference to W., whom he now disdains for favoring Condi over him in the second term, and for not pardoning “Cheney’s Cheney,” Scooter Libby.

“I had a job to do,” he said... “I got on the telephone with the president, who was in Florida, and told him not to be at one location where we could both be taken out.” Cheney kept W. flying aimlessly in the air on 9/11 while he and Lynn left on a helicopter for a secure undisclosed location, leaving Washington in a bleak, scared silence, with no one reassuring the nation in those first terrifying hours. “I gave the instructions that we’d authorize our pilots to take it out,” he says, referring to the jet headed to Washington that crashed in a Pennsylvania field. He adds: “After I’d given the order, it was pretty quiet. Everybody had heard it, and it was obviously a significant moment.”

This guy makes Al Haig look like a shrinking violet. When they testified together before the 9/11 Commission, W. and Cheney kept up a pretense that in a previous call, the president had authorized the vice president to give a shoot-down order if needed. But the commission found “no documentary evidence for this call.” In his memoir, W. described feeling “blindsided” again and again. In this film, the blindsider is the éminence grise who was supposed to shore up the untested president. The documentary reveals the Iago lengths that Cheney went to in order to manipulate the unprepared junior Bush. Vice had learned turf fighting from a maniacal master of the art, his mentor Donald Rumsfeld. When he was supposed to be vetting vice presidential candidates, Cheney was actually demanding so much material from them that there was always something to pick on. He filled W.’s head with stories about conflicts between presidents and vice presidents sparked by the vice president’s ambition, while protesting that he himself did not want the job. In an unorthodox move, he ran the transition, hiring all his people, including Bush senior’s nemesis, Rummy, and sloughing off the Friends of George; then he gave himself an all-access pass. He was always goosing up W.’s insecurities so he could take advantage of them. To make his crazy and appallingly costly detour from Osama to Saddam, and cherry-pick his fake case for invading Iraq, he played on W.’s fear of being lampooned as a wimp, as his father had been.

But after Vice kept W. out of the loop on the Justice Department’s rebellion against Cheney’s illegal warrantless domestic spying program, the relationship was ruptured. It was too late to rein in the feverish vice president, except to tell him he couldn’t bomb a nuclear plant in the Syrian desert...

“I don’t lie awake at night thinking, gee, what are they going to say about me?” he sums up.

They’re going to say you were a misguided powermonger who, in a paranoid spasm, led this nation into an unthinkable calamity. Sleep on that.

WAY TO GO, MO!

Demeter

(85,373 posts)They hover over Hollywood film sets and professional sports events. They track wildfires in Colorado, survey Kansas farm crops and vineyards in California. They inspect miles of industrial pipeline and monitor wildlife, river temperatures and volcanic activity. They also locate marijuana fields, reconstruct crime scenes and spot illegal immigrants breaching U.S. borders. Tens of thousands of domestic drones are zipping through U.S. skies, often flouting tight federal restrictions on drone use that require even the police and the military to get special permits. Armed with streaming video, swivel cameras and infrared sensors, a new breed of high-tech domestic drones is beginning to change the way Americans see the world - and each other.

Powered by the latest microtechnology and driven by billions in defense industry and commercial research dollars, domestic drones are poised for widespread expansion into U.S. airspace once regulation catches up with reality. That is scheduled to begin in late 2015, when the U.S. government starts issuing commercial drone permits.

Veteran aerial photographer Mark Bateson, a consultant to the film and television industry and some police departments, said one reality show producer asked him last year whether his custom-made drone could hover over a desert and use its thermal imaging sensors to spot ghosts for a ghost-hunter reality series. Bateson rejected that request. "But I heard they eventually found someone to do it," he said. "Commercially, the culture already exists," said Ben Miller, a Mesa County, Colorado, sheriff's deputy who has been flying drones with special authorization from the Federal Aviation Administration since 2009. "Turn on your TV and pay close attention to major sports events. You'll see that in many cases they are getting aerial shots using a UAS (unmanned aerial system). I would venture to say that if you've seen an action movie in the last five years, chances are that a UAS was used."

OPEN SKIES

Federal legislation enacted last year requires the FAA to prepare a plan to open U.S. skies in 2015 to widespread use of unmanned aircraft by public agencies and private industry. Potential markets include agriculture, shipping, oil exploration, commercial fishing, major league sports, film and television production, environmental monitoring, meteorological studies, law enforcement and the news media. The aviation and aerospace industry research firm Teal Group estimated last year that global spending on unmanned aircraft will double over the next 10 years, to nearly $90 billion, with the U.S. accounting for 62 percent of research and development spending and 55 percent of procurement spending... While public agencies can get permission to use unarmed drones, all commercial use remains banned. "As a hobbyist - I can do whatever I want right now, within remote-control guidelines," said Bateson, the aerial photographer. "But as soon as you turn it into a business ... the FAA says you are violating the national airspace." Bateson said that whether his drone shoots video for fun or for profit, "there is no greater danger to the national airspace."

Patrick Egan, an unmanned aircraft consultant to the U.S. military and editor of sUAS News, a drone news website, said the FAA's commercial ban on drones is unenforceable.

"How do you possibly enforce these regulations?" he said.

....

"Honestly?" said one commercial operator, who requested anonymity to protect his business. "My hope is that I'm far afield enough and small enough potatoes to the FAA that I can fly under the radar on this one."

MORE ALARMS AND EXCURSIONS AT LINK

Demeter

(85,373 posts)In February 1913, exactly a century ago, the Sixteenth Amendment gave Congress a constitutional green light to levy a federal tax on income. Later that same year, lawmakers made good on that opportunity. An income tax has been part of the federal tax code ever since. So what can we learn, as progressives, from this first century of income taxation?

Lesson One

Steeply graduated income tax rates can help societies do big things.

A half-century ago, America’s federal income tax rates rose steadily—and quite steeply—by income level, with 24 tax brackets in all. On income roughly between $32,000 and $64,000, in today’s dollars, couples in the 1950s faced a 22 percent tax rate. On income that today would equal between $500,000 and $600,000, affluent Americans faced a tax rate of 65 percent. The highest 1950s tax rate, 91 percent, fell on annual income that would today exceed $3.2 million...Today, our federal tax rates rise much less steeply. The current top rate? The “fiscal-cliff battle” earlier this winter raised the top federal rate on individual income over $400,000 from 35 to 39.6 percent, less than half the 91 percent top rate in effect through the Eisenhower years.

Those high tax rates in the middle of the 20th century made a huge difference. The revenue these tax rates generated funded new government programs like the justly celebrated G.I. Bill. Within a single generation, the United States went from a nation two-thirds poor to a nation two-thirds middle class. Americans saw the difference that government can make—and felt that difference personally. Most Americans today, by contrast, don’t expect much from their government. And for good reason. Most of us around today haven’t seen our government undertake any major new initiative improving the quality of the lives we lead. In this low-expectations political environment, conservative lawmakers demand endlessly lower income taxes for everybody, at every opportunity, and mainstream liberals dare not even hint at raising taxes on “middle class” incomes under $250,000. But back in our steeply graduated tax-rate past, politicians did dare talk about higher taxes, and middle class Americans didn’t much mind paying those taxes—for two reasons. They saw big results from the tax dollars they paid. They also knew that America’s wealthiest were sacrificing at tax time, too. We don’t do big things in America anymore. But we could, if we made paying taxes politically palatable again. Steeply graduated income tax rates helped work that magic a half-century ago. They could work that magic again.

Lesson Two

Progressive tax rates can do much more than raise significant amounts of revenue.

Our progressive forebears a century ago didn’t see the income tax as just a prolific source of revenue. They saw progressive taxes as a battering ram against plutocracy, or rule by the rich. An income tax that levied a much greater burden on high incomes than low, progressives believed, would both raise revenue fairly and shrink plutocratic fortune down to democratic size. The nation needed, as ex-President Theodore Roosevelt had famously declared in 1910, to “destroy privilege.” Ruin for our democracy, Teddy continued, would be “inevitable if our national life brings us nothing better than swollen fortunes for the few.”MORE

Lesson Three

Progressive income tax rates don’t just happen. People have to battle for them.

Lesson Four

Tax loopholes cost our society more than just tax revenue.

In the middle of the last century, the richest Americans traced their fortunes to one of two sources. They had either inherited their fortunes from a time before taxes became steeply progressive or they did business in an industry—like oil—that enjoyed massive federal tax loopholes. Tax breaks for oil first became a permanent and enormously lucrative tax code fixture in 1926. Tax lawyer Jerome Hellerstein would note that one oilman he knew had collected $14 million in income over a five-year period and paid only $80,000 of that in federal tax. Windfalls like this helped oil become what the New Yorker called mid-century America’s “most important source” of modern grand fortune. Those who held these Big Oil grand fortunes would do their best to remake America into a land where riches like theirs would be forever safe. Many of these Big Oil super rich saw attacks on their tax breaks as part of a broader attack on their way of life—the “American way of life”—from an un-American horde intent on fouling a proud nation with trade unions and integration. In the years right after World War II, these rabid right-wingers could hardly have felt politically more isolated...MORE

Lesson Five

Just copying our progressive tax-rate past won’t ensure a progressive tax future.

...We should honor our progressive forebears for their long and successful struggle to write steeply graduated tax rates into our federal tax code. But we also need to keep in mind that these tax rates, in the end, did not prove sustainable. In fact, progressive tax rates—as traditionally structured—haven’t proved sustainable for more than a few decades anywhere in the world. The basic structural flaw of these tax rates, in hindsight, now seems fairly obvious. The super rich essentially take steeply graduated tax rates much more personally than the rest of us...Our task as progressives: Restructuring progressive tax rates to make their benefits much more broadly appreciated. We could, for instance, tie our tax system’s maximum top rate to our federal minimum wage. Instead of setting the threshold for a new 91 percent top rate at a fixed dollar figure, we could set that threshold as a multiple of a minimum-wage income. With this structure, advocates for a higher minimum wage would suddenly have a new ally: the nation’s richest. The tax bill on these rich would go down if the minimum wage went up. We would, in effect, be making the income tax a promoter of a more equal distribution of the nation’s market income, not just a means to attack the inequality markets generate...

AND STILL MORE, A TREASURE OF POLICY IDEAS AT LINK

Ghost Dog

(16,881 posts)If you liked the 692 percent bond return Hugo Chavez delivered during his 14 years as Venezuelan president, Fidelity Investments and Schroder Investment Management Co. say you have nothing to fear from his successor...

... His policies, which included currency controls and the seizure of more than 1,000 companies, deterred many bond investors and kept the nation’s overseas borrowing costs at an average 12.39 percent during his presidency, or 3.78 percentage points above emerging-market government debt. While Venezuela faces the risk of political infighting and social unrest, Fidelity and Schroder say Maduro will follow his predecessor’s lead and keep paying bondholders to ensure oil exports that fund half the country’s budget. Chavez never missed a payment, producing returns that more than doubled the regional average.

“Maduro would likely follow the previous model, and yields will probably remain elevated unless there is a regime change,” Luis Martins, a portfolio manager at Fidelity in Boston who helps oversee $16.5 billion and has been investing in Venezuela for almost 20 years, said in a telephone interview. “Investing in Venezuela is a question of risk management. If these guys are paying you -- in a world of zero interest rates -- 9 or 10 percent, very few things beat this.”...

... Venezuela’s dollar-denominated bonds, which are rated four levels below investment grade by Standard & Poor’s, have rallied 26 percent over the past year, swelling their return to 692 percent since Chavez’s inauguration in 1999. The gains, equal to an annualized 14.7 percent, topped those from investment-grade countries including Brazil, whose debt returned 656 percent, and beat the 370 percent emerging- market average over that period, according to data compiled by JPMorgan Chase & Co...

... “The key thing is that Venezuela will keep servicing its debt,” James Barrineau, director of Latin America at Schroder, which manages $327 billion in assets, said in a telephone interview from New York. “The last thing the Chavistas want is to create a crisis in the economy. They will try to maintain things the Chavez way as much as possible.” ...

/... www.bloomberg.com/news/2013-03-06/chavez-s-692-bond-gain-seen-living-on-to-fidelity-andes-credit.html