Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 9 November 2012

[font size=3]STOCK MARKET WATCH, Friday, 9 November 2012[font color=black][/font]

SMW for 8 November 2012

AT THE CLOSING BELL ON 8 November 2012

[center][font color=red]

Dow Jones 12,811.32 -121.41 (-0.94%)

S&P 500 1,377.51 -17.02 (-1.22%)

Nasdaq 2,895.58 -41.71 (-1.42%)

[font color=green]10 Year 1.57% -0.07 (-4.27%)

30 Year 2.75% -0.10 (-3.51%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Hotler

(11,428 posts)What's an embattled banker to do? Make nice, and fast. One Wall Street lawyer told The New York Times that the industry "made a bad mistake" in backing Romney so completely. "They are going to pay a price," he said. "It will soften over time, but there will be a price."

http://money.msn.com/top-stocks/post.aspx?post=5ab79e59-5e56-428a-9005-4de4393fd1d4

Posting this before I go home. Enjoy the read.

Demeter

(85,373 posts)Unless somebody takes the cluestick to President Rerun...Elizabeth, darling, can you lend a hand here?

Hotler

(11,428 posts)President Obama reaches down to his toe nails and pulls up his spine.

Demeter

(85,373 posts)Divers have found a Russian ship carrying 700 tons of gold ore that sank off the Pacific coast last month. The freighter Amurskaya had been missing since Oct. 28 when it sent a distress call from the Sea of Okhotsk, an arm of the Pacific. A statement from the Transportation Ministry said its 11 crew members remain unaccounted for.

The ship was found by divers in about 75 meters (230 feet) of water on Wednesday, the ITAR-Tass news agency reported.

Police have lodged criminal charges against the ship's owner, who also is director of the Nikolaevsk-on-Amur port, where the ship is registered, for allegedly instructing the ship to sail despite bad weather and improper cargo procedures.

No details on how much gold the ore could contain have been released.

Fuddnik

(8,846 posts)The only thing missing in that toon, is Rove twirling on a spit with an apple in his mouth.

Tansy_Gold

(17,862 posts)And Rove may yet be on that spit.

bread_and_roses

(6,335 posts)Demeter

(85,373 posts)Business is tough at Goldman Sachs Group Inc., but the past is paying off: More than 30 executives, including Chief Executive Officer Lloyd C. Blankfein, recently cashed in stock options awarded in the afterglow of the company's initial public offering in 1999. According to a securities filing, the executives, all Goldman partners, pocketed a total of $21.8 million by exercising options and selling the underlying shares in the three days after the firm reported third-quarter results in mid-October. The options expire at the end of November, and cashing in produced instant profits because Goldman's share price is more than 50% higher than when the options were awarded in 2002.

"By exercising 10-year-old options before they expired later this year, executives captured some of the value we have built for shareholders over that period," said a spokesman for the securities firm.

In contrast, many of the executives' remaining options are worthless, at least for now, because they were granted from 2005 to 2008. The stock peaked in October 2007 at about $239, or 89% higher than Tuesday's closing price of $126.25 in New York Stock Exchange composite trading at 4 p.m.

The biggest gain went to Michael S. Sherwood, a Goldman vice chairman and the firm's top executive in Europe, who received $5.2 million from exercising options on 115,211 shares. Mr. Blankfein collected $3.1 million, while departing Chief Financial Officer David A. Viniar got $2.3 million, the filing shows. While the payouts aren't huge by Wall Street standards, they are a sign of Goldman's staying power since it went public, ending the last major partnership among U.S. securities firms. Yet some experts also saw the sales as evidence of the problems now hurting Goldman's profits and stock price, since most of the executives' remaining options are underwater....Goldman last gave out stock options in 2008. In the financial crisis, Congress outlawed stock options at some companies that received taxpayer-backed bailouts from the government. Goldman and other financial firms weren't subject to the edict but stopped the practice anyway...Goldman executives now mostly hold options granted at exercise prices of $131.64 to $204.16, making them worthless for now...

Demeter

(85,373 posts)The economic downturn is pressing more employers to reduce pension benefits and significantly delaying when people launch their careers, darkening the already bleak picture that young workers face in saving for retirement. Corporations have been slashing pensions for decades, but such cuts are common now in the public sector, where retirement benefits were traditionally much better. In both cases, employers frequently reach for the same tool — preserve benefits for current employees but make severe cuts for new ones.

As Washington turns in the coming weeks from the presidential election to the long-term debt issues facing the nation, the discussions will center on whether the country can afford programs such as Social Security and Medicare in their current form. (AND REMEMBER, FOLKS, ALTHOUGH WP IS TOO CRAVEN TO MENTION IT, SOCIAL SECURITY DOES NOT HAS NOT AND COULD NOT CAUSE THE BUDGET DEFICIT--DEMETER)

So far, these debates have focused little on how potential cuts in federal benefits may affect retirement for younger generations of workers who already are seeing employers shrink their safety nets. The confluence of events is creating a dichotomy in the nation’s workforce and a massive burden for the country that will not be fully evident until the next generation approaches retirement.

“We have a looming retirement-income crisis in this country,” said Diane Oakley, executive director of the National Institute on Retirement Security. “The problem is we won’t see the ultimate brunt of it until 30 years down the road when it is too late to do something about it.”

Young workers are having little or no say in any of this, but the changes will affect them most. “How the hell do I get ahead?” said Sandra Conchar, 27, director of community relations at Potomac Pizza, a local restaurant chain. “And retirement? Oh, God.” Blue-chip corporate giants such as IBM and Verizon are among those that have closed their traditional pension plans to new workers in order to limit future liabilities. Meanwhile, public workers in states from Rhode Island to California have seen pension promises scaled back as governments struggle to reduce debt.

As it is, most workers are vastly underprepared for retirement. Although coverage is near universal among the small minority of workers employed in the public sector, just over two in five private-sector workers between ages 25 and 64 are covered by pensions or 401(k)-type retirement plans in their current jobs, according to Boston College’s Center for Retirement Research. On average, workers in their prime working years have a retirement funding gap of $90,000 per household, the center has found. The share of workers covered by traditional pensions has been dwindling since the 1980s, and now the plans are a cherished rarity for young workers. Adding to the challenge, the recession forced many young workers to launch their careers later, which reduces their earnings — and their ability to save for retirement — in ways many are unlikely to overcome, analysts say...

Demeter

(85,373 posts)Banking and credit should become public utilities, feeding the economy rather than feeding off it. In the 2012 edition of Occupy Money released last week, Professor Margrit Kennedy writes that a stunning 35% to 40% of everything we buy goes to interest. This interest goes to bankers, financiers, and bondholders, who take a 35% to 40% cut of our GDP. That helps explain how wealth is systematically transferred from Main Street to Wall Street. The rich get progressively richer at the expense of the poor, not just because of “Wall Street greed” but because of the inexorable mathematics of our private banking system.

This hidden tribute to the banks will come as a surprise to most people, who think that if they pay their credit card bills on time and don’t take out loans, they aren’t paying interest. This, says Dr. Kennedy, is not true. Tradesmen, suppliers, wholesalers and retailers all along the chain of production rely on credit to pay their bills. They must pay for labor and materials before they have a product to sell and before the end buyer pays for the product 90 days later. Each supplier in the chain adds interest to its production costs, which are passed on to the ultimate consumer. Dr. Kennedy cites interest charges ranging from 12% for garbage collection, to 38% for drinking water to, 77% for rent in public housing in her native Germany.

Her figures are drawn from the research of economist Helmut Creutz, writing in German and interpreting Bundesbank publications. They apply to the expenditures of German households for everyday goods and services in 2006; but similar figures are seen in financial sector profits in the United States, where they composed a whopping 40% of U.S. business profits in 2006. That was five times the 7% made by the banking sector in 1980. Bank assets, financial profits, interest, and debt have all been growing exponentially.

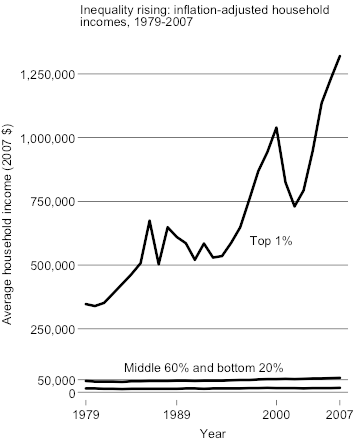

Exponential growth in financial sector profits has occurred at the expense of the non-financial sectors, where incomes have at best grown linearly.

By 2010, 1% of the population owned 42% of financial wealth , while 80% of the population owned only 5% percent of financial wealth. Dr. Kennedy observes that the bottom 80% pay the hidden interest charges that the top 10% collect, making interest a strongly regressive tax that the poor pay to the rich...

MORE AT LINK AND MUST READ!

Demeter

(85,373 posts)...The implications of all this are stunning. If we had a financial system that returned the interest collected from the public directly to the public, 35% could be lopped off the price of everything we buy. That means we could buy three items for the current price of two, and that our paychecks could go 50% farther than they go today...

...Globally, 40% of banks are publicly owned, and they are concentrated in countries that also escaped the 2008 banking crisis. These are the BRIC countries—Brazil, Russia, India, and China—which are home to 40% of the global population. The BRICs grew economically by 92% in the last decade, while Western economies were floundering....

...A Radical Solution Whose Time Has Come

Public banking may be a radical solution, but it is also an obvious one. This is not rocket science. By developing a public banking system, governments can keep the interest and reinvest it locally. According to Kennedy and Creutz, that means public savings of 35% to 40%. Costs can be reduced across the board; taxes can be cut or services can be increased; and market stability can be created for governments, borrowers and consumers. Banking and credit can become public utilities, feeding the economy rather than feeding off it.

******************************************************

Ellen Brown is an attorney, author, and president of the Public Banking Institute. Her latest book is Web of Debt.

xchrom

(108,903 posts)

xchrom

(108,903 posts)China has reported encouraging economic data, indicating that growth in the world's second-largest economy may be rebounding.

Industrial production, retail sales and fixed-asset investment all rose more than expected in October, from a year earlier.

Meanwhile, the inflation rate fell, giving room to policymakers to employ stimulus measures to support growth.

The numbers come as China's growth rate has hit a three-year low.

xchrom

(108,903 posts)xchrom

(108,903 posts)The UK is to end financial aid to India by 2015, international development secretary Justine Greening has said.

Support will gradually be phased out between now and 2015, saving £200m ($319m), and the UK's focus will then shift to offering technical assistance.

Ms Greening said the move, which will be popular with Tory MPs, reflected India's economic progress and status.

Giving his reaction, India's foreign minister Salman Khurshid said: "Aid is the past and trade is the future."

xchrom

(108,903 posts)European (SXXP) stocks fell, heading for their biggest weekly decline since September, amid concern that the so-called fiscal cliff of automatic spending cuts and tax increases may push the world’s largest economy into a recession. U.S. index futures and Asian shares slid.

Credit Agricole sank 6.2 percent after posting a wider third-quarter loss than analysts had estimated. Lonmin Plc slipped 2.7 percent after posting a full-year loss. Novo Nordisk A/S (NOVOB) rallied 8.5 percent as an advisory panel to the Food and Drug Administration backed its insulin treatment.

he Stoxx 600 slid 0.5 percent to 269.23 at 11:01 a.m. in London, extending its retreat this week to 2 percent. The gauge has still rallied 15 percent from this year’s low on June 4 as European Central Bank President Mario Draghi said he would do everything to protect the single currency and the Federal Reserve opted for a third round of asset purchases. Futures on the Standard & Poor’s 500 Index slipped 0.3 percent today, while the MSCI Asia Pacific Index lost 0.3 percent.

xchrom

(108,903 posts)Billionaire investor George Soros said the euro zone’s debt crisis is harming the forces that have held the currency bloc together as well as the vision that led to the creation of the European Union.

“The euro crisis is threatening Europe’s cohesion and the ideals behind the European Union,” Soros said at the Martti Ahtisaari Day seminar in Helsinki today. “The attractive idea of equal states being devoted to common goals is threatened, as there is a division between countries. Investors and creditors are in charge,” he said.

Greece is under pressure to make more efforts to rein in its budget deficit and deregulate the economy. While German Chancellor Angela Merkel last month traveled to Athens to signal her willingness to keep Greece in the euro, the country is still struggling to reach its debt-reduction targets amid a combination of Greek political resistance to more cuts and recession that has brought record unemployment and mass street protests.

Greece’s debt plight has created a “humanitarian crisis” in the nation that has to be recognized, Soros said.

Demeter

(85,373 posts)The International Monetary Fund on Thursday urged the United States to quickly reach an agreement on a permanent fix to avoid automatic tax hikes and spending cuts early next year, saying a stop-gap solution could be harmful to the global economy. Many analysts believe Washington will come up with a deal that would temporarily stave off what has become known as the fiscal cliff, although doubts persist as to whether Congress can agree on a timely compromise. In a report prepared for the Group of 20 finance ministers' meeting in Mexico on November 4-5 and published on Thursday, the IMF warned that the euro zone crisis and the threat of a political impasse in Washington over the looming fiscal cliff posed the biggest risks to the world economy. The Fund said, however, there were signs that financial stress and global economic conditions "may be stabilizing" due to recent steps by major central banks to cut interest rates to spur growth, although economic activity remains sluggish.

The combined U.S. government spending cuts and tax rises to be implemented under existing law at the start of 2013 are seen by many as threatening to tip the economy back into recession. The IMF has estimated that the tax increases and spending cuts amount to $700 billion in 2013. Unless avoided, this could contract U.S. gross domestic product by around 4.5 percent. "A last-minute deal that relies on suboptimal fixes or largely 'kicks the can down the road' may ultimately prove harmful," the IMF said in the report. It also said a temporary U.S. fiscal cliff was a "medium-term probability event," and said that even if the cuts were quickly unwound, damage to the economy would be "substantial" because businesses and consumers would be unsure about tax and spending policies. "The severity of the economic effects would partly depend on the duration of the cliff - here, staff sees a temporary cliff, before measures or extensions could be implemented, as a medium-probability event," the IMF said.

Dealing with the fiscal cliff is the biggest near-term challenge facing the Obama administration. It is also one of the biggest concerns for international policymakers, with Canada warning this week it could fall into recession if Washington does not reach a deal to avoid the cliff.

The IMF said the U.S. economy could fall back into recession if Congress fails to avert the package of tax hikes and spending cuts. The IMF also urged Washington to agree on a credible plan to reduce government debt, warning that failing to do so could "exacerbate uncertainty," and could "lead to a gradual erosion of the reserve currency status of the U.S. dollar and put upward pressure on Treasury bond yields."

Demeter

(85,373 posts)To say the obvious: Democrats won an amazing victory. Not only did they hold the White House despite a still-troubled economy, in a year when their Senate majority was supposed to be doomed, they actually added seats. Nor was that all: They scored major gains in the states. Most notably, California — long a poster child for the political dysfunction that comes when nothing can get done without a legislative supermajority — not only voted for much-needed tax increases, but elected, you guessed it, a Democratic supermajority. But one goal eluded the victors. Even though preliminary estimates suggest that Democrats received somewhat more votes than Republicans in Congressional elections, the G.O.P. retains solid control of the House thanks to extreme gerrymandering by courts and Republican-controlled state governments. And Representative John Boehner, the speaker of the House, wasted no time in declaring that his party remains as intransigent as ever, utterly opposed to any rise in tax rates even as it whines about the size of the deficit.

So President Obama has to make a decision, almost immediately, about how to deal with continuing Republican obstruction. How far should he go in accommodating the G.O.P.’s demands? My answer is, not far at all. Mr. Obama should hang tough, declaring himself willing, if necessary, to hold his ground even at the cost of letting his opponents inflict damage on a still-shaky economy. And this is definitely no time to negotiate a “grand bargain” on the budget that snatches defeat from the jaws of victory.

In saying this, I don’t mean to minimize the very real economic dangers posed by the so-called fiscal cliff that is looming at the end of this year if the two parties can’t reach a deal. Both the Bush-era tax cuts and the Obama administration’s payroll tax cut are set to expire, even as automatic spending cuts in defense and elsewhere kick in thanks to the deal struck after the 2011 confrontation over the debt ceiling. And the looming combination of tax increases and spending cuts looks easily large enough to push America back into recession. Nobody wants to see that happen. Yet it may happen all the same, and Mr. Obama has to be willing to let it happen if necessary.

Why? Because Republicans are trying, for the third time since he took office, to use economic blackmail to achieve a goal they lack the votes to achieve through the normal legislative process. In particular, they want to extend the Bush tax cuts for the wealthy, even though the nation can’t afford to make those tax cuts permanent and the public believes that taxes on the rich should go up — and they’re threatening to block any deal on anything else unless they get their way. So they are, in effect, threatening to tank the economy unless their demands are met. Mr. Obama essentially surrendered in the face of similar tactics at the end of 2010, extending low taxes on the rich for two more years. He made significant concessions again in 2011, when Republicans threatened to create financial chaos by refusing to raise the debt ceiling. And the current potential crisis is the legacy of those past concessions. Well, this has to stop — unless we want hostage-taking, the threat of making the nation ungovernable, to become a standard part of our political process.

So what should he do? Just say no, and go over the cliff if necessary...So stand your ground, Mr. President, and don’t give in to threats. No deal is better than a bad deal.

xchrom

(108,903 posts)BEIJING (AP) -- Asset disclosure for Chinese officials is likely to be slowly phased in over time, a senior Communist Party leader said Friday, as the government grapples with the fraught task of rooting out the corruption that has fed widespread public anger.

The comments from Wang Yang, a member of the decision-making Politburo with a reputation as a reformer, came a day after the party opened a weeklong congress to install a new leadership with a call to fight corruption.

Speaking to reporters, Wang said that the province he runs, Guangdong, is exploring methods for officials to declare their wealth and that in the future public disclosure of assets will be required of all officials.

"Officials will slowly all disclose their assets," Wang said after a meeting with congress delegates from Guangdong. He did not give a time frame.

Demeter

(85,373 posts)Can you help me pick a good escapist topic?

Didn't we do Tahiti already? Where else is a good place to get away from it all....

Don't make me reach for the Mouse....Tansy will have conniptions.

Tansy_Gold

(17,862 posts)Fuddnik

(8,846 posts)Funny. What seemed amazing back then, is not so much any more. I still love his books, and can't believe I lost The Demon Haunted World. I recently wanted to re-read it.

Tansy_Gold

(17,862 posts)Buy yourself another copy. It's worth it.

Roland99

(53,342 posts)DOW -0.3%

NASDAQ -0.1% [/font]

Demeter

(85,373 posts)He should feel honored by his peers, and rejected by the 99%.

Demeter

(85,373 posts)The two most important trends, confirmed in the jobs report from the Bureau of Labor Statistics, are that (1) jobs slowly continue to return, and (2) those jobs are paying less and less.

The report showed 171,000 workers were added to payrolls in October, up from 148,000 in September. At the same time, unemployment rose to 7.9 percent from 7.8 percent last month. The reason for the seeming disparity: As jobs have begun to return, more people have been entering the labor force seeking employment. The household survey, on which the unemployment percentage is based, counts as “unemployed” only people who are looking for work. As I’ve said, you have to take a single month’s report with a grain of salt because the job reports bounce around a great deal, and are often revised. Last month the BLS announced that 114,000 new jobs were created in September. Today the BLS revised that September figure upward to 148,000. Overall, the jobs trend is in the right direction. The President and Democrats can take some comfort.

The most disturbing aspect of today’s report is the continuing decline of wages. Average hourly earnings climbed 1.6 percent in October from the same time last year. That’s not enough to match the rate of inflation – meaning that hourly earnings continue to drop in real terms. It’s also the smallest gain since comparable year-over-year records began in 2007, before the Great Recession. Earnings for production workers – about 80 percent of the workforce — rose only 1.1 percent in the 12 months to October. That’s way behind inflation, and the weakest wage growth since the BLS began keeping records on wages in 1965. The biggest challenge ahead isn’t just to get jobs back. They’re coming back. It’s to raise the wages of most Americans.

This isn’t a new challenge. The median wage has been flat for three decades, when you adjust for inflation. Since 2000 it’s been dropping... Some of the biggest wage losses over the last several decades have been among white men who haven’t attended college. And, not coincidentally, they’re the ones who have been abandoning the Democrats in droves. Three decades ago, non-college white men were solidly Democratic. Many of them were unionized. They had jobs that delivered good middle-class incomes. But over the last three decades they stopped believing the Democratic Party could deliver good jobs at decent wages. Republicans have done no better for them on the wages — in fact many policies touted by the GOP, such as its attack on unions, have accelerated the downward wage trend.

But Republicans have offered white non-college males the scapegoats of racism and immigration — blaming, directly or indirectly, blacks and Latinos — and the solace of right-wing evangelical Christianity. Absent any bold leadership from Democrats, these have been enough.

Demeter

(85,373 posts)When the applause among Democrats and recriminations among Republicans begin to quiet down — probably within the next few days — the President will have to make some big decisions. The biggest is on the economy. His victory and the pending “fiscal cliff” give him an opportunity to recast the economic debate. Our central challenge, he should say, is not to reduce the budget deficit. It’s to create more good jobs, grow the economy, and widen the circle of prosperity. The deficit is a problem only in proportion to the overall size of the economy. If the economy grows faster than its current 2 percent annualized rate, the deficit shrinks in proportion. Tax receipts grow, and the deficit becomes more manageable.

But if economic growth slows – as it will, if taxes are raised on the middle class and if government spending is reduced when unemployment is still high – the deficit becomes larger in proportion. That’s the austerity trap Europe finds itself in. We don’t want to go there. This is why January’s so-called “fiscal cliff” — $600 billion in automatic spending cuts and tax increases – is so dangerous. It’s too much deficit reduction, too soon. Tax increases on the middle class would reduce their spending just when the economy needs that spending in order to keep growing, and cuts in government’s own spending would make the problem worse. If we go over the fiscal cliff, we’re in another recession. Don’t just take my word for it. That’s also the view of the Congressional Budget Office and most private economic forecasters.

The way to ensure continued growth is to continue the President’s payroll tax cut and extend the Bush tax cuts for income under $250,000, and continue government spending. The way to increase growth is to permanently exempt the first $20,000 of income from the payroll tax and make up for lost revenues by raising the ceiling on income subject to it (that ceiling is now $110,100). And increase government spending — especially on critical public investments like education, job training, and infrastructure. Any “grand bargain” on deficit reduction should contain a starting trigger — and that trigger should be when the economy can safely be assumed to be back on track. I’d make that trigger 6 percent unemployment and 3 percent economic growth for two consecutive quarters, and make sure that trigger was in the legislation.

The President needs to make it clear to the public that the only way we can achieve a better economy is through a larger and more buoyant middle class. If we continue lurching toward widening inequality and ever more concentrated income and wealth at the top, the vast middle class – as well as all those who aspire to join it – won’t have the purchasing power to grow the economy and create more jobs. That’s why taxes must be increased on the wealthy, and the proceeds used to reduce the deficit over the long term, extend and enlarge the Earned Income Tax Credit (a wage subsidy for lower-income workers), and invest in education. The President’s victory doesn’t give him a clear mandate to achieve any of this – the margin of victory was too small, and he didn’t tell the American electorate explicitly that his priority would be creating jobs and growing the middle class instead of reducing the deficit. But his victory gives him the attention of the nation and the authority that comes with having won reelection. It therefore gives him the opportunity to recast the economic debate. The upcoming fiscal cliff makes it particularly urgent he do so quickly.

mnhtnbb

(31,395 posts)I added to a couple of positions--one foreign and one domestic--this morning. So far, so good!

Fuddnik

(8,846 posts)My week-end is looking better already!

mnhtnbb

(31,395 posts)Roland99

(53,342 posts)Police, directed by Serious Fraud Office prosecutors, will act in the next month, said the person, who declined to be identified because the matter isn’t public. Arrests in the U.K. are made early in investigations, allowing people, who may not be charged, to be questioned under caution.

The SFO has 40 people working on the probe into manipulation of the London interbank bank offered rate, a benchmark for financial products valued at $360 trillion worldwide, and has involved the City of London Police, said David Green, the agency’s director.

“Significant developments” in the case are coming “in the near future,” Green said yesterday in an interview at his office in London, without giving further details and declining to comment on possible arrests.

Demeter

(85,373 posts)It worked, a little.

Roland99

(53,342 posts)Hotler

(11,428 posts)JPMorgan Chase CEO Jamie Dimon may be particularly interested in watching Warren's moves. Warren called for Dimon's resignation as a director at the Federal Reserve Bank of New York after his bank's embarrassing $6 billion trading loss earlier this year.

http://money.msn.com/investment-advice/warren-win-has-wall-street-worried

I'm going to rumage around in the closet and see if I can find some left over hope.

Fuddnik

(8,846 posts)Now, she's in a position to pay him back in spades for at least 6 years. And hopefully longer.