Economy

Related: About this forumWeekend Economists Batten Down the Hatches October 26-28, 2012

This clipping from "Bell, Book and Candle", my favorite Hallowe'en movie, is a riff on "Stormy Weather", a standard mood piece:

Either way, we are facing rough weather.

First there's the big scary Frankenstorm that is the biggest buzz in meteorological circles:

"Frankenstorm" — a potentially devastating and highly unusual mix of tropical and winter weather approaching the mid-to-upper Eastern Seaboard — is being called simply Hurricane Sandy by The Weather Channel, along with the National Weather Service, the National Hurricane Center and other forecasters.... http://www.chicagotribune.com/news/ct-talk-frankenstorm-sandy-athena-1027-20121026,0,6607579.story

http://finance.yahoo.com/news/people-starting-freak-hurricane-sandy-144250090.html

...Writing today in the WSJ, resident weather expert Eric Holthaus is pointing toward a worrying scenario for the North-East: The hurricane could blend with a snowstorm to create havoc before Halloween, becoming a "snor’eastercane." Holthaus believes the odds of the storm hitting NYC are 2 in 3.

AccuWeather Alex Sosnowski also warns an inland storm could result in "coastal flooding, flooding rainfall, high winds, downed trees, power outages, travel mayhem and even Appalachian snow" from Boston to DC (including New York City).

Some even say the financial impact of this "mega-storm" worse than the Perfect Storm, the deadly storm immortalized by a George Clooney movie. The Weather Channel's meteorologist Jim Cantore is completely freaking out about the storm on Twitter.

The unique nature of the storm is its scariest aspect. From the National Weather Service:

THE HIGH DEGREE OF BLOCKING FROM EASTERN NORTH AMERICA ACROSS THE ENTIRE ATLANTIC BASIN IS EXPECTED TO ALLOW THIS UNUSUAL MERGER TO TAKE PLACE, AND ONCE THE COMBINED GYRE MATERIALIZES, IT SHOULD SETTLE BACK TOWARD THE INTERIOR NORTHEAST THROUGH HALLOWEEN, INVITING PERHAPS A GHOULISH NICKNAME FOR THE CYCLONE ALONG THE LINES OF "FRANKENSTORM", AN ALLUSION TO MARY SHELLEY'S GOTHIC CREATURE OF SYNTHESIZED ELEMENTS.

Mayor Bloomberg has warned New Yorkers to be prepared for an evacuation...

Then there's the election...and that's all I'm going to say. Fatigue set in early.

And of course, there's the ongoing economic climate change...

So post any and all these things. Or just post diversions in the art world.

Welcome to the Weekend!

Demeter

(85,373 posts)The Federal Deposit Insurance Corporation (FDIC) approved the payout of the insured deposits of NOVA Bank, Berwyn, Pennsylvania. The bank was closed today by the Pennsylvania Department of Banking and Securities, which appointed the FDIC as receiver.

The FDIC was unable to find another financial institution to take over the banking operations of NOVA Bank. The FDIC will mail checks directly to depositors of NOVA Bank for the amount of their insured money. As a convenience to depositors, the FDIC has made arrangements with National Penn Bank to accept the failed bank's direct deposits from the federal government, such as Social Security and Veterans' payments through January 25, 2013. The seven National Penn Bank locations designated to service NOVA Bank's customers receiving federal government direct deposit payments are as follows: One Penn Center; East Falls; Norristown; Wynnewood; Paoli; Wayne, and Lionville.

Customers with questions about today's transaction, including those with accounts in excess of $250,000, should call the FDIC toll-free at 1-800-830-3256. The phone number will be operational this evening until 9:00 p.m., Eastern Daylight Time (EDT); on Saturday from 9:00 a.m. to 6:00 p.m., EDT; on Sunday from noon to 6:00 p.m., EDT; on Monday from 8:00 a.m. to 8:00 p.m., EDT; and thereafter from 9:00 a.m. to 5:00 p.m., EDT. Interested parties also can visit the FDIC's Web site at http://www.fdic.gov/bank/individual/failed/novabank.html.

Beginning Monday, depositors of NOVA Bank with more than $250,000 at the bank may visit the FDIC's Web page "Is My Account Fully Insured?" at http://www2.fdic.gov/dip/Index.asp to determine their insurance coverage.

As of June 30, 2012, NOVA Bank had approximately $483.0 million in total assets and $432.2 million in total deposits. The amount of uninsured deposits will be determined once the FDIC obtains additional information from those customers.

The FDIC as receiver will retain all the assets from NOVA Bank for later disposition. Loan customers should continue to make their payments as usual.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $91.2 million. NOVA Bank is the 47th FDIC-insured institution to fail in the nation this year, and the second in Pennsylvania. The last FDIC-insured institution closed in the state was American Eagle Savings Bank, Boothwyn, on January 20, 2012.

Demeter

(85,373 posts)"We're not trying to hype it," National Weather Service meterologist Paul Kocin tells Bloomberg News. "What we're seeing in some of our models is a storm at an intensity that we have not seen in this part of the country in the past century."

So get ready, mid-Atlantic states, the Northeast and New England: Hurricane Sandy, which has already caused at least 21 deaths in the Caribbean, is still on track to turn toward you on Monday. And if that happens, it will meet up with a winter storm coming from the West and cold air coming down from Canada to become what could be a horrible "Frankenstorm" (Halloween is Wednesday).

Oh, and there's also a full moon on Monday. As that affects tides, the concern about storm surges along coastal areas grows. The Federal Emergency Management Agency is warning folks from Florida to New England to "update your family communication plans, check your supplies, and stay informed."

The storm that Kocin and some other meteorologists are saying this could rival was a 1938 hurricane that hit Long Island and New England hard — more than 500 people were killed, Bloomberg notes...

Demeter

(85,373 posts)Flight cancellations and alerts for travel in Hurricane Sandy’s path are already in place and more are on tap for the weekend should the storm stay on its trajectory toward Boston, New York and eventually Delaware.

US Airways already has cancelled flights to and from Jamaica, which was hit hard by Hurricane Sandy’s 105 mph winds, knocking out 70% of the island’s power. The airline also has canceled flights to the Bahamas.

...forecasters are 90% certain that the storm will hit land on the East Coast this weekend and early next week, though it’s still too early to predict exactly where.

Fuddnik

(8,846 posts)bread_and_roses

(6,335 posts)"Batten down" is perfect - preparedness, that's the word. Could be a watchword for much of what is posted here in SMW and WE. Especially from the essential AnneD. Here, we're in the possible path. I told spouse this AM that I was going to do my "Frankenshopping" today: stocking up on the essentials, which in my house are:

bottled water (well water, so no power, no pump - somehow we've never gotten around to getting an emergency generator, though every year we say we will - we are grasshoppers at heart, and only ants by necessity)

batteries

matches

candles

dog food

cat food

toilet paper

peanut butter

crackers

various canned foodstuffs (we have a gas stove run on propane, so even if power out can cook - also, a wood stove)

A long, unread book if possible to find one I want to read. Otherwise, there's always Jane Austin, a never-ending pleasure.

Alas, I didn't get to the store until 6:00 pm and the shelves were already bare of bottled water. But according to the forecasts, we have days yet, so tomorrow I'll go foraging.

Fuddnik

(8,846 posts)Usually, every April, before hurricane season, I make a special trip to Costco. Stock up on everything. Keep two tanks of propane in the garage. And our local liquor store (the best one ever!) has a sale and a $50 rebate on a case of Stoli.

sheshe2

(83,846 posts)but but but don't forget the olives!![]()

AnneD

(15,774 posts)meds, condoms ( or risk the 9 month blowback), and Fudd's recommendation, your adult beverage of choice, and games and activities for the family.

I cannot tell you the peace of mind my pantry gives me every day of the week, especially with emergency situations. I hope the situation does not become as dire as the weather folks are predicting.

I bought my first generator this summer. Bought it second hand from a Cajun GOB friend of my brothers. It can power a house. I forgot the total watts but it way more than what you can buy off the shelf at Home Depot. Bradah said it was a great deal and took up half of his truck. Best $250 I could have spent. You really only need enough to power the fridge, freezer, lights, or fan/heater. It is not like you have to supply your everyday needs, just enough to get by. You can get by with less than you think.

Demeter

(85,373 posts)AnneD

(15,774 posts)You saw orange or yellow extension cord running across neighborhood streets. People would pool their power so that everyone had some juice. And the when one side of the street got power, folks were still sharing. The term having a neighborhood shower took on a whole new meaning.

Demeter

(85,373 posts)It's was all X's idea. And a good one!

DemReadingDU

(16,000 posts)10/26/12 The Oddest Revelation From the Bank of America Fraud Suit By Jonathan Weil

There is something very weird about the civil complaint the Justice Department filed this week against Bank of America Corp. (BAC) for allegedly defrauding Fannie Mae and Freddie Mac. Prosecutors are suing under a statute called the False Claims Act, which imposes liability on those who defraud the federal government. Curiously, the suit is seeking damages for acts that Countrywide Financial Corp. committed before Fannie and Freddie were seized by the government -- back when U.S. officials were adamant that Fannie and Freddie didn’t have any implicit government guarantee. (Bank of America bought Countrywide in July 2008.)

Perhaps the Justice Department has a sound case on the merits anyway; the lawsuit alleges violations of a different federal law as well. Still, I can’t help but wonder if this is how the False Claims Act was intended to be used.

The Justice Department’s complaint alleges that from 2007 through 2009 –- pay close attention to those years -- Countrywide implemented a new mortgage-origination process it called the “Hustle.” The complaint says the program generated thousands of fraudulent loans that were sold to Fannie and Freddie and later defaulted, causing the companies more than $1 billion in losses.

Fannie and Freddie were placed into government conservatorship in September 2008. Until then, the government’s position was that Fannie and Freddie were for-profit, private-sector, shareholder-owned corporations -– and most definitely not part of the government.

During testimony before Congress in 2003, then-Treasury Secretary John Snow explicitly denied there was any implicit government guarantee of Fannie or Freddie: “We do not believe there is any government guarantee, and we go out of our way to say there is not a government guarantee,” he said. “We need to be on guard against this perception. It is a perception. It is not, in our view, a reality.” Here’s a quote from U.S. Representative Barney Frank, one of the companies’ most vocal supporters in Congress, in 2003: “There is no guarantee. There's no explicit guarantee. There's no implicit guarantee. There's no wink-and-nod guarantee. Invest and you're on your own.”

Of course, now we’re being asked to believe that Countrywide was defrauding the government in 2007 and early 2008 when it was ripping off Fannie and Freddie -- in spite of the government's vehement insistence that Fannie and Freddie weren’t backed by the government in any way. The wheels of justice grind strangely.

http://www.bloomberg.com/news/2012-10-26/the-oddest-revelation-from-the-bank-of-america-fraud-suit.html

Demeter

(85,373 posts)but stuff like that will never see the inside of a courtroom....until after the revolution.

Demeter

(85,373 posts)The New England Hurricane of 1938 (or Great New England Hurricane, Yankee Clipper, Long Island Express, or simply the Great Hurricane) was the first major hurricane to strike New England since 1869. The storm formed near the coast of Africa in September of the 1938 Atlantic hurricane season, becoming a Category 5 hurricane on the Saffir-Simpson Hurricane Scale before making landfall as a Category 3 hurricane on Long Island on September 21. The hurricane was estimated to have killed between 682 and 800 people, damaged or destroyed over 57,000 homes, and caused property losses estimated at US$306 million ($4.7 Billion in 2012). Even as late as 1951, damaged trees and buildings were still seen in the affected areas. It remains the most powerful, costliest and deadliest hurricane in recent New England history, eclipsed in landfall intensity perhaps only by the Great Colonial Hurricane of 1635....wikipedia

Demeter

(85,373 posts)For many U.S. companies, the earnings period has been scary enough. For those with big overseas operations, it has been a horror show.

Corporate America overall is struggling, with year-over-year earnings expected to decline for the first time in three years. But in a big switch from last year, a high proportion of overseas business is no longer a ticket to big earnings - and, in fact, has been a hindrance.

"It's how the worm turns," said Uri Landesman, president at Platinum Partners in New York. "Right now, the U.S. is not super-exciting, but relatively speaking, it's doing well. Anybody who is doing a lot of business overseas, things are slow."

The slowed growth overseas, particularly in Europe, has hurt U.S. companies' sales. The U.S. economy is growing at a middling 2 percent at an annual rate that compares favorably with the 17-nation euro zone, which is expected to have fallen into recession in the third quarter...A basket of 39 S&P 500 companies among those having the highest percentage of sales from overseas are expected to see earnings decline 8.5 percent from a year ago. That's based on actual results from 24 companies and estimates for the rest, according to the Thomson Reuters data...

Demeter

(85,373 posts)Sweet dreams!

Demeter

(85,373 posts)Nine more banks have received subpoenas in connection with a probe into alleged widespread interest-rate manipulation by banks, a person familiar with the investigation said. The probe, a joint effort by the offices of New York Attorney General Eric Schneiderman and Connecticut Attorney General George Jepsen, could lead to civil enforcement action related to breaches of antitrust and fraud laws.

The subpoenas, which were issued in August and September but haven't been previously reported, bring the total number of subpoenas in the case to 16. The banks involved in the probe include most members of the panel that helps set the dollar London interbank offered rate. The investigation by the state prosecutors is part of a global probe, in which more than a dozen federal and other regulators across three continents are looking into allegations that several banks rigged Libor.

The nine banks that received subpoenas in August and September were: Bank of America Corp., Bank of Tokyo Mitsubishi, Credit Suisse Group AG, Lloyds Banking Group, Rabobank Groep NV, Royal Bank of Canada, Société Générale, Norinchukin Bank and West LB AG, according to the person familiar with the investigation.

(Barclays, Citigroup, Deutsche Bank, JPMorgan Chase, HSBC, Royal Bank of Scotland and UBS were in the first batch--Demeter)

Demeter

(85,373 posts)A former chief financial officer at Xilinx Inc on Friday became the latest executive to settle civil charges of being part of now-imprisoned hedge fund tycoon Raj Rajaratnam's insider trading network.

The technology executive, Kris Chellam of Saratoga, California, was charged by the U.S. Securities and Exchange Commission of giving Rajaratnam confidential information on Xilinx in December 2006.

The tip helped the Galleon Group founder, who was Chellam's close friend, make nearly $1 million in illicit profits, the SEC said in its lawsuit.

Chellam has not been criminally charged. He agreed to pay $1.75 million to settle the case, the SEC said. The agreement is subject to approval by U.S. District Judge Barbara Jones in New York...

Demeter

(85,373 posts)The bank says the customers paid unnecessary fees for their loans. If customers cash the checks, they can't later sue Wells Fargo....Thousands of Wells Fargo & Co. home loan customers recently received a surprise in the mail: refund checks from the big bank, along with letters saying they had paid unnecessary fees for their mortgages.

The unsolicited offers of thousands of dollars arrived with a catch — if the borrowers cash the checks, they can't later sue the No. 1 U.S. home lender. The San Francisco bank said in the letters that borrowers were put into more expensive loans when they could have qualified for cheaper ones.

Analysts said the letters sent to potentially 10,000 Wells Fargo borrowers were a way for the bank to sidestep further litigation over "steering" customers into unfavorable loans — allegations that the government has made about certain Wells Fargo operations in the past.

It's one in a long series of legal troubles for major mortgage lenders, the five largest of which agreed in February to a $25-billion settlement of accusations that they "robo-signed" foreclosure affidavits and otherwise abused distressed borrowers. Mortgage investors have barraged them with lawsuits over defaulted loans, and the government also recently filed separate complaints against banks including Wells Fargo, JPMorgan Chase & Co. and Bank of America Corp.

"It sounds like they either found some problems themselves or the regulators discovered them and told them to get things fixed," said Paul J. Miller, an analyst who follows Wells Fargo for Friedman, Billings, Ramsey & Co.

Wells Fargo's mailed refunds involve government-backed FHA mortgages made from 2009 through 2011. These loans are often made to borrowers with shaky credit or those who can't come up with the 20% down payments required for conventional loans.

Though they require as little as 3.5% down, the FHA loans are also more expensive because they require borrowers to pay steep insurance payments to protect against a default. However, in this case, the borrowers actually had the down payments or home equity needed to get a conventional loan, bank officials said.

Wells Fargo spokeswoman Vickee Adams said the problematic FHA loans turned up as the bank reviewed operations at two mortgage channels it has closed down: a subprime lending arm, Wells Fargo Financial, and a wholesale arm that made loans through independent brokers.

The bank previously paid a combined $260 million to settle Federal Reserve and Justice Department allegations that its lending, pay and sales quota practices in the home lending business caused borrowers to be placed into higher-cost mortgages. It didn't admit wrongdoing....

IF IT LOOKS LIKE A CON, AND SMELLS LIKE A CON, AND TASTES LIKE A CON...

http://4closurefraud.org/2011/11/10/must-read-paper-the-mers-mortgage-in-massachusetts-genius-shell-game-or-invitation-to-fraud/

Demeter

(85,373 posts)New York City’s financial markets were rolling out operational contingency plans Friday as the East Coast began to batten down the hatches in anticipation of Hurricane Sandy...Rich Adamonis, a spokesman for the New York Stock Exchange (US:NYX), said contingency plans are being drawn up. A Nasdaq OMX Group Inc. (US:NDAQ) spokesman said Friday the electronic equities exchange plans to continue to operate despite the approach of Hurricane Sandy early next week. “We have fully rehearsed business continuity plans for all critical operations including facilities, market operations and key staff and stand ready to implement should a situation necessitate,” said Nasdaq spokesman Ryan Wells. Last year, the Nasdaq and the NYSE operated even after Hurricane Irene shut down much of the region’s transportation infrastructure...The New York Mercantile Exchange said it has plans in place to make sure its markets continue to function...

While still only a Category 1 as it rumbled over the Atlantic on Friday, the hurricane could mushroom into a colossal “Frankenstorm” if it mixes with a cold front moving eastward from the Midwest, according to meteorologists. The hurricane is expected to make landfall between Washington and Boston before Monday. As of Friday evening, Sandy was trudging slowly past the northern Bahamian islands, about 420 miles southeast of Charleston, S.C., according to the National Weather Service. Click here for National Hurricane Center.

Of particular concern to officials were indications that the storm will likely hit several of the nation’s most densely populated cities, including New York, Philadelphia, Baltimore and Boston. “With the angle that it’s coming in, it’ll just pile up water right up against the shoreline,” said Henry Margusity, senior meteorologist with AccuWeather. “We’re still trying to assess the surge of water from the storm. There could be flooding up the Hudson River all the way to New York City.” Unlike a standard hurricane that focuses its power near the eye of the storm, the worst of Sandy may come from its edges, in areas spanning New England to Virginia, he said. Under a worst-case scenario, New York could face the most intense storm in its history. “There will be school closures, travel will be messed up for days and major airports will be closed,” Margusity said. “This could be a disaster of biblical proportions — a multi-billion-dollar disaster.” Winds in the storm’s outlying areas are expected to gust as high as 80 miles per hour, he said.

Demeter

(85,373 posts)SWITZERLAND tops the latest global competitiveness ranking of 144 countries by the World Economic Forum, best known for its annual shindig in Davos (a Swiss ski resort). It is closely followed by Singapore, while Finland has replaced Sweden in third place. That may be some comfort to the Finns, whose economy is lagging while Sweden’s is thriving. Of the big emerging economies, China remains on top, with Brazil moving up. The most striking fall is for the United States, which has dropped in the rankings for four years in a row. It is now seventh. The rankings, based on criteria such as availability of capital, flexibility of labour markets, economic stability, infrastructure and public services, also reveal the mountains that the troubled countries of southern Europe need to climb. Greece is in 96th place. Plotting the rankings against GDP per person reveals an unsurprising link: competitiveness brings wealth, but rich countries can most easily afford competitiveness. They can also squander it though. Outliers on the chart include countries that are more wealthy than their competitiveness suggests—or even vice-versa.

http://www.economist.com/blogs/graphicdetail/2012/09/daily-chart-2

Demeter

(85,373 posts)SORRY, ALL THE MARKET IS GETTING IS COAL FOR XMAS...

http://blogs.wsj.com/marketbeat/2012/10/23/stock-market-needs-a-little-christmas-right-this-very-instant/?mod=WSJ_latestheadlines

Demeter

(85,373 posts)Federal Reserve Chairman Ben S. Bernanke and the rest of the Federal Reserve policy committee gather again this week for what is sure to be a less dramatic meeting than last month, when they unveiled a new program of bond buying to try to drive down unemployment.

But while major changes in policy will probably be scarce when the Federal Open Market Committee unveils its handiwork Wednesday afternoon, the events of the six weeks since its last big change have shown the real importance of the Fed’s new approach to policy. The economic data has improved since that Sept. 13 announcement. At the time of the meeting, for example, Macroeconomic Advisers (which has an economic forecasting model similar to that used internally by the Fed) estimated that third-quarter gross domestic product rose at a 1.5 percent annual rate; now it estimates that number to be 2 percent. The unemployment rate plunged to 7.8 percent in September from 8.1 percent in August. Housing starts, retail sales and consumer confidence numbers have all soared.

That improvement would seem to call into question the rationale for the Fed’s decision to pump $85 billion a month into the economy, commonly known as QE3 because it is the third round of “quantitative easing.” Maybe growth is stronger than Bernanke & Co. realized at the time of that meeting, and they were faked out by a few months of bad data...Quite the contrary. Even leaving aside that some other indicators of the economy’s recent performance aren’t so hot (particularly measures of business investment and hiring), the uptick in growth could make the Fed’s decision even more potent...

TALK ABOUT SHELL GAMES!

Demeter

(85,373 posts)The next significant event for monetary policy is not the Federal Reserve’s meeting Tuesday and Wednesday, which is likely to pass quietly, but the presidential election two weeks later. Mitt Romney, the Republican nominee, has said that he opposes the Fed’s efforts to stimulate the economy as ineffective and inflationary. And as president, he has promised to appoint a new Fed chairman. The term of the current chairman, Ben S. Bernanke, runs through early 2014. But the impact could be immediate as investors revise their assumptions about the future.

“I certainly would expect the markets to respond, that they will take this as the Fed being more hawkish and that will be reflected in rates,” said Laurence H. Meyer, senior adviser at Macroeconomic Advisers and a former Fed governor.

Such a reversal would be welcomed by critics who argue that the Fed’s efforts are undermining economic stability, and mourned by supporters who say more must be done to revive economic growth. But Mr. Meyer and others cautioned that the impact would not be fully felt until it becomes clear whom Mr. Romney intends to nominate as a successor to Mr. Bernanke. A range of experts regard two of Mr. Romney’s economic advisers as the most likely candidates: R. Glenn Hubbard, who was chairman of the Council of Economic Advisers under President George W. Bush, and N. Gregory Mankiw, who followed Mr. Hubbard in that role. John B. Taylor, a Stanford University economics professor and outspoken critic of Fed policy, also is mentioned frequently. The choice of Professor Taylor — or a like-minded critic — would represent a dramatic step to change the course of monetary policy. By contrast, Professor Mankiw, an economist at Harvard University, and Professor Hubbard, dean of the Columbia University business school, both are seen as centrists. Professor Mankiw co-wrote a 2011 paper endorsing policies like those the Fed has pursued as the best way for government to enliven the economy. Professor Hubbard told Reuters TV in August that Mr. Bernanke is “a model technocrat” who should get “every consideration” for another term.

“If people really do think it would be Taylor, I would think that would interfere” with the Fed’s ability to influence markets, said Joseph Gagnon, a senior fellow at the Peterson Institute for International Economics and former Fed economist. “But if it’s not Taylor, I don’t think it would have such a large effect.”

ANTICIPATING MUCH?

Response to Demeter (Original post)

hamerfan This message was self-deleted by its author.

hamerfan

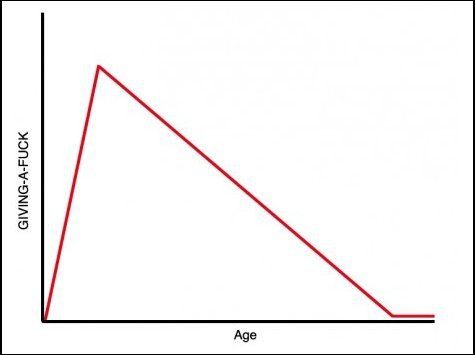

(1,404 posts)Sunday is my birthday, and this chart seems to sum up my feelings:

The Rolling Stones have a new album, oops, CD coming out next month. Here's a tune from it:

Demeter

(85,373 posts)Debt collection agencies, whose sometimes aggressive tactics have earned them scrutiny from consumer protection groups and state regulators, will come under federal supervision for the first time beginning Jan. 2, when the Consumer Financial Protection Bureau begins oversight. In addition to companies that specialize in collecting money from consumers for personal, family or household debt, the consumer bureau will begin monitoring debt collectors that contract with the Education Department to collect overdue student loans. The department has more than $850 billion in student loans outstanding, officials said.

“Millions of consumers are affected by debt collection, and we want to make sure they are treated fairly,” Richard Cordray, the director of the consumer bureau, said in a statement issued before the public release of the bureau’s rules on Wednesday. “We want all companies to realize that the better business choice is to follow the law — not break it.”

The authority to oversee debt collection agencies comes under the portion of the Dodd-Frank regulatory law that deals with so-called nonbank financial companies. The consumer agency will examine companies to ensure that they properly identify themselves to consumers and properly disclose the amount of debt owed. In addition, collectors must have a process to resolve disputes and communicate “civilly and honestly” with consumers. The rules will cover collectors that have annual receipts of more than $10 million, roughly 175 companies. They account for about 63 percent, or $7.7 billion, of the industry’s $12.2 billion in annual collections, the bureau said. Over all, there are about 4,500 debt collection companies in the United States.

Debt collection agencies have long been a target of consumer protection agencies, which accuse collectors of abusive practices like repeatedly engaging consumers or threatening to have them imprisoned for failure to pay debts. The industry accounts for a large portion of consumer complaints to the Federal Trade Commission, which enforces restrictions against abusive practices. The F.T.C. said it collected more than 180,000 complaints about debt collectors in 2011, up from 13,950 in 2000

“There has been an explosion of shady debt collection tactics in recent years,” Suzanne Martindale, a staff attorney for Consumers Union, said. “Businesses have a right to collect what they are owed but not to harass consumers for debt that has been already paid off or doesn’t belong to them.”

But debt collectors said that regulators, including the consumer bureau, have characterized the companies inaccurately, particularly about how they respond to consumer complaints. They said the number of complaints increased in large part because it has become easier to file them online....The consumer agency is releasing its final rules identifying the types of companies it will oversee on Wednesday, when it also will conduct a public hearing in Seattle on debt collection practices.

DemReadingDU

(16,000 posts)The Perfect Storm

Warning! This synopsis may contain spoilers

In September 1991,the swordfishing boat,The Andrea Gail,returns to port in Gloucester,Massachusetts,with a poor catch. Desperate for money,Billy Tyne(The Captain),convinces the crew to join him for one more late season fishing expedition. They head out past their usual fishing grounds,leaving a developing thunderstorm,behind them. Initially unsuccessful,they head to the Flemish Cap,where their luck improves. At the height of their fishing the ice machine breaks;the only way to preserve their catch is to hurry back to shore. After debating whether to sail through the building storm or to wait it out,the crew decide to risk the storm. However,between the Andrea Gail and Gloucester is a confluence of 2 powerful weather fronts and a hurricane,which the crew of Andrea Gail underestimate. After repeated warnings from other ships,the Andrea Gail loses her antenna,forcing a fellow ship to call in a Mayday. An Air National Guard rescue helicopter responds,but after failing to perform a midair refuel,the helicopter crew ditch the aircraft before it crashes,and all but one of the crew members are rescued by a Coast Guard Vessel,The Tamaroa.

The Andrea Gail endures various problems;with 40-foot/12 meter waves crashing on to the deck,a broken stabilizer ramming the side of the ship,and two men are thrown overboard. The crew decide to turn around to avoid further damage by the storm. After doing so,the vessel encounters an enormous rogue wave. After attempting and failing to ride over the wave,the stricken fishing vessel capsizes and sinks. Only Bobby Shatford,manages to get out of the boat;however,he has no chance of surviving. He is last seen all alone among the waves. Back at shore a memorial ceremony is carried out while friends and family worry and wait for a ship that never comes home.

http://www.imdb.com/title/tt0177971/synopsis

Fuddnik

(8,846 posts)It gives so much detail, even right down to what the body goes through when you drown.

I liked the movie, but the book was way better.

xchrom

(108,903 posts)

xchrom

(108,903 posts)The superstorm expected to develop from Tropical Storm Sandy probably will cut power to millions of people for a week, ground airplanes and may bring a tidal surge and rain that combine to flood coastal areas.

The system, dubbed “Frankenstorm” by the National Weather Service, will grow out of Sandy and two other storms rushing eastward across the U.S., said Tom Kines, a senior meteorologist at AccuWeather Inc. in State College, Pennsylvania. As many as 43 people were killed when Sandy crossed the Caribbean at hurricane strength, the Associated Press reported. Sandy weakened to tropical-storm force today.

The National Guard and Air Force put as many as 45,000 personnel in seven states on alert for possible duty in response to the storm, according to George Little, a spokesman for the Defense Department in Washington.

“Because of the large size of the system and the slow motion, it’s going to be a long-lasting event, two to three days of impacts for a lot of people,” said James Franklin, branch chief at the National Hurricane Center in Miami. “The kinds of things we are looking at ultimately would be wind damage, widespread power outages, heavy rainfall, inland flooding and again, somebody is going to get a significant surge event out of this.”

xchrom

(108,903 posts)

Last month, a Senate investigative panel put a spotlight on how the accounting firm Ernst & Young LLP helped Hewlett-Packard Co. (HPQ) use gimmicks and loopholes to avoid taxes on billions of dollars of profits stashed overseas.

The program involved money transfers through the Cayman Islands, as well as transactions structured to make cash distributions into the U.S. from offshore subsidiaries seem like nontaxable loans. Ernst & Young isn’t just a tax consultant to HP; it is also the computer maker’s outside auditor.

hat means Ernst & Young had to opine on whether HP accounted properly for the financial-reporting effects of Ernst & Young’s own tax advice. This dual role -- auditor of the books, plus adviser on how to get around the tax laws -- is allowed under U.S. auditor-independence rules, even though it results in firms auditing their own work. That’s not the worst part, though.

Here we have the U.S. approaching the edge of a fiscal cliff. More than $600 billion of federal spending cuts and tax increases are set to take effect in January unless Congress acts. And it isn’t just politicians who are to blame. Tax avoidance, legal and otherwise, by large multinational corporations is a significant cause of the budget deficit.

xchrom

(108,903 posts)Standard and Poor’s (S&P) ratings agency downgraded three French banks on Friday, including global giant BNP Paribas, as new data showed French consumer confidence had once again hit record lows.

S&P lowered its long-term outlook for BNP Paribas to A+ from AA- and placed another 10 French banks on negative outlook, including Société Générale, Crédit Agricole, Allianz Bank and Crédit Mutuel.

BNP, France's No. 1 listed bank, fell 3.1 percent to 38.39 euros in early Friday trade, behind Société Générale and Crédit Agricole, respectively down 3.7 and 3.4 percent, on the news. They were among the biggest decliners in the STOXX Europe 600 bank index .SX7P, down 1.5 percent.

"The economic risks under which French banks operate have increased in our view, leaving them moderately more exposed to the potential of a more protracted recession in the eurozone," the ratings agency said in a statement.

Demeter

(85,373 posts)xchrom

(108,903 posts)xchrom

(108,903 posts)Several months ago, we reported about a troubling development in Vietnam, happy inflationary host of one of the world's most rapidly devaluing and best named currencies, that in direct refutation of Ben "Gold is not money, it is tradition" Bernanke's claim that gold is just a trinket one can fondle with no inherent value, the local banks had gone as far as paying the local residents a dividend to "store" their gold (recall all those charges against gold that it never, ever pays a dividend....).

However, as we subsequently warned, any time a bank, and especially an entire banking sector, is willing to pay you paper "dividends" for your gold, run, because all this kinda of (s)quid pro quo usually ends up as a confiscation ploy.

Sure enough, as Dow Jones reports today, the gold, which did not belong to the banks and was merely being warehoused there (or so the fine print said), was promptly sold by these same institutions to generate cash proceeds and to boost liquidity reserves using other people's gold, obtained under false pretenses.

Now, it is time for the forced sellers to become forced buyers, as "the State Bank of Vietnam, the country's central bank, may allow local banks to buy up to 20 metric tons of gold over the next two months to improve their liquidity ahead of a ban soon on their use of gold as a means of boosting their operating capital."

Read more: http://www.zerohedge.com/news/2012-10-26/vietnamese-banks-who-paid-dividend-stored-gold-were-quietly-selling-it-appear-solven#ixzz2AV5ge2CZ

Demeter

(85,373 posts)xchrom

(108,903 posts)Over the past several months we have been discussing that this is no longer your "father's economy." What we have meant by this is the economic environment today is vastly different than that which most of our parents grew up in. We recently discussed in "Debt: Driving Our Economy Since 1980" that: "From the 1950’s through the late 1970’s...the U.S. was the manufacturing and production powerhouse of the entire global economy post the wide spread devastation of Europe, Germany and Japan during WWII. The rebuilding of Europe and Japan, combined with the years of pent up demand for goods domestically, led to a strongly growing economy and increased personal savings. However, beginning in 1980 the world changed. The development of communications shrank the global marketplace while the rise of technology allowed the U.S. to embark upon a massive shift to export manufacturing to the lowest cost provider in order to import cheaper goods."

The importance of this shift in the U.S. from away from being the epicenter of global production and manufacturing to a service and finance based economy should not be overlooked. This transition is responsible for the issues that are impeding economic growth in the U.S. today from structural unemployment, declining wage growth and lower economic prosperity. The four-panel chart below gives you a visualization of this transition showing the year-over-year change in the data, with the exception of the personal savings rate which is linear, prior and post-1980.

Demeter

(85,373 posts)xchrom

(108,903 posts)

Richard Herman, 53, was so upset with firms phoning him up and trying to sell him goods and services he decided to charge them for the time they took out of his day.

He recorded the calls and then sent an invoice charging £10 for every minute he spent on the phone.

When they refused to pay up he sued them at the small claims court and won.

The marketing company AAC agreed to pay the full £195 for 19-and-a-half minutes of calls, plus a £25 court fee.

Read more: http://www.businessinsider.com/cold-caller-firm-pays-out-for-wasting-businessmans-time-2012-10#ixzz2AV8DXGFI

xchrom

(108,903 posts)Hurricane Sandy could merge with a winter storm out of the west and an arctic blast of air from Canada to become the worst Northeast storm in 100 years, described as a Frankenstorm.

National Weather Service meteorologist Paul Kocin tells Bloomberg: “What we’re seeing in some of our models is a storm at an intensity that we have not seen in this part of the country in the past century ... We’re not trying to hype it, this is what we’re seeing in some of our models. It may come in weaker.”

New York, Pennsylvania, Maryland and Virginia have all declared states of emergency in advance of the megastorm.

Find out if you live in a New York City hurricane evacuation zone.

Click here for all of our Hurricane Sandy coverage.

Read more: http://www.businessinsider.com/hurricane-sandy-map-2012-10#ixzz2AVBZlFim

Fuddnik

(8,846 posts)I'm making a batch right now. Depending on how you blend it, you can make either a salsa or sauce.

Habanero-Cranberry Sauce

Ingredients

1 bag fresh cranberries

1 habanero chile

1 clove garlic, peeled

1 cup sugar

1/2 cup water

1/2 cup orange juice, not from concentrate or fresh squeezed

Directions

Put first five ingredients in a sauce pan and bring to boil.

Lower heat and simmer till thickened.

Remove from heat and add orange juice.

Let cool about 15 minutes, then place in a food processor.

Pulse to desired consistency.

Fuddnik

(8,846 posts)That's what Al Rokkor, on the Weather Channel is calling it. I guess it has a little bit of everything in it.

Demeter

(85,373 posts)THE REAL QUESTION IS: WHO IS THE LIAR? AND CONSIDER HOW MANY PEOPLE LIVE IN THE NORTHEAST, AND THEN SAY THAT THINGS ARE "LOOKING UP".

AND BY THE WAY, UNEMPLOYMENT IS UP IN MICHIGAN

http://www.washingtonpost.com/blogs/ezra-klein/wp/2012/10/20/unemployment-is-falling-everywhere-except-the-northeast-what-gives/

The U.S. economy has an unexpected weak spot. It’s not Ohio or Michigan or any of the usual suspects. It’s the Northeast... According to the latest data from the Bureau of Labor Statistics, U.S. unemployment is falling in 41 states — including most of the swing states. But there’s one huge exception. Unemployment in the Northeast United States appears to have been getting significantly worse over the past year. (That includes everything from Pennsylvania and New Jersey up to Maine.) The Northeast unemployment rate has risen from 7.9 percent in April to 8.5 percent this past September:

You can see a similar story in this chart from Calculated Risk. Unemployment rates in states like Ohio, Michigan, even California and Nevada have all dropped significantly from their recession peak. Even if some of those states are still struggling, the trend is encouraging.* (* Correction: Actually, as Marcy Wheeler points out, I spoke too soon in the case of Michigan. The state’s unemployment rate is up from 8.3 percent in April to 9.3 percent in September. It did go down last month—and Michigan is still in a far better place than it was during the worst of the recession—but that’s a worrisome uptick.)But it’s the opposite in states like New York, New Jersey, Connecticut, and Pennsylvania. Those states have barely improved at all since the worst of the recession. Indeed, as Evan Soltas observed at Bloomberg, the recent deterioration of the Northeast — a region that was holding up relatively well in 2010 and 2011 — helps explain why the U.S. unemployment rate has fallen so slowly this year.

So… any theories? The popular line among politicians in New York and New Jersey is that the unemployment numbers are just plain wrong. The Bureau of Labor Statistics says that the jobless rate in New York climbed from 8.2 percent when Gov. Andrew Cuomo took office last year to 9.1 percent today. Cuomo’s administration, by contrast, says that this is out of whack with state payroll data that show rising job growth. (It’s possible, for instance, that BLS’s household surveys are missing population growth in New York City.) Another theory is that the Northeast has been hit harder by the slowdown and debt crisis in Europe than anywhere else. As Steve Cochrane of Moody’s Analytics has noted, the Northeastern U.S. exports more to Europe than any other region. Manufacturing has shrunk more rapidly here than anywhere else in the country this year. And the already-shrinking financial sector in New York and Connecticut has been battered by the euro zone’s debt crisis.

One thing Cochrane pointed out in his “U.S. Regional Outlook” report last year was that the Northeast had greater “downside risks” and was more susceptible to a global slowdown than any other region in the country. The South has benefited greatly from oil and gas production. The West is buoyed by growth in technology firms. The Midwest has “the most diversified export markets.” But, he noted, the Northeast is still getting crunched by the slowdown in the financial sector. Note also that the housing market has been slower to recover in the Northeast than in the rest of the country, at least judging from the latest data on home sales and prices. And, as Soltas points out, states like New Jersey, Pennsylvania, and Connecticut are all seeing a sharp cutback in public sector employment. In any case, the Northeast’s woes aren’t likely to get a ton of political attention, since most of the states here aren’t swing states for the presidential race. But this slowdown might help explain why the Senate contest in Connecticut remains so close—that’s usually a clear blue state—as well as why Pennsylvania is a tight race. But either way, it’s certainly an important economic story.

HE DOESN'T HAVE TO SOUND SO CHIPPER ABOUT IT!

Demeter

(85,373 posts)TALK ABOUT YOUR SLOW LEARNER, POOR LISTENER, DOESN'T KNOW WHICH SIDE OF HIS BREAD IS BUTTERED...

http://www.washingtonpost.com/business/economy/obama-says-hell-renew-pursuit-of-grand-bargain-offering-specifics-on-agenda/2012/10/24/0e2b843c-1e0e-11e2-9cd5-b55c38388962_story.html

President Obama, criticized as failing to offer a vision for a potential second term, has begun sketching out his agenda with greater specificity in recent days, including a pledge to solve the nation’s intractable budget problems within “the first six months.” In an interview made public Wednesday, Obama said he would pursue a “grand bargain” with Republicans to tame the national debt and would quickly follow that with a push to overhaul the nation’s immigration laws.

...STOP ME IF YOU'VE HEARD THAT ONE BEFORE...

With less than two weeks until Election Day, Obama chose to highlight two issues that have bedeviled him during his presidency: the debt, which has soared past $16 trillion on his watch, and immigration legislation, which never got off the launching pad over the past three years. Both are politically significant, with the debt a concern among independent voters and immigration important to the Hispanics who could decide whether Obama carries swing states such as Colorado and Nevada.

The interview, conducted Tuesday with the editor and publisher of the Des Moines Register, the largest newspaper in Iowa, also marked an unusual moment in the president’s dealings with the press. Obama had initially insisted that the exchange, which he conducted by phone from a stop in Florida, be off the record. Then on Wednesday, his campaign abruptly decided to release a transcript after the newspaper’s editor, Rick Green, wrote a blog post calling the interview terms a “disservice” to voters. Obama is seeking the influential paper’s endorsement. The transcript gave a surprising glimpse of Obama as political pundit, gaming out timetables and calculations for his dealings with Capitol Hill Republicans. He predicted, for instance, that an expectedly poor showing by Republican challenger Mitt Romney among Hispanics would put pressure on GOP lawmakers to ease their opposition to an immigration overhaul that offers a path to citizenship for illegal immigrants....

WHEELER-DEALER DRONE BOY...TWISTING IN WHICHEVER WIND IS BLOWING AT THE MOMENT. A VERITABLE FLYWEIGHT. ON PAR WITH MILLARD FILLMORE...

Fuddnik

(8,846 posts)Same shit, different flies.

The repukes will be more than happy to stymie him for the next four years. And take the whole damned world down with them.

Unfortunately, I voted two weeks ago.

Demeter

(85,373 posts)It's not like FDR will be reincarnated, or Pecora, or any of the giants of our glorious past.

And that's more than depressing. If I knew that the country would be ruled by bought-off pygmies, I would have trained for public office, instead of engineering. There was a whole crop of promising young public servants from the Boomers. What happened to them all? I knew some of them, at EPA and such.

Demeter

(85,373 posts)THAT WOULD BE IRONIC, WOULDN'T IT? ONCE THE SCREAMING AND DYING WERE OVER, OF COURSE...

http://www.zerohedge.com/contributed/2012-10-26/more-dozen-nuclear-plants-near-hurricane-sandy%E2%80%99s-path-brace-impactcc

Bloomberg reports:

The NRC met earlier today to discuss the necessary precautions to take for the storm, Sheehan said. Plants must begin to shut if wind speeds exceed certain limits, he said. As of 2 p.m. New York time (FRIDAY), Sandy had winds of 75 miles (121 kilometers) per hour, according to the National Hurricane Center in Miami. It was about 430 miles south-southeast of Charleston, South Carolina, moving north at 7 mph. The current Hurricane Center track calls for the system to come ashore just south of Delaware Bay on Oct. 30.

Reuters provides a list:

The following lists the nuclear reactors and utilities in Sandy’s potential path.

While we don’t foresee any problems, the risk of nuclear accident in the U.S. is actually much greater than it was in Japan before Fukushima. For example, fuel pools in the United States store an average of ten times more radioactive fuel than stored at Fukushima, and have virtually no safety features.

Let’s review the list and look at examples of problems experienced by the nuclear plants in Hurricane Sandy’s path:

It’s not surprising that there have been problems at all of these nuclear plants. After all, the U.S. has 23 reactors which are virtually identical to Fukushima. The archaic uranium reactor designs developed more than 40 years ago are only good for making bombs. Most American nuclear reactors are old. They are aging poorly, and are in very real danger of melting down. And yet the NRC is relaxing safety standards at the old plants. Indeed, while many of the plants are already past the service life that the engineers built them for, the NRC is considering extending licenses another 80 years, which former chairman of the Tennessee Valley Authority and now senior adviser with Friends of the Earth’s nuclear campaign David Freeman calls “committing suicide”.

Demeter

(85,373 posts)1. The names on those reactors--the owners--such a fine outstanding group of bastards. They'll be sure to fuck it up.

2. This is one way to take care of Wall St. and the higher unemployment in the Northeast....not the way I'd choose, but nobody's asked me.

BONUS POINT! THE ELECTION IS THE WEEK AFTER...UNLESS SOMEBODY TAKES ADVANTAGE OF A CRISIS AND DECLARES MARTIAL LAW....

xchrom

(108,903 posts)

The elite Beijing Sports Car Club was founded in 2009 and meets once per week in an exclusive lounge near the city's football stadium. The club's 700 members also travel on luxury trips together to places like Las Vegas and London.

A visit with Mr. Huang, one of the richest and most controversial men in the People's Republic of China, is full of surprises. Take, for example, the four pairs of climbing boots lined up like exhibits behind the door to his office. "I was at the South Pole and North Pole, and twice on Mt. Everest with these," says Huang, pointing proudly to a series of photos that serve as proof of his adventures. There are Buddha statues and various animals in the adjacent rooms, including rhesus monkeys and pygmy rabbits in cages, as well as small sharks swimming in circles in a large aquarium leaning against a wall.

"I love nature," says Huang Nubo, 56, a businessman with an estimated net worth of at least $1 billion (€772 million). The founder and chairman of the Beijing Zhongkun Investment Group, Huang discovered a market niche: He builds resorts with an emphasis on sustainable design. His company benefits from the new wanderlust and "green" consciousness of the affluent Chinese upper and middle classes.

He tells the short version of life story while a Siam cat purrs on his lap. He was orphaned at 13, and in 1960 his father committed suicide after a quarrel with a party secretary. His mother later died of grief. He attended Beijing University, joined the Communist Party to further his career and became an official in the party's propaganda division. Then he withdrew from politics and founded his company.

"As an entrepreneur, you have more freedom than you do in politics, and you can usually move around more," says Huang, whose party connections certainly didn't hurt his growing business. But, as he points out, "Chinese society has developed unevenly, which isn't good. Too many people are losing out." This is why Huang gives a substantial portion of his profits to the needy. With charitable donations of about $5 million a year, he is seen as one of the country's most generous philanthropists.

xchrom

(108,903 posts)MADRID (AP) -- About 3,000 off-duty police officers are demonstrating in Madrid to protest the government's austerity measures, including the cancellation of their Christmas bonuses.

Saturday's protest blocked one of the capital's central boulevards opposite the Interior Ministry. On-duty police officers watched as their plainclothes colleagues demonstrated by throwing loud and smoky fireworks and chanting slogans.

A demonstrator was medically treated after a firework he was set to throw exploded in his hand.

One Spaniard in four is now unemployed as the economic crisis tightens its grip. The government is under pressure to seek aid to ease debts while the country sinks into its second recession in three years.

Demeter

(85,373 posts)backstory--the kid has had his car repo'ed and his house foreclosed.

Demeter

(85,373 posts)

In this satellite image provided by National Oceanic and Atmospheric Administration, Hurricane Sandy's huge cloud extent of up to 2,000 miles churns over the Bahamas, as a line of clouds associated with a powerful cold front approaches the U.S. East Coast on Friday.

It's still not clear whether Sandy will be a devastating storm or just a bad one. It is clear, however, that Sandy will be remembered as the storm that broke all the rules and baffled the nation's top weather forecasters. Early Saturday morning, the storm was downgraded from a hurricane to a tropical storm by the National Weather Service — only to be returned to hurricane status a few hours later. Either way, forecasters warn, "widespread impacts" are still expected along the coast. Three days before reaching land — a time when the National Hurricane Center usually puts a bulls-eye on a small stretch of coast — government forecasters were still talking about the possibility of the storm striking anywhere from Maryland to New York.

Their uncertainty was especially surprising because hurricane track forecasts have become so good in the past couple of decades. They are usually accurate five or more days out. Yet during a press conference on Friday, James Franklin of the NHC was still deflecting reporters' questions about Sandy's track. "We cannot be precise at this stage about exactly where it will come in," he said.

Forecasters say Sandy just isn't like other hurricanes. "The whole thing is unprecedented," Henry Margusity of AccuWeather told NPR's Melissa Block. "We've never seen anything like this."

For one thing, Sandy is about to start moving the opposite direction from a typical storm system. Tropical storms in the Atlantic usually make a right turn and head out to sea as they travel north up the coast. But Sandy is expected to turn left and head straight inland. That's because the storm is expected to encounter a highly unusual weather pattern. This pattern "blocks the system from going north and east and forces it to go more westward," said Louis Uccellini of the National Oceanic and Atmospheric Administration.

Another odd thing about Sandy is that it is expected to get slightly stronger as it moves north. Usually, hurricanes weaken as they reach cooler waters. The reason for this strengthening is that Sandy is about to undergo a strange metamorphosis, forecasters say. Shortly before it reaches land, it will begin to encounter cold air from the north, and this cold air will change Sandy to something more like a winter storm. As a practical matter, this means that instead of drawing its power primarily from warm ocean water the way a hurricane usually does, Sandy will be powered by pressure and temperature differences in the atmosphere, Uccellini says. So it can pick up strength when most storms would be weakening.

Becoming a winter-type storm also means Sandy won't have the usual structure of a hurricane, with a clearly defined eye. Instead it will be an enormous swirling mass of wind and rain, and even snow. Of course Sandy isn't the first late-season storm to behave oddly. In 1991, right around Halloween, a hurricane named Grace merged with a powerful nor'easter to become what's still known as "the perfect storm."

I DON'T REMEMBER GRACE--SHE PROBABLY DIDN'T MAKE IT TO NH.

xchrom

(108,903 posts)http://www.businessinsider.com/hurricane-sandy-map-2012-10

Hurricane Sandy is a big deal. Although there is always a chance that the storm could go out to sea, weather experts are 90 percent certain that Sandy will strike the U.S. East Coast, gaining in strength and size as it comes ashore.

There are many factors that come together to make Sandy so destructive.

The hybrid storm

First, Sandy is a hurricane, which is menacing by itself. But as the storm moves north, it will combine with a winter storm, or strong low pressure system, from Canada.

The blending of these two weather systems is what makes Sandy so unusual. Experts call it the "perfect storm." Conditions like these have not been seen since the New England Hurricane of 1938, which generated 50-foot waves and killed 500 people.

Read more: http://www.businessinsider.com/hurricane-sandy-frankenstorm-dangerous-2012-10#ixzz2AWU5YUjJ

Demeter

(85,373 posts)Bottom line: The president is complicit in creating an increasingly unequal -- and unjust -- society...this piece is an attempt at laying out the progressive case for why one should not vote for Barack Obama for reelection, even if you are in a swing state.

There are many good arguments against Obama, even if the Republicans cannot seem to muster any. The civil liberties/antiwar case was made eloquently a few weeks ago by libertarian Conor Friedersdorf, who wrote a well-cited blog post on why he could not, in good conscience, vote for Obama. While his arguments have tremendous merit, there is an equally powerful case against Obama on the grounds of economic and social equity. That case needs to be made...So why oppose Obama? Simply, it is the shape of the society Obama is crafting that I oppose, and I intend to hold him responsible, such as I can, for his actions in creating it. Many Democrats are disappointed in Obama. Some feel he’s a good president with a bad Congress. Some feel he’s a good man, trying to do the right thing, but not bold enough. Others think it’s just the system, that anyone would do what he did. I will get to each of these sentiments, and pragmatic questions around the election, but I think it’s important to be grounded in policy outcomes. Not, what did Obama try to do, in his heart of hearts? But what kind of America has he actually delivered? And the chart below answers the question. This chart reflects the progressive case against Obama.

The above is a chart of corporate profits against the main store of savings for most Americans who have savings — home equity. Notice that after the crisis, after the Obama inflection point, corporate profits recovered dramatically and surpassed previous highs, whereas home equity levels have remained static. That $5-7 trillion of lost savings did not come back, whereas financial assets and corporate profits did. Also notice that this is unprecedented in postwar history. Home equity levels and corporate profits have simply never diverged in this way; what was good for GM had always, until recently, been good, if not for America, for the balance sheet of homeowners. Obama’s policies severed this link, completely. This split represents more than money. It represents a new kind of politics, one where Obama, and yes, he did this, officially enshrined rights for the elite in our constitutional order and removed rights from everyone else (see “The Housing Crash and the End of American Citizenship” in the Fordham Urban Law Journal for a more complete discussion of the problem). The bailouts and the associated Federal Reserve actions were not primarily shifts of funds to bankers; they were a guarantee that property rights for a certain class of creditors were immune from challenge or market forces. The foreclosure crisis, with its rampant criminality, predatory lending, and document forgeries, represents the flip side. Property rights for debtors simply increasingly exist solely at the pleasure of the powerful. The lack of prosecution of Wall Street executives, the ability of banks to borrow at 0 percent from the Federal Reserve while most of us face credit card rates of 15-30 percent, and the bailouts are all part of the re-creation of the American system of law around Obama’s oligarchy.

The policy continuity with Bush is a stark contrast to what Obama offered as a candidate. Look at the broken promises from the 2008 Democratic platform: a higher minimum wage, a ban on the replacement of striking workers, seven days of paid sick leave, a more diverse media ownership structure, renegotiation of NAFTA, letting bankruptcy judges write down mortgage debt, a ban on illegal wiretaps, an end to national security letters, stopping the war on whistle-blowers, passing the Employee Free Choice Act, restoring habeas corpus, and labor protections in the FAA bill. Each of these pledges would have tilted bargaining leverage to debtors, to labor, or to political dissidents. So Obama promised them to distinguish himself from Bush, and then went back on his word because these promises didn’t fit with the larger policy arc of shifting American society toward his vision. For sure, Obama believes he is doing the right thing, that his policies are what’s best for society. He is a conservative technocrat, running a policy architecture to ensure that conservative technocrats like him run the complex machinery of the state and reap private rewards from doing so. Radical political and economic inequality is the result. None of these policy shifts, with the exception of TARP, is that important in and of themselves, but together they add up to declining living standards.

While life has never been fair, the chart above shows that, since World War II, this level of official legal, political and economic inequity for the broad mass of the public is new (though obviously for subgroups, like African-Americans, it was not new). It is as if America’s traditional racial segregationist tendencies have been reorganized, and the tools and tactics of that system have been repurposed for a multicultural elite colonizing a multicultural population. The data bears this out: Under Bush, economic inequality was bad, as 65 cents of every dollar of income growth went to the top 1 percent. Under Obama, however, that number is 93 cents out of every dollar. That’s right, under Barack Obama there is more economic inequality than under George W. Bush. And if you look at the chart above, most of this shift happened in 2009-2010, when Democrats controlled Congress. This was not, in other words, the doing of the mean Republican Congress. And it’s not strictly a result of the financial crisis; after all, corporate profits did crash, like housing values did, but they also recovered, while housing values have not.

This is the shape of the system Obama has designed. It is intentional, it is the modern American order, and it has a certain equilibrium, the kind we identify in Middle Eastern resource extraction based economies. We are even seeing, as I showed in an earlier post, a transition of the American economic order toward a petro-state. By some accounts, America will be the largest producer of hydrocarbons in the world, bigger than Saudi Arabia. This is just not an America that any of us should want to live in. It is a country whose economic basis is oligarchy, whose political system is authoritarianism, and whose political culture is murderous toward the rest of the world and suicidal in our aggressive lack of attention to climate change...MUCH MORE WORTHYOF YOUR READING....We need to build a different model of politics, one in which people who want a different society are willing to actually bargain and back up their threats, rather than just aesthetically argue for shifts around the margin. The good news is that the changes we need to make are entirely doable. It will cost about $100 trillion over 20 years to move our world to an entirely sustainable energy system, and the net worth of the global top 1 percent is $103 trillion. We can do this. And the moments to let us make the changes we need are coming. There is endless good we can do, if enough of us are willing to show the courage that exists within every human being instead of the malevolence and desire for conformity that also exists within every heart.

Systems that can’t go on, don’t. The political elites, as much as they kick the can down the road, know this. The question we need to ask ourselves is, do we?

bread_and_roses

(6,335 posts)... except maybe for more drones. What does that tell us? Last time, we heard promises we hadn't heard in - what? I can't remember. Certainly not from the timid and uninspiring Gore and Kerry. But after 8 years of Bush, we had to have promises that things would "change."

This time, not even that.

Demeter

(85,373 posts)the articles I'm finding are so depressing, that I cannot do it.

Plus, it's bedtime. Sweet dreams, all. We will cross the bridge of ugliness tomorrow.

hamerfan

(1,404 posts)Rock You Like A Hurricane. The Scorpions:

xchrom

(108,903 posts)xchrom

(108,903 posts)Thousands of people flocked to Spain's parliament building, chanting anti-austerity slogans

Thousands of people have joined fresh protests in the Spanish capital, Madrid, angered by budget cuts and calling on the government to quit.

Demonstrators held a minute's silence with their backs to parliament, then shouted "resign" with fists clenched.

Parliament was guarded by hundreds of police officers.

xchrom

(108,903 posts)Things are happening in Spain.

On Thursday, the government unveiled a draconian budget - its latest attempt to get its borrowing under control.

And on Friday, independent auditors confirmed that the country's banks would need an extra 59bn euros ($76bn; £47bn) - most of it from the government - to prop them up.

And then there's one other big event that many suspect is drawing closer - Spain's government is under pressure to request a formal bailout, not just for its banks, but also for itself.

Here, then, are the six big questions that are likely to be playing on Prime Minister Mariano Rajoy's mind:

Can the government cut its borrowing?

Some economists would say this is a wrong-headed question.

Spain is stuck in an economic trap, they argue, with large debts, an overvalued currency and collapsing property market, and it is entirely right for the government to borrow and spend unprecedented amounts to prop the economy up.

Demeter

(85,373 posts)Get a clue from Iceland.

xchrom

(108,903 posts)***SNIP

Some of the goals outlined are specific, others more aspirational. They include:

Boosting Australia's average national income from $62,000 (£41,000) per person now to $73,000 in 2025

Improving the school system so it is ranked in the world's top five, with 10 of its universities in the world's top 100

Making studies of Asia a core part of the Australian school curriculum

Giving all students the opportunity to learn a priority Asian language - Chinese (Mandarin), Hindi, Indonesian or Japanese

Making sure more business leaders are "Asia-literate"

A member of the 21-member Asia-Pacific Economic Cooperation (Apec) group, Australia is one of the 11 nations involved in negotiations for a Trans-Pacific Partnership (TPP), both of which aim to liberalise regional trade.

xchrom

(108,903 posts)xchrom

(108,903 posts)

A range of protesters from communists to academics mount a 'No Monti Day' demonstration against government austerity policies in downtown Rome October 27, 2012. (Photo: Reuters/Alessandro Bianchi)

Tens of thousands of anti-austerity protesters marched through Rome on Saturday, declaring "No Monti Day" in growing anger over austerity measures introduced by Prime Minister Mario Monti.

Since last November, Monti's government has pushed through extreme painful spending cuts, pension overhauls, and tax hikes, all of which reach into the pockets of the lower and working classes of Italy.

"We are here against Monti and his politics, the same politics as all over Europe, that brought Greece to its knees and that are destroying half of Europe, public schools, health care," said demonstrator Giorgio Cremaschi, expressing the growing regional discontent with the Eurozone's handling of the financial crisis.

"United with a Europe that is rebelling. Let's get rid of the Monti government," read one of the banners held at the demonstration.

xchrom

(108,903 posts)Demeter

(85,373 posts)It is remarkable that social security hasn't been a more prominent issue in the presidential race. After all, Governor Romney has proposed a plan that would imply cuts of more than 40% for middle-class workers just entering the labor force. Since social security is hugely popular across the political spectrum, it would seem that President Obama could gain an enormous advantage by clearly proclaiming his support for the program. But President Obama has consistently refused to rise to the defense of social security. In fact, in the first debate, he explicitly took the issue off the table, telling the American people that there is not much difference between his position on social security and Romney's.

On its face, this is difficult to understand. In addition to being good politics, there are also solid policy grounds for defending social security. The social security system is perhaps the greatest success story of any program in US history. By providing a core retirement income, it has lifted tens of millions of retirees and their families out of poverty. It also provides disability insurance to almost the entire workforce. The amount of fraud in the system is minimal, and the administrative costs are less than one 20th as large as the costs of private-sector insurers. In addition, the program is more necessary now than ever. The economic mismanagement of the last two decades has left the baby boomers ill-prepared for retirement – few have traditional pensions. The stock market crashes of the last 15 years have left 401(k)s depleted, and the collapse of the housing bubble destroyed much of their housing equity, which has always been the main source of wealth for middle-income families.

It would be great if we had reason to believe that the generations that followed had better retirement prospects, but we don't. Even in good times, the 401(k) system does more to enrich the financial industry than to provide a secure retirement income. Any reasonable projection indicates that social security will provide the bulk of retirement income for most middle-class retirees long into the future. In this context, the idea of cutting back benefits, even for younger workers, seems misguided.

But there is another set of economic considerations affecting the politics of social security. These considerations involve the economics of the political campaigns and the candidates running for office. The story here is a simple one: while social security may enjoy overwhelming support across the political spectrum, it does not poll nearly as well among the wealthy people – who finance political campaigns and own major news outlets. The predominant philosophy among this group is that a dollar in a workers' pocket is a dollar that could be in a rich person's pocket – and these people see social security putting lots of dollars in the pockets of people who are not rich. Cutting back benefits could mean delays in repaying the government bonds held by the Trust Fund. The money to repay these bonds would come primarily from a relatively progressive income tax revenue. The wealthy certainly don't want to see changes like raising the cap on wages that are subject to the social security tax, which is currently just over $110,000.

For this reason, a candidate who comes out for protecting social security can expect to see a hit to their campaign contributions. They also can anticipate being beaten up in both the opinion and news sections of major media outlets....

************************************************************

Dean Baker is co-director of the Center for Economic and Policy Research and author of the new book, The End of Loser Liberalism?

Demeter

(85,373 posts)The Fix the Debt coalition is using the so-called “fiscal cliff” to push the same old corporate agenda of more tax breaks while shifting the burden on to the rest of us...“Fix the Debt” is a coalition of more than 80 CEOs who claim they know best how to deal with our nation’s fiscal challenges. The group boasts a $60 million budget just for the initial phase of a massive media and lobbying campaign.

The irony is that CEOs in the coalition’s leadership have been major contributors to the national debt they now claim to know how to fix. These are guys who’ve mastered every tax-dodging trick in the book. And now that they’ve boosted their corporate profits by draining the public treasury, how do they propose we put our fiscal house back in order? By squeezing programs for the poor and elderly, including Social Security, Medicare, and Medicaid.

Fix the Debt claims their agenda is not just about spending cuts. But when it comes to their tax proposals, they use the slippery term “pro-growth reform” to push for cuts in deductions that are likely to include credits for working families and — you guessed it — more corporate tax breaks. Chief among these is a proposal to switch to a territorial system under which corporate foreign earnings would be permanently exempted (instead of being taxed when they are returned to America). This idea, also supported by the Bowles-Simpson deficit commission, would make it even more profitable for big corporations to use accounting tricks to disguise U.S. profits as income earned in tax havens. Citizens for Tax Justice estimates that such tax haven abuse will cost the Treasury more than $1 trillion over the next decade.

So who are the CEOs who are telling the rest of us to be responsible and tighten our belts after they’ve spent decades stiffing the U.S. Treasury? Of the 80 members of Fix the Debt’s CEO Fiscal Leadership Council, here are 10 that stand out as the biggest hypocrites:

1. Jeffrey Immelt, General Electric

2. Jim McNerney, Boeing

3. Lloyd Blankfein, Goldman Sachs

4. Brian T. Moynihan, Bank of America

5. David Cote, Honeywell Corporation

6. Randall Stephenson, AT&T

7. Arne Sorenson, Marriott International

8. Alexander Cutler, Eaton Corporation

9. Lowell McAdam, Verizon

10. Steve Ballmer, Microsoft

UGLY DETAILS AT LINK

Sanders to CEOs: Look in the Mirror

When Fix the Debt launched their 80 CEO-strong coalition on October 25, Senator Bernie Sanders responded by stating, “Before telling us why we should cut Social Security, Medicare and other vitally important programs, these CEOs might want to take a hard look at their responsibility for causing the deficit and this terrible recession.”

MORE

Demeter

(85,373 posts)...Though a lot of Americans really (really, really) hate paying taxes, most of us can at least justify it as our contribution to some greater good, whether it’s the broad range of social programs favored by progressives or a libertarian night watchman state. But what if the government instead told us, “We don’t want your money, but we would like to make friends with some rich guys, so just give it to them and let them have fun with it”? That could soon be the law of the land in Pennsylvania, where the state legislature has passed a bill that would, as Philadelphia City Paper blogger Daniel Denvir describes it, “allow companies that hire at least 250 new workers in the state to keep 95-percent of the workers' withheld income tax.” These workers will essentially be paying their employers for the privilege of having a job. Some have called this “corporate socialism,” but it also calls to mind an even older economic model that was once popular in Europe – except back then, the bosses were called lords. It’s a more modern innovation in the U.S., but combined with increased political pressure from employers and a crackdown on workers’ rights, it all adds up to feudalism, American-style.