Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 11 October 2012

[font size=3]STOCK MARKET WATCH, Thursday, 11 October 2012[font color=black][/font]

SMW for 10 October 2012

AT THE CLOSING BELL ON 10 October 2012

[center][font color=red]

Dow Jones 13,344.97 -128.56 (-0.95%)

S&P 500 1,432.56 -8.92 (-0.62%)

Nasdaq 3,051.78 -13.24 (-0.43%)

[font color=green]10 Year 1.67% -0.06 (-3.47%)

30 Year 2.88% -0.07 (-2.37%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

jtuck004

(15,882 posts)Could I have a link please?

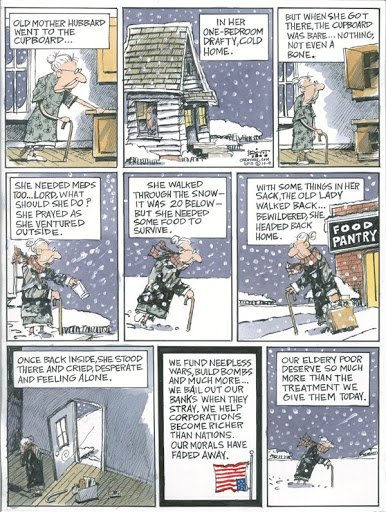

DemReadingDU

(16,000 posts)the link doesn't give the author. I'd like to have the original link for the author or newspaper where it is found.

Thanks the great toon today, Tansy!

Tansy_Gold

(17,865 posts)www.cagle.com but they don't like hot links so I had to copy it into a file of my own and then post that link.

The economy is pretty much off the cartoonists' radar right now, except for the flap (pun intended) about Big Bird and PBS.

I thought it was interesting listening to Robert Reich last night, I think on the Ed Show, mentioning "fear" several times. I've said from the beginning that this is how the right wing nutcases operate: They generate and then play on the fears of people who aren't capable to seeing through to the truth.

Rachel Maddow needs to have Barry Glassner on her show. Or Wendy Kaminer. (Hear that, Rache?) No, not Charlie Pierce, because he'd be too funny and everyone would think he's only kidding.

mother earth

(6,002 posts)than the one percent who line their pockets. How else do you get someone to vote outside of their own best interest? Fear and disinfo.

Great OP/cartoon, Tansy. That's reality these days for the majority.

Ghost Dog

(16,881 posts)sometimes happy human beings.

Beautiful. But unsustainable.

The logic is ... terrible.

otherone

(973 posts)Demeter

(85,373 posts)Not quite 99% of us...not yet.

Demeter

(85,373 posts)

otherone

(973 posts)sigh..

Roland99

(53,342 posts)DOW +0.2%

NASDAQ +0.4%

xchrom

(108,903 posts) ?__SQUARESPACE_CACHEVERSION=1326185544357

?__SQUARESPACE_CACHEVERSION=1326185544357Demeter

(85,373 posts)Don't ask. Just pray.

xchrom

(108,903 posts)Demeter

(85,373 posts)Day two in the new school program for the Kid....

xchrom

(108,903 posts)Demeter

(85,373 posts)We are talking autism here....

xchrom

(108,903 posts)xchrom

(108,903 posts)

Christine Lagarde has called for decisive action from world leaders to end uncertainties in the global economy that are prolonging “terrifying and unacceptable” levels of unemployment.

Rounding on Europe and the US in particular, the managing director of the International Monetary Fund said this week’s annual meetings in Tokyo needed to be marked by “courageous action on behalf of our members”.

Speaking just days after the IMF slashed its global growth forecasts for both this year and next, Ms Lagarde said the economic weakness was not just a result of “tail risks” such as a eurozone break-up but “the degree of uncertainty in many corners of the world – whether it is Europe or America”.

“It is deterring investors from investing and creating jobs,” she said. “We need action to lift the veil of uncertainty.”

Read more: http://www.businessinsider.com/lagarde-jobless-rates-are-terrifying-2012-10#ixzz28zZbUTrb

Demeter

(85,373 posts)What a hypocrite.

xchrom

(108,903 posts)i should have known better...sigh.

Ghost Dog

(16,881 posts)It says here: http://investmentwatchblog.com/the-spanish-financial-system-completely-collapses-and-spain-is-about-to-reboot-with-a-100-percent-decline-in-gdp-and-100-percent-unemployment-its-absolutely-terrifying/

Spanish Revolution very possible. I say.

xchrom

(108,903 posts)and here the people in charge are supposed to be smarter than us.![]()

Demeter

(85,373 posts)and saving their own necks goes...but probably still not smart enough to overcome the 99% advantage in numbers!

Ghost Dog

(16,881 posts)Would be more along the lines of Anglo-Saxon/American (ie. not exactly Austrian) racist economics?

xchrom

(108,903 posts)

NEW DELHI (AP) — As Western sanctions squeeze Iran and its currency tumbles, the country's energy minister wooed Indian businesses for more investment and trade.

Majid Namjoo told a meeting of Indian business leaders Wednesday that huge business opportunities exist with Iran's private sector, which remains largely unaffected by sanctions imposed by the United States and the European Union.

Namjoo is on a four-day visit to India to explore the possibilities of trade and joint ventures in renewable energy, power, pharmaceuticals, agriculture and food processing.

The United States and the European Union have imposed sanctions on Iran to deter it from pursuing a nuclear weapons program. Iran insists its nuclear program is for peaceful purposes.

Read more: http://www.businessinsider.com/iranian-minister-woos-india-2012-10#ixzz28zaqZjKV

***i think trade between india and iran is a geographic natural.

xchrom

(108,903 posts)

Brian Eno has created a new iPad app, Scape, that aims to revolutionise the concept of the 'album'.

"I've got nothing against records - I've spent my life making them - but they are a kind of historical blip," says Brian Eno. We're in his Notting Hill studio talking about Scape, the iPad application that Eno has made with musician and software designer Peter Chilvers. Scape challenges the concept of what an 'album' of music can be.

"Until about 120 years ago," Eno says, "all music was ephemeral in the sense that you would never actually hear the same thing twice. Recording changed that. You could listen to an identical thing over and over and over again and that's what all of us grew up doing. Most of our experience is of perfectly repeatable music."

He adds: "Scape is positioned exactly halfway between the traditional experience of music as constantly changing and the last hundred years experience, as a totally fixed thing."

Read more: http://www.businessinsider.com/brian-enos-new-app-redefines-the-concept-of-an-album-2012-10#ixzz28zcxrga9

xchrom

(108,903 posts)Oct. 11 (Bloomberg) -- Goldman Sachs Group Inc. President and Chief Operating Officer Gary D. Cohn sees a “small” probability that the euro area will stick together, saying it’s more likely that some countries will exit to pursue growth.

“In federalism, you create a unified Europe, where the countries that are thriving because of the currency subsidize the countries that are contracting because of the currency,” Cohn said in an interview in Tokyo today. “I would put a relatively small probability of that happening.”

The European Central Bank program pledging unlimited support to debt-burdened nations if they sign up for economic reforms deals with the “pre-existing condition” but hasn’t addressed the lack of growth, Cohn said. ECB President Mario Draghi pledged to “do whatever it takes” to defend the euro as officials seek to stem the debt crisis.

Europe still needs a “moment” similar to Lehman Brothers Holdings Inc.’s 2008 bankruptcy, Cohn said, reiterating comments made in June. The 17 countries that share the euro must find ways to support economic growth in the weaker members, he had said at that time, adding that austerity programs don’t support expansion.

Read more: http://www.businessinsider.com/goldman-small-chance-euro-area-holds-2012-10#ixzz28zdkPx1e

Demeter

(85,373 posts)I WOULDN'T KNOW--IT'S NEVER BEEN TRIED

http://davidbrin.blogspot.com/2012/10/the-tytler-insult-is-democracy-hopeless.html

Well... it's back. One of the best examples of a mass-hypnotic pseudo-wisdom that helps to lobotomize politics in American life.

"A democracy is always temporary in nature; it simply cannot exist as a permanent form of government. A democracy will continue to exist up until the time that voters discover that they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates who promise the most benefits from the public treasury, with the result that every democracy will finally collapse over loose fiscal policy, (which is) always followed by a dictatorship."

This widely-circulated nostrum is called the "Tytler Calumny" and it is the great example of what has gone wrong with the mental processes of our friends on the right, who used to be represented in sage debate by great minds like Barry Goldwater and Friedrich Hayek and William F. Buckley... but who are now reduced to slinging around aphorisms and fact-free fox-assertions. (In fairness, after watching Bill O'Reilly hold his own with Jon Stewart in the great 2012 Rumble in the Air-Conditioned Auditorium, I have to admit, there are still islands of sort-of almost Goldwater-style adult-honesty on that side, though lamentably rare, as this missive will show you.)

First off, although named for a 19th Century Englishman Alexander Tytler, there is no actual evidence that Tytler actually said it! This aphorism is also often attributed falsely to historian Arnold Toynbee or Lord Thomas Macauley, or even Alexis de Tocqueville, although recent scholarship appears to follow a trail leading to a 1943 speech by one Henning Webb Prentis, Jr., President of the Armstrong Cork Company.

It is often accompanied by another feat of cynicism called the Fatal Sequence:

"Great nations rise and fall in a 200 year cycle. The people go from bondage to spiritual truth, to great courage, from courage to liberty, from liberty to abundance, from abundance to selfishness, from selfishness to complacency, from complacency to apathy, from apathy to dependence, from dependence back again to bondage."

...And indeed, there certainly are some patterns! Such as the dominance, in 99% of human societies, of small cabals of owner oligarchs, who passed on their property-based power to sons who never did a thing to earn it. The persistent-feudal pattern that Adam Smith and the American Founders strove so hard to break. Yes, I see the pattern-seeking allure. But I've learned to be wary of glib nostrums that seem just too convenient to be true. Consider how the Tytler Calumny appeals to the vanity of the one repeating it. The sad cynicism of someone who considers himself above the hoi polloi of the mere "people." It is a blithe dismissal of even the possibility that a democracy can maintain itself. This despite the fact that -- if you include the vigorous colonial legislatures -- we in the U.S. have three centuries of ever-ripening success, on this continent alone, becoming steadily mightier at the same pace that we've grown more inclusive.

The calumny draws believers, despite the fact that our democracy has accomplished more prodigious feats, more wonders and more improvements to human happiness and knowledge than all of humanity's other nations and cultures combined. By far. By orders of magnitude. The Tytler nostrum sounds "logical" in its smug contempt for the masses... except that it runs contrary to actual fact. For example, when the citizens of Athens voted against distributing the windfall from new silver mines to every citizen, and instead asked Thucydides to invest it in their future. Would most kings have done that? All through the 1990s, Bill Clinton allied himself with fiscal moderates of both parties to stave off efforts by the supply-siders to raid the budget surplus and give it all -- not to the People -- but to the rich. Clinton and Senators Tsongas (D) and Rudman (R) and others in the moderate middle were able to accomplish that because they were backed up by the public! By opinion polls showing that the middle class overwhelmingly wanted the budget surplus spent on paying down debt. And not on tax cuts for themselves. Should we be surprised? Indeed, who is more likely to have the habit of weighing the consequences of debt? Middle class citizens who must wrestle with tradeoffs, stanching their impulses and appetites every day, in favor of budgeting tightly for the future? Or aristocrats who are accustomed to indulging whims out of copious coffers, knowing that there are always more coppers, pennies, pfennigs etc to be squeezed from those below them on the pyramid?

Both before and after 2001, those who were demanding that all the surplus be "given back to us, right now" were aristocrats. The same caste that bankrupted most past societies...

MORE--A GOOD READ

Demeter

(85,373 posts)...Merkel was the epitome of understanding. Greece is in a “very difficult period,” she said, but should “finish what it has started,” otherwise “things will be even harder.” It’s about “our children and grandchildren.” Then, brutally, she pointed at the sword of Damocles hanging over Greece: “Of course, we are not the representatives from the Troika.”

The mighty Troika. It will come out with a report that had been delayed, rescheduled, and re-rescheduled. It will spell out whether or not Greece complied with the agreed-upon 89 “structural reforms.” It’s a huge report, worked on for months, a shield for politicians to hide behind, even for Merkel [Greece Prints Euros To Stay Afloat, The ECB Approves, The Bundesbank Nods, No One Wants To Get Blamed For Kicking Greece Out].

And what was the purpose of her visit, a reporter asked. “I came here to understand the situation on the ground,” she said. “Close contact leads to greater understanding. What the visit means to Greeks, I don’t know.”

ANGELA ISN'T MUCH FOR MENDING FENCES, IS SHE?

xchrom

(108,903 posts)BERLIN (AP) -- Europe's economic outlook darkened further Thursday when top economists slashed their growth forecasts for Germany and warned that public support for financial aid for struggling countries was evaporating.

In a joint report for the Economy Ministry released Thursday, leading economic research institutes said they now expect gross domestic to increase by only 1 percent in 2013 instead of 2.0 percent. They said the financial woes of other eurozone nations were weighing on the currency bloc's largest economy, hurting business spending on new equipment and production facilities, a key component of growth.

They said that Germany risked a worse outcome if political leaders around the eurozone do not keep up their efforts to control the debt crisis. A new eruption of market tensions - which have calmed recently due to action by the European Central Bank - could make things worse. If the debt crisis should worsen and borrowing costs for troubled countries spike, they said, "there is a great danger Germany will fall into recession."

They also noted that patience was "evaporating" in Europe's richer countries such as Germany and Finland for continued financial support for indebted countries such as Greece.

xchrom

(108,903 posts)MADRID (AP) -- The Spanish government's dilemma over whether to request a European bailout has become more acute following a downgrade of the cash-strapped country's credit rating.

Standard & Poor's late Wednesday cut its rating on Spain's debt by two notches to BBB-, just a step above junk status, or non-investment grade. That could make it more expensive for the Spanish government to borrow money as it might scare some of its bond investors away.

The agency said it was concerned by the deepening economic recession, which has seen unemployment rise to nearly one in four and fueled social discontent. It also noted that the government's hesitation in requesting a European financial lifeline was "potentially raising the risks to Spain's rating."

Though S&P's warning may nudge the Spanish government to make a bailout request sooner rather than later, rival agency Moody's has indicated it may cut its rating for Spain in the event of a bailout request.

xchrom

(108,903 posts)WASHINGTON (AP) -- The number of Americans seeking unemployment aid plummeted last week to seasonally adjusted 339,000, the lowest level in more than four years. The sharp drop offered a hopeful sign that the job market could pick up.

The Labor Department said Thursday that weekly applications fell by 30,000 to the fewest since February 2008. The four-week average, a less volatile measure, dropped by 11,500 to 364,000, a six-month low.

Weekly applications are a proxy for layoffs. They can fluctuate sharply from week to week. If they stay near last week's level, it would likely signal better hiring ahead.

When applications consistently drop below 375,000, it suggests that hiring is strong enough to lower the unemployment rate.

Roland99

(53,342 posts)My daughter is now working part-time for Party City. They hired nearly 30 part-time workers to handle the Halloween decoration/costume rush but those jobs will disappear after November. I'd bet that same thing is happening in many of these stores across the country.

seems it was just seasonally adjusted but the actual claims is up over the previous week:

http://www.dol.gov/opa/media/press/eta/ui/current.htm#.UHbFmlEuf30

xchrom

(108,903 posts)Roland99

(53,342 posts)The numbers are cooked like the Three Bears' porridge. Except there isn't any "just right".

Tansy_Gold

(17,865 posts)And after the Halloween "season" will come the "christmas/channukah/kwanzaa" season of gift buying and cold weather clothing, etc. So I'm not sure what "seasonal adjustment" means any more, other than I am going to have to adjust to rain today.

jtuck004

(15,882 posts)of the stores, and coffee houses, and home health care aide orgs who pay too little, give people a little money to pay the utility for their unpaid heating that only lasted until February, or part of the bills from the emergency room they have to use. Then millions can begin a new under-employed year only a little less in debt.

The American Dream is nightmare for too damn many.

Roland99

(53,342 posts)xchrom

(108,903 posts)WASHINGTON (AP) -- The U.S. trade deficit widened in August as exports fell to the lowest level in six months, a worrisome sign that a slowing global economy is cutting into demand for U.S. goods.

The deficit increased to $44.2 billion in August, the biggest gap since May and a 4.1 percent increase from July, the Commerce Department said Thursday.

Exports dropped 1 percent to $181.3 billion. Demand for American-made cars and farm goods declined. Imports edged down a slight 0.1 percent to $225.5 billion as purchases of foreign-made autos, aircraft and heavy machinery fell. The cost of oil imports rose sharply.

A wider trade deficit acts as a drag on growth because it means the U.S. is earning less on overseas sales of American-produced goods while spending more on foreign products.

Roland99

(53,342 posts)U.S. SEPT NON-PETROLEUM IMPORT PRICES +0.2 PCT, YEAR-OVER-YEAR -0.9 PCT

U.S. SEPT EXPORT PRICES +0.8 PCT (CONSENSUS +0.4 PCT) VS AUG +1.0 PCT (PREV +0.9 PCT)

U.S. SEPT IMPORT PRICES +1.1 PCT (CONS. +0.7 PCT) VS AUG +1.1 PCT (PREV +0.7 PCT)

US AUG OIL IMPORT PRICE $94.36/BBL VS JULY $93.83/BBL, -8.1 PCT FROM AUG'11 $102.65/BBL

US AUG EXPORTS -1.0 PCT VS JULY -1.1 PCT, IMPORTS -0.1 PCT VS JULY -0.6 PCT

Demeter

(85,373 posts)The Washington Post has a new multi-part investigation into the wealth of Congressmembers, including an in-depth look at how legislators personally benefit from laws that they pass. They dug into financial disclosure forms from all 535 members of the Senate and House of Representatives, looking at how many millionaires there are on Capitol Hill, who made money and who lost it during their time in office, and much, much more.

One of the key findings was that while Americans saw their median net worth fall a full 39 percent during the crisis years of 2007-2010, the median wealth of members of Congress rose 5 percent in that time, and the wealthiest third saw their riches increase by 14 percent.

Interestingly, the 253 millionaires in the current session of Congress, the Post noted, is the smallest group in eight years—though “The numbers are likely to be underestimated because lawmakers are not required to list their homes among their assets.” That may be a result of an influx of Tea Party freshmen in 2010 – many of them "outsiders" who bested more established candidates.

Seventy-two of those members may have doubled their estimated wealth between 2004 and 2010, though the Post's estimates are inexact because members of Congress don't have to report exact details. Eleven of them, including House Minority Leader Nancy Pelosi, may have added more than $10 million to their net worth. (The Post has statements by spokespeople for many of the members called out by name in the piece; Pelosi's explained that, “San Francisco is one of the places where the market has skyrocketed in terms of price per square foot and has been fairly insulated in terms of the 2008 financial crisis.”) MORE

Demeter

(85,373 posts)JP Morgan Chase CEO Jamie Dimon, wearing a dark suit possibly made of sackcloth, didn't hold back when discussing the derivative trades that led to massive losses for his company.

"We made a stupid error," he said before a lunchtime audience at the Council on Foreign Relations in Washington on Wednesday. "We screwed up." Then he got more specific: "I should have caught it ... I didn't."

The company estimates it lost $5.8 billion, thanks to a London-based trader, nicknamed the "London whale," who took large, risky positions in credit derivatives. But Dimon noted that making mistakes is part of capitalism. When companies make errors, "they learn from it," he said.

Critics might point out, however, that when immense banks make mistakes, they might also turn around and ask Congress for multi-billion-dollar bailouts. That's been known to happen.

Demeter

(85,373 posts)...Although Mr. Romney’s standing declined by two points in the Gallup national tracking poll, he improved slightly in four other tracking surveys, from Rasmussen Reports, Ipsos, Investors’ Business Daily and the RAND Corporation. And the state polling data that came in on Wednesday was generally consistent with about a three-and-a-half-point bounce for Mr. Romney, similar to previous days. There is some spotty evidence that Mr. Romney’s bounce may have been as large as five or six points in polls conducted in the 48 hours after the debate, so perhaps the most recent data does reflect something of a comedown for him. But if his bounce started out at five or six points and has now settled in at three or four, that would still reflect an extremely profound swing in the race — consistent with the largest shifts produced by past presidential debates. We’ll see what happens once the news cycle turns over, such as after Thursday’s vice-presidential debate. For the time being, however, Mr. Romney continues to rocket forward in our projections. The forecast model now gives him about a one-in-three chance of winning the Electoral College (more specifically, a 32.1 percent chance), his highest figure since Aug. 22 and more than double his chances from before the debate. Mr. Romney may have increased his chances of becoming president by 15 or 20 percent based on one night in Denver.

The more troubling sign for Mr. Romney, however, is that although he’s made gains, he does not seem to have taken the lead in very many state polls. That trend, if anything, has become more entrenched. Of the half-dozen or so polls of battleground states published on Wednesday, none showed Mr. Romney ahead; the best result he managed was a 48-48 tie in a Rasmussen Reports poll of New Hampshire. (We ran the model on Wednesday before the latest polls from Marist College, The Philadelphia Inquirer, or The New York Times, Quinnipiac University and CBS News were published overnight, which were also suggestive of a narrow advantage for Mr. Obama in the majority of swing states.)

How to reconcile this against the fact that Mr. Romney is about tied — or perhaps even has a small lead — in the average of national polls right now? From a forecasting standpoint, this is the question that the whole election may turn upon. There are basically four ways to explain the difference.

1) This is a statistical quirk that will work its way out of the system.

2) Mr. Obama has some pronounced advantage in the Electoral College relative to his position in the popular vote.

3) The state polls systematically overestimate Mr. Obama and underestimate Mr. Romney.

4) The national polls systematically overestimate Mr. Romney and underestimate Mr. Obama.

... some of our competitors are issuing forecasts suggestive of a very large difference between the Electoral College and the popular vote — to a degree that is frankly not credible, in my view. (We’ll compare the FiveThirtyEight forecasts against some alternatives in a moment.)...In the chart below, I’ve compared the results from the FiveThirtyEight “now-cast” as of Wednesday night to those issued by three other polling sites: Real Clear Politics, HuffPost Pollster and Talking Points Memo’s PollTracker. The results cover the 11 battleground states that the campaigns have made a material amount of advertising expenditures in, along with each site’s estimate of the national popular vote. On average among the 11 battleground states, we show Mr. Obama with a 2.3 percentage point lead, or 1.9 percentage points as weighted by each state’s turnout in 2008. Among the four methods, we have the worst figure for Mr. Obama in Iowa, New Hampshire, New Mexico and Wisconsin, and the highest in none. Our average result for Mr. Obama among the 11 states is also the lowest of the four systems, although tied with RealClearPolitics if weighted by turnout...The flip-side is that our estimate of Mr. Obama’s national popular vote is the highest of the four systems: the “now-cast” shows him one and a half percentage points ahead nationally, while HuffPost Pollster shows a tie, and the other two methods have Mr. Romney slightly ahead.

Thus, we perceive only about a half-point difference between Mr. Obama’s performance in the battlegrounds and his national figures. This is similar to the actual results from 2008, when Mr. Obama won the 11 battleground states by an average of 7.7 percentage points (weighted by turnout) and the national popular vote by 7.3 points. By contrast, Talking Points Memo has Mr. Obama three points ahead on average in the battlegrounds, but three points behind in the national popular vote — a six-point spread. Real Clear Politics shows about a three -and-a-half-point gap, while HuffPost Pollster, whose methodology is the most similar to FiveThirtyEight, has a two-point difference. A two-point difference is within the realm of possibility, although our model would require a bit more evidence to support a difference that large (specifically, poor polling for Mr. Obama in non-battleground states relative to his polling in swing states). But there’s just no way that Mr. Obama would be even-money in the Electoral College if he were trailing in the national popular vote by four to six points.

All of this is a very long-winded way of answering the question in the headline: is Mr. Romney ahead right now? None of the systems that rely on state-level polling say that he’s ahead in the Electoral College right now, although the FiveThirtyEight models perceive a slightly smaller Electoral College gap between Mr. Romney and Mr. Obama than some of the other systems.

MORE THAN YOU WILL EVER WANT TO KNOW ABOUT POLLING AT LINK

IMO, IT'S THE SLACKER-IN-CHIEF'S TO LOSE....

xchrom

(108,903 posts)When it comes to publicly urging greater integration, most European leaders aren't to be outdone.

"We need more Europe, not less," says German Chancellor Angela Merkel. "We don't need less Europe, but rather more intelligent integration," contends Luxembourg Prime Minister Jean-Claude Juncker. And French President François Hollande says: "We realize that the euro zone must have a common economic policy."

Herman Van Rompuy appears to take these affirmations literally. At next week's European Union summit, the EU Council President intends to present a bold concept to fundamentally restructure the monetary union.

According to this proposal, the European Commission, the EU's executive, would gain the right not only to recommend amendments to national draft budgets, but also to enforce them. If a government resists, the Brussels-based institution would have the power to impose fines.

Demeter

(85,373 posts)

AnneD

(15,774 posts)end up as GOP door mat.

xchrom

(108,903 posts)Greece’s unemployment rate climbed to more than a quarter of the workforce in July, extending its record high as the country’s five-year recession deepened.

The jobless rate rose to 25.1 percent from a revised 24.8 percent in June, the Athens-based Hellenic Statistical Authority said in an e-mailed statement from today. That’s the highest since the agency began publishing monthly data in 2004.

Greece’s recession and deepening labor slump has been exacerbated by austerity measures imposed to trim a budget deficit that was more than five times the euro-area limit in 2009. Prime Minister Antonis Samaras’s coalition government is hashing out a 13.5 billion-euro ($17.4 billion) package of budget cuts for 2013 and 2014 needed to keep rescue loans from the euro area and the International Monetary Fund flowing.

“The unemployment rate is a lagging indicator of domestic economic activity,” said Platon Monokroussos, head of financial market research at Eurobank Ergasias SA in Athens. “One should expect a further increase in the jobless rate for as long as domestic economic conditions remain depressed.”

Demeter

(85,373 posts)I'm going to go do something useful, like sleep.

xchrom

(108,903 posts)xchrom

(108,903 posts)

The "New York by Gehry" residential building, stands in New York.

Manhattan apartment rents surged in September, coming within 2.1 percent of the peak, as improving employment boosted competition among tenants.

The median monthly rent jumped to $3,195, up 10 percent from a year earlier and 3.2 percent from August, according to a report today by appraiser Miller Samuel Inc. and broker Prudential Douglas Elliman Real Estate. The number of new leases signed last month jumped 55 percent from a year earlier to 2,535, as renters facing sharp renewal increases moved out in search of better deals, said Jonathan Miller, president of New York-based Miller Samuel.

“This is not a fluke,” he said. “This is where the die has been cast for the next year or two years.”

Improving employment in the city has increased demand for leasing, putting monthly rents on course to surpass the 2006 peak of $3,265 in the first quarter of 2013, according to Miller. Newly hired potential tenants are competing for housing in a market already crowded with would-be homebuyers who are lingering in their apartments because they can’t get a mortgage, he said. New York City added 77,400 jobs in the 12 months through August, according to the state Labor Department.

xchrom

(108,903 posts)A type of financing that peaked before credit markets seized up four years ago is staging a comeback just as concern mounts that corporate profits are falling and the global economy is losing steam.

Offerings of $2.1 billion in the past 30 days of so-called payment-in-kind notes, which allow borrowers to pay interest with extra debt, account for more than a third of this year’s $6 billion of deals, according to data compiled by Bloomberg. Pharmaceutical Product Development Inc., a Wilmington, North Carolina-based contract research firm, sold $525 million of the notes yesterday.

Sales of high-yield, high-risk bonds are soaring to a record pace as interest rates hover at unprecedented lows send investors toward riskier assets. JPMorgan Chase & Co. says credit metrics are deteriorating, with leverage at investment- grade borrowers potentially approaching financial crisis levels by year-end, as the International Monetary Fund lowers its global growth forecast to the slowest pace since 2009.

“You only hear about PIK bonds when the high-yield markets are really frothy,” William Larkin, a fixed-income money manager who helps oversee $500 million at Cabot Money Management Inc. in Salem, Massachusetts, said in a telephone interview. The trend “is OK if we’re at that part of the cycle where things start to accelerate. But we don’t know that.”

xchrom

(108,903 posts)

According to the complaint, Blackstone President Tony James, seen here wrote in an e-mail to KKR co-founder George Roberts in reference to the Freescale Semiconductor Ltd. buyout,“We would much rather work with you guys than against you.”

Top executives at buyout firms including Blackstone Group LP (BX), KKR & Co. (KKR), Bain Capital Partners LLC and Carlyle Group (CG) LP assured each other in e-mails that they wouldn’t compete on deals to avoid driving up prices and angering competitors, according to a now public court complaint.

“We would much rather work with you guys than against you,” Blackstone President Tony James wrote in an e-mail to KKR co-founder George Roberts in reference to the Freescale Semiconductor Ltd. (FSL) buyout, according to the complaint. “Together we can be unstoppable but in opposition we can cost each other a lot of money.” According to the complaint, Roberts replied, “Agreed.”

The disclosures are a setback for the industry’s efforts to clean up its image, which has come under scrutiny as Bain Capital co-founder Mitt Romney seeks to become the next U.S. president. Individuals and pension funds that held shares in companies including Freescale, HCA Holdings Inc. (HCA), Neiman Marcus Group Inc., Clear Channel Communications Inc. and Aramark Holdings Corp. sued the private-equity firms and large investment banks including Goldman Sachs Group Inc. (GS) and JP Morgan Chase & Co (JPM) in 2007 and 2008.

The correspondence was cited as evidence that the firms rigged bids in 19 leveraged buyouts and eight other transactions, including the biggest deals of the leveraged buyout boom, according to the amended complaint unsealed yesterday by a federal judge in Boston.

xchrom

(108,903 posts)THE EUROPEAN Central Bank did more to finance the Irish economy before the State’s bailout than “perhaps any central bank did for any economy”, the institution’s former chief Jean-Claude Trichet has said.

The ECB’s dealings with Ireland in the run-up to the rescue two years ago has been a source of controversy since the late Brian Lenihan claimed last year that the Frankfurt bank had betrayed Ireland by bouncing the government into a rescue programme.

The Irish Times disclosed new information last month about the pressure the bank brought to bear on the then government, which culminated in an insistence it apply for a bailout or risk losing emergency support for Irish banks. Mr Trichet wrote three letters to the late Mr Lenihan, then minister for finance, and spoke with him directly more than a week before the Fianna Fáil-Green coalition applied to the EU and International Monetary Fund for the bailout in November 2010.

Asked yesterday if he believed his letters to Mr Lenihan would be published, Mr Trichet declined to say but stressed that the ECB had taken unprecedented steps to help Ireland’s banks during the period.