Economy

Related: About this forumAnonymous Weekend Economists August 31-September 3, 2012

Why Anonymous?

Well, I am hoping to be as anonymous as the next man or woman...keep my head down and all that. And I am hoping that Anonymous is still on the side of all those men and women...although, one never knows who will sell you out next. I doubt that the 1% has the brains to try to buy off Anonymous...because the price would most likely include depriving them of a small portion of all the loot they have stolen.

But mostly it's Anonymous because I am otherwise without a theme--Clueless has already been taken.

In its early form, the concept has been adopted by a decentralized online community acting anonymously in a coordinated manner, usually toward a loosely self-agreed goal, and primarily focused on entertainment. Beginning with 2008, the Anonymous collective has become increasingly associated with collaborative, international hacktivism. They undertook protests and other actions in retaliation against anti-digital piracy campaigns by motion picture and recording industry trade associations. Actions credited to "Anonymous" are undertaken by unidentified individuals who apply the Anonymous label to themselves as attribution. Some analysts have praised Anonymous as the freedom fighters of the internet, and a digital Robin Hood, although others have condemned them as "anarchic cyber-guerrillas".

Although not necessarily tied to a single online entity, many websites are strongly associated with Anonymous. This includes notable imageboards such as 4chan, their associated wikis, Encyclopædia Dramatica, and a number of forums. After a series of controversial, widely publicized protests, distributed denial of service (DDoS) and website defacement attacks by Anonymous in 2008, incidents linked to its cadre members have increased. In consideration of its capabilities, Anonymous has been posited by CNN to be one of the three major successors to WikiLeaks. In 2012, American magazine Time named Anonymous as one of the most influential groups of people in the world.---Wikipedia

And why not Anonymous? The 1%ers are embarrassed to garner public attention...because it's usually when they are caught with their pants down, hands in the cookie jar, or running around with boorish political hacks. Or all three.

So, let's take their masks off, shall we?

Demeter

(85,373 posts)There'd have to be a damn good reason to shut the FDIC in Podunk on a 3 day weekend....

Demeter

(85,373 posts)While a majority of jobs lost during the downturn were in the middle range of wages, a majority of those added during the recovery have been low paying, according to a new report from the National Employment Law Project. The disappearance of midwage, midskill jobs is part of a longer-term trend that some refer to as a hollowing out of the work force, though it has probably been accelerated by government layoffs.

“The overarching message here is we don’t just have a jobs deficit; we have a ‘good jobs’ deficit,” said Annette Bernhardt, the report’s author and a policy co-director at the National Employment Law Project, a liberal research and advocacy group.

The report looked at 366 occupations tracked by the Labor Department and clumped them into three equal groups by wage, with each representing a third of American employment in 2008. The middle third — occupations in fields like construction, manufacturing and information, with median hourly wages of $13.84 to $21.13 — accounted for 60 percent of job losses from the beginning of 2008 to early 2010. The job market has turned around since then, but those fields have represented only 22 percent of total job growth. Higher-wage occupations — those with a median wage of $21.14 to $54.55 — represented 19 percent of job losses when employment was falling, and 20 percent of job gains when employment began growing again. Lower-wage occupations, with median hourly wages of $7.69 to $13.83, accounted for 21 percent of job losses during the retraction. Since employment started expanding, they have accounted for 58 percent of all job growth. The occupations with the fastest growth were retail sales (at a median wage of $10.97 an hour) and food preparation workers ($9.04 an hour). Each category has grown by more than 300,000 workers since June 2009.

Some of these new, lower-paying jobs are being taken by people just entering the labor force, like recent high school and college graduates. Many, though, are being filled by older workers who lost more lucrative jobs in the recession and were forced to take something to scrape by.

Since then, she has cobbled together a series of temporary jobs in retail and home health care and worked as a part-time receptionist for a beauty salon. She is now working as an unpaid intern for a construction company, putting together bids and business plans for green energy projects, and has moved in with her 86-year-old father in Forked River, N.J.

“I really can’t bear it anymore,” she said, noting that her applications to places like PetSmart and Target had gone unanswered. “From every standpoint — my independence, my sense of purposefulness, my self-esteem, my life planning — this is just not what I was planning.”

jtuck004

(15,882 posts)which can be found here and many other places.

This one ought to be posted right under it, perhaps at eye level.

Here.

Report found Here.

Also from the report

"... The unbalanced recession and recovery have meant that the long-term rise in inequality in the U.S. continues.

The good jobs deficit is now deeper than it was at the start of the 21st century ..."

It's hard to fathom that even the most joyous about "the recovery" ignore the idea that all the new jobs might just be from the inertia we create while circling the drain.

Response to Demeter (Reply #2)

jtuck004 This message was self-deleted by its author.

Demeter

(85,373 posts)SEE ABOVE FOR THE REASON WHY IT HAPPENED...

http://www.thecrimson.com/article/2012/8/30/academic-dishonesty-ad-board/

Nearly half of more than 250 students in "Introduction to Congress" are under investigation...

I WOULD SAY THEY ALL ACED THE COURSE...BUT I'M A REALIST AND A CYNIC

Demeter

(85,373 posts)Diane Szukovathy wondered why, in her opinion, the federal government is working so hard to put other flower growers and her out of business by helping competitors thousands of miles away in the temperate regions of Colombia...First came the international war on drugs, with the U.S. government spending millions since 1999 to help poor Colombian farmers destroy their coca plants and replace them with flowers. Then Congress passed a free-trade agreement with Colombia last year, making those blooms cheaper for Americans to buy. With Colombian imports now accounting for three of every four cut flowers sold in the United States, domestic growers say they can’t compete with the planeloads of Colombian flowers that are flown in through Miami each day.

“It’s job robbing. I mean, it’s so bad. It’s so wrong,” said Szukovathy, 49, who’s run her farm in the Skagit River Valley, about an hour north of Seattle, for nearly 10 years. “Those politics are such a mess. I don’t really feel like that’s my government, almost.” SHE'S RIGHT, YOU KNOW

For small growers caught in the crossfire of global trade, it means the possible loss of an industry they love. For Americans, it means the possible loss of the simple notion of heading to the neighborhood florist to buy locally grown flowers for special friends or spouses or to decorate the graves of loved ones. In Washington and California, two of the top-producing states for flowers used mainly in bouquets, growers are trying to fight back, but they fear they don’t have much time before their industry collapses. For starters, they’re banding together by forming cooperatives that they hope will reduce their transportation costs and make it easier to deal with the expanding foreign competition. And they’re trying to push new buy-American, buy-local campaigns, hoping that consumers will think twice when they realize that their Valentine’s Day bouquets and nearly all the roses on the California’s Rose Parade floats are South American imports.

“My sense is that people don’t understand what we’re really up against, the Costco effect of flowers being shipped in by 747s each day, between seven and 10 a day and up to 35 on the holidays,” said Kasey Cronquist, the chief executive officer of the California Cut Flower Commission. “It really puts us at a sizable disadvantage.”

Growers say it’s a far cry from 20 or 30 years ago, when Americans could be reasonably confident that florists were selling local products. Cronquist said that foreign nations, led by Colombia, now sell 82 percent of the cut flowers in the United States. And he said the U.S. flower industry was on its “last stand” and needed U.S. consumers to demand more locally grown flowers. He said flowers growers wanted to piggyback on the growing demand for locally grown food.

Demeter

(85,373 posts)???ή ?ύ?? AS YOU WOULD SAY....FROM LAST WEEK AUG 22

http://www.aljazeera.com/news/europe/2012/08/20128221891153880.html

Antonis Samaras, Greece's prime minister, has embarked on a diplomatic push to earn his nation more time to complete reforms and retain access to bailout loans, but a top European official said that any decision will depend on a report by international debt inspectors next month. Jean-Claude Juncker, who chairs meetings of eurozone finance ministers and is also Luxembourg's prime minister, insisted on Wednesday that Greece must remain within the euro. Its exit from the currency used by 17 European Union countries would hurt both the country and the wider continent...

But Athens has faltered in the speed and effectiveness with which it has implemented the reforms, fuelling impatience by its creditors, notably Germany, which is the single largest contributor to the bailout. Samaras will be in Berlin on Friday to speak with German Chancellor Angela Merkel and in Paris on Saturday with French President Francois Hollande...In an appeal to German public opinion, Samaras told the popular mass-circulation Bild that his country needs more time to effectively implement reforms, but that this would not translate into needing more funds.

"Let me be very clear: we are not asking for extra money," Samaras was quoted as telling Bild.

"We stand by our commitments and the implementation of all requirements. But we must encourage growth, because that reduces the financing gaps.

"All we want is a little 'air to breathe' to get the economy going and increase state income," Samaras added, without specifying any time frame.

But Merkel on Wednesday dismissed the chances of agreeing on changes to Greece's bailout package during upcoming talks with the Greek prime minister.

"We won't have a solution on Friday," Merkel said on Wednesday during a visit to Moldova.

"We wait for the report of the troika. Then we will decide," she added in reference to representatives from the EU and its Central Bank as well as IMF who are now auditing Greek finances.

Hinging on a favourable report from the troika is a massive 31.5bn-euro bailout installment ($38.6bn), without which Greece faces a chaotic default on its vast debts and a possible exit from the euro. A Greek exit would destabilise markets and economies around the world as other vulnerable countries in the eurozone are caught up in investor panic.

Demeter

(85,373 posts)The name Anonymous itself is inspired by the perceived anonymity under which users post images and comments on the Internet. Usage of the term Anonymous in the sense of a shared identity began on imageboards. A tag of Anonymous is assigned to visitors who leave comments without identifying the originator of the posted content. Users of imageboards sometimes jokingly acted as if Anonymous were a real person. As the popularity of imageboards increased, the idea of Anonymous as a collective of unnamed individuals became an internet meme.

Anonymous broadly represents the concept of any and all people as an unnamed collective. As a multiple-use name, individuals who share in the "Anonymous" moniker also adopt a shared online identity, characterized as hedonistic and uninhibited. This is intended as a satirical, conscious adoption of the online disinhibition effect.

“ We [Anonymous] just happen to be a group of people on the internet who need—just kind of an outlet to do as we wish, that we wouldn't be able to do in regular society. ...That's more or less the point of it. Do as you wish. ... There's a common phrase: 'we are doing it for the lulz.' ”

—Trent Peacock. Search Engine: The face of Anonymous, February 7, 2008.

Definitions tend to emphasize the fact that the concept, and by extension the collective of users, cannot be readily encompassed by a simple definition. Instead it is often defined by aphorisms describing perceived qualities. One self-description, originating from a protest video targeted at the Church of Scientology, is:

We are Anonymous. We are Legion. We do not forgive. We do not forget. Expect us.

bread_and_roses

(6,335 posts)I love it.

Though on the last of my triad, I only wish ... hope ... wait....

... we'll get there?

Will try to contribute this weekend. Am done in by going to see my frail and failing mother. Plus siblings who are neither emotionally nor physically well. Eight hour drive both ways.

and hey, Demeter - I caught the tail end of an NPR story on some law trying (I think?) to avert the arrival of feral hogs in Michigan - and "farmers" who seemed to be making thinly veiled promises about armed resistance if "the gub'mt" went through with it ...?

wild times out there?

It is Labor Day weekend. I'll try to focus any posts I manage to make on the state of Labor.

I am truly exhausted, and will work all day on Labor Day. I will contribute what I can manage.

Demeter

(85,373 posts)There are wild turkeys on the North Campus, not 2 miles from my house. Coyotes roam freely (I knew a guy whose side business was trapping). There was a cougar sighting (but it was hushed up to prevent panic). There's a small herd of deer that I encounter on my rounds of the neighborhood, so fear of ticks is rather high.

We joke about having to register the raccoons and groundhogs that live on the property along with other pets. There are swans in our ponds; they hatched out 9 cygnets this spring, but the foxes got 6. Muskrats, huge snapping turtles, I even saw a pheasant once.

The feral hogs are north and west of here. I hope. With the rednecks. They are welcome to each other.

I'm going to the state fair Saturday. It's a reconstituted, State Fair Light and Suburban. The govt. shut down the original two years ago for lack of money. And the traditional BBQ is Monday 12-5. You are all invited, should you be in the area. Please specify beef, turkey or soy burger when you RSVP.

My sister flies in Tuesday, on an errand of mercy. Let's hope we don't kill each other.

So I figure by Wednesday, I'm gonna need a vacation. Unfortunately, that's the day I get the safety inspection....

bread_and_roses

(6,335 posts)... BAKER: During the revolution in this country, there were only 20 percent of the colonists that did anything. And of that 20 percent, very few actually picked up arms. If you're part of that 20 percent, that'll actually do something, and I would suggest that you do...

... COLLISON: Rumors that any pig with floppy ears and a curly tail might be implicated spread quickly. Mike Adams is a conservative commentator who sends out a podcast from Arizona.

MIKE ADAMS: The state of Michigan is now just days away from kicking in the doors of all these farmers, shooting the pigs and then arresting all of these farmers as felons.

... COLLISON: The DNR never conducted raids forcing farmers to kill their pigs on the spot. But they do maintain that anyone with Russian boar must, quote, "dispossess them."

DemReadingDU

(16,000 posts)We in Ohio are supposed to get the rain coming from hurricane Isaac. If so, I hope to stay in and catch up on reading!

Demeter

(85,373 posts)I hope we get some water, too. I want the drought to end.

AnneD

(15,774 posts)I can give two enthusiastic ![]()

![]()

Remember remember the Fifth of November.

Demeter

(85,373 posts)DON'T GET YOUR HOPES UP---THERE'S ONLY SO LONG ONE CAN HOLD THE WORLD TOGETHER WITH RUBBER BANDS AND DUCT TAPE, AND THEN IT'S TIME TO BUY REPLACEMENTS....A CONCEPT THE 1% JUST DON'T GRASP

http://www.reuters.com/article/2012/08/30/us-economy-idUSBRE87S0ID20120830

Consumer spending got off to a fairly firm start in the third quarter, rising by the most in five months and offering hope economic growth would pick up this quarter. DON'T HOLD YOUR BREATH

Other data on Thursday showed the number of Americans filing new claims for jobless benefits held steady last week.

The reports were consistent with only moderate economic and job growth, and they kept alive the prospect of additional monetary stimulus from the Federal Reserve.

"The economy does not seem to be faltering or going into reverse," said Chris Rupkey, chief financial economist at Bank of Tokyo-Mitsubishi in New York. "![]() But) for a Fed that thinks the economy is not good enough, the data today is not consistent with 3 percent-plus growth or a falling unemployment rate."

But) for a Fed that thinks the economy is not good enough, the data today is not consistent with 3 percent-plus growth or a falling unemployment rate."

NO KIDDING! REALLY? ![]()

Demeter

(85,373 posts)

GEE, I DON'T KNOW....

Simon Johnson is the Ronald A. Kurtz Professor of Entrepreneurship at the M.I.T. Sloan School of Management and co-author of "White House Burning: The Founding Fathers, Our National Debt, and Why It Matters to You."

********************************************************

Top executives from global megabanks are usually very careful about how they defend both the continued existence, at current scale, of their organizations and the implicit subsidies they receive. They are willing to appear on television shows - and did so earlier this summer, pushing back against Sanford I. Weill, the former chief executive of Citigroup, after he said big banks should be broken up. Typically, however, since the financial crisis of 2008 the heavyweights of the banking industry have stayed relatively silent on the key issue of whether there should be a hard cap on bank size.

This pattern has shifted in recent weeks, with moves on at least three fronts.

William B. Harrison Jr., the former chairman of JPMorgan Chase, was the first to stick out his neck, with an Op-Ed published in The New York Times. The Financial Services Roundtable has circulated two related e-mails "Myth: Some U.S. banks are too big" and "Myth: Breaking up banks is the only way to deal with 'Too Big To Fail'" (these links are to versions on the Web site of Partnership for a Secure Financial Future, a group that also includes the Consumer Bankers Association, the Mortgage Bankers Association and the Financial Services Institute). SEE ORIGINAL POST FOR LINKS Now Wayne Abernathy, executive vice president of the American Bankers Association, is weighing in - with a commentary on the American Banker Web site. These views notwithstanding, mainstream Republican opinion is starting to shift against the megabanks, as former Treasury secretary Nicholas Brady makes clear in a strong opinion piece published in The Financial Times. Mr. Brady was Treasury secretary under Presidents Ronald Reagan and George H.W. Bush, and to the best of my knowledge, no one has ever accused him of being any kind of leftist.

Yet Mr. Brady's thinking in his Financial Times commentary is strikingly similar to the reasoning that motivated the Brown-Kaufman amendment (supported by 30 Democrats and three Republicans) in 2010, which would have put a hard cap on the size and leverage of our largest banks, i.e., how much an individual institution could borrow relative to the size of the economy. (See this analysis by Jeff Connaughton, who was chief of staff to Senator Ted Kaufman; Senator Sherrod Brown, Democrat of Ohio, is still pushing hard on this same approach.) Mr. Brady also stresses that we should make our regulations simpler, not more complex. Senator Kaufman made the same point repeatedly - and capping leverage per bank (Mr. Brady's preferred approach) would be one way to do this.

Mr. Brady is not alone on the Republican side of the political spectrum. A growing number of serious-minded politicians are starting to support the point made by Jon Huntsman, the former governor of Utah and a Republican presidential candidate in the recent primaries: global megabanks have become government-sponsored enterprises; their scale does not result from any kind of market process, but is rather the result of a vast state subsidy scheme. As Paul Singer, a hedge fund manager and influential Republican donor, says of the big banks, "Private reward and public risk is not what conservatives should want."

A second problem for the bankers is that their arguments defending big banks are very weak...

AND I THINK THE REAL QUESTION IS: WHAT MADE THE GOP MINDS CHANGE?

Demeter

(85,373 posts)The pace of Wall Street’s war against the 99% is quickening in preparation for the kill. Having demonized public employees for being scheduled to receive pensions on their lifetime employment service, bondholders are insisting on getting the money instead. It is the same austerity philosophy that has been forced on Greece and Spain – and the same that is prompting President Obama and Mitt Romney to urge scaling back Social Security and Medicare.

Unlike the U.S. federal government, most states and cities have constitutions that prevent them from running budget deficits. This means that when they cut property taxes, they either must borrow from the wealthy, or cut back employment and public services. For many years they borrowed, paying tax-exempt interest to wealthy bondholders. But carrying charges on these have mounted to a point where they now look risky as the economy sinks into debt deflation. Cities are defaulting from California to Alabama. They cannot reverse course and restore taxes on property owners without causing more mortgage defaults and abandonments. Something has to give – so cities are scaling back public spending, downsizing their school systems and police forces, and selling off their assets to pay bondholders.

This has become the main cause of America’s rising unemployment, helping drive down consumer demand in a Keynesian nightmare. Less obvious are the devastating cuts occurring in health care, job training and other services, while tuition rates for public colleges and “participation fees” at high schools are soaring. School systems are crumbling like our roads as teachers are jettisoned on a scale not seen since the Great Depression. Yet Wall Street strategists view this state and local budget squeeze as a godsend. As Rahm Emanuel has put matters, a crisis is too good an opportunity to waste – and the fiscal crisis gives creditors financial leverage to push through anti-labor policies and privatization grabs. The ground is being prepared for a neoliberal “cure”: cutting back pensions and health care, defaulting on pension promises to labor, and selling off the public sector, letting the new proprietors to put up tollbooths on everything from roads to schools. The new term of the moment is “rent extraction.”

...So we are now seeing the folly of untaxing property and replacing tax revenues with borrowing – paying tax-exempt interest to the nation’s wealthiest bondholders. Cutting the property tax base thus finds its twin casualty in the wave of defaults on pension promises. Real estate taxes have plunged from two-thirds of urban revenues in the 1920s to just one-sixth today for the United States as a whole. Federal grants-in-aid also are being cut back, and state aid to the cities is following suit. But instead of making housing more affordable, these tax cuts have “freed” rental value from the tax collector only to end up being paid to the banks...

MUCH MORE...PROP 13, GREECE, AND CHAOS...AT LINK

Demeter

(85,373 posts)Just like Microsoft, Apple's evolution from smart tech company to global uber-brand contains the seeds of its own destruction...I HADN'T NOTICED MICROSOFT'S DEMISE.....

Apple came close to destroying its business in the late 1980s by pursuing a suit against Microsoft claiming that Windows infringed the look and feel of the Mac desktop metaphor. Apple focused its hopes and business future on this lawsuit, while its market share dwindled. Rather than competing, it litigated. And lost.

Last week, it litigated against Samsung over its iPhone design and won.

The first justifiable conclusion might be that big companies get their way. The second might reasonably be that Apple doesn't change much: its business model remains aggressive self-righteousness. The third is what everybody knows: patent rules and philosophy are all screwed up.

As for the first point, Apple is not just a big company, but the biggest. And it is not just the biggest American company, but the most American company. It has entered a rarefied brand status in which it is now almost synonymous with American virtue: American as Apple. Its good design sense has become a major point of American pride, if not nationalism. The brand is a national asset. Apple is AT&T in its pre-break-up from; it's GM, in its what's-good-for-General-Motors-is-good-for-the-country stage; it's United Fruit when it made US foreign policy; it's Microsoft when desktop computing was transforming the world.

This is about as close to commercial omnipotence as it gets. Its unassailability, its right to be preternaturally aggressive, is built into its share price. We believe in Apple. So let us briefly consider the chance for a Korean company defending itself against (or, perish the thought, challenging) the greatest American company of the age in the eyes of an American jury....

I BOUGHT A KOREAN REFRIGERATOR...AND LET ME TELL YOU, I'M SORRY I DID.

Demeter

(85,373 posts)Software giant Apple has blocked an app that would notify subscribers every time a US drone carried out a deadly mission on the grounds that it is "objectionable and crude", according to the program's designer.

Josh Begley, a graduate student at New York University, developed Drones+ to provide up-to-date information on strikes, using reports collated by the London-based Bureau of Investigative Journalism – an organisation that tracks the use of unmanned CIA aircrafts.

But repeated attempts to get Apple to offer the software at its app store have been fruitless. At first, Begley was informed that the program – which he hoped would raise awareness of the growing death toll from drone strikes – was "not useful" enough and did not appeal to a "broad enough audience".

The company position has since shifted, but only in the reasoning behind its refusal to stock Drones+.

In the latest rejection email, Apple reportedly informed him: "We found that your app contains content that many audiences would find objectionable, which is not in compliance with the app store review guidelines."

Demeter

(85,373 posts)Today Peter Schiff stunned King World News when he said the US will be back on a gold standard “... in a year or two.” Schiff also said, “I would have expected a (financial) collapse to have already happened.” Schiff went on to warn, “... at this point I’m going to assume there is no more stay of execution and we are going to have our crisis coming up right after Europe.”

But first, Schiff had this to say regarding Bernanke and his Jackson Hole speech: “QE3 is coming. He’s got that card up his sleeve. It’s been hidden up there for a long time. He’s reluctant to admit it, but he will play it eventually. He’s going to be coy about it because he doesn’t want to actually come out and reveal his hand.”

Peter Schiff continues:

We have a lot of problems, and if we cure them it’s going to mean a short-term recession as we repair the damage. Until the Fed lets us have a real recession, as painful as that may be, we are never going to have a recovery. We’re just going to have these artificial, stimulus induced highs that are going to result in relapse to recession as the stimulus wears off.

We’ve got massive economic imbalances, structural malinvestments around the world because the dollar is the reserve currency. It’s too weak. We print too many. So other central banks have to print up more money to buy up all of the unwanted dollars.

All of this money printing and central planning by the central banks trying to manipulate the economies is resulting in all of these problems. Until we put an end to this, the problems keep getting worse. Who is more reckless, Europe or the US? I think we’re still in the lead. So I think we’ll win the race to the bottom when it comes to debasing the currency.”

Peter Schiff was attending the Republican Convention, but when KWN asked about it he unloaded:

There are a lot of Ron Paul supporters here. I think it would have been nice if the convention acknowledged Ron a little bit more and let the people show their support for other candidates, in addition to Romney. The Ron Paul camp felt strong-armed, and I think that was a mistake.

You’ve got a lot of energetic, motivated people that would join in with this party, and were enthusiastic about Ron Paul. They should have tried to cultivate that and bring them into the fold, into the tent and acknowledge their efforts. Instead they basically slapped them in the face and turned them off.

This can have the effect of getting them so discouraged that they look to a third party candidate or don’t even bother to participate or vote. The bottom line is there are a lot of people who are frustrated about the way they were treated.

This convention has been a lot of sound bites so far, but not a lot of substance. To me it’s not really a convention, it was more like a coronation, and an infomercial for the Republican Party. The Democrats are going to do the same thing. I think we’ve really lost the meaning of these conventions because they are now all about the TV and the sound bites.

Probably the most frustrating thing was to have to listen to Republican candidates talk about how much they love Medicare, and how they don’t want to cut it, and how they always want to make sure it’s here. They want to protect it and stop the Democrats from cutting it.

Worse than the candidates saying it were the people in the convention applauding it. The only boos were when they talked about Obama cutting Medicare. They booed. We can’t be booing spending cuts. We need spending cuts. That’s what the Republicans should be about, less government, not more government.”

When asked about talk in the Republican Party discussing a move to the gold standard, Schiff responded, “Well, discussing and doing are two different things. But eventually we will be back on a gold standard, not because politicians want it, but because the public demands it and the situation requires it.

We are headed for a currency crisis, and the only way we’re going to stop it is by putting real value back into the paper dollar. So we have to tie it to gold. In fact, if you are listening to the Republican Convention and realizing that, despite the talk, they are committed not to cut anything of substance.

They want to keep growing the government, growing the deficits. That eventually means we will have a currency crisis, and a sovereign debt crisis, which will lay the foundation for a return to the gold standard.”

When asked when he sees the US returning to the gold standard, Schiff replied,

I would have expected a (financial) collapse to have already happened. I thought it was going to happen in Obama’s first term. The miscalculation I made was not seeing Europe’s problems coming and preempting it. I knew there were problems with the euro, I just assumed the problems with America and the dollar would surface first.

But the US is not using the reprieve to get our act together. We are just using it to get deeper into debt. Will something else happen to delay our day of reckoning? I don’t know what that might be. So at this point I’m going to assume there is no more stay of execution and we are going to have our crisis coming up right after Europe.”

WELL, MR. SCHIFF...IF THE US DOES GO BACK TO GOLD, IT WILL ONLY BE EXTERNAL, ACROSS BORDERS. AND TO DO SO, THE US WILL CONFISCATE ALL INTERNAL GOLD. SO I DON'T THINK IT WILL HAPPEN THE WAY YOU SEE IT HAPPENING...

AnneD

(15,774 posts)Love to get your thoughts.....

Demeter

(85,373 posts)BECAUSE....

how could the Banksters steal it?

AnneD

(15,774 posts)Like they did last time. They buy from unwilling seller (read we the people) at less than the going price say $1650 and as soon as the market open gold shoots up to it's true unmanipulated price is suddenly 'discovered'. Yes, they paid you before the confiscated it, but not the true price so guess who lost out.

This happen here one before, and happens in a regime change or any totalitarian regime. Governments, fleecing tapayers and small investors everywhere.

Demeter

(85,373 posts)FDR had the Presidency, and he used it, backed up by the Army and the National Guard and the Governors, the House AND the Senate, and the consent of the Governed (little people).

What we have now is a chain of Kleptocracy, like one of those chocolate fountains, only that brown stuff isn't chocolate.

Fuddnik

(8,846 posts)We have something they call a "government". But, it's so dysfunctional it barely operates.

DemReadingDU

(16,000 posts)It is really really difficult to discuss this with them because they don't see it as dysfunctional, but operating just fine...until they are personally impacted.

mother earth

(6,002 posts)Demeter

(85,373 posts)AND WHERE DOES IT ALL GO? ASK JPMORGAN. ITS MUTUAL FUNDS ARE FULL OF FACEBOOK...

http://www.dailymail.co.uk/news/article-2196135/Dustin-Moskovitz-Facebook-founder-sells-450-000-shares.html

LOTS OF GOSSIP AND GUESSING AT LINK

Demeter

(85,373 posts)...Mr. Ryan’s big lie — and, yes, it deserves that designation — was his claim that “a Romney-Ryan administration will protect and strengthen Medicare.” Actually, it would kill the program.... The Republican Party is now firmly committed to replacing Medicare with what we might call Vouchercare. The government would no longer pay your major medical bills; instead, it would give you a voucher that could be applied to the purchase of private insurance. And, if the voucher proved insufficient to buy decent coverage, hey, that would be your problem. Moreover, the vouchers almost certainly would be inadequate; their value would be set by a formula taking no account of likely increases in health care costs.

Why would anyone think that this was a good idea? The G.O.P. platform says that it “will empower millions of seniors to control their personal health care decisions.” Indeed. Because those of us too young for Medicare just feel so personally empowered, you know, when dealing with insurance companies. Still, wouldn’t private insurers reduce costs through the magic of the marketplace? No. All, and I mean all, the evidence says that public systems like Medicare and Medicaid, which have less bureaucracy than private insurers (if you can’t believe this, you’ve never had to deal with an insurance company) and greater bargaining power, are better than the private sector at controlling costs.

I know this flies in the face of free-market dogma, but it’s just a fact. You can see this fact in the history of Medicare Advantage, which is run through private insurers and has consistently had higher costs than traditional Medicare. You can see it from comparisons between Medicaid and private insurance: Medicaid costs much less. And you can see it in international comparisons: The United States has the most privatized health system in the advanced world and, by far, the highest health costs. So Vouchercare would mean higher costs and lower benefits for seniors. Over time, the Republican plan wouldn’t just end Medicare as we know it, it would kill the thing Medicare is supposed to provide: universal access to essential care. Seniors who couldn’t afford to top up their vouchers with a lot of additional money would just be out of luck.

Still, the G.O.P. promises to maintain Medicare as we know it for those currently over 55. Should everyone born before 1957 feel safe? Again, no. For one thing, repeal of Obamacare would cause older Americans to lose a number of significant benefits that the law provides, including the way it closes the “doughnut hole” in drug coverage and the way it protects early retirees. Beyond that, the promise of unchanged benefits for Americans of a certain age just isn’t credible. Think about the political dynamics that would arise once someone born in 1956 still received full Medicare while someone born in 1959 couldn’t afford decent coverage. Do you really think that would be a stable situation? For sure, it would unleash political warfare between the cohorts — and the odds are high that older cohorts would soon find their alleged guarantees snatched away.

The question now is whether voters will understand what’s really going on...

Demeter

(85,373 posts)WHO HIRES THESE PEOPLE TO WRITE HEADLINES?

http://www.latimes.com/news/nationworld/nation/la-na-08-29-portland-loo-20120829%2c0%2c104499.story

http://portlandloo.com/wp-content/uploads/2011/04/Matthias-at-Loo.bmp

The Oregon city has successfully tackled several urban issues with its solar-powered, not-that-private public toilets. Now other cities smell a winner... It's called the Portland Loo, and it may be the first toilet so popular it has its own Facebook page. The solar-powered, 6-by-101/2 -foot street-corner cabin, ingeniously stripped of much of its plumbing and privacy, has been installed at six locations around Portland, from the city's dodgiest centers for the homeless to an upscale waterfront where stay-at-home moms take their children to play. So well has it eased into the urban landscape that Portland is looking to build and market Loos across the continent, hoping the profits will allow for the construction and maintenance of more at home. San Diego, Vancouver, Houston, Baltimore and Seattle all have expressed interest. The first official export was installed in Victoria, British Columbia, in November.

"I'm convinced Portland is the only city in the U.S., and maybe the world, that celebrates the opening of bathrooms," City Commissioner Randy Leonard said at the dedication ceremony for the city's fifth Loo, as students from a nearby school, whose art adorns the exterior wall, sang "Skip to My Lou."...Portland officials say the Loos buck many of the conventions of public toilets: They are not installed in out-of-the-way spots where no one will see them. Rather, most are placed along sidewalks in full public view. They are not self-cleaning, but are made of prison-grade steel with plumbing so basic that they are almost impossible to damage, and a twice-a-day check by maintenance staff seems to keep them in good working order. The only water faucet is on the outside, making customers less likely to linger for hair-washing or laundry. Perhaps most important, they aren't all that private. Louvered slats from foot level to knee level and again just above head level make activity inside somewhat visible, and audible, to passersby.

To enter the Portland Loo with a mission in mind is to understand the Zen of utilitarian human biology. Function is all. There are no mirrors, no lavender sachets, no paper towel holders, no sink. Just four walls, a small dispenser of hand sanitizer and the reason you came: the steel, prison-grade toilet. The sounds of people chatting and laughing outside waft in disconcertingly between the slats. One feels the urge to act quickly and quietly, and move on...architectural designer Curtis Banger came up with a peekaboo toilet powered by two solar panels on the roof and with graffiti-washable panels. The cost: $60,000 to install plus $1,200 a month to maintain. The first installation, in December 2008, was near the Greyhound bus station in the Old Town-Chinatown area, or as Leonard puts it, "ground zero for homelessness in Portland." The sixth, near the Portland Art Museum and Portland State University, opened this month....

"We took a poll. Essentially we asked, what are the most pressing issues facing the homeless community that we should act on here? And they said bathrooms," Jensen said. "For a population that is by definition not housed, we thought the first priority would be housing, and it wasn't," she said. "They said, 'Until we have somewhere to go to the bathroom, we're not even human. We're like animals.'"

MORE DETAILS AT LINK

Demeter

(85,373 posts)

Demeter

(85,373 posts)“ [Anonymous is] the first Internet-based superconsciousness. Anonymous is a group, in the sense that a flock of birds is a group. How do you know they're a group? Because they're traveling in the same direction. At any given moment, more birds could join, leave, peel off in another direction entirely. ”

—Chris Landers. Baltimore City Paper, April 2, 2008.

Anonymous consists largely of users from multiple imageboards and Internet forums. In addition, several wikis and Internet Relay Chat networks are maintained to overcome the limitations of traditional imageboards. These modes of communication are the means by which Anonymous protesters participating in Project Chanology communicate and organize upcoming protests.

A "loose coalition of Internet denizens," the group is banded together by the Internet, through sites such as 4chan, 711chan, Encyclopædia Dramatica, IRC channels, and YouTube. Social networking services, such as Facebook, are used for the creation of groups which reach out to people to mobilize in real-world protests.

Anonymous has no leader or controlling party and relies on the collective power of its individual participants acting in such a way that the net effect benefits the group. "Anyone who wants to can be Anonymous and work toward a set of goals..." a member of Anonymous explained to the Baltimore City Paper. "We have this agenda that we all agree on and we all coordinate and act, but all act independently toward it, without any want for recognition. We just want to get something that we feel is important done..."

A statement attributed to a member of Anonymous has described Anonymous as containing every belief and lifestyle, and that the views of "the loudest" of Anonymous aren't necessarily the views of the rest of Anonymous. Anonymous members have previously collaborated with hacker group LulzSec.

It is impossible to 'join' Anonymous, as there is no leadership, no ranking, and no single means of communication. Anonymous is spread over many mediums and languages, with membership being achieved simply by wishing to join.

Demeter

(85,373 posts)The Chinese investment vehicle known as "Golden Elephant No. 38" promises buyers a 7.2 percent return per year. That's more than double the rate offered on savings accounts nationally. Absent from the product's prospectus is any indication of the asset underpinning Golden Elephant: a near-empty housing project in the rural town of Taihe, at the end of a dirt path amid rice fields in one of China's poorest provinces. "They haven't even built a proper road here," said Li Chun, a car repairman, who said he lives in the project. "The local government is holding onto the flats and only wants to sell them when prices go up."

Golden Elephant No. 38 is one of thousands of "wealth-management products", instruments aimed at monied investors, which have shown phenomenal growth over the last five years. Sales of them soared 43 percent in the first half of 2012 to 12.14 trillion yuan ($1.90 trillion), according to a report by CN Benefit, a Chinese wealth-management consultancy. They are usually created in China's "shadow banking" system - non-banking institutions that are not subject to the same regulations as banks - which has grown to account for around a fifth of all new financing in China. Like the subprime-debt lending spree in the United States that helped spark the 2008 financial crisis, the products are often opaque, and usually dependent on high-risk underlying assets, such as the Taihe housing project.

WARNING BELLS

Financial instability in the world's second-largest economy could have global ramifications, and warning bells have begun to sound about the way these products are marketed in China. It has become a mammoth industry, comprising an array of financial products. Analysts have different ways of measuring the size of the sector. Barclays estimates some 22 trillion yuan worth of wealth management products will be issued this year. Fitch Ratings says China's banks had about 10.4 trillion yuan in wealth management product liability at the end of June this year...The China Banking Regulatory Commission, which oversees banking products, said more than 20,000 wealth management products were now in circulation, from a few hundred just five years ago.

In an email response to the questions raised in this story, the regulator told Reuters new banking regulations require more transparency about these products. "It is uncommon to find wealth management products that fail to clearly specify the underlying securitized assets," it said, adding that a regulation issued last year "clearly states that WMP prospectuses must indicate how the money is being used, and the percentage of money that is being put into each asset class." The commission is looking into further strengthening the regulatory framework over these products, and "will continue to encourage the wealth management industry's growth under the principles of transparency and sufficient risk control".

MUCH MORE AT LINK...AND SCARY

Demeter

(85,373 posts)The European elite are getting the economics wrong and the current policy of austerity is not going to bring any relief, not to say economic growth, says Roger Bootle, a Wolfson Prize winner for developing a practical plan to dissolve the eurozone. The only possible solution for the euro crisis is the departure of the peripheral countries...A country wanting to leave the euro must prepare a plan in secret among a very small group of senior ministers and officials. Pretty soon as the plan is agreed it must be enacted in order to prevent the news leaking out. The banks will have to be closed over a relevant period, which is probably a weekend. During that period capital controls would be in place. On Friday night it would be announced to the people of the departing country – let’s call it Greece – that from then on all amounts that were in bank accounts, be it their pensions or wages which were formerly expressed in euros were now to be expressed in drachmas. We suggest that the conversion rate between the euro and drachmas be one for one.

All the people get this mixed up. They all think “what about the exchange rate?” On the exchanges there is no connection between the official conversion rate and what the drachma trades at. We’re pretty sure that it would trade at a much lower rate, probably at around 1.5 to one or even two to one against the euro. Then the banks open again on Monday or Tuesday, people put their cards into ATMs. They can get euros out of their bank accounts, which are now expressed in drachma, but they get those out at the exchange rate that rules now between the euro and drachma because now the euro is treated as a foreign currency. Initially, they are not going to have drachma notes and coins available and a lot of people would get fixated on that. We argue that that does not really matter, for the overwhelming majority of transactions, particularly business transactions, they are done electronically anyway. People use debit and credit cards. They continue to do that, only now it is drachma they are actually transacting.

For small transactions that require cash our suggestion is that Greece carries on using euros until new drachma notes are available... a dual price system would develop. Because people will know that drachmas aren’t the same as euros, that though they have been converted at a one-to-one rate, there tends to be a different price for euro cash on drachma debit and credit cards. That would be to some extent messy, but it would be perfectly practical. There are a lot of countries in the world that operated dual-currency and a dual-pricing system...A German creditor is not going to want his assets converted into drachma and he is going to argue that the contract was framed in euros and it should still be in euros and in Greece they are going to say, “oh no, no, no, it`s now in drachma.” And so there are going to be arguments. The court is going to be heavily involved. But the scope for this can also be reduced if eurozone governments reach an agreement on this, which they probably would, but they will have to lay down guidelines under which terms the contracts are going to be interpreted in drachma and in which occasions it will be in euros. This would minimize the scope for legal argument.

The other major issue, and it is not a complication, it is a reality, is that initially this is going to be very far from a magic wand. When the drachma falls on the exchanges, the price of goods and services in Greece is going to go up – possibly by quite a lot. So, initially, living standards are going to be squeezed. Far from bringing relief to the ordinary Greek person, it is actually going to make matters worse initially. However, going forward things will then completely transform because in a flash Greece is more competitive, not the grinding deflation they were in for ten or fifteen years, but instantaneously Greece is forty or fifty or sixty per cent more competitive and the demand for Greek output is going to take off. That does not happen overnight, but in a measure of months that will happen. Greek exports will start to rise, Greek imports will fall. That would generate employment and more income in Greece. So there is a trade-off, a difficult period to go through first of all in order to secure later greater prosperity... I think there is no doubt Greece needs to get out of the euro. I cannot see any way in which this current policy of austerity is going to bring any relief. There is a grinding process of trying to bring prices and wages down, but it takes not years but decades. And what is more it raises the real value of debt. Greece and other weaker members of the euro face not one key problem, but two. They are uncompetitive and they are also settled with very high levels of debt. The problem with domestic deflation is in principle that it deals with one of these problems, namely the lack of competitiveness but at the cost of making the other problem – debt – even worse.

The leaders of Europe have to ask themselves how you can imagine prosperity and stability for Europe under the current set-up. ...

Demeter

(85,373 posts)Demeter

(85,373 posts)The only remaining white Democrat in the House of Representatives from the Deep South, Rep. John Barrow, is in jeopardy of losing his job in November, which would mark a monumental shift in American politics.

In an stark realignment, voters in the Deep South have divided into an increasingly black Democratic Party and a mostly white Republican Party. Already, Mississippi, Alabama and Louisiana are represented in the House solely by white Republicans and black Democrats. Georgia could join that list if Mr. Barrow, who is running in a district redrawn to include more whites and Republicans, loses in November.

I HAVE VERY MIXED FEELINGS ABOUT THIS REPORT

Demeter

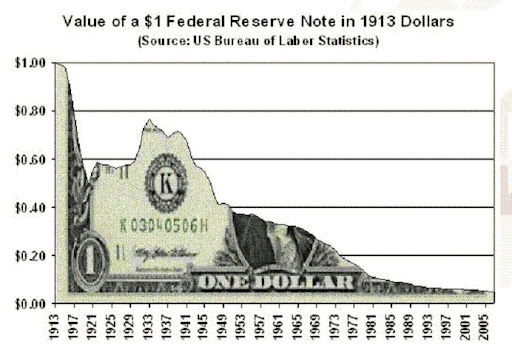

(85,373 posts)Wages need to rise to keep up with inflation, especially since the value of the dollar has been trashed:

But Michael Greenstone and Adam Looney of the Hamilton Project document that real median earnings for men declined between 1969 and 2009:

And wages have only kept dropping since 2009. In addition – when those who have only part-time work are taken into account – we have depression-level unemployment.

As Klein notes:

When you take all men, not just those working fulltime, into account, the slight decline in the above graph becomes a plummet of 28 percent in median real wages from 1969 to 2009.

The bottom line is that – due to idiotic government policy – most of the jobs being created are part-time and low wage jobs.

Demeter

(85,373 posts)...

President Eisenhower re-wrote the tax laws so that they would favor investment abroad. President Kennedy railed against tax provisions that “consistently favor United States private investment abroad compared with investment in our own economy”, but nothing has changed under either Democratic or Republican administrations.

For the last 50-plus years, the tax benefits to American companies making things abroad has encouraged jobs to move out of the U.S.

AP noted last year:

Actually, many American companies are — just maybe not in your town. They’re hiring overseas, where sales are surging and the pipeline of orders is fat.

***

The trend helps explain why unemployment remains high in the United States, edging up to 9.8% last month, even though companies are performing well: All but 4% of the top 500 U.S. corporations reported profits this year, and the stock market is close to its highest point since the 2008 financial meltdown.

But the jobs are going elsewhere. The Economic Policy Institute, a Washington think tank, says American companies have created 1.4 million jobs overseas this year, compared with less than 1 million in the U.S. The additional 1.4 million jobs would have lowered the U.S. unemployment rate to 8.9%, says Robert Scott, the institute’s senior international economist.

“There’s a huge difference between what is good for American companies versus what is good for the American economy,” says Scott.

***

Many of the products being made overseas aren’t coming back to the United States. Demand has grown dramatically this year in emerging markets like India, China and Brazil.

Most of the Emergency Money Went Abroad

In addition, a large percentage of the bailouts went to foreign banks . And so did most of money from the second round of quantitative easing.

That’s not going to help the American worker.

The Government Has Encouraged Mergers

The government has actively encouraged mergers, which destroy jobs.

For example, the Treasury Department encouraged banks to use the bailout money to buy their competitors, and pushed through an amendment to the tax laws which rewards mergers in the banking industry.

This is nothing new.

Citigroup’s former chief executive says that when Citigroup was formed in 1998 out of the merger of banking and insurance giants, Alan Greenspan told him, “I have nothing against size. It doesn’t bother me at all”.

And the government has actively encouraged the big banks to grow into mega-banks.

The Government Has Let Unemployment Rise in an Attempt to Fight Inflation

MORE

Demeter

(85,373 posts)YVES SMITH NOTES: Obama commissioned this study.

http://www.theonion.com/articles/study-pretending-everythings-okay-works%2c29099/

A study released Thursday by researchers at Harvard University's Department of Psychology has found that the simple act of pretending one's life is not a complete shambles threatening to collapse at any moment works. "Even when everything is coming apart at the seams and disaster is almost certainly imminent, putting up a good front for friends and loved ones makes everything better," said Professor Christine Wanamaker, who explained that smiling a lot and evasive answers were usually enough to get by. "Tell everyone that things are fine, and they will be fine. Just don't over-think it." When asked about her study's methodology, Wanamaker said the research was rock-solid, had been looked over by a bunch of scientists, and definitely wasn't anything to worry about....

Demeter

(85,373 posts)Look no further than the mirror if you want to know why the economy remains so sluggish, says the CEO of the JPMorgan Chase & Co.

“It’s because of us. We scapegoat each other. We point fingers,” Jamie Dimon said yesterday while visiting with customers of the bank’s Kingsdale office in Upper Arlington, as well as the branch’s current and former employees.

“I actually think the underlying economy is not bad,” Dimon told about 200 people gathered in a tent set up next to the branch.

Consumers and small and large businesses have healthier balance sheets than before the recession, he said.

“I can’t prove it in real time,” Dimon said of his thesis.

But Dimon pointed to last summer’s debate in Washington over raising the debt ceiling and critical comments made of banks and other businesses as examples of how such episodes sap the confidence of consumers and businesses to invest and expand.

“We’ve done it to ourselves,” he said. “I just hope something breaks the back of this political environment.”

Demeter

(85,373 posts)Spain's national bank rescue fund said on Friday it will inject emergency liquidity into troubled lender Bankia (BKIA.MC) immediately after the bank reported losses of over 4 billion euros ($5 billion) in the first half of 2012. Bankia, nationalised by the Spanish government in May, lost 4.448 billion euros in the six months to end-June after provisioning 2.7 billion euros in the second quarter against bad debt and assets.

Spain's Fund for Orderly Bank Restructuring (FROB) said it would inject capital into Bankia immediately as an advance on European aid negotiated by Spain for its ailing banking sector in June. It did not specify how much capital would be given to Bankia. "I am very satisfied with what the European and Spanish authorities have said because it means there is big support for our project," said Bankia Chairman Jose Ignacio Goirigolzarri. WHICH PROJECT IS THAT? BANKRUPTING THE NATION?

A financial sector analyst in Madrid said Bankia's poor results were expected and that a capital injection from the FROB had also been seen as a possibility. "The results are very bad, the provisions have really ruined the results, but in operating terms they are more or less what we were expecting," said the analyst, who asked not to be named...The government also on Friday created a so-called bad bank to take over tens of billions of euros in defaulted loans and unsaleable property and to accelerate the clean-up of the banking sector...

Demeter

(85,373 posts)Yves here. Readers are likely to assume that the “broken market” of the headline is US housing related, say the private mortgage securitization market, but the subject is what once was the gold standard of trading markets, equities. Index Universe has cited a study by the Tabb Group that finds that investor confidence in stock markets is even lower than in the period immediately following the flash crash of 2010. Back then, 53% of respondents had high or very high confidence in the markets, and only 15% weak or very weak confidence. As of its August 2012 survey, the number with positive views and negative views were equal, at 34%. This interview with Chris Sparrow, an expert on high frequency trading, describes why he thinks the market is now fundamentally flawed and what can be done to reform it.

By Paul Amery, editor of Index Universe. Cross posted from Index Universe

IndexUniverse.eu: Chris, what’s wrong with the current structure of equity markets?

Sparrow: The current market structure is fundamentally unfair, since different participants have unequal temporal access to information. To put it simply, if other people can see that your order has been filled before you can, or that there’s been an update to a price quote before you are able to see it, you’ll lose confidence in the market. This comes down to how price signals are propagated. Currently, no two participants receive price and quote information simultaneously. If you want to ensure fairness in the markets you need to level the playing field for everyone. If we can fix this then we should be able to restore some confidence to the markets and trading volumes, which have declined dramatically in recent years, should recover.

IndexUniverse.eu: Is the fragmentation of equity market trading between different venues a concern?

Sparrow: I’m not concerned with fragmentation per se, as competition between trading venues is good. What’s missing is synchronisation and coordination. Let’s take the air travel system as an analogy. Airlines want to minimise fuel use and so all have an incentive to land their planes first. If you allow that, you’re going to have lots of crashes. Regulators impose structure via an air traffic control system, reducing the systemic risk. Such coordination simply doesn’t exist in the equity markets today and regulators tend to take a passive role, watching what happens and taking action after the event if something goes wrong.I’m not for overregulation and in my opinion introducing competition between trading venues, which happened in the US under Regulation NMS in 2005 and in Europe following the introduction of MiFID in 2007, was a good thing, as I’ve said. But there have been some unintended consequences of these reforms that now need to be dealt with.

IndexUniverse.eu: Should exchanges be forced to go back to some kind of utility status from their current for-profit model?

Sparrow: I don’t think that’s necessary. I think the for-profit exchange model can continue to exist, but subject to a requirement for synchronisation. Here’s another example. Let’s say I buy a solar panel and want to contribute electricity back to the grid. If I want to do that I have to supply the electricity at 60 Hz. I can’t unilaterally decide that I want to give the electricity back at 45 Hz. There’s an infrastructure requirement that should be based on a policy of coordination. If I want to build an ATS (automated trading system) and plug it into the rest of the market grid I should have to do so in a standardised way. Otherwise the system will generate a huge amount of quote “noise” and introduce exploitable latencies that act to inhibit fair trading.

IndexUniverse.eu: What led you to identify the current trading system as a problem?

Sparrow: I’ve done a lot of work in transaction cost analysis (TCA). I was looking at a particular order and for purposes of comparison wanted a proxy for the Canadian equity market. For this I used the iShares S&P/TSX 60 ETF (TSE: XIU). It turned out that there were a million quote updates in this ETF during a single trading day of 23,400 seconds. Why do we need so many updates? They impose significant storage requirements on everyone, take up significant network bandwidth and arguably do not contribute significantly to price discovery. All the trading data that’s being produced is an externality on the whole market. We all have to buy bigger hard drives, bigger servers and network switches just to process the data, even though there’s little extra benefit in doing so.

I'M NOT SURE ALL THE SPIT AND POLISH IN THE WORLD CAN FIX THIS FIDDLE THEY'VE STRUNG UP...BUT I'M A REALIST AND A CYNIC--DEMETER

Chris Sparrow’s proposal for reforms to market structure is outlined in more detail at http://www.bima.ca/Portals/17/2012Conference/Chris%20Sparrow%20-The%20Failure%20of%20Continuous%20Markets%20BIMA.pdf

Demeter

(85,373 posts)The Kid refuses to go. It's perversity.

Tansy_Gold

(17,864 posts)But stay away from the pigs?

DemReadingDU

(16,000 posts)Not sure if the egg layer is Henny or Penny, but I can have breakfast!

http://www.democraticunderground.com/?com=view_post&forum=1116&pid=19579

Tansy_Gold

(17,864 posts). . . .or a peace egg?

![]()

jtuck004

(15,882 posts)Not poking fun. I think there are at least hundreds of thousands, if not millions of people who would be far better off if they would just raise a portion of their food. Ignoring the mortgage, growing some food and eating it completely bypasses the corrupt system of profit that has built itself around everything.

And if the shtf in a big way, it's very possible that those who have never learned to do these things will find out this is one learning opportunity they should not have passed up.

I only grew around 12-15 lbs of hard neck garlic this year, but when I went to the Farmers Market and saw them selling for $3/bulb, I realized I was doing better than I thought. Working on learning how to reliably make garlic products, the latest a hand-crafted gourmet garlic powder.

I bet you felt a little thrill when you got that egg out. Congratulations.

Fuddnik

(8,846 posts)I waste a lot also, trying to figure out this Florida "soil". When I lived in Cleveland, I supplied most of our cul de sac with tomatoes and such.

I went to Home Depot today looking for plants, to hopefully get my winter crop in this week-end, and they didn't have shit. I guess I'll get a few tomatoes, beans and broccoli to plant this week, and keep looking for the rest.

I should try some garlic this winter, maybe in the spot where the sweet potatoes are now.

jtuck004

(15,882 posts)http://www.motherearthnews.com/organic-gardening/grow-your-own-food-zm0z12aszmat.aspx

_____________________________

The way to take out a tyrant is to remove their support, they fall of their own weight. I am fully convinced that gardening (especially heirlooms grown organically) removes part of that support, at least from Conagra, Monsanto, Coke, etc, as well as a lot of commodity traders. Get a few hundred thousand gardeners together, who knows what could happen...

I don't think corporations are scared of anything except assets they can't control, and there is much potential in co-ops, food, and manufacturing to develop these in a more egalitarian manner, outside of their control. Gardening is a start.

In the North we plant hardneck garlic in about October, into ground that has seed meal or some other source of organic nitrogen. Cover it with about 6" of straw, where it sits developing roots and undergoing vernalization over the winter so it will turn into cloves. Pokes out around March here, where I start weekly watering, foliar feeding of kelp, and a little more nitrogen in the ground until a month before our harvest, around July - August.

I know you didn't ask for advice, and you may know already, (but this is DU.

The difference in taste between the California Early or Late in the stores is vastly different. Much Chinese-sourced garlic is here now, where they are now experiencing a boom in prices, from 3 cents for a kilo to 60 cents. Millionaires are being made, though it has really put the hurt on the stuff the corporations grow in California.

Enjoy!

DemReadingDU

(16,000 posts)After we moved the chickens to the side yard, away from the dogs, we returned the battery operated radio noise/static correction system and received $100. So the 1st egg was only $326, lol.

But now I've had 2 eggs, so the investment is beginning to get cheaper, and more rewarding in additional eggs!

AnneD

(15,774 posts)Yard eggs. I don't know what I love more on Bradah's farm; the hens or the cows. Hens, chicks and roosters and their social orders are an endless fascinating soap opera.....the young and breast less. Cows and their young lover with his roaming eyes and roving way......all his children.

The eggs keep very well in a cool place as long as the bloom is not washed off, just incase they get more productive. She started off with a few but the flock is now in her words 'fifty-more or less'. I am always up first and let them out of their coops in the morning. I get a cup of coffee and sit outside in the morning and watch them chase the grasshoppers, teach their young ones to scratch and watch the barnyard Romeos chase their unwilling dates across the yard.

bread_and_roses

(6,335 posts)Published on Saturday, September 1, 2012 by Common Dreams

Thank Goodness Labor is its Own Reward!

by Robert Shetterly

... but standing in the hosts’ kitchen we were suddenly debating the idea of a “living wage.” My position was that any adult who is willing to work should be paid at least a living wage—no matter what the occupation.

... Who could not see that to offer hard working people a wage that condemns them to poverty in spite of their labor, is to condemn them to wage slavery and cripple the idea of democratic community?

I soon discovered that my liberal friends would indeed begrudge such a wage. Why? Because, they said unanimously, we must insist that people have an appropriate work ethic, and that such an ethic, coupled with honest labor, is its own reward. A good work ethic, even when working for pay below a basic living standard, builds character, self-respect, determination, and a good social fabric. In other words, the work ethic is like a religious ethic—it may not put a roof over your head and feed your children, but you won’t need those amenities because you will be such a good person.

I must say that something about this anecdote rings false to me. I have heard too many so-called "Liberals" renege on a Living Wage to doubt that most are quite willing to sell out their low-wage neighbors in the name of "practical," or "realistic" to doubt that. But not on the basis of some supposed work ethic. Though I have heard them demean many low-wage jobs as, basically, "for the stupid" - though they don't use that language, they say "unskilled".

And obviously, people who would deny any worker a living wage are neither "decent", nor "generous", nor "trustworthy". They are elitists. They are Monty Python's all-too-true spoof of Robin Hood.

edit for a mistake in phrasing

Demeter

(85,373 posts)It's ideas like theirs that lead to lives of crime. If only criminals can afford to live...

Demeter

(85,373 posts)It was held indoors! In a convention hall. They hauled in 8 inches of dirt to form an arena for the animal judging, and a fountain full of trout to fish, and stalls for the livestock...including the Belgians, Percherons and Clydesdales. They had the Clydesdales in a troika pulling a snazzy green wagon around the area.

It was rather surreal.

And the air conditioning is keeping it all cool, while there are large doors open on two sides--one to the animal trailers, the other to the circus, midway, and all that.

It sure wasn't like the State Fair I remember as a very young kid.

In any event, I am wiped. It wasn't horribly hot, like yesterday, but very sunny. There were a lot of people there. The Polish chickens were adorable as ever....and I don't say that just because I am Polish, too....

DemReadingDU

(16,000 posts)No excuse to stay home because of the rain or heat. It would be interesting to see if the attendance was greater indoors than if held outdoors.

Demeter

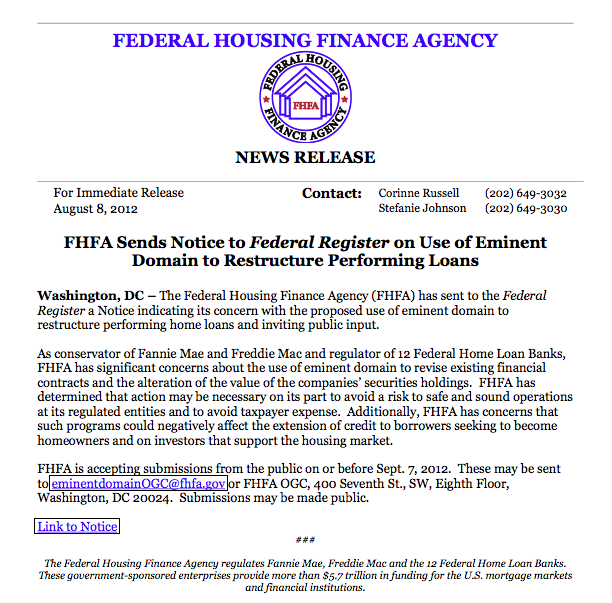

(85,373 posts)All this talk of firing Ed DeMarco seems to have led him to decide to live up to his reputation.

Amanda F pointed to a wee notice released by Fannie’s and Freddie’s regulator:

Now let us recall that using eminent domain is a mere fondly-hoped-of cash cow for promoters like Mortgage Resolution Partners, who plan to nick a fee on every performing mortgage condemned (they are targeting ONLY borrowers that are paying on time but deeply underwater). While we think eminent domain could be a tremendously useful tool for getting around servicers who refuse to do modifications of borrowers who are delinquent or under financial stress, we are firmly opposed to the MRP scheme (the big reason is that the price at which they propose to condemn the mortgages is under fair market value and hence tantamount to stealing).

And by starting where investors will come out losers, MRP has set out to galvanize the opposition. When servicers have been sitting on their hands and abusing both borrowers and investors, condemnation is a win-win. But the MRP proposal is an exercise in extraction from investors, who most often place their money with fund managers who can’t be bothered to sue. While they say they will only condemn non Fannie and Freddie mortgages, their huge PR push has led other groups to start pushing eminent domain proposals. The nay-sayers’ slippery slope argument isn’t nuts. Anyone who condemns a first mortgage ought to condemn a related second (which will of course get the banks up in arms). And if you are a local pol, how can you justify condemning private label mortgages when someone in your jurisdiction might be identically situated from an economic standpoint, but doesn’t get a break because he is in a Fannie or Freddie mortgage?

The key bit of the FHFA notice is this:

This is code for “If our concerns are validated, we will throw our weight against it.” And the FHFA has a lot of weight. While the SIFMA threat to exclude municipalities that started doing condemnations from the Fannie/Freddie “to be announced” market is a close to meaningless threat (as in it sounds impressive but the economic impact is pretty close to nada), the FHFA could bar Fannie and Freddie refis in the same areas. Since any local official who produced such an outcome would be tarred and feathered, you can expect that if the FHFA adopts this tactic, eminent domain is pretty much dead, barring a change in leadership at the regulator.

Now of course, we can expect any and every friend of servicers to provide submissions to the FHFA saying how terrible using eminent domain on mortgages would be. But cut through the lobbying BS, and there are two valid concerns. One is the one I flagged, that plans now being discussed seriously would condemn money good mortgages at significant losses to investors. Although most of the industry objections to date have focused on the constitutional issues (which I am told are pretty serious in California, one of the test grounds), simply because that’s the first line of defense. To my mind, the pricing, or more accurately, stealing issue is stronger, and the FHFA has legitimate grounds to be concerned. A second issue is that even if performing mortgages were condemned at a true fair market price, it would still increase prepayment risk, which is already hard to model. The undesirable feature of mortgages is that they go away just when bondholders are happiest, when interest rates drop. So MBS have a higher interest rate than fixed maturity bonds of the same credit quality to compensate for this unattractive quality...

Read more at http://www.nakedcapitalism.com/2012/08/fhfa-threatens-to-kneecap-use-of-eminent-domain-to-condemn-mortgages.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29#V7VSgd8w6Hd4zxrc.99

Roland99

(53,342 posts)From Le Figaro:

"To allow the group CIF to meet all its commitments, the government decided to respond favorably to its request to grant a guarantee," said Saturday the Ministry of Economy, confirming a report in Le Figaro. "This guarantee will be implemented subject to the approval of the European Commission and Parliament, which will be seized within the next Finance Bill," says the statement of Bercy. As in the granting of state guarantees for Dexia, the government needs the approval of Brussels under the State aid procedure.

The government supports the establishment to avoid panic on a large French issuer. Because if the CIF is a small branch network with 300 branches, more than 30 billion euros in loans bear its signature. However, the downgrade by Moody's gave investors the right to be reimbursed for certain bond lines. Therefore unable to refinance since the first degradation of the note in February, was moving rapidly towards the liquidity crisis. Friday evening, a board of CIF followed up with the inevitable next step.

Demeter

(85,373 posts)Nothing else will make any difference.

Hotler

(11,428 posts)I still have no hope. I still see no future but, good music helps. Let me share a good song.

Turn it up.

Peace

AnneD

(15,774 posts)With out music or dance, or even laughter.

Besides, nothing pisses off tyrants than more than having their authority laughed at or the thought of people other than themselves having fun.

Hotler

(11,428 posts)take to the streets by the thousands or tens of thousands. It's not a revolution when all people want to do is sit behind their keyboards and bitch. Revolution takes action. It isn't going to work with just a handful. Du the largest progressive website in the world can't even organize to take to the streets. There needs to be so many people protesting that the cops have no choice but to join in on the side of the people. I challenge the membership of DU. You folks get a minimum of 50 thousand people (the number @ a Bronco game or NASCAR race) in any city in any state and I'll show up and stand a the front. I'll take the first baton strike, the first rubber bullet, the first tear gas canister to the head, the first dog bite etc. Just stand behind me, push onward and march forward.

DemReadingDU

(16,000 posts)What is it going to take to get 100,000+ off their butts and into the streets?

The entire electric grid to go down in the U.S., for a month?

Empty grocery stores, nor restaurants, for a month?

Unless it is something that will have a huge impact to millions of people, nothing will happen.

AnneD

(15,774 posts)In Wisconsin. How many people were in the streets in the Occupy Wall Street moment and how long was it before MSMeven reported on it. My guess is that OWS was the first shot over the bow. Nothing has changed and the chance of real change occurring from the ballot box or courts is steadily diminishing. There will be rubber bullets and tear gas before it is over with.

Hotler