Economy

Related: About this forumWeekend Economists Go Out with a Boom August 24-26, 2012

In AD 79 on this date...

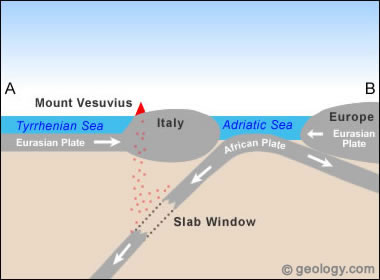

After centuries of dormancy, Mount Vesuvius erupts in southern Italy, devastating the prosperous Roman cities of Pompeii and Herculaneum and killing thousands. The cities, buried under a thick layer of volcanic material and mud, were never rebuilt and largely forgotten in the course of history. In the 18th century, Pompeii and Herculaneum were rediscovered and excavated, providing an unprecedented archaeological record of the everyday life of an ancient civilization, startlingly preserved in sudden death.

The ancient cities of Pompeii and Herculaneum thrived near the base of Mount Vesuvius at the Bay of Naples. In the time of the early Roman Empire, 20,000 people lived in Pompeii, including merchants, manufacturers, and farmers who exploited the rich soil of the region with numerous vineyards and orchards. None suspected that the black fertile earth was the legacy of earlier eruptions of Mount Vesuvius. Herculaneum was a city of 5,000 and a favorite summer destination for rich Romans. Named for the mythic hero Hercules, Herculaneum housed opulent villas and grand Roman baths. Gambling artifacts found in Herculaneum and a brothel unearthed in Pompeii attest to the decadent nature of the cities. There were smaller resort communities in the area as well, such as the quiet little town of Stabiae.

At noon on August 24, 79 A.D., this pleasure and prosperity came to an end when the peak of Mount Vesuvius exploded, propelling a 10-mile mushroom cloud of ash and pumice into the stratosphere. For the next 12 hours, volcanic ash and a hail of pumice stones up to 3 inches in diameter showered Pompeii, forcing the city's occupants to flee in terror. Some 2,000 people stayed in Pompeii, holed up in cellars or stone structures, hoping to wait out the eruption.

A westerly wind protected Herculaneum from the initial stage of the eruption, but then a giant cloud of hot ash and gas surged down the western flank of Vesuvius, engulfing the city and burning or asphyxiating all who remained. This lethal cloud was followed by a flood of volcanic mud and rock, burying the city.

The people who remained in Pompeii were killed on the morning of August 25 when a cloud of toxic gas poured into the city, suffocating all that remained. A flow of rock and ash followed, collapsing roofs and walls and burying the dead.

Much of what we know about the eruption comes from an account by Pliny the Younger, who was staying west along the Bay of Naples when Vesuvius exploded. In two letters to the historian Tacitus, he told of how "people covered their heads with pillows, the only defense against a shower of stones," and of how "a dark and horrible cloud charged with combustible matter suddenly broke and set forth. Some bewailed their own fate. Others prayed to die." Pliny, only 17 at the time, escaped the catastrophe and later became a noted Roman writer and administrator. His uncle, Pliny the Elder, was less lucky. Pliny the Elder, a celebrated naturalist, at the time of the eruption was the commander of the Roman fleet in the Bay of Naples. After Vesuvius exploded, he took his boats across the bay to Stabiae, to investigate the eruption and reassure terrified citizens. After going ashore, he was overcome by toxic gas and died.

According to Pliny the Younger's account, the eruption lasted 18 hours. Pompeii was buried under 14 to 17 feet of ash and pumice, and the nearby seacoast was drastically changed. Herculaneum was buried under more than 60 feet of mud and volcanic material. Some residents of Pompeii later returned to dig out their destroyed homes and salvage their valuables, but many treasures were left and then forgotten.

In the 18th century, a well digger unearthed a marble statue on the site of Herculaneum. The local government excavated some other valuable art objects, but the project was abandoned. In 1748, a farmer found traces of Pompeii beneath his vineyard. Since then, excavations have gone on nearly without interruption until the present. In 1927, the Italian government resumed the excavation of Herculaneum, retrieving numerous art treasures, including bronze and marble statues and paintings.

The remains of 2,000 men, women, and children were found at Pompeii. After perishing from asphyxiation, their bodies were covered with ash that hardened and preserved the outline of their bodies. Later, their bodies decomposed to skeletal remains, leaving a kind of plaster mold behind. Archaeologists who found these molds filled the hollows with plaster, revealing in grim detail the death pose of the victims of Vesuvius. The rest of the city is likewise frozen in time, and ordinary objects that tell the story of everyday life in Pompeii are as valuable to archaeologists as the great unearthed statues and frescoes. It was not until 1982 that the first human remains were found at Herculaneum, and these hundreds of skeletons bear ghastly burn marks that testifies to horrifying deaths.

Today, Mount Vesuvius is the only active volcano on the European mainland. Its last eruption was in 1944 and its last major eruption was in 1631. Another eruption is expected in the near future, would could be devastating for the 700,000 people who live in the "death zones" around Vesuvius.

http://www.history.com/this-day-in-history

It all looks peaceful and calm. Oh, sometimes there's a little rumbling, a burst of steam, or even a shower of ash. But we're just going about our lives, just like the citizens of Pompeii and Herculaneum did. Until the volcano of financial fraud and abuse blows the top off the global economy.

Then we will see who lives, who dies, and who gets to tell the tale...

Post your rumbles and seismic data below.

Demeter

(85,373 posts)One of the mysteries surrounding Mitt Romney’s taxes is how the former private-equity executive managed to get $100 million into a family trust for his children without incurring federal gift taxes.

A potential clue may be found in a previously unreported 2008 presentation made by a partner at law firm Ropes & Gray LLP, which represents the GOP presidential nominee. It focuses on how private-equity executives could minimize gift and estate taxes by giving family members some of their “carried interest” rights, a major form of compensation that entitles private-equity executives to a slice of the firm’s future investment profits.

This is complicated stuff, but bear with us even if you’re not a tax geek. Much remains unclear about Mr. Romney’s taxes given his limited disclosure and the complexity of his personal finances.

The attorney at Ropes & Gray wrote that in the 1990s and early 2000s estate-planning lawyers “commonly advised” that executives could claim a value of zero on these transfers of carried-interest rights for federal gift-tax purposes. He said the practice ended by 2005...Gifts of carried-interest rights are common, but several estate-planning attorneys at major New York firms said they are puzzled by the claim that the rights ever could have been valued at zero, particularly at an established private-equity firm. They said long-standing rules require taxpayers to value all gifts at fair-market value, or what a willing buyer would pay a willing seller...

NOW THAT'S ONE ERUPTION I'M GOING TO GET POPCORN FOR...

Demeter

(85,373 posts)The New York Fed said its final sale of AIG-related securities resulted in a $6.6-billion profit, which was added to gains of about $11 billion...The Federal Reserve said taxpayers ended up earning $17.7 billion from the central bank's role in bailing out insurance giant American International Group Inc.

On Thursday, the Federal Reserve Bank of New York, the investment management arm of the Fed, sold the last of the asset-backed securities it acquired in the multi-step bailout of AIG, which the central bank engineered in 2008 with the Treasury Department.

The government pledged more than $182 billion to AIG in exchange for a 92% ownership stake as it stepped in to keep the company from filing for bankruptcy and possibly causing a global meltdown in financial markets.

AIG used about $125 billion of the money, and the Fed and Treasury have been working since 2011 to extricate the government from AIG...The Treasury Department still has about $25 billion invested in AIG as it slowly sells its shares in the company. The Treasury sold about $5.75 billion in AIG stock this month, reducing the government's stake to about 53%.

MORE

Demeter

(85,373 posts)Quelle Surprise! SEC Plans to Make the World Safer for Fraudsters, Push Through JOBS Act Con-Artist-Friendly Solicitation Rules

http://www.nakedcapitalism.com/2012/08/quelle-surprise-sec-plans-to-make-the-world-safer-for-fraudsters-push-through-jobs-act-con-artist-friendly-solicitation-rules.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

If you merely looked at the SEC’s record on enforcement, you’d conclude that it suffered from a Keystone Kops-like inability to get out of its own way. The question remains whether that outcome is the result of unmotivated leadership (ex in the safe realm of insider trading cases) and long-term budget starvation leading to serious skills atrophy, or whether the SEC really, truly, is so deeply intellectually captured by the financial services industry that it thinks industry members don’t engage in fraud, they only make “mistakes”?It’s sure looking like the latter. We’ve railed repeatedly on the refusal of the SEC to use an obvious tool, Sarbanes Oxley, to pursue not only the massive failings of these firms to install adequate risk controls during the crisis, but also to go after obvious recent cases, namely, the JP Morgan CIO losses and the MF Global collapse. Further confirmation comes today in the form of investor abuse and repudiation of Dodd Frank requirements that the SEC hopes to slip next week when hopefully no one will notice.

We and numerous others have railed about how absolutely awful the JOBS Act is. It’s going to do perilous little to help small businesses raise dough; in fact, the number of frauds that will arise will almost certainly raise the cost of capital for small ventures over time. The JOBS Act was a wet dream for bucket shop operators. And the SEC seems determined to make a bad situation worse. The Consumer Federation of America, along with a number of distinguished co-signers, has written the SEC objecting to its plan to circumvention of the public comment process for issuing rules under the JOBS Act. Specifically, it plans to end a long-standing ban on widespread solicitation and advertising in private offerings (yours truly is well aware of these rules: there are restrictions, for instance, on the number of parties that can be presented a possible deal when it is not registered with the SEC). As the CFA notes via e-mail:

What is depressing, if you read the letter below, is that the SEC clever ruse to avoid public comment is violation of the Administrative Procedures Act. And worse, the CFA contends that the SEC is putting its finger on the weighing machine when it makes a cost-benefits assessment as mandated by Dodd Frank, ascribing far too much importance to industry compliance costs, and too little to the risks to the public...MORE

Read more at http://www.nakedcapitalism.com/2012/08/quelle-surprise-sec-plans-to-make-the-world-safer-for-fraudsters-push-through-jobs-act-con-artist-friendly-solicitation-rules.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29#vfmTFCw8l8IuFzDH.99

Demeter

(85,373 posts)Abstract:

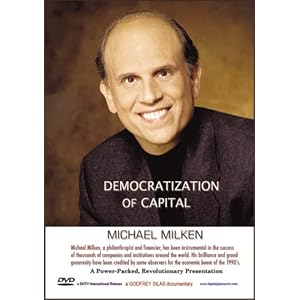

Three scandals have fundamentally reshaped business regulation over the past thirty years: the securities fraud prosecution of Michael Milken in 1988, the Enron implosion of 2001, and the Goldman Sachs “Abacus” enforcement action of 2010. The scandals have always been seen as unrelated. This Article highlights a previously unnoticed transactional affinity tying these scandals together — a deal structure known as the synthetic collateralized debt obligation (“CDO”) involving the use of a special purpose entity (“SPE”). The SPE is a new and widely used form of corporate alter ego designed to undertake transactions for its creator’s accounting and regulatory benefit.

The SPE remains mysterious and poorly understood, despite its use in framing transactions involving trillions of dollars and its prominence in foundational scandals. The traditional corporate alter ego was a subsidiary or affiliate with equity control. The SPE eschews equity control in favor of control through pre-set instructions emanating from transactional documents. In theory, these instructions are complete or very close thereto, making SPEs a real world manifestation of the “nexus of contracts” firm of economic and legal theory. In practice, however, formal designations of separateness do not always stand up under the strain of economic reality.

When coupled with financial disaster, the use of an SPE alter ego can turn even a minor compliance problem into scandal because of the mismatch between the traditional legal model of the firm and the SPE’s economic reality. The standard legal model looks to equity ownership to determine the boundaries of the firm: equity is inside the firm, while contract is outside. Regulatory regimes make inter-firm connections by tracking equity ownership. SPEs escape regulation by funneling inter-firm connections through contracts, rather than equity ownership.

The integration of SPEs into regulatory systems requires a ground-up rethinking of traditional legal models of the firm. A theory is emerging, not from corporate law or financial economics but from accounting principles. Accounting has responded to these scandals by abandoning the equity touchstone in favor of an analysis in which contractual allocations of risk, reward, and control operate as functional equivalents of equity ownership, and approach that redraws the boundaries of the firm. Transaction engineers need to come to terms with this new functional model as it could herald unexpected liability, as Goldman Sachs learned with its Abacus CDO.

SEE LINK

Demeter

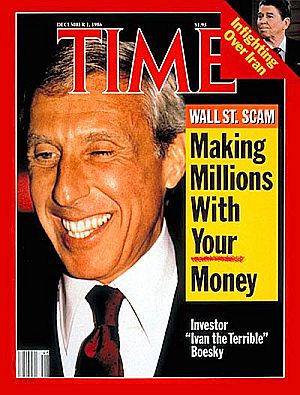

(85,373 posts)Martin Siegel meets Ivan Boesky at the Harvard Club in New York City to discuss his mounting financial pressures. Arbitrageur Boesky offered Siegel, a mergers-and-acquisitions executive at Kidder, Peabody & Co., a job, but Siegel, who was looking for some kind of consulting arrangement, declined. Boesky then suggested that if Siegel would supply him with early inside information on upcoming mergers there would be something in it for him.

In January 1983, although little information had been exchanged, Boesky sent a courier with a secret code and a briefcase containing $150,000 in $100 bills to be delivered to Siegel at the Plaza Hotel.

Over the next couple of years, Siegel passed inside information to Boesky on several occasions. With Siegel's inside tips, Boesky made $28 million dollars investing in Carnation stock before its takeover. But his success began to fuel investigative inquiries by both the press and the Securities and Exchange Commission. Rumors that Siegel and Kidder, Peabody & Co. were involved in illegal activities began floating around.

Despite the pressure, Siegel and Boesky met at a deli in January 1985, where Siegel demanded $400,000. This time, the cash drop-off was made at a phone booth. Siegel, who was apprehensive about his relationship with Boesky, decided to put an end to it after he had received his money. Still, he continued to trade inside information with other Wall Street executives.

In 1986, the illegal schemes, which by then included many of the biggest traders in the country, came crashing down. Arrests were made up and down Wall Street, and Boesky and Michael Milken, the junk bond king charged with violating federal securities laws, were no exception.

Siegel turned out to be one of the few cooperative witnesses for the government and virtually the only one who showed remorse for his role in the fraud, causing him to be ostracized on Wall Street. Nevertheless, he did fare better than the others: Milken received a 10-year sentence and Boesky received 3 years, but Siegel was only required to return the $9 million he had obtained illegally. The entire incident came to symbolize the era of unfettered greed on Wall Street in the mid-1980s.

Demeter

(85,373 posts)July 2007

When reporter Anne Maria Nicholson was inside the crater of Mt Vesuvius in Naples, she was less alarmed by the smoking fumeroles that were expelling clouds of gas around her than the ground giving away beneath her.

"I was there with a scientist from Naples University, Professor Benedetto de Vivo. He was so intent on pointing out the intricacies of the inside of the crater that he wasn't looking at the ground beneath him. There was an enormous drop in front of us and the ground wasn't that stable. He told me there's a lake of magma about 12 kilometres beneath us but at that point, my main concern was falling rather than the thought of a massive eruption."

Nicholson and cameraman Louie Eroglu filmed the mountain from all sides, including the towns in the so-called red zone that are at risk.

"They say a volcano is only dangerous if there are people around it. In this case there are three million people and the major problem is that it so congested that if there is an eruption with little warning, it will be impossible for people to escape.

"Unfortunately, there's a major disagreement among scientists with some saying there will be several weeks warning while others say it could be as little as a day. In spite of this, the authorities have allowed lots of high rise buildings and have now given permission to build the biggest hospital in southern Italy, right in the path of the last lava flow from Vesuvius.

"We've looked at what might happen if there is an eruption with a pyroclastic flow like the one that killed everyone in the Roman town of Pompeii in 79 AD. It's a terrifying proposition."

Demeter

(85,373 posts)Not that I'm expecting any until after Labor Day....

DemReadingDU

(16,000 posts)My sisters and my daughter and I went to the Pompeii exhibit at the Cincinnati Museum, formerly the Union Train Station for our annual bonding weekend on August 4. The exhibit was excellent!

http://www.cincymuseum.org/pompeii/

Demeter

(85,373 posts)Wayne State University in Detroit has proposed a new contract that would radically redefine the terms for eliminating faculty. The school would be the first research university to effectively abolish tenure, said officials of the American Association of University Professors (AAUP), opening the door for other campuses under pressure from cuts in public spending to try similar moves.

Traditionally, tenured faculty could be removed only after undergoing an extended peer review or in cases where the university is facing extreme financial stress. The contract language management proposed in late July, however, would effectively remove peer review and centralize the power to terminate faculty in administrators' hands. When the university's chief negotiator, James Green, was asked if the new terms would amount to eliminating tenure he replied, "It would have that effect, yes."

University President Allan Gilmour, a former top-level executive at Ford, quickly denied the charge. "Faculty tenure is an important aspect of academic freedom," Gilmour told reporters, "but it cannot be a place to hide for those whose performance or behavior is poor."

Wayne State enrolls nearly 32,000 students, 89 percent of whom are from metro Detroit, and has almost 3,000 faculty members. About a third are tenured or tenure-track. Faculty are represented by a joint AAUP-Teachers (AFT) Local 6075. The proposed contract would allow the administration to remove faculty in cases of "the substantial curtailment or discontinuance of a program which removes any reasonable opportunity for using a faculty member's services," a "failure to meet professional responsibilities," a "failure to perform academic assignments competently," and a "financially based reduction in force."...Management also wants a provision limiting faculty members' political freedom, by allowing professors to be terminated for "intentionally causing injury to persons and/or damage to property, forcibly interrupting the normal daily teaching, research or administrative operation of the University or directly inciting others to engage in such actions." This kind of vague language would leave the door open to disciplining or eliminating tenured faculty who participate or assist in organizing protests on campus, such as the recent Occupy protests that swept campuses and cities across the United States last fall, or the ongoing student strike in Quebec....Other universities have been experimenting with terminating tenured faculty, including the eight-campus University of Louisiana system last year. Florida State University tried to lay off 21 tenured faculty two years ago, but the move was blocked by an arbitrator.

MORE AT LINK

Demeter

(85,373 posts)Should police and the government be able to track you by your cell phone GPS without obtaining a search warrant? A federal appeals court appears to believe so, and recently ruled that tracking suspected criminals by their cell phones is similar to tailing their car or tracking their scent with police dogs.

Civil liberties groups say the broad ruling, handed down by the Sixth Circuit Court of Appeals in Ohio, could have sweeping impacts on the Fourth Amendment privacy rights of the innocent as well as those suspected of crimes.

The case involves alleged marijuana trafficker Melvin Skinner, who was busted with 1,100 pounds of pot after a complicated Drug Enforcement Administration (DEA) investigation that involved tracking Skinner's movements by his prepaid cell phone for three days. To track Skinner, the DEA obtained various forms of cell phone data, including cell site information, GPS real-time location data and "ping" data.

Agents gathered Skinner's cell phone information and tracked him without a search warrant and instead obtained a court order that did not meet the probable cause standard of most search warrants. The American Civil Liberties Union (ACLU) and the Electronic Frontier Foundation (EFF) filed briefs in similar cases arguing that warrantless cell phone tracking and data access violates the Fourth Amendment, which protects citizens against unreasonable search and seizure without probable cause....

Demeter

(85,373 posts)Two landmark developments on August 16 give momentum to the growing interest of cities and counties in addressing the mortgage mess using eminent domain:

- The Washington State Supreme Court held in Bain v. MERS, et al., that an electronic database called Mortgage Electronic Registration Systems (MERS) is not a "beneficiary" entitled to foreclose under a deed of trust; and

- San Bernardino County, California, passed a resolution to consider plans to use eminent domain to address the glut of underwater borrowers by purchasing and refinancing their loans.

MERS is the electronic smokescreen that allowed banks to build their securitization Ponzi scheme without worrying about details like ownership and chain of title. According to property law attorney Neil Garfield, properties were sold to multiple investors or conveyed to empty trusts, subprime securities were endorsed as triple A and banks earned up to 40 times what they could earn on a paying loan, using credit default swaps in which they bet the loan would go into default. As the dust settles from the collapse of the scheme, homeowners are left with underwater mortgages with no legitimate owners to negotiate with. The solution now being considered is for municipalities to simply take ownership of the mortgages through eminent domain. This would allow them to clear title and start fresh, along with some other lucrative dividends.

A major snag in these proposals has been that to make them economically feasible, the mortgages would have to be purchased at less than fair market value, in violation of eminent domain laws. But for troubled properties with MERS in the title - which now seems to be the majority of them - this may no longer be a problem. If MERS is not a beneficiary entitled to foreclose, as held in Bain, it is not entitled to assign that right or to assign title. Title remains with the original note holder; and in the typical case, the note holder can no longer be located or established, since the property has been used as collateral for multiple investors. In these cases, counties or cities may be able to obtain the mortgages free and clear. The county or city would then be in a position to "do the fair thing," settling with stakeholders in proportion to their legitimate claims and refinancing or reselling the properties, with proceeds accruing to the city or county.

Bain v. MERS: No Rights Without the Original Note

The underlying question, said the Bain panel, was "whether MERS and its associated business partners and institutions can both replace the existing recording system established by Washington statutes and still take advantage of legal procedures established in those same statutes." The court held that they could not have it both ways:

MERS suggests that, if we find a violation of the act, "MERS should be required to assign its interest in any deed of trust to the holder of the promissory note and have that assignment recorded in the land title records, before any non-judicial foreclosure could take place." But if MERS is not the beneficiary as contemplated by Washington law, it is unclear what rights, if any, it has to convey. Other courts have rejected similar suggestions. [Citations omitted.]

Bain is binding precedent only in Washington State, but it is well reasoned and is expected to be followed elsewhere.

READ ON...IT GETS BETTER!

xchrom

(108,903 posts)

xchrom

(108,903 posts)IRISH BANK Resolution Corporation chief executive Mike Aynsley said a representative of the Barclay brothers threatened to embarrass him after the bank refused to sell them loans secured on shares owned by client Paddy McKillen in the Maybourne hotels in London.

Mr Aynsley said the threat was made after IBRC executive Richard Woodhouse told Richard Faber, the representative of David and Frederick Barclay, in January 2012 that it would not sell Mr McKillen’s loans secured on his 36 per cent stake in the hotels but that it would support him instead.

Mr Aynsley said that Mr Woodhouse was told by Mr Faber that he was going to go out of his way “to embarrass me”. Mr Aynsley was speaking on the publication of IBRC’s interim results.

Mr McKillen and the Barclays are locked in a battle for control of Claridge’s, the Connaught and the Berkeley hotels. The High Court in London ruled against Mr McKillen on a claim that the Barclays had unlawfully bought into the hotels.

xchrom

(108,903 posts)THE EUROPEAN Commission has asked Spain to delay unveiling a banking reform by a week to allow it study the measures in more detail, the government said yesterday.

The conservative administration of Mariano Rajoy had been expected to announce the approval of several changes to the country’s struggling financial system after yesterday’s cabinet meeting. However, deputy prime minister Soraya Sáenz de Santamaría said the commission wanted to analyse the reform further before its presentation on August 31st. “There aren’t any sticking points; we’re simply working on it together,” she said.

The Bill is expected to give the Fund for Orderly Bank Restructuring and the Bank of Spain more powers to intervene in and restructure underperforming lenders to prevent further collapses in the sector.

In May, Spain’s fourth-largest lender, Bankia, was part-nationalised after the authorities announced it would require €24 billion in state funds to keep it afloat.

xchrom

(108,903 posts)A gauge of planned spending by US businesses fell in July for a second straight month, suggesting a slowing growth trend in the factory sector, even though demand for long lasting manufactured goods surged.

The Commerce Department said today non-defence capital goods orders excluding aircraft, a closely watched proxy for business spending plans, declined 3.4 per cent after falling 2.7 per cent in June.

Economists polled by Reuters had expected a 0.7 per cent rise after a previously reported 1.7 per cent decline in June.

This category tends to weaken at the start of a quarter, but it was the second straight month of weakness, hinting at a cooler growth pace in manufacturing, a sector that has shouldered the economy's recovery from the 2007-09 recession.

Demeter

(85,373 posts)

Bay of Naples--highly urban, far too close for safety

They call it the Garden of Fugitives

Vesuvius erupting in 1944

SEE THE WEBPAGE, READ THE TEXT

About the Author of the webpage

Jessica Ball is a graduate student in the Department of Geology at the State University of New York at Buffalo. Her concentration is in volcanology, and she is currently researching lava dome collapses and pyroclastic flows. Jessica earned her Bachelor of Science degree from the College of William and Mary, and worked for a year at the American Geological Institute in the Education/Outreach Program. She also writes the Magma Cum Laude blog, and in what spare time she has left, she enjoys rock climbing and playing various stringed instruments.

Demeter

(85,373 posts)Why is unemployment still so high? Are people still just not spending enough? Or is there a structural problem at work?

Most economists think it’s the former. They will argue that the unemployment crisis is all about “aggregate demand” — that is, people just aren’t buying enough stuff. Consumers aren’t spending and businesses aren’t buying from each other, so businesses don’t have money to hire people and mass unemployment persists. This explanation was first put forth by John Maynard Keynes in “The General Theory of Employment, Interest and Money” and continues to be accepted by current Keynesians like Paul Krugman and Larry Summers. Yet even monetarists, the Keynesians’ main critics, agree that most recessions are due to a lack of demand.

Other economists, however, have challenged this picture, arguing that even if the underlying recession is due to insufficient demand, structural factors are also keeping unemployment high. Nobel laureate Michael Spence is the most prominent advocate of this view. The real problem, Spence argues, is that too many of America’s jobs are in ”non-tradable” sectors like nursing or construction. That leaves our “tradable” sector, which produces goods and services for export, at a disadvantage at a time when other countries’ tradable sectors are growing. We need to invest heavily in education to make our tradable sector more productive and increase employment there, Spence argues. Sachs agrees that increasing the workforce’s education and skill level is more important than spurring greater demand.

If this theory is true, then current unemployment is due to a skills mismatch — people don’t just have the skills to do the jobs we need them to do. The solution to this is to increase education so that people can handle those jobs, rather than to increase demand. There’s one problem: This isn’t the main reason unemployment is high now. A new paper (pdf) from New York Fed economists Aysegul Sahin, Joseph Song, Giorgio Topa and Giovanni L. Violante finds that a skills mismatch is responsible for at most a 1.5 percentage point increase in the unemployment rate during the recession. Given that unemployment shot up by about 5 points, that leaves the other 3.5 percentage points explained by a shortfall in demand. What’s more, the effects of skill mismatch only really appear during the recession:

Both lines show the increase in unemployment for each period caused by a skills mismatch. The red dotted line adjusts for differences between economic sectors, while the black line doesn’t. In either case, both measures find that skills mismatches have a very large effect only in the aftermath of the 2001 and 2008 recessions, whereas in 2007 mismatches only increased unemployment by about 0.2 percentage points. This suggests that addressing the underlying lack of demand would prevent mismatches from hurting unemployment. This makes intuitive sense. When there are a lot of jobs due to healthy demand, the likelihood that a given person can find a job that matches their skill set is much higher. When there’s low demand and jobs are scarce anyway, chances of finding a job matching one’s skill set are low.

All of which suggests that the best response to the jobs crisis is one that spurs aggregate demand, through looser monetary policy, fiscal stimulus or another means, rather than one that tries to build up skills for workers. The latter policy may be desirable for other reasons, but it’s really neither here nor there on the jobs crisis.

PROVING ONCE AGAIN THAT KEYNES LIVES

Demeter

(85,373 posts)I HAD THE MISFORTUNE TO SEE SOME OF CNN'S PRE-CONVENTION BLATHER...

THE "AUTHORITIES" (READ FASCISTS) RUNNING THE CITY ARE FEARFUL OF ANARCHISTS, WHOM I BELIEVE THEY HAVE CONFUSED WITH THE ANTI-CHRIST...IF THERE ARE MORE THAN 25 BONA FIDE ANARCHISTS IN THIS NATION, I'D BE SURPRISED.

http://truth-out.org/news/item/11074-tampa-authorities-empty-jail-in-anticipation-of-mass-arrests-at-gop-convention

Thousands of Republicans from around the country will descend upon Tampa, Florida next week for the Republican National Convention, and if recent history is any guide, so too will hundreds of protesters.

To prepare, Hillsborough County Sheriff David Gee has ordered the Orient Road Jail, a 1,700 bed prison in Tampa, emptied, relocating some inmates to another nearby prison and releasing others on bond. The entire facility has been transformed into a one-stop booking, detention, and bond-issuance center capable of handling large numbers of arrests, which begs the question: will Tampa police keep demonstrators on a short leash?

Sheriff Gee says no, but also indicated in a letter posted on a county website that his department would have very little tolerance for anything more than chanting and holding up signs:

Four years ago, police in Minneapolis, Minnesota were criticized for their treatment of protesters and reporters covering the RNC, and were even forced to settle in an excessive force lawsuit. And in 2004, police in New York City were found to have been surveilling dozens of protest groups for months leading up to the RNC, even embedding undercover officers within several larger groups.

NOBODY CAN BE A SIMPLE, 60'S STYLE PROTESTER ANYMORE...ONE HAS TO BE CLASSIFIED AS EITHER AN ANARCHIST, A TERRORIST, OR SOME OTHER EVIL THREAT TO THE STATUS QUO AND THE GOP.

a geek named Bob

(2,715 posts)Don't play their game.

Establish a paper trail that clearly and consistently shows that you are a law-abiding citizen, who is simply using your first amendment rights.

If you've got a well established history of NOT trying to hurt folks, The PTB will have a lot harder time making you look terroristic.

Demeter

(85,373 posts)Such touching, charming naivete! I used to be young once, back in the 60's....

And while you are establishing that paper trail, do try to be born white, male, Christian (big C) and Republican. Nobody else has any 1st Amendment rights. It's written right in the Constitution.

a geek named Bob

(2,715 posts)By the way, love the bounty you provide.

(Being a good Pagan, I try to be thankful to the higher powers, for setting a delicious banquet.)

1.) As I have a funny last name, I've had some earlier run ins with LEO, back when I was younger.

2.) I'm sorry, but I must have missed the "whites only" clause in the constitution. I was uder the impression that the 14th amendment was still in effect.

3.) The paper trail has worked for me so far.

Mind you, I'm also a student pilot, a professor, a tinker, and a rocketeer. I think most police put me into the cubbyhole of "civilian that may need help crossing the street."

Demeter

(85,373 posts)Oh, yes, the one that legalized slavery...yes, that is now officially color-blind....

a geek named Bob

(2,715 posts)I must be reading the wrong constitution...

Last I read, the 14th amendment forbid slavery

http://americanhistory.about.com/od/usconstitution/a/14th-Amendment-Summary.htm

Basically, if you're here, and you are a citizen, you get equal rights.

Sounds kind of cool, to me...

Demeter

(85,373 posts)It's now wage slavery...and take away the wage, what do you have?

(((genocide)))(((class war)))

a geek named Bob

(2,715 posts)I am quite a geek, and take pride in being a geek.

Begin Vanity Block:

15,000 books, 6 computers, 3 TB of data

homebuilt generator with battery back up

homebuilt lab (leaning towards light mechanical)

and converted a trailer into a mobile machine shop

Member in good standing of a local Maker group

End Vanity Block

Also, I don't subscribe to marxist/marxian theories. (A little too much rhetoric at the expense of logic and fact).

westerebus

(2,976 posts)Oh Bob, I tend to look at Marx as another economist with a philosophical bent of a different persuasion to say Smith or Krugman and just as valid given what he knew at the time compared to what either have written on.

a geek named Bob

(2,715 posts)1.) a Maker Group is a local collection of people who build things largely from scratch. (The name comes from a quarterly magazine: Make Magazine.) Each group puts together a workshop/lab/debating group. Every year, there's about 8 big Maker Fairs. Make NYC gets about 20,000+. My local group has already built a 3D printer, a laser cutter, re-habbed a sewing machine, and put in a keg. One of the things that I'm pushing the group to get into, sometime in the future, is to build up an open sourced, linked set of micro-power grids. This way, if the Economy does go south in a hurry, we can provide the backbones for a functioning and stable civilization.

2.) Marx MAY have had some valid point, at some time in the past. The majority of his writing seems to be rhetoric run amuck. I've yet to see one functioning country that runs on Marxist thought. Until that time, I guess my red beret will have to remain in the closet. One of the things that I worry about, is the lack of reality-testing displayed by the would-be Marxists. (I expect that lack in academics, but it's a little scary to hear it from certain groups outside of same.)

3.) Given your logo/pic, I'll assume you're a marine. Thank you for serving. (My wife has given me the on-again/off-again nickname of "Speaker to Marines," as I usually find myself conversing with same.) Semper Fi.

westerebus

(2,976 posts)Welcome to DU and the economy group. Just between you and me, they are all a bunch of crazy people here and when you consider this is a leftist blog that tells you something. Let me rephrase that, crazy as in passionate, crazy like foxes, and to the person, the kind of crazy you want to be around to keep things in perspective.

Then there's a few folks like myself who are, depending on the rise of the moon or solar flare activity, known to have moments of intensive collateral affect upon the populace in general while in a Zen like state. Or not.

No one has come close to what Marx envisioned, neither has anyone come close to Plato's republic, currently the ideals of the American Constitution are circumspect and western capitalism is due for a reorganization. Baby, bath water.

The logo belongs to the USMC. I'm classified as a Marine Veteran. No need to thank me, it was something to do that needed doing and I was available at the time.

a geek named Bob

(2,715 posts)for the kind response.

As to the matter of the crazy people, I play with High Voltage and rockets... So I figure I'm not one to judge.

Most of the problems that we are having in the US can - in my somewhat humble opinion - be derived from loss of good regulatory laws, and massive chains of one-way benefit. I we can at the very least fix the transportation costs, we have enough money to again start having a functioning culture. I get together with some of the Makers I know, under the guise of going to small and medium Science Fiction conventions, and try to game out how to fix the problems in the USA. With the advent of 3D printers, we can bring back a form of the old local manufacturing economy. With lower fuel costs (and the money staying local), and the local manufacturing, Maybe we can start to fix things.

My thanks are still on the table. You can keep them, or turn them into an attractive paperweight.

DemReadingDU

(16,000 posts)That will be quite useful for a source of power when the economy implodes. What kind of batteries? How do you charge them?

My spouse has a garage full of machines and tools to build racing gokarts. Unfortunately, he has not yet thought ahead to the time when he will need a generator with battery backup to power up all those machines.

a geek named Bob

(2,715 posts)and the manuals to keep them maintained. (I also have the books detailing how to build them from scratch.)

If the machines your spouse has, run on AC... He'll need a bunch of inverters.

Personally, I don't think the economy will implode.

a geek named Bob

(2,715 posts)I'm hoping to replace those lead-acid batteries with large surface area Capacitors, when money and time allow.

Po_d Mainiac

(4,183 posts)lead/acid batteries have a near infinite shelf life

won't bust the bank

will likely, at least, preserve the initial investment

require zero maintenance, other than a reasonably dry storage area

don't require a lot of space

can be recycled into bullets, over a wood fired flame

a geek named Bob

(2,715 posts)checking the water/acid levels.

The capacitor bank will last longer, and will take a much longer time to discharge.

As to bullets...

to paraphrase brother Machiavelli, as long as you have the love of the people, you're fine.

Po_d Mainiac

(4,183 posts)And you been doin this for how many hours/days? And you do this for what reason?

I'm guessing I got batteries with more birthdays than you.

As for love, it don't put meat in the freezer. Lead, accelerated by expanding gases will.

a geek named Bob

(2,715 posts)I've got three batteries that I regularly use in my set up. Going on 10 years.

As for the lead and expanding gases, I'll go with the soy and the other beans, with Kombucha for my B12.

Sustainable, can't be used against me, and probably better for my heart.

the other use for a fire arm is defense. I got that covered.

Demeter

(85,373 posts)Earlier this summer we explored some things we could do as a nation to improve work-life balance, from the basic (paid sick leave, anyone?) to the truly innovative. This time, we're looking around the world: which countries fare better than ours in helping citizens survive without working themselves to death? Of course, it’s hard not to respond to this question: “hmmm anywhere without child labor and a two-day weekend!” After all, not only do we rank among the worst in terms of paid leave for parents or family sickness and have zero mandatory vacation hours, Americans often don’t even take the vacation we’ve got! Still, not everyone is better than we are in every way. We have more women in the workforce than most, for instance. That’s why it’s instructive to compare ourselves to other countries and see who does what better, and what policies and attitudes we could emulate.

Tthe Organization for Economic Cooperation and Development (OECD) makes a study of this sort of thing, ranking countries on quality of life -- the “Better Life Index” -- based on a number of factors, including work-life balance, safety, health, longevity, and more. Based on that series of data as well as other information, here are some countries that have better work-life balance--either overall, or in individual categories--than we do. And yes, though the Scandinavian countries basically kick everyone else’s ass in this category, we didn’t exclusively highlight them, since there are so many other countries that best us in this area we had the liberty to choose.

1. Canada: Not perfect, but better than the US...

2. Denmark: Overall champ...

3. Brazil: Vacation heaven...

4. Sweden: World leader in paternity leave...

5. France: Lavishing love on moms...

No other place is perfect, but as I learned through my research, each of these countries has something unique to offer its citizens. Here in America, this issue is on the radar in a way it hasn't been before, evidenced by the fact that companies continue to pioneer interesting vacation solutions to prevent burnout and their ideas are getting play in the national media...

*********************************************************

Sarah Seltzer is an associate editor at AlterNet and a freelance writer based in New York City. Her work has been published at the Nation, the Christian Science Monitor, Jezebel and the Washington Post. Follow her on Twitter at @sarahmseltzer and find her work at sarahmseltzer.com.

xchrom

(108,903 posts)xchrom

(108,903 posts)

Rising anchovy prices are affecting the world's fishing industry. Photograph: Kevin Schafer/Getty Images

"If you like anchovies on your pizza you'd better be careful," warns Mark Livingston, investment director of Fidelity Worldwide Investment.

You would not expect the head of a global asset fund managing £138bn of pensions and investments to care about the cost of pizza toppings. But the global nature of the food chain means severe storms off the coast of Peru have led to a dramatic jump in the price of the oily fish – which will in turn lead to a spike in Scottish farmed fish, Chinese pigs and even Omega 3 tablets in Holland & Barratt.

"That's the nature of today's food business – everything's connected," Livingston says. "If you can catch some anchovies you'll make some serious money."

And that's why Livingston cares about this silvery-coloured fish. Three years ago Fidelity spotted the growing importance of the "forgotten fish" and invested in Copeinca, a Norwegian company that owns a fleet of 30 Peruvian anchovy fishing boats and five processing plants across the country.

Fuddnik

(8,846 posts)But, with Isaac getting ready to pop, it's probably a madhouse.

I love it! All the pukes, from Idaho, and Indiana they're interviewing on TV say, "Bring it on, we're here to spend some time on the beach". ![]()

They've obviously never seen a tropical storm or hurricane before. The beaches will be closed by tomorrow evening, morans. And by Wed. they'll be gone. The beaches.

And, you're all staying on the Pinellas County beaches, across the bay from the convention center. When it hits, they close all the bridges, because they're flooded. So, you'll be stuck in the hotel bar for three days. Fuck all you ignorant baggers. You deserve it!

And, if you do get a chance to take a dip, it's hammerhead and bull shark mating season in the gulf. Have fun!

xchrom

(108,903 posts)I hope the storm is just bad enough to provide amusement at their discomfort.

AnneD

(15,774 posts)Darwin Awards given to GOP numb nuts.

I hate to wish it on anyone, but a hurricane interrupting the convention could be seen as a blessing.

DemReadingDU

(16,000 posts)There will be more time devoted to the passing of one of America's greatest heroes. I'm sure many of us remember July 20, 1969 when he walked on the moon.

Fuddnik

(8,846 posts)They gave us extra rec time in the lounge that night to watch it.

I think it was the last time everyone was proud to be an American. He was probably the best pilot ever. Absolute nerves of steel. And he avoided the limelight ever since. I wish I could have gone to Ohio State just to study under him.

DemReadingDU

(16,000 posts)He had just gotten out of the Marines after serving in Vietnam. 1969 was a great time to be an American. We young people had a wonderful future ahead of us, or so we thought at that time.

In the middle 80's our son was racing gokarts, and one of the races was in Wapakoneta, Armstrong's home town. We happened to meet his dad and briefly talked to him about his son walking on the moon. Obviously he was quite proud of him, but not in a gushing manner. Just normal people from small-town America, no big egos.

Spouse also thought quite highly of Neil Armstrong, and John Glenn too. Both great heroes from Ohio.

Edit: Spouse just sent me this link for Neil Armstrong famous quotes...

http://www.brainyquote.com/quotes/authors/n/neil_armstrong.html

DemReadingDU

(16,000 posts)http://www.daytondailynews.com/s/news/neil-armstrong/

I feel really sad today. Neil Armstrong represented the proudest time of being an American, and with his death, so is America dying.

xchrom

(108,903 posts)Angela Merkel has rejected pleas from her Greek counterpart for a two-year repayment extension after receiving backing from the French president, François Hollande, for her hardline stance.

The German chancellor said it was up to the people of Greece to show they can implement austerity measures agreed with Brussels and the International Monetary Fund (IMF) before there could be any further discussion about the latest €130bn (£103bn) debt package.

But she softened the blow with a commitment to wait for a report next month on the progress by Athens to cut government spending and implement far reaching tax and labour market reforms. She said Greece should stay in the euro "and that's what I'm working for."

The uncertainty surrounding the eventual outcome of talks between Antonio Samaras, the Greek prime minister, and the troika of representatives from the IMF, Brussels and the European Central Bank unsettled markets before the bank holiday.

Demeter

(85,373 posts)xchrom

(108,903 posts)Demeter

(85,373 posts)WHY ARE THEY SO WORRIED? WHAT COULD POSSIBLY GO WRONG?

http://www.washingtonpost.com/business/economy/analysts-fear-euro-zone-capital-flight-might-snowball/2012/08/23/e02102a2-d1cc-11e1-8bea-6dc0b4879aab_story.html?hpid=z4

Insurance giant AIG startled markets last week when it signaled its waning faith in the euro by moving tens of millions of dollars worth out of the currency zone, reducing its holdings in banks in Germany, France, Spain and Italy.

The news came on the heels of a similarly unsettling announcement by International Airlines Group, the parent company of British Airways, which said Aug. 3 that it had reduced its exposure to Spain and formed a committee to prepare for the worst-case scenario of Spain exiting the euro zone.

The one-two punch is the latest in a series of efforts by corporations, central banks and individuals to move money out of crisis-stricken euro-zone countries as the debt crisis envelops an ever-larger part of the continent.

Such currency moves are bets on the future of national economies. The recent capital flight, analyst say, is a vote of no confidence in the euro that some worry could snowball into a series of silent bank runs. If institutions and consumers lose faith in the euro, a massive flight could lead to economic collapse...

Demeter

(85,373 posts)

Tansy_Gold

(17,877 posts)While seismic activity around the volcano was intense in the years preceding the cataclysmic 1883 eruption, a series of lesser eruptions began on May 10, 1883. The volcano released huge plumes of steam and ash lasting until late August.[13] On August 27 a series of four huge explosions almost entirely destroyed the island. The explosions were so violent that they were heard 3,500 km (2,200 mi) away in Perth, Western Australia and the island of Rodrigues near Mauritius, 4,800 km (3,000 mi) away.[4] The pressure wave from the final explosion was recorded on barographs around the world, which continued to register it up to 5 days after the explosion. The recordings show that the shock wave from the final explosion reverberated around the globe seven times.[12] Ash was propelled to a height of 80 km (50 mi). The sound of the eruption was so loud it was said that if anyone was within ten miles (16 km), he would go deaf.

The combined effects of pyroclastic flows, volcanic ashes, and tsunamis had disastrous results in the region. The death toll recorded by the Dutch authorities was 36,417, although some sources put the estimate at more than 120,000. There are numerous documented reports of groups of human skeletons floating across the Indian Ocean on rafts of volcanic pumice and washing up on the east coast of Africa up to a year after the eruption

http://discover-indo.tierranet.com/volcano02.htm

The event: Monday, August 27, 1883 at 10:02 am. At that very moment came the culminating and terrifying main eruption of the Krakatoa. Krakatoa's final twenty hours and fity-minutes were marked by a number of phases. It started by a series of explosions on Sunday at about 7 p.m. The explosion was so huge that most of the volcano's mountain (or island) desapeared under the level of the sea. A new smalest volcano island was formed later on, and called Anak Krakatoa.

This eruption of August 1883 was the largest recorded in Java, and is considered as one the world's biggest volcano explosion recorded by human in the last centuries, with the Tambora Volcano in Sumbawa on April 1815, an other Indonesian island. Coming back to the Krakatao eruption, the sound was so loud that it was heard in Thailand and in Australia. Some studies are also pointing out thet the smoke was so important that it propagated in the atmosphere for months, generating climate modification in an extended portion of the globe.

On August 27, 1883 the most powerful volcanic eruption in recorded history took place on the Krakatoa Islands. Located between Java and Sumatra, the islands themselves owed their existence to a massive eruption early in the 5th century AD. In the wake of the 1883 eruption over 36,000 lay dead and the entire island detonated with a force unknown in the pre-atomic age. Krakatoa, which stood some 6000 feet above sea level on August 26th, had simply ceased to exist twenty-four hours later. Some three-quarters of the island had been blasted away or sank beneath the ocean into the crater where the volcano once stood. The eruption bundled together a catalogue of individual disasters: massive explosions, earthquakes, toxic clouds of superheated ash and gasses, and a tsunami whose 140 foot waves decimated 165 villages in the region. A ship in a nearby bay was lifted by the ensuing tidal wave and deposited two miles inland. A volcanic hail of stones rained from the sky while shrouds of ash turned the daytime sky pitch black.

* * *

Krakatoa's eruption generated a shockwave that traveled the earth seven times. The tons of ash propelled into the sky generated climactic changes as particles blocked sunlight and reduced temperatures. Created by volcanic eruption, the island was destroyed by the same geological forces. For a half-century the ravaged remnant of the island stood as a testament to the volcano's explosive fury. But the cycle does not end here. In 1927 a volcanic peak began to rise from the ocean where part of Rakata Island had once been. It now stands 2600 feet above sea level.

Its name: Anak Krakatoa. The child of Krakatoa.

http://www.washingtonpost.com/wp-adv/discovery/index_krakatoa.html

Tansy_Gold

(17,877 posts)(Since DU is acting squirrelly and won't let me edit the above post) The photos in Post #25 are all of Anak Krakatau, or "Child of Krakatau," the "new" island formed in 1927. The following is shows the size of the islands prior to the 1883 eruption.

Demeter

(85,373 posts)How are you doing, my friend? Is DU incapable of PM any more? Or is it something in your loop?

hamerfan

(1,404 posts)Pink Floyd. Live at Pompeii.

One Of These Days:

Fuddnik

(8,846 posts)I saw it way back when it was first released. And, they have the entire "Directors Cut" posted on Youtube.

My nephew plays lead guitar for THE Pink Floyd act in St. Louis. They sell out a large venue 7 or 8 nights every December. They're called El Monstero.

DemReadingDU

(16,000 posts)I had not read anything about it, other than Matt Damon wasn't in it (except for his picture). So I had no clue about any plot. Once I figured out what was going on, it was pretty good.

Demeter

(85,373 posts)and I really, really enjoyed it.

It was a story, a real story, without much preaching, for tweens and teens and parents. That was really at the Kid's emotional level: about 12-13, and about as much excitement as I could handle today.

The amazing thing is seeing these young kids acting their butts off....they were really good.

I've also been to the farmer's market (the squashes and peaches are in, and blueberries are horribly expensive while the raspberries are delicious!) and the thrift store, where we had a 50% off coupon. The Kid stocked up on VHS tapes at 25 cents each, which as the clerk said: "my kids can play them without getting them scratched."

And the papers are huge today...it took two car trips, full to the scuppers, to bring home the first half. Bet the second half is 3 hours late, again....

Demeter

(85,373 posts)Demeter

(85,373 posts)U.S. mutual funds run by Morgan Stanley, the lead underwriter in Facebook Inc.'s $16 billion initial public offering, have disproportionately high investments in the social-media company, leaving fund shareholders exposed to the stock's big drop since its May 18 IPO.

New data show that eight of the top nine U.S. mutual funds with Facebook shares as a percentage of total assets are run by Morgan Stanley's asset-management arm, according to fund tracker Morningstar Inc...

OOOPS! MY BAD!

Demeter

(85,373 posts)WHAT DO THEY WANT? EGG IN THEIR BEER?

http://in.reuters.com/article/2012/08/23/us-nasdaq-facebook-compensation-idINBRE87L0W620120823

The $62 million compensation plan proposed by Nasdaq OMX Group for fallout from Facebook's botched IPO is "inadequate to address the magnitude of Nasdaq's unprecedented failures", UBS Securities LLC said in a letter to U.S. regulators.

UBS Securities, an arm of Swiss bank UBS AG, said it lost over $350 million when Nasdaq technical malfunctions led to a delay in order confirmations during the $16 billion May 18 IPO, causing UBS's systems to re-enter orders multiple times and leaving it with a huge position of unwanted stock.

Major market makers and broker dealers, including UBS, lost upward of $500 million in the IPO.

UBS also said the types of claims for trading losses that Nasdaq agrees to compensate "should be expanded to include the full extent of losses caused by Nasdaq, and that the requirement that participants in the program release other legitimate claims they may have against Nasdaq is fundamentally unfair".

"Simply put, Nasdaq's proposal to pay $62 million in the aggregate for all Facebook-related claims is woefully inadequate," UBS said in the letter to the U.S. Securities and Exchange Commission (SEC) dated August 22. The UBS letter was one of nine posted by market makers, brokers, a trade group, and lawyers, on the SEC's website on Thursday by around midday. Eight of the letters were critical of the proposal, calling for changes or the outright rejection of the plan. One urged for its passage...

Ghost Dog

(16,881 posts)The interviewer does a particularly nice job of drawing Hedges out.

I would like to add an observation I made in thinking further this afternoon about the Sophie Scholl piece I put up earlier this morning. There is something about gardening that focuses the mind.

...

This is an almost perfect illustration of the credibility trap. One cannot allow the illusion to falter, even a little, to the bitter end. And as the fraud fades, the force intensifies, becoming almost rabid. Because that illusion has become the center of a hollowed person's being, their raison d'être, and mythological justification.

If the ideology had been a lie, then they are not heroes and gods on earth, but monsters and criminals, and their life has been meaningless, without credibility and honor.

/... http://jessescrossroadscafe.blogspot.com.es/

Demeter

(85,373 posts)Death Takes a Policy: How a Lawyer Exploited the Fine Print and Found Himself Facing Federal Charges

Joseph Caramadre has spent a lifetime scouring the fine print. He's hardwired to seek the angle, an overlooked clause in a contract that allows him to transform a company's carelessness into a personal windfall. He calls these insights his "creations," and he numbers them. There have been about 19 in his lifetime, he says. For example, there was number four, which involved an office superstore coupon he parlayed into enough nearly free office furniture to fill a three-car garage. Number three consisted of a sure-fire but short-lived system for winning money at the local dog track. But the one that landed him on the evening news as a suspect in a criminal conspiracy was number 18, which promised investors a unique arrangement: You can keep your winnings and have someone else cover your losses....Caramadre portrays himself as a modern-day Robin Hood. He's an Italian kid from Providence, R.I., who grew up modestly, became a certified public accountant and then put himself through night school to get a law degree. He has given millions to charities and the Catholic Church. As he tells his life story, his native ability helps him outsmart a phalanx of high-priced lawyers, actuaries and corporate suits. Number 18 came to fruition, he says, when a sizable segment of the life insurance industry ignored centuries of experience and commonsense in a heated competition for market share.

Federal prosecutors in Rhode Island and insurance companies paint a very different picture of Caramadre: They say he's an unscrupulous con artist who engaged in identity theft, conspiracy and two different kinds of fraud. Prosecutors contend he deceived the terminally ill to make millions for himself and his clients. For them, Caramadre's can't-miss investment strategy was an illusion in which he preyed on the sick and vulnerable. ProPublica has taken a close look at the Caramadre case because it offers a window into a larger issue: The transformation of the life insurance industry away from its traditional business of insuring lives to peddling complex financial products. This shift has not been a smooth one. Particularly during the lead up to the financial crisis, companies wrote billions worth of contracts that now imperil their financial health.

In a series of detailed interviews, Caramadre said the companies designed the rules; all he did was exploit them. Their hunger for profits in a period of dizzying growth and competition, he contends, left them vulnerable to someone with his unusual acumen. The companies have argued in court that Caramadre is a fraud artist who should return every last dime he made. In his rulings to date, the federal judge hearing the civil cases has agreed with Caramadre's contention that he was doing what the fine print allowed. The secret to Caramadre's scheme can be glimpsed in a 2006 brochure for the ING GoldenSelect Variable Annuity. On the cover is a photo of a youthful older couple. The woman sits next to a computer, sporting a stylish haircut and wire-framed glasses. A man with graying hair and an open collared shirt, presumably her husband, is draped over her in a casual loving way. Images of happy vibrant seniors enjoying their golden years together — frolicking on the beach, laughing in chinos next to a gleaming classic car, enjoying the company of grandkids — populate the sales material for life insurance's hottest product — the variable annuity. As outlined in the brochure and in countless others like it, the contracts worked this way: The smiling couple gives money to ING in return for the promise of future payments. The consumer chooses how the money is invested, usually in mutual-like funds that have stocks, bonds or money market instruments. This is the "variable" part of the equation.

There are two main benefits to this arrangement not found in the ordinary mutual funds sold by brokers and financial advisers. Taxes on variable annuities are deferred until the consumer takes out cash, which means it's possible to move your money among funds without paying taxes until the money is withdrawn. (An investor who cashes in shares of a mutual fund must pay taxes on any gains.) Variable annuities also typically include a life insurance component called a guaranteed death benefit. With this guarantee, if the market crashes — but you die before your investment recovers — your beneficiary still gets a lump sum equal to either the death benefit or the value of the investments in your account, whichever is greater. The target audience for brochures like that of ING's are people nearing retirement with a nest egg to safeguard and perhaps grow a bit. It's a huge and growing market. In 2011, as the first wave of baby boomers began to retire, there were more than 40 million people age 65 or over. Between 2001 and 2010, life insurance companies sold about $1.4 trillion worth of variable annuities, according to LIMRA, an industry association.

...Today, several of the companies Caramadre targeted have stopped selling variable annuities. ING has been forced to get out of the business and write down billions in losses. Others have had to boost their reserves. Transamerica is trying to buy back some of the variable annuities it sold to policyholders. The French insurer Axa is offering its variable annuity holders money if they surrender their death benefit guarantees.

Demeter

(85,373 posts)

Demeter

(85,373 posts)GUESS WHERE THOSE RESERVES ARE?

http://www.spiegel.de/international/germany/debate-breaks-out-in-germany-over-foreign-gold-reserves-a-833289.html

A large portion of Germany's massive gold reserves are stored abroad, mainly in the Federal Reserve in New York. But are the bars really where they are supposed to be? A dispute has broken out over whether the central bank needs to check on its gold, or if Germany can trust its international partners...Germany has gold reserves of just under 3,400 tons, the second-largest reserves in the world after the United States. Much of that is in the safekeeping of central banks outside Germany, especially in the US Federal Reserve in New York. One would think that with such a valuable stash, worth around €133 billion ($170 billion), the German government would want to keep a close eye on its whereabouts. But now a bizarre dispute has broken out between different German institutions over how closely the reserves should be checked.

IT'S CALLED THE CHAVEZ SYNDROME...REMEMBER HE FLEW ALL VENEZUELA'S RESERVES HOME?

Germany's federal audit office, the Bundesrechnungshof, which monitors the German government's financial management, is unhappy with how Germany's central bank, the Bundesbank, keeps tabs on its gold. According to media reports, the auditors are dissatisfied with the fact that gold reserves in Frankfurt are more closely monitored than those held abroad.

In Germany, spot checks are carried out to make sure that the gold bars are in the right place. But for the German gold that is stored on the Bundesbank's behalf by the US Federal Reserve in New York, the Bank of England in London and the Banque de France in France, the German central bank relies on the assurances of its foreign counterparts that the gold is where it should be. The three foreign central banks give the Bundesbank annual statements confirming the size of the reserves, but the Germans do not usually carry out physical inspections of the bars.

IT SOUNDS LIKE THE THIEVES ARE HAVING A FALLING OUT

According to German media reports, the Bundesrechnungshof has now recommended in its confidential annual audit of the Bundesbank for 2011 that Germany's central bank check its foreign gold reserves with yearly spot checks. The Bundesbank has rejected the demand, arguing that central banks do not usually check each others' reserves. "The scope of the checks that the Bundesrechnungshof wants does not correspond to the usual practices among central banks," the Bundesbank said in a statement quoted by the Frankfurter Allgemeine Zeitung newspaper. "There are no doubts about the integrity and the reputation of these foreign depositories." Now the finance committee of the German parliament, the Bundestag, has gotten involved. Parliamentarians apparently demanded to see the Bundesrechnungshof's audit report on the Bundesbank after they were alarmed by a report in the influential tabloid daily Bild, which claimed that the central bank had not checked its gold reserves in five years.. The Bundesrechnungshof will now provide the committee with its report, a spokesman for the federal auditors confirmed on Monday.

IT'S POPCORN TIME..AND WE HAVE ALL THESE NICE VOLCANOES TO POP IT FOR US!

Demeter

(85,373 posts)NOW THAT I'LL BELIEVE! IT'S CALLED CHUTZPAH, BABY!

http://www.independent.co.uk/news/world/europe/obama-asks-eurozone-to-keep-greece-in-until-after-election-day-8076852.html

US officials are worried that if Greece exits the eurozone, it will damage President's election hopes...YEAH, A GLOBAL ECONOMIC COLLAPSE COULD DO THAT!

...Representatives from the International Monetary Fund, the European Central Bank and the European Commission are due to arrive in Athens next month to assess Greece's reform efforts. They are expected to report in time for an 8 October meeting of eurozone finance ministers which will decide on whether to disburse Greece's next €31bn aid tranche, promised under the terms of the bailout for the country. American officials are understood to be worried that if they decide Greece has not done enough to meet its deficit targets and withhold the money, it would automatically trigger Greece's exit from the eurozone weeks before the Presidential election on 6 November.

They are urging eurozone Governments to hold off from taking any drastic action before then – fearing that the resulting market destabilisation could damage President Obama's re-election prospects. European leaders are thought to be sympathetic to the lobbying fearing that, under pressure from his party lin Congress, Mitt Romney would be a more isolationist president than Mr Obama. The President discussed the eurozone crisis with David Cameron during a conference call on Wednesday and both welcomed statements by the European Central Bank that it was "standing firmly behind the euro"...Britain is understood to have pressed the Germans to ensure that if eurozone leaders decide Greece's position is unsustainable the financial "firewall" around Spain and Italy is made stronger. Officials are worried that if Greece was to exit the eurozone, the move could result in dramatic increases in the cost of debt for other weaker eurozone members – making their financial situation unsustainable.

Demeter

(85,373 posts)THIS IS ONLY AN EXCERPT...SEE FULL ARTICLE AT LINK

http://www.informationclearinghouse.info/article32284.htm

The United States has collapsed economically, socially, politically, legally, constitutionally, and environmentally. The country that exists today is not even a shell of the country into which I was born. In this article I will deal with America’s economic collapse. In subsequent articles, I will deal with other aspects of American collapse.

Economically, America has descended into poverty. As Peter Edelman says, “Low-wage work is pandemic.” Today in “freedom and democracy” America, “the world’s only superpower,” one fourth of the work force is employed in jobs that pay less than $22,000, the poverty line for a family of four. Some of these lowly-paid persons are young college graduates, burdened by education loans, who share housing with three or four others in the same desperate situation. Other of these persons are single parents only one medical problem or lost job away from homelessness. Others might be Ph.D.s teaching at universities as adjunct professors for $10,000 per year or less. Education is still touted as the way out of poverty, but increasingly is a path into poverty or into enlistments into the military services. Edelman, who studies these issues, reports that 20.5 million Americans have incomes less than $9,500 per year, which is half of the poverty definition for a family of three. There are six million Americans whose only income is food stamps. That means that there are six million Americans who live on the streets or under bridges or in the homes of relatives or friends. Hard-hearted Republicans continue to rail at welfare, but Edelman says, “basically welfare is gone.”

In my opinion as an economist, the official poverty line is long out of date. The prospect of three people living on $19,000 per year is farfetched. Considering the prices of rent, electricity, water, bread and fast food, one person cannot live in the US on $6,333.33 per year. In Thailand, perhaps, until the dollar collapses, it might be done, but not in the US. As Dan Ariely (Duke University) and Mike Norton (Harvard University) have shown empirically, 40% of the US population, the 40% less well off, own 0.3%, that is, three-tenths of one percent, of America’s personal wealth. Who owns the other 99.7%? The top 20% have 84% of the country’s wealth. Those Americans in the third and fourth quintiles--essentially America’s middle class--have only 15.7% of the nation’s wealth. Such an unequal distribution of income is unprecedented in the economically developed world. In my day, confronted with such disparity in the distribution of income and wealth, a disparity that obviously poses a dramatic problem for economic policy, political stability, and the macro management of the economy, Democrats would have demanded corrections, and Republicans would have reluctantly agreed. But not today. Both political parties whore for money.

The Republicans believe that the suffering of poor Americans is not helping the rich enough. Paul Ryan and Mitt Romney are committed to abolishing every program that addresses needs of what Republicans deride as “useless eaters.” The “useless eaters” are the working poor and the former middle class whose jobs were offshored so that corporate executives could receive multi-millions of dollars in performance pay compensation and their shareholders could make millions of dollars on capital gains. While a handful of executives enjoy yachts and Playboy playmates, tens of millions of Americans barely get by. In political propaganda, the “useless eaters” are not merely a burden on society and the rich. They are leeches who force honest taxpayers to pay for their many hours of comfortable leisure enjoying life, watching sports events, and fishing in trout streams, while they push around their belongings in grocery baskets or sell their bodies for the next MacDonald burger....The economic destruction of America benefitted the mega-rich with multi-billions of dollars with which to enjoy life and its high-priced accompaniments wherever the mega-rich wish. Meanwhile, away from the French Rivera, Homeland Security is collecting sufficient ammunition to keep dispossessed Americans under control.

***********************************************************

Paul Craig Roberts was Assistant Secretary of the Treasury for Economic Policy and associate editor of the Wall Street Journal. He was columnist for Business Week, Scripps Howard News Service, and Creators Syndicate. He has had many university appointments. His internet columns have attracted a worldwide following.

AnneD

(15,774 posts)Is having a world class museum district.

Several years ago, we had a wonderful Pompeii exhibit at the museum of science. The frescos, art pottery and jewelry were amazing. The castings were the most haunting. In CSI parlance, the defensive posturing were evident. The saddest were the parents protecting the children from a horrible yet inevitable death.

Pompeii and Herculaneum were affluent sea side resorts filled with the well to do business class....the ancient 1%. The trappings of wealth were evident in the artifacts recovered. This was a society that enjoyed luxuries of the day, hot baths, oils and fragrances, and a good diet. I enjoyed looking at the tools of the various trades. They loved sports and other diversions. Very similar to what we do today.

Excellent topic.

DemReadingDU

(16,000 posts)I wonder if the exhibit you saw was the same exhibit we saw couple weeks ago? For this tour, only 4 cities were approved for the exhibit. New York, Boston, Cincinnati, and just now going to Denver. So if anyone lives in the Denver area, go see the Pompeii exhibit!

AnneD

(15,774 posts)But we tend to get a lot of first class exhibits first. It might have been the same one. Museums tend to have traveling exhibits. The revenue is split between the two museums. They like Houston because we have lots of foot traffic and excellent security. It is win win.

xchrom

(108,903 posts)

xchrom

(108,903 posts)Citigroup Inc. (C) Chief Executive Officer Vikram Pandit said regulators shouldn’t dictate what banks can sell to clients because such controls risk undermining financial stability and have no clear economic benefit.

Former Citigroup Chairman Sanford “Sandy” Weill said last month banks should be broken up, separating investment banking from lending and deposit-taking. U.S. regulators are also working to complete controls that include a ban on proprietary trading by banks -- the so-called Volcker rule.

Speaking on the Australian Broadcasting Corp., Pandit said he supports the “concept” of the Volcker rule -- that a bank’s capital should be used for clients. Still, he said dividing Citigroup, the third-biggest U.S. bank, in the manner suggested by Weill would be an “artificial separation” and the New York- based bank must continue to lend as well as tap capital markets for customers.