Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 20 April 2012

[font size=3]STOCK MARKET WATCH, Friday, 20 April 2012[font color=black][/font]

SMW for 19 April 2012

AT THE CLOSING BELL ON 19 April 2012

[center][font color=red]

Dow Jones 12,964.10 -68.65 (-0.53%)

S&P 500 1,376.92 -8.22 (-0.59%)

Nasdaq 3,007.56 -23.89 (-0.79%)

[font color=red]10 Year 1.96% +0.01 (0.51%)

30 Year 3.12% +0.02 (0.65%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

Financial Sector Officials Convicted since 1/20/09 = [/font][font color=red]12[/font]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

westerebus

(2,976 posts)Demeter

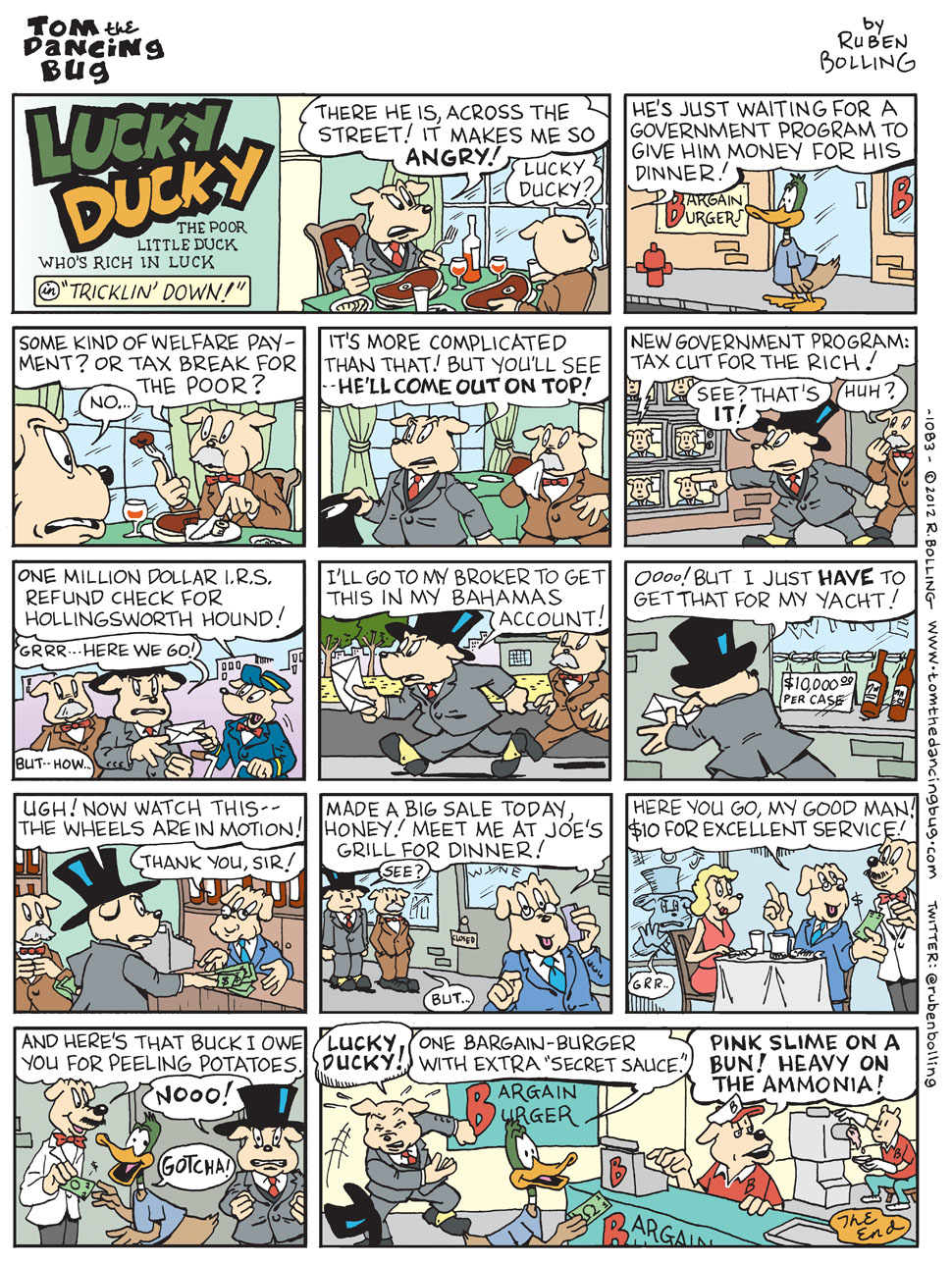

(85,373 posts)The devil is in the details. When will the politicians realize that? Good cartoon.

Demeter

(85,373 posts)

Demeter

(85,373 posts)Somewhere along the line, everything got turned upside down. It used to be that we envied the rich for their wealth, but now we pity them. For it seems that no one works harder than a millionaire (except perhaps a billionaire), which is why we must do everything in our power to help them keep every penny that comes their way.

At the same time, we envy the poor, those lazy lucky ducks who just sit around all day, collecting unemployment, avoiding taxes and living it up on food stamps. Read Ruben Bolling’s latest cartoon starring Lucky Duck, POSTED ABOVE.

It wasn’t always this way. Once, not so very long ago, people saw the world as it really was. We all knew that the rich have it easy while the poor have hard times. Indeed, that’s the main reason people want to be rich instead of poor. We knew why they called it “the working class.” We developed theories about the leisure class that explained why the rich spent so much time, energy and money making sure that no one would ever confuse them with someone who actually worked, with someone who got calluses or got sunburned. Read Thorstein Veblen’s book, The Theory of the Leisure Class AAVAILABLE ON LINE FROM THE GUTENBERG PROJECT.

Somehow, however, in the popular imagination the rich and the poor have switched places. Now, it’s the rich who toil from sun up to sun down, while the idle poor among us never lift a finger...

RANT CONTINUES...ENDS SWIPING ANN ROMNEY (BUT NOT BY NAME)

Demeter

(85,373 posts)We're far from poor -- we just have a wildly lopsided distribution of wealth that makes us seem poor. America is loaded. We are not a struggling nation ready to go under. We are not facing an enormous debt crisis despite what the politicians and pundits proclaim. We are not the next Greece. Rather, we have an enormous concentration-of-wealth problem -- one that must be solved for the good of our commonwealth. We are a very rich nation but it doesn’t seem that way because our wealth is so concentrated in the hands of a few. This is America’s disaster.

But wait. Doesn’t the wealth belong to the super-rich? Didn’t they earn it fair and square? Isn’t that the way it’s always been?

Not by a long shot. The amount of wealth that flows to the super-rich is determined by our public policies. It’s all about how we choose to share our nation’s productivity.

Productivity and the Wealth of Nations

Our country is rich because we are enormously productive as measured by output per hour worked. The greater our collective output per hour, the more our economy produces and the wealthier we are…or should be. It’s not a perfect measure since it doesn’t adequately take into account our environment, our health or our overall well-being. But it is a good gauge of our collective level of effort, skill, knowledge, level of organization, and productive capacity. As the top line on the productivity chart below shows, we’ve been able to produce more and more per hour year after year since WWII. It’s a remarkable achievement.

From 1947 until the mid-1970s, the fruits of our bountiful productivity were shared reasonably fairly with working people. As productivity rose so did workers’ real wages (See the bottom line in the chart below. It represents the average weekly wage of non-supervisory workers who make up about 80 percent of the entire workforce.) This wasn’t socialism. There were still plenty of rich people who earned a significant slice of the productivity harvest. But much of that wealth was plowed back into the economy through taxation rates that between 1947 and 1980 hovered between 70 to 91 percent on incomes over $3 million (in today’s dollars). Much of that money was used to build our physical and knowledge infrastructures, and to fight the Cold War. Unions were supported by public policy and workers' real wages rose steadily after accounting for inflation. Wall Street was tightly controlled and the middle-class grew like never before.

Then something happened.

It wasn’t an act of God, or the blind forces of technological change, or the mysterious movements of markets. Nor did the super-rich become enormously smarter than before. Instead, flesh-and-blood policy makers decided that deregulation and tax cuts should become the order of the day starting in the mid-1970s. The idea was that if we cut taxes on the super-rich and deregulated the economy (and especially Wall Street), investment would dramatically increase and all boats would rise. But as we can see from the chart below, the average worker's wage in real terms stalled and even declined after the mid-'70s. The fruits of productivity no longer were shared equitably. The enormous gap between the two lines (trillions of dollars per year) went almost entirely to the super-rich. The wealth of the wealthy skyrocketed, not by accident, but by policy design. "Greed is good" replaced the middle-class American dream...

RANT CONTINUES AT LINK

Demeter

(85,373 posts)Why We Need a Financial Transaction Tax

Most Americans live on earned income which is taxed instantly through substantial payroll taxes. You can’t collect a paycheck without paying taxes. The super-rich, however, receive most of their income through financial investments that are taxed at lower capital gains rates and which can be offset through a myriad of deductions and loopholes. In effect, the super-rich live by one tax code and the rest of us use another. This is why the wealthiest Americans pay lower effective tax rates than their servants. It’s also why our government appears to be starved for income. If we want a vibrant economy and good investments in our public infrastructures, the wealthy must pay a great deal more, just like they did during the early post-WWII period.

For starters we need a financial transaction tax which is a small sales tax on each and every financial trade – from stocks and bonds to futures and other derivatives. Since the super-rich hold so many financial assets, this kind of tax would directly target their excessive trading and enormous holdings. Not only would this sales tax produce upwards of $150 billion a year in federal revenue, but also, it may help eliminate much of the financial gambling that took down the economy in 2007. Considerate it a tax on financial toxic waste.

A Wealth Tax to Improve our Commonwealth

Finland, France, Iceland, Luxembourg, Norway, Spain, Sweden and Switzerland have small net wealth taxes, and England has had a financial transaction tax for three centuries. We should join them. A 1 to 3 percent wealth tax with a million-dollar deduction would only hit the top 1 percent and would provide the nation with from $50 to $150 billion per year in income. Spare change for the super-rich.

The beauty of a wealth tax is that there are no loopholes. Your assets (which include both foreign and domestic) and your liabilities are easily calculated. It’s easier to spot the cheaters. It’s easier to press for information from other countries that may be tempted to launder money for our super-rich. There’s nowhere to run unless the super-rich want to give up their citizenship...

*********************************************************************************

Les Leopold is the executive director of the Labor Institute and Public Health Institute in New York, and author of The Looting of America: How Wall Street's Game of Fantasy Finance Destroyed Our Jobs, Pensions, and Prosperity—and What We Can Do About It (Chelsea Green, 2009).

Demeter

(85,373 posts)The most striking change in American society in the past generation—roughly since Ronald Reagan was elected President—has been the increase in the inequality of income and wealth. Timothy Noah’s “The Great Divergence: America’s Growing Inequality Crisis and What We Can Do About It” (Bloomsbury), a good general guide to the subject, tells us that in 1979 members of the much discussed “one per cent” got nine per cent of all personal income. Now they get a quarter of it. The gains have increased the farther up you go. The top tenth of one per cent get about ten per cent of income, and the top hundredth of one per cent about five per cent. While the Great Recession was felt most severely by those at the bottom, the recovery has hardly benefitted them. In 2010, ninety-three per cent of the year’s gains went to the top one per cent.

Since rich people are poorer in votes than they are in dollars, you’d think that, in an election year, the ninety-nine per cent would look to politics to get back some of what they’ve lost, and that inequality would be a big issue. So far, it hasn’t been. Occupy Wall Street and its companion movements briefly spurred President Obama to become more populist in his rhetoric, but there’s no sign that Occupy is going to turn into the kind of political force that the Tea Party movement has been. There was a period during the Republican primary campaign when Romney rivals like Newt Gingrich tried to take votes from the front-runner by bashing Wall Street and private equity, but that didn’t last long, either. Politics does feel sour and contentious in ways that seem to flow from the country’s economic distress. Yet much of the ambient discontent is directed toward government—the government that kept the recession from turning into a depression. Why isn’t politics about what you’d expect it to be about?

Traditionally, class figured less in politics in America than in most other Western countries, supposedly because the United States, though more economically unequal, and rougher in tone, was more socially equal, more diverse, more democratic, and better at giving ordinary people the opportunity to rise. That’s what Alexis de Tocqueville found in the eighteen-thirties, and the argument has had staying power. It has also been wearing thin. During the five decades from 1930 to 1980, economic inequality decreased significantly, without imperilling “American exceptionalism.” So it’s especially hard to put a good face on the way inequality has soared in the decades since. Even if you think that all a good society requires is—according to the debatable conservative mantra—equal opportunity for every citizen, you ought to be a little shaken right now. Opportunity is increasingly tied to education, and educational performance is tied to income and wealth. When it comes to social mobility between generations, the United States ranks near the bottom of developed nations.

Read more http://www.newyorker.com/arts/critics/atlarge/2012/04/23/120423crat_atlarge_lemann#ixzz1sYK7AStt

Demeter

(85,373 posts)As America’s Great Middle Class crumbles, the Rich are again grasping for every possible regulatory rollback and tax cut, all the better to fund some final bacchanal of late-stage capitalism, a well-catered cocktail party of aging men and women wearing the false face of Botox, as poet Phil Rockstroh observes.

Wall Street is again flush with the electronic facsimile of the stuff once known as money. But this is a Botox Recovery: A superficial procedure, accomplished with a nerve paralyzing poison, reserved for the wealthy whose vanity has driven them to transform their faces into caricatures of corruption … to acquiring a countenance, frozen as a creepy doll, incapable of showing emotion — a grotesque simulacrum of the human face.

A Botox-distorted face reveals an individual with a distorted view of existence: that life’s limits, in this case the process of aging, must be hidden, and by doing so, artifice trumps reality. In a similar manner, life under our current Botoxed economic and political structure seems a gruesome distortion of life itself — a desperate gambit to veil the carnage inflicted by the monstrous excesses of oligarchic and Anthropocene Age exploitation of populace and planet.

Upon seeing the face of a narcissist whose features have been willingly disfigured by Botox, one wonders the obvious: Does he even look in the mirror? Yes. But, as is the case with the One Percent, he only sees what he is desperate to see. He has succeeded in fooling himself, thus he believes he fools all who have the misfortune to gaze upon him...

Demeter

(85,373 posts)An important fight between rich countries and developing countries over the question of UN involvement in researching and advocating for a new global financial architecture has spilled into the open in the weeks leading up to the April 21-26 quadrennial ministerial meeting in Doha, Qatar, of the United Nations Conference on Trade and Development (UNCTAD). At issue are apparent efforts by the rich countries to water down and block the key planks of UNCTAD's proposed work plan related to needed reforms in finance and the global financial architecture. The proposed work agenda for the next four years is set to be approved in Doha. However, in an unprecedented step, nearly 50 former UNCTAD officials and staff recently issued a public letter of concern expressing alarm at the degree of pressure being placed on UNCTAD by the industrialized countries, which have long been critical of UNCTAD's policy advice to developing nations. According to trade officials from developing countries, industrialized countries such as the United States and the EU believe that UNCTAD's advice on finance, environment, food security, intellectual property rights and development clashes with their agenda for free trade and free markets.

As currently drafted, UNCTAD's next four-year work plan outlines its proposed research and policy advice on subjects including the current economic recession, exchange rate misalignments, the volatility and financialization of commodity markets, special and differential treatment for developing countries, regional financial and monetary cooperation, and the need for the reform of the international financial and economic architecture. UNCTAD has called for a paradigmatic shift to development-oriented growth that would bring about sustainable and inclusive economic and social change in the world's least-developed countries (LDCs), including a host of alternative macroeconomic development policies and a range of broad reforms to the global financial architecture.

However, former UNCTAD officials, including one former secretary-general (Rubens Ricupero), and two former deputy secretaries-general (Carlos Fortin and Jan Pronk), are claiming that the rich countries are now trying to block UNCTAD from undertaking work in the areas of finance, governance of international finance, the exchange rate in the international monetary system and reform of the international financial architecture. According to Ylimaz Akyuz, former chief economist at UNCTAD and now chief economist at the South Centre, the rich countries, "don't want to see the word 'finance' in the agreed text defining the mandate of UNCTAD"; rather, they want to keep the issues regarding finance restricted to spaces they control, such as the International Monetary Fund (IMF) and the G20 - and out of the UN system, not just out of UNCTAD.

John Burley, one of the signatories to the statement, said that an attempt is going to be made in the Doha meeting, "to change UNCTAD's mandate by denying the organization the right to continue - and I emphasize, to continue - to analyze and report on global macroeconomic issues, including the role of global finance in development." This would constitute a major break with UNCTAD's traditional interdependence approach, in which it analyzes the relationship among the various flows of trade, finance and technology, and how that relationship affects development....MORE

Demeter

(85,373 posts)I’ve been rereading Larry Ball’s impressive and disturbing what-happened-to-Ben-Bernanke analysis — an analysis that, I happen to know, has caused much consternation in some circles. (“Surely it can’t be just groupthink! There must be very good reasons the Federal Reserve hasn’t done more!”)

And I think there’s a way to further refine Mr. Ball’s analysis, published on Feb. 28 on Vox, the Center for Economic Policy Research’s online policy portal — a way that makes more sense of Mr. Bernanke’s retreat from earlier positions, albeit one that still doesn’t cast a very flattering light on the Fed.

Mr. Ball, a professor of economics at Johns Hopkins University, starts from what many of us had already noted: The former Fed chairman’s harsh early-naughties critique of the Bank of Japan’s inadequate response in the face of the zero lower bound — its “self-induced paralysis” — applies with almost eerie precision to the Bernanke Fed. So the question is: What happened?

Mr. Ball gets much more specific by pointing to an apparent shift in 2003, following a Federal Open Market Committee discussion of policy at the zero bound...

xchrom

(108,903 posts)

Tansy_Gold

(17,860 posts)Finally fell asleep around 2:30, and here I am at work three hours later. It's gonna be a long, long day.

xchrom

(108,903 posts)Spreads it around.

Tansy_Gold

(17,860 posts)too much root beer with the pizza.

I'm usually so exhausted I fall asleep within seconds of crawling into bed. The two of us went through almost two full pitchers of root beer and I'm not used to that much sugar. But it sure was good!

xchrom

(108,903 posts)DemReadingDU

(16,000 posts)It would have been even better with ice cream

xchrom

(108,903 posts)AnneD

(15,774 posts)and Blue Bell Vanilla Bean Ice Cream. Taste so good it will make you sell your soul to the devil, or at least hock it.

xchrom

(108,903 posts)dixiegrrrrl

(60,010 posts)and we have Blue Bell Vanilla Bean Ice Cream ( no HFCS!!)

AND Barq's root beer in the store just a teensy few blocks from here.

hmmm..shall I ?

dare I?

xchrom

(108,903 posts)BANGKOK (AP) -- Asian stock markets fell Friday as strong U.S. company earnings failed to calm investor nerves in the face of economic reports that suggest the world's No. 1 economy is struggling to maintain its recovery.

Tokyo's Nikkei 225 index dropped 0.4 percent to 9,551.41 and Hong Kong's Hang Seng shed 0.3 percent to 20,941. South Korea's Kospi lost 1.4 percent to 1,972.47, with the government saying that exports are likely to face headwinds in the second quarter of the year due to Europe's debt crisis and a slowdown in the Chinese economy.

xchrom

(108,903 posts)WELLINGTON, New Zealand (AP) -- New Zealand's government has for the second time approved the contentious sale of 16 dairy farms to Chinese investors, despite objections from critics who say the country's prosperity could be jeopardized by such transactions.

The sale of farmland, the first to Chinese investors, has sparked vigorous debate in a country that is reliant on agriculture for much of its export earnings but which is also forging closer trade and tourism ties with China.

The sale was initially approved by the government in January but was contested in court by a consortium of local farmers and businessmen who hoped to buy the land themselves.

A New Zealand judge in February ordered the government to review the sale using stricter criteria. New Zealand law allows the sale of farmland to foreign investors only if it can be shown to economically benefit the country.

xchrom

(108,903 posts)The Goldman Sachs coup that failed in America has nearly succeeded in Europe - a permanent, irrevocable, unchallengeable bailout for the banks underwritten by the taxpayers.

In September 2008, Henry Paulson, former CEO of Goldman Sachs, managed to extort a US$700 billion bank bailout from the US Congress. To pull it off, he had to fall on his knees and threaten the collapse of the entire global financial system and the imposition of martial law; and the bailout was a one-time affair.

Paulson's plea for a permanent bailout fund - the Troubled Asset Relief Program or TARP - was opposed by congress and ultimately rejected.

By December 2011, European Central Bank (ECB) president Mario Draghi, former vice president of Goldman Sachs Europe, was able to approve a 500 billion euro (US$657 billion) bailout for European banks without asking anyone's permission.

And in January 2012, a permanent rescue funding program called the European Stability Mechanism (ESM) was passed in the dead of night with barely even a mention in the press. The ESM imposes an open-ended debt on EU member governments, putting taxpayers on the hook for whatever the ESM's eurocrat overseers demand.

xchrom

(108,903 posts)INTERNATIONAL MONETARY Fund managing director Christine Lagarde has said further action is needed in the euro zone to protect the “timid and fragile” global recovery from “several dark clouds on the horizon”.

Responding to a question about rising tensions over Spain’s banking system, Ms Lagarde called for a change in the way Europe’s bailout facilities are structured so that they can engage directly with financial institutions that need to be recapitalised.

“[Currently] it has to be channeled through loans to sovereigns because that’s the way its been structured ... we are advocating that this be done without channeling through the sovereign,” she said. “We would see that as a move towards stronger and better integration, a stronger and better Europe.”

At an earlier event hosted by the Bertelsmann Foundation think-tank, however, the IMF chief singled out Ireland and Germany for praise for their labour policies.

“In Germany, skilled employees have been retained in many companies. In Ireland, strong incentives have helped train unemployed people and then nudged employers to hire those newly trained individuals,” she said.

xchrom

(108,903 posts)

As candidates use charts and numbers to prove their points about unemployment during the election season, some observers are noting that many may look upside down compared to those using some more logical numbers.

“If you’re looking strictly at a chart of the “official” unemployment rate,” ZeroHedge.com says, “you should flip it upside down – that would give you a better idea of how things really are out there.”

ZH notes that, “The number of people not in the labor force is now at an all time high, as nearly 88 million people are not participating,” and suggests that in actuality, only 64% of Americans have a job, “in any capacity.”

Demeter

(85,373 posts)as in, who has any, and how has it declined....

xchrom

(108,903 posts)xchrom

(108,903 posts)***snip

Buffett, Zuckerberg

The combined wealth of the index is $1.1 trillion. The 40 billionaires have gained a combined $88.2 billion since the beginning of the year.

Mexican telecommunications magnate Carlos Slim, 72, remains the richest person in the world, with a fortune of $68.8 billion, down $572.3 million for the day. Second is Microsoft Corp. (MSFT) co-founder Bill Gates, 56, with $62.7 billion, followed by Warren Buffett, who’s worth $44.6 billion.

Buffett, 81, the chairman of Berkshire Hathaway Inc. (BRK/A), said in an April 17 letter to investors that he has been diagnosed with stage 1 prostate cancer that is “not remotely life threatening.”

Mark Zuckerberg, the 27-year-old founder of Facebook Inc. (FB), the world’s largest social-networking company, is 25th on the ranking. Based on a roughly $100 billion valuation the Menlo Park, California-based company was trading at in the private market when it ceased trading April 3, Zuckerberg may be worth $20.5 billion, or about 25 percent less than previous estimates, once Facebook holds its initial public offering.

bread_and_roses

(6,335 posts)... Back in the late '90s, when I was studying for a doctorate in English at NYU, my friend at the Wharton School of Business used to tell me about his studies of rational behavior, perfect information and the pure motivation of self-interest.* When I noted that a single exposure to Shakespeare or a page out of Freud's oeuvre could relieve him of such fantasies, he got defensive and complained that all we did in the English department was sit around and read fiction. “Well,” I shot back, “That’s what you seem to be doing. Only you don’t call it that.”

I worried a lot that he and his colleagues, ignorant of human psychology and alarmingly shallow in their understanding of traditional Western values and ethics, would leave business school and go on to run large companies.

I had reason to fear: They went on to help blow up the world’s economy

* My emphasis added - gee, where could that have come from? And how ironic that the "economists" were sneering at literature, they were basing their oh so "mathematical" theories on a couple of trashy pot-boilers.

xchrom

(108,903 posts)Demeter

(85,373 posts)...I was struck by the idea that just as religious elites had once created an elaborate system based on “Divine Will” to justify their power and oppression, the obstinate free-market economists had created their own supernatural entities, referred to as “The Market” and “The Invisible Hand” in order to pretend that their policies were inevitable and natural. Was a Reformation now in the works?

Throughout the week, I heard economists (certainly not all, but many) talking as if human beings mattered. Chinese economist Jiahua Pan mentioned the need for an ethical foundation and ecological principles. James K. Galbraith discussed the human costs of inequality. Arjun Jayadev of the University of Massachusetts, Boston, talked about why people needed debt forgiveness. Speeches centered as often on what humans think and feel as they did on what financial models could predict. There were lectures on neuroscience and social values.

Some will say this is all just talk. You don't get an insurrectionary adrenaline rush at an economic conference the way you do at an Occupy Wall Street protest. But such talk, particularly among those who teach tomorrow's leaders and act as policy advisers at high levels of government, is critical to any chance of changing the paradigm. Do we want a society that is people-driven, rather than profit-driven? Then Johnson is right: economics must reacquaint itself with the humanities. Do we want an economy that serves society rather than a society that serves the economy? Then we have to keep insisting on the social nature of economics....

Tansy_Gold

(17,860 posts)

(But you guys knew that already)

Fuddnik

(8,846 posts)But, he got charged with Freud.

Demeter

(85,373 posts)That was atrocious.![]()

![]()

AnneD

(15,774 posts)Oedipus complex with Goldman Sex er Sachs. It looks pretty incestuous from here.

xchrom

(108,903 posts)Two years after regulators gave Americans more power to manage overdrafts of their checking accounts, the Consumer Financial Protection Bureau is reviewing bank practices to determine if the crackdown went far enough.

The agency, which will decide by the end of the year whether to write new rules, is scrutinizing nine banks including JPMorgan Chase & Co. (JPM), Wells Fargo & Co. (WFC) and Bank of America Corp., said four people briefed on the examination.

The inquiry focuses on how financial institutions persuade customers to enroll in what they call overdraft protection programs. Examiners are looking at online and mailed marketing material as well as scripts used by the banks’ customer-service representatives to determine whether they could be confusing to consumers, said the people.

Bureau examiners have conveyed “a tone of skepticism that this is really a good product for borrowers,” said Jo Ann Barefoot of Washington-based Treliant Risk Advisors, who counsels banks on dealing with federal supervisors.

Demeter

(85,373 posts)INTERESTING, BUT PROBABLY NOT VERY RELEVANT...NOT QUITE GOSSIP, OR HISTORY, OR HOW-TO, AND IMPOSSIBLE TO INDEPENDENTLY VERIFY...

xchrom

(108,903 posts)Initial jobless claims came out yesterday, but we wanted to make sure to hit on one point: Initial jobless claims have a fantastic track record over the last few years of aligning with the stock market.

And in recent weeks we've had a stallout and a spike.

Now there may be a seasonal explanation for this (as we discussed at the bottom of this post), but still when you have an indicator like this that that's such a solid guide to the stock market, you have to be concerned.

This chart shows the S&P 500 vs. the inverse of initial jobless claims.

xchrom

(108,903 posts)McDonald's earnings are out, and they've failed to beat expectations.

Earning of $1.23 were right in line with expectations.

Revenue was also right on the mark at 6.54 billion.

Here are some key highlights from the report:

Global comparable sales increased 7.3%, and benefited from one additional day due to leap year

Consolidated revenues increased 7% (8% in constant currencies)

Consolidated operating income increased 8% (9% in constant currencies)

Diluted earnings per share of $1.23, up 7% (8% in constant currencies)

Returned $1.5 billion to shareholders through share repurchases and dividends

Click here for the latest >

Because of McDonald's global reach, this is a good proxy for the global economy.

Lazard Capital Markets offers their take on what we'll see around the world: "Expect 1Q SSS to fall below consensus: We expect Global: 4.2% (vs. consensus of 6.6%); US: 7.4% (vs. 8.0%); Europe 2.9% (vs. 4.3%); and APMEA of 5.0% (vs. 5.8%). Our estimates imply a conservative slowdown of two-year SSS trends compared to 4Q11. As a result, we also anticipate EPS below Street estimates as we model $1.21 vs. consensus of $1.23."

Read more: http://www.businessinsider.com/mcdonalds-earnings-2012-4#ixzz1saBcH1Th

Roland99

(53,342 posts)DOW 12,982 +80.00 0.62%

NASDAQ 2,698 +14.50 0.54%

Demeter

(85,373 posts)PARDON MY GUFFAWS

http://news.yahoo.com/brics-demand-bigger-imf-role-giving-cash-000406129--business.html

...Support from Russia, China and Brazil is crucial to achieve the doubling of the IMF's war chest the global lender is seeking. Europe and Japan already have pledged $320 billion. An international diplomat said that in all, emerging nations have lined up at least $100 billion. The IMF has warned that the euro zone's debt crisis presents the gravest risk to the global economic expansion, and financial markets worry that Spain and Italy may next require bailouts, following Greece, Ireland and Portugal. Enlarging the IMF's coffers could offer solace to nervous investors that any widening of the crisis could be contained. Lagarde said on Thursday she expects to seal a deal on fresh funds at the World Bank/IMF meetings this weekend.

But Brazil said that as a condition for funds, emerging powers want fresh pledges to recognize their fast-growing global economic weight written into the G20 communique. They are frustrated over delays - particularly by the United States - in implementing an agreement to lessen Europe's sway at the IMF and lift China into the No. 3 voting slot. "What we want and demand in every meeting is that this commitment be reaffirmed," Brazilian Finance Minister Guido Mantega said Thursday after a meeting of officials from the so-called BRICS nations - Brazil, Russia, India, China and South Africa. Mantega drove the point even more forcefully in a speech prepared for delivery on Saturday to the IMF's steering committee, saying it was no longer enough to simply repeat that voting reforms are crucial for the effectiveness of the IMF...

------------------------------------------------------------

Canada, meanwhile, is pushing against Europe's dominance on the IMF's 24-member board. It wants to hold two votes when the IMF decides on how to use its new resources - one by euro zone countries and another by others. The idea would be to dilute Europe's power on euro-zone-related issues. This drive reflects growing concern among non-European countries over the fairness in the global lender's dealings with Europe. The region has the largest single bloc on the IMF board and the Fund is headed by a French woman.

"Given that the major challenge here is a sovereign debt challenge in euro-zone countries, and that euro-zone countries are asking non euro-zone countries to contribute to resources at the IMF, our view is that there ought to be two votes," said Canadian Finance Minister Jim Flaherty.

---------------------------------------------------------------------------------

...China could contribute $60 billion, matching Japan's pledge, although Beijing had not finalized the number. Saudi Arabia would chip in a little less than China, while Russia and Brazil were likely to contribute between $10 billion and $20 billion each, the diplomat said. This would easily reach the marker of at least $400 billion set by Lagarde. The firewall would complement the $1 trillion in emergency funds for Europe agreed upon by the EU leaders last month, which was another precondition for countries bolstering the IMF resources.

Demeter

(85,373 posts)The financial fraudsters, the One Percenters, fleece the most vulnerable -- military families, minorities, low-income people -- to generate their fast riches...

This past Thursday, a Modesto, California, man whose house was in foreclosure shot and killed the Sheriff’s deputy and the locksmith who came to evict him from his condominium unit. Modesto authorities responded by sending 100 police and SWAT snipers to counter-attack, and it ended Waco-style, with the fourplex structure burning to the ground with the shooter inside. It’s not surprising that this should happen in Modesto: Last year the Central California city’s foreclosure rate was the third worst in the country, with one in every 19 properties filing for foreclosure. The entire region is ravaged by unemployment, budget cuts, and blight — the only handouts that Modesto is seeing are the surplus military equipment stocks being dumped into the Modesto police department’s growing arsenal. The shooter who died was 45 years old and he appears to have lost his condominium over a $15,000 home equity loan he took out almost a decade ago, owed to Bank of America. The condo was sold at an auction for just $12,988 to a shady firm, R&T Financial, that doesn’t even have a listed contact number. Too much for the former security guard, who barricaded himself in the condo which had been in the family for decades. He refused to walk out alive.

These “death by foreclosure” killings have been going on, quietly, around the country ever since the housing swindle first unraveled. Like the story of the 64-year-old Phoenix man whose daughter and grandson were preparing to move in with him after losing their home to foreclosure — only to get a knock on his door surprising him with an eviction notice on the house he’d owned for over 30 years. Bank of America foreclosed on him despite his attempts to work out a fair plan.

...Sometimes the “losers” in this class war make it easier on everyone else by killing themselves and setting themselves on fire as they’re being evicted, as one Ohio couple recently did. Others class war “losers” aren’t as cooperative, like a Florida man who was gunned down by police after he set his foreclosed townhouse on fire last year....

Less well-known or discussed is what happened to Sgt. Bales on the other front: the class war front. Three days before his shooting rampage, the house where Bales’s wife and two children lived in Tacoma, Washington, put up for a short sale, $50,000 underwater. This was exactly what Sgt. Bales and his wife feared might happen if the Army forced him into a fourth battlefield deployment.

THERE'S MUCH MORE

I THINK THAT I NEED A MENTAL VACATION, SO AS TO BE ABLE TO PUT UP THE WEEKEND...SEE YOU ALL TONIGHT.

TalkingDog

(9,001 posts)Futures look bright, but I'm to poor to buy it.