California

Related: About this forumHere's my Covered California "Obamacare" rates...THANK YOU OBAMA!!!

My stats:

2 people

57 and 55 yrs old

$52,000 per year

92024 zip code

That's all they asked to take a look.

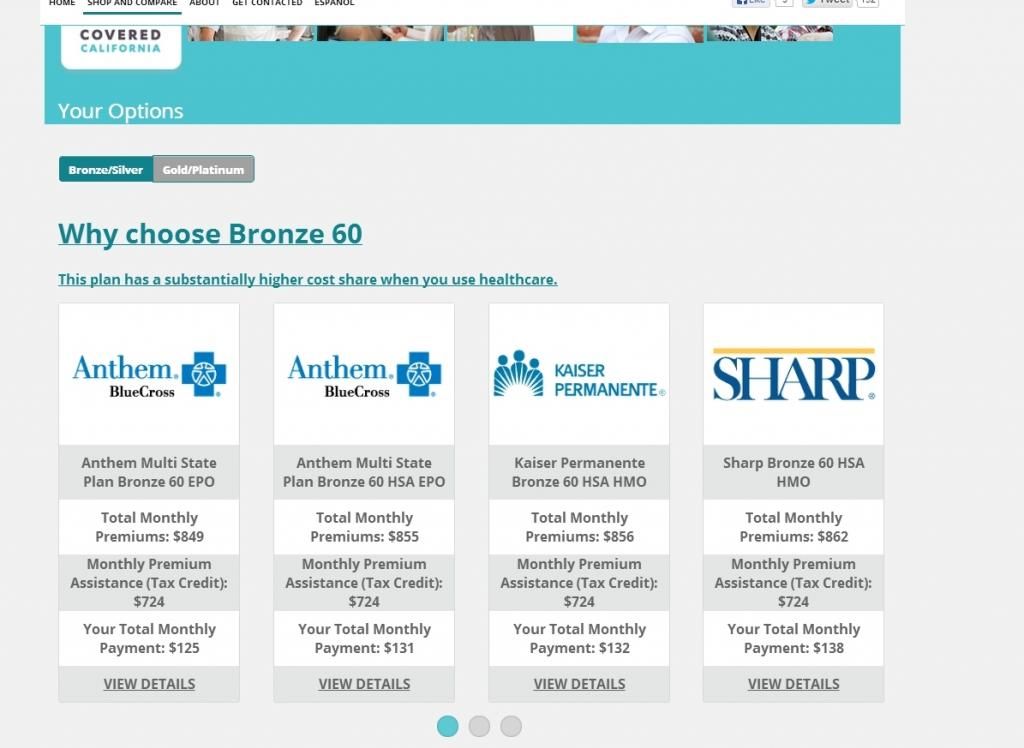

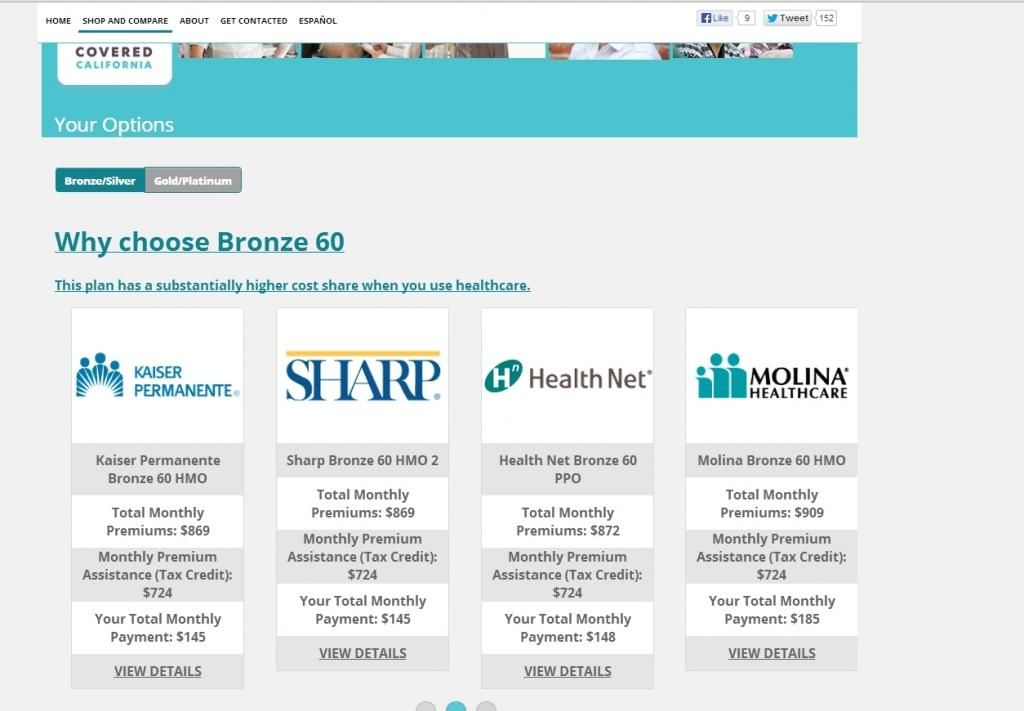

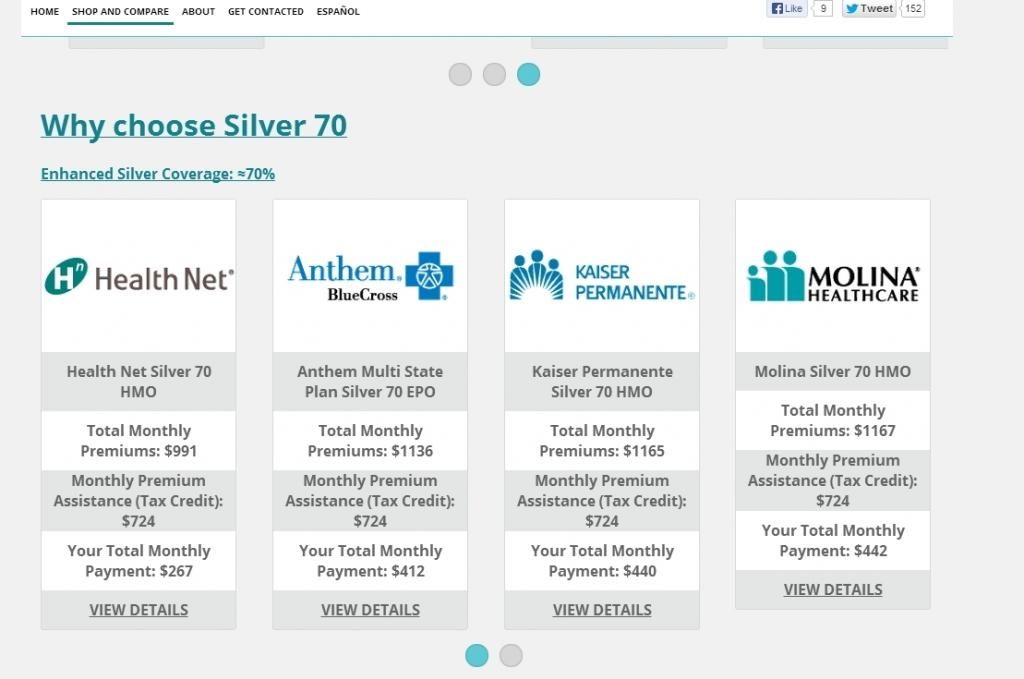

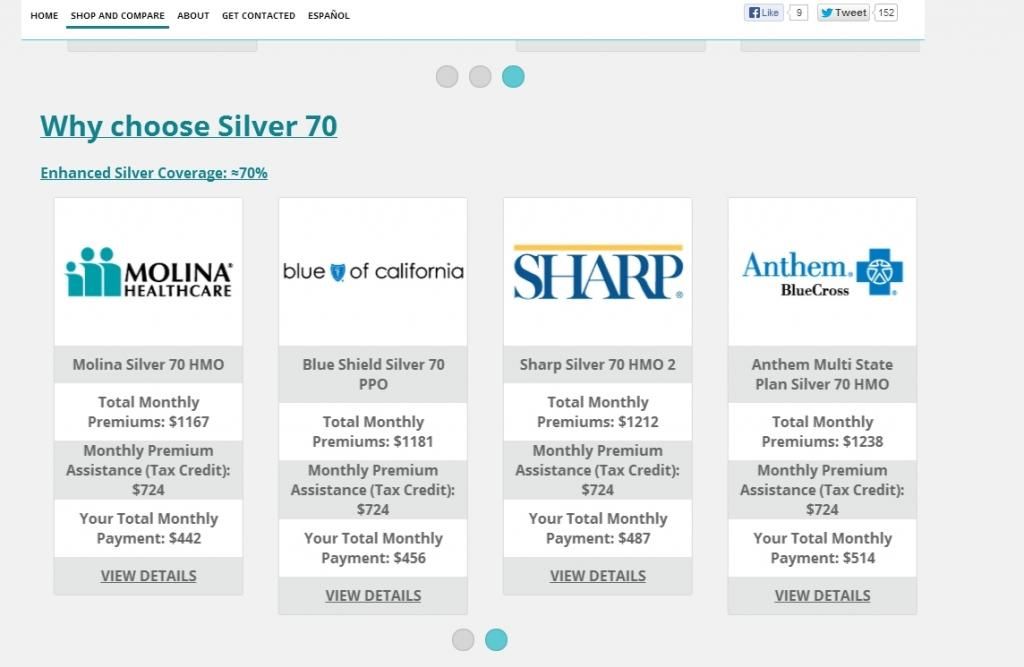

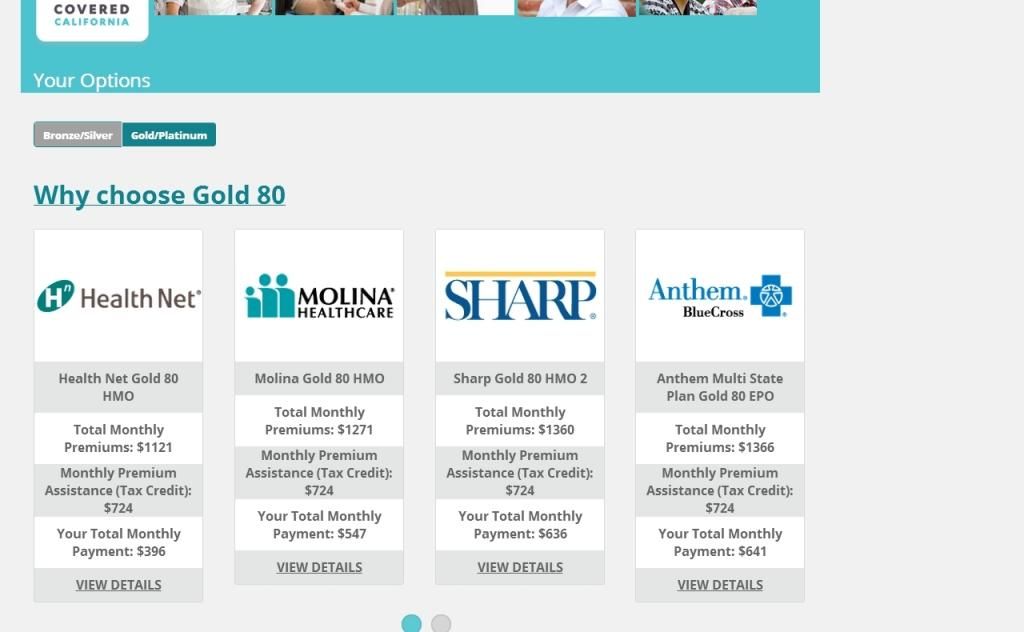

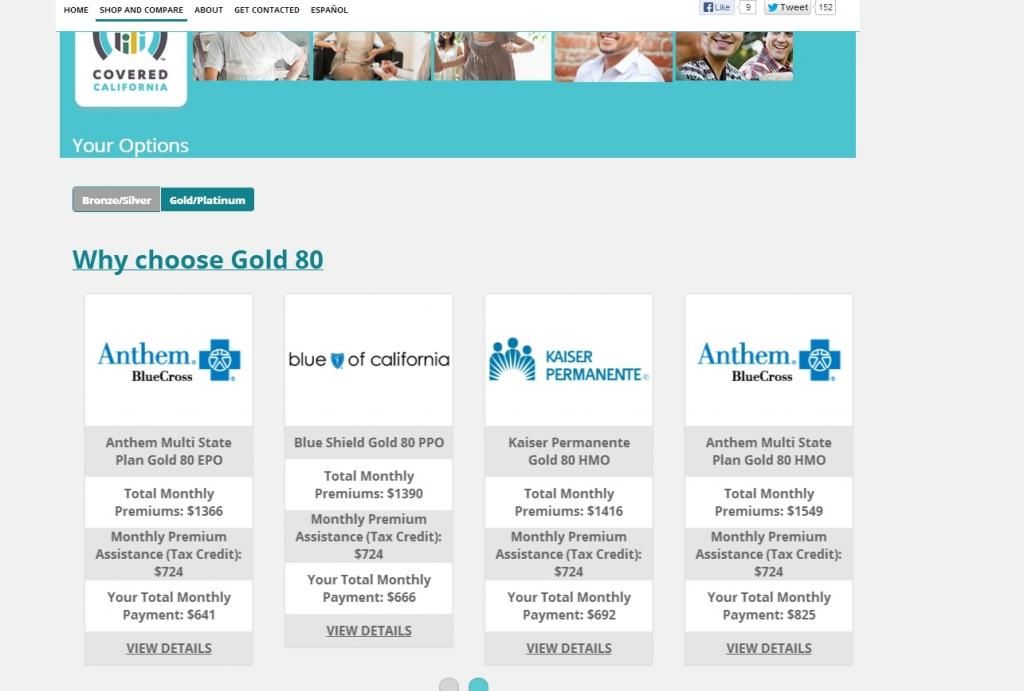

And here are some screenshots.

I left out the Platinum level since we aren't interested in that level.

The ACA will allow me to retire April 1st, 2014.

I am very thankful.

https://www.coveredca.com/shopandcompare/#calculator

NYC_SKP

(68,644 posts)Different numbers but the same format.

Four levels, each has four different providers.

I only wish we had a bit more competition, but I'll still be paying half, or less than half, what I pay now for Anthem COBRA.

K/R

SHRED

(28,136 posts)russspeakeasy

(6,539 posts)SHRED

(28,136 posts)dkf

(37,305 posts)SHRED

(28,136 posts)Really??

dkf

(37,305 posts)The Cadillac tax or the medical devices tax? Don't think that's enough.

SHRED

(28,136 posts)...you were so concerned with those making $200K per year and over.

They will get a slight increase in their capital gains tax and Medicare contribution.

---

Higher-income individuals will have to pay an additional Medicare tax on their wages and on net investment income starting in 2013. The Medicare payroll tax will increase by 0.9 percent from 1.45 percent to 2.35 percent, on wages over $200,000 for individuals and $250,000 for couples filing jointly. There will also be an additional 0.9 percent Medicare tax on net investment income, increasing the tax from 2.9 percent to 3.8 percent, for net investment income in excess of $200,000 for individuals and $250,000 for couples filing jointly. Net investment income includes interest, dividends, rents, royalties, gain from disposing of property, and income earned from a trade or business as a passive activity. Both self-employed individuals and estates and trusts will be liable for the tax. However, distributions from qualified retirement plans will be exempt from paying the additional tax.

http://www.larkinhoffman.com/news/article_detail.cfm?ARTICLE_ID=636

dkf

(37,305 posts)JoePhilly

(27,787 posts)dkf

(37,305 posts)JoePhilly

(27,787 posts)dkf

(37,305 posts)But a premium subsidy til $90,000 changes the equation.

itsrobert

(14,157 posts)My family would be in a world of hurt if we were forced onto the exchange.

NoOneMan

(4,795 posts)itsrobert

(14,157 posts)$12 for doctor visit at a civilian practice?

NoOneMan

(4,795 posts)Yes, I agree with your sentiment you stated. Those plans would put my family in a world of hurt too. I'd be bleeding more money than I already do just having a family.

JDPriestly

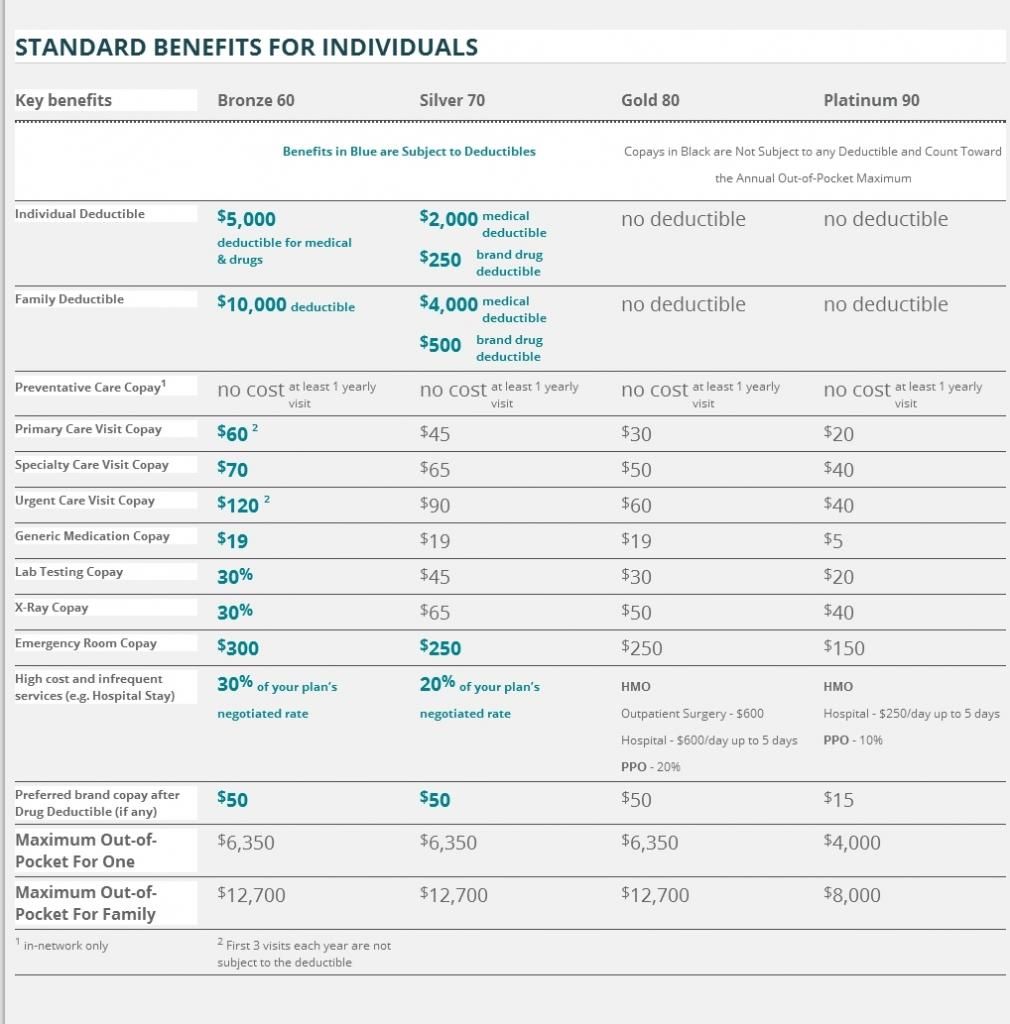

(57,936 posts)Co-pays for office visits are $20 each. Does that seem reasonable to you?

NoOneMan

(4,795 posts)Especially since those on Medicare can afford this the least. They are senior citizens without income many times!

Copays used to seem reasonable to me when I was a kid and it was $5. Now I see copays as just another way to keep the lessers out of the doctor office. Especially families with multiple kids who get sick multiple times throughout the year.

Copays are not reasonable. They are fucking nuts. They are about inducing self-rationing among the lower tiers of society. It is only within a sick society that we would deem this as permissible. It is only within such sickness would we tout a reform that institutionalized them.

So yeah, its possible I'm just not seeing things from the same context as anyone else

JDPriestly

(57,936 posts)SHRED

(28,136 posts)msongs

(67,420 posts)Prove it.

itsrobert

(14,157 posts)a year. And see the the government assistance is gone. And if you were fortunate to gross a combine income for two people of $104,000 (not out of the question in high price California) you would be paying 3 to 5 times for the insurance.

Is that really fair? double the income, but 3 times the rates?

Or just look at your rate without government subsidy, that's what's someone has to pay at your ages in the zip code at $63,000.

SHRED

(28,136 posts)If they could get it. And that's a BIG if.

And you and quite a few others seem a bit confused regarding how the ACA is funded.

-

itsrobert

(14,157 posts)Why should a couple that makes $63,000 to your $52,000 have to pay 3 times more for the same coverage?

If that was me and my wife at 63K, I would be looking to cut back on working hours for me and my wife. Or one of us would be forced to early retire to get our income down where we would get the govt subsidy.

SHRED

(28,136 posts)...that the cutoff is too harsh. There are issues I have with the ACA and this is one of them.

But Federal individual income taxes do not fund the ACA and insurance premium rates are only small fractionally affected if at all.

Playing "class warfare" as if those not in the exchange are funding those in them is fucking nonsense.

I'm not gonna Google ACA funding for you. If you want to know then look it up. I have.

itsrobert

(14,157 posts)? If it is not from tax revenue?

SHRED

(28,136 posts)Response to itsrobert (Reply #12)

lostincalifornia This message was self-deleted by its author.

JDPriestly

(57,936 posts)Pre-ACA, their insurance would have been much more expensive than the insurance of a younger person.

SHRED

(28,136 posts)We "pre-existing" conditions like the rest of the 86% of those over 55.

We have two choices:

1. Stay in my employer's group at full cost which is $1,700-$2,000 per month.

2. Go without insurance and risk our life's savings.

Now there is a third...the ACA.

For the record I am a single-payer advocate. I have been very critical of the ACA and still am on many levels.

But this is what we have for now and it won't just help me and my wife. We are talking about millions who were denied access to any meaningful healthcare because they had no way to pay for it.

Kolesar

(31,182 posts)If one had been "continuously covered" through an employer, COBRA, or a private policy, one could have "forced" an insurance company to cover you. That was how I understood it four years ago. I looked into it, but never had to use it. I spent a huge amount of time at Ohio and federal websites.

I was terrified that I would be laid off. I had a diagnosis that might have meant huge premiums. I will never know, since policy has changed. I agree with your last paragraph.

Response to itsrobert (Reply #10)

lostincalifornia This message was self-deleted by its author.

JoePhilly

(27,787 posts)Turbineguy

(37,343 posts)from $782 to $193 per month. With better coverage.

Response to SHRED (Original post)

lostincalifornia This message was self-deleted by its author.

IronLionZion

(45,457 posts)Not in response to the OP, but rather for the folks here who have expressed concerns over how the subsidies are funded. Its through various sources. Revenue collection is deliberately complicated in this country and is manipulated for political purposes.

Thanks for sharing your screenshots OP. That's probably the most complete sharing method. Glad it is working out for you.