The Stressed-Out Oil Industry Faces an Existential Crisis

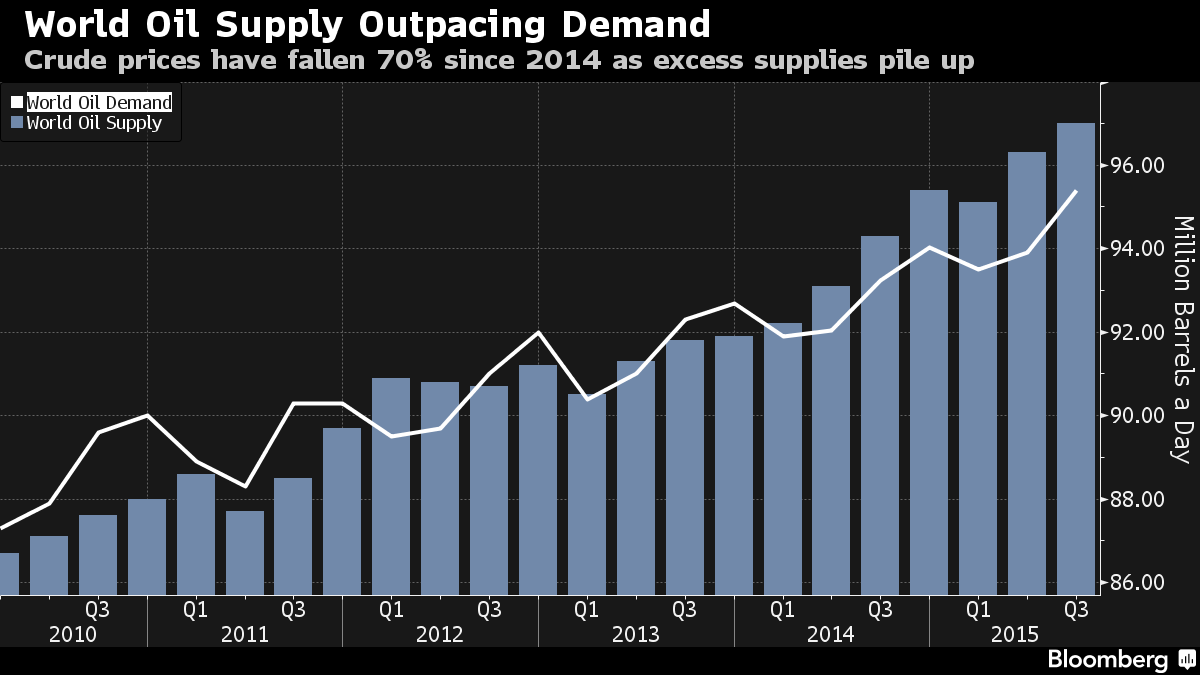

The Saudis may go public, OPEC’s in disarray, the U.S. is suddenly a global exporter, and shale drillers are seeking lifelines from investors as banks abandon them.

Welcome to oil’s new world order, full of stresses, strains and fractures. For leaders gathering in Houston next week at the IHS CERAWeek conference -- often dubbed the Davos of the energy industry -- a key question is: what will break first? Will it be the balance sheets of big U.S. shale companies? The treasuries of Venezuela and Nigeria? The resolve of Saudi Arabia, whose recent deal with Russia to freeze output levels offered the first hint of a rethink?

After watching prices crash through floor after floor in the worst slump for a generation, the industry is eager for answers. Insiders say it’s not too hard to visualize what markets might look like after the storm -- say five years down the line, when today’s cost-cutting creates a supply vacuum that will push up prices. But it’s what happens in the meantime that’s got them scratching their heads.

“This is a weird thing for a market analyst to say because it’s usually the opposite case, but I have more conviction in my five-year outlook than my one-year outlook,” said Mike Wittner, head of oil market research for Societe Generale SA. “Maybe I’m letting my head get turned upside down by the last couple months.”

Seeking clarity at closed-door sessions, cocktail hours and water-coolers in Houston will be some of the industry’s biggest players, from Saudi Petroleum Minister Ali al-Naimi to Royal Dutch Shell Plc Chief Executive Officer Ben Van Beurden.

more...

http://www.bloomberg.com/news/articles/2016-02-18/there-s-a-new-world-order-to-talk-about-at-the-davos-of-energy

SoLeftIAmRight

(4,883 posts)unless you think we should have listened to Carter and done it 40 years ago

newthinking

(3,982 posts)One of the best ways for big companies to reduce competition is to artificially flood the market and put the smaller companies out of business. Then they go in and buy out the competition.

Conditions were ripe because PTB also has objectives that line up.

It will go back up once those goals are accomplished, or the manipulation becomes too difficult to maintain.

Lodestar

(2,388 posts)which leaves them more open to losing control of the ruse. Hence the concerns about

the relative unpredictability of the short term.