U.S. Homeownership Rate Falls to the Lowest Since 1995

Source: Bloomberg

By Prashant Gopal Apr 29, 2014 11:00 AM ET

The homeownership rate in the U.S. declined to the lowest in almost 19 years as rising property prices and mortgage rates held back demand.

The share of Americans who own their homes was 64.8 percent in the first quarter, down from 65.2 percent in the previous three months, the Census Bureau said in a report today. The rate is the lowest since the second quarter of 1995, when it was 64.7 percent.

Recovering home prices and mortgage rates that have climbed from near-record lows last May have put real estate out of reach for some would-be buyers. The S&P/Case-Shiller (SPCS20) index of values in 20 cities increased 12.9 percent in February from a year earlier after rising 13.2 percent in the 12 months through January, the group said today.

“The homeownership rate is held back by slow job growth, tight mortgage credit and declining affordability,” Jed Kolko, chief economist of San Francisco-based property-listing service Trulia Inc., said in an interview before the report was released. “We’ll see it stay around this level for some time.”

Read more: http://www.bloomberg.com/news/2014-04-29/u-s-homeownership-rate-falls-to-the-lowest-since-1995.html

They_Live

(3,236 posts)tridim

(45,358 posts)We can't buy new cars either.

KansDem

(28,498 posts)Those Americans born between 1946 and 1964.

It used to be a retiring couple could add the sale of their house to their retirement nest-egg; sometimes getting back 10 times or more what they paid for it. Not anymore. Now they'll be lucky to sell their house and break even, if they sell it all.

Add to this the war on Social Security, Medicare, and pensions and it doesn't paint a pretty picture.

It'll get worse before it gets better--if it gets better at all.

ballyhoo

(2,060 posts)crackdown on Boomers. There are already groups formed and forming. I know this with one hundred per cent certainty.

knightmaar

(748 posts)I don't think you're using that term correctly.

Home ownership implies, y'know, OWNING a HOME. Mortgage rates can not possibly affect your ability to buy a home. Now, if you can't yet afford it, that could prevent you from eventually buying out the bank's portion of your home, but that's not what they mean.

Words have meanings, people, and you don't own a thing if you're still paying somebody for it.

A more accurate stat would be: how much does the average person owe on their homes? how much of their homes do people own in total?

FBaggins

(26,748 posts)Sorry... that simply isn't true.

And it leads to further nonsense like claims that since you continue to pay the government property taxes (or they'll take the home too)... you never really own it.

Ownership does not mean that nothing you do can cause you to lose that interest.

knightmaar

(748 posts)But let's say you see a $200k house.

Do you have $200k? If not, you are incapable of owning that house. Changing the mortgage rate will not affect your ability, at this moment, to own that house.

Now you can get a mortgage, put down 5%. Then you will own 5% of that house and your bank (*) will own 95%. But you should never, ever, ever be allowed to consider yourself a "home owner" while you owe the bank money. That's just bullshit and it's misled the finances of your entire country down a giant hole of stupid for several years now.

(*) - or, in the U.S., an international conglomerate of people determined to fuck you over for money.

FBaggins

(26,748 posts)You can reword it cleverly again if you like, but the bank doesn't "own" 95% of your house when you take out a mortgage for 95% of its value. They don't own any of the house.

As you correctly stated, but badly misapplied, about... words have meanings. You don't get to make up your own.

If you fail to pay the bank on time, the bank will assert its right to 95% of your home, have the law kick you out and sell your house and your stuff to get their money back.

And you think you "own" that house?

I realize your name is on the deed. I realize you can modify the property and in many legal senses, you do in fact "own" it. But you can't delude yourself into thinking it's really, completely yours when you still owe against it.

And I think using it the way it was used in this article, as a way of measuring the economy, is a travesty.

FBaggins

(26,748 posts)IF you fail to pay on time (in reality... it's if you fail many times). You can also lose a property with no mortgage at all if you fail to pay the property taxes.... or the HOA dues... or by eminent domain... or any number of other possibilities. But none of those things means that you don't "really" own the property.

And I think using it the way it was used in this article, as a way of measuring the economy, is a travesty.

All housing is owned by someone... and that person (or group of persons) owns both the risks and rewards of that property ownership. Far more common historically than the recent market declines, are people who slave away from month to month making rental payments for a home that isn't theirs... only to watch the home climb in value and someone else gets the profits (as well as the income from the rental). Not everyone should own their home (volatile life situations, not living in one place long enough, can't afford it, etc), but overall, it is certainly a valid measure of economic strength (properly understood). What we learned in the last correction is that the number can also be too high.

knightmaar

(748 posts)In that sense - of owning the risk and benefits - I'll concede that you "own" the asset.

I stubbornly stand by my assertion that, given the availability of 0% down mortgages and shady lenders, this home ownership is a stupid way to measure economic stability or progress.

FBaggins

(26,748 posts)Economic indicators are not simply "the higher the better" (or lower for things like unemployment). Many of them have sweet spots and you've got trouble when you get out of that range (above or below).

As I said above... there are lots of people who should not own a home. Perhaps they can't afford it (and yes, 0% down probably means that in most cases... it's just that not being able to afford a pair of shoes doesn't mean that you don't own them when you run up your credit card to buy them). Perhaps they've moved every two years with job changes and there's little reason to expect that to change. Perhaps their life situation is in flux (getting married and 2-3 kids in their near future... but they're buying a 1BR condo?).

Any one of these things (and many more) means that they shouldn't buy that house... but lots of them did it anyway on the lie that home values only go straight up and they don't want to miss out on a couple years of those profits. And, of course, on some bank's willingness to loan to anyone with a pulse.

A too-high home ownership figure hints that there are lots of people in those situations... while too-low hints at other problems (declining net worth, falling credit ratings, poor confidence levels, unstable labor market, etc).

IOW... the number is a perfectly valid indicator. You just need to understand how to read it.

ballyhoo

(2,060 posts)banks do, particularly Wells Fargo. My houses are all paid for. But even if I owned 2% of the loan balance I would not refer to myself as a home owner on that piece of property. The banks can take it nowadays by a number of means with the full permission of the US government. This is not 1974.

JoePhilly

(27,787 posts)their business.

Right?

knightmaar

(748 posts)You run your business. You're in charge. But if other people have invested in that business, they are partial owners too. You only own that business if you are the sole shareholder.

You can, if you have a privately held business with a small number of owners, call that collective group "the owners", but that simply doesn't apply to a private individual calling him or herself a "car owner" or a "home owner" based on a gigantic financing arrangement.

It's an error of syntax that leads to a more dangerous error of delusion. Don't let the bank trick you into the dream of "home ownership" of something you can't actually afford to pay off.

JoePhilly

(27,787 posts)My equity is almost triple what I owe.

The idea that home ownership is a dream one can't actually realize, is silly.

Loans, when structured properly, are an important part of owning almost anything of significant value.

knightmaar

(748 posts)Mortgages certainly should be viewed as a path to home ownership.

But we shouldn't delude people into thinking they are "home owners" based on a 5% down payment. Home owning, generally, is something you gradually ease into as you pay off the mortgage.

When the mortgage is done, congratulation, you are now a "home owner".

DCBob

(24,689 posts)With "home ownership" you have control of the domicile, have the opportunity to build up equity, the possibility to make a decent profit when you sell and at some point pay it off and own it outright. Renting offers none of that.

Yo_Mama

(8,303 posts)Realistically, almost no one but trust fund babes can buy their first home with cash.

And sorry, you do have legal ownership of a home when you purchase with a mortgage. The creditor has a claim on your ownership interest to secure their debt/payments, but you have all the responsibilities and rights of ownership, including all the usage rights and the appreciation of the home.

You might as well claim that because you will have to pay property taxes each year you don't own a home. If you don't pay the property taxes the municipal authorities have the legal right to seize it and sell it, but that doesn't mean you don't own the home.

knightmaar

(748 posts)... when you put down 0% for the down payment? Isn't this a terribly costly delusion?

You can't afford it. You can't afford a down payment, but you're going to call yourself a "home owner".

Worse, this is a terrible economic measure. "The economy is doing great because a bunch of people signed up for mortgages they can't afford! Yay! Home ownership is rising!"

I can make the economy look good or bad by fiddling with weird and obscure lending laws or just getting a bunch of crooked housing appraisers.

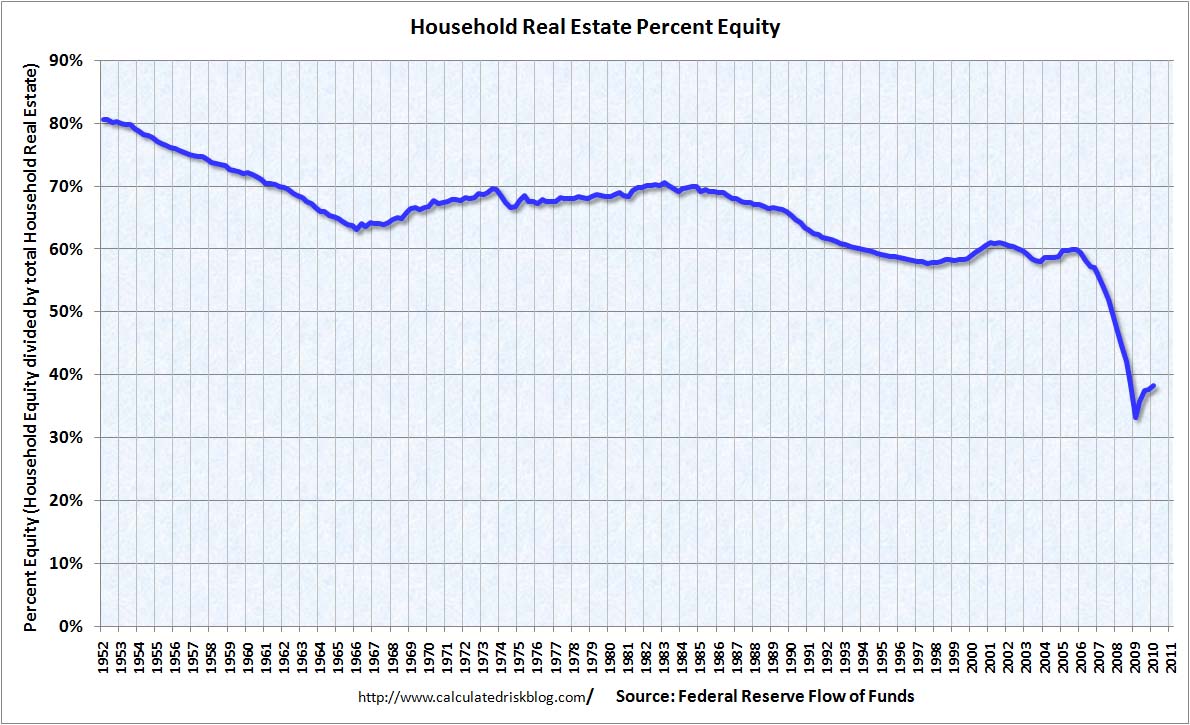

A valid way to look at "home ownership" is to look at how much equity people have in their homes. Are they building up equity? Or losing it? That will give you a measure of "home ownership" that will actually reflect the stability of your middle class.

FBaggins

(26,748 posts)You retain the rights of:

Possession

Control

Exclusion

Enjoyment

Disposition

The bank has none of those right and cannot get them unless you default on the mortgage (or even then absent legal action).

knightmaar

(748 posts)I won't argue any further on the use of the word "own".

I still think it's an incredibly misleading use of the word, as far as using this kind of "ownership" for determining how well the economy is doing. For that, I want to know "how much do people owe" and "how much equity they have".

As far as determining economic stability, "ownership" should be synonymous with "equity".

davidn3600

(6,342 posts)It's paper...or even just digits on a computer screen. Money only has value because the government says it has value.

jtuck004

(15,882 posts)I own the house and that confers with it certain rights and obligations.

For example, if I walk away, and the bank forgives my loan, the IRS may well decide I had some benefit from the loans being forgiven and come after ME for the taxes, not the bank.

That is because when your name is put on the title, you are the owner, and you are an owner with a lien by the bank. The mortgage does not determine ownership, the title does.

That you may be house rich and cash poor has little or nothing to do with it.

But in your last comment you suggested equity as the only measure - that's a mis-reading of the law, but still very much germain to the issue, which makes this chart interesting:

and

Homeownership Remains a Key Component of Household Wealth here.

DCBob

(24,689 posts)We are nowhere near back to normal on household equity which has an enormous impact on all of us.

jtuck004

(15,882 posts)Yo_Mama

(8,303 posts)When the FRB creates the conditions for a housing bubble by playing with interest rates, and the Fed gov goes along with it by pushing I-give-you-money-to-buy-a-house loans, and the FRB does nothing to stop the practices, but instead presses responsible lenders to go with the funny-money flow, then housing equity stats rise very rapidly, because housing values are rising very rapidly.

But it's "vapor" equity - as soon as you start reimposing reasonable lending standards, housing sales and housing prices plummet.

So equity is a poor measure of real housing ownership.

Yo_Mama

(8,303 posts)In other words, if you can afford to pay closing costs for the mortgage, and afterwords pay principal + interest + property tax + property insurance + mortgage insurance (if any), you can afford the home. And if the cost of that monthly payment is just above or below what you would have to pay for a rental, it's probably a good deal.

But if you can't afford to pay PITI, or if you can only do so by getting a below-market interest rate for a 30 year mortgage, or if you have to get a 40 year mortgage, or if you are buying interest-only or worse yet, on a loan on which you aren't even paying the full interest for a few years, you are speculating.

If you have to get someone else to through in a required downpayment, you can't really afford the home - especially if that someone is the seller or one of those seller-affiliated behind-the-scenes type deals.