Sales of New Homes in U.S. Surge by Most in Three Decades

Source: Bloomberg

Purchases of new U.S. homes surged in October by the most in three decades, signaling buyers are starting to take higher mortgage rates in stride.

Sales jumped 25.4 percent to a 444,000 annualized pace, following a 354,000 rate in the prior month that was the weakest since April 2012, figures from the Commerce Department showed today in Washington. The median forecast of 62 economists surveyed by Bloomberg called for 429,000.

Home sales are regaining strength as gains in employment and stock prices help consumers adjust to this year’s increase in borrowing costs and property values, which have hurt affordability. Builders such Hovnanian Enterprises Inc. (HOV) are optimistic about the outlook for the market, which will need to expand to meet the needs of a growing population.

“The worst of the impact of higher mortgage rates seems to be behind us,” said Millan Mulraine, director of U.S. rates research at TD Securities USA LLC in New York, who forecast an increase in sales to 445,000. “If we continue to see improvements in employment and if mortgage rates stay where they are, we should see these levels sustained.”

Read more: http://mobile.bloomberg.com/news/2013-12-04/sales-of-new-u-s-homes-rose-in-october-by-most-in-three-decades.html

fredamae

(4,458 posts)and the next "banking bubble" created by Wall Street, imo. I heard something about this on Thom Hartmann...I'm lousy at "banking, finance, wall street stuff"-but the jist of it will cause Another Big 2008 style Crash by around 2016'ish...just like right before the 2008 General Election....

Banks are buying the Majority of foreclosed homes-renting them out- allowing for inflation of these house sales and doing the same type of "betting on betting on betting" "circular game of values" of the now new corp rental industry.

They can't do the "mortgage" thang anymore so they are now doing this.

I hope someone who better understands "the game" can chime in here...

There is something wrong with this report-I just don't know how to best explain it. Sorry ![]()

geek tragedy

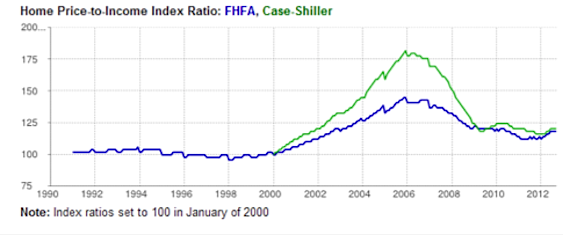

(68,868 posts)markets like NYC and San Francisco, are affordability--the ratio of the typical house payment to the typical income.

The rest is just noise.

2000-2007 was the inflation of the bubble. We're just coming out of the post-bubble bursting period.

fredamae

(4,458 posts)Posted and Is what I was trying to explain...

http://www.democraticunderground.com/1017162676

geek tragedy

(68,868 posts)If the average household's housing payment keeps pace with household income, then we're not in a bubble.

A bubble is when the value of the asset is out of whack compared to what economic fundamentals would predict. The best predictor for housing prices is household income.

niyad

(113,348 posts)Colorado Springs-area home sales dip in November, but prices still on the rise

Home sales in the Colorado Springs area fell last month for the first time in nearly a year and a half, although prices continued to climb, according to a report Tuesday by the Pikes Peak Association of Realtors.

Single-family home sales totaled 709 in November, down 4.3 percent from the same month last year, the association's report showed. It was the first decline in year-over-year sales since June 2012.

. . .

Read more at http://gazette.com/colorado-springs-area-home-sales-dip-in-november-but-prices-still-on-the-rise/article/1510410#Gx8jw61v6XugX3Vm.99

geek tragedy

(68,868 posts)niyad

(113,348 posts)every block. in my neighborhood alone, within a ten-block area, there are a dozen houses for sale. on ONE street alone, in the high rent district, there were, as of a week ago, 14 houses were for sale.

geek tragedy

(68,868 posts)In general, supply and demand can only be assessed in comparison to one another. The article notes that inventory was up about 11% YoY, but it's very possible that demand is up by even more.

Then again, there could easily be something else going on--the mix of units being sold etc.

Evasporque

(2,133 posts)Greedy Republicans are building new McMansions further out in the country to escape "the riff raff".