Romney’s deduction cap would touch sensitive tax breaks

Source: Politico

Mitt Romney floated the idea of a $17,000 limit on itemized tax deductions Tuesday night — and is likely to get a quick lesson in the risks of providing details about his tax plans.

While a $17,000 limit would hit hardest on people in the highest tax brackets, it would take a bite out of a lot of homeowners who live in places where housing prices are high. A $500,000 mortgage, for example, would require interest payments that would exceed a $17,000 cap, leaving homeowners in and around many large cities with interest they could no longer deduct. Add in other deductions these homeowners are likely to take — including ones for state income tax — and it’s even easier to exceed the $17,000 cap.

...

Romney has proposed a rewrite of the tax code that would lower marginal tax rates and pay for it by narrowing or eliminating certain credits or deductions. But his vague plan has drawn many questions and charges that it would result in tax hikes on middle-income individuals and families.

...

A disproportionate share of mortgage interest deduction claims come from urban areas. And the GAO study noted that in 2008, tax returns from 10 such states — California, Colorado, Connecticut, Illinois, Maryland, Massachusetts, New Jersey, New York, Virginia and Washington — accounted for 51 percent of mortgage interest and property tax deductions, even those states accounted for just 37 percent of all returns.

Read more: http://www.politico.com/news/stories/1012/81954.html

This news article is different from other articles reporting Romney's comment about capping the tax deduction because this article reports who will be affected and how they will be affected.

Specifically, Romney's proposed tax policy would disproportionately hurt voters in Colorado and Virginia. See http://gao.gov/assets/600/593752.pdf

We should make sure that voters in Colorado and Virginia are aware of this fact.

Also, this is just a tip-of-the-iceberg elimination of tax deductions affecting the middle class. If Romney is going to fund a reduction in the tax rates for the ultra-wealthy 1%, he's going to have to eliminate many, many more middle class tax deductions that just this proposal.

fleur-de-lisa

(14,628 posts)the more he opens his mouth, the more he screws himself.

renate

(13,776 posts)Ryan says there isn't time to go into the details, but I suspect the president would give Romney some of his own time so he can explain them.

no_hypocrisy

(46,234 posts)Museums, symphony orchestras, programs for feeding the poor, clothes donations, etc.

While there would remain a segment of millionaires and billionaires would continue their philanthropy, others would simply dwindle or stop their donations, impacting the budgets and survival of those entities.

central scrutinizer

(11,665 posts)since if they government does it, it is socialism. Oh well, who cares about those freeloading parasites anyway?

awoke_in_2003

(34,582 posts)with education and the art for years.

jmowreader

(50,567 posts)The most popular reason to give huge money to a charity is for the donation's tax treatment. (We're not talking about a hundred to the church or $250 to your alma mater, we're talking endowing scholarships and building hospital wings--donations that have more than one comma in them.) These guys are NOT going to continue donating tens of thousands or hundreds of thousands if they can't write most of it off.

In a sad number of cases, a rich man is a person who would rather give $1,000,000 to a charity than $1000 to the government.

bucolic_frolic

(43,362 posts)All they want is a hard number to float ... $17,000.

Then every Fundie and Tea Pottier can flit around the country

twisting arms telling people Mitt is going to give them $17,000

it they'll vote for him.

I know this to be a tried and true GOP tactic. They bashed

AHA as a 4% tax on home sales ... and neglect to tell you

that only applies if your earned income is more than $250,000

AND you have home capital gains on the sale of your home that

exceed $500,000 AND anything above that is taxed at 4%.

So it applies to millionaires, but the GOPers twist it to sound

like it's going to cost you a lot of money.

BEWARE THE $17,000 figure. Don't let it float by!

Cosmocat

(14,575 posts)And let them expire for the upper 5%.

All this contrived BS about cutting the rate but dickering with deductions.

KISS.

Funny thing is, he went from the cookie cutter GOP BS about cutting the TOP rates to SPUR THE ECONOMY to now cutting all rates but tweaking deductions to limit the change on the effective rate for the upper income earners.

ALL smoke and mirrors for the odd chance these two half wits manage to win, so they can have the House lunatics do the heavy lifting of cutting the rates across the board while taking OUR deductions to purportedly balance it, but it won't.

jmowreader

(50,567 posts)Mitt-level guys can't take advantage of many of the deductions and credits you and I enjoy because they're tied to income -- there is an income phaseout on many itemized deductions including mortgage interest. So if we totally get rid of the mortgage interest deduction it won't hurt the Mitts of the world one iota.

I am going to repeat this in every thread about Mitt's tax plan: Mitt Romney cannot make his scheme work unless all deductions and credits, except for charitable contributions, are eliminated. He has to except charitable contributions from his scheme because no religious person, especially the Mormons, would vote for him if they knew he was going to make their tithes non-deductible. I am not sure if he can make the nut if he does this, but he definitely can't if he doesn't.

Cosmocat

(14,575 posts)understand this.

Two Rs at the gym, they get the math, and I think they are on the fringe of voting for BO, and might at worst just not vote.

I had a go around on Facebook with a loose friend over this.

I posted that he should know they are going to take our deductions. He got a bit testy, bought into the idea of how we all have to pitch in to pay down the debt. I laid out how they will drop all rates 20 percent then let the lunatics in the House tell US how we have to feel the pain and take our deductions, leaving the upper income with clear cuts AND STILL NOT BALANCING the cuts.

No reply on that.

There are some so far gone it won't matter.

But, I think the dissonance on this issue is out there, and if you have some personal credibility with them, some Rs might be willing to admit it if you address it.

BlueStreak

(8,377 posts)If it is just itemized deductions, this will come nowhere close to being revenue neutral.

If it is all deductions and exemptions, that would come closer to making it revenue-neutral, but that would then hit most families with kids and just about everybody who has a mortgage.

muriel_volestrangler

(101,390 posts)http://www.cbsnews.com/8301-250_162-57524964/romney-$17k-tax-deduction-lid-a-possible-route/

It sounds unformed, but it may not be all itemized deductions. I have seen someone say they think it wouldn't get anywhere making it revenue neutral.

BlueStreak

(8,377 posts)the average taxpayer doesn't have $17,000 in deductions today, so for many taxpayers, this would be a 20% cut in the tax rate and no additional collections. To be revenue neutral, you would have to collect an additional $500,000,000,000 a year, and I don't think this would come close, assuming that Romney still plans to allow billionaires to launder essentially all of their income at the capital gains rate.

But let's say there is a number where it would be revenue neutral -- maybe that is $5000 of deductions. the people who would get hit the hardest would be those who have a mortgage balance over $200,000 and those who give thousands to charity.

That really begs the question why we would be screwing around with this nonsense at this time? If we make it revenue neutral, we don't reduce the debt -- all we do is REDISTRIBUTE WEALTH one way or another. Why are we even talking about that at a time when we have such real problems that need attention?

Cosmocat

(14,575 posts)Been saying this since they started up with this nonsense a few weeks ago.

If it is supposedly revenue neutral, THAT is their big idea to justify getting the job?

Tweaking the tax code?

This is the question that HAS to driven home to them by the feckless media dolts.

Romney started out with the cookie cutter republican bullshit of CUT THE RATES FOR THE JOB CREATORS.

When he got pinned down on how that would make the deficit worse, he did what he does, just say that he thinks people want to hear, he threw out tweaking deductions.

Being the moron he is, that opened the door to the obvious - tweaking deductions that mostly benefit the middle class to help balance the cuts to the upper income earners would shift the tax burden to the middle class (IMO, this IS where the Rs want to go with this).

Once he got called out for that, he has now gone WAY off the republican reservation to saying the middle class will get the best of the cuts (how is unknown), though he did say the other day for the middle class NOT to except much of a tax break on it.

IF that is the goal, then ...

Why not do what the president has called for twice now, and which is a LOT simpler. Let the Bush tax cuts expire for the upper 5% and extend them for the other 95%.

Why not, because that really isn't what they want.

They want to somehow win this thing, get into office and get to work in the big economy spurring tax cuts, but during the course of the work on the bill let the lunatics in the House try to "balance" it by cutting middle class deductions. It won't balance then, as you seem to know, but they get what they perversely want. Even more tax cuts for wealthy people and to screw everyone else, and somehow it will be President Obama and the evil liberal boogyman's faults.

BlueStreak

(8,377 posts)It was intended to be the "Two Santas" strategy once again.

When I get discouraged at how inept out MSM is, I then think back on all the times that Republicans have gotten away with the "Two Santa" thing. This time is different. The netroots are really pushing back and forcing the MSM to do their jobs at least a little.

And we should understand that today's media talking head doesn't have any time or staff for analysis. All they can do is repeat what they have seen or heard elsewhere. That is the real contribution everybody on the progressive side has made. The information is getting out there. A MSM talking head doesn't have to go far to find the truth and very well done analysis.

THAT is the factor that has changed this cycle. So everybody who has been putting together the analysis, tracking the illicit election rigging activities, putting together graphics and cartoons -- you are making a difference. Truth is a force bigger than all that money.

jmowreader

(50,567 posts)He also plans to cut the rate Subchapter C corporations pay, or don't pay in a lot of cases, from 35 to 25 percent.

Oh, but he plans to immediately demand that Congress cut five percent from non-defense spending, "reducing the deficit by $20 billion." I just googled it and the deficit is somewhere around $1.4 trillion. When the deficit is $1400 billion, $20 billion is a rounding error.

I am sorry, kids, but we currently have a choice. We can balance the budget NOW and fix the private sector's problems later, or we can fix the private sector now and use the increased tax revenue to plug the fiscal holes we've got. If you want to balance the budget, you triple taxes, decimate spending, go after the most significant tax evaders like the republican candidate for president, and basically send the private sector to hell in a handbasket. (This is what Ceaucescu did to fix his trade deficit and Romania is STILL fucked up over it.) If you want to fix the private sector you trot out one of those great old Reagan quotes the teabaggers don't want to talk about (it went 'deficits don't matter') and start spending in ways that will stimulate the economy--if you want to stimulate the manufacturing sector, you find 100 high-priced, high-demand products that could be manufactured right now, pay people to build factories to make them, buy everything that can't find markets in the US, and sell it overseas using the profits to help pay for the program. If you want to stimulate the energy sector AND the manufacturing sector, you send government inspectors to every refinery, find anything that could fail and blow the place up and fix it at a low cost so "a major fire in a TexxonMobvron refinery will halt production there for nine months" can't shove gasoline prices through the roof.

BlueStreak

(8,377 posts)You suggested the choices are to stimulate the economy now and to work on revenues later, or vice versa.

There are many other options that lie between those extremes. We can cut government expenses that don't do much of anything to improve America. This includes some government military, particular the spending that goes into contractors and supplies purchased overseas. Accelerating the departure from Afghanistan saves a lot of money that we can cut from the Pentagon with minimal consequences on the American economy. There are still hundreds of thousands of troops stationed al over the world in places where it is completely unnecessary. We can cut that and save a lot of money with no risk to the American economy.

And there are lots of revenues that can be raised with no negative effect on the economy. Look at all the huge companies that are paying no taxes or next to none. Fix that. Fix the laws that allow companies to evade taxes by parking money offshore. Get out of the unfavorable trade agreements and charge reasonable tariffs on imports where the labor costs are essentially slave level and the environmental impact is severe.

There are lots of things we can do besides the simple either-or proposition.

jmowreader

(50,567 posts)However...when you're looking at a $1400 billion deficit commonsense reforms like yours would give us maybe $400-500 billion in deficit reduction.

The other problem: Republicans are contractually obligated to use savings garnered from reforms like yours to pay for tax cuts.

Maybe the first order of business in next year's Democratic-controlled Congress should be to pass the Grover Norquist Can Go Fuck Himself Act of 2013.

BlueStreak

(8,377 posts)At this point I thing there are a lot of Republicans that wish they had the GNCGFH Act now.

Lasher

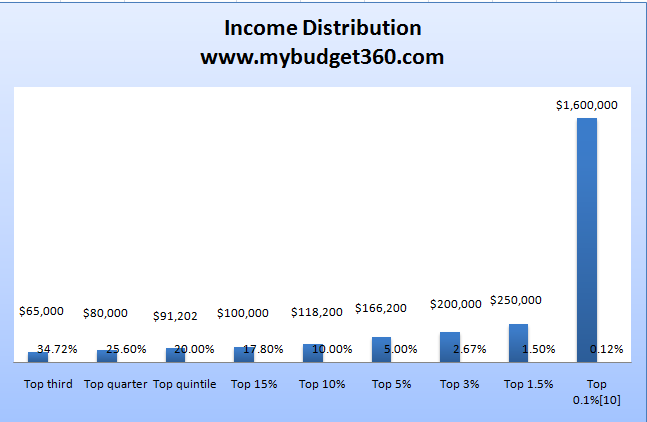

(27,641 posts)If your household income is $166,200 you are in the top 5%.

emulatorloo

(44,205 posts)Isn't just mortgages.

DallasNE

(7,403 posts)Unless medical expenses exceed something like 7% of income there is no deduction. This cap would be a real burden on those years where there was an expensive medical emergency, however. Lets take someone with income of $60,000 that had a medical emergency that resulted in $20,000 out of pocket, including insurance premiums, and other deductions of $12,000. Hardly out of the ordinary. Under Romney's proposal that person could only take $5,000 of the medical expenses versus the current $18,600. Talk about kicking someone while thay are down.

progree

(10,924 posts)on top of mortgage. Fortunately, I don't have enough medical/dental expenses to exceed the 7.5% AGI limit on those (only medical/dental expenses, including health insurance above 7.5% of Adjusted Gross Income are deductible. So, IF my AGI was 100 K$, and my medical/dental expenses was 10 K$, only 10 K$ - 7.5 K$ = 2.5 K$ would be deductible. If my medical/dental expenses were 7.5 K$ or less, none of it would be deductible).

This $17,000 deduction cap thing is a gimmick. The Tax Policy Center (TPC) 8/1/12 determined that Romney's plan -- cutting marginal tax rates 20% across the board, eliminating some deductions and loopholes (starting with the wealthy's first in the TPC study), and still have a revenue-neutral tax system without raising taxes on the middle class -- is mathematically impossible. Adding on a $17,000 deduction cap doesn't make the mathematically impossible suddenly possible. Actually, by adding another constraint, it becomes mathematically more impossible.

The below is my synopsis of a number of press reports on the Tax Policy Center study.

The well respected non-partisan Tax Policy Center ( http://www.brookings.edu/research/papers/2012/08/01-tax-reform-brown-gale-looney ) has determined that it is mathematically impossible for Mitt Romney's plan to not result in both a decrease in taxes paid by the higher income earners and an INCREASE in taxes paid by the middle and lower classes.

In the words of the Tax Policy Center: [font color=brown]"Even when we assume that tax breaks – like the charitable deduction, mortgage interest deduction, and the exclusion for health insurance – are completely eliminated for higher-income households first, and only then reduced as necessary for other households to achieve overall revenue-neutrality– the net effect of the plan would be a tax cut for high-income households coupled with a tax increase for middle-income households."[/font]

Romney's stated plan, at the time of the Tax Policy Center study on 8/1/12, was:

* lower marginal tax rates across the board by 20%

* eliminate the estate tax

* eliminate some unspecified deductions and loopholes

* be revenue neutral (i.e. no reduction or increase in total taxes collected)

Because the value of the 20-percent tax cut for richer Americans would exceed the gains they get from popular tax breaks that Romney might chop, they would see the greatest income gain from Romney's possible changes, the study said.

The Tax Policy Center even assumed what they called some implausibly large economic growth effects of Romney's plan.

Kolesar

(31,182 posts)emulatorloo

(44,205 posts)CreekDog

(46,192 posts)500k mortgage at 4% interest rate is roughly $2400/month payment.

At 36% of monthly gross, income would be $7000/month or 84k per year.

The median housing price in San Francisco is 705k.

Anyway, I think it's pretty bad to post false numbers in order to falsely make people with 500k mortgages out to be wealthier than they often actually are.

Kolesar

(31,182 posts)And as they pay down their mortgages, they will be able to deduct *all* of their interest.

--*

Home prices would be lower if gimmicks like deductible interest didn't allow buyers to *bid* the prices higher.

CreekDog

(46,192 posts)knock yourself out! ![]()

Kolesar

(31,182 posts)Are you proud?

CreekDog

(46,192 posts)CreekDog

(46,192 posts)which is the income you're saying a 500k mortgage requires.

you must be living on another planet to think that.

Lasher

(27,641 posts)You have furnished nothing meaningful to refute my rough estimate.

Better to remain silent and be thought a fool than to speak out and remove all doubt. - Abraham Lincoln

CreekDog

(46,192 posts)people with 500k mortgages don't require a 150k household income.

how do i know this? i qualified for such a mortgage while making a little over half of that. ended up getting a cheaper place, but i digress...

Lasher

(27,641 posts)I'm trying to discuss what people can afford, not liars' loans.

CreekDog

(46,192 posts)look, if you can't be honest when you try to win this argument, then it's clear you don't think being honest will convince anybody.

meanwhile, the tax hike you are saying is no problem will raise my taxes probably 4000 per year.

if that ended poverty and provided health care to all people, i'd be all for it, even though it would be difficult.

but knowing that the money from me is just going to help a wealthy person pay less is adding insult to injury.

Lasher

(27,641 posts)Your total monthly debt obligation should not be more than 36 percent of your gross income. Total debt includes the mortgage payment plus other obligations such as car loans, child support and alimony, credit card bills, student loans, condominium association fees. (Note: Government and certain other lenders may be more lenient.) This is your debt-to-income ratio.

http://loan.yahoo.com/m/basics6.html

You cited a 36% maximum of monthly gross. That is improper unless you take into account the additional liabilities mentioned in the second paragraph above. You didn't mention this. For the sake of simplicity, and especially since you seem to cherish honesty, let's use the 28% maximum.

I said you would need a gross income of roughly $150K in order to afford a $500K mortgage (28% of $150,000 = $42,000 ÷ 12 = $3,500 maximum monthly payment).

Now let's have a look at that $500,000 mortgage mentioned in the OP. I used the calculator to be found here. Home value and loan amount = 500,000, loan purchase = new purchase, interest rate = 4%, loan term = 30 years, property tax = 1.25%, PMI = 0.5%. That leaves us with a monthly payment of $2,907.91

Therefore, upon closer examination, it appears you would only need an annual income of about $125K to afford a $500K mortgage (28% of $125,000 = $35,000 ÷ 12 = $2,917). That would put your income in the top 10%, not the top 5% as I first projected. I hope to be forgiven for this exaggeration, particularly since I did say, roughly $150,000.

If you have a $500K mortgage, and if your household income is not in the top 10%, you are engaging in risky behavior that should not be encouraged with tax incentives. And if you are in the top 10%, congratulations. But you don't need a tax break in that case either.

CreekDog

(46,192 posts)let's be clear, that's what's on the table.

i live in a 900 square foot condo in a neighborhood that will be lucky gangs from nearby neighborhoods don't take over.

you don't know what you're talking about.

and i'm not engaging in any risky behavior.

take back the thing you said about NEEDING 150k/year to get a 500k mortgage or be called dishonest for doubling down on it.

Lasher

(27,641 posts)No need to take it personal. After all, your problem is not with me. It is with the facts I have presented.

You seem to think that qualifying for a mortgage is the same thing as being able to afford one. Actually I'm not sure you even bothered to read my last reply.

DallasNE

(7,403 posts)Something that would make more sense would be to follow the medical expense methodology whereby first dollars are exempt until a percentage of total income is met. Assume 2 different people have the exact $20,000 in medical expenses but one earns $55,000 and the other earns $800,000 and the percent is 6% of income. For the person with an income of $55,000 the first $1,200 would not be allowed, giving them an $18,800 deduction. For the person with income of $800,000 the first $48,000 would not be allowed meaning they get no deduction. Lets now do that with all expenses but this time the first person has another $10,000 in mortgage interest, etc. and the second person has another $80,000 in various expenses. The first person still has $1,200 not allowed which would lead them with a $28,000 deduction. The 2nd person still has $48,000 not allowed but this time gets a $42,000 deduction. Lastly, lets change the medical expenses to a more normal $7,500 for both. The first person has $17,500 in expenses minus the $1,200 not allowed so they get a deduction of $16,300. The second person has $87,500 in expenses minus the $48,000 not allow so they get a deduction of $39,500. Right now deductions are geared to offset the progressivity in the tax rates. This would remove some of the regressive nature of deductions. Often made regressive by allowing deductions that are only available to those on the top end. Lastly, nothing works unless all income is treated equally.

BlueStreak

(8,377 posts)If the taxes work out exactly the same for every taxpayer, what is the point? Why is Romney wasting our time with that when we have serious problems to deal with?

If the taxes are not the same for each taxpayer, then it is WEALTH REDISTRIBUTION. And who among us believes that the REDISTRIBUTION Romney has in mind will be good for the 99%?

Texas Lawyer

(350 posts)propose a wealth redistributive change to the tax code the next day without even blinking.

I don't believe that Willard would actually pass a tax plan that redistributed wealth anywhere but up to the top 1%, but redistributing is clearly at the heart of what he is proposing and he does so without any apparent recognition.

OldDem2012

(3,526 posts)JDPriestly

(57,936 posts)Blue states with high housing prices. This $17,000 limit is a bone Romney is throwing voters in Alabama and Mississippi and Florida where housing prices are relatively low. It won't really help them, but they will get a little pleasure from knowing that people living in the Blue states are getting pinched a bit.

This is Romney at his meanest. Shows you how low he will go.

An ordinary family in urban LA can hardly find a house for less than $400,000 nowadays in spite of the housing market crash. The prices are just horrible here.

Turbineguy

(37,374 posts)People of the professional classes with good incomes and retirement accounts.

NutmegYankee

(16,201 posts)I'm an engineer in a blue state, and this just barely would impact me. It's not the interest from my mortgage, I own a modest home, but the local and state taxes.

OldHippieChick

(2,434 posts)That's more code for "tax the poor". In order to get to revenue neutrality, they must broaden the base (include all the "moochers"![]() and take away a substantial portion of the itemized deductions for the middle class. Believe me, I am middle class and my mortgage interest is over $16,000. I could not deduct my substantial charitable deductions AND my self-paid health insurance. I would be paying more than an addiitonal $2,000 in income tax. The BS idea that they would take away more from the rich is what they want morans to read between their fake lines.

and take away a substantial portion of the itemized deductions for the middle class. Believe me, I am middle class and my mortgage interest is over $16,000. I could not deduct my substantial charitable deductions AND my self-paid health insurance. I would be paying more than an addiitonal $2,000 in income tax. The BS idea that they would take away more from the rich is what they want morans to read between their fake lines.