Core U.S. Consumer Prices Rise by Most in Over Four Years

Source: Bloomberg

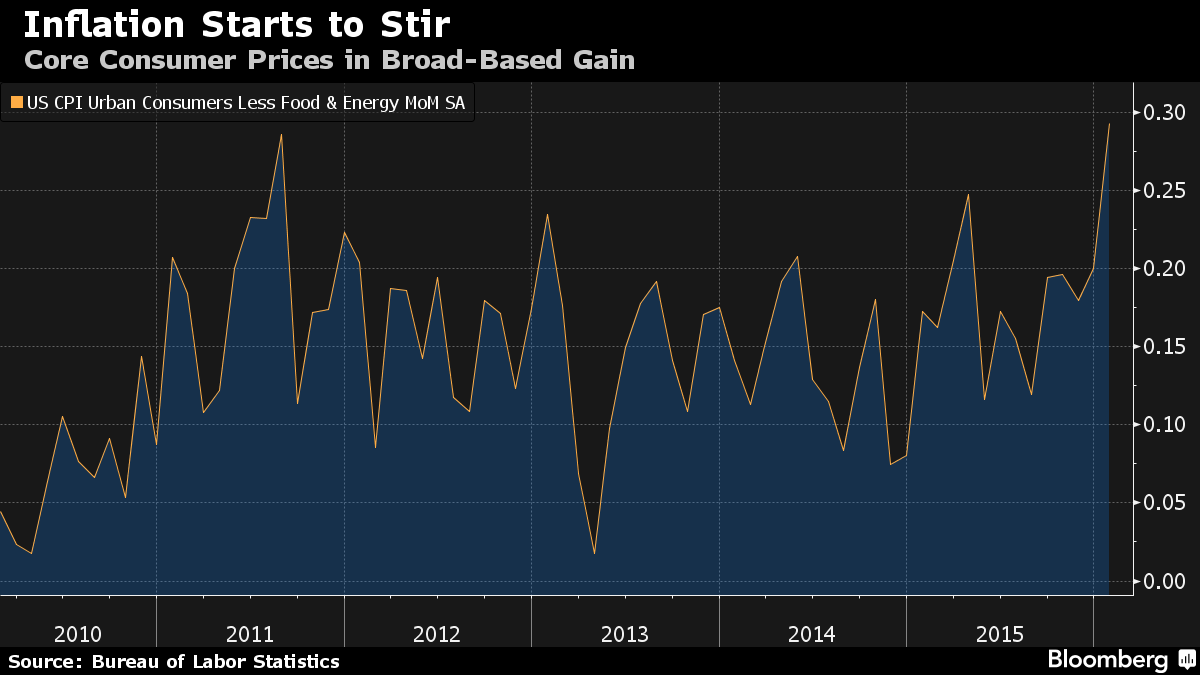

The cost of living in the U.S. excluding food and fuel increased in January by the most in more than four years, reflecting broad-based gains that signal companies may be getting some pricing power.

The so-called core consumer-price measure climbed 0.3 percent, more than forecast and the most since August 2011, after a 0.2 percent gain the month before, a Labor Department report showed Friday in Washington. Total prices were little changed, depressed by the continued plunge in energy costs.

A tightening labor market and nascent signs of wage growth bode well for domestic demand, a rebound in which could help stoke inflation if energy costs stabilize. The increase in inflation will likely hearten Federal Reserve policy makers, who are monitoring the U.S. economy’s durability against headwinds such as stock-market turmoil and weaker foreign markets.

“Prices are firming up, and it’s across a fairly nice breadth,” said Tom Porcelli, chief U.S. economist at RBC Capital Markets LLC in New York. “If that doesn’t convince people that inflation is not dead, I don’t know what will.”

Read more: http://www.bloomberg.com/news/articles/2016-02-19/core-u-s-consumer-prices-rise-by-most-in-more-than-four-years

mnhtnbb

(31,395 posts)Thanks a lot!

Jopin Klobe

(779 posts)... the GENIUSES in Wash. DC said that it's not necessary because the price of GASOLINE was staying so low ...

... and HOW MANY people over 65 years old and above actually drive a lot of miles every week? ...

... not enough to justify this craven, amoral, political STUPIDITY of keeping a few dollars from the elderly ...

... oh, by the by, we've GOT to rebuild the Middle East ... with YOUR tax money ... HUNDREDS OF BILLIONS PLUS ...

... after we saved Wall Street ... with YOUR tax money ... TRILLIONS, baby ... WITH bonuses ...

Igel

(35,320 posts)Not possible or projected increases.

I like to remind people that there was a debate over changing the COLA formula a few years ago to one that reflected more closely what seniors' did and how they behaved. It would have resulted in a lower COLA because the old formula included things like more gasoline than the new one, and gasoline prices had spiked. In other words, it's the reverse of your post--"seniors don't really drive a lot of miles every week, so their COLA doesn't have to reflect so strongly the increased cost of gas."

It was soundly shouted down because it would have decreased the COLA and because suspicion. Not because it was more inaccurate than the usual metric for COLA increases.

Now that the usual metric for COLA increases results in too-low SS increases, it, of course, must be wrong. Which was the argument a number of years ago. What really matters is larger increases, and we go with what principled stance gives us larger increases.

forest444

(5,902 posts)Anything with a microchip in it, for instance, is considered to be going down in price precipitously every year because the chips contain more memory all the time.

The obscene rise in heath care costs doesn't count because, the rationale goes, whenever the cost of medicine or care jumps overnight (like the recent 5,000% increases dictated by "Pharma Boy" Shkreli) consumers switch to cheaper alternatives or discontinue treatment altogether. Rent, according to the BEA, goes up a lot less than we all know it does because whenever it does a lot of people move to less desirable areas. And so on.

The fact is that, while this past year has been a welcome exception thanks to collapsing commodity prices, real inflation in the U.S. has rarely been below 6% a year since Bush invaded Iraq.

houston16revival

(953 posts)Recession inventories are gone for the most part

Even thrift stores have raised prices, some to the point of online prices,

meaning there's no value to be had

Groceries too

On the Road

(20,783 posts)The worries were more about deflation. And this does not sound like an economy going into a recession:

A tightening labor market and nascent signs of wage growth bode well for domestic demand...

Cassiopeia

(2,603 posts)Remember when everything was jacked up to cover those costs already?