Stocks Worldwide Tumble as Credit Weakens Amid Signs of Distress

Source: Bloomberg

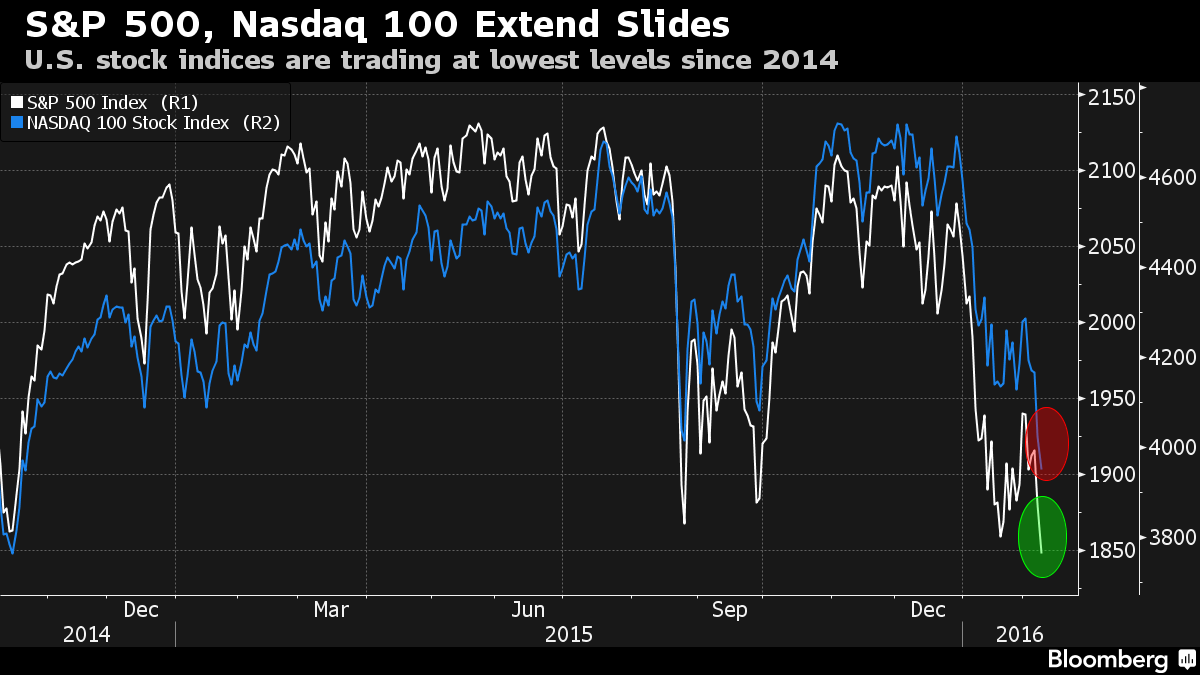

Signs of distress in financial markets accumulated amid deepening concern over the health of the global economy, with U.S. stocks sliding to a 22-month low as the cost of protecting against default by junk-rated companies soared to the highest level since 2012.

Mining and banking stocks drove the Standard & Poor’s 500 Index to its lowest close since April 2014, even as energy producers erased losses. Investors sought out the safest assets, sending yields on 10-year Treasuries to the lowest level in a year, and rates on Germany’s 10-year bunds to their lowest point since April. Meanwhile, yields on bonds of Europe’s most-indebted countries rose. Oil slid below $30 a barrel amid ongoing glut concerns, while gold advanced for a seventh day, its longest advance since March.

“We’re still seeing selling pressure from the tech valuation resetting last week, as well as the drop in oil,” said Matt Maley, an equity strategist at Miller Tabak & Co LLC in New York. “But it’s not just a problem with technology and some of the high-flyers that have rolled over in recent days, but also the recent stresses in the credit markets.”

Equities have been whipsawed all year as concern over China to oil and monetary policy spurs strategists to lower their year-end projections for U.S. stocks. In Europe, data Monday showed the Sentix investor confidence index dropped to the lowest level in more than a year in February, while anxiety over Deutsche Bank AG’s ability to pay coupons on its riskiest debt mounted. Crude failed to hold onto gains after Saudi Arabia held talks Sunday with Venezuela, which is trying to drum up support for a coordinated oil-output cut to buttress prices. Most Asian markets were closed for the Lunar New Year holidays.

Read more: http://www.bloomberg.com/news/articles/2016-02-07/japan-stocks-to-drop-on-yen-china-reserves-fall-99-5-billion

saturnsring

(1,832 posts)Duval

(4,280 posts)orpupilofnature57

(15,472 posts)cstanleytech

(26,293 posts)FUD as they could.

Doesnt matter if the FUD is over oil prices, food, war, social security or whatever you care to name if they can find a way to exploit it they will.

orpupilofnature57

(15,472 posts)cstanleytech

(26,293 posts)many of whom of course are rich themselves.

orpupilofnature57

(15,472 posts)OkSustainAg

(203 posts)Why would anyone trust your retirement or SS or anything else to that casino outfit.

marble falls

(57,099 posts)elias49

(4,259 posts)about this kind of crap.

![]()