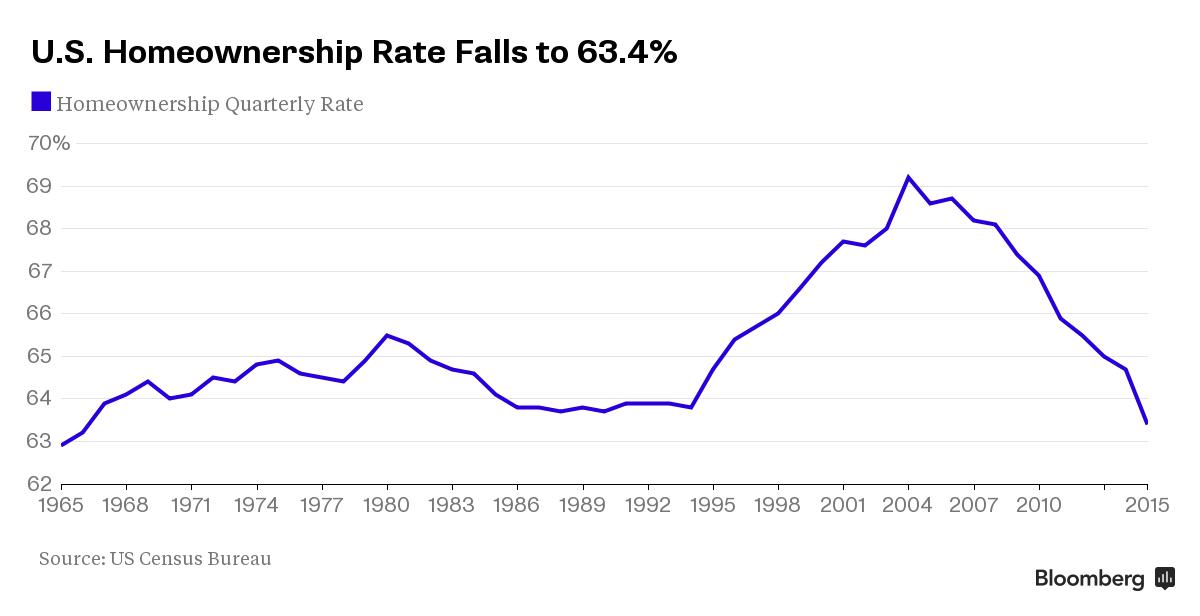

U.S. Homeownership Rate Falls to the Lowest Level Since the 1960s

Source: Bloomberg

by Kathleen M Howley

July 28, 2015 — 10:14 AM EDT

The share of Americans who own their homes fell to the lowest level in almost five decades, extending a multiyear decline as families struggle to regain ground lost during the financial crisis and rentals gain favor.

The U.S. homeownership rate was 63.4 percent in the second quarter, down from 63.7 percent in the previous three months, the Census Bureau reported Tuesday. It was lowest reading since 1967.

Would-be homebuyers have been held back by stringent mortgage standards and wage growth that hasn’t kept up with surging home prices. The average household income in June was 4 percent below a record high set in early 2008, even as unemployment dropped to its pre-recession rate, according to Sentier Research LLC.

“We’re still suffering the effects of the housing collapse and the financial crisis,” said Mark Vitner, senior economist with Wells Fargo Securities in Charlotte, North Carolina. “We may have another percentage point to go before we see a bottom” in the homeownership rate, he said.

Read more: http://www.bloomberg.com/news/articles/2015-07-28/u-s-homeownership-rate-falls-to-lowest-since-the-1960s

840high

(17,196 posts)forest444

(5,902 posts)And what are they doing with all that money? You guessed it: they've snuck right back to the derivatives roulette table.

http://www.globalresearch.ca/global-derivatives-1-5-quadrillion-time-bomb/5464666

geek tragedy

(68,868 posts)is there data on how many are renting by choice as opposed to renting because they can't buy (can't get mortgage, can't afford down payment) etc?

Hydra

(14,459 posts)I almost posted about the underutilization numbers in our economy, but I don't think most people want to believe it. There are less jobs, less income at those jobs, and things like houses are reaching bubble levels again.

Where I live though, there is a severe housing shortage- rents have increased by 50% in just 3 years.

erronis

(15,303 posts)You want to live in a house - rent it.

You want to own a car - lease it.

You want to drive that car on a road - pay for it by your tracking device.

You want your child to have education - enroll in a private academy.

You want to drink "pure" water - insert coins.

Everything will become a fee-only service soon. This is to replace the reprehensible "socialist" form that we have now.

The private companies will show how much more efficient they are vs. the government. And do you think their profits will come back to you?

jtuck004

(15,882 posts)The United States of Servile. ![]()

Psephos

(8,032 posts)Where do you live?

What I see is that govt. increasingly fails to administer its traditional providings while increasingly taking care of its own insiders. It then uses (fill in the blank - bad roads, shitty schools, unmaintained parks, militarized police, crumbling infrastructure, harebrained grants to sports teams or film companies, etc.) as crowbars to pry more money to fix the "emergencies." Lather, rinse, repeat.

the band leader

(139 posts)renting and/or leasing is often truly a better option.

leftyladyfrommo

(18,868 posts)I hate trying to keep up the lawn. And I need to get the gutters fixed and the roof is old.

But I like the privacy and my yard for my dogs

Adrahil

(13,340 posts)Some is building wealth on that property, and it ain't the renter.

If you want to a pay a premium for "mobility" and "flexibility" then do so by all means, just relaize it comes at a cost.... a transfer of wealth from the renter to the owner.

Warpy

(111,276 posts)The old model of buying a house in your early 30s and having it paid off by the time you have to retire just doesn't work. People don't have stable careers any more they have jobs and increasingly, those jobs require them to move around, following work.

The other model that works is buying a house in a depressed market that has rising rent. That's why I bought here, as a hedge against rising rent, one that paid off within 2 years.

appalachiablue

(41,145 posts)Hoyt

(54,770 posts)they won't lend it, fearing another downfall. They can't win.

Psephos

(8,032 posts)And now they don't lend under pressure from Feds. In both cases, politics and not economic rationality is the driver.

Feds loan bankster unlimited money at 0.25%, they lend it to you on credit cards at 18%, and use the rest to pump more air into the stock and bond bubbles. Why fuck around with mortgages at 3.5%?

Feds and bankers belong to the same club. You and I are not members.

Adrahil

(13,340 posts)Uh no. They lent becuase they were many ridiculous amounts of money by lending to under-qualified people, then packaging up the debt into mortgage-backed securities rated AAA despite the fact that the ratings agencies KNEW they were chock full of high risk debt. The "lenders" made a killing with all the risk displaced on the MBS's they sold. The problem for the banks came when the investment side thought the gravy train would go on forever and they bought MBS's themselves, without any scrutiny or due diligence.

appalachiablue

(41,145 posts)jomin41

(559 posts)such an abrupt (90 degrees?) and sustained shift? Honest question. What was left of Glass-Steagel was repealed in 1999 (Thanks,Bill), but maybe some other piece of de-reg?

former9thward

(32,025 posts)Although some on DU would disagree this was a bad law which allowed local governments and non-profits to pressure banks into lending to people who could not afford the loans. This drove up housing prices and eventually with all the people not being able to pay back the loans the housing prices collapsed and took down a lot of people with it.

https://www.congress.gov/bill/103rd-congress/house-bill/238

brentspeak

(18,290 posts)would be anyone who promulgates the bull$hit that the Community Development Banking Act (actually called the Community Reinvestment Act) had anything to do with the housing bubble and subsequent financial industry collapse.

http://www.menendez.senate.gov/news-and-events/press/fed-chairman-bernanke-confirms-to-menendez-that-community-reinvestment-act-is-not-to-blame-for-foreclosure-crisis

The "CRA helped cause the financial crisis" myth was cooked up in a smoke-filled room in 2008 by conservative think tanks who needed to concoct some bogus reason to exculpate Wall Street for its criminal behavior. They weren't too sure people exactly how many people would be dumb enough to actually believe that an obscure banking act like the CRA (which many RWers themselves had never heard of before they decided to cite it) could be blamed for the crisis, only that enough people would be dumb enough to believe to it so as to create just a smidgen of misdirection away from Wall Street and its White House and Congressional enablers.

former9thward

(32,025 posts)Dismisss the facts, got it.

brentspeak

(18,290 posts)CreekDog

(46,192 posts)Not only do you post from the right, but despite claiming to be a lawyer you've posted bogus things repeatedly here.

Like everyone cheats on their taxes, you wouldnt answer if that includes you.

You posted that Harry Reid lied about his excercising injury.

You even tried to slip a lie through about a poll on the word "socialism" by purposely qouting a different poll, years older than the OP LINKED TO, and you did that to try to make the OP sound like a liar by saying the OP had different numbers than the poll showed.

Surely your boast to me that you work actively on liberal causes outside DU is contradicted by your playing up right wing memes like the one in this thread.

What is the point if being here if not to try to make liberals you argue with look like misguided hypocrites?

former9thward

(32,025 posts)Always good to hear from you.

CreekDog

(46,192 posts):lol:

salib

(2,116 posts)Just like yelling "Benghazi"

MFrohike

(1,980 posts)It was a combination of easy money and lax regulation. The exact same thing happened in the 20s and there was no Community Development Banking Act back then. It's the same damn thing every time we have a debt bubble inflate and pop. It's not that hard to understand if you actually bother to read the history.

former9thward

(32,025 posts)Banks were forced to give loans to people who they know could not pay it back. That is what led to the housing bauble and the collapse in housing prices.

MFrohike

(1,980 posts)Please cite the text of the statute or the applicable regulation in the CFR that required them to hand out easy money. In other words, prove it.

While you're doing that, you should also look for the regulations that required them to buy stated income loans (liar's loans), lie repeatedly to their investors about the status of those loans, lean on mortgage appraisers to falsely inflate house values, and repackage the worst dregs of the loan pools into CDOs. Once you're done with that, we can discuss the issue of ARMs, a fake ratings system, and the teensy issue of MERS and how it relates to a potential chain of title issue in this country. Sound good?

You're spouting off a right-wing talking point with limited basis in reality. The fundamental problem that you have with that argument is that usually right-wingers claim that the act forced Fannie and Freddie to buy bad loans. Why do they matter? They were required to buy a set percentage of loans to further affordable housing. The problem for your argument is that their default rates were ridiculously lower than private label MBS. Private label had a 50% higher default rate than the GSEs. The GSEs had a default rate of around 6% after everything went to hell, which is definitely high, but the investment and commercial banks were over 9%. That pretty much neuters the living hell out of your argument because the private entities weren't required to do jack squat for affordable housing.

If you're going to make specious claims like this one about the Community Reinvestment Act, you should at least understand how the process worked. It didn't operate on private entities, just Fannie and Freddie. They weren't required to loan money, they were required to buy mortgages in order to securitize them for their collateralized loan obligations (issued since the 60s). Their underwriting standards clearly didn't change much over the years of the bubble because their default rate was far lower than their private counterparts. Given all of that, my guess is that you really have no clue what happened with the subprime crisis.

former9thward

(32,025 posts)Something you are not acquainted with. A world that politicians pressure businesses to do things. They don't care what the law says. Move to Chicago where the real world operates. You will freak out.

MFrohike

(1,980 posts)Prove it. Show me how your quote unquote real world magically makes your right-wing talking point true. Please, lay it out and be specific. Name the banks. Name the politicians. Show me exactly how those lenders made the crisis happen by lending to poor black and Hispanic people. I patiently await your detailed response.

Man, I just have to laugh at your response. If you understood just 1/4 of what I wrote, you'd realize I was laying out a case for massive corruption. The fact you don't understand that at all tells me all about the world you inhabit.

former9thward

(32,025 posts)"massive corruption". I guess you don't know the majority of Chicago's Alderman have been sent to prison over the last 20 years. But tell me more. ![]()

MFrohike

(1,980 posts)Something about bullshit walks? You talk a good game, but I'm not seeing you back it up with any proof. Why is that?

Yeah, massive corruption. The subprime market was almost $2T. Chicago ain't shit next to that, chuckles.

Gormy Cuss

(30,884 posts)like redlining. Nothing in the law allowed or encouraged lending to people who could not afford the loans. Rather, it encouraged investment in under-served communities

And FWIW, I spent years as a federal housing policy researcher.

former9thward

(32,025 posts)to "under served communities" So they made loans to people who they knew could not pay them back in order to avoid heat. If your research did not uncover this then it was bad research. That is what caused the housing bubble crisis.

Gormy Cuss

(30,884 posts)Nothing about the CRA pressured banks to make bad loans. Politicians aren't authorized by the CRA to pressure lenders, BTW. If a corrupt pol did that it wasn't because the CRA required it, which is what you implied above.

If you want to point the finger at a leading causing of the housing bubble, it's the poor underwriting standards used after mortgages were securitized.

former9thward

(32,025 posts)So spare me the academic ivory tower nonsense. Politicians pressure business all over all of the time. And business owners are smart enough to know what happens if they don't comply.

Gormy Cuss

(30,884 posts)a fact that keeps escaping your notice. Not to mention, your opinion on what may have happened somewhere in Chicago is not evidence.

"academic ivory tower nonsense" --- you are showing your lack of knowledge again.

CreekDog

(46,192 posts)Last edited Tue Aug 4, 2015, 12:32 AM - Edit history (1)

CreekDog

(46,192 posts)former9thward

(32,025 posts)I learned that from from another poster who has disappeared. But thanks for trying.

CreekDog

(46,192 posts)appalachiablue

(41,145 posts)Bloomberg Business, Hot Property, "Bill Clinton's Drive to Increase Home Ownership Went Way Too Far", Posted by Peter Coy, Feb. 27, 2008.

http://www.businessweek.com/the_thread/hotproperty/archives/2008/02/clintons_drive.html

(Just don't call me Fannie)

Historic NY

(37,451 posts)"This Administration will constantly strive to promote an ownership society in America. We want more people owning their own home. It is in our national interest that more people own their own home. After all, if you own your own home, you have a vital stake in the future of our country." - President George W. Bush, December 16, 2003

http://georgewbush-whitehouse.archives.gov/infocus/achievement/chap7.html

appalachiablue

(41,145 posts)early from the FED; Lehman Bros. CEO Richard Fuld cashed out $100 Mill that year; and some folks at Fraudie & Freddie 'left' that year and cashed out. Maybe they sensed something in the wind? ![]()

- Oct. 2008, Rep. Henry Waxman Grills Lehman Bros. CEO Rich. Fuld about $500 Million he made in salary, 2000-2007.

Days before becoming the largest bankruptcy in US history, Lehman steered millions to execs. while pleading for federal rescue. The stockholders rec'd. zero.

Recursion

(56,582 posts)Simultaneously, the Fed decided to keep money cheap.

Sunlei

(22,651 posts)and working together to pay off early and fast as you can.

appalachiablue

(41,145 posts)LeftyMom

(49,212 posts)I've got two sick parents. He'd rather die than depend on anyone, I think I'd kill her after a week, they despise each other and both of them worked too damn hard to wind up sharing a bathroom with their teenage grandson.

I'd rather live in the fucking woods.

appalachiablue

(41,145 posts)and bust, big time.

melm00se

(4,993 posts)it appears to me that we are approaching the historical norm after a significant run up (for many reasons: some good, some bad).

I predict that there will be a drop to underneath the historical average and then bounce back to the historical average of between 63% and 65%.

This, of course, will be greatly influenced by millennials and how long it will take for them to jump into the housing market.

TexasBushwhacker

(20,202 posts)Stretch them out, compress them, make them look as alarming or insignificant as you want. Considering how many people lost their homes or walked away from underwater mortgages, I'm surprised the numbers aren't worse.

candelista

(1,986 posts)That is all.

ForgoTheConsequence

(4,868 posts)Hard to buy a house on 9 bucks an hour. Of course the morons at the top don't realize that.

ananda

(28,866 posts)Rents are rising too!

Lurks Often

(5,455 posts)Granting that renting is throwing money down a hole without a return, it also doesn't put you in a position where you owe more then what the house is worth.

I'd rather rent then buy a house and know I won't get my money back on it if I choose to move.

Gormy Cuss

(30,884 posts)Last edited Mon Aug 3, 2015, 08:42 PM - Edit history (1)

Homeownership can be either an investment with an appreciation or throwing money down a hole, and paying for it also acts as product payment too (IOW, rent or own, you're paying for a place to live which is the immediate use.)

There are rent vs. own calculators out there and sometimes renting IS the better move from a financial standpoint.

candelista

(1,986 posts)TexasBushwhacker

(20,202 posts)As a single person, it would make sense for me to buy a condo or town home, but the only affordable ones here are very old and the resale value here isn't very good. Even a small house is really more than I need, and since my income has gone up and down over the last 10 years, I wouldn't want to commit to payments I may not be able to make in the future. Plus the standard deuction is so high now that there really would be any tax benefit. My apartment is cheap, safe and quiet.

romanic

(2,841 posts)aren't getting paid enough to buy a home, much less rent. Plus were not interesting in living in some house on a cul-de-sac anyway. My 600 sq foot studio apartment works just fine for me. I have a laundromat, an Aldi's, a Rite-Aid and several local businesses lined on a nearby Main Street I can walk to plus a nature trail I can jog and bike on; plus the area I live in his dense enough to not need a car all the time. I know most people my age feel the same about living in a area without depending on the car. We'd rather live in an affordable apartment than some big old house far off from our jobs anyway.

a la izquierda

(11,795 posts)are around $239K. You read that right. In Morgantown, West freaking Virginia. For $100K you can buy a real piece of shit that needs a ton of work...

Try being a professor on one salary making $50K with student loans. No way to afford that. And then there's the rental market, which is way overvalued for slum conditions.

Yeah, I hate where I live. But the academic market dictates it...

LeftyMom

(49,212 posts)The best way to keep their housing affordable is to make sure there's enough on-campus housing for students. Once off-campus rates start getting set by overgrown teenagers living two to a room the housing prices reflect overheated rents rather than the incomes of live-in tenants.

But a friend of mine lives in a one stoplight WV town way up near the PA border, and she is- no joke- seriously considering moving home to CA because houses are cheaper and the schools are better.

a la izquierda

(11,795 posts)The schools are meh, the houses are dilapidated pieces of crap, and everything else is expensive. I fill up my tank in WV and then high-tail it to NJ and hope I can fill up when I get there, because it's a LOT cheaper for gas near my mom's.

CreekDog

(46,192 posts)LeftyMom

(49,212 posts)Wages are lower here but they're not *that* much lower.