General Discussion

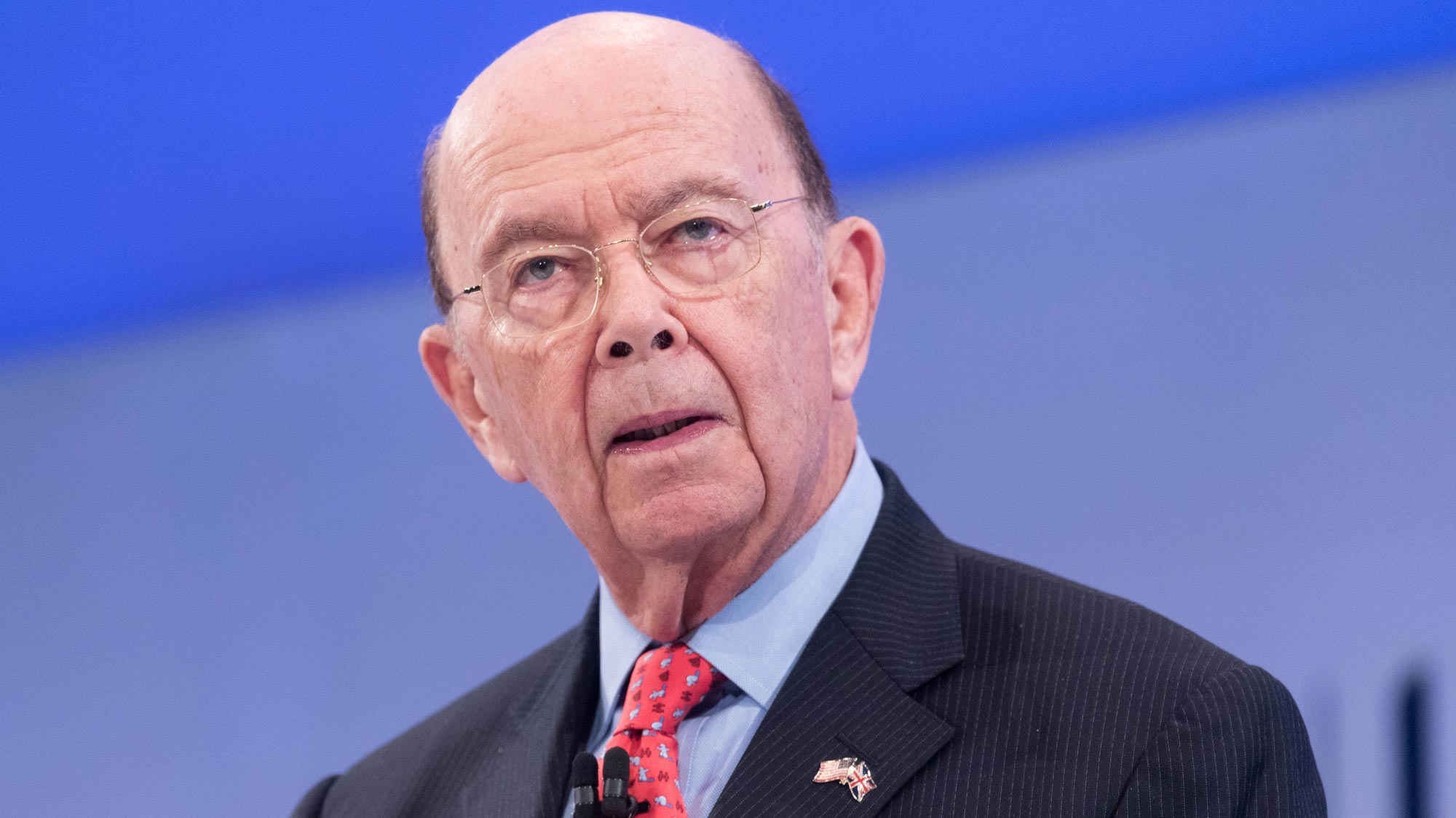

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsEuropean Parliament Report Accuses Wilbur Ross of Insider Trading

Earlier this year, Luke Ming Flanagan, an Irish politician and member of the European Parliament, the European Union’s governing body, commissioned a report on the 2008 eurozone banking crisis. The final version of this report, written by two Irish financial analysts, was presented in Brussels last week to a group of 52 European Parliament members affiliated with left-leaning parties. And it included a section covering Ross’ investment in the Bank of Ireland, in which he was a major shareholder and a member of the board of directors. The report alleges that when Ross sold off his holdings in the bank for a massive profit in 2014, he possessed inside information that the bank was relying on deceptive accounting practices to mask its losses and embellish its financial position.

Ross’ involvement with the Bank of Ireland began in July 2011, when his hedge fund, WL Ross & Co., joined several institutional investors to purchase a 34.9 percent stake in the struggling financial firm for 1.12 billion euros ($1.6 billion). At the time, the deal “led to much head-scratching,” according to the Irish Examiner. That’s because Ross and the other investors obtained stock in the company at the low price of 10 euro cents a share just months after the bank received a 3.5 billion euro bailout from the Irish Central Bank and a guarantee of up to 10 billion more. (The bank’s shares were trading at about 30 euro cents two months before the sale.) The Irish government’s decision “to sell a large chunk of Bank of Ireland at the bottom of the market” so soon after the government’s cash infusion had stabilized the institution “was on the face of it baffling,” the newspaper reported.

In 2012, Ross joined the bank’s board of directors. Two years later, he began liquidating his stake. In March 2014, he sold a chunk of his holdings at 33 euro cents a share—more than triple what he had paid for the stock. A couple of months later, he sold the remainder of his shares for about 26 euro cents per share. Together, the sales netted him a profit of about 500 million euros ($682 million). The Irish Independent reported at the time that Ross had “pulled off the deal of the century.”

http://www.motherjones.com/politics/2017/12/european-parliament-report-accuses-wilbur-ross-of-insider-trading/#

oasis

(49,388 posts)She'll have no comment, of course, but the more exposure, the better.

spanone

(135,843 posts)Denzil_DC

(7,242 posts)for tax-dodgers, money-launderers etc.

The EU's Anti Tax Avoidance Directive will come into force on 1 January 2019: https://ec.europa.eu/taxation_customs/business/company-tax/anti-tax-avoidance-package/anti-tax-avoidance-directive_en

I always bear that in mind when I read of a billionaire or his media outlet cheering on a hard Brexit with no transition period.

The EU also has plans to clamp down on tax havens and money laundering: https://www.theguardian.com/world/2016/sep/15/uk-overseas-territories-eu-tax-crackdown-economic-sanctions

A Russian oligarch/kleptocrat who thought he was immune was recently arrested in France: https://www.democraticunderground.com/10141921422

spanone

(135,843 posts)Denzil_DC

(7,242 posts)The EU has some clearing out to do in its own upper echelons, and this won't be a glitch-free process, but this seems to be the trajectory it's on.