General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsFormer BofA Exec Indicted For Fraud

An indictment filed yesterday in federal court in Charlotte, North Carolina charged the former head of Bank of America’s municipal derivatives desk, Phillip Murphy, with conspiracy to defraud the U.S, wire fraud, and conspiracy to make false entries in bank records. From Bloomberg:

http://livewire.talkingpointsmemo.com/entries/former-bofa-exec-indicted-for-fraud

Former Financial Services Executive Indicted for His Participation in a Far-Reaching Conspiracy and Scheme to Defraud Involving Investment Contracts for the Proceeds of Municipal Bonds

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-at-895.html

2pooped2pop

(5,420 posts)ProSense

(116,464 posts)I'm surprised this wasn't in LBN.

unc70

(6,115 posts)Bloomberg ran a piece on him several years ago. I believe this Phillip Murphy was at BofA from 1998 to 2002. It's confusing because another one from Goldman Sachs is an ambassador.

I believe he was fired by BofA ten years ago. Not absolutely certain. I'll dig around tomorrow.

2pooped2pop

(5,420 posts)Too bad.

unc70

(6,115 posts)If I understand correctly, there have been convictions of others involved in this particular scheme.

I would assume that DOJ did not let the clock run out on this. He left BofA about 10 years ago.

MineralMan

(146,317 posts)In fact, there have been several stories like this one. Maybe those who are saying that the feds never go after the bankers are incorrect.

ProSense

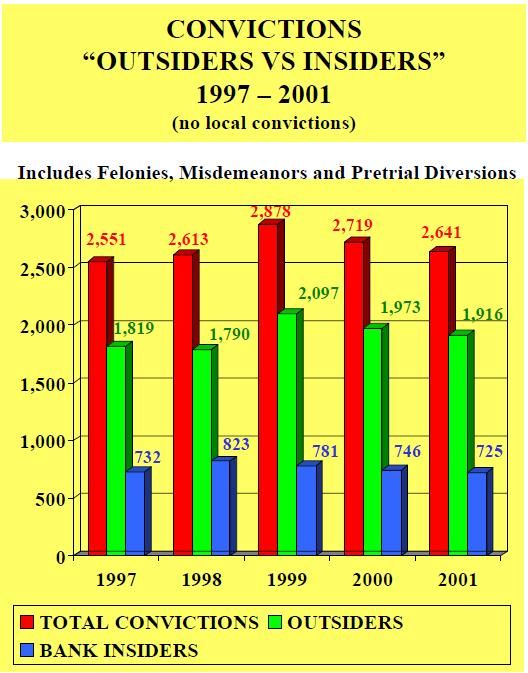

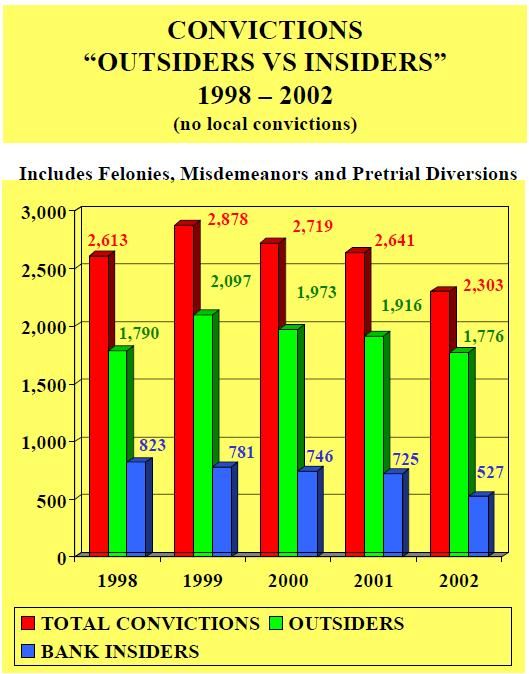

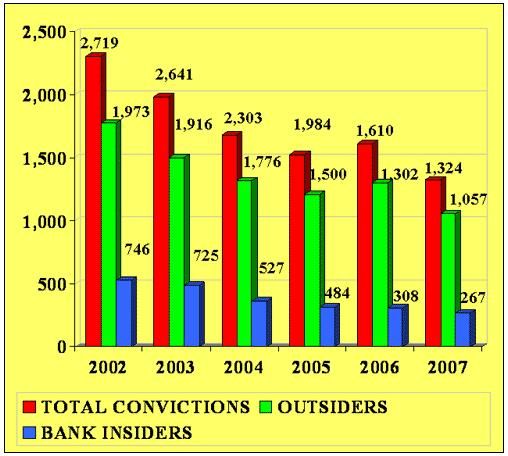

(116,464 posts)not only does the chart you posted shows that prosecutions started dropping after the repeal of Glass-Steagall, it also shows prosecutions, not convictions. It's also not conclusive because it doesn't state what specifically it includes and appears to be related to bank fraud. Here's the reference:

This category can refer to crimes committed both within and against banks. Defendants include bank executives who mislead regulators, mortgage brokers who falsify loan documents, and consumers who write bad checks. (Here are some recent cases of bank fraud prosecutions.)

Goldman Sachs is not a bank. Still, even if it is bank fraud, it does offer more evidence of Bush's "abysmal" record, as these prosecutions dropped significantly during his Presidency.

The following is from the Financial Institution Fraud and Failure Reports for each fiscal year.

http://www.fbi.gov/stats-services/publications/fiff_00-01

http://www.fbi.gov/stats-services/publications/fiff-2002

(b): Types of Subjects Convicted in FIF Cases During FY 2007*

SUBJECT TYPE NUMBER OF SUBJECTS

Legal Alien 8

Illegal Alien 20

All Other Subjects 1,038

Bank Officer 88

Bank Employee 179

International or National Union Officer 1

President 1

Business Manager 2

Office Manager 2

Financial Secretary 1

Federal Employee - GS 12 & Below 1

State - All Others 1

Local Law Enforcement Officer 1

City Councilman 1

Possible Terrorist Member or Sympathizer 1

Company or Corporation 7

Local - All Others 2

Total 1,354

http://www.fbi.gov/stats-services/publications/fiff_06-07/fiff_06-07

http://www.fbi.gov/stats-services/publications/fiff_06-07/fiff_06-07

Given yhe above charts and the break out for 2007, it appears that most of the convictions were not bank executives. In fact, the majority were bank "outsiders," likely meaning more bad-check writers and document falsifiers.

Also, bank fraud is separate from corporate fraud, mortgage fraud, and securities and commodities fraud.

The following is from the Financial Crimes Report to the Public for each fiscal year:

(Note: The 2005 report does not break out securities and commodities fraud. The 2010-2011 report is the only one that breaks out financial institution fraud. All reports show corporate fraud and mortgage fraud.)

http://www.fbi.gov/stats-services/publications/fcs_report2005/fcs_2005#CORPORATE

http://www.fbi.gov/stats-services/publications/fcs_report2005/fcs_2005#MORTGAGE

_________

http://www.fbi.gov/stats-services/publications/fcs_report2006

http://www.fbi.gov/stats-services/publications/fcs_report2006/financial-crimes-report-to-the-public-fiscal-year-2006#Securities

http://www.fbi.gov/stats-services/publications/fcs_report2006/financial-crimes-report-to-the-public-fiscal-year-2006#Mortgage

___________

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#corporate

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#securities

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#mortgage

______________

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#corporate

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#securities

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#mortgage

____________

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009#securities

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009#mortgage

_____________

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Corporate

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Securities

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Financial-ins

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Mortgage

Pending cases are important because they can still result in convictions.

President Obama’s Financial Fraud Enforcement Task Force STRIKES AGAIN! $200 Million Fraud

http://www.democraticunderground.com/1002844790

JDPriestly

(57,936 posts)Also, I think we need to bring back Glass Steagall or something much more like it than the very mild reforms we got recently. We need to tax the gains from the speed-trading at regular income tax rates. That would slow the markets to a pace that would permit small investors to keep up with what is going on and gain confidence in those markets. Right now, the companies that do the computer fast-trading are just stealing from the fools who think that they are trading and buying into companies on their home computers.

Tarheel_Dem

(31,235 posts)You're a treasure. ![]()

![]()

bookmarked

BlueToTheBone

(3,747 posts)the pukes went after Holder...to stop him from doing his job.

jillan

(39,451 posts)Horrible company.

valerief

(53,235 posts)Or shoot himself twice in the head.

2pooped2pop

(5,420 posts)in the back of the head with a shotgun, twice.

Can't remember who that was but it happened and they claimed it a suicide.

valerief

(53,235 posts)FreakinDJ

(17,644 posts)of course him implicating "Poppy Bush and his apparent suicide taking place soon as Bush Jr took office was purely circumstantial"

2pooped2pop

(5,420 posts)banana? condom? I better take a closer look, lol.

Scurrilous

(38,687 posts)HiPointDem

(20,729 posts)BumRushDaShow

(129,096 posts)because DU told me that the "third way" President won't ever go after the banksters. Nope no siree. ![]()

Spitfire of ATJ

(32,723 posts)to some little place called CDR Financial Products.

Am I supposed to get excited about seeing a big bank use our Justice Department as a club on a second rate place?

ProSense

(116,464 posts)"Okay, so BofA went to the Justice Dept because they didn't like paying kickbacks to some little place called CDR Financial Products.

Am I supposed to get excited about seeing a big bank use our Justice Department as a club on a second rate place? "

...know what excites you, but I'm excited that a BoA executive was indicted. I also really don't give a shit about the bid-rigging "little place."

Spitfire of ATJ

(32,723 posts)But it sounds like they tossed one of their own to the wolves.

girl gone mad

(20,634 posts)"Bank of America, which self-reported the illegal activity, has been cooperating for more than four years with Justice Department prosecutors"

![]()

ProSense

(116,464 posts)"Bank of America, which self-reported the illegal activity, has been cooperating for more than four years with Justice Department prosecutors"

...I'm "grateful" that BoA went to the Bush Justice department so that the Obama Justice department could indict one of its executives.

Feel better?

sabrina 1

(62,325 posts)in this case, not that it's not a good thing.

DCKit

(18,541 posts)"Prosecution" is Greek to this DOJ. Not a clue.

ProSense

(116,464 posts)"No shit. Four years, and they don't know what to do with him."

...have some idea:

Murphy is charged with two counts of conspiracy and one count of wire fraud. The fraud conspiracy with which Murphy is charged carries a maximum penalty of five years in prison and a $250,000 fine. The wire fraud charge carries a maximum penalty of 30 years in prison and a $1 million fine. The false bank records conspiracy carries a maximum penalty of five years in prison and a $250,000 fine. The maximum fines for each of these offenses may be increased to twice the gain derived from the crime or twice the loss suffered by the victims of the crime, if either of those amounts is greater than the statutory maximum fine.

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-at-895.html

woo me with science

(32,139 posts)It's a matter of taking sides.

Holder, Geithner, coordinated assaults on Occupy, settlements for corrupt banks...

They have not taken ours.

The denial needs to stop.

http://www.democraticunderground.com/?com=view_post&forum=1014&pid=146626

ProSense

(116,464 posts)WTF does that stupid image have to do with Obama and the point of the OP?

"The denial needs to stop."

The silliness needs to stop.

woo me with science

(32,139 posts)We have excused this nonsense long enough.

ProSense

(116,464 posts)woo me with science

(32,139 posts)Fed-up cop says "enough" - tired of seeing starving, poor, struggling elderly

http://www.democraticunderground.com/1002986127

Homeless US Schoolchildren top one million, leaving advocates "horrified."

http://www.democraticunderground.com/101633605

ProSense

(116,464 posts)http://www.democraticunderground.com/1002986127

Homeless US Schoolchildren top one million, leaving advocates "horrified."

http://www.democraticunderground.com/101633605

...this is Obama's fault?

What the fuck does this have to do with the OP and prosecuting fraud?

Your point isn't silly, it's absurd.

woo me with science

(32,139 posts)What the fuck, indeed.

[font size=2]It's not a matter of not having a clue. It's a matter of taking sides. Holder, Geithner, coordinated assaults on Occupy, settlements for corrupt banks...

They have not taken ours.[/font size]

The denial needs to stop.

http://www.democraticunderground.com/?com=view_post&forum=1014&pid=146626

ProSense

(116,464 posts)silly!

woo me with science

(32,139 posts)Meanwhile,

13 TRILLION dollars hidden by the world's elite.

http://www.democraticunderground.com/?com=view_post&forum=1014&pid=173038

...and we are supposed to take THIS story as a sign of seriousness?

The denial needs to stop.

http://www.democraticunderground.com/?com=view_post&forum=1014&pid=146626

ProSense

(116,464 posts)"+100000 This is a joke. "

...some more funny stuff:

Former Chief Investment Officer of Stanford Financial Group Pleads Guilty to Obstruction of Justice

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-785.html

Former Corporate Chairman of Consulting Firm and Board Director Rajat Gupta Found Guilty of Insider Trading in Manhattan Federal Court

http://www.stopfraud.gov/iso/opa/stopfraud/NYS-120615.html

Hedge Fund Founder Raj Rajaratnam Sentenced in Manhattan Federal Court to 11 Years in Prison for Insider Trading Crimes

http://www.stopfraud.gov/news/news-10132011.html

CEO and Head Trader of Bankrupt Sentinel Management Indicted in Chicago in Alleged $500 Million Fraud Scheme Prior to Firm’s 2007 Collapse

http://www.stopfraud.gov/iso/opa/stopfraud/ILN-120601.html

Yahoo! Executive and California Hedge Fund Portfolio Manager Plead Guilty in New York for Insider Trading

http://www.stopfraud.gov/iso/opa/stopfraud/NYS-120521.html

Three Former Financial Services Executives Convicted for Roles in Conspiracies Involving Investment Contracts for the Proceeds of Municipal Bonds

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-at-620.html

Former Chairman of Taylor, Bean & Whitaker Sentenced to 30 Years in Prison and Ordered to Forfeit $38.5 Million

http://www.stopfraud.gov/news/news-06302011-2.html

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-342.html

Former Chief Financial Officer of Taylor, Bean & Whitaker Pleads Guilty to Fraud Scheme

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-342.html

Seattle Investment Fund Founder Sentenced to 18 Years in Prison for Ponzi Scheme and Bankruptcy Fraud

http://www.stopfraud.gov/iso/opa/stopfraud/WAW-120210.html

Former Hedge Fund Managing Director Sentenced to 20 Years for Defrauding 900 Investors in $294 Million Scheme

http://www.stopfraud.gov/iso/opa/stopfraud/ILN-111117.html

http://www.stopfraud.gov/news-index.html

woo me with science

(32,139 posts)Give me a fucking break. We are talking about TRILLIONS and the collapse of our economy.

Manhattan Federal Court?

US District Court in Chicago?

38.5 million?

This is very much like "The List." Lots of small potatoes trying to obscure the fact that the big outrages go utterly unpunished.

No, not only unpunished: PROTECTED:

Obama sides with banks (corrupt loans, foreclosures); pressures NY Atty. General for settlement.

http://www.democraticunderground.com/discuss/duboard.php?az=show_mesg&forum=439&topic_id=1795232&mesg_id=1795232

ProSense

(116,464 posts)"Give me a fucking break. We are talking about TRILLIONS and the collapse of our economy. "

...you're good at making no point. All you have are lame attempts to try to dismiss anything.

"This is very much like 'The List.' Lots of small potatoes trying to obscure the fact that the big outrages go utterly unpunished. "

I could post the entire list of everyone convicted and you would still throw out your red herrings.

woo me with science

(32,139 posts)Third Way messaging is inherently hopeless, because it burdens its messengers with an impossible task: trying to convince people that what they have seen, heard, and experienced with their own eyes and ears isn't happening.

[font size=1]13 TRILLION dollars hidden by the world's elite.

http://www.democraticunderground.com/?com=view_post&forum=1014&pid=173038

...and we are supposed to take THIS story as a sign of seriousness?

The denial needs to stop.

http://www.democraticunderground.com/?com=view_post&forum=1014&pid=146626[/font size]

ProSense

(116,464 posts)"Third Way messaging is inherently hopeless..."

...another lame red herring?

If you think that means anything to me maybe you're the one in denial.

Fuck Third Way.