General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsIs it true that Trump is going to remove the state income tax and 401 K exemption

Is it true that Trump is going to remove the state income tax and 401 K exemption to pay for tax cuts for the rich ?

SMFH

no_hypocrisy

(46,202 posts)He and the GOP are removing the exemption for municipal taxes. I'm in NJ and paying about $15,000 per year. If the tax reform goes through, then that's $15,000 added to my "income" to calculate my taxes. And I'll end up paying more federal taxes to allow 10% of the 1% get their tax cuts.

marylandblue

(12,344 posts)Trump has come down.on both sides of the 401K issue. He has not said anything about state tax deductability, but I suspect he would want to keep it because it would help his own bottom line.

GP6971

(31,220 posts)that the deduction for state sales tax was being considered. I haven't heard anything about state income taxes though.

Orangeutan

(204 posts)and the ones who voted for Hillary keep the old?

dpd3672

(82 posts)that it forces people in low tax states to pick up the "slack" for people in high tax states. It's really not so much a partisan issue, depends more on if you win or lose as a result of it.

People who pay a lot of local taxes lose, people who have low state taxes tend to win. Not sure how it would affect me, Michigan is sort of in the middle.

DemocratSinceBirth

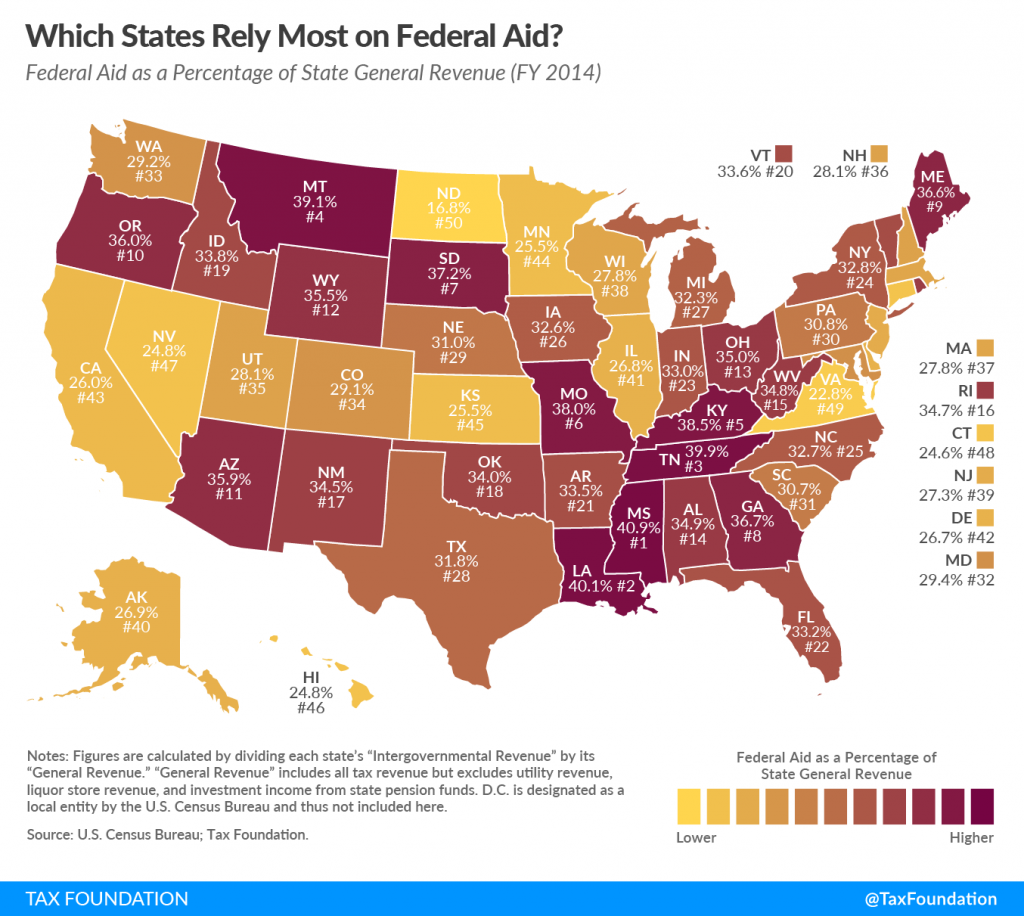

(99,714 posts)The states most dependent on federal aid tend to be red states:

that have no state income tax.

A HERETIC I AM

(24,380 posts)Only 7 states have no State income tax;

So 3 of the really red ones on your map, GA, LA, and MS, DO have a state income tax

trof

(54,256 posts)A HERETIC I AM

(24,380 posts)WinkyDink

(51,311 posts)than manipulating numbers and working backwards from their ONLY GOAL:

"Motive: Enrich our donors more.

Means: Figure it out! Drop, add, shuffle, rob---IT DOESN'T MATTER! Just get the looted lucre to our OWNERS!

Opportunity: NOW! Before 2018!"

Same as any other common criminal.

WinkyDink

(51,311 posts)rufus dog

(8,419 posts)I have already see a spokesperson say that States like California and New York take more than their fair share and are being subsidized by the other states.

And the fucking lemming repukes will eat it up.

You see because if you take total revenue across all states and then divided it by 50 then California and New York would obviously get less.

WinkyDink

(51,311 posts)they find out that the mortgage deduction has gone the way of the other deductions.

rufus dog

(8,419 posts)Take away the mortgage deduction and the value of real estate will immediately be impacted, negatively. Most people have very little saved for retirement, but have equity in their home. If they were like me, bought a house 20 years ago, didn't refinance every year, then they will have equity basically 3x of what they paid for the house. Even if they kept refinancing they will have 2x the value of the home as long as they didn't use the home as an ATM. I am going to guess for the HUGE majority of these people that the home equity accounts for about 80 to 90 percent of their net worth.

If it goes through then San Diego to Orange County will be solid blue, except for a couple districts further inland, a pick up of five to six House seats. At this point we probably have three to five seats that will flip just based upon the Orange Asshole and his racist comments.

question everything

(47,537 posts)Reduced before tax exemptions of 401K form $18,000 (24,000 if your are over 50) to... $2450.

Supposedly the standard deductions will rise from $12,000 to $24,000 thus there would be no need for itemized deductions... if one's total Sch. A is less then 24,000. But, I think, also eliminate the exemptions that for a married couple is 8,100.

The 401K is really shitty and I've already wrote my Repulsive member of Congress.

Most people no longer have pensions. Member of Congress, though, do. Even the one who have, like public workers, may not have it when they retire.

The irony is that Professor Thaler, who won the Nobel Prize in Economics, proposed that since people act irrationally, that instead of choosing to join the 401K plan, that they would automatically be enrolled and than, if they don't want it, choose to opt out.

Many employers have followed this suggestion.

Write your member of congress about that.