General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsBank dividends are near all-time highs

President Trump has condemned the Dodd-Frank rules placed on Wall Street as a "disaster" that have prevented banks from lending money to cash-starved businesses.

House Republicans responded by passing the Financial Choice Act, a bill that would gut many of Dodd-Frank's post-crisis safeguards in an effort to accelerate the sluggish U.S. economy.

But banks have more cash than they know what to do with these days. American banks raked in record profits last year.

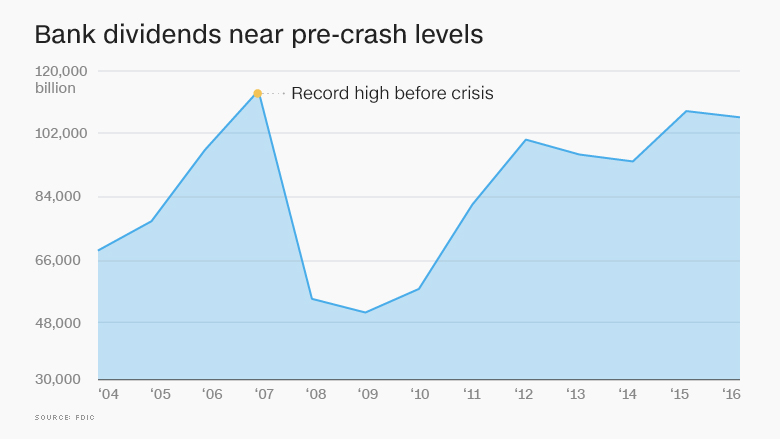

More tellingly, banks handed out $102.8 billion in dividends to shareholders in 2016, according to the FDIC. That's the third-highest amount on record, going back to 1984. It is just shy of the all-time high of $110.4 billion shelled out in 2007, the year before the financial meltdown.

Bank dividends crumbled in half in 2008, sinking to $51.1 billion, FDIC stats show. But they rebounded steadily following that, even after Congress passed Dodd-Frank in 2010.

"Banks have plenty of extra money for expanding their lending. They choose not to lend that money, instead 'returning capital' to their shareholders," Cornell University law professor Saule Omarova told the Senate banking committee last week.

...

"Dodd-Frank was a very, very positive thing for the industry. We now have one of the stronger banking industries in the world because of it," said Charles Peabody, an analyst at Compass Point Research & Trading.

http://money.cnn.com/2017/06/22/investing/bank-dividends/index.html?iid=hp-stack-dom

Who's ready for Trump to make America great again like it was before those job killing financial regulations? What could go wrong? ![]()

bresue

(1,007 posts)My god....and you know they have all those hidden fees which they do not report as profit!!!

IronLionZion

(45,529 posts)I just find it hilarious that Trump and Republicans are acting like financial regulations are hurting the banking industry somehow when it's obviously the opposite.

Must be alternative facts

doc03

(35,367 posts)on credit cards over 20%?

IronLionZion

(45,529 posts)and is predatory. https://www.nerdwallet.com/blog/credit-cards/how-credit-card-interest-calculated/

The certificate rate you have is tied to the Fed Funds rate set by the Federal Reserve. If you want a higher rate, it's up to Janet Yellen to raise it. She's choosing to raise it gradually over time, like 3-4 times a year.

doc03

(35,367 posts)else to put your money. But where is all this money going car loans are 6% or more but banks pay nothing for our deposits?

No wonder their dividends are up.

IronLionZion

(45,529 posts)So the house of cards may come crashing down soon anyway ![]()