General Discussion

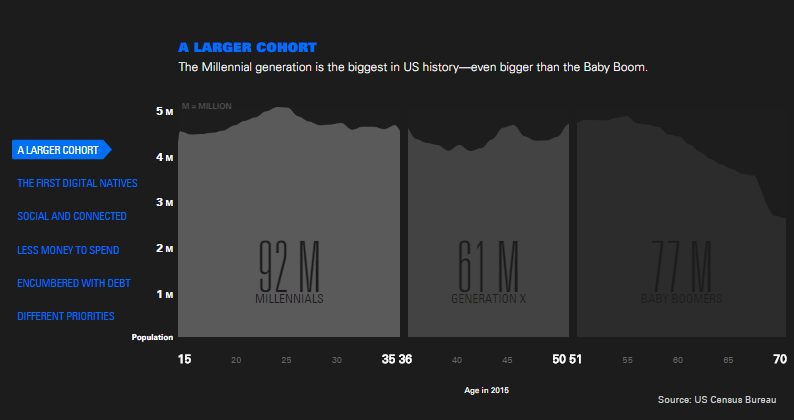

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWill Millennials save the housing market? 92 million strong and many still living at home and rentin

http://www.doctorhousingbubble.com/number-of-millennials-baby-boomers-home-buying-real-estate-funds/#more-8808

Millennials as a group and buying trends

Millennials are much more focused on lifestyle design than having a McMansion. Crossfit, paleo diets, and travel are much more important to this group than taking on a health destroying commute just so you can have a big home. It is also the case that many Millennials are deep in student debt and are suck living at home with parents after embarking on a very expensive college journey. A journey that I would imagine would open up their eyes to things beyond simply buying a crap shack as the end all goal in life.

Here are the numbers:

...

It says the first cohort (Millennials) are about 92 million, vs 61 in the next, Baby Boomers.

When interest rates go up, these should go down, but we will see.

The market is simply juiced on low interest rates. We’ve been in a solid bull market since early 2009 (a solid 7 years). Even last year, probably 5 percent of the population would have forecasted this political season. So to think things can’t adjust in a market that seems frothy is simply naïve. Also, just look at the economic numbers on incomes for Millennials. There is more than $1 trillion in student debt being carried by this group largely. Many already have mini-mortgages. The recent price movement has been pushed by investors, foreign buyers, and very low inventory. But Millennials are not the group saving this market, at least for now.

Warpy

(111,342 posts)in which labor is valued again and capital is forced to invest in domestic industries in order to avoid high taxes.

Otherwise, they'll just have to hope they inherit, not a great plan.

jtuck004

(15,882 posts)insurance companies, big pharma, etc.

There will be a few privileged enough to get something, but a large percentage will be surprised to find there is nothing there.

Warpy

(111,342 posts)Statistically speaking, very few of us will land in nursing homes. Mostly we'll stay at home with part time home health care, a much cheaper option, or just tough it out alone until we croak. Most of us will be wiped out by heart disease. The rest will go from the other diseases of aging like various organ failures, cancer, and the occasional case of pneumonia.

What you described is what happened to a lot of our parents, which is why the country got Medicare for the old folks that private insurance companies wouldn't write policies for.

The horrible part is age 55, when the corporate expiration date throws people out of good jobs, and 65, the year Medicare kicks in. The people lucky enough not to get a catastrophic illness in that decade will only have to work a patchwork of part time, dead end jobs to eat and pay the mortgage until Social Security kicks in.

This is why we need a revolution to reassess and renegotiate the relationship of labor to capital. Right now, it's exploitative and vicious.

GummyBearz

(2,931 posts)Well said. Too bad many don't see it. How will those who can't afford an overpriced house "save" the overpriced housing market?? Its so obvious yet no one seems to see it. The housing market NEEDS to fall about 30% so it can be back in line with median incomes

Cicada

(4,533 posts)Why are boarding houses illegal in most places? Why can't you build a residence smaller than 600 square feet? Why don't we tax vacant land as if it had a building on it in places with high home prices? Why doesn't San Jose zone residential areas along Bart for 30 storey apartment buildings? Building permits should be hard to deny in areas desperately in need of cheaper housing. Citizens who use the phrase Nimby should be forced to Skype with Ann Coulter at least one hour per day if they live where normal people can't find affordable housing within 25 miles.

Warpy

(111,342 posts)All your ideas are stop gap measures to be used in a crisis.

I would like to see areas zoned for smaller houses, whether manufactured "mobile" homes on foundations or stick built structures.

The big yuppie barns will eventually go the way of the dinosaurs, they're ridiculously expensive to heat and cool, many are cheaply built to satisfy fads and not needs, and if the screening room, man cave, and other silly amenities aren't convertable to more useful space, they'll be torn down within 50 years.

redstatebluegirl

(12,265 posts)Until we do something about income inequality and get some of the money from the hands of the bosses, to the hands of the workers they won't be financially able to buy a house.

Of course it the baby boomers are easy targets as a reason these young people have no money. The 1 percent is trying to start a race war AND a generational war to distract everyone from what is really wrong here.

The baby boomers (oldsters like me) are not your problem. Put the blame where it truly belongs.

SammyWinstonJack

(44,130 posts)jtuck004

(15,882 posts)bills, and have lived large and on credit for the past 40 years, living fat and lazy off of their parents sacrifice, while jobs and tax money were moved off shore.

Of course we are part of the problem. They voted in the very people who created this. And their kids lived, and live, the same way. There is no one with clean hands.

But the 1% have nothing, can do nothing, without our arms and legs and eyes to help them. It is completely up to us, and this is what we created.

This was described around 1550, but it still seems we haven't learned the lessons we need...

https://mises.org/library/politics-obedience-discourse-voluntary-servitude/html/c/114

Where has he acquired enough eyes to spy upon you if you do not provide them yourselves? How can he have so many arms to beat you with if he does not borrow them from you? The feet that trample down your cities, where does he get them if they are not your own? How does he have any power over you except through you? How would he dare assail you if he had not cooperation from you? What could he do to you if you yourselves did not connive with the thief who plunders you, if you were not accomplices of the murderer who kills you, if you were not traitors to yourselves?

You sow your crops in order that he may ravage them; you install and furnish your homes to give him goods to pillage; you rear your daughters that he may gratify his lust; you bring up your children in order that he may confer upon them the greatest privilege he knows — to be led into his battles, to be delivered to butchery, to be made the servants of his greed and the instruments of his vengeance; you yield your bodies unto hard labor in order that he may indulge in his delights and wallow in his filthy pleasures; you weaken yourselves in order to make him the stronger and the mightier to hold you in check. From all these indignities, such as the very beasts of the field would not endure, you can deliver yourselves if you try, not by taking action, but merely by willing to be free.

Resolve to serve no more, and you are at once freed. I do not ask that you place hands upon the tyrant to topple him over, but simply that you support him no longer; then you will behold him, like a great Colossus whose pedestal has been pulled away, fall of his own weight and break into pieces.

...

redstatebluegirl

(12,265 posts)years working my tail off to pay my bills, keep a roof over my head and educate kids. Sorry I was mistaken about how I have lived. You seem to have a better handle on my life than I do. I feel for the young people we have worked with. They are struggling to get along.

jtuck004

(15,882 posts)"Blame does nothing" and then without pause you start blaming.

Egnever

(21,506 posts)Lending has also loosened considerably from a few years ago.

I think people see it as risky after the last crash and justifiably so. Still paying a premium to rent doesn't really make sense.

Johonny

(20,889 posts)I'm trying to buy a house, but losing house after house to all cash offers. It isn't the low lending rate, it's the fact a small percentage of people have huge amounts of $$ and they are investing in land. We are going back to the days of the land owning gentry and the renter that pays way too much to live on their land.

CK_John

(10,005 posts)and accepted that corporations will use you and discard you the minute they slow down, there is no pension, and a college degree is bogus, and anything bigger than a cargo container is a waste.

jtuck004

(15,882 posts)as I could. ![]()

But you have to own some real estate, assets, else someone that owns it will own you as well.

We desperately need a different system - 92 million people may not be content to live in servitude like we are. I kinda hope not.

They need to come up with something, likely global, that destroys this one, else it will never get better, I think. Or just wait until we burn ourselves up.

Auggie

(31,191 posts)and rent them out (just as they're doing, only more so).

jtuck004

(15,882 posts)could not take advantage of - by policy- and now that they have inflated, they are selling them at a profit.

But real estate will go down again, so we will see if people allow a repeat.

Egnever

(21,506 posts)I don't think there is any reason to expect that cycle to change.

Auggie

(31,191 posts)though to be fair, I believe the majority of these buyers are extraordinarily wealthy.

Californians are buying real estate in Nevada from the proceeds of sales and creating an artificial bubble in Nevada. Right now, if you want a house in the Reno/Sparks area, a starting offer is full asking price.

In addition to real estate prices going up, local rental costs are increasing 5% above the national average pushing out families that already have difficulty making ends meet in an area that offers distribution center jobs at $11.50 an hour in an at will, right to work state.

Sen. Walter Sobchak

(8,692 posts)Something no sane individual would do.

tymorial

(3,433 posts)My wife and I do rather well financially but the houses around here start at 300k and that is for a small cape or ranch. We rent house outside Waltham and the landlord is a nice guy who has never raised our rent. We are not building equity though but we couldn't afford this place if we tried. It is a nice enough raised ranch on a quiet cul de sac. It's old and dated but it is valued at 650k. I am outside Boston. I would love to move but my wife has a very good job in Boston that she loves. We would need to move over an hour south or west to even find a place we could afford. Mass didn't burst as much as other parts of the country.

As for the rent elsewhere.. we would be trading down so we can't even downsize to save money for a down payment. It really sucks.

Yo_Mama

(8,303 posts)Even at these incredibly low rates.

The housing market is out of sync with incomes and obligations.

Dreamweaver 5.0

(124 posts)It's the down payment.

My neighborhood the 20% down pmt average is 80 grand.

Good luck.

Feel bad for the younglings.

They are dealing with the remnants of Ronnie Reagans trickle down economics.

sarcasmo

(23,968 posts)Rex

(65,616 posts)I guess this country has to fall apart first, before we address the needs of the People.

davidn3600

(6,342 posts)These people are highly educated and little job experience.

Companies don't see as much value in that anymore. They'd rather outsource or demand the government grant more H1B visas. They see it as cheaper.

jtuck004

(15,882 posts)and the working poor, by swelling their ranks with people who used to make a good living.

Doesn't seem to have stopped things from getting more unequal - I wouldn't have foreseen that.

We are learning the wrong things I think. Teaching sheep, maybe, instead of teaching shepherds.

a la izquierda

(11,797 posts)Universities across the nation are losing humanities majors, the cornerstone of any well-educated person's learning for centuries. Without humanities, we have an incredibly I'll-informed population.

Oh, and I'm struggling paycheck to paycheck to pay loans and a bloated rent in an incredibly expensive town (undeservedly expensive, fwiw).

roamer65

(36,747 posts)Dreamweaver 5.0

(124 posts)They make 40 to 60 grand a year.

Sounds good right?

Try savng 80 grand for a down on that.

Living expenses are 70% of that before taxes.

We live in SoCal.

It ain't cheap.

My parents bought their first home for 500 down and a 30 year 16k mortgage.

Those days are long gone.

taught_me_patience

(5,477 posts)By 30, they'll be making close to 100. If they don't squander the money, they'll easily save up for a home in 6-10 years. I live in socal.. Made 50k at 25... By 30, made 100 and still lived with roommates. Bought first condo at 32 with 20%down. Just bought a house at 37. Patience is required... Something millennials are seriously lacking here in socal.

Zing Zing Zingbah

(6,496 posts)30 year standard mortgage.... $120,000. Yeah, you can't get a home for $16,000 anymore unless it is a total dump, but there are places with reasonably priced homes, I guess it just isn't in southern California.

Initech

(100,103 posts)Where I live, studio apartments are $1200 a month. Condos go in the $600,000 range. Think about that number for a minute. $600,000. It's criminally insane. Houses - $2 million minimum and that's not including furniture. The market is going to implode if we don't do something. ![]()

Godhumor

(6,437 posts)I'm forty. I bought my first home in 2009. In 2018, I'm selling and building a new home.

I'm not unique for this age group either. Gen Xers are beginning to hit the accelerated career earning years before hitting peak earning years next decade.

We might not be the biggest cohort, but we are a necessary step in the road before millennials can take over driving home ownership.

madville

(7,412 posts)I always rented in higher priced/higher taxed areas but I've also always been on the move, working projects for maybe two years in any one place and most times I was getting a housing allowance or expense account to cover rent anyway.

I own a house in the middle of nowhere these days, paid $93k for it on some acreage, taxes are $680 a year. It makes sense to own out here because there is no rental market, its really the only option.

I couldn't imagine buying a several hundred thousand dollar home, paying five figures a year in taxes/insurance/HOA dues, and trying to do it on under six figures a year. I worked with guys making 80-100k a year and some of them bought in higher priced areas, always living paycheck to paycheck, buying a $275,000 house and a $40,000 vehicle and $25,000 boat, etc and financing it all with little down will eat up a paycheck quick I guess.

UnFettered

(79 posts)Where I live it's much more expensive to rent then to buy in some cases. Now It's a far cry from some big hip thriving city, but housing prices here are pretty cheap. Especially if you don't live in the city.

It's not unheard of to find a decent older ranch style home for less than a 100k. Now being able to come up with the down payment is another story. This millennial owns a home, but I do know others my age that choose to rent even if they can afford to buy.

Zing Zing Zingbah

(6,496 posts)they really seem to be referring to the younger half of the generation (born 1990 - 2000). I was born at the tail end of Gen X, so I know a lot of young X'ers and old Millennials. The people I know who were born in the early 80's don't seem to have a lot of these Millennial traits. The old Millennials are in their thirties and lot of them have families and own homes. There is a huge difference between 20's and 30's. In another 10 years, we'll probably see a lot more Millennials owning homes.

mnhtnbb

(31,404 posts)when we left California is now valued at 8 TIMES what we sold it for 28 years ago, which at the time, was already about triple

what my husband paid for it when he bought it in the mid-70's.

We could not afford to buy back today the house we sold.

My oldest son--who didn't want to go to college--and started working in computers out of high school

bought a townhouse (with our help) 7 years ago when he was 22. He used some money his grandmother left him, and some

money we gave him (equivalent to what we helped his brother with in college who had a scholarship

that paid most of his tuition at an in-state university) to make the down payment. He and his partner

have started looking around to "move up"--get a little more space and a garage--and his place has appreciated

enough that the equity he has in the home should be enough to make the down payment on a place that will

cost twice what he paid 7 years ago, although he'll probably only get about 20% more square feet.

His younger brother, who is now getting a master's degree, will have no money to buy a house or condo when he's done with school, but he also

won't have any student loans. He has had great financial aid in grad school, and we have helped him with his living expenses.

The only way he'll probably be able to afford buying will be to use money he'll inherit when my husband and I die.

It's totally crazy out there.

Exilednight

(9,359 posts)It's cyclical, prices drop, people jump into the market and suddenly buyers outnumber available homes thus driving up price and poof the bubble bursts.