General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forums...and boom goes the dynamite. (TurboTax)

TurboTax Temporarily Halts E-Filing In All States Amid Fraud Concernshttp://www.forbes.com/sites/kellyphillipserb/2015/02/06/turbotax-temporarily-halts-e-filing-in-all-states-amid-fraud-concerns/

marym625

(17,997 posts)On your second post about this ,claimed you were incorrect and "jumped the gun" Although they said "someone" and not you.

Thank you for keeping us up to date on this incredibly important matter.

Dr Hobbitstein

(6,568 posts)This article disputes his claim of TT being hacked. It specifically says there was no breach, that the information was obtained outside of TT systems. Fraud =/= hacking.

leveymg

(36,418 posts)Dr Hobbitstein

(6,568 posts)He claimed the Turbo Tax was hacked, and implied that QuickBooks could be part of that as well.

The facts are that Turbo Tax was NOT hacked, and that there were a couple thousand cases of fraudulent returns filed via TT. The information that was used to file the returns was collected outside of TurboTax. There was no hack (aside from Will), contrary to his original claims. The original story he quoted updated their info, and Will doubled down and refused to change his story, instead claiming that TT was "flexing their muscles".

http://www.democraticunderground.com/?com=view_post&forum=1002&pid=6185351

leveymg

(36,418 posts)Please get back into your vehicle, and drive out of the neighborhood at a safe speed.

Dr Hobbitstein

(6,568 posts)I've been around this site for quite some time and am just as much a member as Will is. I'm attacking Will's claims and his refusal to retract.

Will has made a claim that isn't backed up by facts and refuses to retract his statement. When real journalists do that, they are no longer trusted.

leveymg

(36,418 posts)Last edited Sun Feb 8, 2015, 01:47 PM - Edit history (1)

I doubt very much whether the company really needs your help.

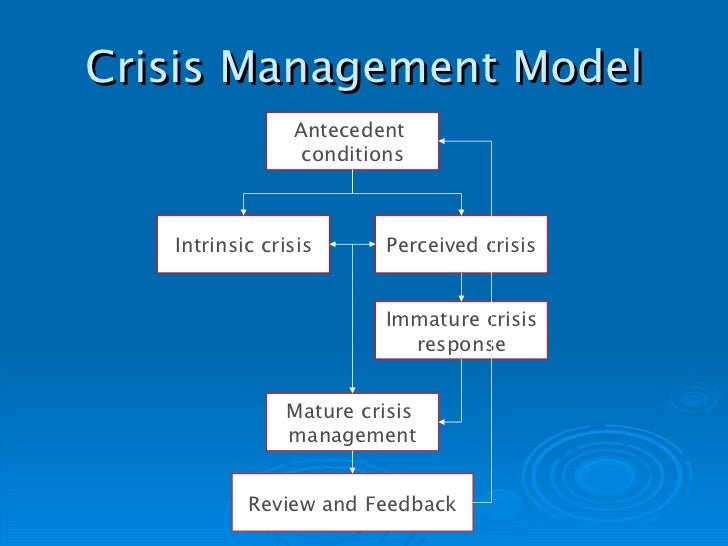

There is the possibility, of course, that your little smear campaign may have some residual value. It may be studied as an example of immature crisis response. Please, see below:

?cb=1322483848

?cb=1322483848

Dr Hobbitstein

(6,568 posts)I care about someone who CLAIMS to be a journalist but has ZERO journalistic integrity, and those that believe his lies. Still waiting on that Karl Rove indictment, myself...

leveymg

(36,418 posts)I guess everyone feels entitled to 15 seconds.

The Velveteen Ocelot

(115,695 posts)will no longer accept returns filed through TurboTax. I've never used it myself because I suck so much at tax return preparation - and hate it so much - that I just throw all my records in a box and take them to an accountant. But my brother has bragged for years about the money he saves doing his taxes himself using TurboTax. I guess he's on his own this year.

Fred Sanders

(23,946 posts)ProfessorGAC

(65,042 posts)My wife and i. That's it. No mortgage for 18 years. Not taking any money from annuities, 401K, or pension plan front load options.

We keep everything in checking and debit card accounts now since the interest earned on MMA and passbook is negligible. (A 100k only pays 100 per year. Big deal! And we don't have a 100k in cash so, it's even less a deal.)

So, it's all just regular income. Taxed at one rate with the standard deduction and no added exemptions. No rental property, no gambling gains or losses, no stock sales for gains or losses.

Jumping on HR Block software and doing it myself and i am 100% confident that no accountant could save me any money.

Now, the year my mom died, that's a different story. I didn't do that year myself.

benz380

(534 posts)ProfessorGAC

(65,042 posts)Since there is no bank account worth worrying about, we max our withholding throughout the year and then the refund is well more than enough for the next years property taxes and homeowner insurance. Actually it's usually quite a bit more and we do household improvements. (Plus the company that treats my lawn. We do our own gardening.)

This year we're just going to sit on the extra cash. We've basically changed every floor in the house, had three rooms repainted, replaced all 3 entry doors, and planted all the perennials we have room for, all in the last 5 years.

So, this year just sitting on it for a rainy day.

benz380

(534 posts)I am contributing 15% to my 401K and maxing out withholding, and it doesn't make much difference than before.

My wife retired from her company and went back to work.

I can't complain since we're debt free with a 4000 sq ft house and

5 acres. We scrimped, saved, worked overtime to get out of debt for years. Our newest vehicle is 11 years old and the oldest is 21 years. I do all my own vehicle and home maintenance. Can't remember the last vacation we took, but we live in the country so don't really miss vacations. Sons' college is paid for too. I don't plan on retiring because I love my work and I'm now doing mostly computer work so my body is being spared.

ProfessorGAC

(65,042 posts)I do most of my work with a computer or in meetings.

However, i didn't get my advanced degrees until i was working full time. And i graduated from HS and college in 3 years each.

So, i started working full time in this field when i was 19. I don't hate it, but i'm going on 40 years and ready to pull the plug.

Rather be somewhere warm, driving with the top down, playing golf in January, and grilling in the backyard without looking like someone who doesn't know what the weather is.

Quite frankly, with my pension plus 401K (non matched because of the pension) plus the 401C i'm well into 7 digits, but the cost of medicine, especially for my MS, and my wife's disability have me working for the insurance.

Still i'm ready to go any time.

Fred Sanders

(23,946 posts)I did not know, and he keeps all my records for me and does follow up for free.

And you can not beat the mail for privacy...filing by internet is asking for it.

ProfessorGAC

(65,042 posts)I do it anyway, although i know the potential issues. My risk assessment says it's acceptable. I hope i haven't underestimated it.

REP

(21,691 posts)So I went back to filing them myself. I just read all the relevant IRS pubs and fill out a ton of forms.

Response to Fred Sanders (Reply #3)

Name removed Message auto-removed

MissB

(15,808 posts)Just print and mail rather than email.

The Velveteen Ocelot

(115,695 posts)because I'm such a knucklehead about such things that I'd do it wrong anyhow.

MissB

(15,808 posts)our taxes are pretty simple (except those years that we exercise stock options or sell stock), so we've always used turbotax. I have a coworker that does taxes for H&R block and she always reviews mine.

If I had rentals I'd use an accountant in a heartbeat. But we just have two w-2s and some donations, and a couple of kids. Turbotax walks us through stuff just fine, even the dread AMT section.

jeff47

(26,549 posts)Their EULA lets you know they upload information.

When Intuit had to contact people who used TurboTax in the past, they used information that indicated they had uploaded some information, even from people who printed and mailed their returns.

MissB

(15,808 posts)don't register the product.

jwirr

(39,215 posts)The Velveteen Ocelot

(115,695 posts)jwirr

(39,215 posts)MH1

(17,600 posts)I switched over due to a relative working for HR Block. At first I hated Block's product compared to TT, but I got used to it, and now I think it's fine.

I hear about e-filing for free and wonder if I need to shell out $25 for the disc every year, but whatever. It's a security blanket and not worth the hassle to switch.

I hope Block doesn't catch TT's flu this year though.

question everything

(47,479 posts)so she decided to file early and was rejected.

Thus, I have to wonder whether these are individuals who've had problem with identity theft before, or is it TurboTax.

I have been using it for 15 years now and will continue. When the state paperwork is complete, I will print and mail or hand deliver - if I can.

The Velveteen Ocelot

(115,695 posts)According to this article, "the state also isn’t currently accepting paper returns from taxpayers affected by the TurboTax issue." http://www.startribune.com/politics/statelocal/291113551.html

question everything

(47,479 posts)Minnesota resumes accepting TurboTax filings after suspicions of fraud

http://www.startribune.com/politics/statelocal/291156911.html

(until it will not...)

The Velveteen Ocelot

(115,695 posts)but you never know.

Rex

(65,616 posts)Gosh Will! Why won't you believe someone that signed up just to post that here!? Now your fans will have to double down from your last thread! ![]()

Actually I bet they just happen to 'miss' this thread.

Where at? In Will's thread?

This I gotta see.

Rex

(65,616 posts)Iggo

(47,552 posts)randome

(34,845 posts)Good God, why all the hair on fire posts before anyone can verify a thing? "...filed through TurboTax" does not mean TurboTax was at fault. Maybe they were but why jump down that hill before you can see what's at the bottom? Sheesh.

[hr][font color="blue"][center]"Everybody is just on their feet screaming 'Kill Kill Kill'! This is hockey Conservative values!"[/center][/font][hr]

Rex

(65,616 posts)But of course you knew that and already had that change of subject at hand. Seriously nice try...not really, but nice try anyway. ![]()

randome

(34,845 posts)

[hr][font color="blue"][center]You should never stop having childhood dreams.[/center][/font][hr]

cwydro

(51,308 posts)Despite our opinions on the MSM, they would be all over this.

Fraud is one thing. Hacking is another.

Rex

(65,616 posts)for themselves. How transparent they are! ![]()

Iggo

(47,552 posts)snooper2

(30,151 posts)Rex

(65,616 posts)From the article:

"Following up on taxpayer concerns, Intuit announced that it is working with state agencies to address the problem. Intuit reached out to Palantir, a third party security expert, to make a preliminary investigation of the most recent fraud activities. The initial findings have led Intuit to believe that these instances of fraud did not result from a security breach of its systems. Instead, the company believes that the information used to file fraudulent returns was obtained from other sources outside the tax preparation process"

The fraudsters got the personal information from some other source. It is akin to someone going through your trash to get your SSN and then filing a tax return or applying for credit cards using your information. The personal information was not lifted from Turbotax, but used on Turbotax.

PeaceNikki

(27,985 posts)Occam's razor meets connect the dots: 80 million datasets with all the information (including ballpark wages) to file a return.

If they were breached, they are required by law to disclose that they were. They are denying it because it's likely they were not.

randome

(34,845 posts)I mean, after you celebrated my "aim, shoot and miss", I'd think you might have a little more self-reflection now.

Notice that I never said I knew what happened, only that it was prudent to wait. How many times have DUers been burned by not waiting for all the facts? There must be a ledger somewhere...

[hr][font color="blue"][center]I'm always right. When I'm wrong I admit it.

So then I'm right about being wrong.[/center][/font][hr]

Dr Hobbitstein

(6,568 posts)MissB

(15,808 posts)She didn't post much

Iggo

(47,552 posts)randome

(34,845 posts)[hr][font color="blue"][center]"Everybody is just on their feet screaming 'Kill Kill Kill'! This is

Rex

(65,616 posts)That anyone can go read from the link I provided? Again...total fail on your part. ![]()

jeff47

(26,549 posts)People filed a big pile of fraudulent returns through TurboTax. They stole the information from other sources, and you can put in any SSN you'd like when signing up at TurboTax.

It's a bit like claiming they "hacked Amazon" when someone uses stolen Credit Card information at Amazon.

http://www.marketwatch.com/story/turbotax-halts-e-filing-of-state-tax-returns-due-to-potential-fraud-2015-02-06

ChosenUnWisely

(588 posts)pkdu

(3,977 posts)My neighbor had his returns stolen from his outgoing mailbox in front our houses. I witnessed it with my own eyes. Bastards.

Fred Sanders

(23,946 posts)pkdu

(3,977 posts)Dr Hobbitstein

(6,568 posts)There was no breach at Turbo Tax. Will has moved the goalposts. He said TT was hacked. They were not. People are filing fraudulent returns through TT. That is NOT hacking. No info was stolen from TT. It was sourced elsewhere.

ChosenUnWisely

(588 posts)pkdu

(3,977 posts)benz380

(534 posts)In our area people were stealing checks made out to 'IRS' and changing it 'MRS' and adding a name to it.

Lex

(34,108 posts)if I recall correctly.

csziggy

(34,136 posts)But restrained myself. I don't want to be audited - again.

CreekDog

(46,192 posts)ChosenUnWisely

(588 posts)CreekDog

(46,192 posts)You are quite wrong and quite sure that you aren't.

Just asking how someone thinks this.

ChosenUnWisely

(588 posts)PeaceNikki

(27,985 posts)who, when, why or where and there is not much recourse.At least in the case of a corporate breach, they are required to disclose, and typically offer some assistance and protections for the future.

ChosenUnWisely

(588 posts)tax returns.

It happens all the time so it must make the news daily.

PeaceNikki

(27,985 posts)http://www.kare11.com/story/news/investigations/2015/02/02/identity-thieves-targeting-tax-refunds/22769445/

http://www.app.com/story/money/business/consumer/press-on-your-side/2015/01/20/tax-identity-theft/22067435/

http://www.10news.com/financial-fitness/its-tax-season-do-you-know-where-your-mail-is

ChosenUnWisely

(588 posts)are no where near the damage caused to millions by one hack.

I will trust the US mail long before I trust a corporation to protect my data.

Others can do what they want, I don't care, either way.

PeaceNikki

(27,985 posts)Dr Hobbitstein

(6,568 posts)There was no hack. Read the article. It specifically states there was no data breach.

Glassunion

(10,201 posts)Filing paper returns does not make you safe. It will in this particular instance protect your data, however your tax information is not 100% safe. None of our tax info is safe.

1. File a paper return

2. IRS receives your paper return

3. IRS employee keys (actually I think they scan it now) your data into their systems

4. IRS systems generate your returns, process payments, flag for audit, etc...

Now here are the risks...

Realities

A. IRS accidentally posts your SSN information on a public website

B. An IRS employee takes personal information home and puts it on their personal internet connected computer

C. The IRS receives a request from someone identifying themselves as law enforcement requesting information, however they do not validate the identity of the requester. Then when they try to go back and validate, they cannot verify who the requester was or what they were given in over 70% of the requests because they do not keep the best of records.

D. IRS employees simply maliciously use the data in identity theft crime

E. (My personal favorite), an IRS supervisor, who has the responsibilities of auditing small businesses and self-employed taxpayers. In particular they were in charge of identifying which taxpayers are to be audited, assigning the auditor, and overseeing the audit. They then run a private outside business that performs tax and accounting services for a fee, including representation of taxpayers before the IRS.

corkhead

(6,119 posts)by reporting it before Intuit was willing to acknowledge a problem![]()

Dr Hobbitstein

(6,568 posts)Inuit was not hacked. Will claimed they are. This new article that will posted specifically states they were NOT hacked.

magical thyme

(14,881 posts)Intuit stressed that this action does not affect the filing of federal income tax returns. It also clearly does not affect taxpayers who are not e-filing state tax returns.

So far, there has been no indication that federal returns have been affected. That information was confirmed by Julie Miller, spokesperson for Intuit earlier today. IRS has not made any announcements; I have reached out to IRS for comment and will pass along information as soon as it becomes available.

WilliamPitt

(58,179 posts)The data they need to do state filings is the same info they need to do federal filings. The only difference is the amount of the return. The money is one thing; all that info being in the wind is another.

magical thyme

(14,881 posts)but that so far it only has been seen at the state level may be one reason why they think the thefts were from outside the turbotax system. Otherwise, why only file fraudulent state returns when the bigger money is typically the federal.

On the other hand, it seems to be taking the IRS longer than usual to acknowledge my return (I don't use TT, I use a free file system) so it may be that the fraud simply hasn't shown up yet at the federal level. ![]()

The Velveteen Ocelot

(115,695 posts)And the same information is used in state returns as in federal returns. So if they can get your state return that's as good as the federal one.

magical thyme

(14,881 posts)And what money have they stolen?

STATE MONEY. Per the linked articles, fraudulent tax returns have been filed at the state level, not the federal.

But the federal level is where the big money is. So either:

1. they are targeting the state level for a reason (maybe a technical reason to do with how/where they hacked in) or

2. the federal level fraud hasn't turned up yet (eg normally my return would have been processed at the federal level by now, but hasn't. So are the feds that far behind in processing? or something more nefarious?) or

3. some other reason

But they don't want your data for shits and giggles. They want it to steal money.

The Velveteen Ocelot

(115,695 posts)and thereby obtain the victims' tax refunds. However, once they have the information in the state returns they will also normally have enough information to file false federal returns, and - worse - having Social Security numbers, addresses, etc., they can commit other forms of identity fraud. So the data can be used to get money in more ways than just state tax refunds.

Generic Other

(28,979 posts)As of last night when I tried to file. Been changing accounts, freezing credit, filling out affidavits, etc. May be Anthem is to blame and not turbotax?

Thanks will for the heads up so I could at least attempt damage control. Bank didn't even believe it happened even though news said it did. They advised turbotax customers to go try to file asap in hopes of beating the crooks. I just got my W2, but no matter, someone already got my return.

Anticipating future headaches. Goddamn.

randome

(34,845 posts)They are combing through their systems to see if they are. It's a smart PR move, regardless of the outcome.

And maybe it will turn out that they are negligent but why not wait and see?

[hr][font color="blue"][center]Where do uncaptured mouse clicks go?[/center][/font][hr]

PeaceNikki

(27,985 posts)randome

(34,845 posts)[hr][font color="blue"][center]"Everybody is just on their feet screaming 'Kill Kill Kill'! This is

OilemFirchen

(7,143 posts)Archaically speaking, of course.

PeaceNikki

(27,985 posts)Rex

(65,616 posts)Do you ever get tired of getting caught changing the subject and getting laughed at? It must be fun for you. ![]()

Skittles

(153,160 posts)Last edited Fri Feb 6, 2015, 05:32 PM - Edit history (1)

Autumn

(45,085 posts)Xyzse

(8,217 posts)I was looking to find more information.

Seems like it is still developing.

Lex

(34,108 posts)which is what I do anyway because I don't get a refund. Seems like that's not affected.

I have to send a check on the state and fed level every year so I never e-file anyway.

jeff47

(26,549 posts)What information isn't clear. An incident occurred in the past where they had to contact people, and they contacted people who filed by mail (I don't remember the details of the incident, just that they had names, addresses and so on from people who did not e-file).

Whether it's in the e-file part or their database of all customers is not known at this point.

C Moon

(12,213 posts)I guess I'll have to pay a real person this year.

At least I have last years forms from TT to go by.

ChosenUnWisely

(588 posts)They even have forms in other languages if you cannot comprehend English.

Has education become so poor now days that people can't even manage to do their own taxes?

The Velveteen Ocelot

(115,695 posts)I prefer to have someone else - i.e., an accountant - organize and review my financial information and prepare my returns, because they are much more likely to sort and identify everything correctly, put the right information in the right place, find deductions that I might not know about, do the math and file the return. And if they made a mistake they'll fix it for me. Not being good at (or wanting to do) tax returns has nothing to do with the level or adequacy of one's education. I suck at all matters relating to accounting and bookkeeping and I have no interest in becoming good at those things. Some other people are good at those things and I am happy to hire them to do something - tax preparation - I'm not good at and don't want to do myself.

ChosenUnWisely

(588 posts)The Velveteen Ocelot

(115,695 posts)and has a solid reputation, as well as E&O insurance. They worked for my dad for some 20 years, and he was so meticulous that if there had been any problems he'd have noticed. Far from ripping me off, they've found deductions for me that I never would have discovered myself, and more than compensated for their fee (which is itself deductible). I'm not worried.

The Velveteen Ocelot

(115,695 posts)how do you know if the surgeon is performing that operation, or did he just make a little incision and then charge you for a procedure he didn't perform? How do you know if your lawyer actually looked at the evidence and interviewed witnesses, or did he just bill you for time spent playing golf?

There are scam artists in every line of work. As with any other professional you might hire, you check out their reputation and get references.

ChosenUnWisely

(588 posts)Many community colleges do have free or low cost classes on doing and understanding your taxes if you are interested in knowledge.

The Velveteen Ocelot

(115,695 posts)"Interested in knowledge"? I hold a graduate degree and teach at a university. There are some things that I find interesting and have time for, but tax prep isn't one of them. The fact that I choose to hire others to do a job I don't care to do is hardly an indication of a lack of interest in "knowledge." I don't know if community colleges offer courses in courtesy and tact, but you might want to look into that.

C Moon

(12,213 posts)ChosenUnWisely

(588 posts)The Velveteen Ocelot

(115,695 posts)Sometimes the only thing that's perfectly clear is arrogance.

C Moon

(12,213 posts)Iggo

(47,552 posts)Autumn

(45,085 posts)ChosenUnWisely

(588 posts)Well I am not in the 99% actually I am in the 5%, but I am still capable of doing my own taxes and I am not an accountant, just can read the 1040 Instruction Book and add, subtract, multiply and divide.

Autumn

(45,085 posts)ChosenUnWisely

(588 posts)If I only made what I pay in taxes I could not even fill out the 1040ez, I would still be on the long form.

Autumn

(45,085 posts)If only we were all that smart. There are people who do those things, like ring up their own groceries. I am not one of them.

ChosenUnWisely

(588 posts)Maybe the quality of education has diminished greatly in America since I went to HS and perhaps people just can't or don't want to do or even understand their taxes either

I don't know.

Maybe a generational thing too, IDK.

Autumn

(45,085 posts)Cal Carpenter

(4,959 posts)other people without condescension just dripping off their words?

What the hell, man. You don't understand that different people have different skills and what seems simple to one may be difficult for another?

I hope you are just young and arrogant, because if you are all grown up, well, how can I put this.... your words sound like the type of words a hypothetical asshole would use.

ChosenUnWisely

(588 posts)average American is not incapable of completing their own taxes?

I contend America is devolving.

We are rapidly becoming Idiocracy, soon art will imitate life.

Don't like my posts you are free to put me on ignore

Cal Carpenter

(4,959 posts)(as evidenced by your use of a double negative that turns your intended meaning on its head. "Not incapable"?)

But that was not my point. You ignored my point because you just want to push buttons. I'm not taking your bait.

Lex

(34,108 posts)I think you mean "is not capable of completing their own taxes." Since you are lecturing the other poster and all.

C Moon

(12,213 posts)jeff47

(26,549 posts)Some even think they're doing it well while paying lots extra.

If you've got no kids, no mortgage, no investments, and so on, you can easily do your own taxes.

As you start to add those confounding factors, you can very easily overpay. Which the IRS will happily not correct.

csziggy

(34,136 posts)At various times in my life I have been too busy running my business to take the time to read up on tax law to make sure I did my taxes correctly; or had extraordinary circumstances that required a CPA (and recently ex-IRS agent) to make sure everything was done correctly.

If you own a business and/or have complicated situations, having access to a CPA for advice can be invaluable. I pay a CPA to do my taxes every year. When I need advice about things that might affect my taxes I can consult with him at no additional charge so I can plan appropriately.

If I had a simpler financial situation, I might do my taxes myself but I would never, ever go through a service such as H&R Block that don't use CPAs to provide their expertise.

jeff47

(26,549 posts)'Cause Turbo Tax wasn't hacked.

Or to translate out of PR-speak, people used stolen information to file fraudulent returns through TurboTax. They didn't hack TurboTax.

A little like claiming bank robbers hacked the road when they drove off.

benz380

(534 posts)Egnever

(21,506 posts)Cause that is how he rolls

cwydro

(51,308 posts)I have not seen any reports of this through the MSM. They would be all over it. They'd love this crap if it were true.

Target, Anthem? Those are companies with some big muscles, so no way TT is "flexing its muscles" against this thread bringing the truth to the people.

notadmblnd

(23,720 posts)I did my nieces the other day and hers was rejected because she did not have a pin number. She did not have a pin number because she filed by paper last year. In order to get a pin number for her, I had to go to the IRS site and request one. The IRS required, her birthday, ssn and address and her filing status for the previous year before they provided a pin number. In addition, my program requires the amount of the previous years refund in order to submit the return electronically.

I was one digit off on her address so the first time I requested a pin, the IRS would not provide it. I finally double checked all her info, found the problem and resolved the issue. I don't know if TT works like this, but for someone attempting to file fraudulent returns, it's a lot of hoop jumping to go through and is impossible to file without the previous years return info.

To check the status of your return, here is the IRS link https://sa.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp

tammywammy

(26,582 posts)jeff47

(26,549 posts)The IRS hasn't complained to Intuit. We don't know how many fraudulent federal returns were filed.

Dr Hobbitstein

(6,568 posts)Turbo Tax was not hacked. The article you posted says exactly that. Fraudulent returns are being filed with information stolen from other sources. That is not a hack in anyway, not does not affect millions.

You know who usually stands behind their lies and doesn't back down when called out? POS used car salesmen.

Egnever

(21,506 posts)greytdemocrat

(3,299 posts)PeaceNikki

(27,985 posts)You should be glad they weren't breached and you should clarify for all those who still foolishly take your "scoops" at face value.

Generic Other

(28,979 posts)but don't let the facts get in the way of piling on Will.

PeaceNikki

(27,985 posts)It wasn't even taken seriously at that point and there were very few resources available to help guide me through it. It's a headache and annoying. My ex-husband also committed fraud by using my son on a tax return when he was not legally supposed to. But, since he filed before me, he got the deduction. It was a total asshole move that netted him a couple hundred while costing me a couple grand. Jerk.

Anyhoo.. I really am sorry you're dealing with it, but it seems that the source of the breach was not TurboTax as Will has incorrectly stated. Repeatedly. There have been over 80 million datasets stolen from Anthem, Home Depot, Target. Occam's razor meets connect the dots: 80 million datasets with all the information (including ballpark wages) to file a return.

If TT/Intuit were breached, they are required by law to disclose that they were. They are denying it because it's likely they were not.

http://www.pymnts.com/news/2015/state-e-filing-suspended-on-turbotax-amid-fraud-concerns/#.VNjSQlXF-Ww

Again, I do hope you are able to navigate through the theft of your identity with as little frustration as possible.

Generic Other

(28,979 posts)Apparently, your description of events is spot on. My apologies for my hair on fire responses. Someone stealing info from Anthem or some other company opened a massive number of new accounts on Turbotax and filed for IRS refunds connecting a whole bunch of dots. Turbo Tax has been fielding calls like crazy since Thursday when the extent of the problem began to surface. So they are also victims of the real identity thieves.

I am grateful to Will for posting the info about the states freezing Turbo Tax returns on Friday as it alerted me to the problem so I could attempt to do damage control. Turbo Tax was incredibly patient and helped me start the process of trying to reclaim my good name.

I am sorry to hear you went through this. I keep reading horror stories of people having ongoing problems. I am trying to lock everything down tight. Otherwise, I will have to change my identity to Generic Nother.

PeaceNikki

(27,985 posts)When it happened to me, I was only a year or so post-divorce so I used it as an opportunity to (gladly) take my maiden name back. Between that and credit monitoring/freezes, the total impact what rather limited but long-term in it's pain-in-the-assedness. It's terrifying. Good luck!

randome

(34,845 posts)...then you can lecture the rest of us. ![]()

[hr][font color="blue"][center]TECT in the name of the Representative approves of this post.[/center][/font][hr]

Nuclear Unicorn

(19,497 posts)Scoops --

PeaceNikki

(27,985 posts)Cali_Democrat

(30,439 posts)SidDithers

(44,228 posts)Sid