General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsHow Local Sales Taxes Target the Poor and Widen the Income Gap

In his State of the Union speech, President Obama will outline a plan to overhaul the federal tax code. His objective will be to reduce inequality in the tax structure, but even if these reforms are enacted, they might only help marginally, says Matthew Gardner, executive director of the Institute of Tax and Economic Policy. That's because they wouldn't address unfair tax systems at the state and local levels.

"At the state level, we're redistributing income away from poor people and giving it to rich people," says Gardner.

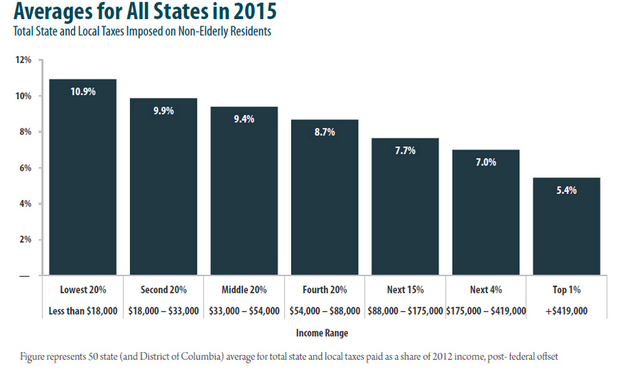

A new report released by ITEP illustrates just how bad the problem has become. The chart below, from the report, shows that the poorest Americans pay nearly 11 percent of their income in taxes. By comparison, the wealthiest only pay a 5.4-percent tax share.

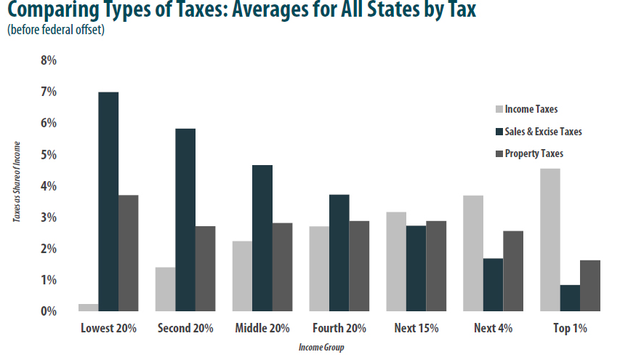

Of the three main forms of state taxes—sales, property, and income—the sales tax hurts the poor most, says Gardner. State sales taxes are highly "regressive," he says. That is, they end up taking a bigger chunk of change from people that have smaller sums of money and slower income growth.

more

http://www.citylab.com/work/2015/01/how-local-sales-taxes-target-the-poor-and-widen-the-income-gap/384643/

1StrongBlackMan

(31,849 posts)Sales taxes do not have an affect on the "income gap" ... unless those taxes are directly related to employment actions, e.g., retention/promotional decisions.

It's just a pique of mine ... all this imprecise language that leads people to incorrect conclusions.

IMO, the worst offending phrase is "Income Inequality" ... when the phrase SHOULD BE, "income INEQUITY". Who among us would argue that everyone's income should be the same ... regardless of qualifications, productivity, effort, or even the dumb luck of being at the right place at the right time? That's what income EQUALITY would mean.

SickOfTheOnePct

(7,290 posts)Something that I hadn't really thought about, but you're 100% correct. Thanks for making me realize the difference.

Also, although I agree that sales taxes are regressive, some of verbiage in the article is misleading. The truth is bad enough; no reason to use misleading terms.

DustyJoe

(849 posts)If a family of 5 spends $200.00 a week at the grocery store for groceries and sundries and the family income is $30k a year, they pay with a sales tax rate of 7.5% (in my area) about $728 in sales tax a year at 2.4% annual hit.

Then the upper middle class family same size, same grocery bill with $250k a year the sales tax hit is about 2 tenths of 1%.

Of course the impact is felt harder for the lower wage earning family.

The tax rate doesn't really 'target' any group, but shows tax equality in the rate structure.

Luckily income taxes are grouped by indexes to spread the hit around, but would be a hard thing to address at the cash register.

Yo_Mama

(8,303 posts)Lower income people spend more on the necessities, and often pay sales tax on those necessities. In many areas these taxes also include services. Lower income people have less money left over after paying for the necessities of life, and therefore no such tax structure can ever have an equal impact across income brackets. But lower-income people also receive tax breaks (and in many case, refundable tax credits), which make the system fairer. By looking at just these taxes, the total picture is lost.

On the federal level, there are similar taxes, such as the gas tax, excise taxes on phone bills, taxes on medical devices, etc. There's a host of them. They also weigh more heavily (as a percentage of income) on the lower-income person than the higher income person.

You could also argue that lower income persons receive more benefit from such taxes than the higher income persons. If you are wealthy, you can afford a private school. If you are lower-income, you cannot. County hospitals, still often supported by local taxes, are there mostly for the benefit of the lower-income persons.

In Europe a large part of funding is done through VAT taxes, and their tax structure is far more regressive than ours. Well, that's what many progressives recommend for here, and I would at least like people to think about the net impacts. If you want socialism a la Europe, you do need to raise the taxes to fund it, and there is no other way.