General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsPresenting The $303 Trillion In Derivatives That US Taxpayers Are Now On The Hook For

Last edited Fri Dec 12, 2014, 07:30 PM - Edit history (1)

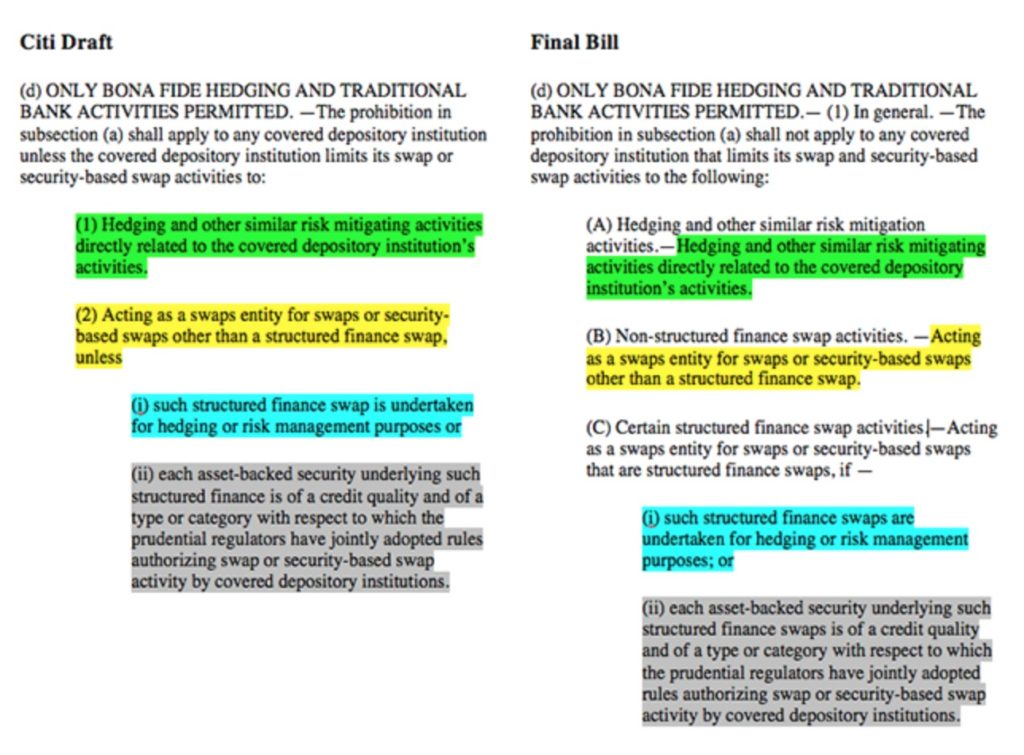

http://www.zerohedge.com/news/2014-12-12/presenting-303-trillion-derivatives-us-taxpayers-are-now-hookFive years after the Wall Street coup of 2008, it appears the U.S. House of Representatives is as bought and paid for as ever. We heard about the Citigroup crafted legislation currently being pushed through Congress back in May when Mother Jones reported on it. Fortunately, they included the following image in their article:

Exhibit A: US banks are the proud owners of $303 trillion in derivatives (and spare us the whole "but.. but... net exposure" cluelessness - read here why that is absolutely irrelevant when even one counterpaty fails):

postulater

(5,075 posts)Made up to make rich people rich and control those who choose not to play the game.

liberal_at_heart

(12,081 posts)They are not even pretending not to own our government anymore. They are coming right out and proclaiming their ownership. Writing legislation and calling politicians to put pressure on them to vote for said legislation.

econoclast

(543 posts)303 Trillion is the NOTIONAL amount. That has nothing to to with the actual risk.

Example. Suppose i have a 10 dollar bet on whether or not the Yankees win the World Series. What is my risk? 10 bucks. What is the notional amount of the bet. Its the value of the thing being bet on. In this case the notional amount is the value of the NY Yankees, which including the YES network is about 64 billion dollars!

liberal_at_heart

(12,081 posts)politicians to pressure them into voting for the bill. That makes our democracy null and void. In 2008, the federal reserve made $9 trillion in over night emergency loans to banks so that we wouldn't have more Bear Stearns collapses, not to mention the $700 million bail out that came later. We should not be passing legislation written by the banks allowing them to take the same exact risks and guaranteeing that we will bail them out all over again.

http://money.cnn.com/2010/12/01/news/economy/fed_reserve_data_release/

econoclast

(543 posts)Same kind of shell game as the 303trillion

liberal_at_heart

(12,081 posts)9 trillion dollars, but they sure can feel the effect of losing millions of jobs. You can try and make it look pretty if you want. The American people know better. This is a crap bill and nothing you say will make it seem better.

econoclast

(543 posts)But they cook up these crazy numbers to distract your attention from the genuine issues.

Warren DeMontague

(80,708 posts)It's like that bullshit figure of "18 Trillion Stolen From the US Taxpayers" in the bailout, which Ron Paul pulled essentially out of his ass.

But people were floating that thing here for months, despite it being demonstratively false.

liberal_at_heart

(12,081 posts)politicians and telling them to vote for the bill and you care about what the numbers are? I have been waiting to put you on ignore for a long time now. I think I am now ready to put you on ignore. Good bye.

Warren DeMontague

(80,708 posts)I don't even have the faintest clue who you are, so there's that.

Anyway, again, if the number doesn't matter, why make one up?

aspirant

(3,533 posts)Stop playing the game and wave bye to Wall Street.

Warren DeMontague

(80,708 posts)Travis_0004

(5,417 posts)Lets say I enter a fixed for floating interest rate swap for 20k. The notional value would be 40k (principal amount of both loan) plus future payments.

I pay you 5%. You pay me LIBOR plus 3%. Right now I owe you a bit in this deal. Ill pay 5% minus what you would pay me.

If I default on our agreement with a notional value of more than 40k (100k or more depending on how long the term was) nobody is out 40k. You are effectively of the agreement, and your loan terms back to 5% when maybe you prefered libor plus 3%. You could probably enter a new interest rate swap and maybe get similar terms and nobody looses a dime.

Another way to look at it. I buy a house for 100k. I will pay 150k in interest so the mortgage has a notional value of 250k. At no point in time can the bank lose 250k. I cab burn the house down and the bank looses 100k and the opportunity to earn that interest, but nobody would claim that is a 250k loss.

liberal_at_heart

(12,081 posts)seem not as bad as it is.

Nuclear Unicorn

(19,497 posts)KamaAina

(78,249 posts)With banks on both sides of the Atlantic using derivatives to hedge, potential losses aren’t being reduced, said Frederick Cannon, director of research at New York-based investment bank Keefe, Bruyette & Woods Inc.

“Risk isn’t going to evaporate through these trades,” Cannon said. “The big problem with all these gross exposures is counterparty risk. When the CDS is triggered due to default, will those counterparties be standing? If everybody is buying from each other, who’s ultimately going to pay for the losses?”

Reread the bolded text enough times until you have enough information to debunk the next time clueless advocates of Morgan Stanley and other banks scramble to say that the banks are hedged, hedged, hedged. No. THEY ARE NOT. And as the AIG debacle demonstrated, once the chain of bilateral netting breaks, whether due to the default of one AIG, one Dexia, one French or Italian bank, or whoever, absent an immediately government bailout and nationalization, which has one purpose and one purpose alone: to onboard the protection written to the nationalizing government, then GROSS BECOMES NET! This also means that should things in Europe take a turn for the worst, Morgan Stanley's $39 billion in gross exposure really is.. $39 billion in gross exposure, as we have been claiming since September 22.

The notional amount is why the risk exists. If the outstanding amount were 300 million, it wouldn't be a big deal because the big banks can cover that without having to run to Uncle Sam.

Your example is wrong. It's not if you had a $10 bet, it's if you had a million $10 bets. That would be a hell of a lot closer to the reality.

Response to KamaAina (Original post)

Warren DeMontague This message was self-deleted by its author.

Rex

(65,616 posts)That anyone would defend the second robbery of the Treasury speaks volumes toward their character. ![]()

Warren DeMontague

(80,708 posts)it's being done for a good cause.

The 303 Trillion Figure is fundamentally impossible, economically speaking. Might as well put "A Gadzooko Bajillion Dollars" in the OP.

Rex

(65,616 posts)A few other OPs are doing their best CYA possible, but there really is no way to smile after taking a big bite out of a shit sandwich.

Warren DeMontague

(80,708 posts)Right back atcha. ![]()

Rex

(65,616 posts)quoting as fact, something a republican is currently lying about in Congress. I didn't think the number could possibly be that high.

![]()

7wo7rees

(5,128 posts)LaRouche wrote abour this derivative problem a very long time ago.

I saved it, I printed it down.

This is real.

Who gives a shit if it is millions, billions or trillions.

Result is still the same.

We are all being robbed.

Warren DeMontague

(80,708 posts)Just a guess?

7wo7rees

(5,128 posts)KamaAina

(78,249 posts)Spitfire of ATJ

(32,723 posts)It'll look at EVERYTHING and assign actual value and all of these potential speculative futures based on nothing are going to collapse.

Hoyt

(54,770 posts)Banks holding on to their money isn't good either. Nationalizing the banks would put us on the hook too.

I wish we could go back to a world with more mom-and-pop, small businesses. But truth is, none of that will produce what we are going to need to take care of the people. We have a lot to do to prepare for the future, I just hope we get there. And, no I don't have the answers.

xchrom

(108,903 posts)Mnpaul

(3,655 posts)shouldn't they be allowed to raise insurance rates on banks engaging in this activity. Free market principles would dictate that happen. More risk --> higher insurance costs.