General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWhat Happened to the Recovery?

from Dollars & Sense:

What Happened to the Recovery?

BY GERALD FRIEDMAN

Part I: Weak Employment, Stagnant Wages, and Booming Profits

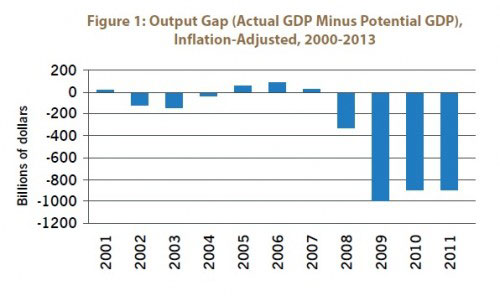

The 2007-2010 recession was the longest and deepest since World War II. The subsequent recovery has been the weakest in the postwar period. While total employment has finally returned to its pre-recession level, millions remain out of work and annual output (GDP) is almost a trillion dollars below the economy’s “full-employment” capacity. This column explains how high levels of unemployment have held down wages, contributing to soaring corporate profits and a remarkable run-up in the stock market.

Output plunged and has not recovered. There was a sharp fall in output (GDP) at the onset of the Great Recession, down to 8% below what the economy could produce if labor and other resources were employed at normal levels (“full employment” capacity). Since the recovery began, output has grown at barely above the rate of growth in capacity, leaving the “output gap” at more than 6% of the economy’s potential—or nearly $1 trillion per year.

........(snip)........

Part II: Government Policy and Why the Recovery Has Been So Slow

The recovery from the Great Recession has been so slow because government policy has not addressed the underlying problem: the weakness of demand that restrained growth before the recession and that ultimately brought on a crisis. Focused on the dramatic events of fall 2008, including the collapse of Lehman Brothers, policymakers approached the Great Recession as a financial crisis and sought to minimize the effects of the meltdown on the real economy, mainly by providing liquidity to the banking sector. While monetary policy has focused on protecting the financial system, including protecting financial firms from the consequences of their own actions, government has done less to address the real causes of economic malaise: declining domestic investment and the lack of effective demand. Monetary policy has been unable to spark recovery because low interest rates have not been enough to encourage businesses and consumers to invest. Instead, we need a much more robust fiscal policy to stimulate a stronger recovery.

The Fed has kept interest rates unprecedentedly low. Determined not to repeat what orthodox economists saw as the main cause of the Great Depression—a “tight” money supply—the Federal Reserve responded very aggressively to the crisis in 2007 and 2008. The Fed drove its main target short-term interest rate, the federal funds rate, down to an unprecedented near-zero level. Even at interest rates below zero in real (inflation-adjusted) terms, however, effective demand has been so depressed and so much unused productive capacity has remained that banks have found few borrowers. .............(more)

The complete piece is at: http://www.dollarsandsense.org/archives/2014/0814friedman.html

Laelth

(32,017 posts)-Laelth

Skittles

(153,160 posts)elleng

(130,916 posts)scarletwoman

(31,893 posts)Thank you, marmar.

Response to marmar (Original post)

Name removed Message auto-removed

L0oniX

(31,493 posts)Eleanors38

(18,318 posts)All other concerns are either irrelevant or antagonistic to this over-arching goal. Even the much-mythologized consumer-based economy is an unused tube-type T.V. in the corner: The sector -- the class -- that matters is finance. Neither the political partys nor their leaders will challenge this sector. Interest rates are irrelevant to this sector. As long as the "Market" booms back up to pre-Recession levels, the financial sector has plenty rate-of-return (10-12%/year?). Does anyone think our economy added 6,000 points from the 10k level at Recession's beginning with something of more value than the swamp gas the financial sector gave us in the first place?

The Chinese are expanding rapidly into developing economies and regions because there is in this country stagnant investment, false employment growth, even falling wages, none of which can create new demand; we're topped off.

I believe we will have another downturn soon, accompanied by a new or more wide-spread phenomenon: Folks will junk the bad-paying, part-time temp jobs as a waste of time, and either go black market, develop new survival-based institutions, turn to crime, or finagle what's left of the safety net.

Or they will hit the streets.

Rex

(65,616 posts)Just took a few more years then they planned.